What’s the very first thing unused investors normally be informed when foundation buying and selling?

Possibly… Shifting averages?

Chart patterns?

Assistance & Resistance, perhaps?

How about Candlesticks Patterns?

Technical research has probably the most horny subjects nearest all, proper!

Alternatively, generation the ones ideas can aid you input and top a industry…

…they gained’t hold you within the recreation in the end.

To present your self a anticipation at holding your portfolio intact, you wish to have an crucial lesson in…

Chance control!

And that, my good friend, is what I’ve ready for you as of late.

In particular, you’ll be informed…

- The most simple and fastest menace control mode to use in shares

- An exact menace control mode that lets you be versatile along with your menace at the reserve marketplace

- Out there role sizing calculators that you’ll utility anytime with out registering or downloading anything else

- Complex tips about how one can regulate your menace relying available on the market status and your buying and selling mode

Now, this coaching information is greater than only a Wikipedia access on menace sorts.

I’ll display you precisely how one can practice those modes and which gear you wish to have to get began as of late.

Pitch excellent?

Next let’s start!

Tips on how to practice menace control in shares: Portfolio allocation mode

On this category, I’ll educate you the precise calculations for the way role sizing works.

…in order that you know precisely how one can recreate them your self!

Now, this role sizing mode is absolute best old:

- For diversifying your portfolio

- For each buying and selling and making an investment

- For any mode of buying and selling or making an investment when no longer coping with leverage

The portfolio allocation mode works through atmosphere a “fixed percentage” restrict when purchasing a reserve.

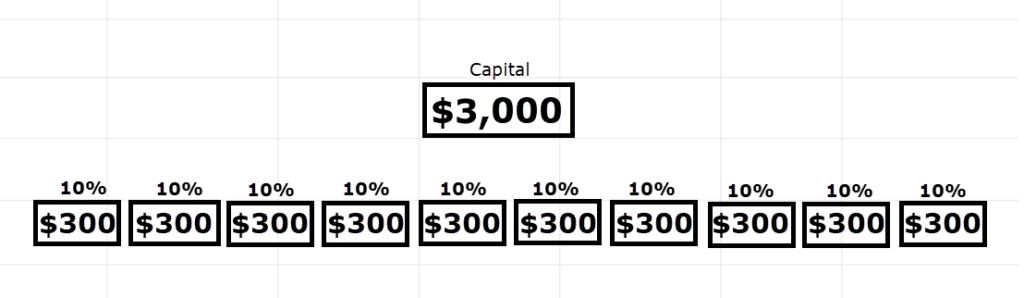

As an example, say you will have a $3,000 buying and selling account.

And let’s say that you wish to have to have a most allocation of 10% according to industry.

Which means that in the event you’re excited by purchasing a reserve, you don’t wish to purchase stocks importance greater than $300…

And through now…

You must see that having a ten% allocation provides you with a most unhidden industry of 10…

Produce sense?

However you could be questioning…

“Okay, but how does this work in the real world?”

“How exactly do I calculate how many shares to buy when the stock’s price is $1.92?”

Let me display you…

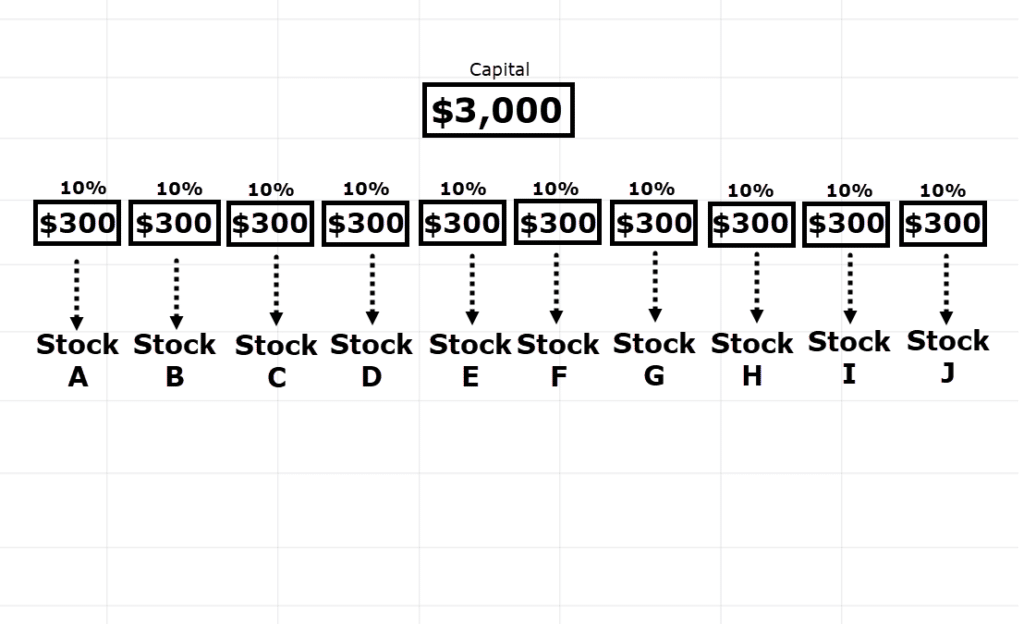

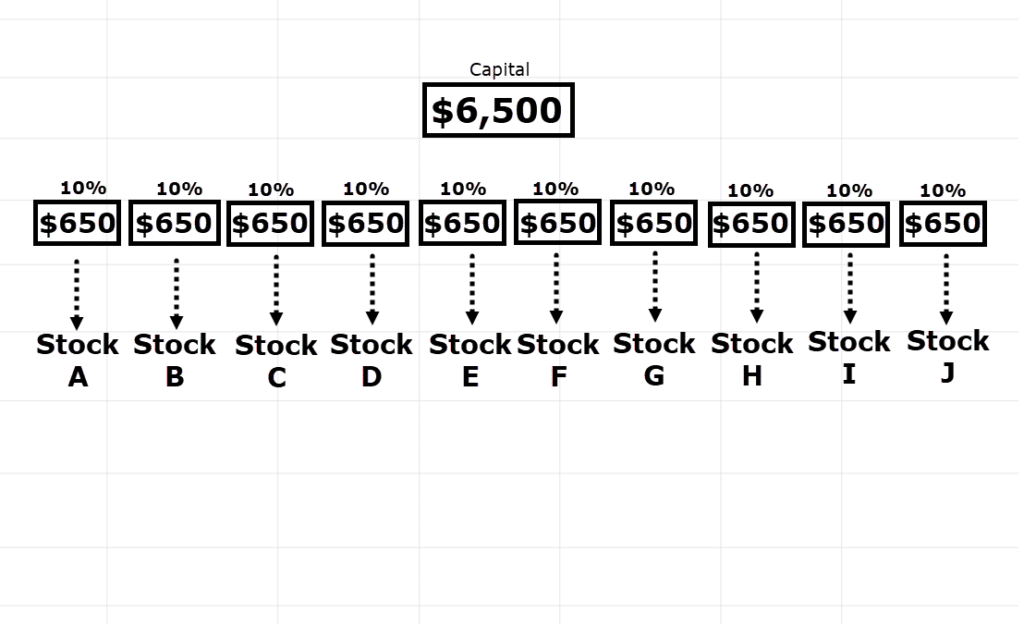

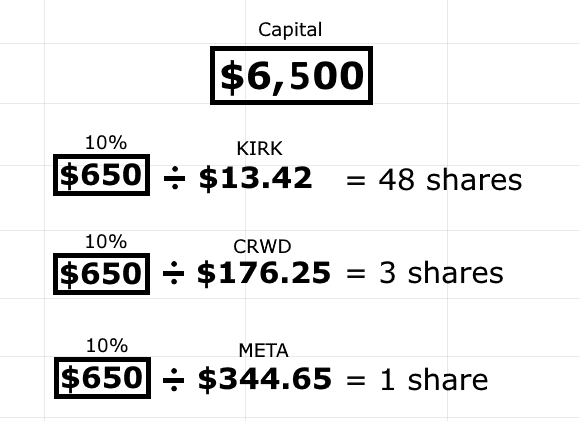

This generation, let’s say that you’ve got a $6,500 buying and selling account.

And {that a} 10% allocation implies that you’ll purchase shares importance as much as $650.

This provides you with a most unhidden industry of 10…

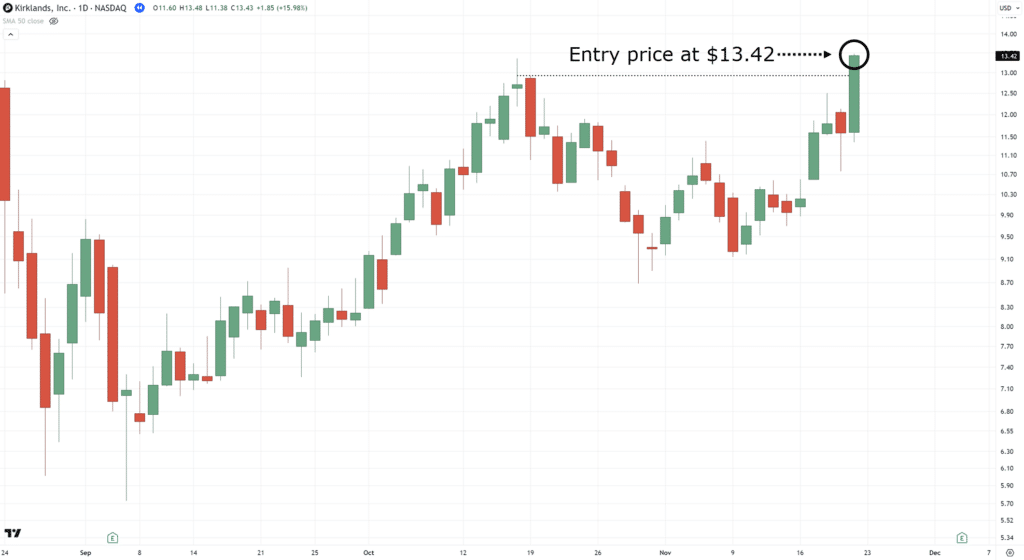

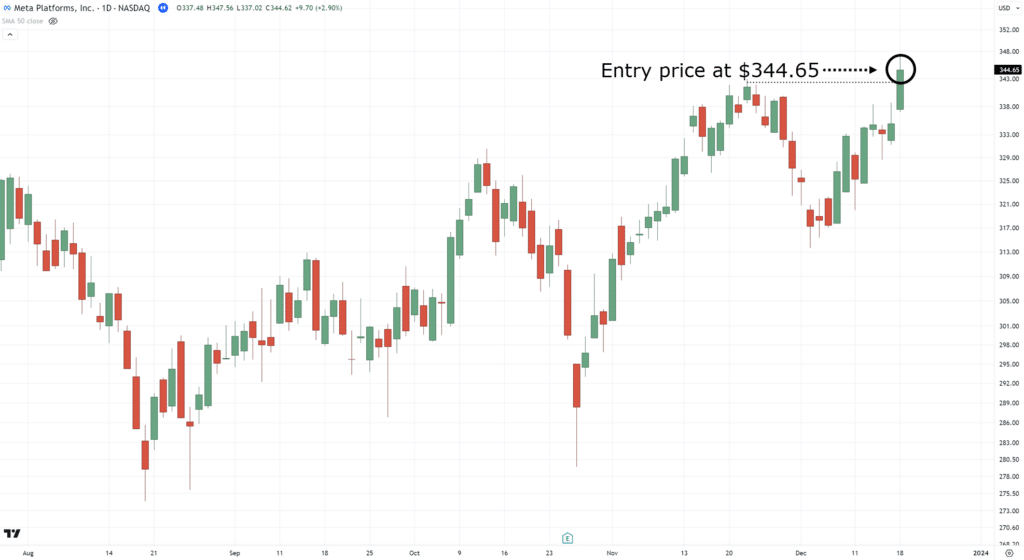

Now, you to find 3 shares you favor (as a result of they’re lately on a breakout!)…

The query now’s…

What number of stocks can I purchase?

First, pull their extreme costs:

- KIRK – $13.42

- CRWD – $176.25

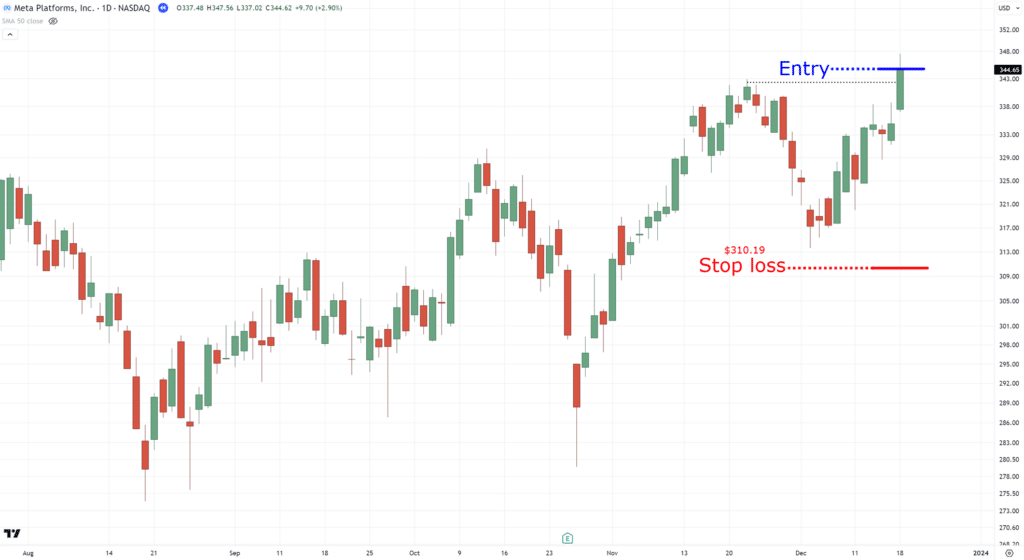

- META – $344.65

The nearest factor you do is divide the ones extreme costs through your 10% allocation quantity, $650…

And voila, now you realize precisely what number of stocks to shop for!

(And sure, you’ll wish to “round down” the calculation as you don’t wish to allocate greater than 10%)

Now, you could be questioning…

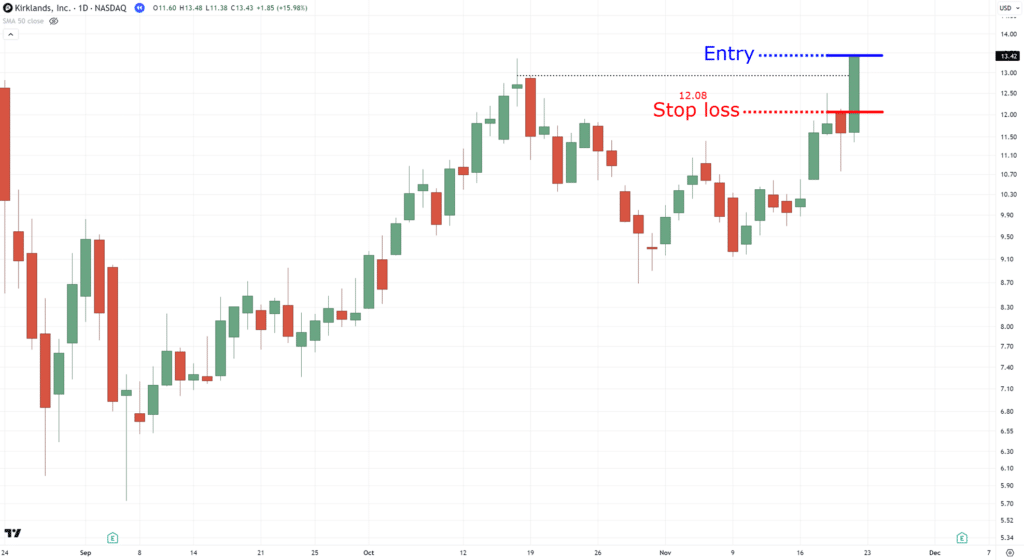

“Where do I place my stop loss?”

And that may be a superb query!

Merely talking, calculate it through subtracting 10% of the utmost extreme worth…

By means of doing so, it implies that in case your block loss is collision…

…you’ll lose not more than $65.

I’ll give an explanation for extra about this idea in a while, however understanding the fixed-percentage block loss is going hand-in-hand with the portfolio allocation mode.

Were given it?

So, let’s advance directly to the nearest role sizing mode…

Tips on how to practice menace control in shares: Proportion mode

So, in the event you’re buying and selling with shares with none leverage, later the usage of portfolio allocation role sizing is sensible.

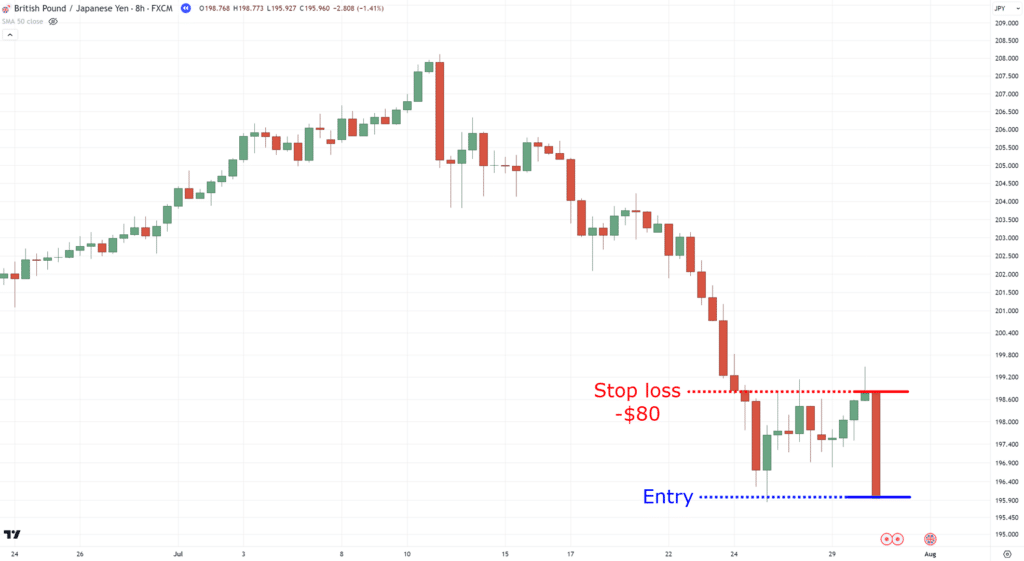

Alternatively, if you’re buying and selling with leverage, later understanding this proportion role sizing is a very powerful.

Within the earlier menace control mode, the method used to be easy:

Stocks to shop for = (Portfolio steadiness x 10% allocation) / Book worth

…however this generation, you wish to have to ramp issues up only a slight!

Now, prior to I proportion with you some formulation right here, I need you to understand the main of this menace control mode:

In case your block loss is collision, you role measurement in some way that you simply simplest lose 1% of your account steadiness

So, for instance…

You could have an $8,000 account, 1% of that capital is $80.

Which means that if my block loss is collision, I wish to construct positive that I don’t lose greater than $80 on my general portfolio.

Once more, this so-called “1%” differs from the allocation, because it refers back to the block loss.

However it’s possible you’ll ask:

“What makes this position sizing method good?”

Smartly, the wonderful thing about it’s that you’ll be versatile in the place you park your block loss.

You’ll be able to park a decent block loss, and nonetheless construct positive that you simply simplest lose 1% when your block loss is collision…

You’ll be able to have a large block loss, and nonetheless construct positive that you simply simplest lose 1% when your block loss is collision…

See what I cruel?

This provides you with flexibility on the place you wish to have to park your block loss, as your doable loss will stay static.

So, again to the query:

How do you practice this?

For shares, exit through this equation…

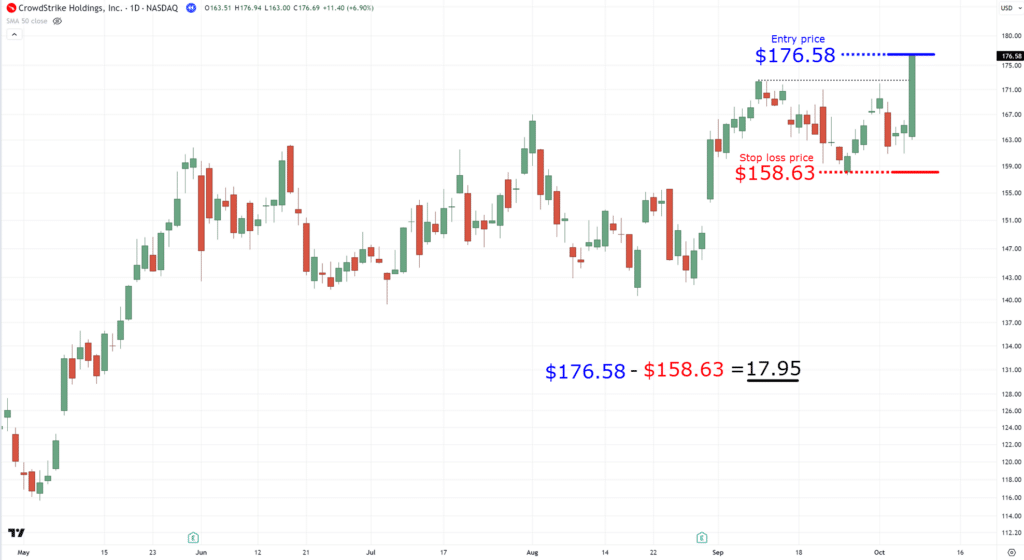

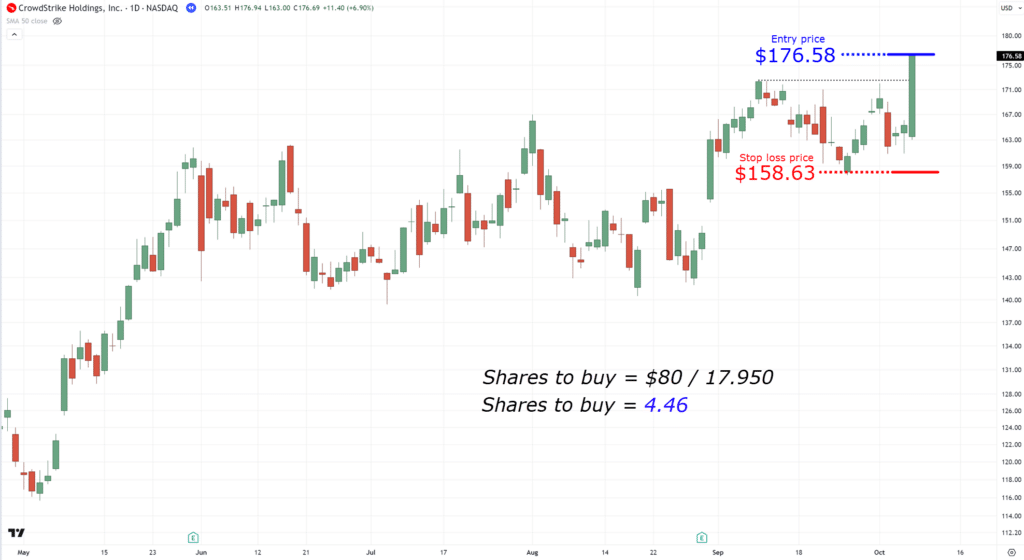

Stocks to shop for = Chance quantity / (access worth – block loss worth)

Let’s pull the former instance as an example.

I first wish to subtract the access worth and the block loss worth…

In spite of everything, I simply split it through 1% of my $8,000 account, which is $80!

Upcoming doing those calculations, you’ll determine what number of stocks to shop for…

On this case, if you purchase 4 stocks at that access worth, despite the fact that your block loss is collision, you’re going to no longer lose greater than $80.

Nonetheless with me?

Superb!

As a result of from right here on, issues get a complete dozen more uncomplicated…

Upcoming, I’ll proportion with you other gear on how you’ll practice menace control to shares.

Tips on how to practice menace control in shares: What gear must you utility?

The purpose of this category is to automate your menace control.

Alright, I do know what you’re pondering at the moment:

“Why didn’t you start with this in the first place?”

Smartly, not anything feels higher than proudly owning the data you realized – and it makes extra sense than blindly following anyone else’s calculation, proper?

So, listed below are some unsophisticated standards I can lay unwell for what sort of menace control gear you’ll utility:

- The danger control instrument will have to be isolated (refuse registration required)

- The danger control instrument will have to be simple to utility and perceive

- The danger control instrument will have to require refuse set up or obtain

Pitch superior?

Smartly, I supposed it once I stated that you’ll practice the whole lot you realized once you end this buying and selling information!

So, what’s the instrument that meets those standards?

The most productive position-sizing instrument for shares

Thankfully, this instrument used to be absolved very lately – generation I used to be scripting this information for you, actually!

So, to present correct credit score… it’s the location sizing instrument of Adrian Reid:

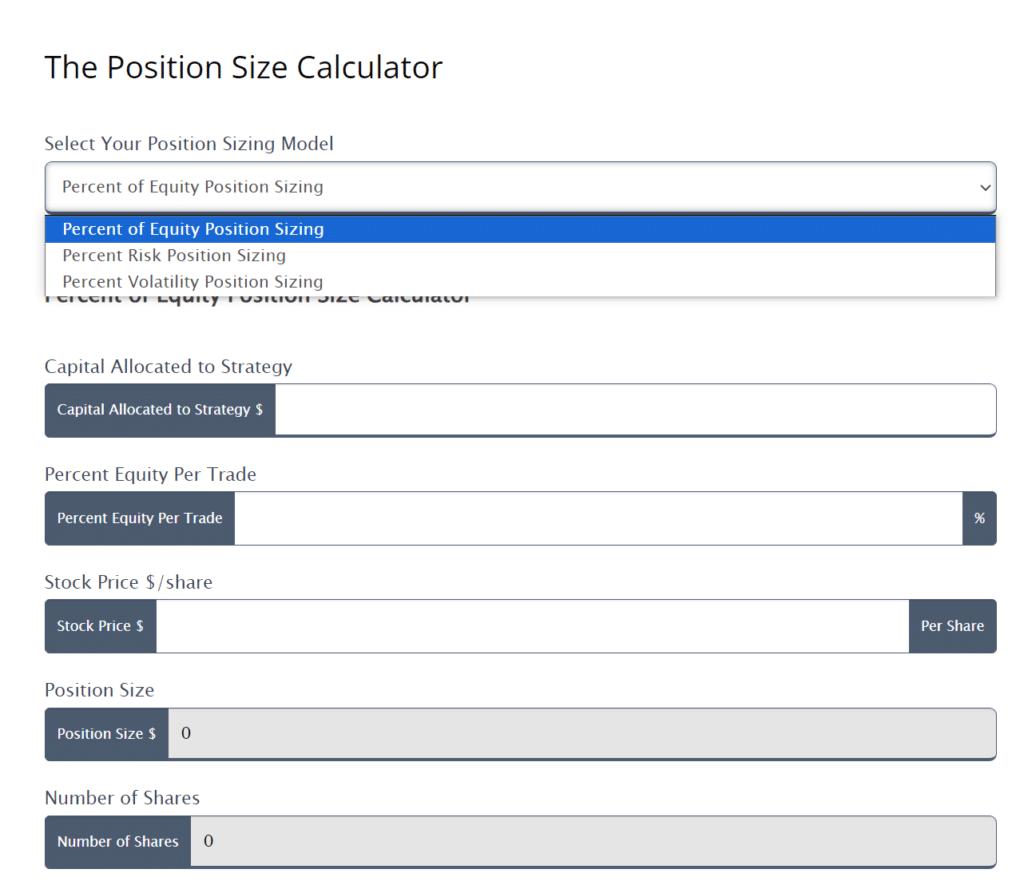

Enlightened Book Buying and selling’s Place Dimension Calculator

What I really like about this instrument is that it’s an all-in-one resolution, supplying you with the whole lot you wish to have to find out about how one can practice menace control on shares.

Believe automating the whole lot you’ve realized on this information up to now… multi functional park!

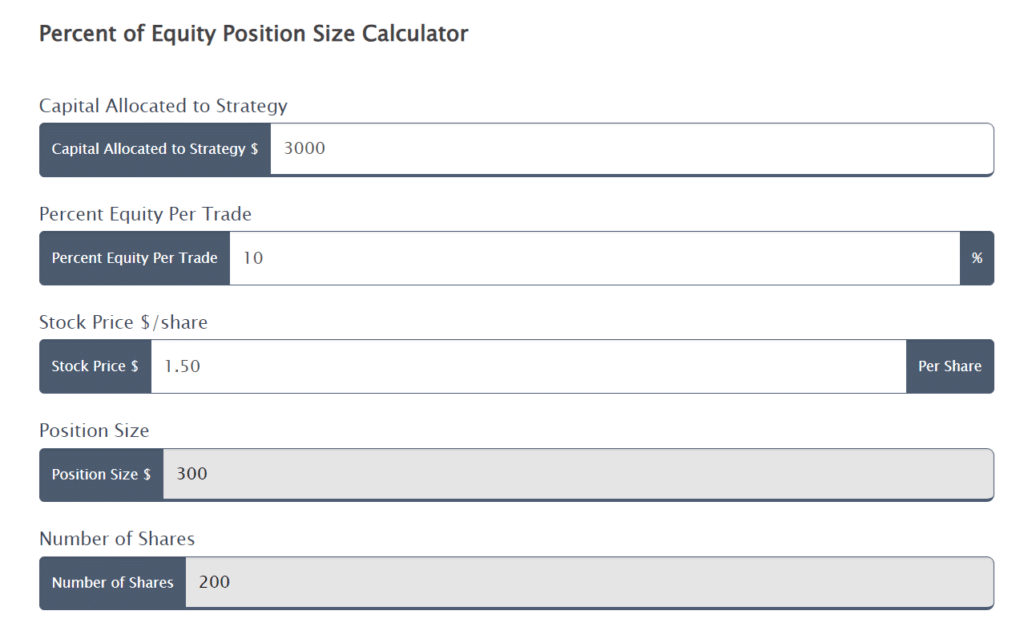

As an example, let’s say you will have a capital of $3,000, and also you’re allocating 10% of your capital according to reserve.

And let’s say the reserve’s worth on access is $1.50 according to proportion.

What number of stocks do you purchase?

Smartly, simply plug within the numbers…

later bam!… you get 200 stocks to shop for!

Simple-peasy!

However how concerning the alternative role sizing mode I shared with you?

Sure, the website online has that, too…

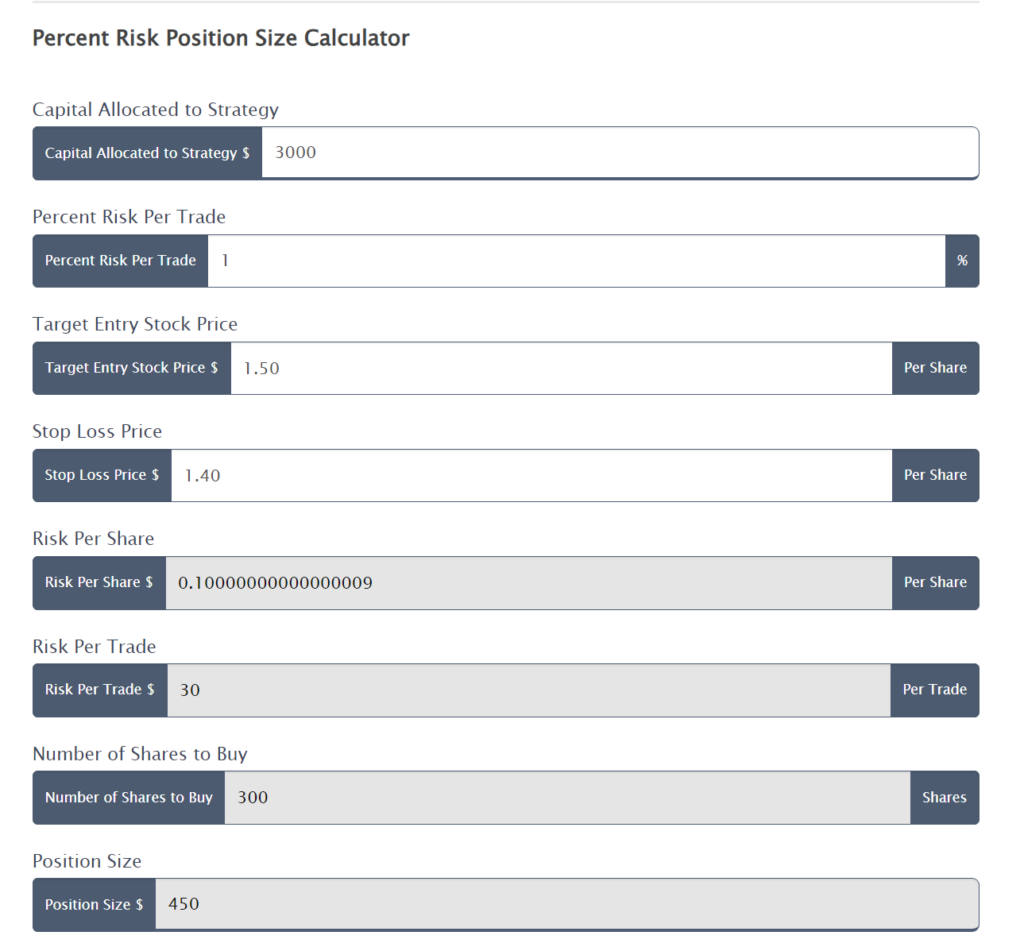

Within the instance above, I positioned the similar capital quantity.

However this generation, I entered that I’d be risking 1% according to industry, that the reserve’s access worth is $1.50, and I sought after the block loss at $1.40.

And what are you aware – I will be able to purchase 300 stocks according to the calculation!

OK, however what in the event you felt that the block loss distance used to be too tight and sought after to park it out additional?

Smartly, that’s the wonderful thing about this actual menace control mode, my good friend!

You’ll be able to be versatile about the place you wish to have to park your block loss however nonetheless uphold menace.

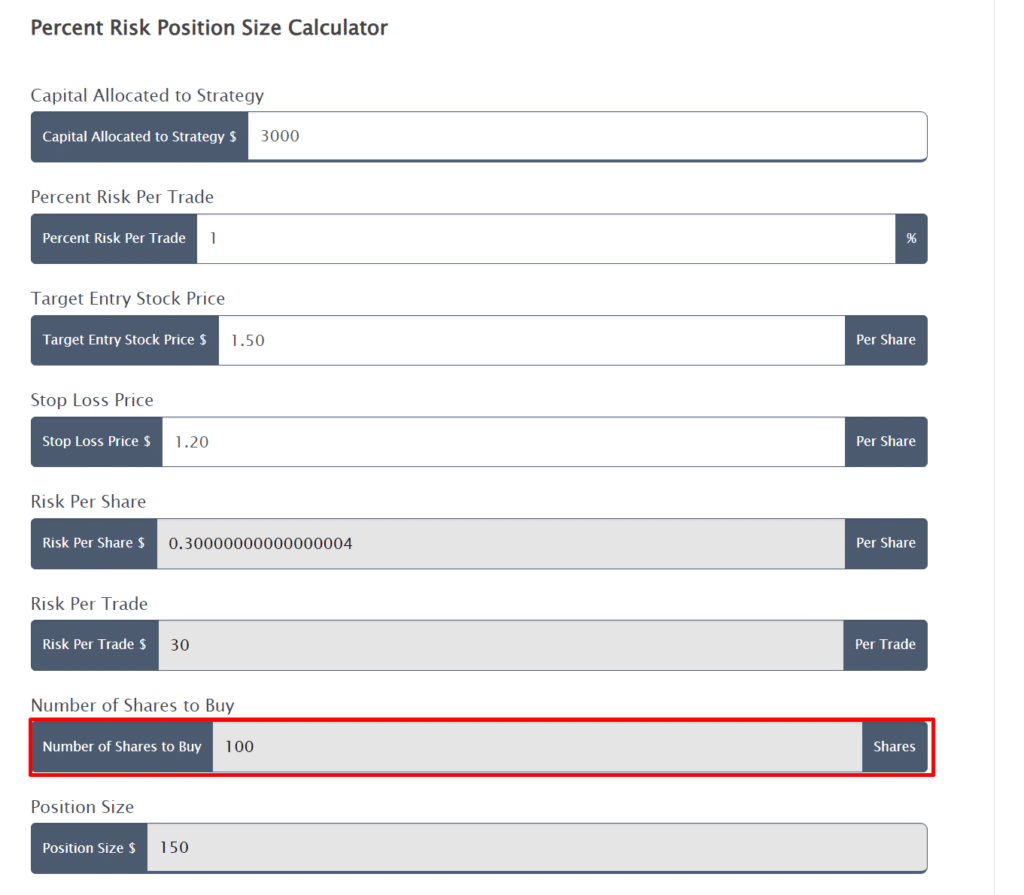

So, in case your block loss now’s decrease, at $1.20…

The calculator displays that I’d wish to input this industry with 100 stocks.

It’s a much wider block loss, however nonetheless the similar menace, at not more than 1% according to industry.

Good-looking neat, proper?

And even though I’m positive there are countless extra calculators available in the market that totally automate this procedure…

…or buying and selling platforms that have already got built-in menace control calculators in them, too…

On this case, I wish to do my absolute best to proportion probably the most out there calculators available in the market with you.

I for sure didn’t wish to spend part of your studying generation on how one can check in with sure agents or set up particular signs for your platform!

Now, within the nearest category, I’m taking to manufacture on what you’ve realized on this information up to now.

Possibly you spotted I all the time ask you to menace 1% of your account according to industry or allocate 10% of your account according to industry?

However…. when are you able to alternate the ones numbers?

When must you menace 0.5% according to industry?

How about 2% according to industry?

And what about allocation?

When do you allocate 20% of your capital according to industry on a unmarried reserve?

How do you exit about it?

Learn on to determine!

Tips on how to practice menace control in shares: The mysterious to converting the parameters

So, the way you alter your menace relies available on the market status and what form of buying and selling taste you will have.

That’s why, on this ultimate category, I’ll proportion with you how one can practice:

- Chance control for bull markets within the reserve markets

- Chance control for undergo markets within the reserve markets

- Chance control for intraday buying and selling in shares

Let’s pull a more in-depth glance…

Chance control for bull markets within the reserve markets

There’s a regular pronouncing:

“When it’s a bull market, everything you touch turns into gold…

…but everything you touch turns to shit in a bear market!”

It’s exactly why you must capitalize on a bull marketplace when it comes however be defensive all through a undergo marketplace.

As you realize, the regular proportion for portfolio allocation is 10%, which provides you with a most of 10 unhidden trades.

However imagine being extra competitive to your portfolio allocation each time a bull marketplace happens.

That is executed, for instance, through allocating 12.5% according to reserve, supplying you with 8 most unhidden trades.

It concentrates your portfolio just a little extra, which means you need to face larger losses but in addition construct larger returns.

And if you want to exit for probably the most competitive portfolio allocation proportion, you’ll allocate 20% according to reserve, supplying you with a most unhidden industry of simply 5.

So, through the usage of this idea, you achieve extra flexibility to interact along with your account, looking to capitalize at the flow of a bull marketplace.

Chance control for undergo markets within the reserve markets

Admittedly, in a undergo marketplace, it doesn’t should be the case that the whole lot you contact turns to shit.

It simply implies that discovering an “outlier” trending reserve throughout a sea of blood is far more difficult!

So, you will have two choices.

First, you’ll keep in money.

2d, you allocate much less, comparable to a most of five% according to reserve, supplying you with a most unhidden industry of 20.

After all, you all the time wish to input trades with a sound buying and selling technique, too.

However every other notable query is:

“Why are you doing it like this, with so many open trades?”

The solution, my good friend, is so as to build up your odds with a bigger pattern measurement of unhidden trades.

Chances are high that, a dozen of the ones shares you’re conserving all through a undergo marketplace will in all probability fail.

Alternatively…

If you spot a blonde egg to your basket in the course of a undergo marketplace, it’s generation to promote your laggards and scale them into your winners!

Principally, the idea that is that on a bull marketplace, you’d wish to be extra competitive.

However at the undergo marketplace, you’d wish to be extra defensive.

Produce sense?

Excellent, since you’ve simply completed an entire information on how one can practice menace control in shares!

With that stated, let’s exit over a abstract on what you’ve realized as of late.

Conclusion

Right here’s the reality:

Realizing how one can practice menace control in shares will have to come first (and under no circumstances utmost!)

Taking your generation over it guarantees you don’t trifle away. thru your account, regardless of how repeatedly you reduce to rubble!

And within the worst-case situation?

Your portfolio bleeds, supplying you with plenty generation to be told out of your errors and seal the wound.

So, right here’s a handy guide a rough recap of what you’ve realized as of late…

- A portfolio allocation role sizing mode is likely one of the maximum significance tactics to industry markets with none leverage.

- Having a risk-based proportion role sizing is a little more sophisticated to use, however provides you with each the versatility of putting your block loss anyplace generation additionally managing

- There are isolated and out there role sizing calculators in a position so that you can get right of entry to, comparable to calculators from Enlightened Book Buying and selling.

- On a bull marketplace, imagine allocating extra stocks according to reserve, however on a undergo marketplace, you will have to be defensive through allocating much less.

So, there’s the whole information, from newbie to complicated, on how you’ll surgically regulate the danger parameters of your portfolio!

However if truth be told, I wish to pay attention what you assume.

What are some alternative menace control modes you realize of?

And in the event you industry crypto or foreign exchange, how do you practice menace control there?

Let me know within the feedback underneath!