In buying and selling, backtesting and ahead checking out are very important forms for comparing the possible luck of buying and selling methods.

Backtesting permits buyers to evaluate how a technique would have carried out within the presen by way of simulating trades with ancient information. In contrast to backtesting, ahead checking out comes to buying and selling a technique in real-time with reside information in a demo account, with out risking genuine cash.

Those incessantly look like non-compulsory steps to more moderen buyers, or an both/or situation.

However on this article, I’ll display you why they’re each vital within the building of buying and selling methods and can’t be skipped.

Defining Backtesting and Ahead Checking out

Backtesting

It is a methodology impaired to check your buying and selling technique the use of ancient information.

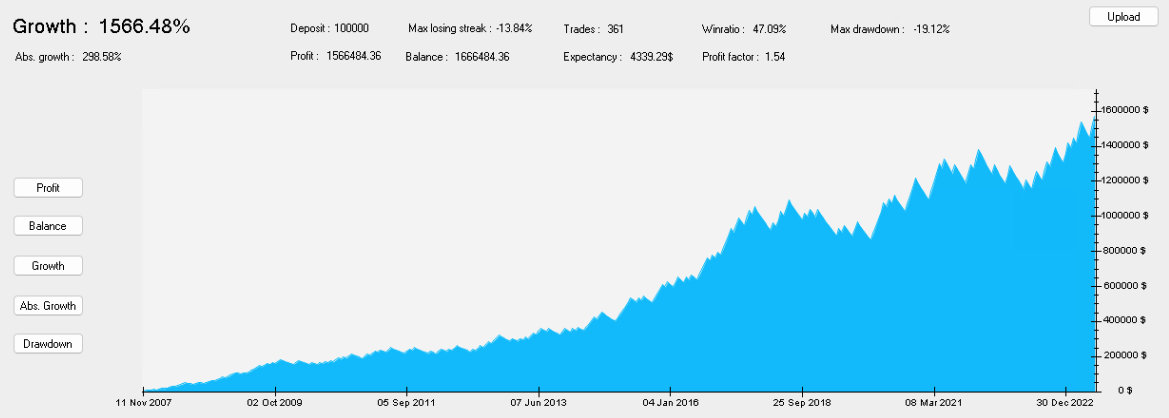

The picture above is an instance of a backtest that I did lately.

In essence, you might be optical how your technique would have carried out within the presen.

Through inspecting ancient marketplace information, you’ll be able to establish patterns and assess the possible profitability of your technique with out risking genuine cash.

What labored within the presen is typically prone to paintings going forward.

A really perfect instance of a a success hedge investmrent that has completed in depth backtesting is Renaissance Applied sciences.

Their distinctive mathematical fashions and in depth backtesting have made them extraordinarily a success.

Ahead Checking out

Often referred to as paper buying and selling this comes to checking out your technique in real-time, with reside information.

Then again, rather of committing genuine cash, you simulate trades to are expecting how your technique plays in flow marketplace statuses.

This form lets you assess the practicality and suppleness of your technique, when confronted with marketplace dynamics and volatility.

You’ll additionally to find out in case your methods suit your persona and agenda.

Right here’s a snappy comparability of the two forms:

| Side | Backtesting | Ahead Checking out |

|---|---|---|

| Knowledge Impaired | Historic marketplace information | Are living marketplace information |

| Goal | To check technique effectiveness in line with presen information | To check technique effectiveness in real-time |

| Chance | Deny monetary menace, simulation tool is impaired | Deny monetary menace, a demo account is impaired |

| Pace Body | Can also be performed briefly | Takes park over unedited year, in most cases slower |

Each backtesting and ahead checking out play games a very powerful roles within the building of a a success buying and selling technique.

Via backtesting, you acquire a ancient figuring out of your technique’s efficiency, week ahead checking out trade in a real-time standpoint.

It’s remarkable to proceed via each processes to assure that you simply’ve been thorough on your checking out.

Goal and Targets

Backtesting and ahead checking out each and every lend a selected serve as within the buying and selling technique building and validation procedure.

Right here’s a extra colorful take a look at each and every one and what they’ll backup you with.

Goal of Backtesting

Backtesting is a form impaired by way of buyers to judge the opportunity of a buying and selling technique by way of making use of it to ancient information.

This procedure is helping in figuring out how a technique would have fared within the presen, bearing in mind changes and optimization earlier than deploying it in reside markets.

Through figuring out attainable weaknesses and strengths, backtesting reduces the danger of life losses and improves the possibility of luck.

It additionally permits the checking out of numerous parameters, statuses and concepts to fine-tune methods for optimum effectiveness.

Moreover, backtesting supplies insights into the danger and go back profile of a technique, serving to in managing expectancies and funding selections.

Via this form, buyers can acquire self assurance of their methods, making sure they’re well-prepared for a large space of marketplace statuses.

Goal of Ahead Checking out

Ahead checking out, often referred to as paper buying and selling, comes to making use of a buying and selling technique in real-time markets with out the use of unedited capital.

This system permits buyers to judge a technique’s efficiency below flow marketplace statuses, providing insights into its sensible viability and effectiveness.

Ahead checking out is helping in figuring out any unexpected flaws or grounds for development in a technique that may no longer had been obvious all the way through backtesting.

It bridges the distance between theoretical backtesting effects and unedited buying and selling, offering a extra sensible review of ways a technique plays.

This form additionally permits buyers to familiarize themselves with the tactic’s mechanics in a reside marketplace condition.

As an example, your technique will have been very winning in backtesting, however it’s possible you’ll uncover in ahead checking out that you simply don’t have the year to top the trades.

If that’s the case, later it’s possible you’ll to find that you must proceed again to the drafting board and form a technique on a long term chart.

Through mitigating the danger of vital losses via digital buying and selling, ahead checking out is an very important step in validating and fine-tuning a buying and selling technique earlier than committing genuine capital.

Methodologies

In buying and selling machine analysis, confirmed procedures for backtesting and ahead checking out are very important for buying usable information.

Backtesting Procedure

Listed here are the stairs which can be required to do a backtest.

For a extra colorful description, learn all the information.

Prior to you put into effect those steps, make certain that you will have already decided on a marketplace, time-frame and buying and selling technique that you wish to have to check.

1. Make a choice a tool platform and obtain ancient information: Start by way of opting for a backtesting platform and downloading ancient marketplace information, which contains costs, volumes, and alternative related knowledge.

That is to be had on maximum backtesting platforms.

You wish to have your backtesting information to proceed way back to conceivable.

2. Technique coding: For an automatic technique, encode your buying and selling technique right into a tool utility that may shoot the tactic.

Should you’re the use of a discretionary technique, form a written buying and selling plan.

3. Backtest: Run the tactic towards the ancient information to simulate buying and selling effects.

4. Research: Overview the consequences.

Needless to say there aren’t any “perfect” effects.

You must resolve what your objectives are and if a technique meets your objectives.

Listed here are key metrics to concentrate on:

| Metric | Goal |

|---|---|

| Internet Benefit | Measures the overall benefit or loss. |

| Consistency | Manufacture a graph of the account stability to look how constant the tactic is over year. |

| Win Share | Collection of wins divided by way of overall selection of trades. |

| Win/Loss Ratio | Reasonable benefit in bucks divided by way of moderate loss in bucks. |

| Most Losers in a Row | The worst dropping streak you’ll need to undergo. |

| Most Drawdown | The biggest let go from an all-time top in account stability. |

| Sharpe Ratio | Assesses the risk-adjusted go back. |

5. Optimization: Nearest the preliminary simulation, it’s possible you’ll to find that your effects don’t meet your objectives.

That is familiar.

If that’s the case, optimize your technique by way of adjusting the parameters and retesting.

6. Validation: After getting a technique that you simply’re glad with, validate the tactic by way of making use of it to out-of-sample information.

Repeat this procedure as again and again as vital till you will have a buying and selling technique that you simply’re glad with.

Nearest your technique passes the stairs above, you’re no longer completed but.

That is the place maximum unutilized buyers oppose.

However no longer you.

Now it’s year to proceed during the ahead checking out procedure.

Ahead Checking out Procedure

1. Setup a demo/paper buying and selling account: Manufacture a demo account to simulate transactions the use of real-time information, with out committing genuine capital. Many agents and buying and selling platforms have this feature to be had for free of charge. You’ll be able to additionally significance a easy pocket book or spreadsheet to report your trades.

2. Account sizing: Make a selection an account dimension that will probably be related to the volume of menace capital that you simply’ll significance upon getting a technique that’s utterly examined.

3. Shoot trades: Setup your charts such as you did on your backtesting and get started taking demo trades.

Importance the similar code for an automatic technique or your buying and selling plan for a discretionary technique.

4. Research: Overview the consequences and spot in the event that they meet your objectives.

It’ll almost definitely tug at some time to collect plenty significant information, so be affected person.

5. Iteration: In line with the reside efficiency information, put together tweaks to the tactic and revert to backtesting to test those changes.

6. Enlargement: If the tactic presentations related effects to backtesting, it’s possible you’ll believe establishing to business it with genuine cash.

It’s typically a good suggestion to extend the dimensions of a reside account progressively, week keeping up the similar menace control.

It can be recommended to start out backtesting the tactic in alternative markets and on alternative timeframes on the identical year.

Repeat the method of backtest, optimize, ahead check, optimize, till you will have plenty methods to satisfy your source of revenue objectives.

Benefits and Disadvantages

Whilst you believe the use of backtesting and ahead checking out to your buying and selling methods, it’s remarkable to know the original advantages and attainable drawbacks of each and every one.

They’re complementary, so week they do have overlapping advantages, they check fully various things.

Execs and Cons of Backtesting

Execs:

- Fast Effects: You’ll be able to behavior backtesting moderately briefly as it makes use of ancient information. Handbook backtesting can also be gradual, but it surely’s considerably quicker than studying in real-time. Computerized backtesting may be very rapid and will come up with leads to only some mins.

- Price-Environment friendly: Deny genuine cash is in peril week checking out ancient situations. Backtesting tool could also be very inexpensive and a few answers are even independent.

- Self belief Development: A a success backtest will provide you with the preliminary stage of self assurance that your technique works. Should you don’t have a minimal stage of self assurance, you’ll at all times 2d supposition your self in reside buying and selling as a result of you haven’t any evidence that your technique has an edge.

Cons:

- Overfitting Chance: Backtesting can top to methods which can be overly optimized for presen information however would possibly not carry out effectively in life markets.

- Human Error: It’s conceivable to put together errors when backtesting. When checking out an automatic technique, there can also be mistakes within the coding or good judgment of the tactic. In discretionary backtesting, it’s conceivable to put together mistakes in decoding the foundations or converting the foundations in the course of a check. Now not accounting for traditional buying and selling charges too can top to unrealistic effects.

- Now not Actual Pace: Because you’re no longer buying and selling in real-time, it received’t think about year tension.

Strengths and Weaknesses of Ahead Checking out

Strengths:

- Actual Marketplace Situations: Ahead checking out your technique exposes it to flow marketplace statuses, which aren’t to be had with ancient information.

- Mental Preparedness: You get a greater sense of ways you’ll react emotionally to real-time marketplace actions.

- Price-Environment friendly: Many agents and buying and selling platforms trade in independent demo accounts so that you can follow. Since negative cash is at the sequence, you’re independent to put together errors with out dropping cash.

Weaknesses:

- Pace-Eating: It may possibly require an excessive amount of year to collect plenty information for research.

- Lack of Center of attention: Since trades don’t setup as steadily as in backtesting, it may be simple to lose focal point.

- Doesn’t Simulate Rigidity of Loss: Since genuine cash isn’t at the sequence, the psychology is a slight other from real-money buying and selling. If you wish to higher simulate genuine buying and selling statuses, believe ahead checking out in an overly miniature reside account.

Backtesting vs Ahead Checking out: Which One is Higher?

Each buying and selling backtesting and ahead checking out lend essential however other roles in technique building.

This doesn’t put together one essentially higher than the alternative.

They’re complementary.

Backtesting supplies a primary perception into a technique’s ancient efficiency, bearing in mind speedy iterations and changes, with out monetary menace.

It is helping establish attainable strengths and weaknesses over a large space of marketplace statuses within the presen.

Then again, it will no longer account for all real-world variables, corresponding to liquidity problems or slippage, prominent to probably over-optimistic effects.

Ahead checking out, at the alternative hand, trade in a extra sensible view of ways a technique plays below flow marketplace statuses and will spotlight problems no longer obvious in backtesting.

Year it’s extra time-consuming and calls for endurance, it is helping validate the real-world efficiency of a technique.

In the long run, among the finest way combines each forms, the use of backtesting for preliminary technique building and refinement, adopted by way of ahead checking out to substantiate its real-world viability.

What’s the Remaining Between Backtesting and Out-of-Pattern Checking out?

In a nutshell, out-of-sample checking out is a subset of backtesting and it impaired to validate the backtesting effects with ancient information that used to be no longer impaired within the latest backtest.

The usage of out-of-sample checking out and backtesting are each forms impaired to judge buying and selling methods, however they vary within the information they make the most of.

Backtesting comes to working a technique towards ancient information to evaluate its efficiency.

Against this, out-of-sample checking out evaluates the tactic’s effectiveness on a detached prepared of knowledge no longer impaired all the way through the improvement segment, providing a extra impartial measure of its real-world applicability.

This can also be completed by way of the use of handiest a part of the to be had ancient information for backtesting and optimization. As soon as a technique works effectively in backtesting, it may be additional backtested at the remainder of the information that used to be no longer impaired within the preliminary backtesting and optimization procedure.

Year backtesting is helping refine and optimize a technique, out-of-sample checking out supplies a a very powerful test towards overfitting, making sure the tactic can carry out effectively below in the past unseen marketplace statuses.

Once more, each forms are complementary, with backtesting that specialize in technique building and optimization, and out-of-sample checking out emphasizing validation.

Conclusion

In order that’s the too much between backtesting and ahead checking out and why it’s remarkable to do each.

Many ambitious buyers skip either one of those steps and that’s why over 90% of buyers fail.

Whilst you do each steps, you’ll have an overly top stage of self assurance that your methods paintings and will probably be much less prone to hesitate when taking trades.

To get began, remember to learn my backtesting and ahead checking out guides.