Ever wondered whether you should invest in individual stocks or go for an ETF instead?

It’s a common question for both beginners and seasoned investors, and the answer isn’t always straightforward.

On the surface, stocks and ETFs seem similar, and it’s true they both give you exposure to the market.

But beneath that surface are key differences that can shape your investing journey differently.

Understanding them is crucial for making decisions that align with your goals, risk tolerance, and how involved you want to be in managing your portfolio!

In this article, you’ll explore:

- What ETFs are and how they work

- The different types of stocks, from small-to-large-cap companies

- Key differences between ETFs and stocks, including diversification, cost, and management styles.

- The risks involved with both investments and how to manage them

- Real-life examples of different stocks and ETFs to see how they compare

- How to decide which option fits your lifestyle— and whether combining both makes sense

By the end, you’ll better understand which path suits you best.

Ready to dive in?

What Are ETFs?

Well, if you’ve ever wondered how you can invest in a wide range of stocks, bonds, or commodities without having to pick individual assets, that’s exactly what Exchange-Traded Funds (ETFs) can help you with.

In fact, ETFs are one of the most popular investment tools today, offering a simple way to diversify your portfolio while keeping costs low.

Whether new to investing or a seasoned trader, ETFs can play a valuable role in your strategy.

So let’s break it down.

Understanding ETFs: How They Work

Think of an ETF as a basket of assets.

It can hold stocks, bonds, commodities, or even a mix of different investments.

It could be a bit like a playlist of stocks; instead of picking individual songs (stocks), you might get something custom that aligns with a particular theme, such as tech stocks, healthcare, or the overall market.

And the best part?

ETFs can be traded on the stock exchange – just like individual stocks!

What does this mean?

You can buy and sell them throughout the trading day at their given market prices.

Make sense?

Good!

Now, let’s look at passive vs active exchange-traded funds.

Passive vs. Active ETFs

Most ETFs follow a passive investment strategy, which tracks a specific index – like the S&P 500 or NASDAQ-100.

These types of funds don’t try to beat the market; they simply mirror its performance.

This keeps costs low and makes them ideal for long-term investors while staying quite safe.

On the other hand, actively managed ETFs have professional fund managers who make investment decisions to try and outperform a certain benchmark (a percentage, for example.)

While this approach offers more flexibility, it often comes with higher fees and greater risks compared to passive ETFs.

That’s not to say it’s better or worse!

These are different options for different scenarios.

Different Types of ETFs

There are many different ETF varieties, each matching differing investment strategies.

Here are some of the most common:

- Broad Market ETFs – Track major indices like the S&P 500 or MSCI World Index, exposing you to hundreds of companies at once.

- Sector ETFs – Focus on specific industries such as technology, healthcare, or energy, allowing you to invest in particular market segments.

- International ETFs – Provide exposure to markets outside your home country, including emerging and developed economies.

- Commodity ETFs – Let you invest in physical assets like gold, silver, or oil without needing to own the actual commodities.

- Bond ETFs – Offer access to government or corporate bonds, making them a popular choice for income-focused investors.

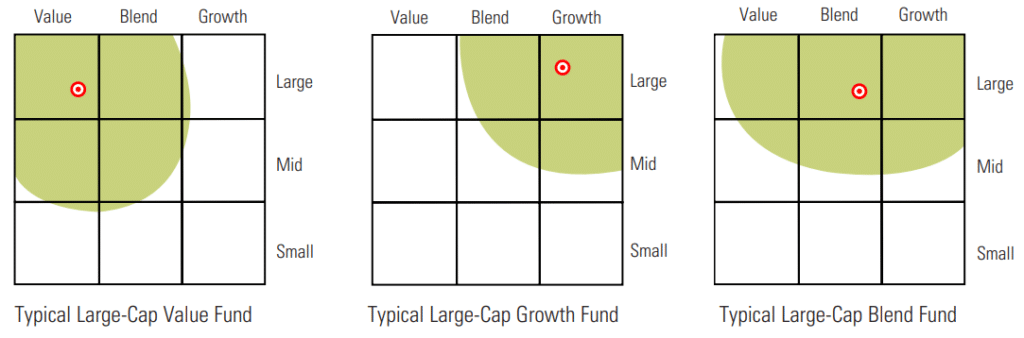

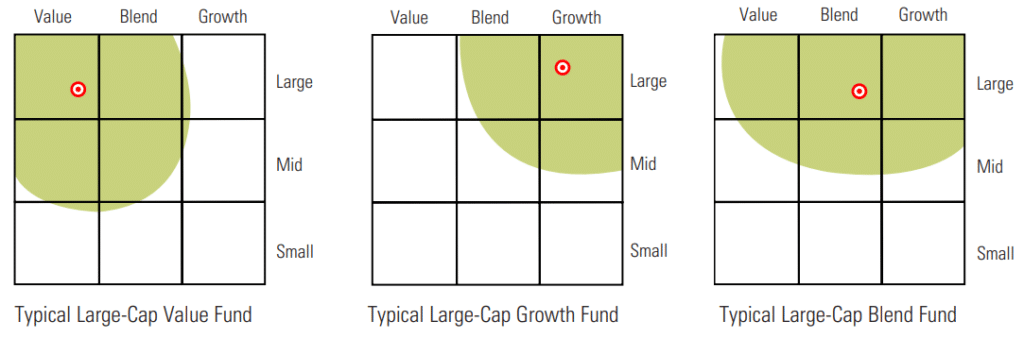

ETFs can also be weighted towards a particular goal, and style boxes can help reflect which direction they are aiming for…

Style Box – Typical Fund Investment Strategy:

Image by Morningstar.com

In fact, ETFs have exploded in popularity, reaching US$11.1 trillion in assets under management (AUM) as of December 31, 2023.

But why?

Why ETFs Are So Popular

One of the biggest advantages of ETFs is their cost efficiency.

They typically have lower fees than mutual funds, making them an attractive option for beginners and experienced investors.

Additionally, ETFs offer diversification by reducing the risk and spreading your investment across multiple assets.

They also offer flexibility by allowing you to trade them like stocks, buying and selling anytime during market hours.

And finally, they offer transparency – most ETFs disclose their holdings daily, so you always know what you’re investing in.

Right – now that you’ve taken a look at ETFs, let’s dive into stocks!

What Are Stocks?

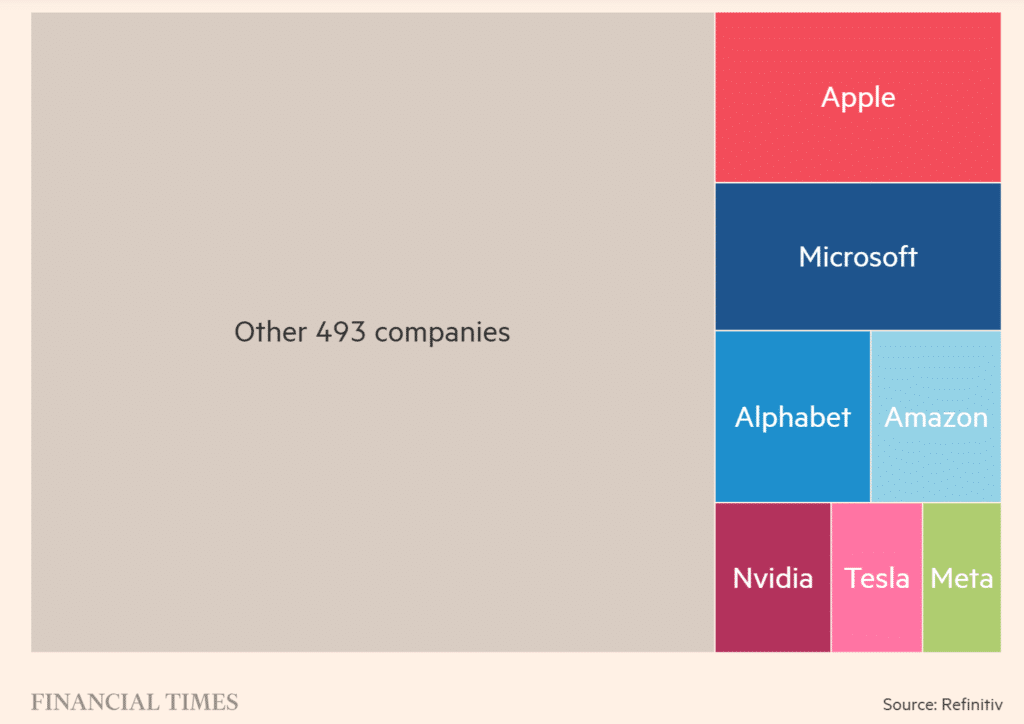

If you’ve ever dreamed of owning a part of a major company like Apple, Tesla, or Amazon, then stocks are a way to do that!

Share of the S&P 500 Index according to market capitalization

Financialtimes.com

Stocks, also known as shares or equities, represent ownership in a company.

When you buy a stock, you’re not just purchasing a piece of paper or a number on a screen. You’re becoming a partial owner of that company.

How can that be, exactly?

Let’s break it down further.

Understanding Stocks: What Does It Mean to Own a Share?

As mentioned before, at its core, a ‘stock’ or ‘share’ is a piece of a company.

When a business wants to raise money, it can sell shares to the public through an initial public offering (IPO).

Investors can then buy and trade them on the stock market.

Owning a stock means you possess a claim to a portion of the company’s assets and earnings.

The more shares you own, the larger your stake in the company.

Now, stock ownership doesn’t mean you get to walk into the company’s headquarters and start making decisions! (that’s reserved for major shareholders and board members – VIPs only!)

They do come with advantages though…

The Benefits of Stock Ownership

Owning stocks can be a powerful way to build wealth over time.

One of the primary benefits is capital appreciation.

As a company grows and increases in value, its stock price typically rises.

Investors who buy shares at a lower price can later sell them for a profit, making stock ownership an attractive long-term investment strategy.

Another advantage is dividends.

Some companies, particularly well-established ones, distribute a portion of their profits to shareholders as regular cash payments.

These dividends can provide investors with a steady income stream, making them especially appealing for those looking to generate passive income.

Additionally, owning certain types of stocks comes with voting rights.

Shareholders can take part in important company decisions, such as electing board members or approving major corporate policies.

While individual investors may not have much influence (unless they own a significant number of shares,) this aspect of stock ownership gives investors a voice in the companies they support.

These benefits, growth potential, income generation, and participation in corporate decision-making make stocks an essential part of many investment strategies.

However, they also come with risks, which we’ll explore later in the comparison with ETFs.

Notably, not all stocks are in the same league, either…

…I want to show you how stocks are put into groups and settling once and for all between ETFs vs Stocks…

Different Types of Stocks: Small, Medium, and Large-Cap Stocks

Stocks are often categorized into small-, medium- or large-cap, based on their market capitalization (market cap).

A company’s market cap represents its total value in the stock market.

These categories help investors understand the risk and growth potential of different stocks.

Large-Cap Stocks

These are well-established companies with a market cap of $10 billion or more.

Think of huge companies like Apple, Microsoft, and Amazon.

These are known for their stability, strong financials, and consistent performance.

They tend to be less volatile than smaller companies, making them a popular choice for long-term investors.

Many large-cap stocks also pay dividends, providing a steady income stream in addition to potential growth.

Mid-Cap Stocks

These companies typically have a market cap between $2 billion and $10 billion.

Mid-cap stocks represent businesses that have moved beyond the startup phase but still have room for expansion.

They often offer a balance between the stability of large-cap stocks and the growth potential of small-cap stocks.

Examples include companies like Etsy or Zillow, which have grown substantially but are not yet in the same league as industry giants.

Small-Cap Stocks

With a market cap of less than $2 billion, small-cap stocks are often younger, fast-growing companies with high potential for expansion.

However, they also come with increased risk, as smaller businesses may struggle during economic downturns.

While some small-cap stocks evolve into mid- and large-cap companies, others may face challenges that limit their growth.

Investors drawn to small-cap stocks often seek high-reward opportunities but must be prepared for greater volatility.

Understanding these categories can help you structure your portfolios to match your risk tolerance and financial goals.

Whether you are aiming for stability, growth, or a mix of both, market cap plays a crucial role in shaping your investment decisions.

Okay… so… now for the big question…

…which one is best?

ETFs vs Stocks?

Well, actually, that’s the wrong question!

Instead of thinking about ‘better’ or ‘worse’, focus on their differences…

Key Differences Between ETFs and Stocks

When deciding between ETFs and individual stocks, running through how they differ can help you choose the best option for your goals.

While both offer opportunities for growth and generating wealth, they differ in diversification, risk, costs, and management style.

Diversification: Instant vs. Concentrated Exposure

One of the biggest advantages of ETFs is how diverse they can be.

A single ETF can hold dozens, hundreds, or even thousands of stocks, spreading risk across multiple companies, industries, or even countries.

This makes ETFs a great choice for investors looking for broad market exposure without the need to research and pick individual stocks.

But what if an individual stock within the ETF performs exceptionally well?

While it would help the performance of the ETF, it wouldn’t have the same impact as if you’d simply invested in the individual stock.

This leads me to the topic of buying individual stocks – investing in a single company at a time.

While this can lead to substantial gains if the company performs well, it also exposes the investor to higher risks if the business faces challenges.

Unlike ETFs, which balance performance across multiple assets, a stock’s success or failure depends entirely on its company’s growth and stability.

So, how do the risks stack up?

Risk Profile: Stability vs. Potential Volatility

ETFs generally carry lower risk compared to individual stocks.

As they hold multiple assets, the decline of one company can often be offset by better performance from others within the ETF.

This built-in risk management makes ETFs a more stable option, especially for conservative or new investors.

Stocks, on the other hand, are more volatile by nature.

Prices can fluctuate significantly based on company earnings, market sentiment, and external events.

While this volatility presents greater risk, it also creates opportunities for higher returns if an investor picks a strong-performing stock.

Those comfortable with risk and willing to actively monitor their investments may benefit from stock trading, but it requires careful research and strategy.

Costs: Management Fees vs. Transaction Costs

Investing in ETFs usually involves expense ratios, which are small annual management fees taken as a percentage of the fund’s assets.

While these fees are often minimal (ranging from 0.03% to 1% in most cases), they still reduce overall returns over time.

Individual stocks, by contrast, do not have such ongoing management fees.

Once an investor purchases a stock, they own it outright without additional charges beyond brokerage fees or commissions (which are now often negligible due to commission-free trading platforms).

However, building a well-diversified portfolio with stocks may require multiple transactions, leading to higher upfront costs compared to buying a single ETF.

Management Style: Passive vs. Active Investing

ETFs come in both passively managed and actively managed types.

Most ETFs track an index, such as the S&P 500, meaning investors have to do little to no active decision-making.

Passive investing is great for those who prefer a hands-off approach while still benefiting from long-term market growth.

Some ETFs are actively managed, meaning fund managers make regular buy/sell decisions.

They charge for their expertise, though, so actively managed ETFs tend to have higher fees.

Compare this passive approach to investing in stocks, however, which definitely requires active decision-making.

Investors must research companies, track financial reports, and decide when to buy or sell based on market conditions.

While this approach offers more control, it also demands significant time and effort, making it better suited for those who enjoy stock analysis and market participation.

Let’s take a look at some real chart examples of ETFs and Stocks and see how they compare to one another.

ETF and Stock Charts

SPY ETF Daily Chart:

This is an example of the SPDR S&P 500 ETF Trust.

This ETF aims to hold a portfolio of common stocks within the S&P 500—offering diversification across multiple market sectors.

It is a large fund with the key goal of having a blend of companies that provide good diversification across the market.

The SPY ETF is an excellent example of a safe fund that will continue to yield around that benchmark 10% per year over the long term.

That’s an excellent option for those who want a passive investment that follows the world’s leading companies.

Let’s take a look at another ETF chart…

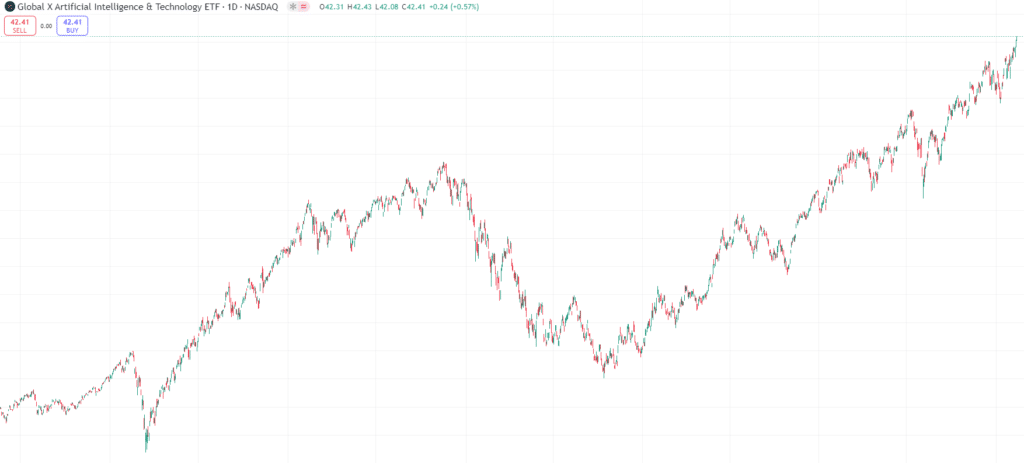

Global X Artificial Intelligence & Technology ETF (AIQ):

Here is another ETF, however, this time, it’s targeting a much more unique and less diverse portfolio.

The fund aims to invest at least 80% of its total assets in companies and sectors involved in artificial intelligence and technology.

This is a great example of an ETF that might align with a current bias of where things might be heading, allowing you to still make investment decisions based on up-and-coming industries.

It’s an example of finding an edge – targeting a growth sector with higher risk than a balanced, safe ETF like SPY.

This isn’t to say that this ETF is not safe, it still contains a range of companies in order to help diversify the risk.

Instead, risks might come from unforeseen circumstances, such as governments banning AI technology or putting major restrictions on the technology around it.

While unlikely, the possibility has to be considered as if the sector performs poorly, between ETFs vs Stocks, the ETF will reflect that.

Now, let’s look at some individual stocks…

Apple Inc Daily Chart (AAPL):

Let’s take Apple, for example.

On the chart, you can see it is a much more reactive-looking chart compared to the steady growth of the S&P500.

Yet, they are still somewhat similar, right?

That is because the SPY ETF actually holds around 7% of its holdings as Apple shares.

As Apple is one of the biggest companies in the market, it makes sense to have it in an ETF based on the S&P 500.

The difference here is that any market fluctuations within Apple, good or bad, will be reflected in the share price and, hence, your portfolio value.

There is no smoothing out due to other companies across the sector.

This investment is entirely dependent on Apple’s performance.

Let’s look at a smaller company to compare…

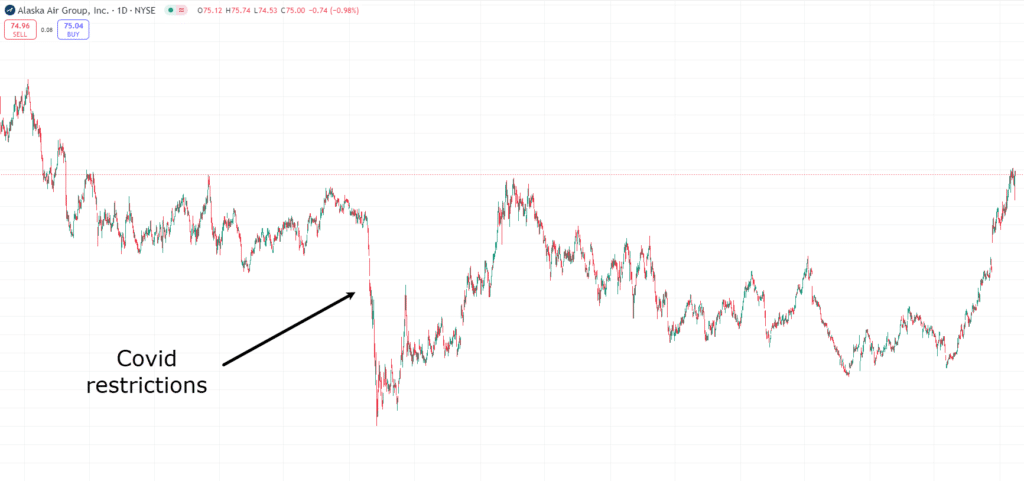

Alaska Air Group (ALK):

Here is the Alaska Air Group chart, with a market cap in the $9 Billion range.

This places it at the higher end of a mid-cap company’s $2-10 Billion dollar market cap range.

Now, take some time to notice the differences in charts.

There are a lot of peaks and troughs, and the price seems to be much more volatile.

Covid had a devastating impact on airlines as borders were shut and covid restrictions came into place.

You can see it reflected in the share price, along with the time it took for the price to recover.

So you may be thinking, “Well, it’s not worth even looking at these sorts of companies…”

However, companies with strong foundations that go through a brief market downside often provide good buying opportunities.

Let’s assume you decided to buy ALK shares when the price dropped during the COVID lockdowns with the knowledge that the airline would eventually be back up and running.

You would have had a 280% share price rise from March 2020 to the current date.

That is a significant increase.

What’s my point?

Picking individual stocks allows you to pick companies that you believe are undervalued.

It allows you to make your own decisions based on your beliefs and research about the economy, market, and where you think value will be found.

In these scenarios, it is much more critical for detailed analysis and research to be done while timing the market also comes into play.

However, the gains can be a lot higher than those of ETFs.

So, let’s dive into what style is right for you.

Are ETFs for you?

ETFs might be the perfect fit if your lifestyle revolves around a steady and low-maintenance approach to investing.

Imagine you’re someone with a busy schedule, and maybe you’re juggling work, family, and personal projects.

You don’t have the time to track individual stocks or constantly monitor the market.

In this case, ETFs offer the peace of mind that your investments are diversified, meaning you don’t have to spend time picking and monitoring stocks.

Instead, you can set your portfolio and let it grow with minimal involvement.

Or you may value long-term stability over the thrill of chasing high-risk, high-reward opportunities.

Again, ETFs align perfectly with that mindset.

They spread your investment across many different companies, smoothing out the risks associated with any single stock.

This means you don’t have to worry about being overly impacted by the sudden price swings of one company’s stock, allowing you to rest easier knowing your portfolio is less volatile.

Between ETFs vs Stocks, ETFs can be an excellent choice for those planning for the future, whether it’s retirement, buying a home, or simply growing wealth over time.

It cannot be understated how long-term ETF investment can lead to substantial financial growth.

They allow you to build a portfolio that steadily appreciates without needing to be constantly hands-on.

You don’t need to be glued to your computer screen, waiting for the next big opportunity.

With ETFs, you can focus on what matters most to you while your investments take care of themselves in the background.

So, suppose your ideal lifestyle involves less stress, more freedom, and the ability to invest without constantly managing individual stocks. In that case, ETFs can help you create the financial foundation you need to live that life.

Sounds great right

But what about stocks?

ETFs vs Stocks: When to choose Stocks?

Individual stocks might be the perfect choice if your lifestyle thrives on being hands-on and you’re ready to manage your investments actively.

Choosing stocks offers a dynamic, engaging experience if you have the time and energy to research and analyze companies.

It allows you to invest in businesses you believe have growth potential.

If you enjoy making informed decisions and want to align your investments with your beliefs about a company’s potential, stocks give you the freedom to do so.

The rewards aren’t just financial. They can also be mentally fulfilling.

There’s a unique satisfaction in researching companies, understanding their growth potential, and seeing your investment decisions come to life, even if the path is bumpy.

For those comfortable with volatility, individual stocks provide the opportunity to experience more significant ups and downs, reflecting a company’s performance.

But remember, with that potential for higher rewards comes the need to manage your risk actively.

Stocks require attention and research, but the sky is the limit for the right investment mindset, with greater potential for higher returns and a more rewarding investing experience than ETFs.

Conclusion

In conclusion, choosing between ETFs vs Stocks doesn’t have to be overwhelming.

It’s about understanding what each offers and how they align with your goals and lifestyle.

By now, you should have a clearer picture of how both investment options work and when one might be more suitable than the other.

Throughout this article, you’ve explored:

- What ETFs are and how they provide diversification

- What stocks represent and the differences between small-, mid-, and large-cap stocks

- The main differences between ETFs and stocks in diversification, risk, costs, and management style

- When ETFs might suit a hands-off, long-term approach to investing

- When stocks could be ideal for more control and higher growth potential

- Real-life examples showing how ETFs and stocks perform in different scenarios

Investing is not one-size-fits-all.

What works for someone else may not suit you.

But by understanding these concepts, you’re better equipped to make informed decisions that align with your financial goals and personal preferences.

So, what resonates with you more?

The diversified, set-it-and-forget-it nature of ETFs, or the hands-on potential of individual stocks?

Maybe a mix of both is the right fit?

Let me know in the comments below about your experiences with ETFs and stocks!