Here’s the thing…

Many novice traders start trading with the impression they can make a quick buck.

Some others believe they have a “holy grail” strategy, destined to make a 50% return in one week!

Before long, these approaches tend to bring you back to breakeven…

…and eventually, a loss!

But it doesn’t end there.

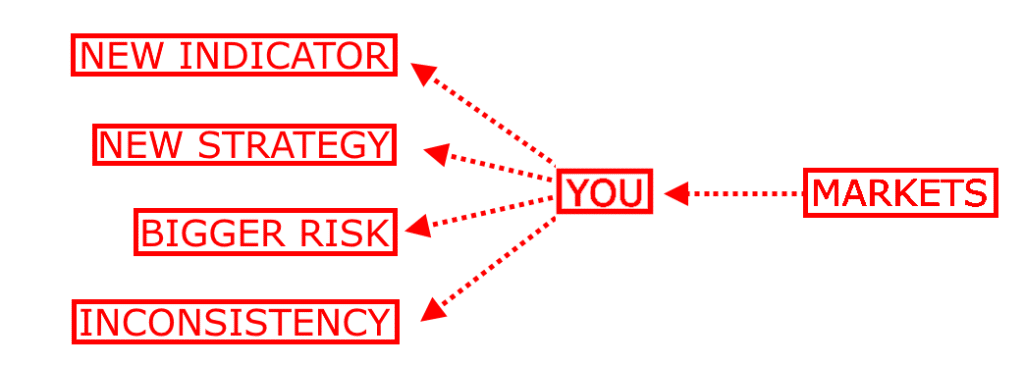

As a result, these very same traders start hunting for the next quick fix…

…searching for the next “best” indicators… or this month’s “killer” trading algorithm…

The cycle begins again!

What’s happening that keeps traders in this fruitless loop?

Isn’t there a better approach to trading that puts you on an actual path to profitability?

Well, that’s exactly what I want to show you in today’s guide.

Specifically, you’ll learn:

- Why unrealistic expectations create a “cycle of loss” in trading

- How having a stable source of income can improve your trading mindset

- The importance of process-oriented goals over outcome-based goals and the three key trading goals every beginner should focus on for long-term success

By the end of this article, you’ll have a clear blueprint for approaching trading as a business.

One that minimizes emotional stress and maximizes your long-term success!

Sound good?

Then, let’s get started!

The truth about the “cycle of loss” and how it keeps your trading goals away

There’s nothing wrong with dreaming big in trading.

It’s not impossible for trading to replace your full-time job!

One day in the future, trading could make you a lot of money each month, but…

…just dreaming about it doesn’t teach you anything about reality.

It acts as a distraction and can put you into a cycle of loss.

Let me explain…

Why unrealistic goals in trading may hurt your results

As a new trader, you often translate goals into expectations…

This can lead to you projecting such expectations onto the markets…

And then what happens when you hit that first losing streak?

That’s right, the market crushes your expectations and drills into you!…

You guessed it…

You lose confidence!

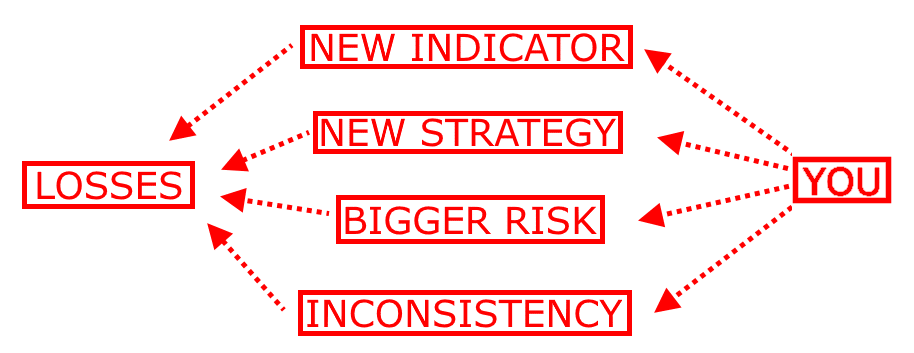

Questioning yourself, you start looking for that “holy grail” in trading, the “best” strategy you can find.

The ending?

Stuck in a never-ending cycle of losing or blowing up accounts…

You see, my friend…

It all boils down to this one thing:

Unrealistic expectations.

How expectations set you back from your trading goals (and what can you do about it)

I know what you’re thinking right now…

“If trading won’t replace my full-time job, I should pursue something else!”

“If trading is just gambling, I’d rather go to a casino!”

Honestly, trading isn’t for everyone.

And for some traders, they grow to realize that at some point in their journey.

But here’s one thing you should hear before packing it in…

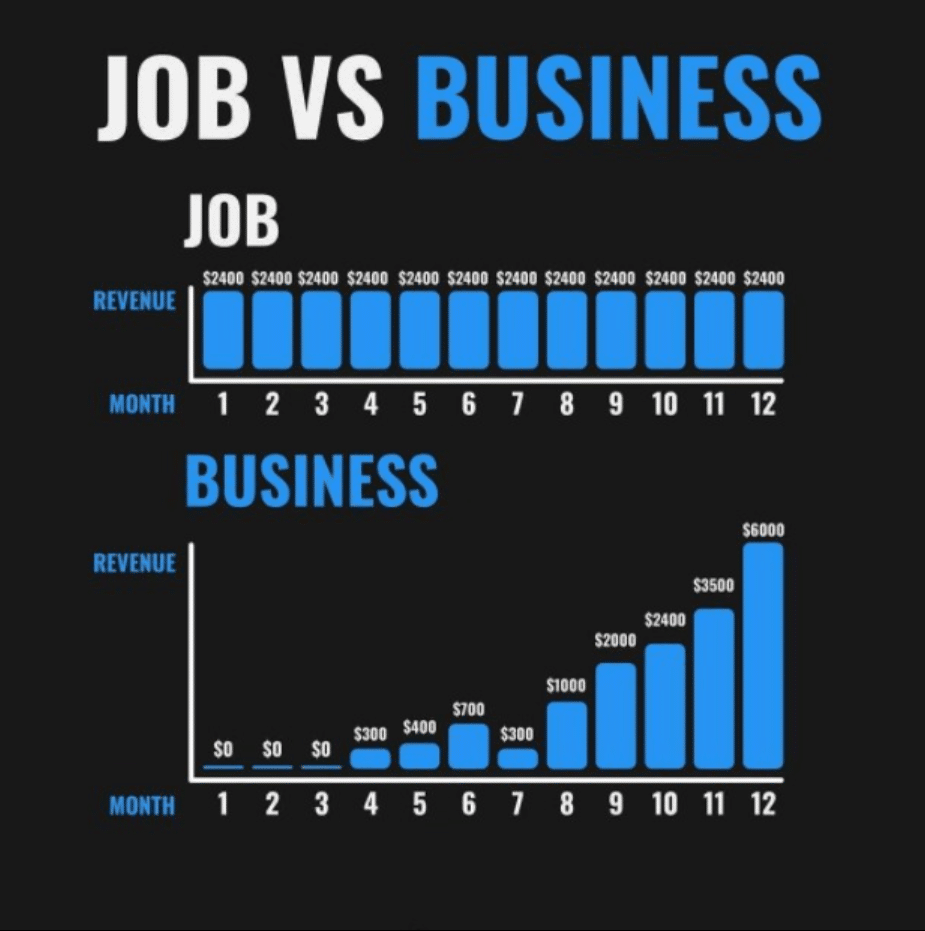

Trading is a business and not a job

There is financial security in having a job.

However, expecting that kind of stability in trading is a bad idea.

Why?

Because, in reality, starting trading is more like growing a business.

And just like any other business, there may be months or even years before you see any results!

So, how should you approach trading as a beginner?

What are the right trading goals to take towards consistent profitability?

Well…

Reduce your expectations in trading!

If you can, remove all of them.

And yes, I know it’s easier said than done!

But there’s a great way to help reduce the pain right from the beginning…

Have a stable source of income

You might be a student planning to trade using your allowance, or an employee making a regular wage…

But when starting your trading business, a stable income can be a massive source of comfort.

It certainly removes pressure when trading!

Importantly, it also enables you to be receptive to learning, which is exactly where you need to be.

Now, I know I shared a big image showing how rewarding a business can be – it might look a lot more exciting than a job!

However, building security first is an important safety net, just in case things don’t work out at the start.

You need to accept that in the beginning, there’s a lot of uncertainty in any business.

Only by having a stable source of income (no matter how big or small) can you reduce that risk of uncertainty.

Does that make sense?

Then let’s make a plan!

Trading goals that propel you towards profitable trading

So…

What trading goals should you focus on at the start?

Trading goals #1: Explore different kinds of trading methods out there

At this point, you should not be live trading yet.

Get a demo account, but treat it as if it were really your own money on the line.

It’s time to gain some perspective on trading…

…watch how other people trade…

…and explore different ways to profit from the markets!

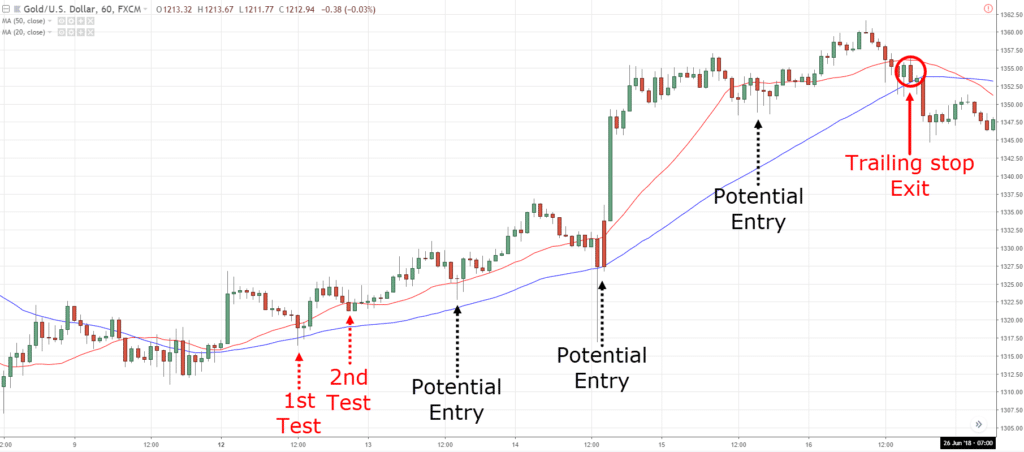

There are trading methodologies such as Trend following…

Swing trading…

Or momentum trading…

While I won’t be able to discuss them in detail in this guide, check out these articles to learn more:

Trend Following Trading Strategy Guide

The NO BS Guide to Swing Trading

The Essential Guide to Momentum Trading

So essentially, your first goal in trading is to step back and learn about different ways to profit from the markets…

…to understand what works and what doesn’t work for you!

Great confidence in trading only happens after you start feeling comfortable in what you are doing.

Remember it.

Trading goals #2: Develop and test a trading plan

At this point, things will start falling into place.

The prior goal was to immerse yourself and gain some perspectives on trading.

This next goal is all about developing an approach that is truly yours!

And here’s an essential tip for success…

…you should try to model someone successful.

You don’t want to waste time reinventing the wheel!

Instead, work on improving an already tried and tested approach, adapting it to become your own.

Remember, you want to reduce the “trial and error” by modeling someone profitable or successful in trading.

Need a successful day trader in the stock markets?

You can check out Humbled Trader (Shay) here.

How about a successful day trader in the forex markets?

Why, you have Darek Dargo, who you can check out here.

A successful price action trader across different markets?

There’s Rayner Teo here!

And, of course, it doesn’t stop there – there are a wealth of successful traders out there.

But the bottom line is this…

Choose a trading style that resonates with you the most, then learn from someone with a proven track record in the markets.

Trading goals #3: Start live trading

Once you have everything in place, such as a well-written trading plan, it’s time to begin live trading!

It’s important to remember – you want to start small.

Why?

Because even when you finally have a strategy that works, it doesn’t mean you have the confidence to trade it with your hard-earned money.

This difference is why many traders can get returns on demo trading, but once they start trading live…

…it all goes out the window!

By starting small in live trading, you match your confidence level (small).

It also puts you in a mindset where you are less pressured to perform.

By becoming less attached to your money, you can become more focused on executing your strategy correctly.

Only once you start seeing positive results should you add more funds.

Because, in that case, you’re betting on something that works!

Now, don’t forget…

The goals listed here are just the bare minimum.

But there’s enough here to ensure your learning curve will be shortened – less pain and less of a barrier to entry into the market.

Basically…

While these trading goals are designed to help you build a sustainable trading business, they are simply the first chapter of your trading journey!

As you achieve these goals one by one, there will come a time when you will start to outgrow them.

You’ll be ready to take things to the next level at that stage!

It’s yet another beautiful aspect of each trader’s journey to success.

Conclusion

I made this guide as snappy as I could to make sure that you can refer to it anytime.

Use it as a blueprint to save you time and money in the long run, reducing how long you spend on trial and error!

To wrap up, here’s what you’ve learned today…

- The “cycle of loss” in trading as a beginner happens when you project your expectations onto the markets

- One way to reduce attachment to expectations in trading is to have a stable source of income, putting you in a mindset to learn

- Some of the best trading goals to start with are process-oriented, such as building a trading plan

Each trader ends up taking their own approach.

Your journey may be different from others!

The goals you choose may align closely with those I mentioned, but there is always scope for individual approaches, too.

On that note, what are some trading goals you think could be added to this list?

Have you already tried some of them in the past?

Were you successful – and what aspects did you learn the most from?

Let me know in the comments below!