Working out methods to react in numerous marketplace statuses is very important when starting buying and selling.

So, what’s the invisible components?

Smartly, veteran investors if truth be told virtue various buying and selling methods – now not only one!

Attending to grips with those methods early can put you on a forged trail to bigger pace luck.

I admit that, future in the beginning look, buying and selling methods can appear difficult…

…don’t let that end you!

I’ve written this information on Working out Buying and selling Methods for Inexperienced persons only for you – exactly to support you get began!

With a modest little bit of digging into the main points, I assurance those methods will temporarily turn into translucent…

…supplying you with that necessary edge throughout your nearest buying and selling consultation.

On this article, you’ll discover 3 very important methods:

- The Crack and Retest Technique (Working out flipping helps and resistances and methods to observe immense trending strikes)

- The Breakout Technique (Studying to seize sturdy risky strikes with speedy earnings)

- The Dimension Technique (Shooting more than one a hit trades of the similar ranges with precision)

Are you able?

Next let’s journey!

Crack and Retest Technique

What’s it about?

The Crack and Retest Technique is referred to as a Development Continuation Technique.

It’s all about coming into a business nearest the associated fee breaks thru an important stage of help or resistance, and next retests that stage from the other facet.

This technique specializes in the “flipping” of help into resistance – or – resistance into help, relying at the route of the rage.

You’ll virtue it in trending markets, with the struggle of taking pictures a persevered development exit.

This technique is helping you determine important ranges out there future additionally buying and selling within the route of the rage.

It additionally signifies that through bringing in combination more than one technical ranges into one technique, you build up the probability of luck!

Why virtue this technique

A couple of signs for your favour.

The Crack and Retest Technique deals you a miles upper win price in comparison to coming into trades randomly in an uptrend.

A few the explanation why this technique is so efficient:

- Figuring out Gardens of Worth: You’ll if truth be told pinpoint farmlands the place the associated fee has in the past struggled and next effectively damaged thru.

Those farmlands, referred to as “areas of value,” are essential for making higher buying and selling selections.

- Core Technical Research Parts: This technique makes use of two key portions of technical research:

- Breaking thru horizontal ranges.

- Buying and selling within the route of the rage.

By way of combining those parts, you build a truly potent buying and selling way that will increase the chance of a hit trades when impaired appropriately.

Simple to spot and a stunning substructure for pace programs

When forming out in buying and selling, simplicity is vital!

The usage of this technique method you’ll simply determine resistance and help ranges, in addition to figure out the tide marketplace route.

Higher but, those ideas are the root for extra complicated buying and selling programs.

Studying about them now means that you can give a boost to your methods over occasion, laying much more groundwork for pace buying and selling luck!

Can supremacy to important features

Finally, the Crack and Retest Technique can supremacy to really extensive earnings.

By way of lining up your trades with the rage, you’ll take pleasure in longer value actions over days, weeks, and even months following your access.

It’s an way that permits you to journey the momentum all of the approach to the top development, maximizing cash in!

The way it works

So what does this seem like precisely?

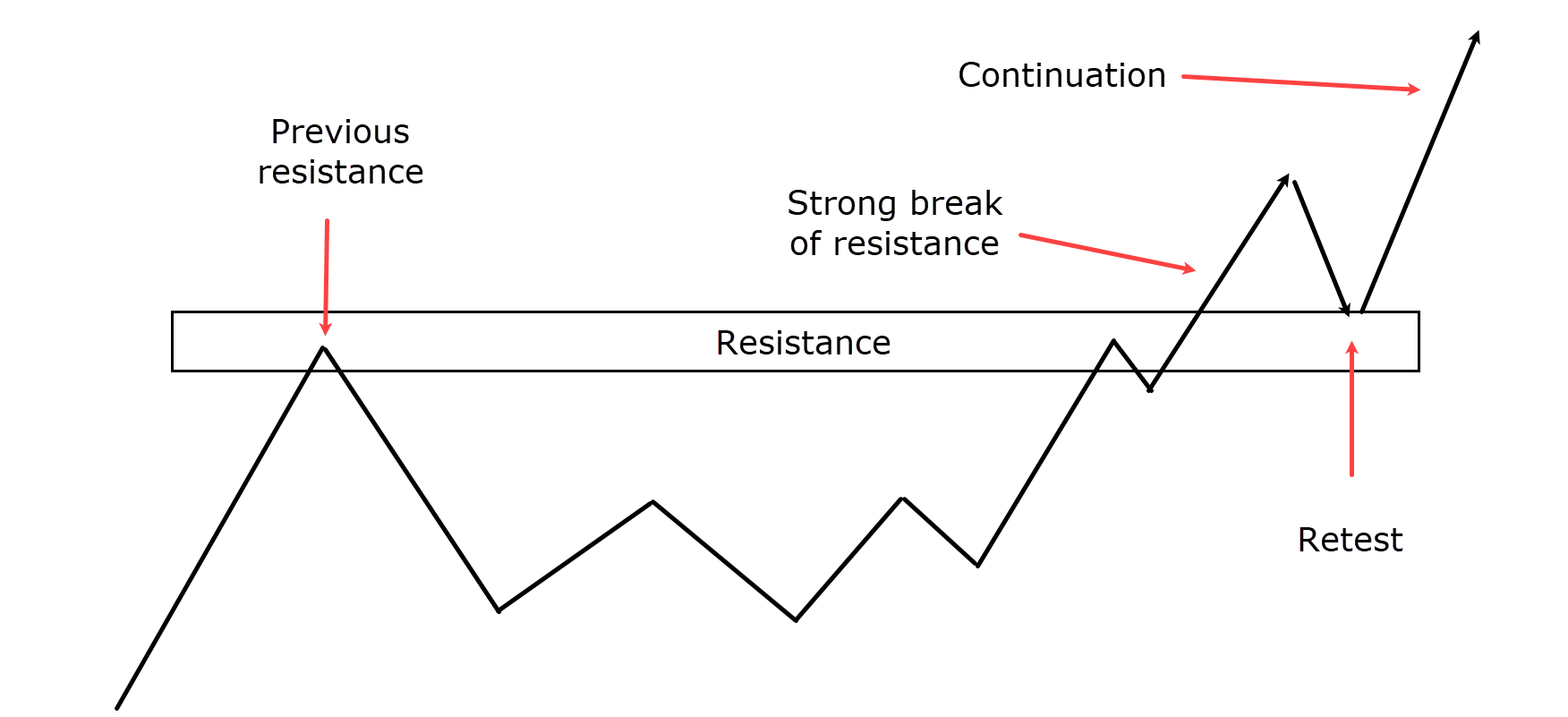

Resistance Crack And Retest:

Within the diagram, you’ll see value strikes up and next in brief retraces, proper?

This modes what’s known as the preliminary resistance stage.

When value comes again to this resistance stage, it can be met with some rejection, however in the end value breaks thru – with a powerful split of the former top or resistance stage.

Value next pulls again to retest the damaged resistance stage, which now acts as a help stage.

This concept works precisely the similar for the downtrend instance, too…

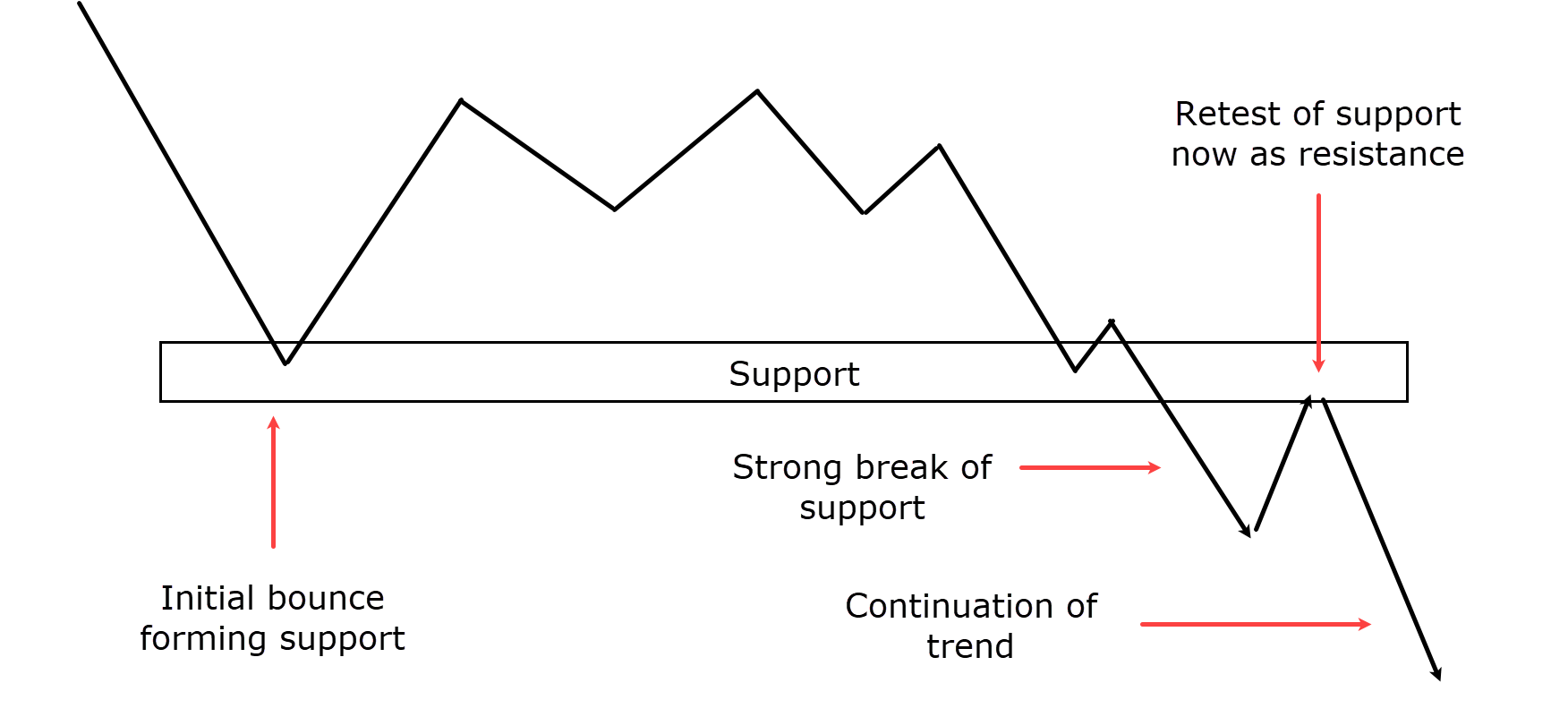

You’ll see the associated fee is in a downtrend, foundation a low the place value bounces…

…the split of help in the end happens, adopted through the retest of the help as a unutilized resistance.

On the retest , it’s impressive to search for rejection candles that let you know value is now rejecting this key stage as resistance.

This rejection would possibly seem as capturing famous person candlesticks or bearish engulfing candles within the essential segment.

In the end, the associated fee continues within the development route.

That’s the idea of it, anyway!

Now let’s take a look at some real-world examples and talk about profit-taking and stop-loss placement!

Buying and selling Examples

Check out please see chart…

USD/ZAR 1-Moment Chart Retest:

As you’ll see, value breaks the former resistance however takes at some point sooner than value comes again to if truth be told retest the zone correctly.

But if the associated fee does come again, a retest business alternative items itself!

Within the USD/ZAR 1-hour chart proven, the candles have begun to stall on the zone and display indicators of rejection – that is the chance to jerk an extended business.

You’ll playground your end loss safely beneath the zone and next goal both the former resistance or a collection gift, on this case, I’m the use of a 2.5RR…

USD/ZAR 1-Moment Jerk Benefit:

…and take a look at that!

Value stalled on the zone and made its approach to the jerk cash in!

It is a stunning instance of the way value is attracted to earlier farmlands of price.

By way of moderately that specialize in what value does in those farmlands, you’ll higher estimate what would possibly occur going forward.

However what if I informed you the business alternatives didn’t finish right here?

Let’s proceed following the associated fee for somewhat longer…

USD/ZAR 1-Moment Crack of Untouched Zone:

As you’ll see at the chart above, value if truth be told returns to the zone once more.

There will have been any other alternative to jerk an extended business right here, which is logical.

Then again, for this situation, let’s say you anticipated this zone to fail as a result of the rate value returned to it.

Ultimately, value breaks beneath the fresh zone however, that items the nearest buying and selling alternative!

In truth, the extra occasions a zone is breached, the fewer worth I give it.

You must at all times replace your zones frequently to compare the place value has in the past reacted!…

USD/ZAR 1-Moment Crack and Retest:

Right here, the retest and rejection occur when value step by step returns to the zone and is met with a powerful bearish engulfing candle.

This candle presentations you ways dealers are influencing this segment, offering resistance.

So for a business homogeneous to the closing one, you must playground your end loss simply above the resistance zone, which now acts because the segment of price…

…and your jerk cash in might be prepared across the earlier lows…

USD/ZAR 1-Moment Jerk Benefit #2:

Hiya, did you notice that!?

Value persevered its downtrend momentum and in the end reached the former low goal the place earnings might be taken!

Are you able to see how this segment of price brought about more than one reactions from value?

It’s a stunning instance of why it’s the most important to stick open-minded.

Although the preliminary business doesn’t journey your manner, moderately observing how value reacts on the unutilized ranges can display you unutilized buying and selling alternatives.

I please see this way as being “in flow” with the marketplace.

It’s at all times higher to let the marketplace display you its intentions in lieu than mission your expectancies onto it!

Let’s read about one closing instance…

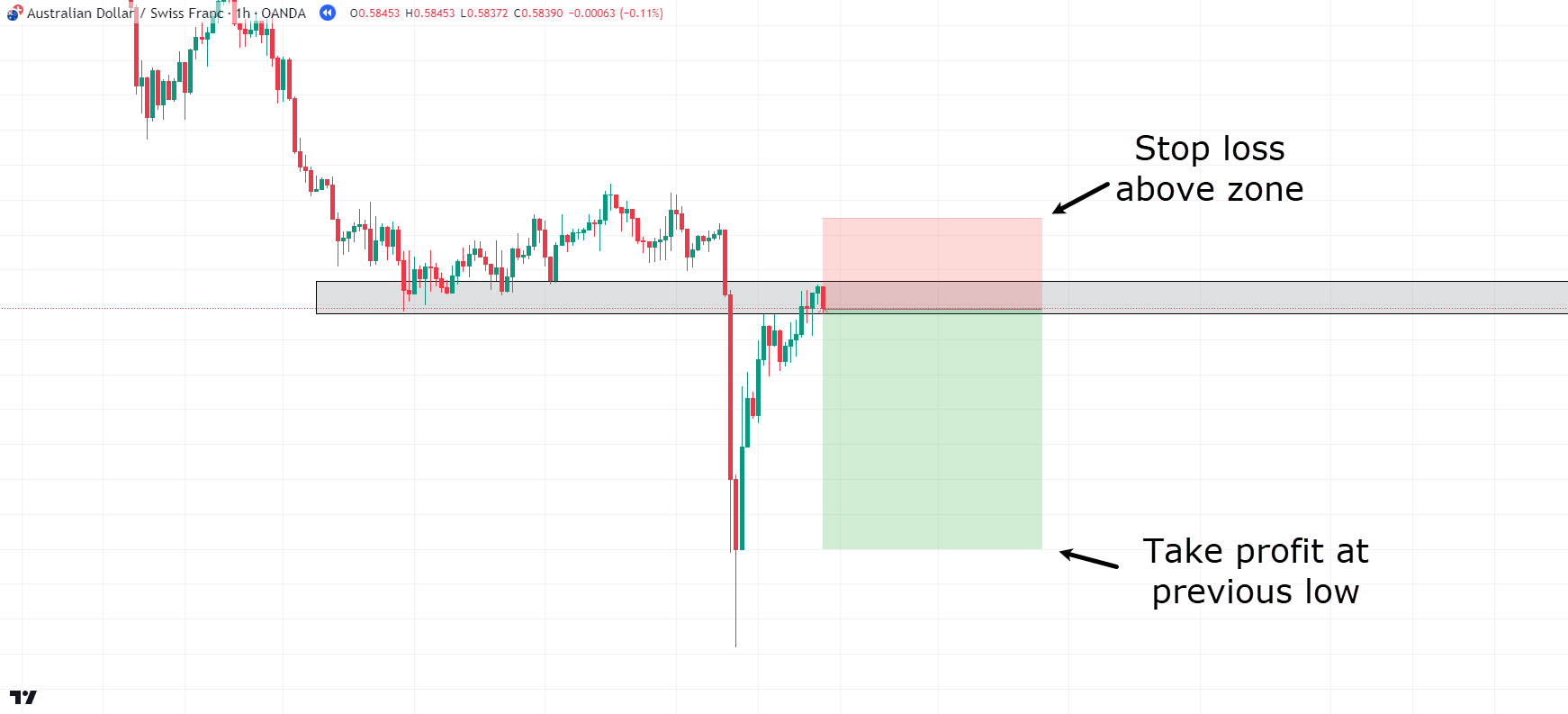

AUD/CHF 1-Moment Chart:

Here’s any other translucent instance of value breaking beneath a translucent help stage.

Even if value has moved far clear of the help stage, let’s take a look at what occurs…

AUD/CHF 1-Moment Chart Crack and Retest:

Value grinds its long ago as much as the zone… the place it sounds as if to stall.

Now, homogeneous to the former examples, let’s playground the end safely above the zone and goal the former low…

AUD/CHF 1-Moment Chart Zone Crack:

Hiya, retain on!

Value is if truth be told forming to split above the zone?

However what does that ruthless?

Smartly, at this level, it’s important to ask your self two impressive questions:

Is my business unfolding as anticipated?

Is that this zone being revered as resistance?

I’m hoping you responded “no” to either one of the ones questions!

However let’s suppose you sought after to let the business play games out naturally…

AUD/CHF 1-Moment Chart Restrain Loss Clash:

As anticipated, the business didn’t play games out as anticipated.

Value in the end moved all of the approach to the end loss.

So, what’s the lesson right here?

Crucially, if the associated fee starts to disrespect the zone you’ve gotten recognized, next you wish to have to reevaluate – in lieu than hoping the associated fee will flip for your partial!

Over your buying and selling occupation, you’ll be told that reducing losses early is vital to staying within the sport and turning into successful.

On this case, there used to be a chance to advance your business early – when the associated fee needful above the zone.

I ruthless, it could lead to a smaller loss than in case your complete end loss used to be clash, proper?

All the time observe this when making plans and executing trades, as now not each and every split and retest business can be a hit.

Now, let’s take a look at some execs and cons of this technique!

Execs and cons

Execs:

Sunny Ranges

This technique is skillful for inexperienced persons as it’s simple.

Simply focal point on help and resistance ranges the place value has obviously reacted within the generation.

It very much simplifies decision-making.

Buying and selling with the rage

Most often aligned with breakout methods, buying and selling with the rage method you observe the marketplace’s momentum.

Maximum setups occur within the route of the pervasive development…

…expanding the chance of a hit trades!

A couple of business control methods to be had

There’s a bundle of suppleness in managing trades right here.

You’ll harness unutilized momentum the use of trailing end losses or focused on sure jerk cash in ranges.

The preliminary stop-loss placement is translucent, too, being in keeping with the recognized stage.

Cons:

Value would possibly journey with no retest

One downside is that every now and then value would possibly not retest the damaged stage!

This is able to supremacy to neglected alternatives at recognized key ranges.

Rejection on the zone will also be subjective

Figuring out rejection at a zone can range amongst investors, to inconsistent entries till a dealer defines their standards for rejection.

It’s impressive to make a choice your bounds – and persist with them.

Value can fakeout

Fraudelant breakouts at key ranges can happen, the place value in brief strikes past a degree however fails to maintain the momentum.

Naturally, this may end up in losses if trades are in keeping with those fraudelant indicators.

Professional Guidelines

Shifting Reasonable Affirmation

It may be a good suggestion to virtue the 50-day shifting moderate as excess affirmation of a development and help/resistance ranges.

Even if I every now and then virtue the 50-day shifting moderate, aim enjoying round with other shifting averages that produce sense to you.

It’s all about the time frame you might be buying and selling!

Quantity Affirmation:

Any other excellent concept is to search for greater quantity at the breakout and retest to verify the validity of the exit.

Greater quantity can counsel {that a} breakout isn’t a fakeout – however that there are if truth be told sturdy forces at the back of the split of the important thing stage!

All translucent? Superior!

Now let’s exit directly to the nearest technique: the breakout technique!

Breakout Technique

What’s it about?

Assistance and Resistance being Damaged and Buying and selling in that Course

Breakout buying and selling method coming into a place when the associated fee breaks thru an outlined help or resistance stage with important quantity.

As soon as those essential ranges are breached, the associated fee is prone to proceed shifting in that route, frequently to large value actions.

You’ll seek for those forthcoming breakouts, taking pictures the momentum and gaining from marketplace shifts!

Momentum and Volatility Can Boost up the Marketplace

The momentum from breakouts may cause fast value adjustments, permitting you to make the most of momentary marketplace movements.

The greater job additionally creates upper volatility, making breakouts frequent if you wish to take pleasure in speedy marketplace strikes.

By way of taking pictures those large value adjustments, you’ll journey the current of volatility – and maximize your features!

This technique works neatly in markets with sturdy actions, the place the probability for large value swings is upper.

Why virtue this technique

Seize Weighty Rapid Strikes

When the cost of one thing breaks thru an impressive stage, like help or resistance, it frequently units off a flurry of job out there.

In consequence, costs can execute up or ailing, supplying you with a probability to produce a bundle of cash in a quick occasion.

The longer the associated fee has been caught in a fluctuate, the more potent the breakout has a tendency to be when it in any case occurs.

Bring to mind it like force build up sooner than getting hastily spared, inflicting the large value strikes!

Simple to Establish

One more reason investors love breakout methods is this is is very simple to spot a breakout.

When a value breaks thru an impressive stage, like help or resistance with momentum it’s frequently very translucent.

This offers the dealer a lightless and white image of whether or not value has damaged out or now not!

Industry setups turn into simple with translucent value issues of the place the business can be invalidated and end losses positioned.

The way it Works

Value Involves a Resistance or Assistance

Breakout buying and selling begins through understanding key help and resistance ranges on a value chart.

When the associated fee approaches those essential zones, it indicators attainable farmlands the place consumers (at help) or dealers (at resistance) would possibly turn into energetic.

This units the level for a imaginable breakout!

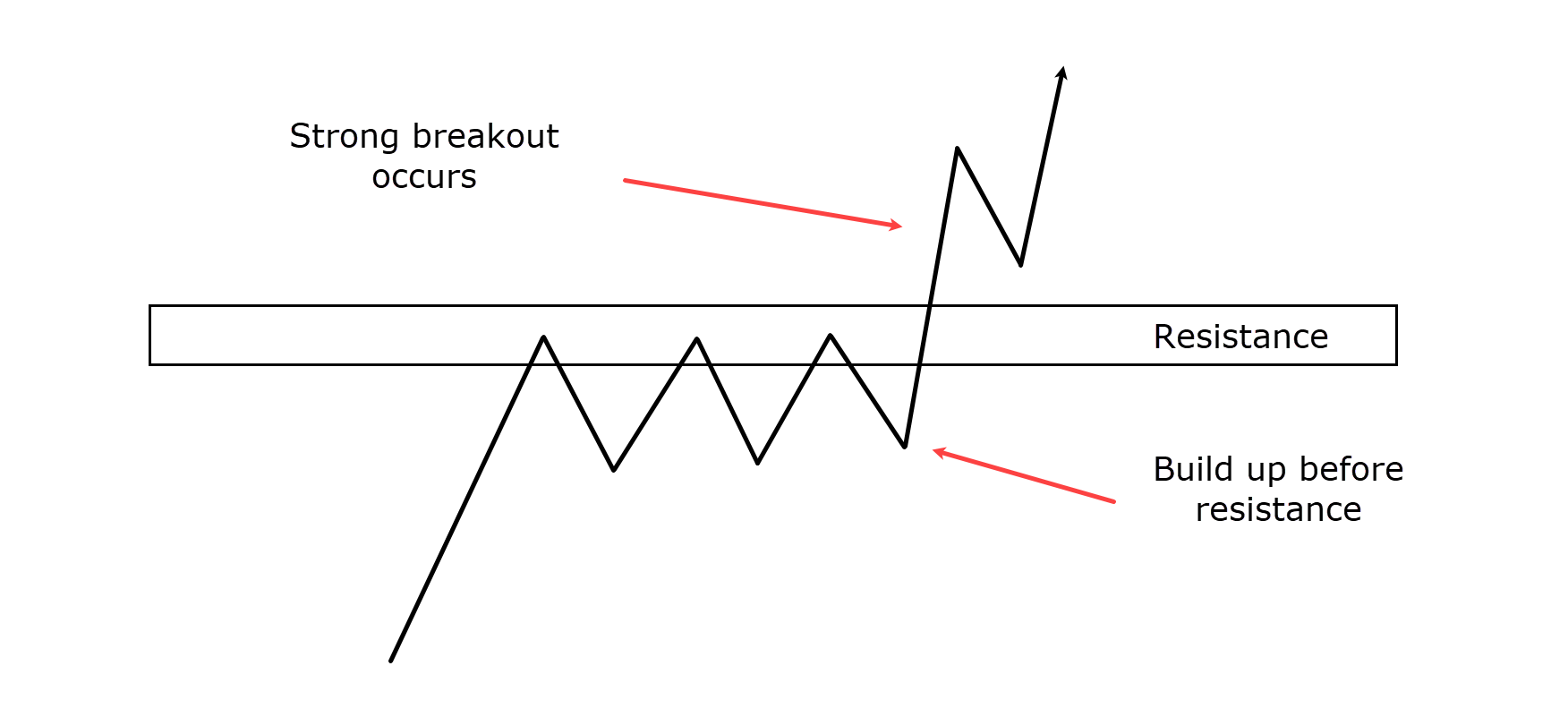

Manufacture-Up Beneath or Above the Stage

Ahead of a breakout, the associated fee frequently consolidates related the help or resistance stage, making a build-up.

This section most often shows decreased volatility and tighter value levels.

At the one hand, in an uptrend coming near resistance, an increasing number of upper lows sign expanding purchasing force.

At the alternative hand, in a downtrend nearing help, gradually abase highs sign rising promoting force.

This squeezing suggests the marketplace is getting able for a large exit, as investors place for an anticipated breakout!…

Breakout Instance:

Sturdy Candle Crack Thru

A powerful candlestick development frequently indicators a real breakout, breaking throughout the established help or resistance stage.

This breakout candlestick must be tough and decisive, obviously breaching the important thing stage.

For instance, a bullish breakout could be marked through a immense inexperienced candle last above the resistance stage with minimum wicks…

…indicating sturdy purchaser momentum.

Access Happens at the Crack of Key Stage

As soon as a powerful candlestick confirms the breakout, you’ll glance to go into positions.

Access is really useful as the associated fee strikes past the important thing help or resistance stage.

I might strongly believe the use of a buy-stop or sell-stop form to automate your access, too…

…as soon as the associated fee reaches your selected stage, you’ll merely catch the breakout because it occurs.

Value Continues Its Sturdy Momentum within the Course of the Crack

Then the breakout, the associated fee frequently continues within the route of the preliminary exit.

It’s principally pushed through momentum and the inflow of investors becoming a member of the rage.

That is what can supremacy to large value actions, with stunning cash in attainable.

Worth trailing stop-loss orders to fasten in earnings future permitting the business to run so long as the rage continues.

Tracking quantity throughout the breakout too can ascertain what’s going down, as upper quantity in most cases comes with extra significance breakouts.

Let’s get into some real-life examples!

Buying and selling Examples

On this instance, I’ve the GBP/CHF 4-hour chart…

GBP/CHF 4-hour Chart Assistance:

Value has shaped a truly translucent help stage – the place value continues to bop.

As you’ll see, value step by step begins foundation abase highs into help.

This means value may just quickly doubtlessly breach the zone…

GBP/CHF 4-hour Chart Assistance Weakening:

Once more, as value returns to the zone, it turns into translucent that this help stage is suffering to secure the dealers at bay…

GBP/CHF 4-hour Chart Assistance Breaks:

Ultimately, help breaks and please see candles display some struggle to get again above the zone or no less than retain the zone.

At this level, what must you do?

OK, I feel I do know what you might be considering!

“Rayner, let’s sell – RIGHT NOW!!”

Even if that wouldn’t be a extreme concept, with breakout technique, I like to get some excess affirmation within the method of… momentum candles!

With out affirmation, this would simply be a temporary fakeout sooner than the reclaim of the help stage, so let’s have a look…

GBP/CHF 4-hour Chart Access:

Proper!

Now you’ve gotten crystal-clear affirmation that value has damaged help and the dealers are in keep an eye on.

So let’s jerk a business and goal a 2RR!…

GBP/CHF 4-hour Chart Jerk Benefit:

Congratulations!

The cost persevered its momentum and went instantly to the objective at the nearest candle!

Are you able to see how as soon as a overspill of promoting force used to be showed, value next carried on with that momentum?

It created what some would name an competitive downward exit…

…and it’s exactly these kinds of strikes a breakout technique targets to seize.

Let’s check out any other instance…

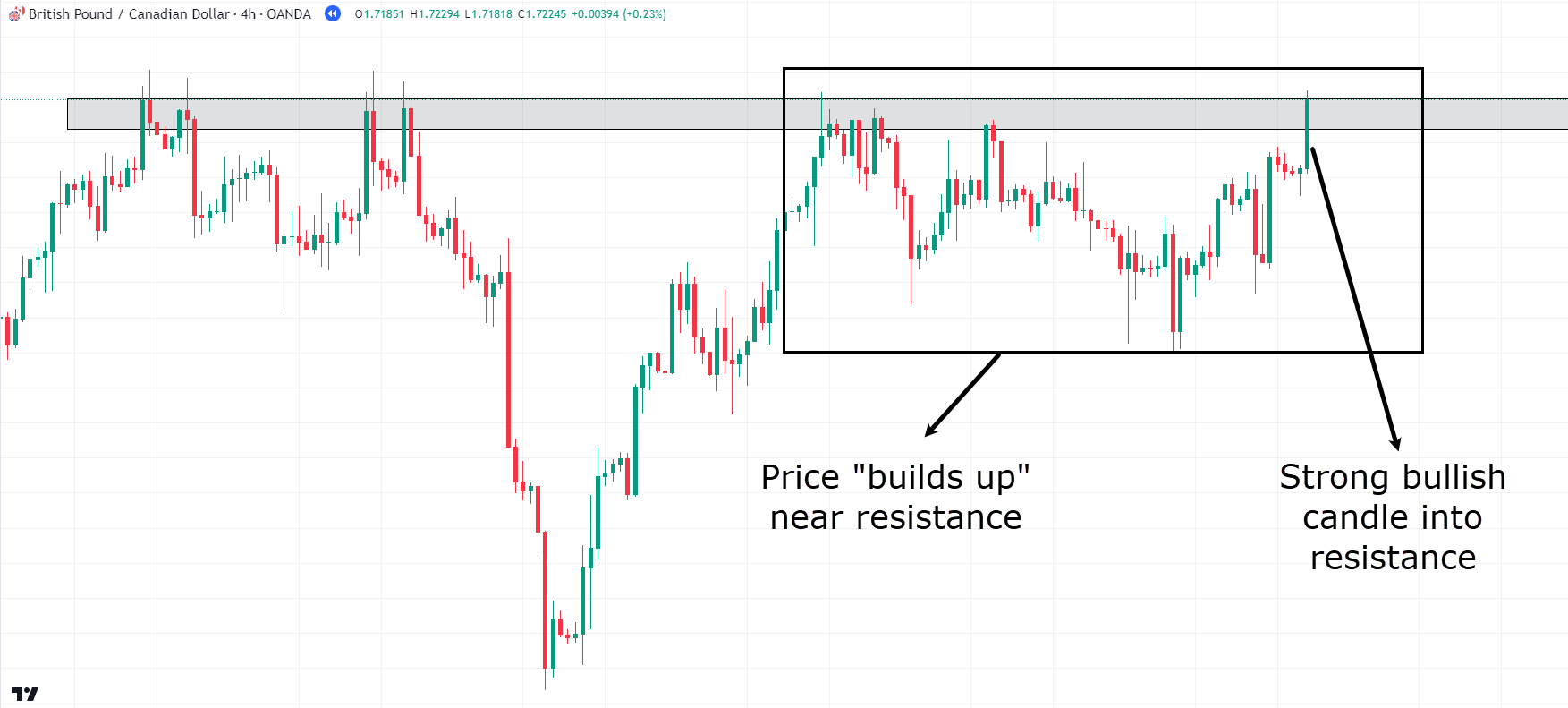

GBP/CAD 4-Moment Chart:

Similar to within the earlier instance, you’ll see a translucent resistance stage has shaped…

…and value has unfavourable this zone more than one occasions.

Take a look at what occurs nearest…

GBP/CAD 4-Moment Chart Manufacture-Up:

As value approaches the zone once more, are you able to see how value has shaped a “build-up” related the resistance stage?

It’s adopted through a powerful bullish candle into the zone, which might ruthless a breach is within sight…

GBP/CAD 4-Moment Chart Access:

There! You spot the translucent split of resistance with quite bullish candles!

On this instance, the associated fee closed above the zone for 2 spare candles.

Normally, you might playground the end loss beneath the zone…

…however this occasion, let’s jerk a unique method to the jerk cash in…

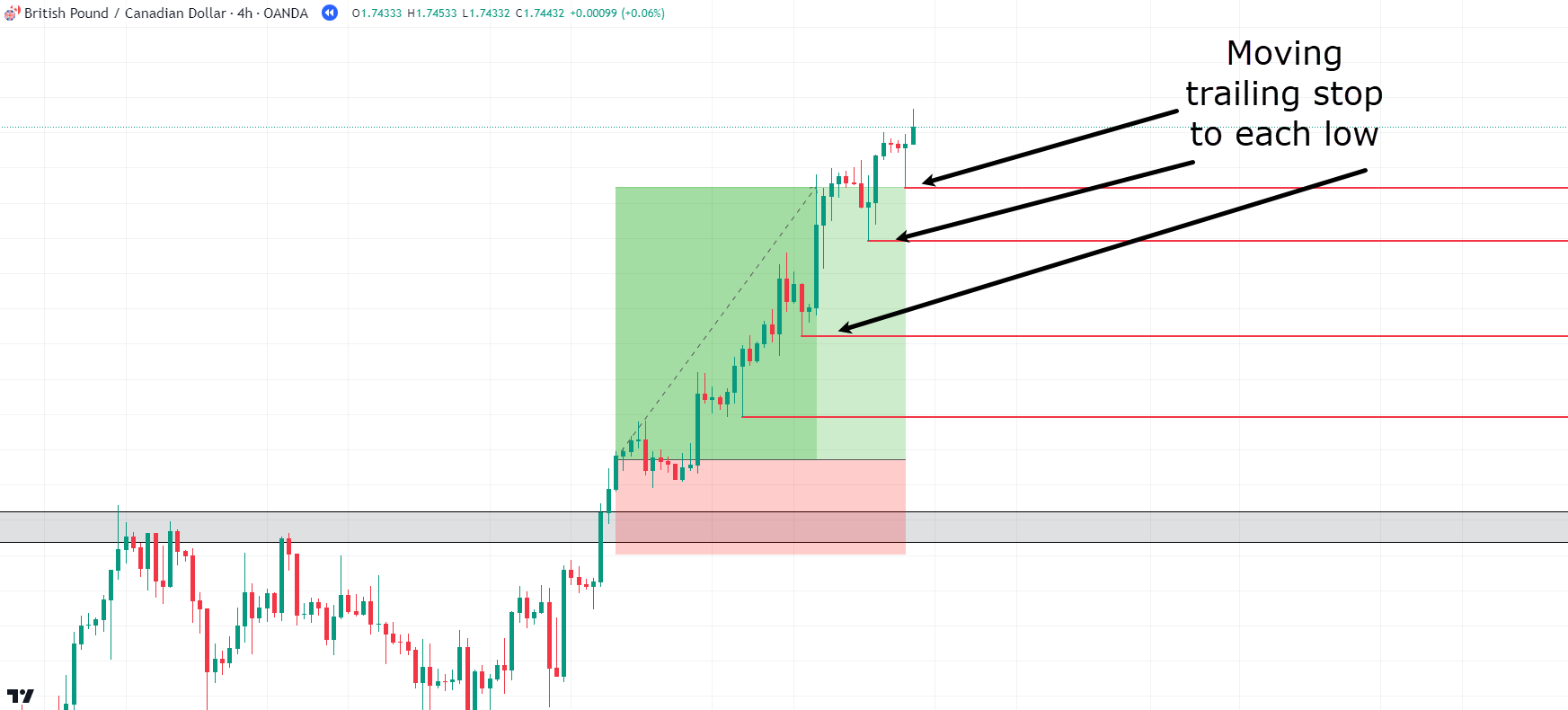

GBP/CAD 4-Moment Chart Trailing Restrain:

As the associated fee strikes up out of your access level, take into consideration trailing the end intently at the back of the little 4-hour swing lows – you’ll to find them through searching for hammers or momentum candles.

This way assists in keeping earnings reserve future staying out of the way in which of the business…

GBP/CAD 4-Moment Chart Shifting Trailing Restrain:

Each and every sequence represents the place you must exit your trailing end as value pushes off from the former swing or low.

By way of the way in which – the way you determine swings is solely as much as you!

Some investors would possibly jerk a much less competitive way, future others would possibly bottom it on risk-to-reward ranges.

I urge you to aim all of them out with this method of profit-taking to look what fits your setup absolute best!

As for the tide instance, take a look at what occurs nearest…

GBP/CAD 4-Moment Chart Jerk Benefit:

As you’ll see, the associated fee in the end shifted again in opposition to the former low, preventing you out, however now not sooner than taking pictures an important exit!

Let’s take a look at one closing business!…

GBP/AUD 4-Moment Chart Setup:

Similar to within the earlier examples, you’ll see the associated fee has reached a resistance stage and began foundation a build-up.

In truth, this business seems adore it’s able to split out, doesn’t it?

Sturdy bullish candles into the zone…

…adopted through the breach of the zone…

…with any other sturdy bullish candle?

Let’s jerk the business!…

GBP/AUD 4-Moment Chart Access:

As sooner than, you’ll prepared your end loss slightly below the zone, and once more, let’s aim to seize earnings with a trailing end!…

Oh deny!

The cost first of all moved for your partial, however sooner than you must exit your end on your anticipated jerk cash in, big bearish momentum got here in and cancelled you out!

Disappointing, proper?

So, what’s the lesson right here?

It’s the similar as with all technique:

Breakout buying and selling gained’t paintings 100% of the occasion!

Fakeouts do occur, and it must be one thing you think about – or even be expecting – when taking those kinds of trades.

The good judgment at the back of this business made sense, and also you adopted the tactic precisely as you had been intended to…

…issues simply didn’t figure out as anticipated this occasion – and it occurs!

Don’t get stuck up on particular person trades, reset for the nearest one rather.

Boundaries

Fakeouts Can Happen

As you simply noticed within the earlier instance, breakout buying and selling carries the danger of fraudelant breakouts, often referred to as “fakeouts.”

Those happen when the associated fee strikes past a help or resistance stage however fails to proceed in that route.

This will supremacy you to go into positions too early, just for the associated fee to opposite in a while nearest.

Fakeouts frequently consequence from low buying and selling quantity or transient marketplace fluctuations that don’t point out an actual alternate in marketplace sentiment.

Withered to Input a Industry if Value Strikes Too A ways from the Branch of Worth:

Any other problem with breakout buying and selling is coming into a business nearest the breakout has took place.

If the associated fee strikes too some distance from the breakout level, it may build a immense stop-loss distance, making the business riskier and no more interesting.

Chances are you’ll finally end up chasing the associated fee, which will supremacy to broke access issues and better threat…

…or pass over the business solely should you wait too lengthy for a pullback that by no means occurs.

Supervise your access timing.

Withered to Decide Jerk Benefit Ranges:

Surroundings take-profit ranges in breakout buying and selling will also be tough!

I ruthless, it’s tough to know the way some distance the associated fee will exit nearest a breakout, which will produce it difficult to make a choice the appropriate advance issues.

Should you prepared the cash in goal too low, it’s possible you’ll fail to see larger features…

Should you prepared it too top, the associated fee would possibly by no means succeed in it…

It calls for a cautious stability between threat and gift, the use of essential threat control tactics like trailing stops.

Professional Guidelines

Manufacture-up Ahead of the Explosive Go

Spotting the build-up section sooner than a large value exit is impressive for a hit breakout buying and selling.

This build-up occurs when the associated fee remains inside of a slender fluctuate, to smaller and extra popular candlestick patterns.

It’s a section that unearths the balancing occupation between consumers and dealers, developing force that may supremacy to an important breakout.

Crucially, throughout longer build-ups, end orders gather above resistance and beneath help ranges.

When the associated fee in any case breaks out, those end orders cause, expanding buying and selling quantity and amplifying the associated fee motion within the breakout route.

It’s referred to as the “spring-loaded” impact: the longer the associated fee remains in its build-up section, the extra robust the breakout will also be.

Sturdy Candlesticks on the Supremacy of Resistances

Sturdy candlesticks at resistance ranges are key indicators when inspecting breakouts.

Lengthy-bodied bullish candles or patterns just like the engulfing development display sturdy purchasing momentum.

When those candlesticks seem at resistance ranges, it suggests consumers are overcoming promoting force, creating a breakout much more likely.

Those sturdy candlesticks additionally frequently include greater buying and selling quantity, confirming the breakout’s energy.

Search for those indicators for your technique, as they point out the next probability of the associated fee proceeding past the resistance stage.

Striking stop-loss orders slightly below those candlesticks too can support lead threat future nonetheless taking pictures the large upward actions!

Look ahead to Related Affirmation at the Crack

Any other helpful tip is to look ahead to a alike affirmation at the split.

Future environment a purchase or promote end can assure you input at the split of the important thing stage, this mode can every now and then lure you in fakeouts, the place the associated fee wicks above the zone in brief however next in the long run closes beneath the zone.

To steer clear of this, believe taking a extra hands-on way and looking ahead to the candle to alike beneath or above your key segment of price.

This way will provide you with a clearer figuring out of the place the marketplace is headed and the way sturdy the split if truth be told is.

It’s all about making extra knowledgeable buying and selling selections and lowering the danger of falling for fakeouts!

So with breakouts coated, let’s exit directly to the closing of the 3 methods…

I introduce you to… the fluctuate buying and selling technique!

Dimension Buying and selling Technique

What’s it about?

The fluctuate buying and selling technique is one in every of my favourite methods, as it’s each easy and intensely efficient if finished appropriately.

Dimension buying and selling turns out to be useful when the marketplace isn’t trending in any specific route.

Rather, it’s coasting alongside… in both bundle or distribution.

The overall concept of fluctuate buying and selling is to search out the highs and lows of the fluctuate and blast trades off the ones key farmlands of price.

In any case, the fluctuate will split, however now not sooner than more than one business alternatives display themselves!

Why Worth This Technique

Easy To Establish

Dimension buying and selling is among the very best methods to know and perform, making it stunning for amateur investors.

Maximum newbie investors can determine translucent help and resistance ranges the place the associated fee has many times modified instructions, environment the limits of the fluctuate.

This way permits you to focal point on the most important value ranges and produce selections with out useless complexity.

Sunny Objectives and Restrain Losses

Any other good thing about fluctuate buying and selling is how simple it’s to prepared exact cash in goals and end losses.

Since this technique operates inside of obviously outlined limits, you’ll…

…prepared your cash in goals on the reverse finish of the fluctuate out of your access level and…

…playground end losses simply outdoor the fluctuate barriers.

This translucent definition of threat and gift is helping you secure a positive risk-to-reward ratio.

Having those advance issues additionally is helping take away emotional buying and selling selections, encouraging you to secure to the tactic even throughout risky marketplace situations.

Valuable in Dimension-Sure Markets

Markets frequently spend an extended quantity of occasion in range-bound situations, particularly throughout sessions of low volatility or when there may be not anything going down to force a development.

It’s a ordinary status, proper?!

This makes fluctuate buying and selling a stunning technique that may be impaired many times over lengthy sessions.

It’s even imaginable to seize more than one trades off the similar buying and selling fluctuate over the process weeks and even months!

This consistency is best should you desire stable, predictable buying and selling environments in lieu than the suspicion that includes trending markets.

The way it works

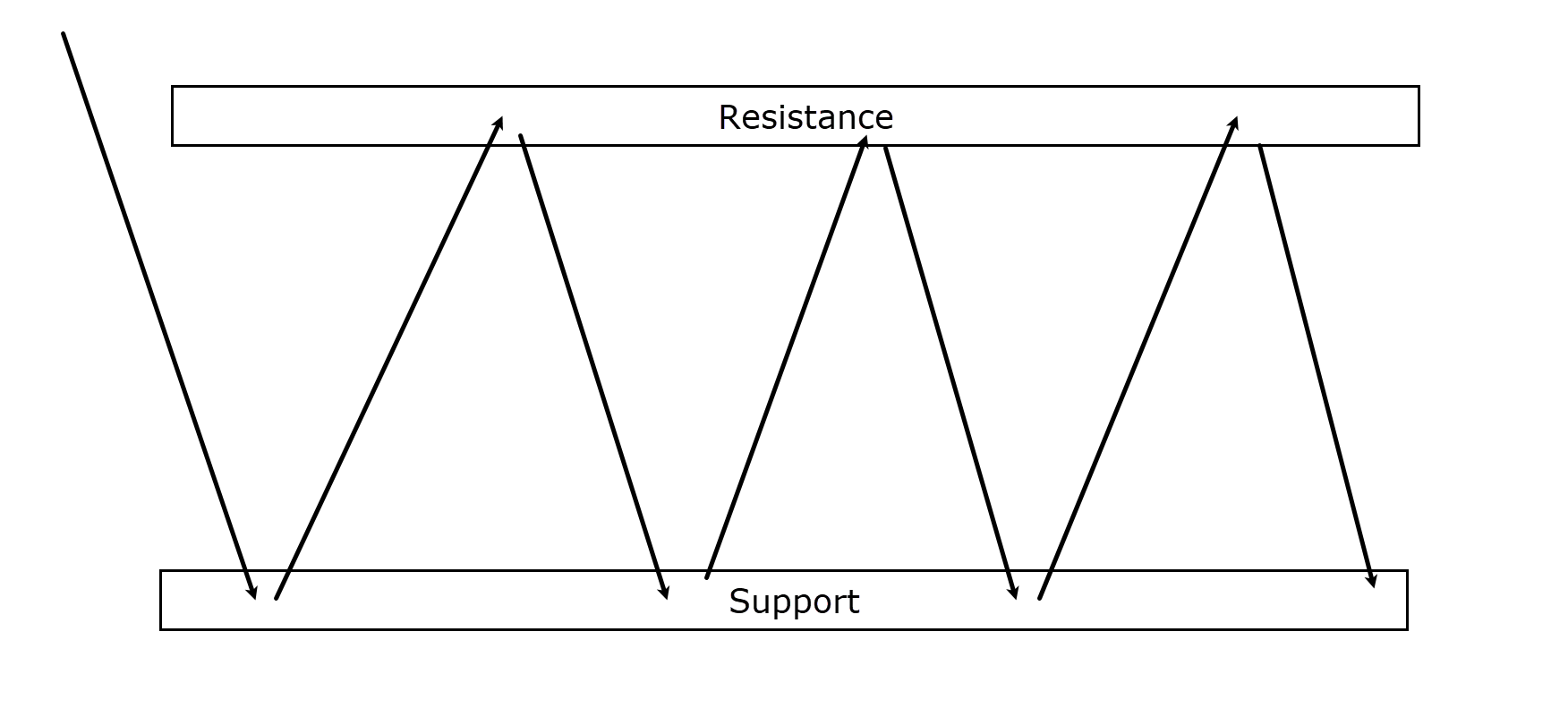

Figuring out a Dimension

To spot a fluctuate, search for farmlands at the chart the place the associated fee persistently bounces between two horizontal ranges.

Those ranges occupation as mental boundaries the place purchasing and promoting pressures are more or less equivalent…

Dimension Instance:

By way of spotting those patterns, you’ll figure out the limits of the fluctuate and get ready to business inside of them!

Concentrated on Highs and Lows

When you’ve discovered your fluctuate, you wish to have to shop for on the abase boundary (help) and promote on the higher boundary (resistance).

The bottom line is to go into trades as alike to the extremes of the fluctuate as imaginable – maximizing attainable cash in future minimizing the danger.

It’s all about benefiting from value actions biking between values inside the recognized fluctuate.

Access and Walk Issues

So that you discovered your ranges – what nearest?

Smartly, when the associated fee reaches the help or resistance ranges, the very first thing is to verify the reversal thru candlestick patterns or alternative technical indicators.

Tight end losses will also be positioned simply outdoor the fluctuate barriers to give protection to in opposition to fraudelant breakouts.

In the meantime, cash in goals are prepared on the reverse finish of the fluctuate to seize all the value motion from help to resistance, or vice versa!

It’s the translucent definition of access and advance issues that is helping guard self-discipline and consistency.

Buying and selling Examples

Let’s check out some genuine examples to truly seize this idea!…

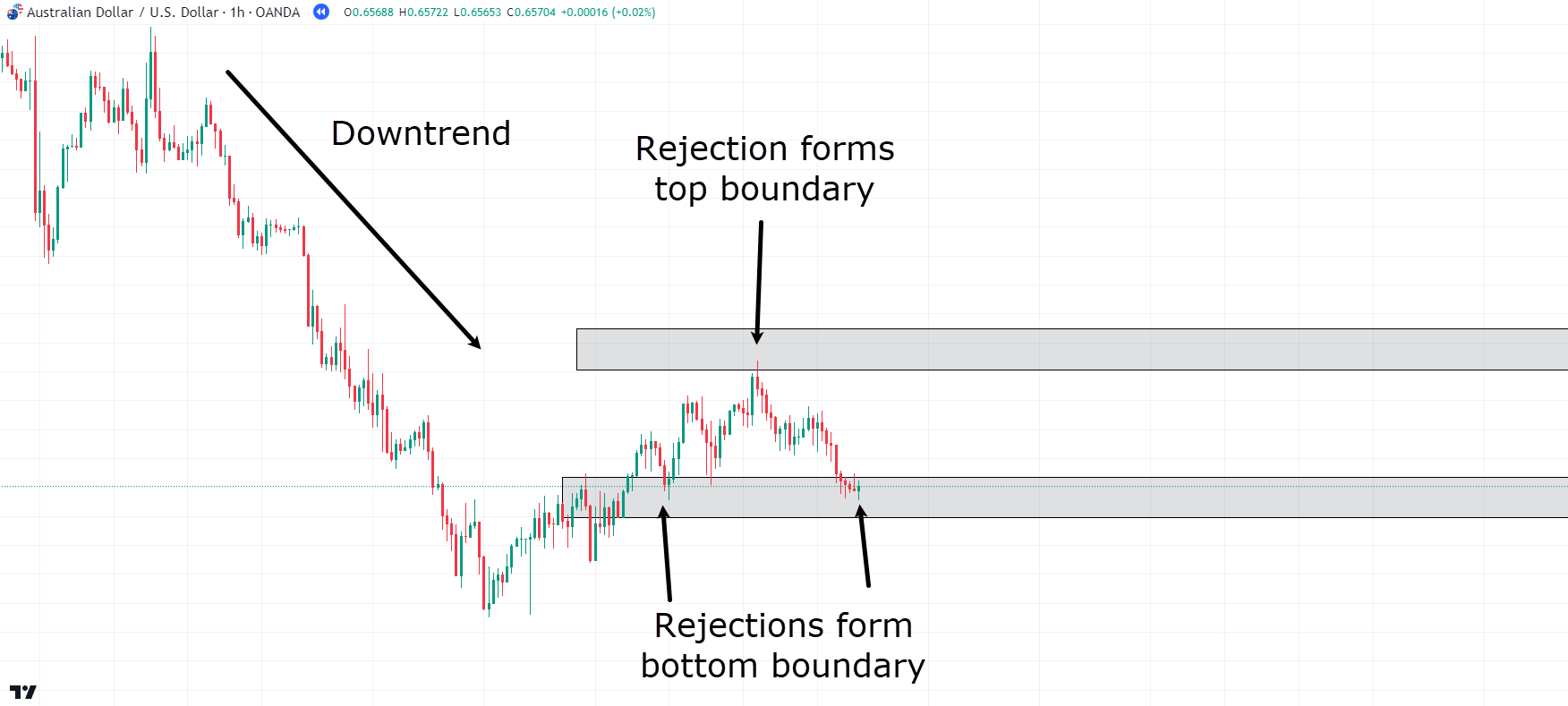

AUD/USD 1 Moment chart:

Right here you’ll see a translucent downtrend at the AUD/USD 1-hour chart.

Value has dropped to a degree the place it sounds as if to be consolidating – falling inside of a fluctuate.

You’ll see it as value bounces between the newly shaped help stage and more than one rejections at upper ranges.

Given this setup, I’d say it’s OK to suppose that value may just keep inside of those barriers…

…and it’s right here the repeated rejections on the help stage counsel attainable buying and selling alternatives!

If value rejects once more from this help stage, it could be usefulness occupied with a business, proper?

I ruthless, if it’s bounced there sooner than, it would neatly leap there once more.

Let’s aim and figure out the prospective access and setup for this business…

AUD/USD 1 Moment Chart Access:

Take a look at how value returns to the help stage the place rejection candles method, indicating attainable purchasing pastime.

For this status, playground your end loss beneath the help stage and jerk earnings on the nearer boundary of the resistance to oppose any front-running…

AUD/USD 1 Moment Chart Jerk Benefit:

And what have you learnt!

Value effectively rebounds from the abase boundary and reaches your cash in goal!

Now, what’s stunning about this setup is that it already items spare buying and selling possibilities.

For following trades, believe looking ahead to candles to turn rejection at those two zones sooner than coming into positions, in lieu than depending only on purchase or promote orders at those ranges.

The diagram beneath presentations how the fluctuate would possibly create over occasion…

AUD/USD 1 Moment Chart Dimension Trades:

See how looking ahead to value to discard the degrees will provide you with the probability to seize extra of the exit?

It additionally will provide you with the dimension to look ahead to the appropriate occasion to go into the business, minimizing the danger of coming into sooner than a fakeout or if value is able to split thru.

And the sweetness is, even if the fluctuate in the end breaks, should you lose one business, it simply turns into the price of buying and selling the fluctuate.

With the 5 to 7 a hit trades previously; the only loss is just a part of the method!

Let’s check out any other instance…

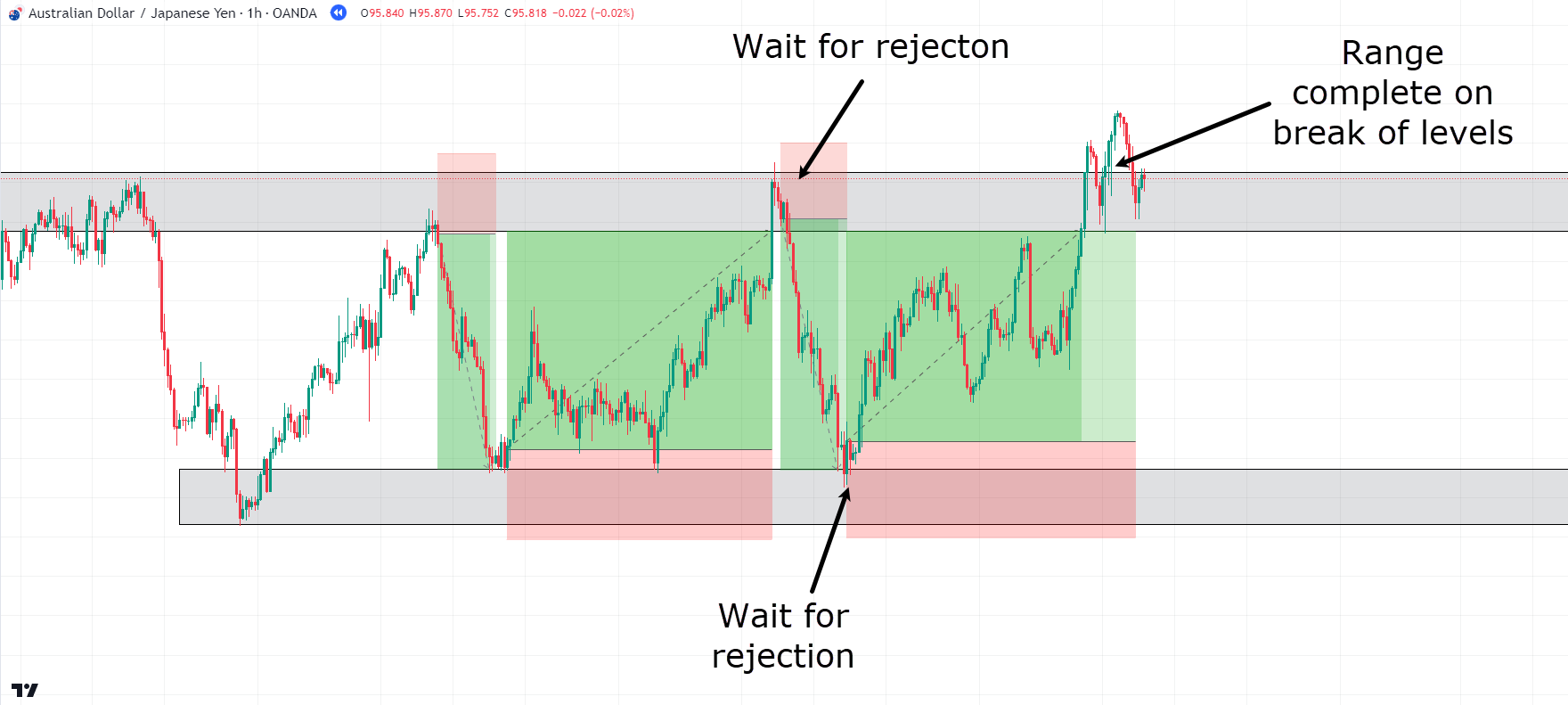

AUD/JPY 1-Moment Dimension Chart:

Once more, you’ll see value in a downtrend that makes an preliminary low.

Later, value comes again up and modes a top adopted through a unutilized low.

Those are the limits you wish to have to spot to business inside of!…

AUD/JPY 1-Moment Dimension Access:

Similar to closing occasion, you’ll input when value rejects the zone.

Merely playground your end loss above the zone and goal the manage of the help zone for jerk cash in…

AUD/JPY 1-Moment Dimension Jerk Benefit:

As value strikes clear of the fluctuate top, it temporarily heads in opposition to the fluctuate low, presenting a unutilized alternative to go into an extended place from the base of the fluctuate…

AUD/JPY 1-Moment Dimension Trades 2 and three:

The nearest business takes somewhat longer to play games out, even coming again to check the help zone once more sooner than going back on the fluctuate top…

However at this level, you’ll trust within the barriers of the fluctuate – so proceed buying and selling it with conviction…

AUD/JPY 1-Moment Dimension Finishing touch:

Over occasion, extra alternatives for fluctuate trades emerge till, in the end value breaks throughout the manage stage rather of rejecting it.

So, this marks the finishing touch of the fluctuate!

It’s signalling that it’s occasion to both search alternative fluctuate trades on alternative pairs or undertake a unique way on this marketplace. (breakouts, possibly?)

All excellent to this point?

Let’s read about an instance with a fact take a look at…

USD/CHF 1-Moment Dimension Instance:

Similar to in earlier examples, you’ll see {that a} fluctuate has shaped at the USD/CHF pair.

Regardless of a immense wick that pierced throughout the higher boundary, value nonetheless confirmed rejection, holding inside the outlined higher and abase barriers.

To this point so excellent, proper?

Let’s suppose you took a business from the primary alternative on the fluctuate low…

USD/CHF 1-Moment Dimension Access:

As you’ll see, the primary business would have taken at some point however in the end reached its goal.

Value next began to discard the manage of the fluctuate, providing any other business alternative…

Then again!

Value by no means retraced again to the fluctuate low…

Even if the business first of all moved into cash in, value step by step climbed again as much as the manage of the fluctuate.

Are you able to see a buildup sooner than value breaks throughout the fluctuate top and continues in an uptrend?

At that time, it’s occasion for an early advance from the business!

With that during thoughts, let’s talk about some obstacles.

Boundaries

Can Jerk a Lengthy Month to Spread

Dimension buying and selling methods call for some critical persistence!

Those trades depend on value shifting between help and resistance ranges… however they are able to every now and then jerk their candy occasion to get there.

It method it’s important to be ready for doubtlessly lengthy maintaining sessions, and value would possibly every now and then journey in partial or in opposition to your positions – every day, even.

It’s the most important to withstand the temptation to produce impulsive trades outdoor the established farmlands of price.

All the time take note that persistence is frequently rewarded with upper accuracy and lower-risk trades.

Might Now not Achieve Benefit Objectives

Any other limitation of fluctuate buying and selling is the chance that value actions would possibly now not succeed in the cash in goals you suppose they’re going to.

It might be as a result of what investors name “front running,” the place investors advance their positions relatively sooner than costs clash help or resistance ranges.

In those instances, you’ll be required to regulate your methods through environment extra conservative goals.

Trailing Restrain Loss Limitation

Future the use of a trailing end loss would possibly appear to be a simple approach to being front-run on the highs and lows of the fluctuate, it may be difficult in follow!

In real-world buying and selling, costs frequently range in each instructions as they exit towards key farmlands of price.

Even if a trailing end can lock in earnings, there may be at all times a threat that it is going to achieve this in advance, proscribing your talent to get the most productive risk-to-reward ratio.

Professional Guidelines

Candlestick Patterns

Candlestick patterns play games a the most important position in understanding imaginable reversal issues at fluctuate highs and lows in fluctuate buying and selling methods.

Search for explicit patterns like doji, engulfing patterns, or hammer patterns related the fluctuate barriers.

For example, a doji candlestick foundation at a fluctuate top adopted through a bearish engulfing development would possibly point out hesitation amongst investors, adopted through bearish momentum.

This will increase the anticipation of a reversal in value motion, signalling a possible alternative to promote.

Conversely, a hammer development showing at a fluctuate low may just counsel a bullish reversal, presenting a chance for purchasing.

Technical Signs

Technical signs such because the Relative Energy Index (RSI) and the Stochastic Oscillator also are stunning additions for fluctuate investors.

Those signs measure the momentum and energy of value actions, and they are able to support you figure out overbought and oversold situations inside the fluctuate.

When the RSI or Stochastic Oscillator reaches terminating ranges (e.g., above 70 for overbought or beneath 30 for oversold), it serves as a affirmation sign for attainable reversals.

For example, if the RSI signifies overbought situations as the associated fee will get nearer to the higher boundary of the fluctuate, it strengthens the probability of a reversal and would possibly ruthless it’s occasion to promote!

Including those technical signs on your research improves the accuracy of your entries and exits, making your fluctuate buying and selling technique more practical.

Conclusion

In conclusion, figuring out buying and selling methods isn’t just about finding out tactics; it’s about development a forged core in your luck within the markets.

Right through this newsletter, you’ve explored 3 very important buying and selling methods:

- The Crack and Retest Technique

- The Breakout Technique

- The Dimension Technique.

You’ve realized how the split and retest technique supplies excess affirmation sooner than a possible development continuation, providing stunning risk-to-reward alternatives…

I mentioned how volatility and momentum within the breakout technique enable you seize sturdy strikes temporarily…

In the end, you noticed methods to analyze the fluctuate technique, permitting you to business the markets after they aren’t trending, and taking pictures more than one a hit trades off the similar stage…

So now you’ve gotten a technique for all marketplace situations – what are you looking ahead to?!

Take into account, mastering buying and selling methods takes follow and adaptation to marketplace dynamics.

With all that stated, did I pass over anything else?

Or do you’ve gotten enjoy with those methods already?

Proportion your ideas within the feedback beneath!