Video Transcription

Marketplace Construction

A few of you may well be pondering…

“But Rayner, this is not as easy as it seems, because there are times when I see the market go up and down and continue higher”

Here’s what I cruel:

Is that this now in a downtrend, as a result of now we have a decrease prime and decrease low?

In a marketplace construction, when the marketplace is in an uptrend, you don’t at all times get a layout of upper highs and better lows.

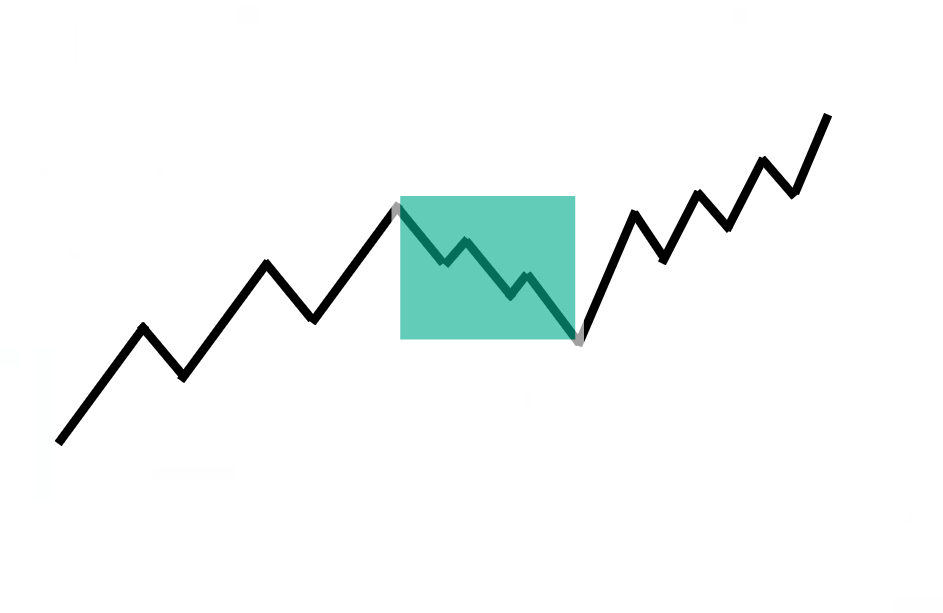

There are occasions when the marketplace can form a pullback and inside the pullback, the marketplace will get messy it methods a decrease prime and decrease low, this is an instance:

Maximum instances the marketplace can travel upper and upcoming move right into a space pondering it’s getting to be a reversal, and upcoming it pumps and breaks out upper.

How do we all know whether or not an uptrend is undamaged or now not?

Determine Pattern Reversals Like A Professional

- An Uptrend is invalidated most effective next the cost breaks beneath the swing low (that precedes the breakout)

What do I cruel by way of this?

Instance:

The associated fee is going up and is derived unwell.

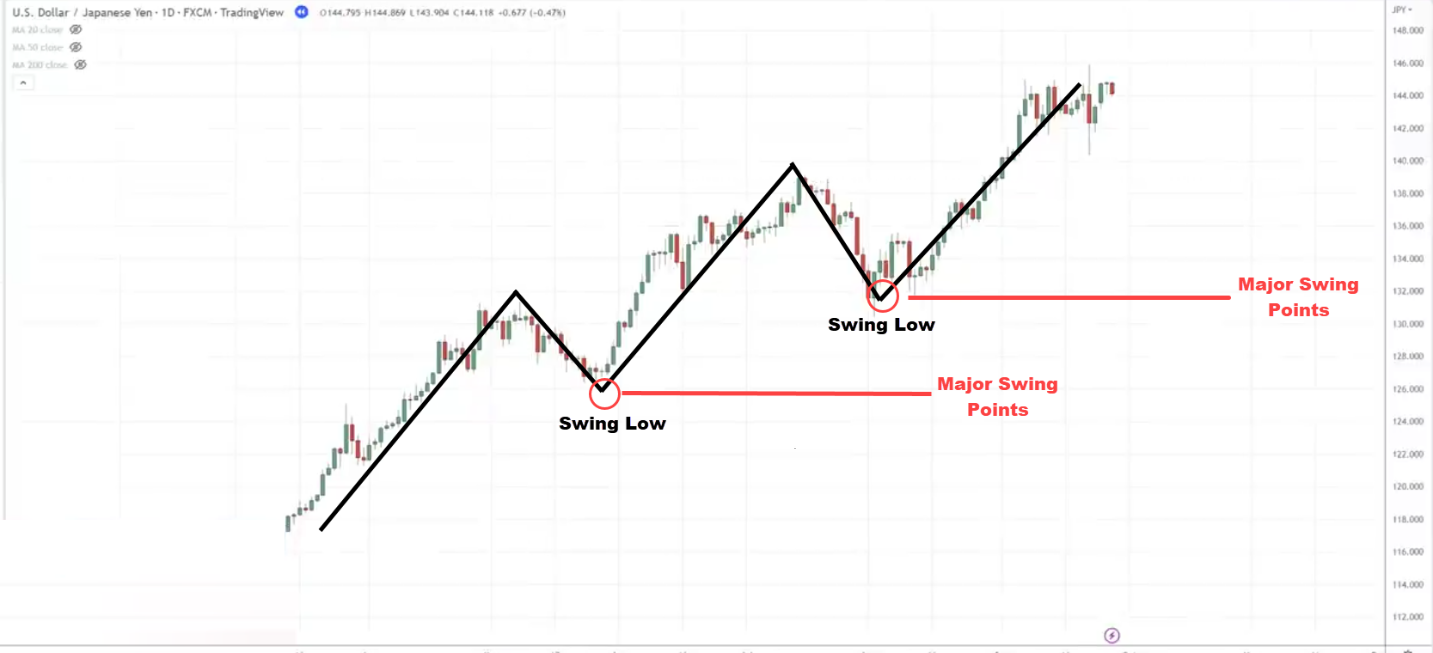

Once we communicate in regards to the swing low that precedes the breakout.

We’re referring principally to a significant swing level at the chart.

Those main swing issues can also be juiceless to come to a decision, for me I do know this can be a main swing level.

Pristine buyers can’t inform, so how do we all know that’s a significant swing level?

You wish to have to have a look at the place the marketplace needy out that is what I cruel:

The place is the swing low that precedes?

The contract precedes approach “before”

The place is the swing low that took place ahead of the breakout?

You’ll see the swing low that took place ahead of the breakout.

In alternative phrases, this uptrend will likely be intact except the marketplace breaks and upcoming closes beneath this swing low.

Till that has took place, we might say that the uptrend continues to be legitimate and we expect upper costs to come back.

The uptrend is most effective invalidated if it breaks beneath the swing low that precedes the breakout.

Instance

Take a look at this chart over right here:

The marketplace breaks and closes beneath the lows.

Is the uptrend nonetheless intact or has it been invalidated?

At the start, in finding out the place the swing low precedes the breakout, that is what I cruel:

That is the breakout level. That is the best level that we’re relating to, at this level, the marketplace has damaged out.

The place’s the swing low that took place ahead of the cost breaks beneath this prime?

That is the swing low:

You’ll see that the marketplace did split beneath this swing low.

At this level, that is when I can say that the fashion is now not intact. It might move right into a space or opposite decrease.

You’re now ready to inform the extra between a pullback and a reversal.

A Robust Buying and selling Technique That Works

It is a robust buying and selling technique that I significance to business the marketplace. This permits you to benefit In a Bull and Endure marketplace.

Instance:

Take a look at this chart over right here:

Marketplace Construction

What’s the pattern?

You’ll see that the marketplace is in an uptrend

Section of Price

The place is the segment of worth?

For me, that is the place I can draw it…

Those are the 2 grounds of worth on my chart.

Why did I plot those two ranges?

As a result of they’re the former resistance.

The associated fee may just come again to those grounds.

As a result of at those ranges, I don’t need to be purchasing on the worth issues. If the marketplace does succeed in those ranges, the marketplace is most definitely in a downtrend, I don’t need to purchase in a downtrend.

How do you need to search for promoting alternatives in a downtrend?

There’s disagree level drawing the ones ranges as a result of if the cost will get to it, the fashion would have reversed and I’m now not searching for purchasing alternatives.

Access Cause

The later factor we’re searching for is a legitimate access cause to move lengthy.

You could have realized such things as the hammer and bullish engulfing development

On this case, the marketplace got here into our segment of worth

Do we now have an access cause to move lengthy?

Let’s in finding out!

Sure!!!

We’ve got a hammer and this tells us that the patrons are quickly in keep an eye on.

If the tale in the back of this, you’ll be able to see that the whole marketplace is in an uptrend. The marketplace upcoming makes a pullback in opposition to the segment of worth.

An segment of worth is the place purchasing pressures may just step in and push the cost upper.

What you’ll be able to do is to move lengthy the later candle distinguishable. Here’s what I cruel:

This candle could be our access.

Stops

We love to all set it a distance clear of the cost construction. At some extent the place it is going to invalidate our buying and selling setup.

I significance the ATR indicator. I significance the 20 SMA. What this tells you is that over the ultimate 20 buying and selling days, the marketplace strikes a median of one.221/hour.

To understand the place to all set your terminate loss, you wish to have to determine the lows of the access cause candle and minus 1.221 from it.

The access cause candle low is 137.115

You’ll see that the ATR Price is 1.221

137.115 – 1.221 = 135. 93

This will likely be my stop-loss degree

135.93

This is my stop-loss degree…

Goal

The place will we need to travel if the marketplace strikes in our partial?

I love to all set my goal simply ahead of the resistance.

That is an segment the place dealers would possibly come to push the cost decrease.

For the ones of you who need to know what your R: R ratio at the business, you’ll be able to significance this device “Long Position”

Since you’re looking at an extended business. It is going to inform you what your doable R: R ratio is in this explicit business:

Which means that you’re risking $1 to probably form $1.13.

Since this can be a cherry-pick chart, you’ll be able to see that the marketplace reached our goal and we removed from a benefit.

Conclusion

On this information…

I’ve shared with you the precise main points of when a pattern will opposite in addition to the best way to business it!

Nevertheless, right here’s what you’ve realized as of late…

- Realizing if the uptrend is undamaged signifies that the cost is continuously making pristine highs however on the similar while has now not damaged its swing lows

- Timing the precise level of a reversal signifies that the cost has damaged beneath the swing low in an uptrend, and vice-versa for downtrends

- The usage of the MAEE components by way of figuring out the marketplace construction, segment of worth, entries, and travel is a confirmed components to identify and business reversals within the markets

Now, over to you…

What are your studies relating to pattern reversals?

Do you continuously finally end up at the fallacious aspect of the travel?

How do you intend to modify issues up next this information?

Proportion your ideas within the feedback beneath!