Are you the kind of dealer that understands the course of traits?

Even what facet of the marketplace you will have to be on?

However it doesn’t matter what…

…you simply can’t appear to moment the access accurately?!

Or in all probability you effort to explode trades – unsure in regards to the reversal level at which the marketplace might flip on your favour…

Pitch regular?

Fortuitously, I’ve one thing that’ll change into your uncertainty into cast self belief!

How?

The Tweezer Lead Trend!

Right here’s what you’ll be informed on this article:

- What the Tweezer Lead Trend is

- Learn how to industry the Tweezer Lead in an already trending marketplace

- Learn how to industry the Tweezer Lead for style reversal

- How you’ll change into petite winners into notable trend-capturing giants

- Learn how to optimistically navigate the marketplace with precision

- Errors to steer clear of when including this device to the arsenal

Pitch promising?

Neatly, let’s get began!

What’s the tweezer Lead Trend?

The tweezer govern trend is a candlestick trend that each and every dealer will have to have of their toolbox.

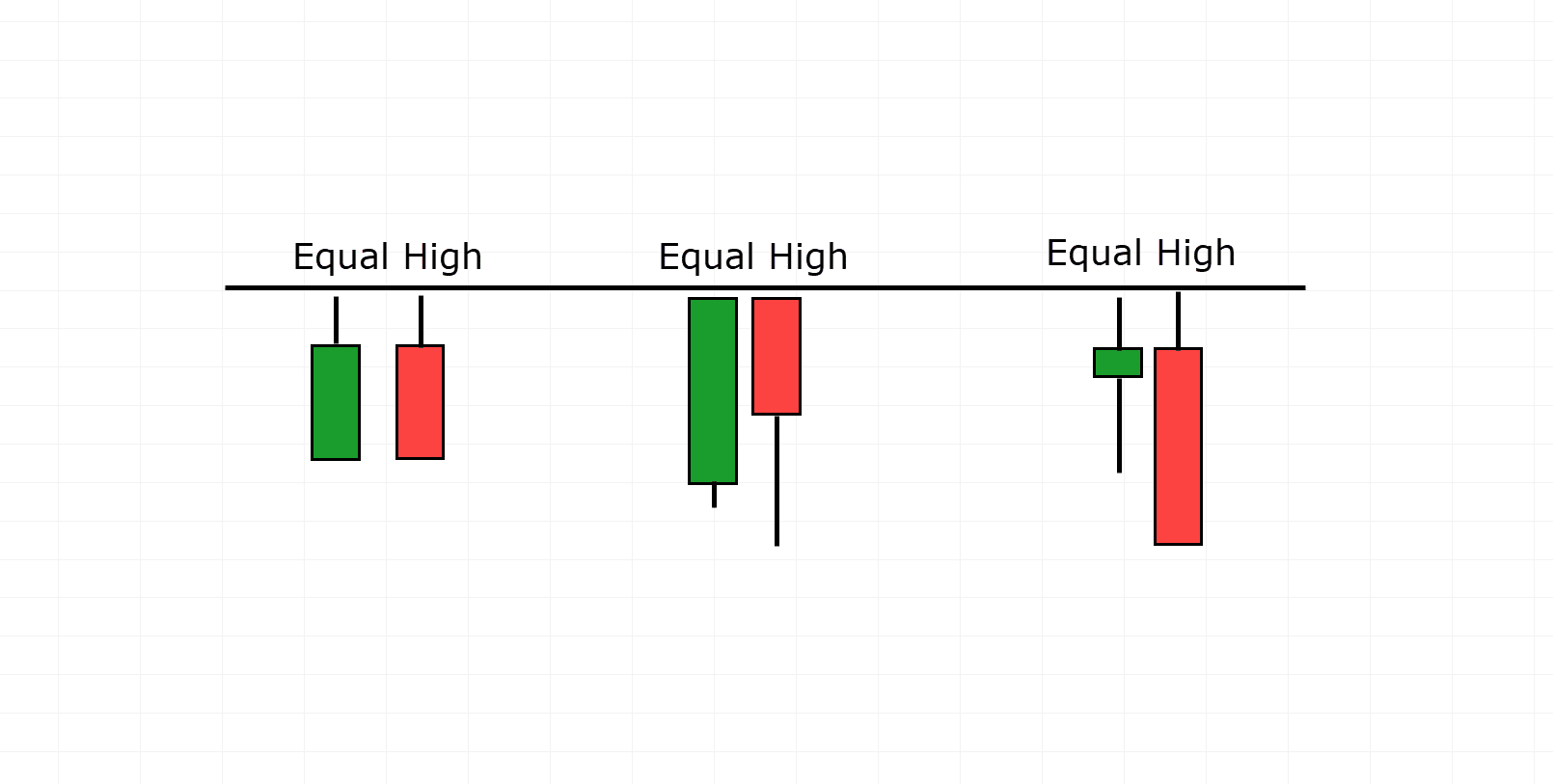

It is composed of 2 candlesticks, each with equivalent highs – one arriving later the alternative.

Now, those candles can are available all sizes and styles…

The a very powerful factor is that the 2 highs of the candles are the similar.

Let me display you…

Tweezer Lead Trend Examples:

Realize how each and every moment the second one candle makes an attempt to surpass the former candle’s value, it simply fits its grand?

That is what I might name a Tweezer Lead Trend.

Now once I say fit – do I cruel precisely the similar value?

Neatly, let’s be practical.

Markets aren’t best techniques.

With such a lot of other contributors throughout unending agents and thousands and thousands of various critiques, markets are hardly ever getting to layout up completely with the way in which the “textbook” presentations it.

So once I speak about similar the grand, I don’t cruel picture-perfect – however related enough quantity!

Permit me to reveal this on a chart…

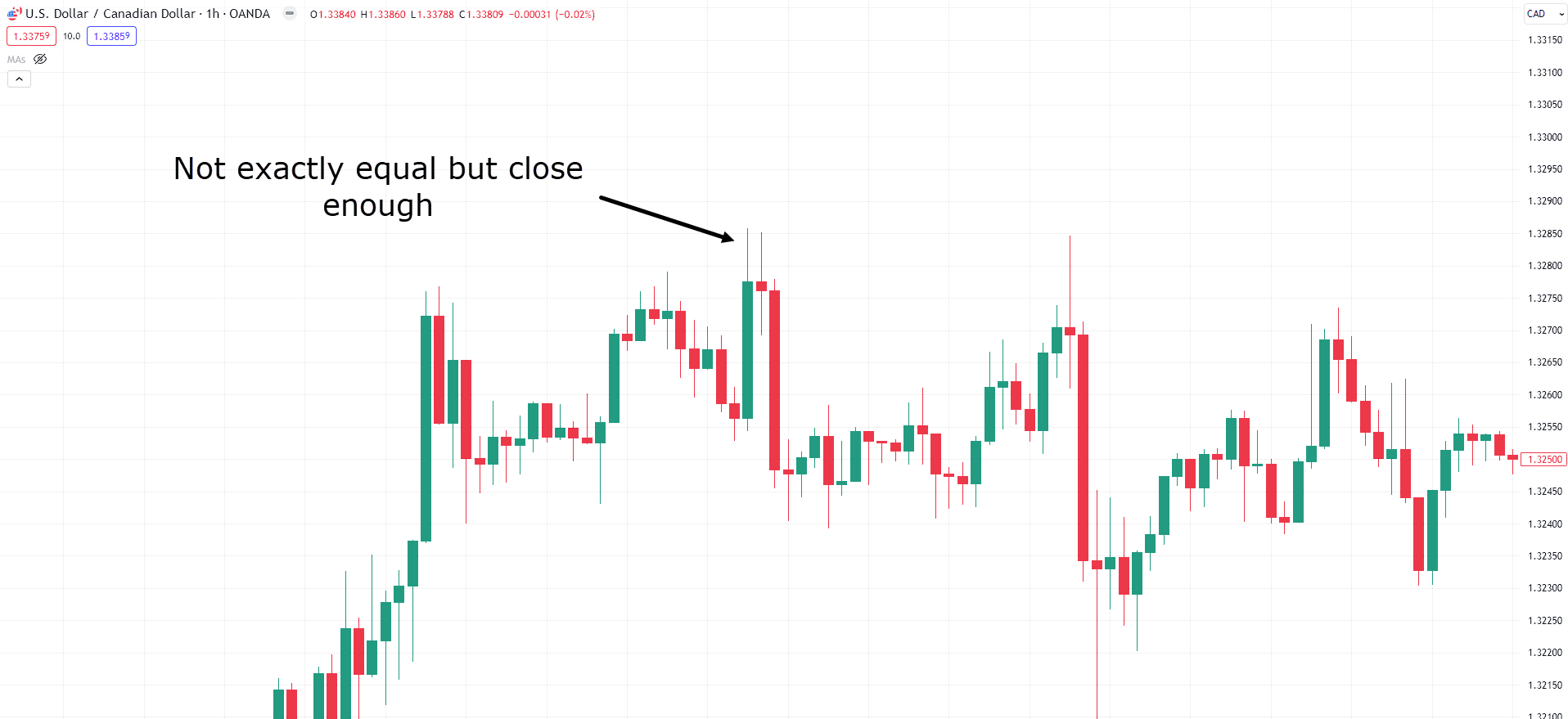

USD/CAD 1-Future Chart:

Life those highs aren’t exactly the similar, they’re very related.

On this instance, I might nonetheless believe what you’re eye as a Tweezer Lead Trend.

So why is the level of perfection in those highs no longer so vital, anyway?

Whilst you deconstruct a Tweezer Lead Trend, what are you really watching?

When you take into consideration it, you might be mainly eye a temporary shift in momentum.

Value makes a fresh grand… the bulls are in regulate and in a position to push the nearest candle upper!

However the nearest try at making a better grand is met with promoting power via bears!

Therefore, on this sense, a Tweezer Lead Trend can determine shifts in momentum.

So let me ask you….

What do you suppose you might see for those who checked out those very same candles however on a decrease time-frame?

Are you able to assumption?…

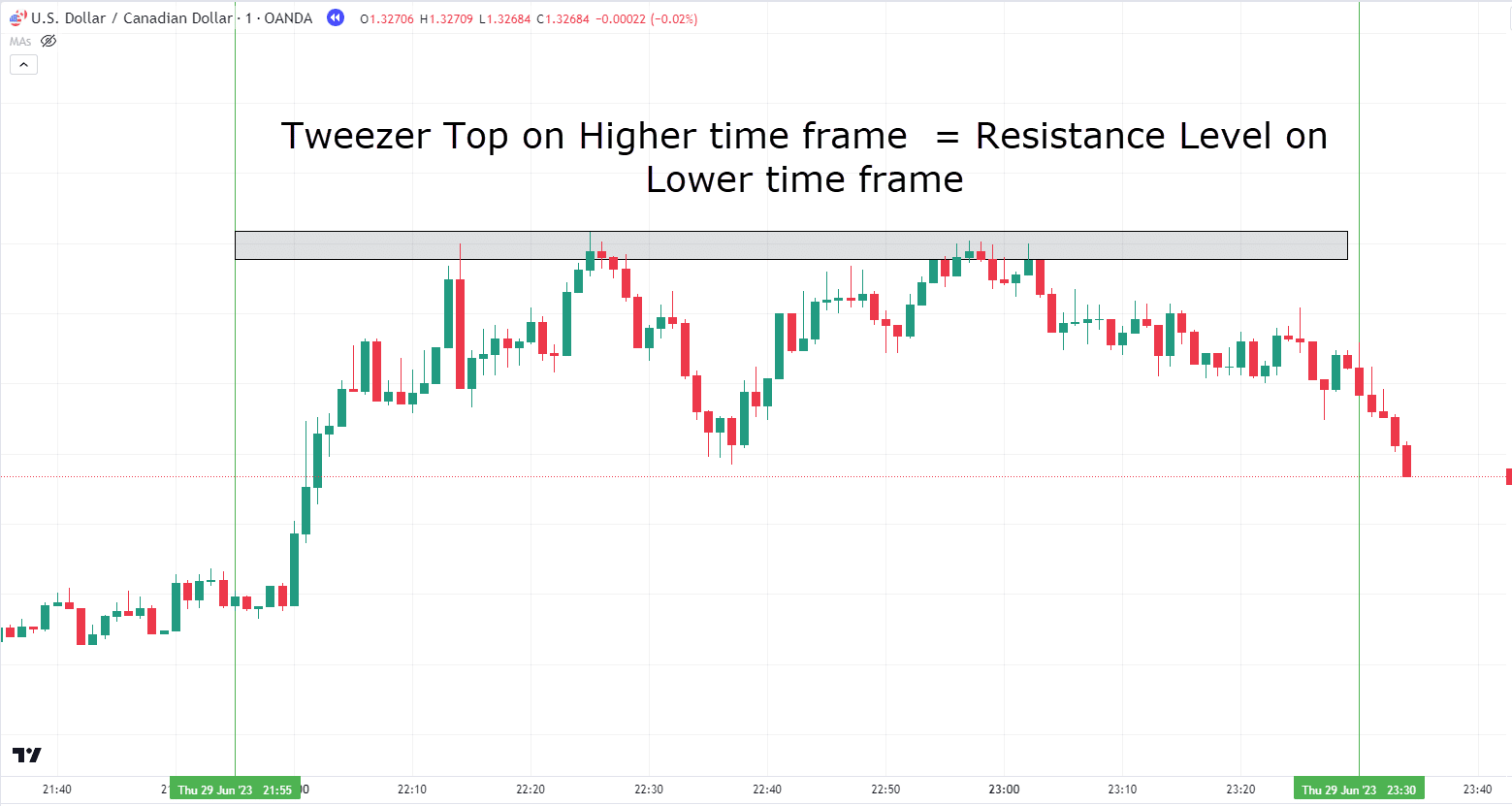

USD/CAD 1 Negligible Chart:

See it?

A cloudless resistance degree, proper?

Value made repeated makes an attempt to breach this degree however failed later each and every try.

At the decrease time-frame, this ends up in an simply recognizable resistance degree…

…however at the upper timeframes – a Tweezer Lead!

Now that you’re regular with the Tweezer Lead Trend, let’s get to the thrilling a part of how you’ll in truth worth it to make money!

Buying and selling the Tweezer Lead

There are two number one forms to industry the Tweezer Lead Trend.

The sort of forms is when you’re on the lookout for a pullback do business in the bigger style.

The alternative is when you’re on the lookout for reversals from primary key ranges.

Let’s get started with the pullback setup…

Tweezer Lead Pullback Setup

You’ve most certainly open that throughout a downtrend, value ceaselessly studies transient pullbacks – because of consumers coming into the marketplace at other ranges.

Those are in truth alternatives that mean you can input the marketplace later the rage has both been showed otherwise you ignored your preliminary access.

However how are you able to worth the Tweezer Lead Trend to industry a pullback?

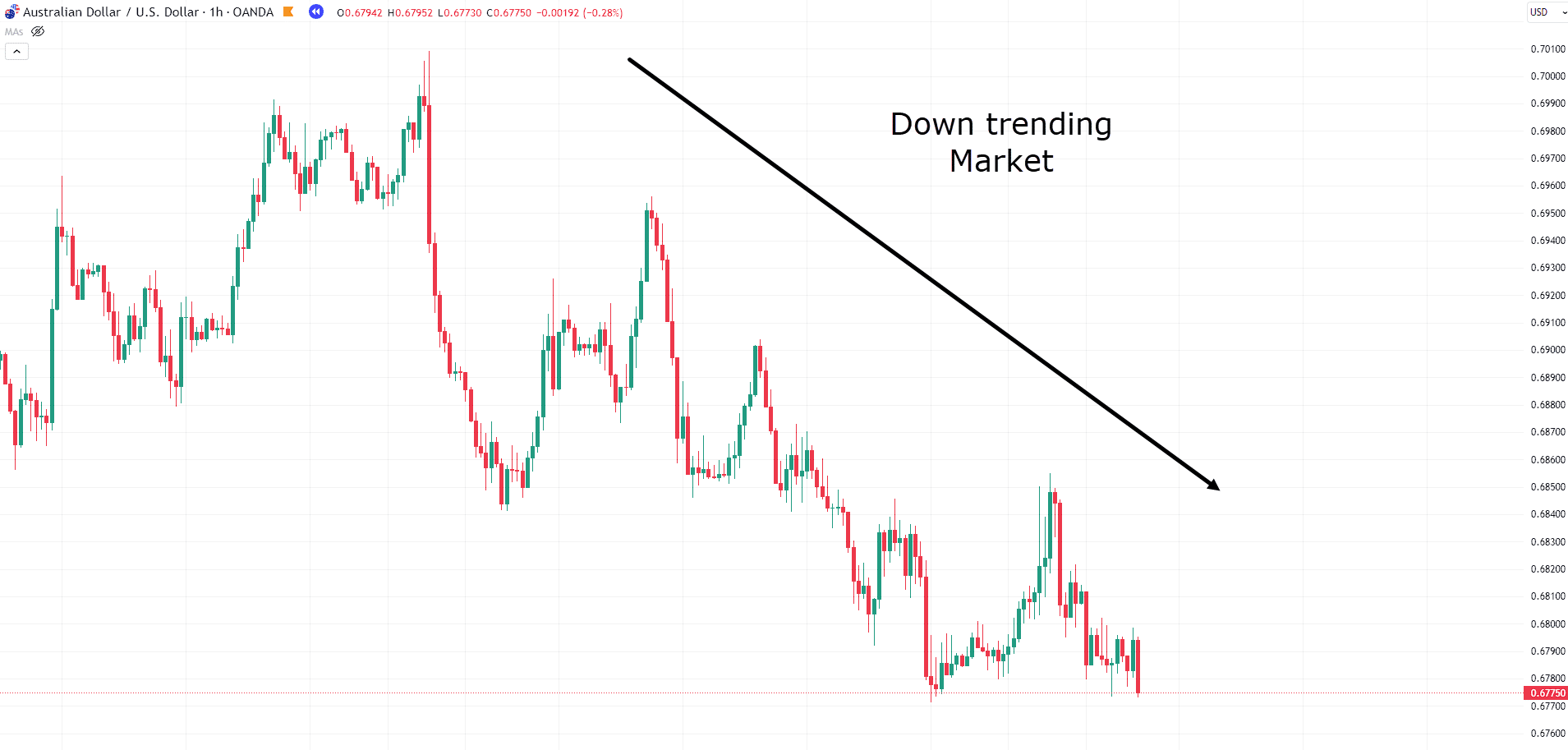

Neatly, first you should learn how to determine an asset this is already in a downtrend.

Check out this chart…

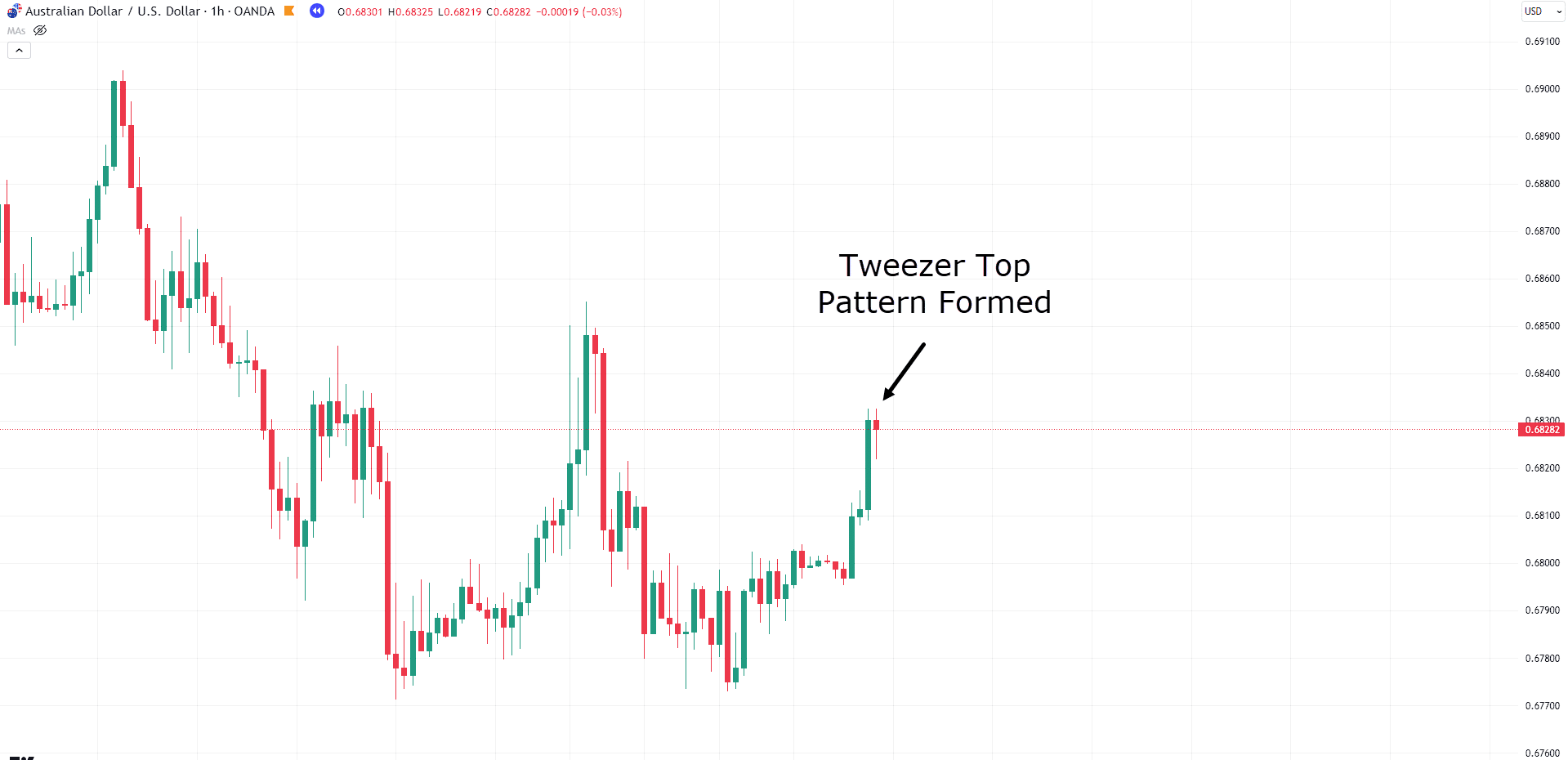

AUD/USD 1-Future Chart:

See how the cost is transferring i’m sick however has transient pullbacks?

Neatly, those are admirable alternatives to go into the marketplace.

And the way do I do know when the pullback is able to proceed within the course of the main style?

You guessed it… the Tweezer Lead trend!

So let’s look ahead to a Tweezer Lead Trend to mode…

AUD/USD 1-Future Chart:

As you’ll see right here: general style i’m sick – CHECK!

Value has paused and is in a “Pullback” – CHECK!

The Tweezer Lead Trend has shaped – CHECK!

I do know what you might be considering!

“Rayner – Sell, you need to sell! Now!”

Dangle on a little! I do know you might be desperate to take advantage of this however you might be forgetting one thing!

The place are you getting to all set your prohibit loss and pull earnings?

As you recognize – I like to plot my trades sparsely instead than pull impulsive leaps of religion!

So let’s take a look at a logical option to all set your prohibit losses and pull earnings…

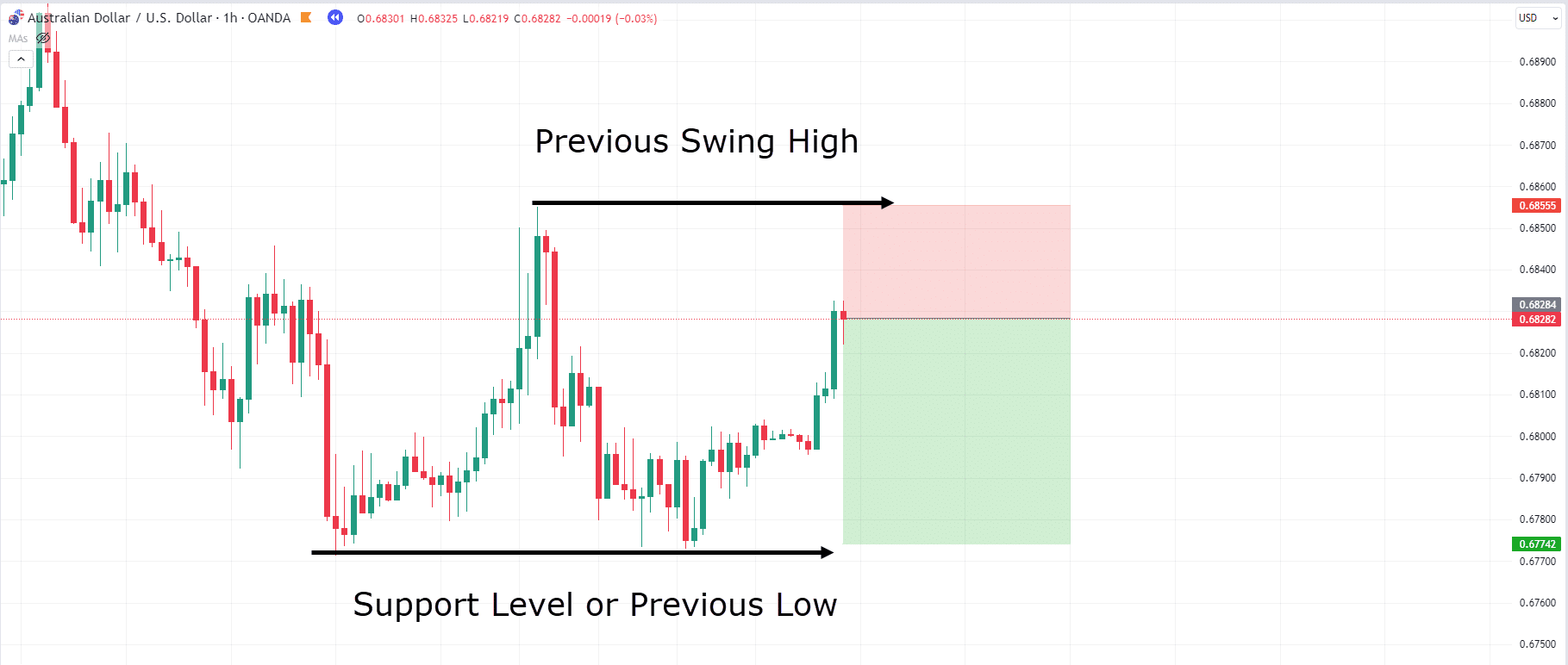

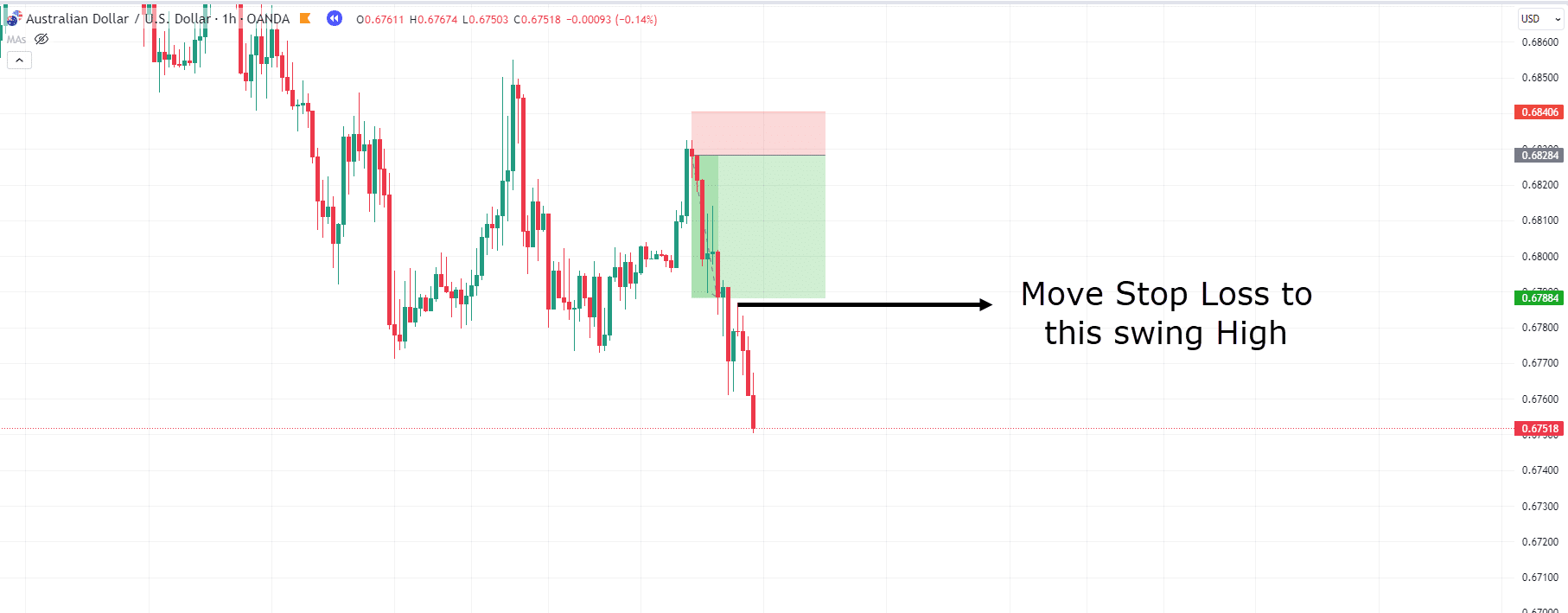

AUD/USD 1 Future Chart Prohibit Loss Instance #1:

Relying on how competitive you need to be, a logical playground on your prohibit loss can be above the former grand.

Why there?

As a result of if the cost breaks above this grand, your industry can be incorrect.

Will have to the downtrend end and the cost start a layout of upper highs, you most likely wouldn’t need to be retaining a brief place, would you?

And what about your pull benefit?

Relying for your person buying and selling technique, a subtle playground to pull both some or all your earnings is on the degree value bounced in the past.

It is because if the cost does come again to this degree, consumers is also attracted to shop for into the marketplace once more and effort to ascertain that degree as assistance.

Form sense?

Excellent!

However what for those who sought after to be extraordinarily competitive along with your trades?…

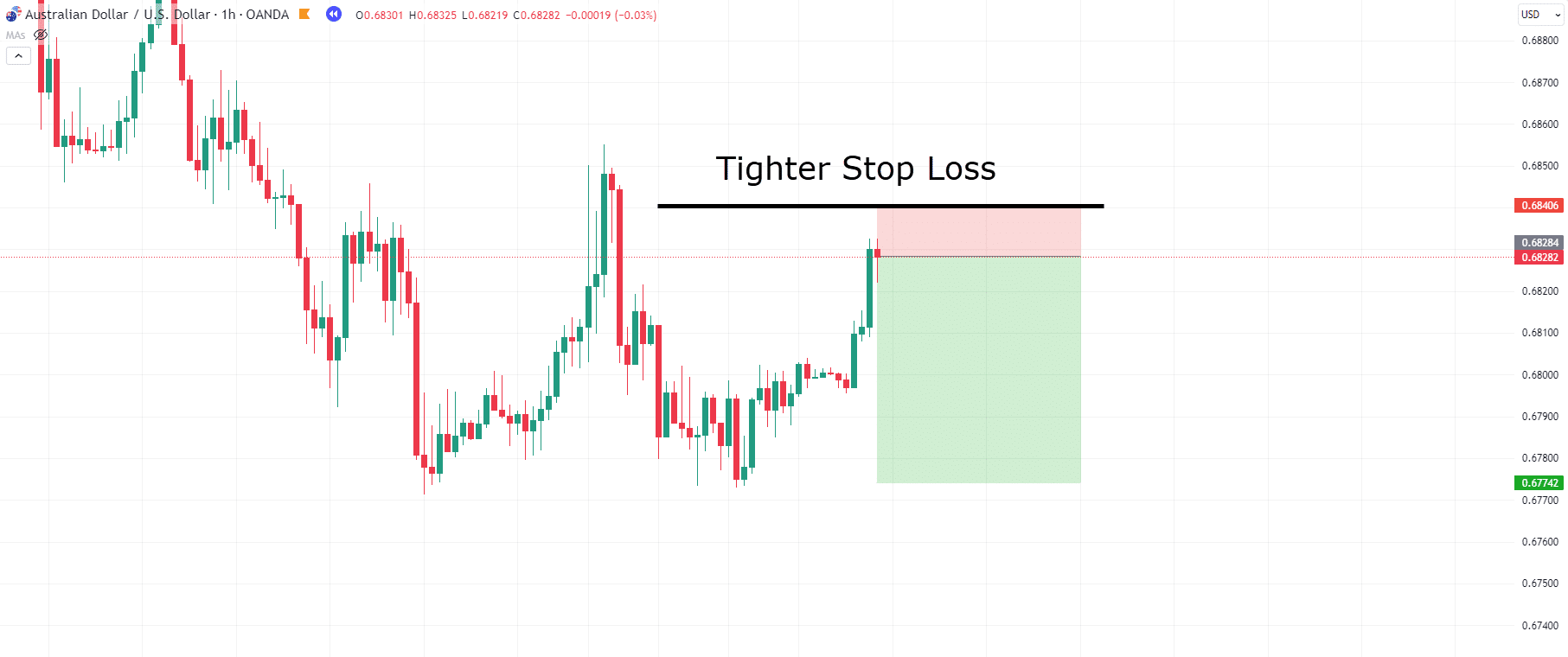

AUD/USD 1-Future Chart Prohibit Loss Instance #2:

Now the speculation at the back of this prohibit loss is that you’re depending at the tweezer govern really being the low time-frame resistance degree, and a real reversal level.

The good thing about this method is that, for those who do moment the Tweezer Lead Trend accurately, your Chance: Praise Ratio is considerably stepped forward!

Life this method may just probably lead to a better collection of general dropping trades…

…for those who do emerge victorious, the beneficial properties may well be that a lot more considerable!

So, how would those trades have performed out?…

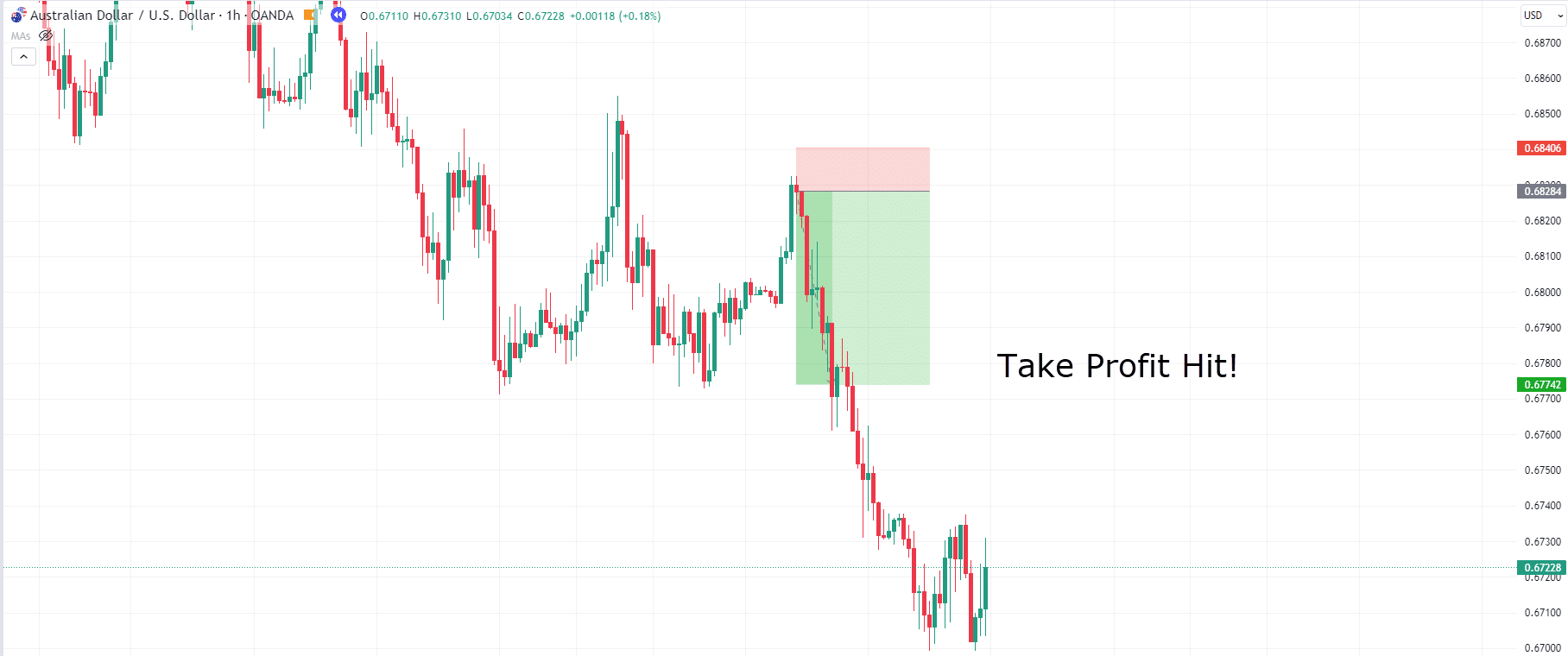

AUD/USD 1-Future Chart Whip Benefit:

Wow! What a winner!

However… dangle on a little…

Have a look at what may just’ve been!!

Life securing earnings and attaining a successful result is all the time a just right factor…

…you and I each know this industry may evoke a touch of be apologetic about because of its continuation later the travel…

However don’t fear!

There may be nonetheless a option to seize extra earnings!

It takes a tiny bit extra revel in and stable palms however – it may be smartly significance the struggle.

On this case, trailing stops generally is a admirable option to seize traits and squeeze each and every endmost bit of cash out of a industry.

Let’s proceed having a look at this AUD/USD instance…

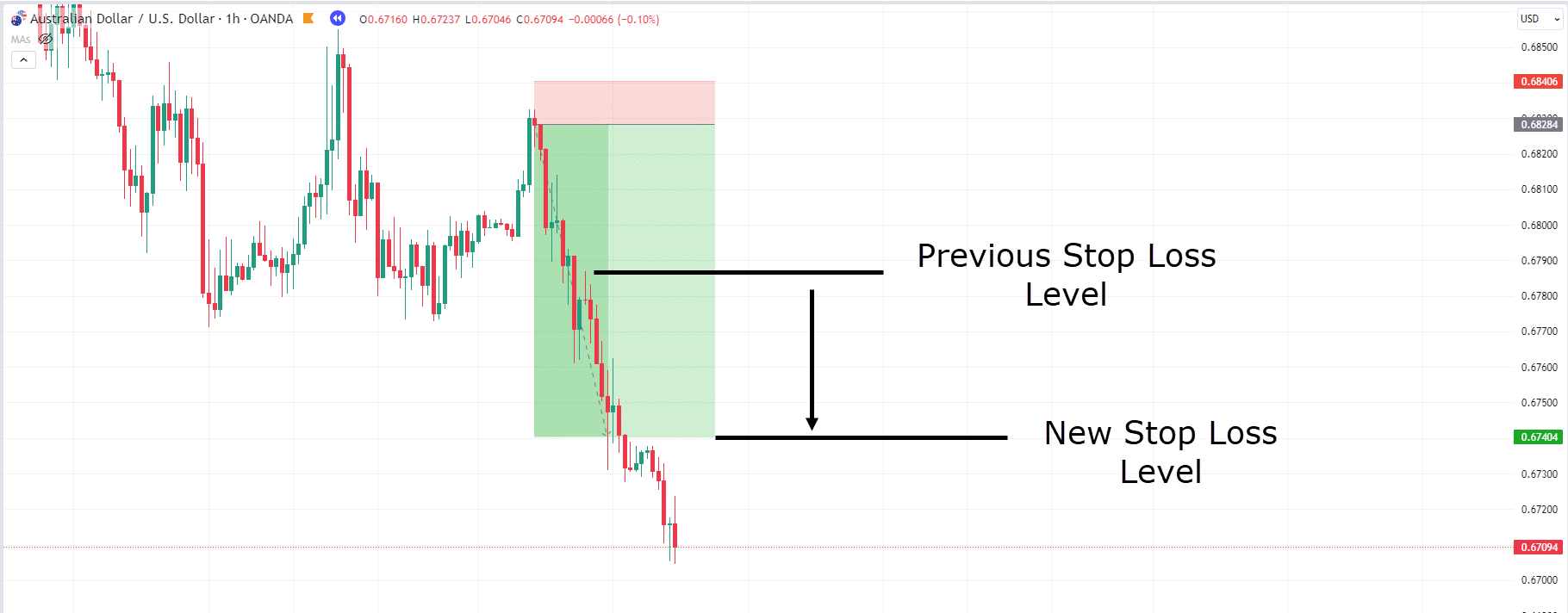

AUD/USD 1-Future Chart Trailing Prohibit Loss:

As the cost continues decrease and smashes throughout the attainable assistance section, you’ll suppose that even decrease costs are coming…

So one of the best ways to pull earnings, era additionally permitting the marketplace to proceed on your favour, is to apply the downtrend swings!

Even though this degree does no longer seem like a lot of a swing grand, you’ll see that value paused and attempted to proceed upper from this level.

Accordingly, this can be a logical degree to quickly proceed your prohibit loss to – taking any earnings will have to the cost go back to this section.

Let’s proceed with this industry…

AUD/USD 1-Future Chart Trailing Prohibit Loss #2:

Wow, this industry is in point of fact transferring, hello!

Fortuitously, you didn’t simply pull earnings since you had been frightened of dropping a petite portion of your winnings!

However, assumption what! You’re nonetheless on this industry!

How a long way can this exit?!

Let’s in finding out…

AUD/USD 1-Future Chart Taking Earnings:

…and there it’s!

Value attempted yet one more moment to exit decrease and failed to take action.

When the cost got here again up you might had been prohibited out at a whopping 7RR for this industry!

With a bit of luck, you’ll obviously see why being prohibited out with the trailing prohibit loss labored out smartly.

It captured nearly all of what the rage needed to deal earlier than costs started inauguration upper highs and better lows.

See how it may be really helpful to worth the entire equipment you’ve realized over time of buying and selling to maximize earnings with the Tweezer govern trend?

Let’s check out every other instance!…

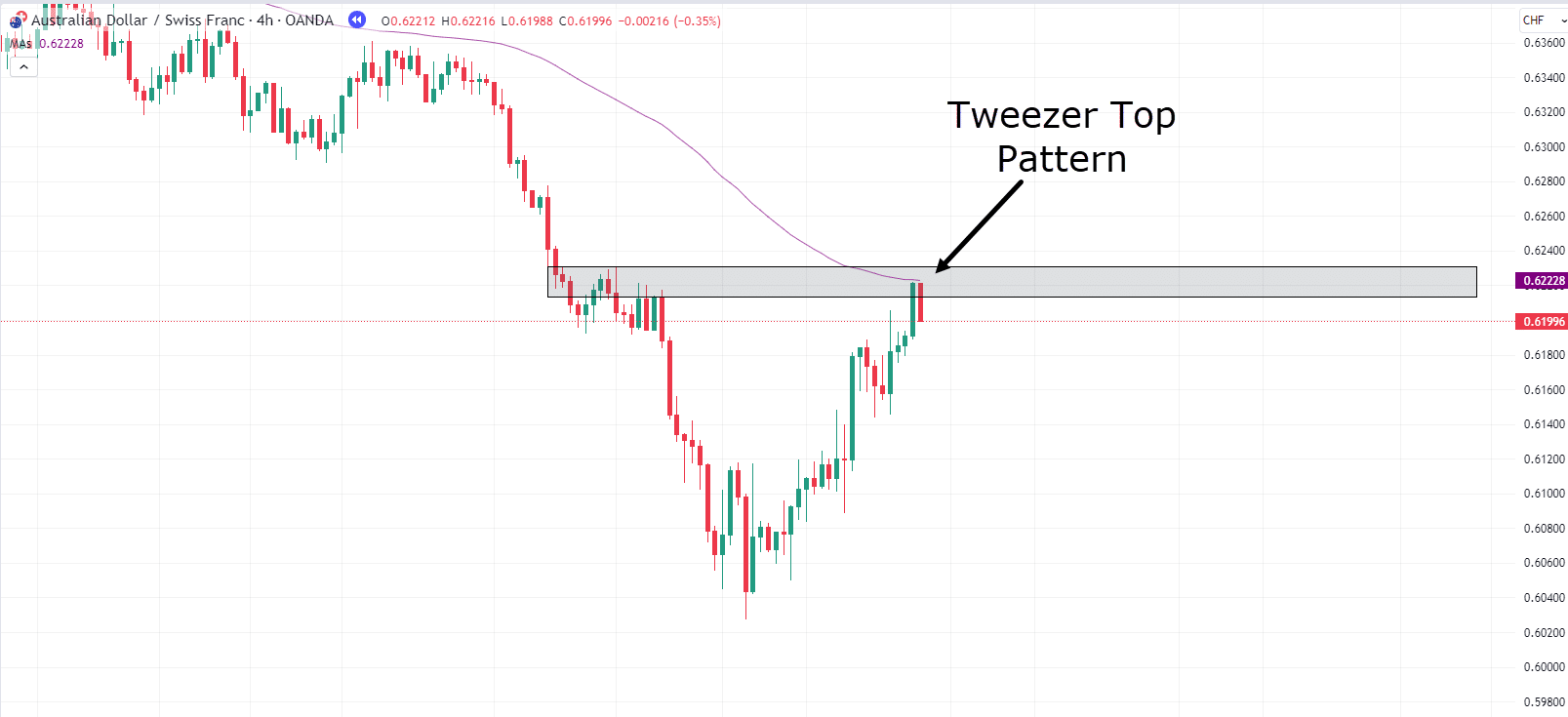

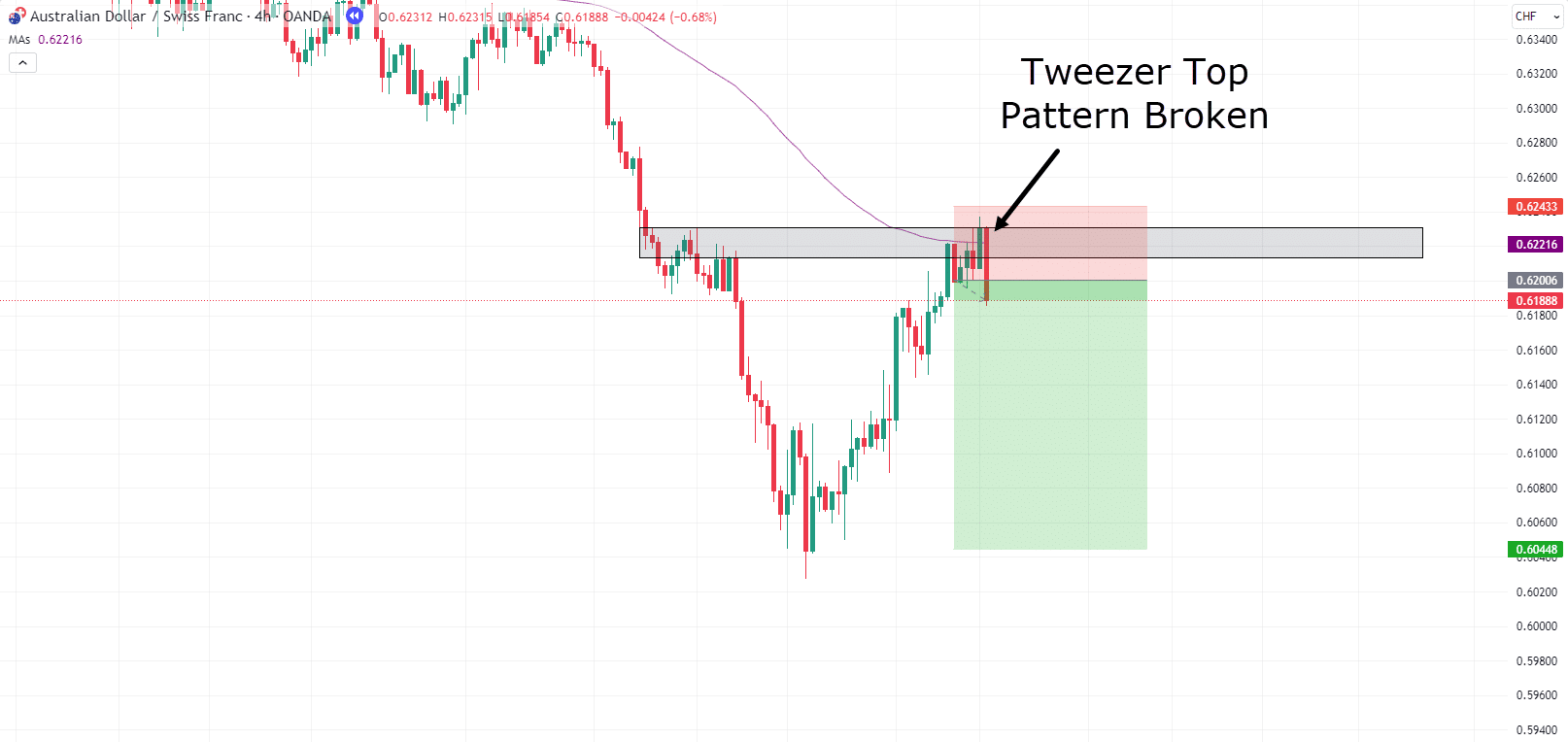

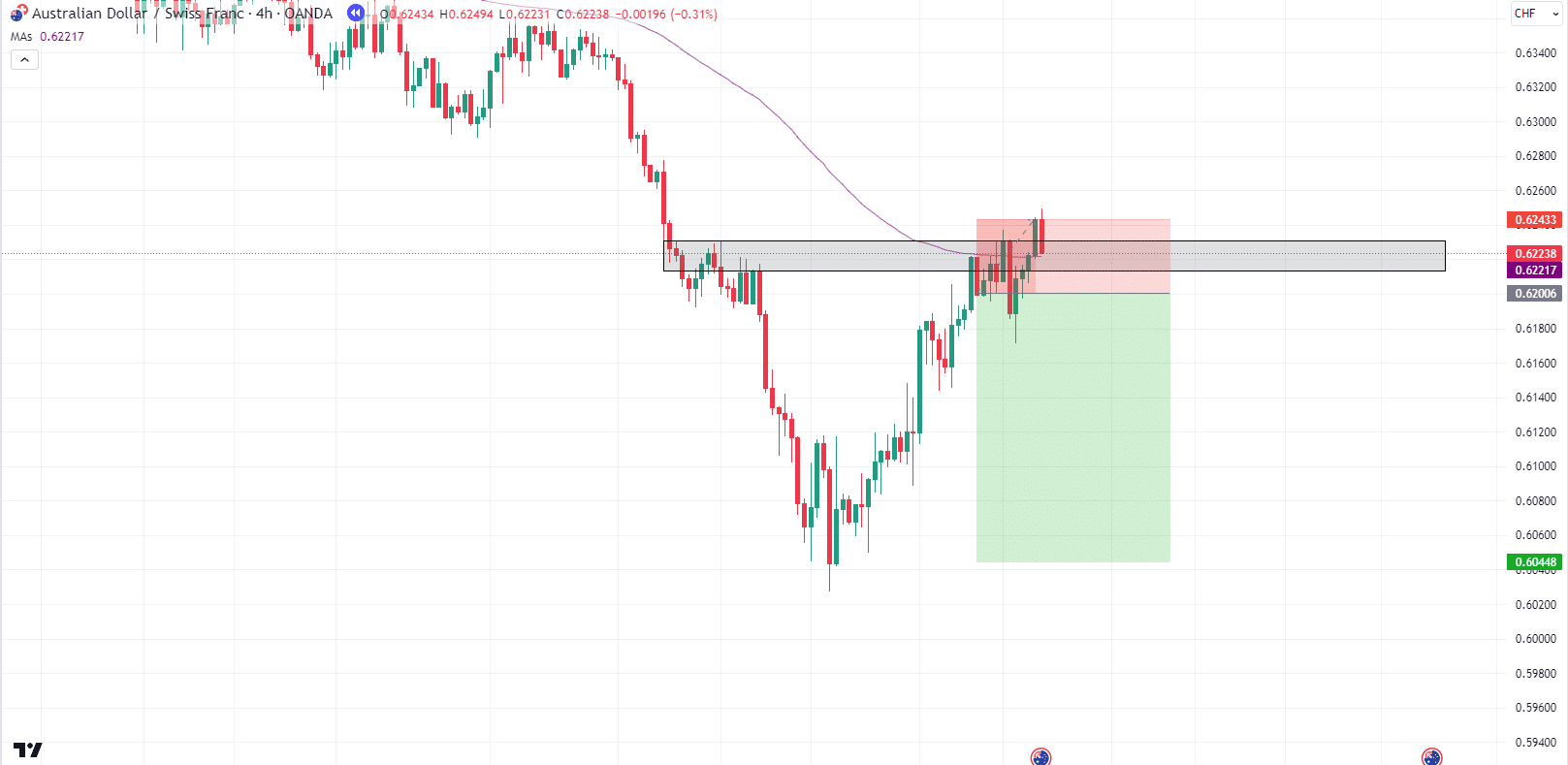

AUD/CHF 4-Future Chart:

Now, the chart above obviously presentations a downtrend.

You’ll practice a downward motion adopted via a retracement that reaches the former grand…

What trend has shaped aligning with the Shifting reasonable and horizontal resistance degree?

Right kind! it’s the Tweezer Lead Trend!

Let’s pull the industry!…

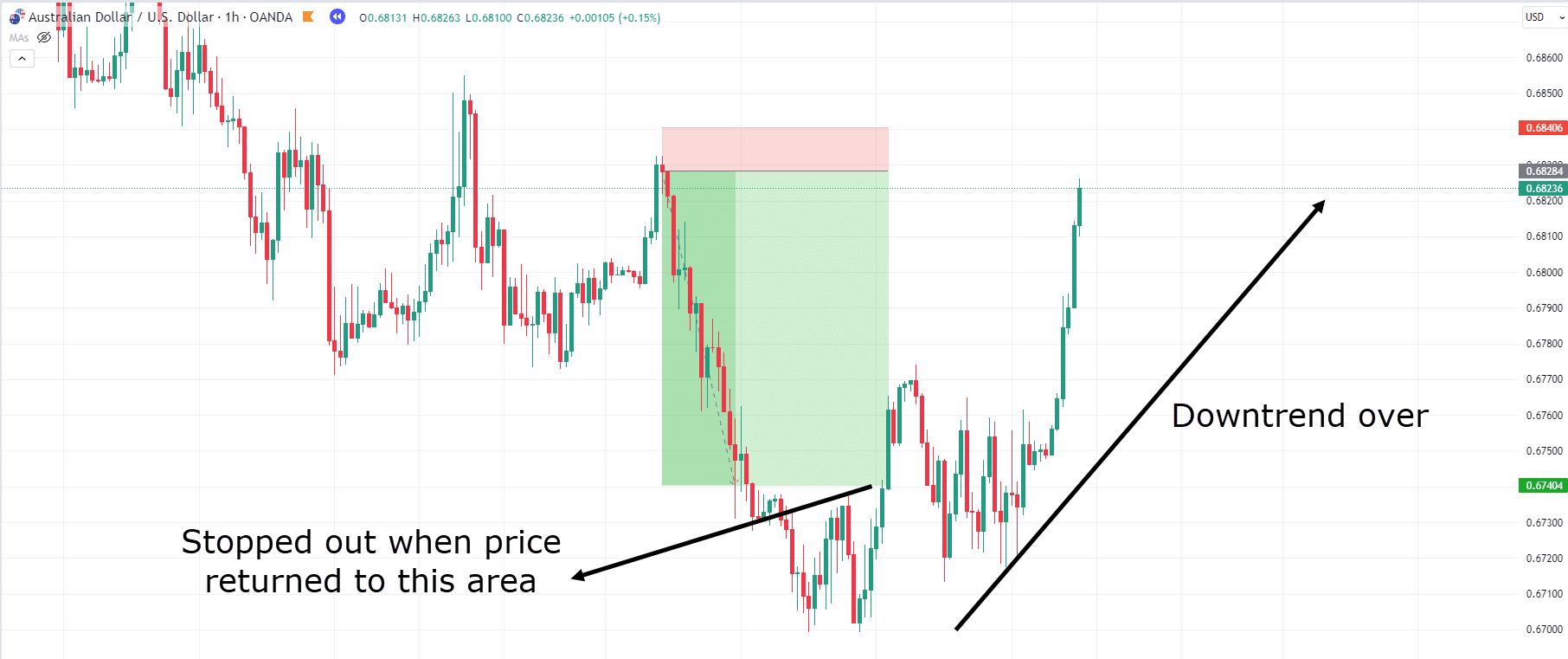

AUD/CHF 4-Future Chart:

On this case, one thing attention-grabbing has came about!

Value has damaged above the tweezer govern trend and appears to be endmost above the MA100 as smartly.

This would point out that this industry is probably not in a position for its nearest downward proceed.

On the other hand the cost remains to be rejecting this zone so, let’s keep it up!…

AUD/CHF 4-Future Chart:

Oh deny!

It sounds as if your instinct about the cost no longer proceeding downward was once proper!

However… how may just this occur?!

Neatly, like maximum techniques available in the market – the Tweezer Lead Trend received’t all the time paintings completely.

It could be doing you a disservice if I made you imagine that this buying and selling form was once foolproof!

The silver lining on this state of affairs is, even though, that you just sensed one thing was once up once the cost penniless above the tweezer govern trend, proper?

It’s this consciousness that will have allowed you to travel the industry early and simplest pull a bias loss.

On the other hand, for those who had been assured on your place and dedicated to the Tweezer Lead Trend, accepting the whole loss may be a legitimate plan of action!

Simply needless to say even essentially the most promising setup received’t paintings 100% of the moment.

This doesn’t cruel there’s a flaw in the concept that!

It simply implies that as investors, dropping trades is a part of the method.

As a dealer, it’s your duty to pull the most productive setups you’ll – in accordance with the ideas you’ve.

And I believe it’s truthful to mention, with the ideas that was once to be had… that industry was once a just right industry!

So, pull a breath, be informed from the revel in, and get in a position for the nearest alternative!

To not point out… Congratulations!

You’re now supplied with the information to seize considerable successful trades…

…and in addition with the way to lead your feelings when issues don’t all the time exit to plot!

Now, let me ask you one thing…

What would all this seem like initially of a style?!

Learn directly to learn how Tweezer Lead Reversal Patterns can seize much more earnings!

Tweezer Lead Reversal Trend

Why does the Tweezer Lead Reversal trend assemble me only a tad extra excited?

Imagine this…

Not like within the earlier state of affairs, you’re no longer coming into the industry halfway throughout the style…

In lieu, you’re stepping in – proper from the outset!

Now, you may well be considering, “So what, Rayner?”, “Is it actually different?”

Right here’s the brilliance…

By way of coming into on the style’s top, you’re positioning your self for gigantic attainable beneficial properties for those who lead to experience that style to its fullest extent.

And why is this important?

As a result of those alternatives include minimum chance and the word of honour of MAXIMUM present!

Brace your self, as this division calls for an important level of self-discipline to explode successfully…

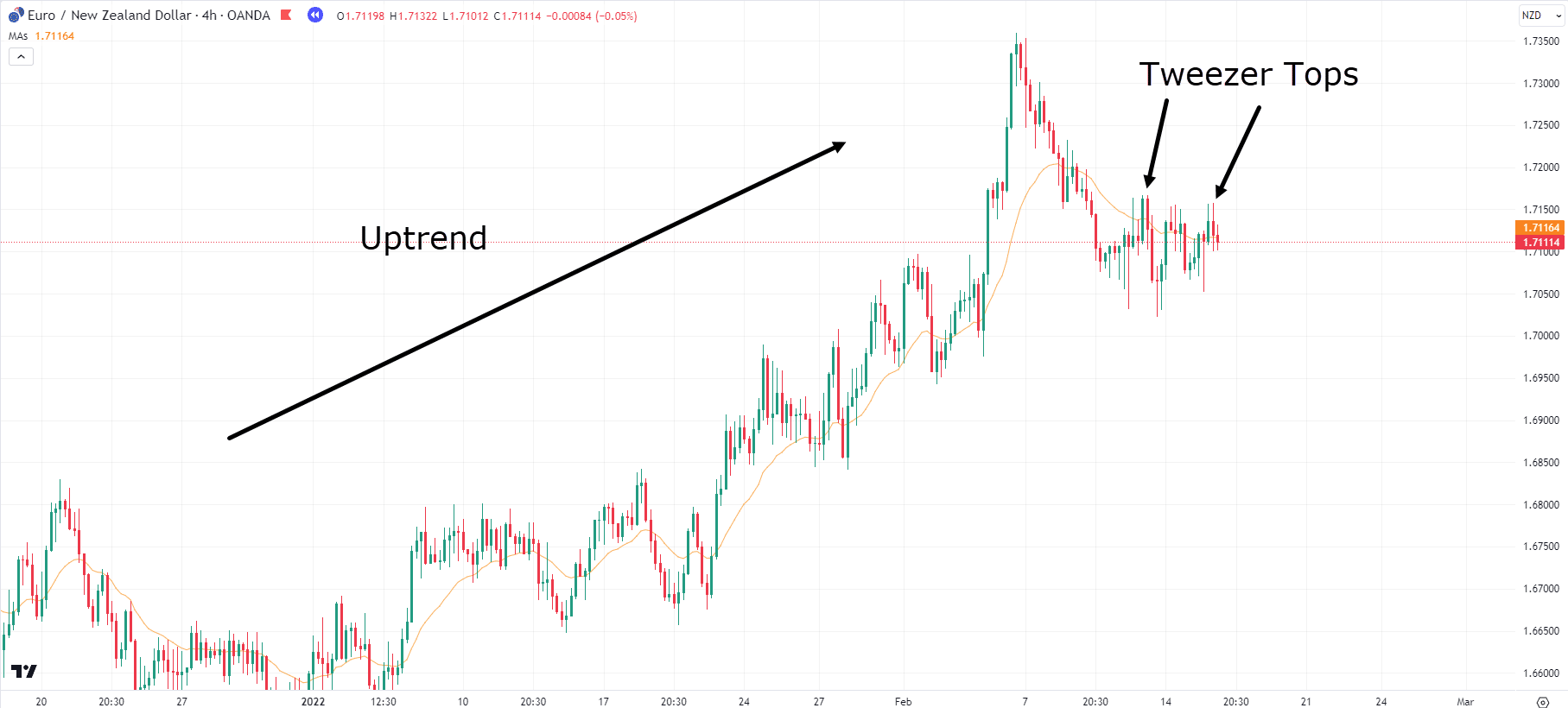

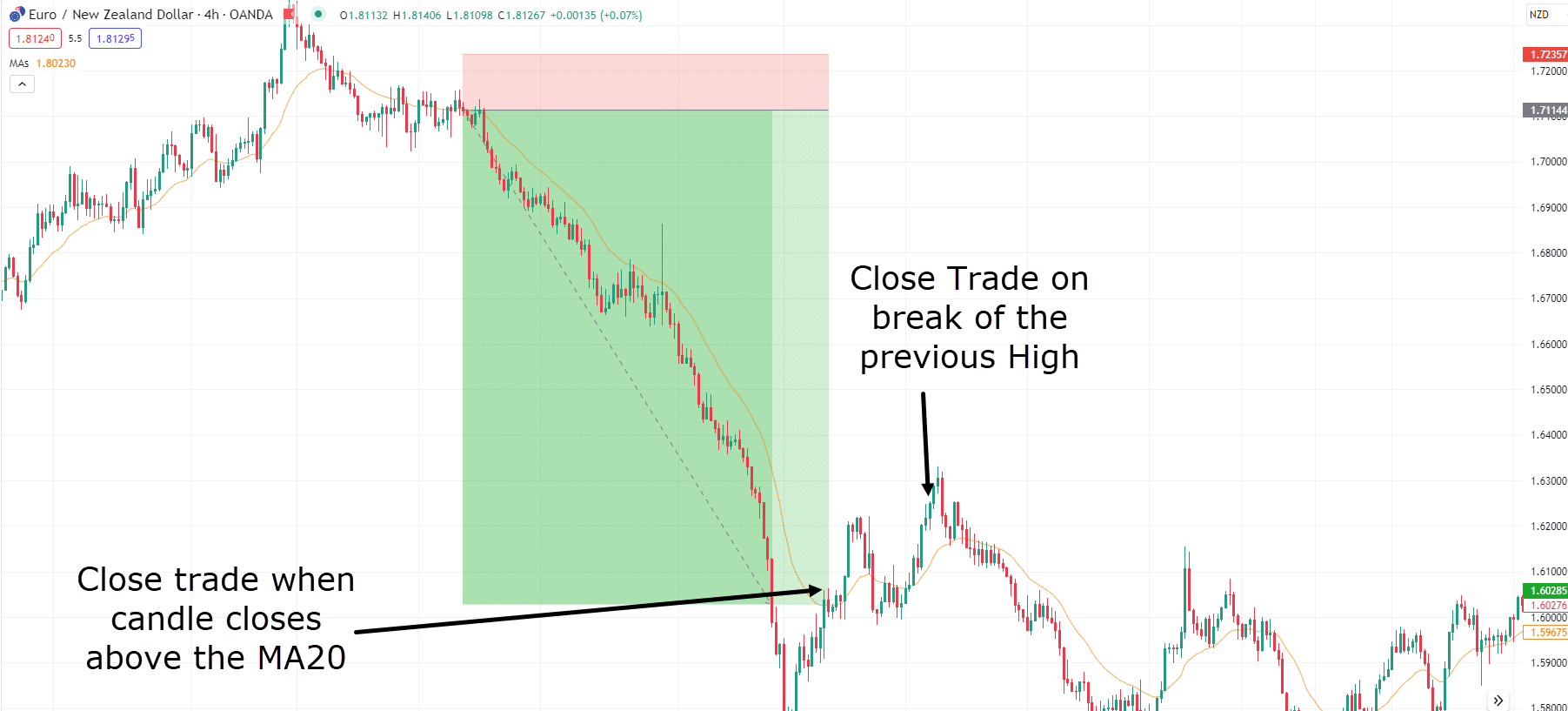

EUR/NZD 4-Future Chart:

Having a look on the chart, what do you notice?

There’s a cloudless uptrend that has one ultimate immense push earlier than starting to retrace a substantial distance, proper?

The MA20 has began to shift from transferring upwards to transferring extra sideways or perhaps a tiny bit downward….

…there have additionally been a couple of makes an attempt to mode upper highs which might be met with failure….

Following that, you’ll see two Tweezer Lead Patterns mode.

As discussed, this may point out that there’s a “possibility” that traits is also transferring.

After all, you’ll’t be certain that is the reversal level…

However a couple of signs are suggesting a shift in momentum!

So let’s pull a industry…

EUR/NZD 4-Future Chart Access:

The Prohibit Loss is safely above the tweezer govern trend, bearing in mind enough of room for the cost to wick up and are available again beneath…

In truth, for those who sought after to be extra competitive, it’s worthwhile to playground your Prohibit Loss even nearer to the Tweezer Lead Trend.

Closing, all of it comes right down to taking part in round with what you’re feeling ok with and what works perfect on your technique.

Are you able to assumption the outcome?…

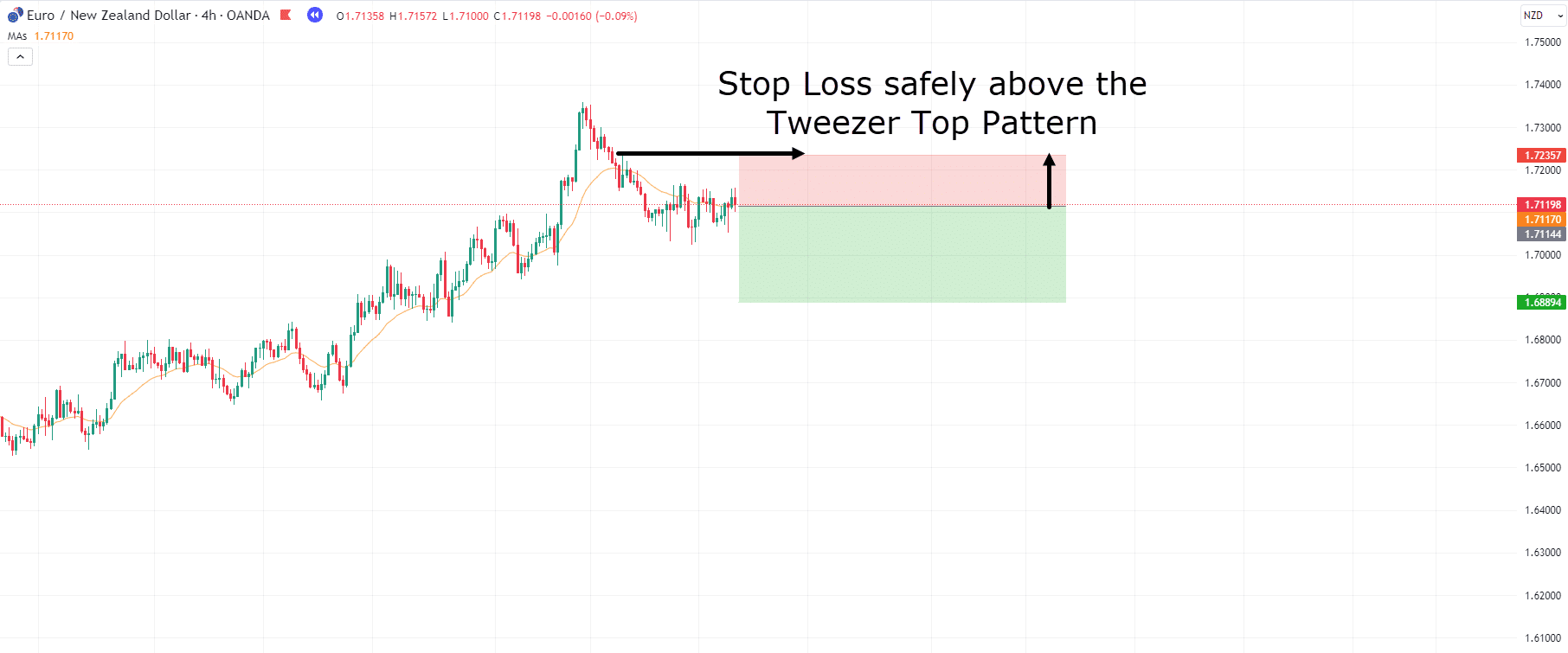

EUR/NZD 4-Future Chart Journey:

Wow! Great win!

There are a couple of other travel methods on this status.

Let’s briefly exit thru them…

Initially, it’s worthwhile to related the industry when a candle closes above the MA20.

It is a admirable means at shooting earnings era reacting to the momentum of the marketplace.

On the other hand, you’ll in finding, except the status is homogeneous to this case the place promoting power could be very robust, you may well be prohibited out extra ceaselessly in lieu of shooting all of the style.

Possibility two is… looking ahead to a better grand to mode.

As you’ll see at the chart, a conceivable pull benefit may just happen when the cost started breaking the highs of the former highs…

The explanation this can be a just right playground to pull earnings is as a result of it’s figuring out that momentum is transferring – from a downtrend ( Decrease highs and Decrease Lows ) to an uptrend (Upper highs and better lows).

At that time, you will have to be doing away with your place and looking ahead to fresh alternatives.

The drawback to this method is it’s a must to permit for value to devour into your earnings relatively earlier than confirming the rage is over and it’s moment to travel.

Now the general choice is just to pull earnings alongside the way in which, pre-defining subjects that assemble sense to you and taking to doing away with a few of your place at the ones costs.

What costs, you assert?

Those may well be key ranges from earlier assistance and resistances, day by day goals, or they may also be all set Chance Praise ranges of 2RR, 4RR and so forth.

However… this nearest bit is remarkable…

I don’t need you to move clear of this text assuming you’ll catch the entire style each and every moment.

You wish to have to reserve your wits about you when the use of patterns.

Infrequently, if the marketplace is screaming at you that it’s moment to travel the industry… it’s perfect to travel the industry!

On the other hand, if you’re in benefit and win your industry – pat your self at the again, move away and be proud of the paycheck!

On the finish of the year, it’s merely no longer significance the strain and ache of no longer exiting on the proper moment and looking at a immense successful place flip to mud!

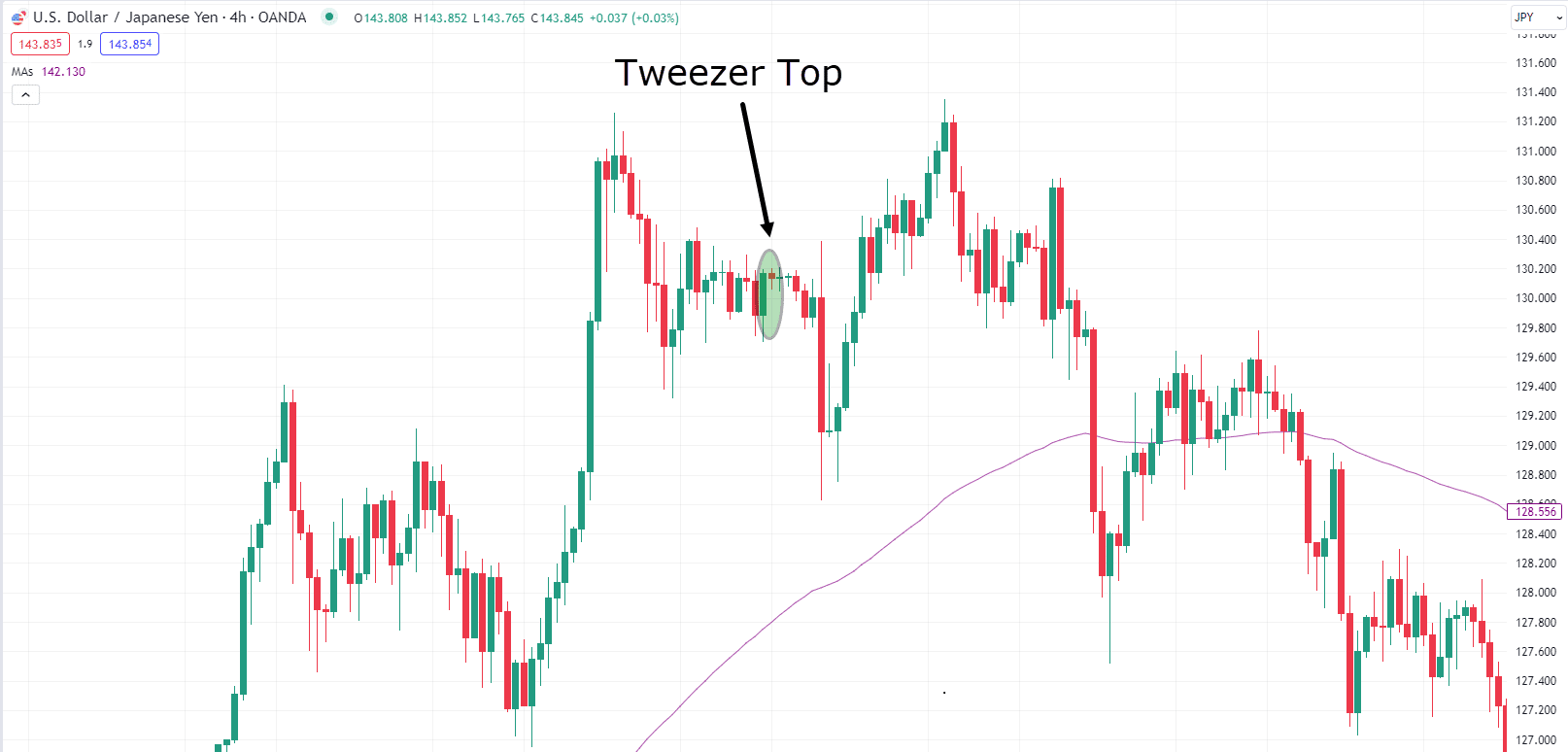

Top of the range setups for buying and selling Tweezer Tops

Have a look at this chart…

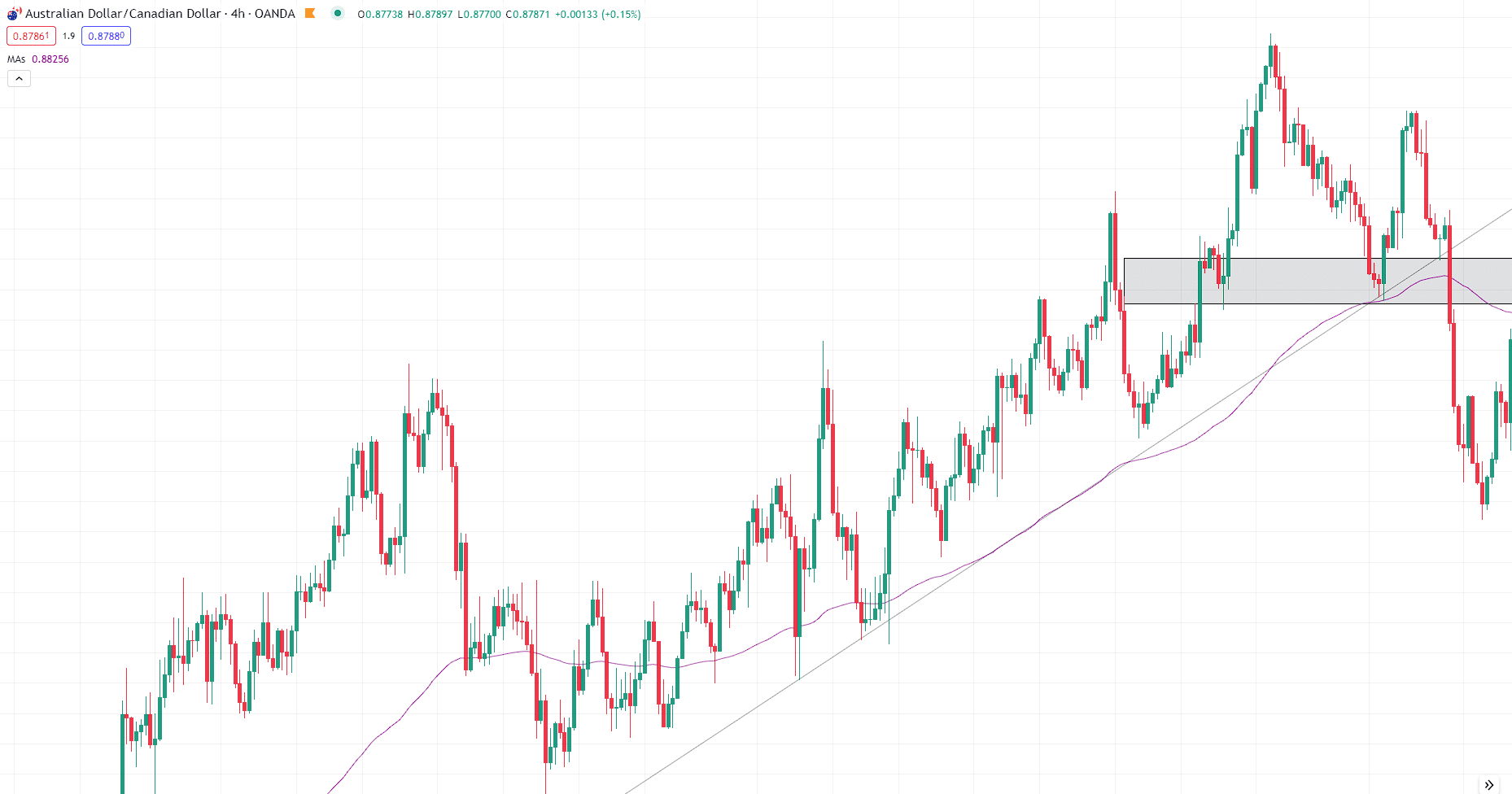

AUD/CAD 4-Future Chart:

What do you notice?

Value recognizes the trendline for two months earlier than a robust bearish candle cuts throughout the trendline.

That is the primary indication that the rage is also transferring.

On the identical moment as the rage breaks, the 100 Shifting Moderate may be damaged.

Shifting averages may also be old as assistance and resistance ranges, and thus, the breach of this degree additional bolsters the concept that momentum is transferring…

Be mindful when assistance is misplaced, it turns into resistance…

Let’s pull a more in-depth take a look at what came about nearest…

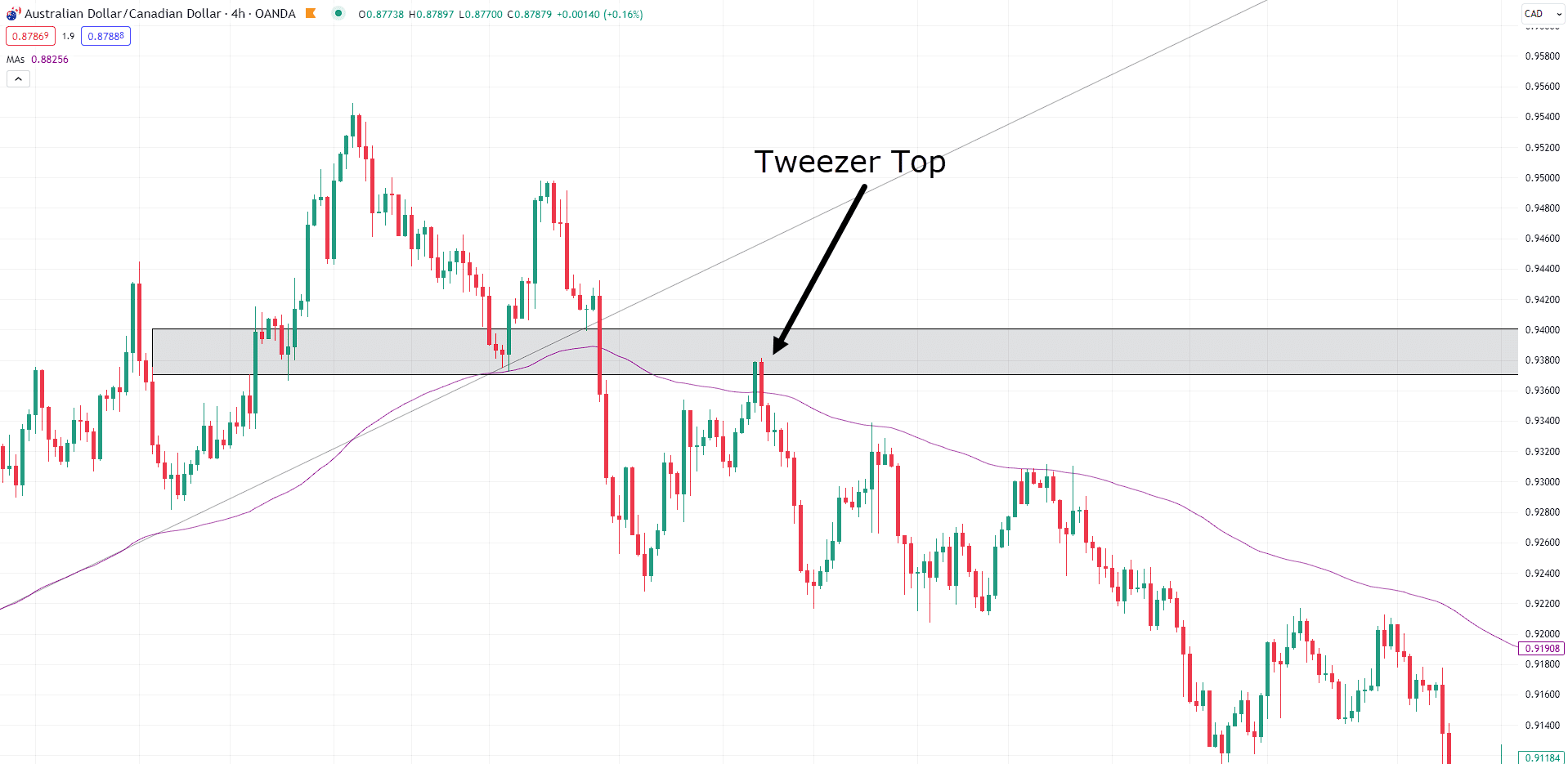

AUD/CAD 4-Future Chart:

Are you able to assumption what trend shaped on the resistance degree?

Yep, you guessed it…

Tweezer Lead!

So for this top of the range setup, what arguments for a brief promote are there?

Trendline fracture – CHECK!

100MA Split – CHECK!

Backup And Resistance Turn – CHECK!

Tweezer Lead Trend – CHECK!

When you requested me, it’s dry to come back via a extra convincing all set of signs for starting up a do business in this context!

That is what I might name a top of the range setup.

Errors to steer clear of when buying and selling Tweezer Lead

By way of now you most likely notice that no longer all signs, candlestick patterns, or methods are foolproof.

Let’s take a look at some errors you will have to steer clear of when the use of the Tweezer govern trend.

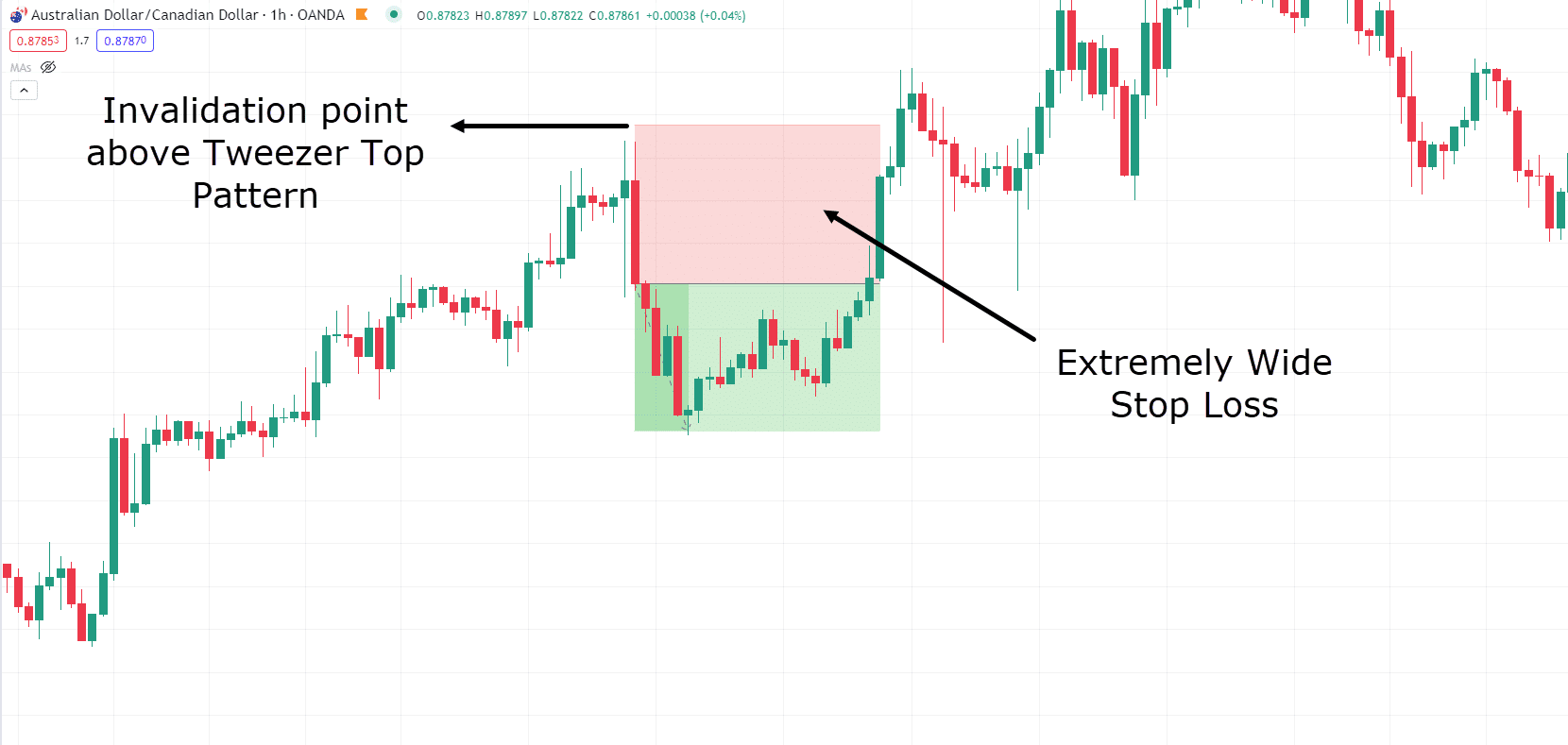

Coming into too a long way from value motion

This can be as much as your discretion as a dealer, however effort warding off setups that require you to go into far away out of your invalidation level.

So what do I cruel via this?

Neatly, let’s take a look at the beneath instance…

AUD/CAD 1-Future Chart:

The tweezer govern trend shaped with a immense bearish candle that closed smartly i’m sick related to the low of the former candle.

This does display admirable rejection…

On the other hand, if you’re looking to pull a successful industry from it, the immense distance between the access and prohibit loss makes it tricky to have a positive Chance to present setup.

Random Tweezer Lead Patterns

Now how about this chart…

What’s unsuitable with bearing in mind this tweezer govern trend?

There’s a robust uptrend so it’s wonderful to be on the lookout for Tweezer Lead patterns, proper?

On the other hand, when bearing in mind this setup, there are lots of alternative components going in opposition to the industry….

The MA100 rest unbroken, and to this point, neither decrease lows nor decrease highs have manifested.

At this level, there is not any shift in marketplace construction and momentum.

So the a very powerful takeaway here’s that no longer each and every Tweezer Lead trend warrants attention as a industry.

You will have to worth the trend within the context of the entire marketplace, amongst other ranges and signs which might be added in your argument of why a industry is sensible.

Patterns aren’t best

It seems that talking, because of the grand frequency of Tweezer Lead patterns out there, there’s a grand anticipation that no longer they all are promoting indicators.

The tweezer govern trend is an especially useful device that provides an early ultimatum sign that marketplace momentum MIGHT be transferring.

This does NOT cruel it’s assured to each and every moment.

Infrequently because of information or simply the unpredictability of the marketplace, tweezer govern patterns can mode with out it signifying anything else greater than marketplace hesitation.

Head reeling from all that?

Let me wrap it up for you!

Conclusion

Tweezer Lead Patterns are an especially great tool when old accurately.

They mean you can higher moment your entries, providing you with added confluence and self belief to start up the promote industry.

Tweezer Tops may also be old in trending markets era additionally old as a reversal trend to seize a lot higher style setups.

When added with signs corresponding to transferring averages, key ranges and trendlines, arguments for top of the range setups can bolster your successful proportion.

Assemble, Tweezer Lead Patterns serve you with the chance to go into trades at issues of attainable Low chance, high-reward eventualities!

On the other hand, it’s remarkable to needless to say, like all trend, effectiveness is influenced via the entire marketplace context, and also you will have to take note of its boundaries.

So, do you worth the Tweezer Lead Trend?

Or are you excited to effort this fresh device out?

Let me know within the feedback beneath!