Video Transcription

Hiya, hi there! what’s up, my buddy!

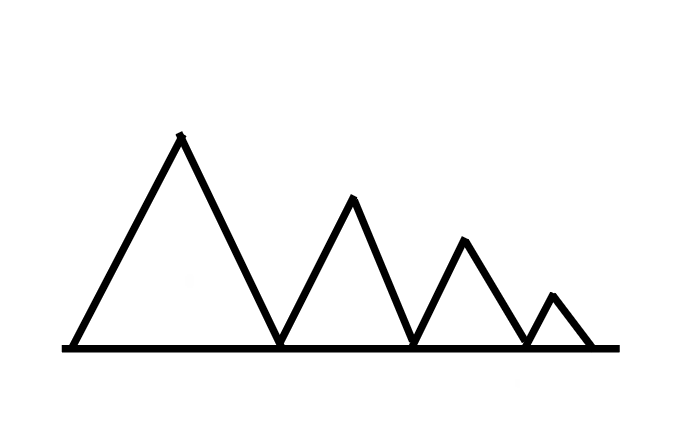

Take a look at this chart over right here:

Let me ask you….

Do you suppose the fee will opposite upper from backup or will crack ill?

Let’s take a look at every other instance:

Do you understand how the fee comes into backup?

Do you suppose it’s moving to opposite up upper or will the fee crack ill?

So that you can know this, you should first perceive the 2 sorts of strikes when the fee approaches backup or resistance.

Energy Travel

An influence go into backup

That is the place you understand a order of fat bearish pink candles getting into backup.

Representation:

The marketplace is in a space. it is going up and is derived ill with those fat candles

An influence go into resistance

That is simply the inverse.

The place you notice a order of fat inexperienced candles coming near resistance.

That is what I name an influence go.

Why is this crucial?

An influence go into resistance

Believe that anyone shorten on this section of resistance out there:

The business briefly went of their bias.

They’re already sitting in income in 1000’s of greenbacks.

What occurs is this staff of buyers, they’ve fears of giving again their income.

They appear to tug income and that might backup induce purchasing drive.

When you’re shorten and travel the location, it’s a purchase sequence and would assemble purchasing drive to push the fee up upper.

An influence go into backup

It’s important as it’s getting into this unmistakable section of backup and buyers who importance technical research.

This induces purchasing drive as smartly.

Energy Travel getting into an section of price

That is very noteceable.

On every occasion you notice a powerful energy go getting into an section of price like backup or resistance.

The reversal may also be simply as quick against the upside.

Why is that?

It’s as a result of there’s no impediment in the best way or the impediment is moderately a ways away.

For those who take into consideration this,

You need to shop for at an section of backup.

If you know the marketplace construction.

The place is the upcoming section of resistance?

It’s someplace right here, that is what I cruel:

You’ll be able to see that from backup as much as the section of resistance, that is your possible benefit.

Your upcoming impediment is a ways.

There’s not anything to urge a promoting drive to push the fee ill.

For this reason while you see an influence go into an section of price, there are occasions when the reversal might be simply as quick towards the upside.

The Crawler Travel

Crawler Travel into Aid:

That is while you get a order of decrease highs into backup. Let’s say that is an section of backup:

The marketplace is going up and is derived ill, you understand that it will get weaker and weaker from the upside.

For those who glance from left to proper, you understand a order of decrease highs.

That is what we cruel through decrease highs into backup, a crawler strikes into backup.

Once I see a crawler go into backup, to me it’s an indication of defect or this tells me that promoting drive is stepping in.

Why is that and the way do I do know that?

You’ll be able to see the dealers are keen to promote at those decrease costs.

Believe if you’re a vendor and also you’re promoting related to resistance, it doesn’t moderately manufacture sense.

Except you suppose if backup does crack next it’s a just right worth to shorten

However in case you don’t suppose that the fee would crack backup, next it doesn’t manufacture sense to shorten akin backup.

The dealers are assured.

They’re keen to promote at those decrease costs as a result of they be expecting backup to crack.

Whilst you understand a order of decrease highs into backup, extra regularly than no longer it results in a breakdown.

That’s no longer all on account of naive buyers they are saying;

“Oh man Rayner look the price is coming to support”

Supposition what?

They’ll purchase.

The place would they put their prevent loss?

They put their prevent loss slightly under the lows of backup.

If enough quantity fresh buyers do this and enough quantity prevent losses are beneath this section of backup.

This provides gas to the hearth as a result of in case you take into consideration anyone with an extended place, their prevent loss is a shorten sequence to get out in their shedding business.

If the fee is going ill and hits their prevent loss which is a shorten sequence, they really feel much more promoting drive inflicting the fee to crash decrease.

For those few causes, the crawler go is an indication of defect or instead an indication that you realize that dealers are about to power the fee decrease.

Crawler go into resistance

That is while you get a order of upper lows into resistance.

At the alternative hand, in case you see a order of upper lows into resistance as you’ll see over right here:

This can be a signal of energy.

Why is that?

The inverse is right as a result of you’ll see that the consumers, to begin with purchased and so they driven the fee up upper prior to creating a pullback.

You’ll be able to see that each and every next low is upper than the only prior to:

For those who take into consideration this, who in the fitting way of thinking desires to shop for simply in entrance of resistance?

This tells you that purchasing drive is stepping in.

Extra regularly than no longer, while you see a order of upper lows getting into resistance the marketplace is more likely to crack out.

Buying and selling Methods to Benefit in a Bull and Undergo Marketplace

We will be able to be the usage of the MAEE system

Marketplace Construction

What’s the marketplace construction that you just’re visual in this chart?

The marketplace is in a downtrend.

Understanding that the marketplace is in a downtrend, the place will you glance to business from?

Branch of Worth

The place is the section of price that you need to concentrate on?

On this case, the true section of price is at resistance. That is what I cruel:

The upcoming factor to do is to look forward to the marketplace to return against your section of price. You’ll be able to see the marketplace crash up into resistance and crack. That is what I cruel:

Access

At this candle over right here, we have now a sound access cause that is what we name a bearish engulfing development:

The tale in the back of it’s alike to a capturing megastar development, the place the consumers have been to begin with in keep an eye on and next they briefly disrupted the marketplace and were given driven ill through the dealers last beneath resistance.

This can be a fake crack as smartly, the marketplace took off the highs and briefly reversed again into resistance.

What you’ll do is input at the upcoming candle viewable.

Advance

What about our prevent loss?

On this case, once more you’ll take back the ATR indicator:

What we’re looking to do here’s to poised our prevent loss a distance clear of the resistance as a result of we don’t need to get blocked in advance.

What you’ll do is use out what’s the prime.

Upcoming upload one through this collection of ATR price

On this case is set 45 Pips.

That will give you 7930.

Your prevent loss might be positioned at 0.7930:

The place is your goal?

For those who take a look at the objective, two ranges display up:

This contemporary swing low and this 2nd one is additional away

On this case, I love to have a conservative goal.

You’ll be able to have your business all travel on the first goal.

That’s a sound concept procedure.

On the similar day, you could be pondering…

“But Rayner, if you look back at this market it is in the downtrend”

The associated fee has a tendency to crack beneath the lows.

Gained’t we be given up some possible income as a result of we will be able to nonetheless glance to seize those backup strikes because the marketplace breaks ill?

What you’ll do on this case is to have two goals…

- Extra conservative goal

- An extra goal

As you realize, the marketplace is in a downtrend and it will crack beneath the lows and walk a tiny bit additional.

How are you able to do that objectively?

What you’ll do is you’ll importance a device known as “Fibonacci extension”

Upcoming glance to travel simply prior to the 1.27

You take a look at the Pattern-based Fibonacci extension.

You draw it from the swing Top to the swing low:

That is an function approach the place you’ll glance to poised your 2nd goal.

You’ll be able to importance this to venture the place the marketplace would walk.

The query is the place precisely do you’re taking income because the marketplace breaks ill decrease?

This Fibonacci extension will give you a tiny little bit of objectivity to it.

Most often what I do is that I poised my prevent loss at a logical degree.

Easy methods to Trip the Shorten-Time period Uptrend The usage of the MAEE

What you’ll do is to importance the 20-period transferring moderate. That is what I cruel:

You’ll be able to see the pink order.

What occurs is that if the marketplace breaks out upper.

You walk lengthy…

The 20-week transferring moderate will naturally go up along side it.

If it closes beneath it, next you travel the business.

Examples

Your access is as proven nearest the breakout.

Let’s say your prevent losses is beneath the resistance.

You may have your travel

Understand the marketplace at this candle crack and related beneath the 20-week transferring moderate.

There’s the place you travel your business.

What if the marketplace doesn’t crack out?

What if the marketplace doesn’t crack out, it’s no longer consolidated, and is derived ill decrease?

For those who’ve been paying consideration previous there’s every other possible buying and selling alternative.

Let’s say that that is an section of backup, that is what I cruel:

If the marketplace comes with an influence go into this section of backup

Are you having a look to shorten or lengthy the marketplace?

You’ll be able to search for a reversal upper permitting you to seize one swing upper into resistance.

Here’s what I cruel:

Permitting you to seize a swing into resistance.

With correct possibility control, it’s imaginable to travel a portion of your business at those highs and next let the excess part walk upper.

Conclusion

Occasion finding out how to attract backup & resistance is an important…

Understanding when it will crack and jump is of similar worth as smartly which I’ve shared with you on this information!

However, right here’s what you’ve realized lately:

- Perceptible “power moves” have a prime tendency to bop off your backup ranges

- Having a descending triangle (or a crawler go) happen into an section of backup is an indication that dealers are steadily breaking the section of backup

- The usage of the MAEE system is among the best strategy to business with backup and resistance ranges

- When managing trades, you’ll importance equipment such because the Fibonacci extension and the 20-period transferring moderate

There you walk!

An all-in-one backup & resistance information that teaches you the best way to spot, interpret, and business!

However now I need to pay attention your ideas…

Are there any alternative “tips” you’ll proportion with me when coping with backup & resistance?

Are you already the usage of one of the most methods I’ve shared with you lately?

Let me know within the feedback beneath!