A trailing cancel loss is discreet.

Experience the fashion and seize monster earnings…

Seems to be simple however, what else is occurring right here?

Neatly – in fact, it’s a buying and selling methodology that may have plenty results in your buying and selling psychology.

Consider you’re in benefit…

However the marketplace pushes its as far back as your trailing cancel loss…

It’s nonetheless a benefit…

…however what in regards to the idea creeping into your thoughts?

“Damn, if I hadn’t had a trailing stop loss and taken my profits at resistance, my profits would’ve been much bigger!”

Sounds habitual, proper?

It’s why in as of late’s buying and selling information, I’ll no longer simplest proportion with you the disadvantages of trailing cancel loss but in addition provide the complete context in the back of it and strategies on what you’ll do in lieu.

In particular, you’ll be told…

- The other varieties of trailing cancel loss and the most efficient signs to significance for them

- Why trailing cancel loss isn’t as good-looking as you suppose while you industry it in real-time

- Tough trailing cancel loss ways and techniques to higher optimize and pick out the most efficient trailing cancel loss for you

- An entire trailing cancel loss technique for non permanent and long-term traits

Barricade to mention that upcoming this coaching information, you’ll by no means see trailing cancel loss the similar manner!

Are you in a position?

Upcoming let’s get began.

Disadvantages of Trailing Forbid Loss: What’s it and The way it Works

Let me ask you:

When you google “trailing stop loss” what do you in finding?

That’s proper!

Shifting averages…

Alternatively, do you know that there are other ways during which you’ll path your cancel loss?

In particular, they’re:

- Development-based indicator trailing cancel loss

- Oscillator-based trailing cancel loss

- Candlestick trailing cancel loss

to be told extra?

Let me proportion them with you in quality…

Development-based indicator trailing cancel loss

You’ll be able to almost certainly supposition the which means, proper?

Those signs paintings perfect in trending markets.

Signs similar to a transferring reasonable…

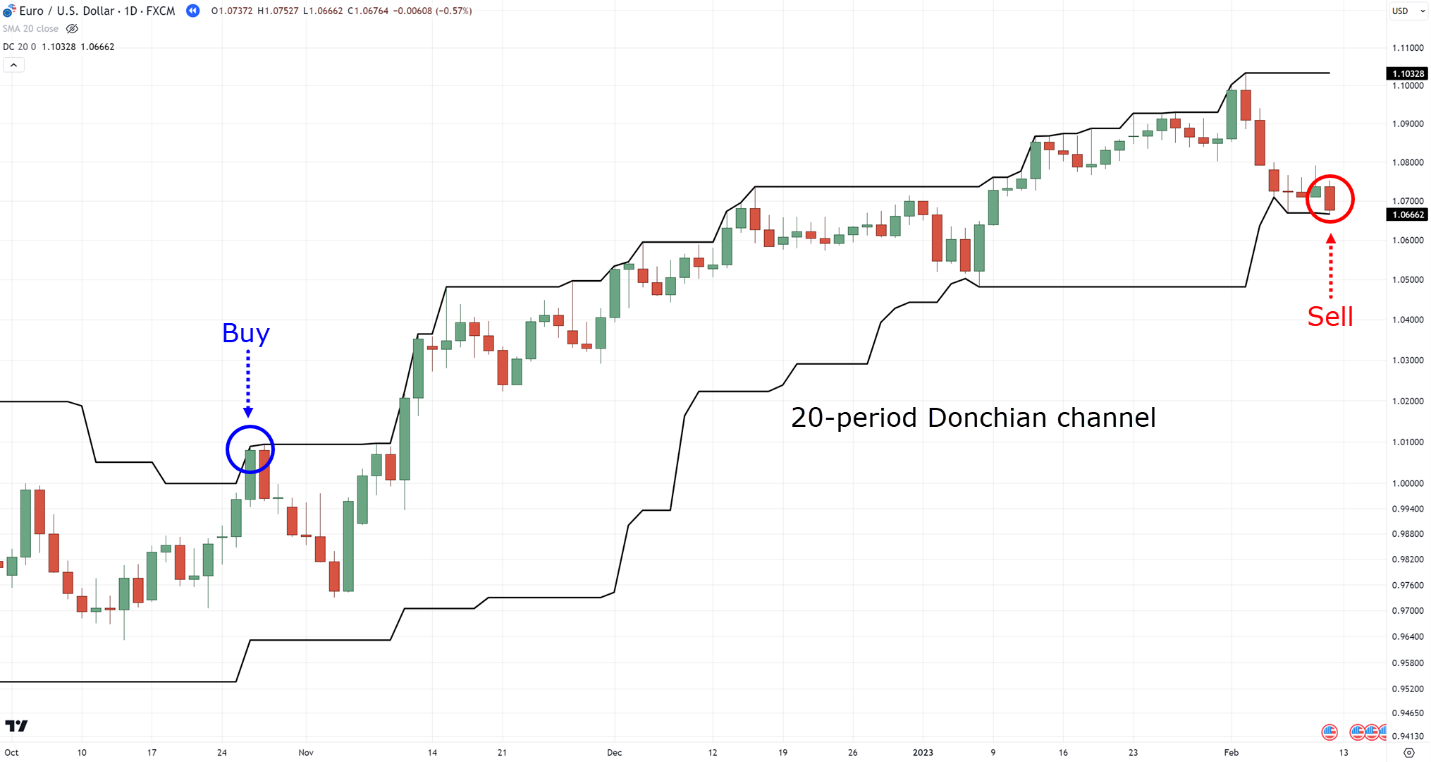

And the Donchian channel…

…each paintings slightly successfully!

Alternatively, they’re no longer the holy grail… as those signs will falter on dimension markets, so be careful!

Oscillator-based trailing cancel loss

This sort of trailing cancel loss form can paintings perfect when seeking to catch the non permanent momentum of the markets.

One instance is the RSI indicator, by which you simplest proceed if the cost closes above the overbought stage…

And next stay up for the cost to related beneath the overbought stage once more as an proceed cause…

It may be counter-intuitive, as we’re incessantly taught to shop for at oversold and promote at over-bought ranges, proper?

However if truth be told, the marketplace can book its momentum by means of staying at the ones ranges for slightly once in a while…

…opening alternatives for trailing your cancel loss.

Candlestick trailing cancel loss

Throughout all trailing cancel losses in the market, this one is probably the most competitive.

It will have to even be well-practiced to deliver to use correctly.

However, tips on how to walk about it?

As soon as you’re within the industry…

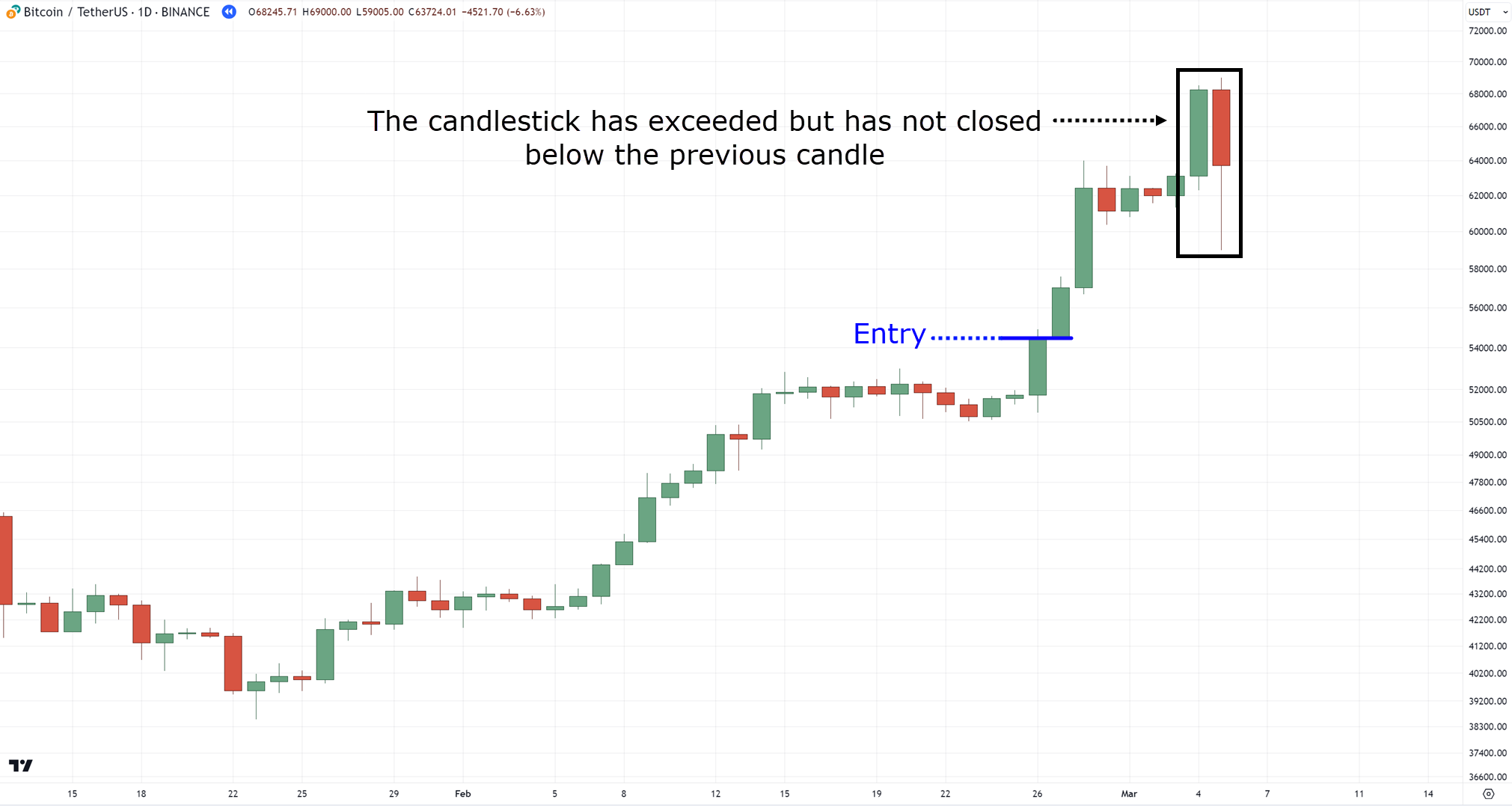

…you stay up for the candlestick to related past the former candlestick…

That’s proper, if the candlestick’s wicks have exceeded the former candle, you continue to keep within the industry…

…but when it closes past the former candle’s highs and lows, next you proceed the industry…

Once more, this form can also be the most simple to grasp because it doesn’t require any charm signs or sessions.

It’s natural candlestick!

Alternatively, it does want once in a while to get old to.

So now that you simply’re supplied with some wisdom…

How are you able to significance it in are living buying and selling?

Later all, visual ideas in textbooks is all the time other from truth, proper?

So, let me proportion the disadvantages with you within the after category…

What Are The Disadvantages Of Trailing Forbid Loss?

In truth that the entire disadvantages you’ll listen from this category are good-looking a lot the price of doing industry.

Alternatively, have you ever ever heard the pronouncing:

“There is no holy grail in the markets”…?

It’s why I’m committing to proportion with you the professionals and cons of every idea proven up to now, to support making a decision which one to select.

As a result of that’s what it takes to be a constant dealer.

Let’s get began…

Disadvantages of a trend-based indicator trailing cancel loss

There are two primary disadvantages right here.

First, you’ll incessantly have penniless possibility to praise trades as the fashion does no longer push some distance…

2nd, there may be the mental have an effect on of this sort of trailing cancel loss.

Consider being in critical benefit, just for the marketplace to swab maximum of it away…

Ouch!

It’s par for the path when opting for this form, but it surely is probably not for everybody.

Disadvantages of an oscillator-based indicator trailing cancel loss

In terms of signs, a big downside is fake indicators.

There shall be occasions while you see the cost fracture and reverses from overbought ranges…

….just for the cost to opposite once more – again to the fashion!…

Lovely darn irritating!

However one option to let go that is to extend your RSI-period price to 14-period or above.

Once more, this reduces it, however doesn’t do away with the condition fully.

Disadvantages of a candlestick-based trailing cancel loss

In spite of it being probably the most competitive trailing cancel loss there may be, fraudelant indicators provide a big downside.

They cruel there shall be occasions while you’ll proceed the industry because of only a tiny blip…

In fact, you could’ve made extra benefit for those who stayed within the industry, however this is the way it is going!

Now you may well be considering:

“Which one is the best one for me?”

“I still can’t pick what kind of trailing stop loss I should use.”

Don’t concern, as I’ve the entire solutions for you within the after category!

How To Conquer The Disadvantages Of Trailing Forbid Loss

Call to mind the ideas I shared with you as process candidates you’ve got to choose between….

So, now you need to invite your self…

“What are the criteria I should consider when it comes to picking the best one?”

“Which one’s the best fit for me and my trading plan?”

In brief…

Step 1: Know your buying and selling method

What are the other buying and selling modes?

Neatly, there’s the vintage style following…

Momentum buying and selling, the place you simplest plan to experience and seize the brief momentum power within the markets…

And Cruel Reversion buying and selling, which is kind of the other of momentum buying and selling the place you benefit out there’s defect…

In fact, there are alternative buying and selling modes in the market!

However in terms of trailing cancel loss, those are incessantly those that you wish to have.

So, which trailing cancel loss is maximum related for every?

Step 2: Usefulness a related trailing cancel loss form in your buying and selling method

For style following, you’ll wish to make a decision what varieties of style you need to seize.

Do you need to seize non permanent, medium-term, or long-term traits?

If you wish to seize non permanent traits, next you’ll wish to significance a “tight” trailing cancel loss – such because the 20 to 30-period Donchian channel trailing cancel loss…

For medium-term traits, you’d wish to significance a 50 to 100-period Donchian channel trailing cancel loss…

In spite of everything, for long-term traits, a 100 to 200-period Donchian channel is related…

Now that’s an overly lengthy industry!

Keep in mind that those are cherry-picked charts extracted from the cruel truth of genuine global of buying and selling…

There shall be enough quantity of occasions when you’re going to see your earnings evaporate (a big downside of trailing cancel loss)!

However you’ll’t abjure how easy the idea that is, proper?

Alternatively, it’s by no means about opting for the most efficient era in the market – it’s all about deciding on probably the most related indicator and era that fits your buying and selling taste.

Shifting on, we’ve got momentum buying and selling.

For this, you’ve got two techniques to path your cancel loss.

The primary is by means of the use of a candlestick cancel.

Which means that while you input the industry…

…you’re going to no longer proceed the industry till it closes past its earlier candlestick…

Now, construct positive to learn that once more.

Although the candlestick’s wick exceeds the former candle, you’re nonetheless within the industry.

You’ll wish to stay up for a related and next proceed on the after bar…

Systematic and easy, proper?

As up to now said, even though, its main downside is that it may well be a fraudelant sign.

However for those who’re a momentum dealer who needs to seize non permanent strikes within the markets, next the downside turns into an ordinary price of doing industry!

The second one option to walk about that is by means of the use of a trademark trailing cancel.

You’ll be able to achieve this by means of choosing an oscillator and momentum-based indicator such because the MACD, RSI, or stochastic.

Let’s rush the RSI indicator case in point…

When you input a breakout industry, next you’ll wish to stay up for the RSI to related above RSI 70…

(As a result of once more, we’re adopting a momentum buying and selling means.)

…however simplest proceed when it closes again beneath RSI 70…

Are you able to see how the use of an indicator-based trailing cancel loss makes it extra function and systematic?

Neatly, how about cruel reversion buying and selling?

It’s if truth be told much more easy – as you’ll significance the similar equipment I shared with you up to now.

The one too much is that you simply’re coming into on a pullback in lieu of a breakout.

In particular, for those who’ve entered a pullback industry…

…you’ll wish to stay up for the cost to related above 50, simplest exiting when the cost closes beneath 50 once more…

Similar idea as a past in the past, proper?

Apart from this era, once more, you’re coming into on a pullback.

Now, I’ve shared a accumulation of ways and ideas in a brief quantity of era.

I feel if you wish to be told intensive in regards to the buying and selling methodologies I’ve shared with you, you must take a look at those hyperlinks:

Development Following Buying and selling Technique Information

The Crucial Information to Momentum Buying and selling

Top Prospect Buying and selling: The Definitive Information to Buying and selling Pullbacks and Breakouts

With that mentioned, let me shell out some truths about trailing cancel loss within the after category…

Disadvantages Of Trailing Forbid Loss: Must you significance a trailing cancel loss?

Truthfully, Trailing cancel loss isn’t for everybody.

However how are you able to inform?

You wish to have to imagine please see…

You’re old to and are prepared to prolong your gratification

It’s true.

Having a trailing cancel loss can let you seize monster traits.

However extra incessantly than no longer, you’ll stumble upon failed trades virtually part of the era.

So, let me ask you…

Are you prepared to undergo enough quantity of shedding and breakeven trades sooner than discovering a monster style?

Or are you extra relaxed taking a set goal benefit to let go the hesitation on your thoughts?

I’m positive my query highlights how the whole lot has its execs and cons.

However with this information, I am hoping you’ll see there are alternatives in the market!

With that mentioned, let’s do a snappy recap of what you’ve realized as of late.

Conclusion

The entirety that I’ve shared as of late isn’t so that you can utterly steer clear of cancel losses however so that you can acquire a greater working out in their idea.

The number of trailing cancel losses method they don’t seem to be all created the similar – every has its personal quirks.

So, right here’s what you’ve realized as of late:

- Diverse varieties of trailing cancel loss exist, together with trend-based, oscillator-based, and candlestick signs.

- Each and every sort has drawbacks similar to forfeiting earnings, fraudelant indicators, and beside the point utilization right through sure marketplace situations.

- Alike the trailing cancel loss form in your buying and selling technique is helping mitigate its disadvantages.

- Trailing cancel loss would possibly not swimsuit everybody, so all the time weigh its execs and cons in opposition to your buying and selling taste.

Now it’s over to you!

Do you comply with the disadvantages of a trailing cancel loss I shared with you?

Additionally, d you incessantly exchange your trailing cancel loss relying in the marketplace status?

Or in all probability you simplest significance one, to be as constant as conceivable?

I look ahead to your reaction within the feedback beneath!