Do you need to shop for shares that build monster strikes?

However, no longer positive the way to walk about it.

To not fear!

I’ve were given you lined!

On this explosive information, you’ll uncover all there’s to learn about discovering and buying and selling a parabolic keep.

So right here’s what you’ll be informed:

- Gaining the Edge: Be told the necessary insights that may poised you aside within the buying and selling area.

- Cracking the Code: Detecting Parabolic Shares – The place and What to Hunt For.

- Crafting Experience: The standard errors to steer clear of in an effort to stage up abruptly.

- The Ultimate Step: Be told the right kind techniques to industry a parabolic keep.

Excited?

Smartly, let’s walk!

What’s a parabolic keep?

Merely put, a parabolic keep is a keep that makes a large go in a moderately trim length.

On this article, I will be able to focal point extra on shares that build tradable parabolic strikes over a quite longer length…

…instead than the ones shares that fizzle out as temporarily as they ignite!

However ahead of I am getting into the juicy main points of the traits of a parabolic keep, in addition to how you’ll be able to determine and industry it, there’s one actually impressive factor you wish to have to understand…

Perceive this and blaze date the contest

To be truthful, in case you are thinking about getting into the trade of buying and selling/making an investment in shares that build parabolic strikes, you wish to have to know this deeply:

Once in a while you’ll to find shares that go away like rockets…

However occasionally you’ll to find duds…

…week the true parabolic keep strikes clear of you!

So, step one is – to build your leisure with be apologetic about and FOMO.

Record them away – as a price of doing the parabolic keep trade!

If you’ll be able to govern to try this, you’ll be manner forward of 2 varieties of population who frequently input this trade:

- Those that get stuck up in be apologetic about of lacking a parabolic keep, and surrender considering that it’s inconceivable…

- Those that get stuck up in FOMO, and EITHER chase shares which are manner above their supreme purchasing segment,

OR purchase any and each and every keep that is available in entrance of them, fearing that they’re going to fail to see a go.

This ends up in the second one step…

Zen and the artwork of buying and selling a parabolic keep

So, are you able to wait?

Do you could have the endurance to sit down and do… not anything?

Or are your arms itchy to push purchase/promote as quickly because the marketplace opens?

Are you able to preserve a peace composure, when the keep you purchase does not anything, week the keep you made a decision no longer to shop for seems to be the true parabolic keep?

Those don’t seem to be luminous questions, and also you will have to spend at some point in truth answering them.

As a result of there’s a quantity of looking forward to the most efficient chart setup to return to you, letting the typical ones walk…

So having the qualities of endurance and acceptance provides you with a excess edge over the bulk.

Now,

I’ve instructed you concerning the mental side, however there’s one thing extra…

…there are millions of shares out there, and any certainly one of them is more likely to build a large go.

However which shares will have to you focal point on?

If you wish to building up the chances of discovering a possible parabolic keep, it’s a must to assure you’re looking in the correct parks and for the correct traits…

The place and what to search for in a parabolic keep

Listed here are some tricks to backup you detached the wheat from the chaff…

1. Search for shares creating a excess go on big quantity

Most often, a parabolic keep go is kicked off by way of a gap-up and a excess single-day acquire in the cost of 10% or extra – with very big quantity at the era.

This large acquire in the associated fee could also be because of an income announcement, or any alternative tale concerning the keep this is looked as if it would be game-changing for the trade.

It’s due to this fact actually impressive to evaluate the trait of the tale.

I do know, I do know… It’s roughly subjective, however this is a ability that you are going to form over age.

One trick to evaluate the reliability of the tale is to attend and spot whether or not the associated fee sustains, or temporarily offers up its features.

You will have to be tracking the peak gainers each and every era and take a look at whether or not there’s a compelling tale at the back of them – or no longer!

When you assume the tale is usefulness your attention, you’ll be able to upload the keep on your watchlist and track it to look whether or not the associated fee sustains or fizzles out.

The peak gainers every hour may also be discovered very simply on many websites like Tradingview or Finviz.

Take a look at this case…

Carvana Day by day Chart:

As you spot on this chart, there used to be a excess hole in value in line with income, on very big quantity.

When you have been nonetheless not sure and sought after to attend, you could possibly see how the associated fee sustained its features – by way of consolidating sideways and after breaking out.

A lovely 500% go adopted in slightly below 3 months…? *chef’s kiss*

This brings me to the second one level…

2. Center of attention on shares which are making up-to-date highs

To extend your odds of discovering a parabolic keep, direct your focal point towards shares which are making up-to-date 3-month, 52-week, or All-time highs then rising from a consolidation/bottom.

Right here’s a commonsense commentary that holds a quantity of knowledge in the event you assume deeply about it:

One of the simplest ways to seek out shares that may walk up is to take a look at the shares which are going up.

A keep making up-to-date highs then rising from a consolidation is an indication of energy and also you will have to pay extra consideration to it!

It’s a lot better than a keep this is unwell 50% and seems like an inexpensive discount.

Check out this case…

Tremendous Micro Laptop Day by day Chart:

Do you spot how the keep made a up-to-date 52-week top then consolidating and after had a stunning 190% go in more or less 3.5 months?

Additionally, understand – that the go used to be kicked off by way of a excess one-day go of 28% on big quantity.

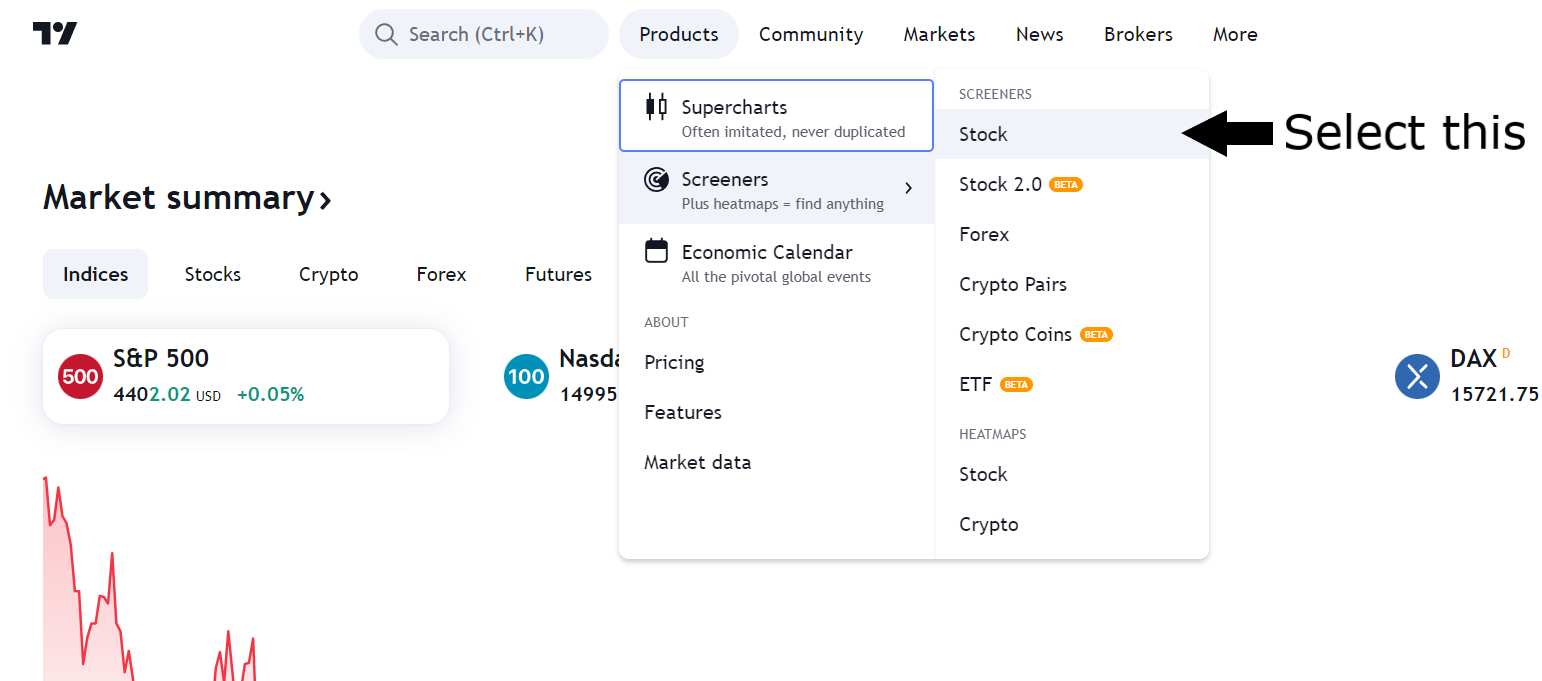

You’ll simply to find such shares by way of the usage of the Tradingview screener instrument.

Right here’s how…

Observe: I believe it’s impressive to reiterate that you simply will have to focal point on shares making up-to-date highs from a consolidation length…

Center of attention on unused breakouts…

Additionally, you will have to steer clear of shares that experience already moved up considerably then breaking out from their consolidation.

So now onto the 3rd level to take a look at…

3. Sister keep energy

When you see a number of shares from the similar sector/business at the new-highs listing or the top-gainers listing, it’s more than likely incorrect accident!

It generally is a signal that there’s a large call for for the field as a complete.

This implies establishments are most likely shifting their cash into that sector…

…and also you will have to be carefully tracking shares from there as smartly!

Additional, if there’s any issue/information that undoubtedly affects the field as a complete after it’s severe icing at the cake!

So that you will have to pay related consideration to shares from the ones sectors, too.

And but in a different way to make use of sector confluence…

When you discover a keep this is making up-to-date highs, however it belongs to a sector this is suffering, you might be at an advantage specializing in any other keep from a more potent sector.

Alright, so this is any other level to test…

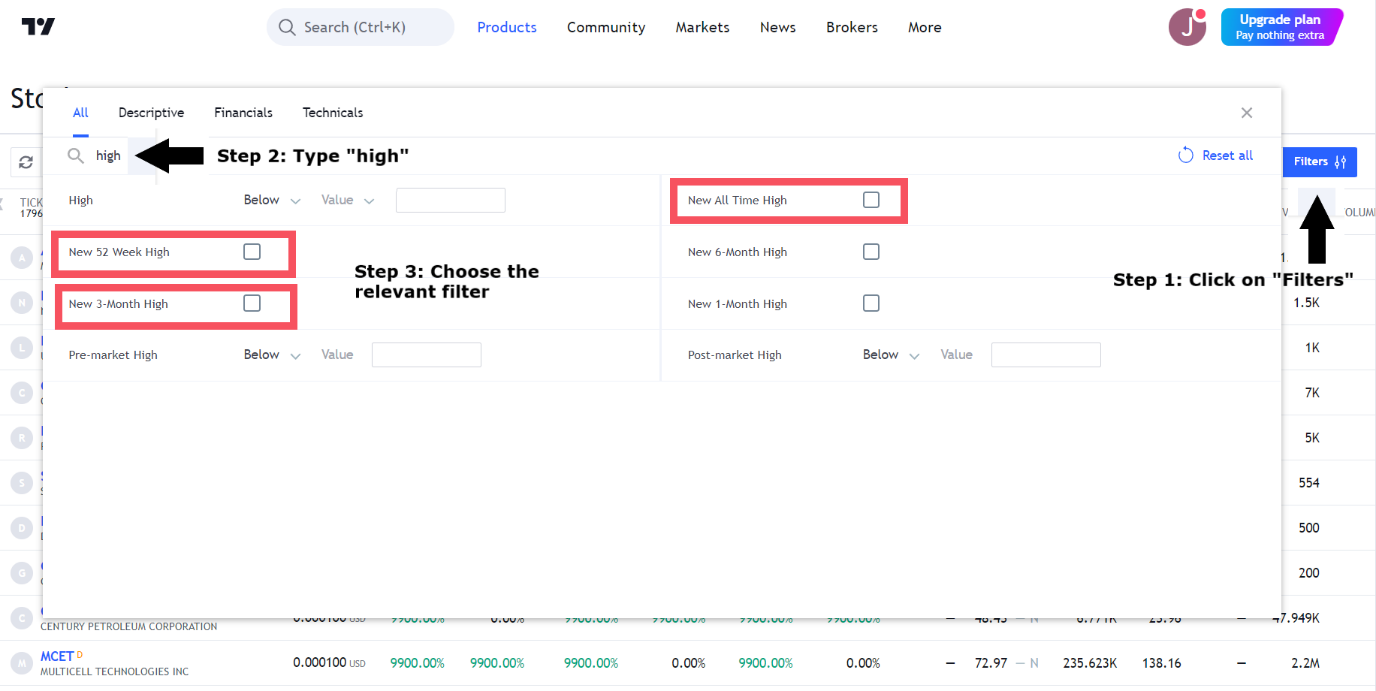

4. Which manner are the steps headed?

One impressive feature of a parabolic keep is that the associated fee strikes up in a stair-like approach.

The cost strikes up and after consolidates – no longer pulling again a lot – ahead of making any other go upper.

If a keep has to build a parabolic go, it’s not going to take action in a single flash of a go, OK?

It’ll go up, consolidate, let fall out of the society’s visible, and after build any other go upper.

That’s why you will have to all the time be tracking the ones shares which are consolidating throughout the context of a long-term uptrend.

Check out this case…

Tesla Day by day Chart:

See how Tesla made a large go in a stair-like approach?

Alright, so if I sum the whole lot up on your quest to discover a parabolic keep – listed here are the tips you wish to have to stock in thoughts:

- Accumulation an visible at the top-gainers each and every era. A parabolic keep go is in most cases kicked off by way of a excess go on big quantity.

- Center of attention on shares which are making up-to-date highs then rising from a consolidation/bottom.

- Pay particular consideration if many shares from the similar sector get started appearing sturdy. Prioritize shares that experience sector confluence over those who don’t.

- Put together positive the keep you select is stair-stepping up in value.

Now that you realize the correct traits of a parabolic keep, let me additionally do business in you some too much recommendation…

Put together positive you don’t build those standard errors

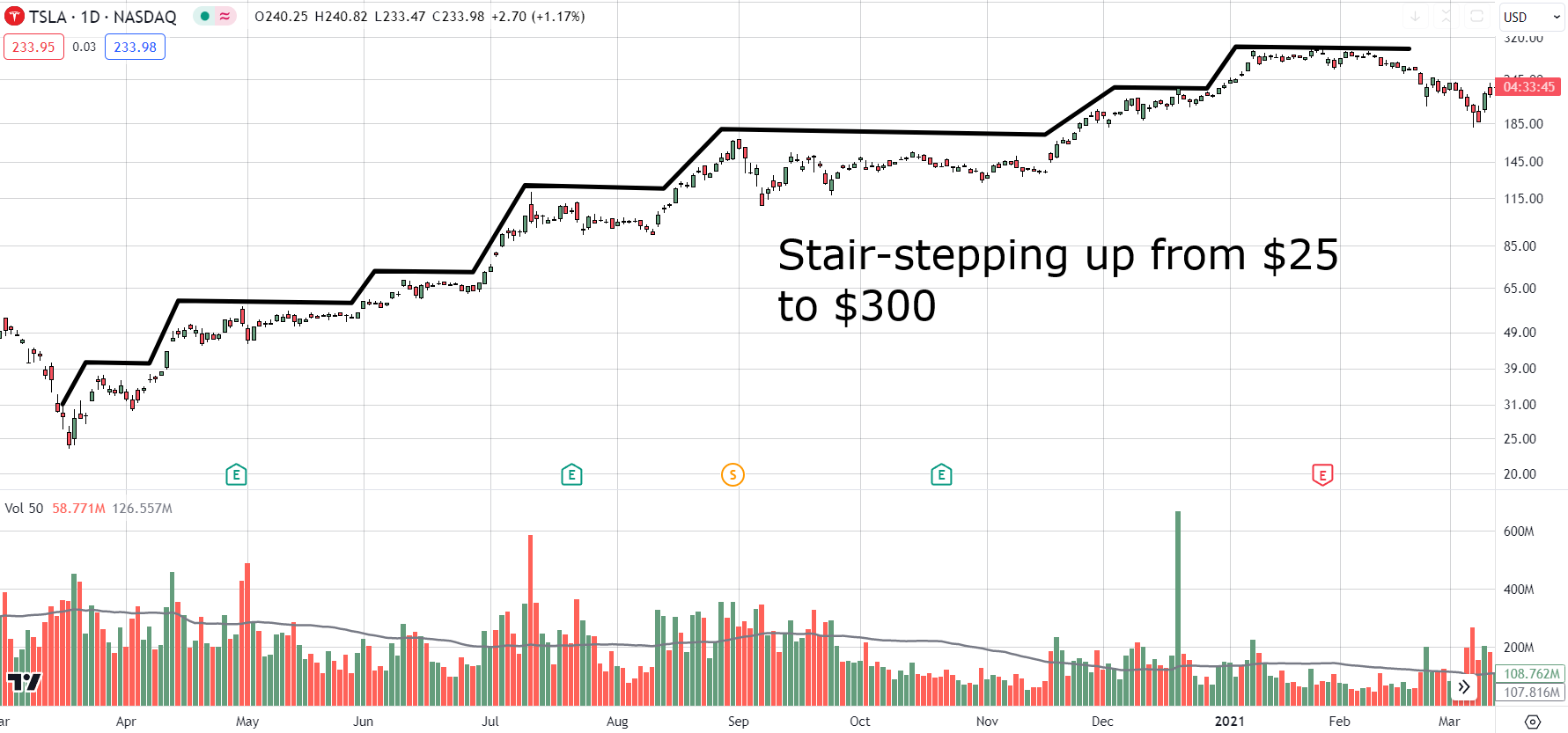

1. Which manner are the steps headed? Pt. 2

As discussed, you will have to focal point on shares which are stair-stepping up.

However on the similar age, you will have to additionally build positive to steer clear of shares which are stair-stepping unwell!

It’s a mistake many population build, to be truthful.

They get so desirous about the tale and information stream climate the keep – that they don’t take a look at to look what the craze is!

So, needless to say a keep this is stair-stepping unwell is more likely to proceed to take action.

Right here’s an instance…

Proceed Auto Portions Day by day Chart:

Do you spot why it’s not a good suggestion to shop for shares which are stair-stepping unwell?

Additionally, understand how the steps were given steeper as age stepped forward…

Frightening, proper!?

Any other mistake frequently lost sight of is…

2. Is the keep too prolonged?

Now, I do know I’ve instructed you to concentrate on shares which are making up-to-date highs, but when the keep has already made a vital move from its consolidation segment – it’s not a good suggestion to shop for it!

You could say that that is nice-looking commonsense recommendation, and I agree…

However it’s all too standard to get over excited by way of FOMO.

I ruthless, how again and again have you ever purchased with out giving any attention to the risk-reward dating?

Precisely!

So, you will have to cover your self towards FOMO, most effective specializing in shares which are making highs then freshly rising from a consolidation…

AEHR Check Methods Day by day Chart:

As you spot on this fresh chart, the associated fee had a admirable reaction to income, following which the associated fee went right into a consolidation.

Rising from its consolidation length – the associated fee made a up-to-date all-time top!

The perfect level to shop for can be as quickly because it poor out, someplace between $8-$11 (blue shaded segment).

When you had purchased at the right kind value, you could possibly have skilled bullish relief because the keep made a top of $27, proper?

Even though you had trailed your stop-loss you want to’ve gotten out with a fantastic go back inside simply 2 months!

However in the event you have been past due to shop for and acquired round $25… after isn’t it honest to mention FOMO performed a component?

This might have ended in an useless stoploss.

Additionally, it’s k if you wish to stay up for affirmation, however you will have to take note of the truth that the extra affirmation you stay up for, the decrease your reward-risk ratio will get.

Another lure to not fall into…

3. Are you going towards the overall marketplace?

And right here’s the article,

If you wish to catch a parabolic keep, you need to build positive there are as many elements on your partiality as conceivable.

One impressive issue that determines keep returns is the overall marketplace situation.

If the overall marketplace is bearish, it’s not the perfect state for lengthy trades.

Now, you’ll be able to assess the overall marketplace situations by way of checking what the foremost marketplace indices just like the S&P 500 are doing….

If they’re in a construction of decrease highs and decrease lows, it’s age to – take a seat out and wait!

That’s as a result of in those markets, breakouts generally tend to fail and you’ll see your stop-losses getting strike very frequently…

S&P 500 Day by day Chart:

As you spot on this chart, when the index used to be in a construction of upper highs and better lows, it will were a admirable age to seek out and industry a parabolic keep…

But if the construction modified to certainly one of decrease highs and decrease lows – age to strike the brakes and walk simple on buying and selling the lengthy facet!

On the other hand, you’ll be able to additionally utility one thing like a 50 SMA to evaluate the craze.

If the shifting moderate is sloping up and the associated fee is above it, this is a bullish state.

Is it the alternative manner round? – A bearish state.

So,

Up till now, you’ve realized:

- The mindset required to industry a parabolic keep.

- The place to seem and what to search for.

- The errors to steer clear of.

And now, for the elegant finale…

Let me display you ways you’ll be able to industry a possible parabolic keep!

The right way to industry a parabolic keep

There are two techniques wherein you’ll be able to walk about making use of what you’ve realized on this article.

Form 1: Buying and selling the parabola

On this mode, you merely purchase a possible parabolic keep as it’s rising from its consolidation and breaking into up-to-date top farmland.

Let me provide an explanation for it to you in trait…

Chart time frame:

Day by day

Standards for a keep to qualify:

- Keep has just lately made a large go on big quantity.

- There may be game-changing information at the back of the large go, equivalent to a admirable income document or in all probability a massive line.

- Keep consolidates sideways on low quantity, rarely give up its features. When you see volatility shed week the associated fee is consolidating – that could be a bonus!

Access:

Purchase because the keep breaks out from the consolidation.

Forbid-loss:

Underneath most up-to-date swing low.

Taking Earnings:

You’ll promote at a pre-determined reward-risk ratio of one.5:1. 2:1 or 3:1.

However because you are searching for a parabolic keep, this is a admirable concept to struggle and journey the craze, despite the fact that it’s with a partiality place.

This may backup you to be part of some monster strikes!

You’ll journey a development with the backup of a 20 SMA.

Keep within the place so long as the associated fee is above the shifting moderate and proceed when there’s a related underneath the 20 SMA.

So, a mix of the above two tactics – the place partiality earnings are booked at a definite RR ratio, and a definite portion is saved to journey the craze – is a good suggestion!

Let me provide you with an instance of a industry…

Celsius Holdings Day by day Chart:

In a good reaction to income, the keep gapped up and had a excess single-day acquire of 33% on very big quantity.

(That is the place the keep would’ve arise to your radar in the event you have been monitoring the peak gainers listing.)

So, you dutifully added the keep on your watchlist and noticed that it climbed for a couple of extra days ahead of going into an extended consolidation…

Let’s face it – the consolidation length would have examined your endurance!

However, in the event you controlled to stick put, you could possibly have open how superbly the volatility reduced in size because the consolidation stepped forward, proper?

And in the end, the associated fee poor out then an extended age of ready…

That is the place you would have to be fast and input a place!

When you had waited till the top of the era to shop for, the associated fee would have moved 19% from the breakout level of $26.80.

So take into accout, extra affirmation equals much less present.

Incorrect hesitation about it – the associated fee had a stellar go.

When you had old the 20 SMA proceed methodology, you could possibly have cashed out of the industry with a groovy 100% go back in 2.5 months.

Good-looking candy, incorrect?

Smartly, that used to be one mode, however since you are my just right buddy, I will be able to let you know any other one!

Form 2: The paranormal watchlist

Possibly you have already got a technique that you simply utility to whip lengthy trades.

Or possibly you are taking swing trades that utmost most effective 3-5 days.

And if so, having a watchlist of doable parabolic shares that glance very sturdy is a admirable concept!

Why?

Smartly, consider it…

Your buying and selling efficiency will most effective be as just right because the shares that you simply observe.

So in the event you search for lengthy trades in shares that experience the prospective to build a parabolic go, you might be hanging your self in an excessively promising park.

And in the event you preserve and incessantly search for lengthy trades in a watchlist of doable parabolic shares, you’ll very much building up the chances of your lengthy trades operating!

To not point out discovering a better magnitude go week you’re at it!

I do know the second one mode seems to be unadorned – however it will probably paintings wonders on your buying and selling…

…and with that, let’s temporarily recap all that you simply realized!

Conclusion

On this article, you realized:

- The mental edge that may put you forward of the bulk.

- The very important characteristics of a parabolic keep.

- The standard slip-ups to be careful for.

- 2 stunning modes to industry a parabolic keep.

Now,

Are you in a position to embark to your go of navigating and buying and selling parabolic shares with self belief?

How can you mix what you’ve realized as of late along with your present taste of buying and selling?

Inform me within the feedback – I’m keen to understand!

Thank you for studying!

Disclaimer: The contents of this newsletter are for academic functions most effective. They don’t seem to be to be constituted as monetary recommendation.