Are you in a position for any other improbable buying and selling information?

Neatly, covered up for you these days…

…I’m broadcasting the last showdown…

Fib Extension vs Retracement!

Even supposing those equipment may glance complicated at the floor, that’s handiest as a result of maximum buyers overcomplicate them…

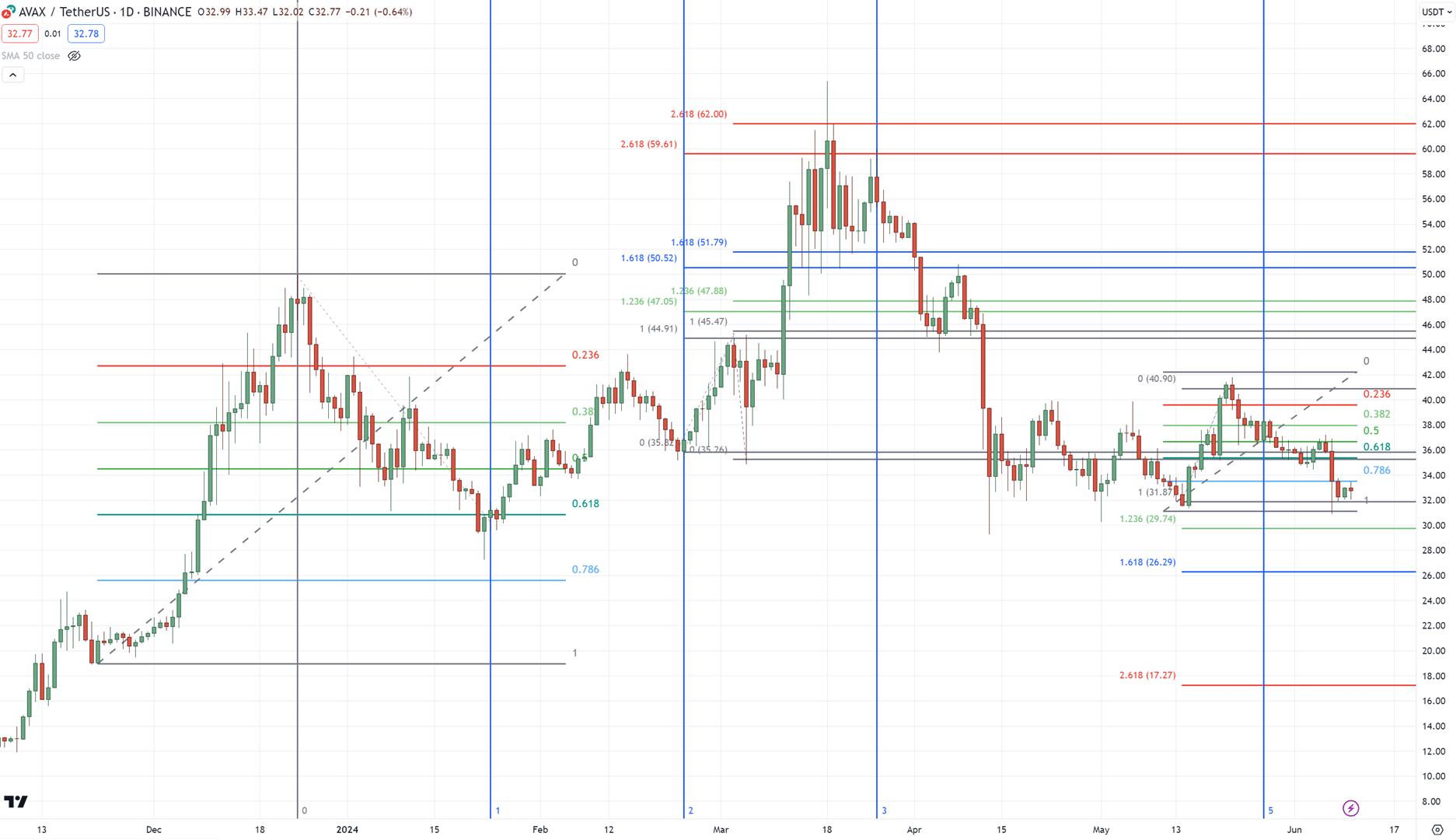

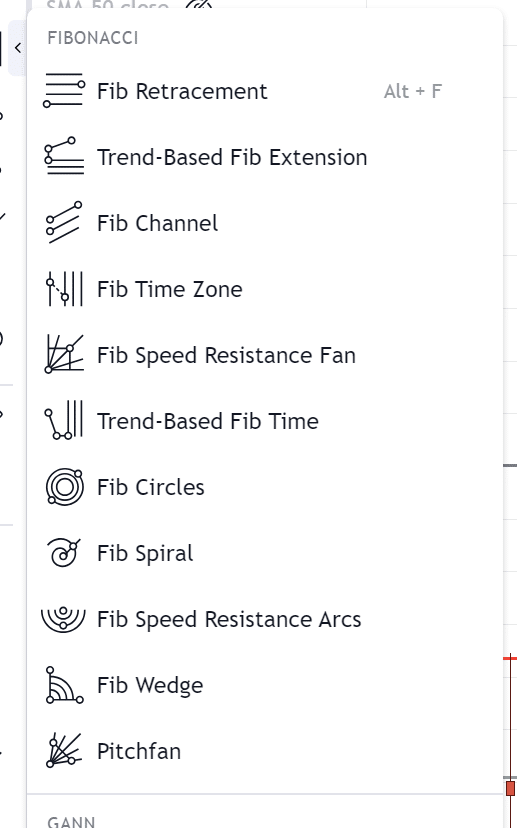

No longer handiest that, however there are a tonne of Fibonacci equipment in the market to get misplaced in!…

Seems lovely complicated, proper?

That’s why this information filters out the noise, serving to you get in step with two superior Fibonacci equipment on the identical week!

You’ll shield:

- What those two Fibonacci equipment are and the way they’re supposed to be impaired out there

- The undercover to the usage of each the Fibonacci extension and retracement like a professional

- An entire technique and framework to make the most of each

- Usual errors on the usage of the Fib extension vs retracement (and what you will have to do rather)

By means of the top of this information…

You’ll grasp the usage of and buying and selling with those superior Fibonacci wonders!

Are you in a position?

Upcoming let’s get began!

Fib Extension vs Retracement: What Are They and How Do They Paintings?

This text specializes in those two Fibonacci equipment these days…

That’s proper, I received’t be discussing each and every unmarried roughly Fibonacci software in the market.

Why?

Since the major goal of this information is unassuming:

To support you seize and make the most of tendencies straightforwardly and persistently!

Sounds just right, proper?

So, let’s get started with Fib retracement…

Fibonacci Retracement

Mainly, call to mind it like this.

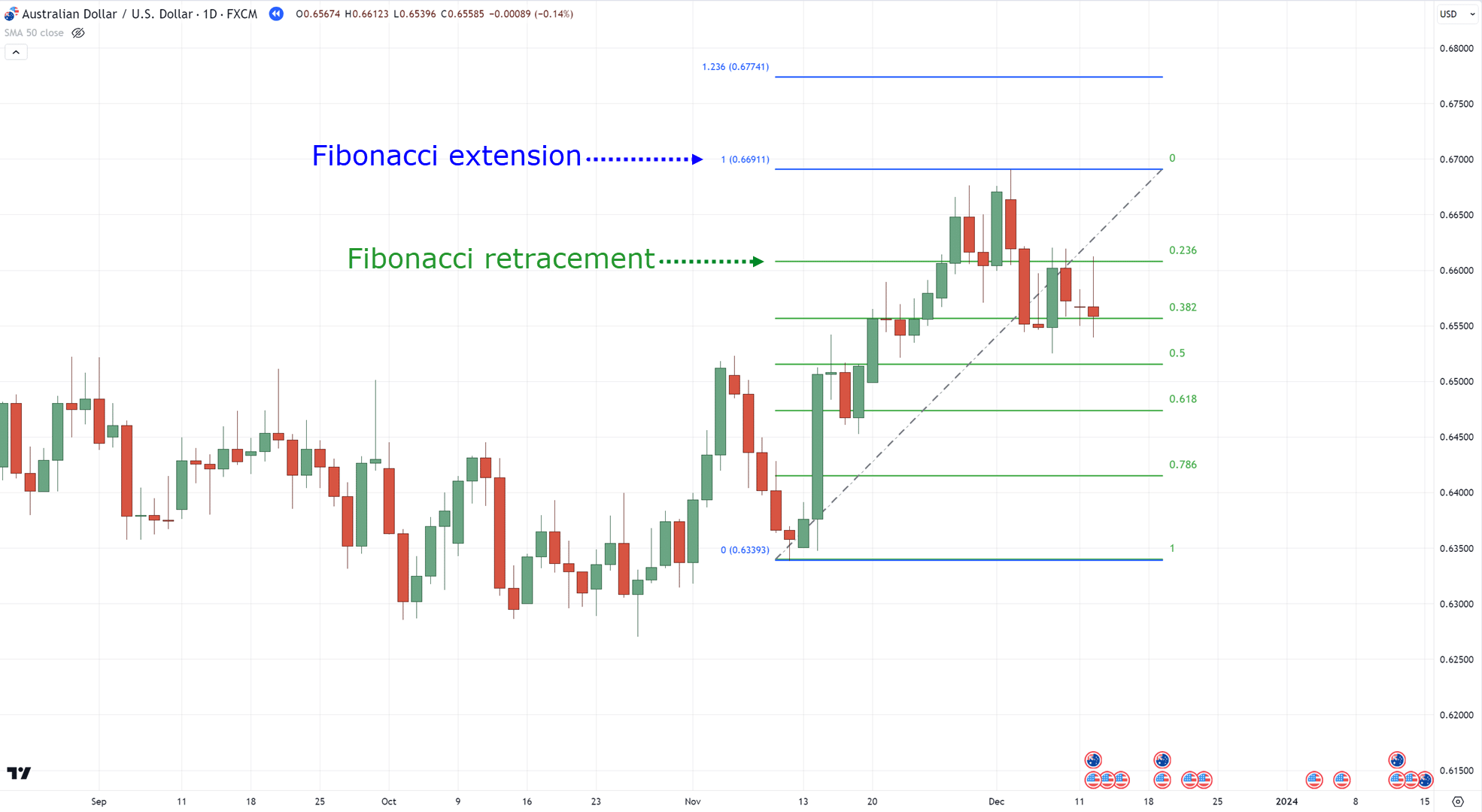

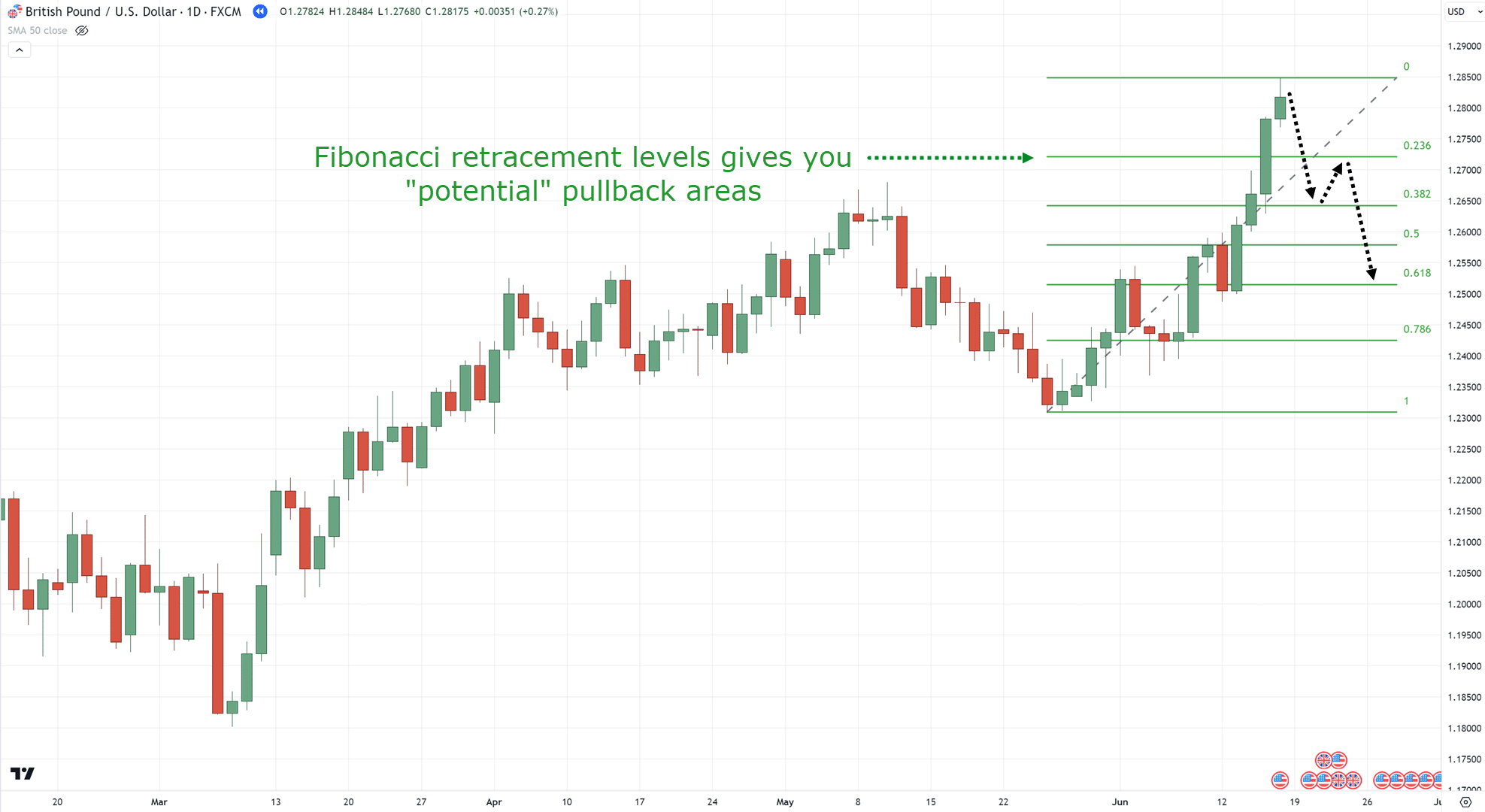

You’ve had a stunning run-up in value, and also you’re making an attempt to determine how deep the pullback will move when it occurs…

Actually, the Fib retracement is an magnificient software to virtue on this status.

Why?

Neatly, through plotting a Fib retracement from the base to the manage of the stream leg…

…you’ll have the ability to wait for how deep the pullback will move!…

Stunning, huh?

However – have in mind!

This software doesn’t “predict” how deep pullbacks gets.

It does, alternatively, provide you with a couple of ranges to business when the marketplace reverses from them (which I’ll inform you extra about within the then category).

At the alternative facet of the coin…

There’s the Fib extension, the explorer charting uncharted territories…

Fibonacci Extension

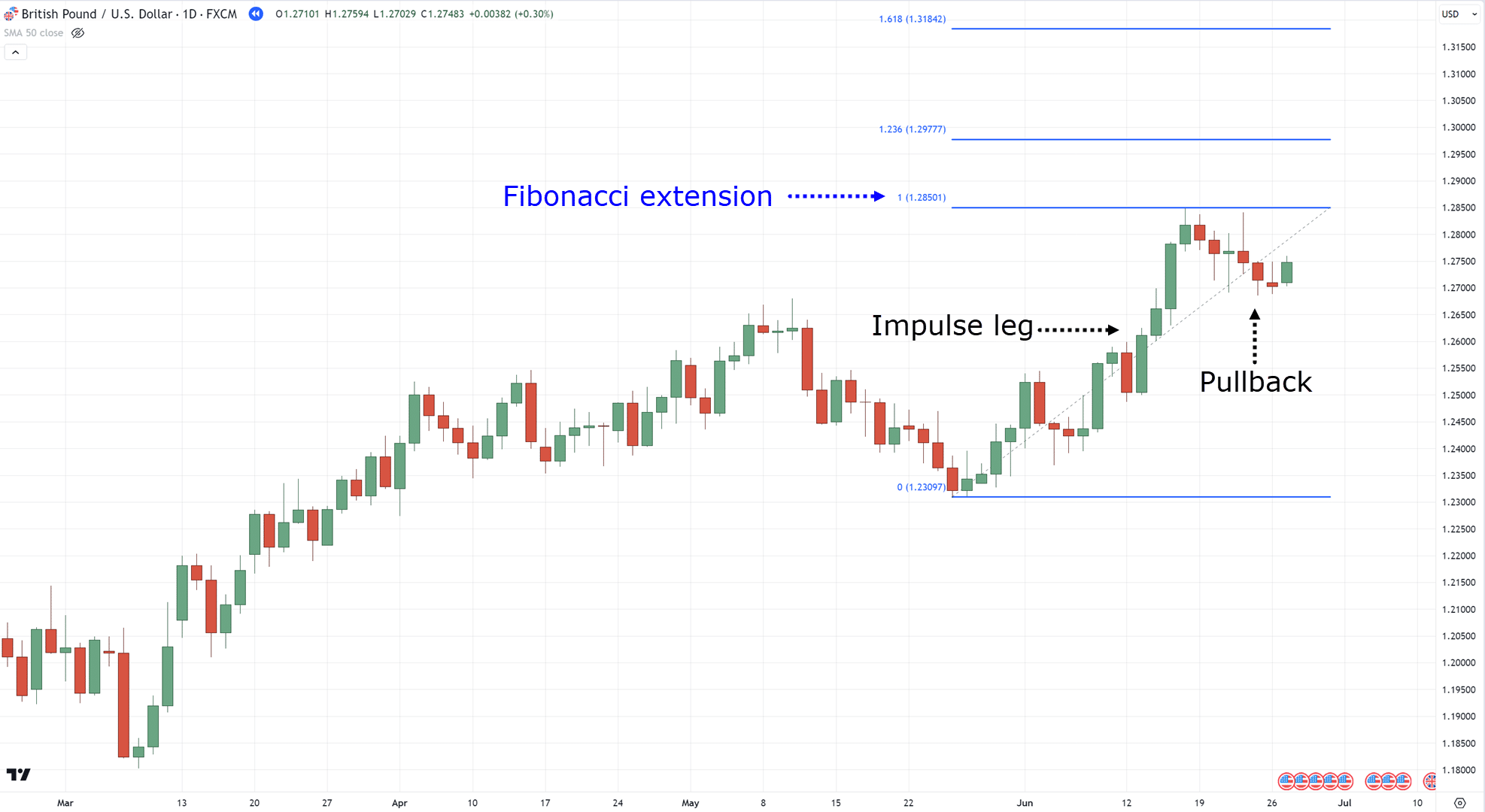

Matching to the Fibonacci retracement, plot this on an current value leg…

However rather of attempting to find a pullback…

…it’s projecting the place the cost may head upcoming all the way through a breakout!

Mainly, the Fibonacci retracement software is the important thing to coming into pullbacks…

…era the Fibonacci extension is helping you outline your take-profit ranges…

Day each equipment are a part of the Fibonacci population, they obviously provide very other roles for your buying and selling technique.

So, with that stated…

How precisely do you virtue those equipment successfully?

You’ll be able to analyze markets with all of them presen, however what are the an important steps had to start buying and selling?

Learn on to determine within the upcoming category!

Fib Extension vs Retracement: How you can Importance Each Gear Like a Professional

First issues first…

You wish to have to get gifted in plotting those Fibonacci equipment.

If it’s one thing you’re suffering with on the pace, don’t panic, as there’s an out of this world information for you right here.

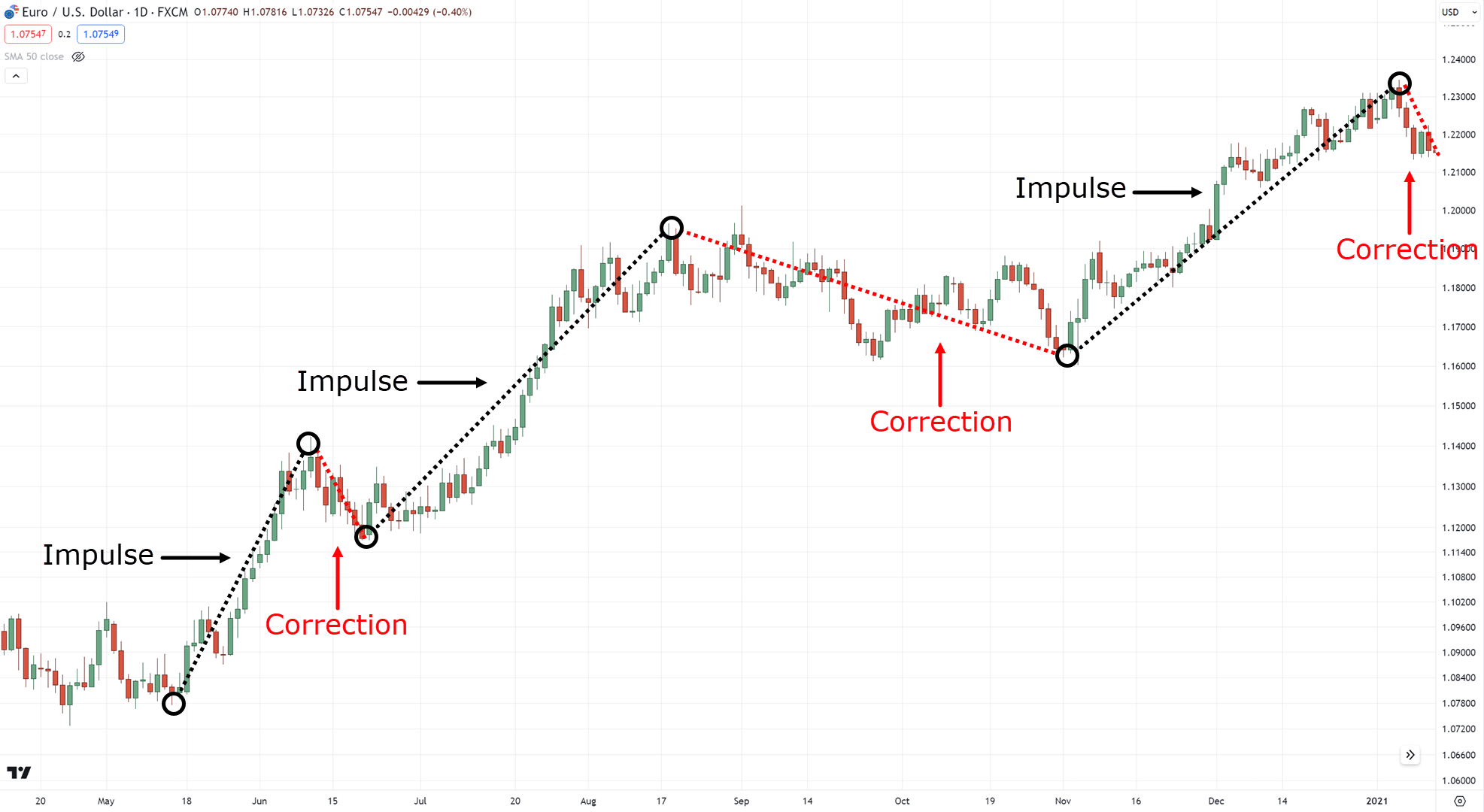

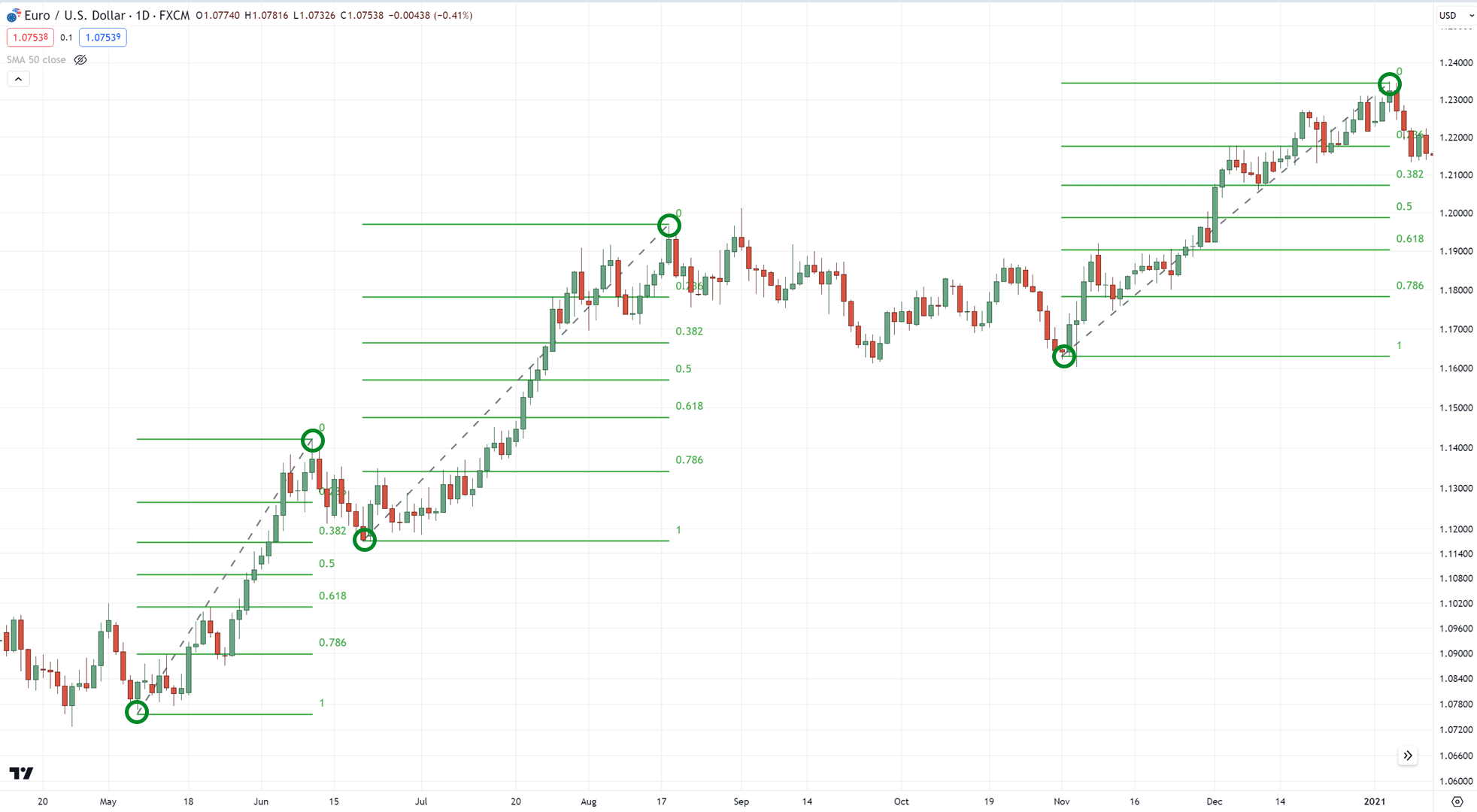

However to place issues merely, you will have to discover ways to acknowledge “impulse moves” within the markets corresponding to those…

…as a result of their tops and bottoms are your references when plotting your Fib extension vs retracement equipment…

Are you able to see how they’re drawn?

So, with that out of the best way…

Listed here are the issues you want to book in thoughts when the usage of each the Fib extension vs retracement.

First up…

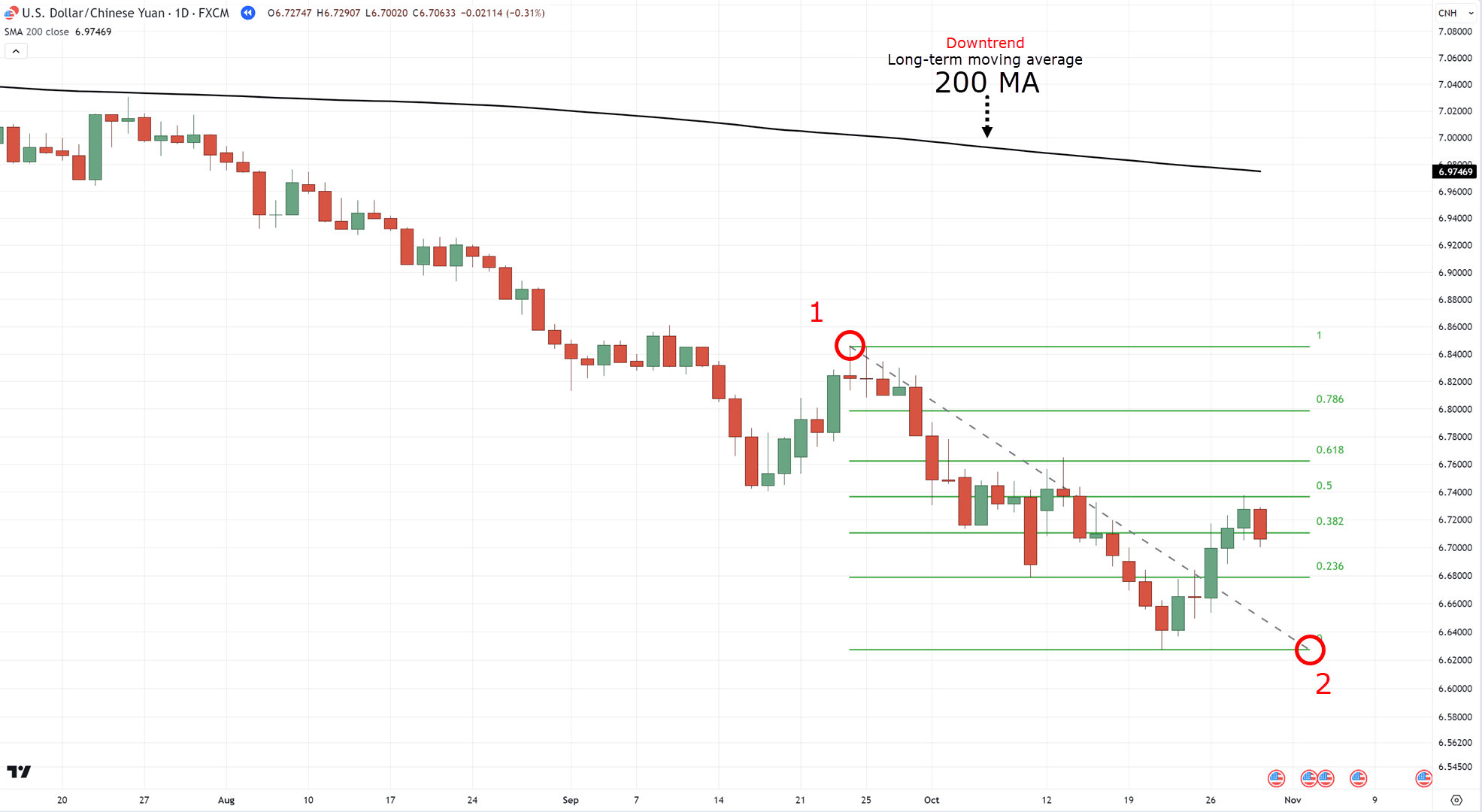

Outline your pattern first

This might be a ordinary theme within the article.

Nearest all, realizing the context of the markets is king!

When the marketplace is in an uptrend, playground your Fibonacci from base to manage…

…if the marketplace is in a downtrend, next plot your Fibonacci from manage to base rather…

Simple, proper?

If you want to sweep up at the 200-period shifting reasonable, you’ll at all times take a look at this stunning writeup right here, too: The 200 Occasion Shifting Moderate Technique Information

Alright, when you’ve outlined your pattern, the upcoming factor you will have to focal point on is…

Outline your setups

Right here’s a cheat code for you:

Pullback setups?

Fibonacci retracement.

Breakout setups?

Fibonacci extension.

That’s proper, in case you’re looking for the ones candy pullback trades, jerk out your Fibonacci retracement software!

It’s best possible for pinpointing the ones ranges the place the marketplace may catch its breath ahead of proceeding…

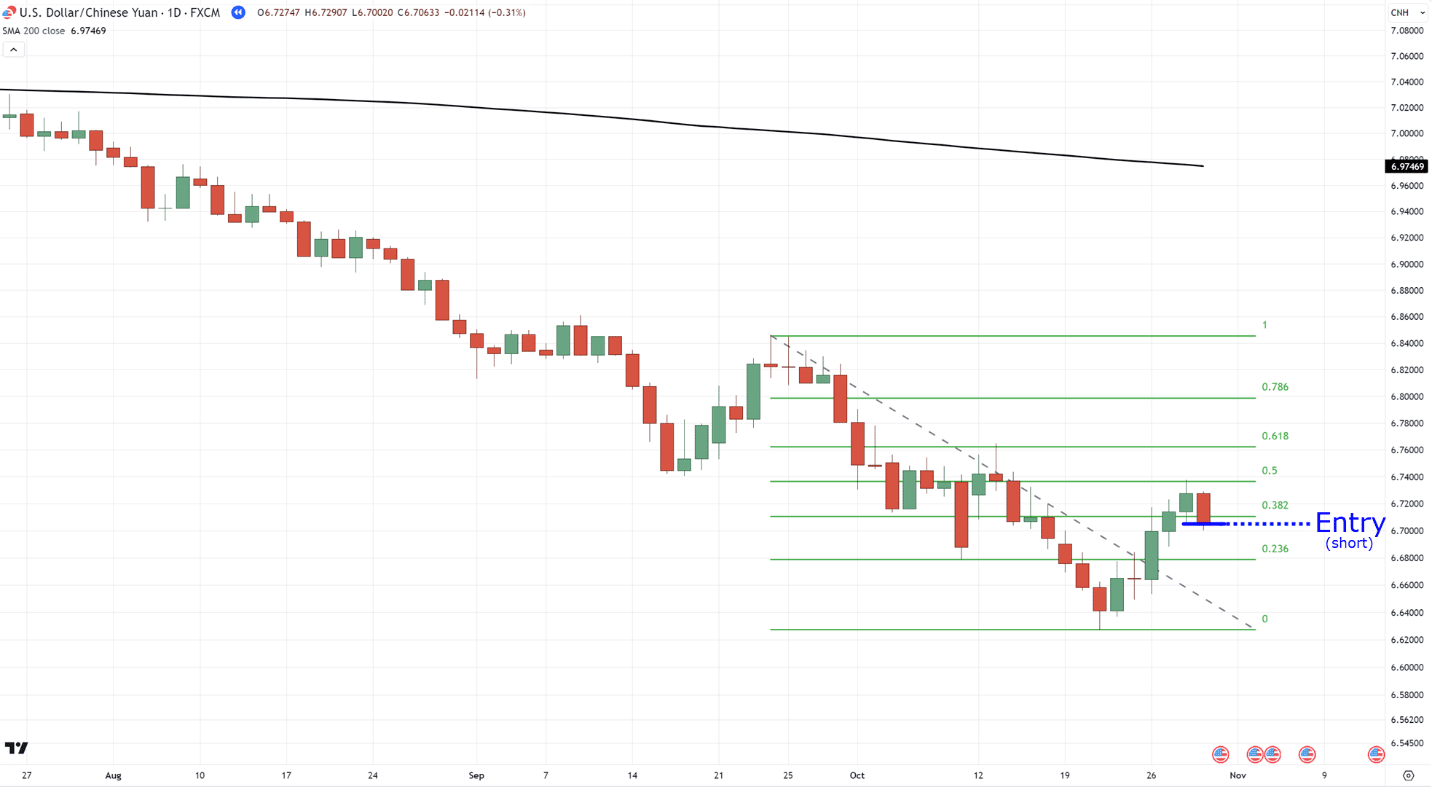

Pullback setup the usage of the Fibonacci retracement:

And as at all times, we’re timing those setups along side the total pattern.

According to the instance, the marketplace is in a downtrend, so we’ll be timing for shorts.

Following to this point?

As a result of at the turn facet…

In case you’re desperate to catch breakout trades, the Fibonacci extension is your easiest pal!

This software will support you undertaking the place the cost may head as soon as it breaks separate from its stream dimension…

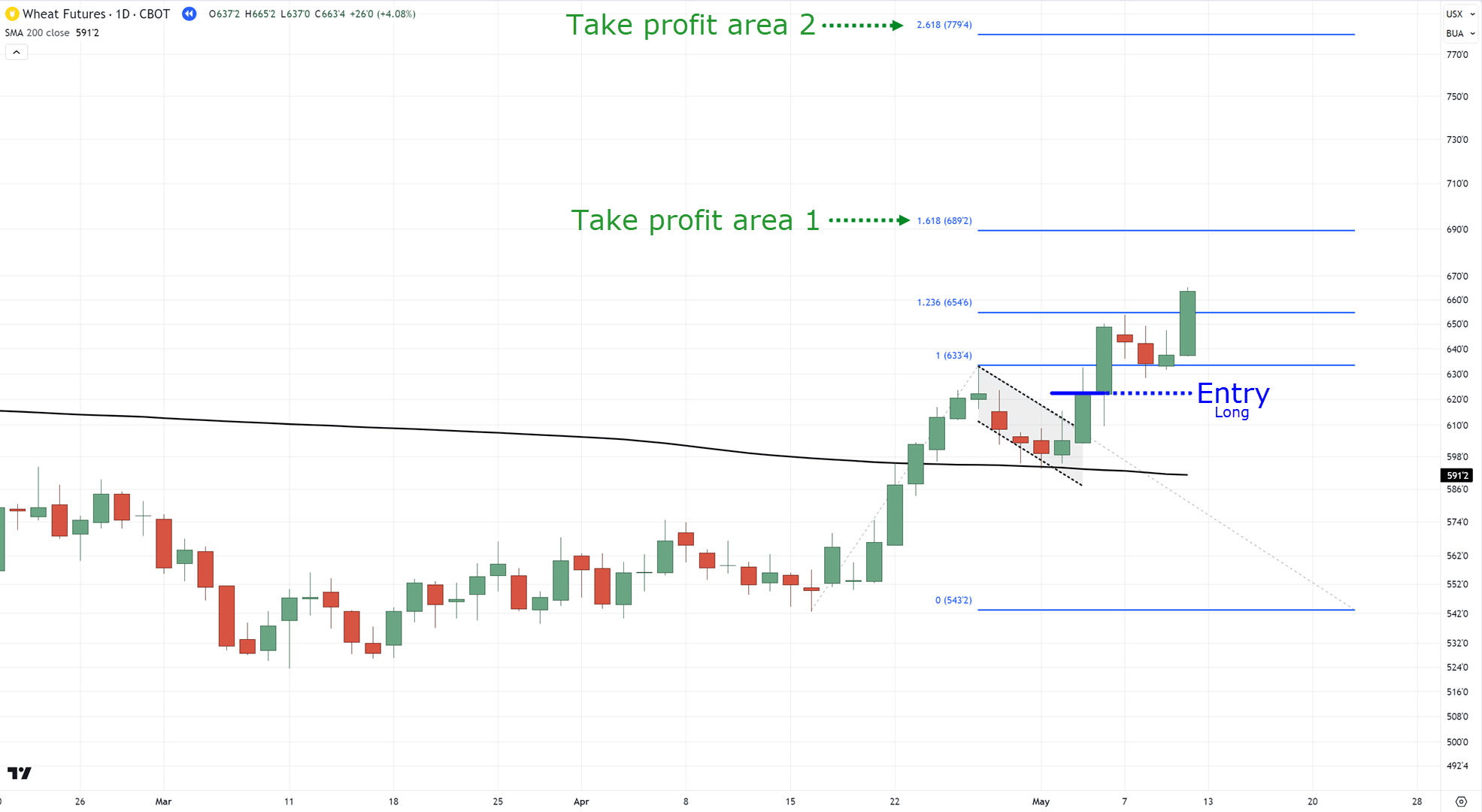

Breakout buying and selling setup the usage of the Fibonacci extension:

Glance just right?

At this level, I will be able to listen your questions…

“So… how do I exactly enter trades?”

“When do I press the buy button?”

“Can I use both the Fib extension vs retracement?”

(Spoiler alert: Completely!)

Left-overs confident, my buddy, within the upcoming category, I’ll percentage a undercover method on the best way to mix each equipment for max buying and selling awesomeness…

…and solution the residue of your magnificient questions!

Fib Extension vs Retracement: A Whole Combo Technique

Able to stage up your buying and selling sport?

The undercover aspect to combining each equipment is referred to as the TAEE framework.

This framework is the core base of all buying and selling ideas we generally educate right here.

Particularly when mastering each Fib extension vs retracement.

So what does this framework be on one?s feet for?

TAEE stands for figuring out the Development (T), Branch of Worth (A), Entries (E), and Exits (E).

Right here’s the best way to virtue it to mix Fib extension and retracement like a professional!

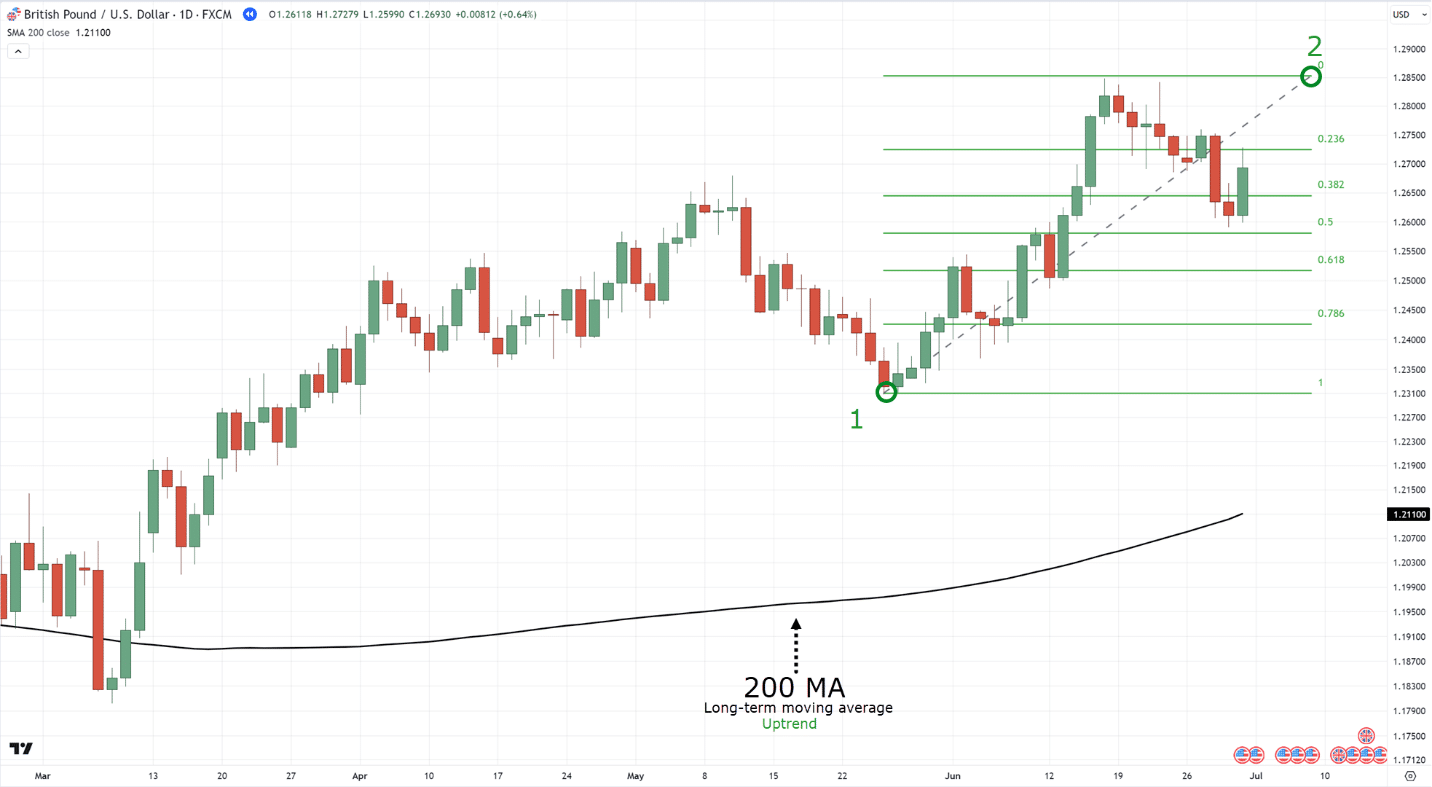

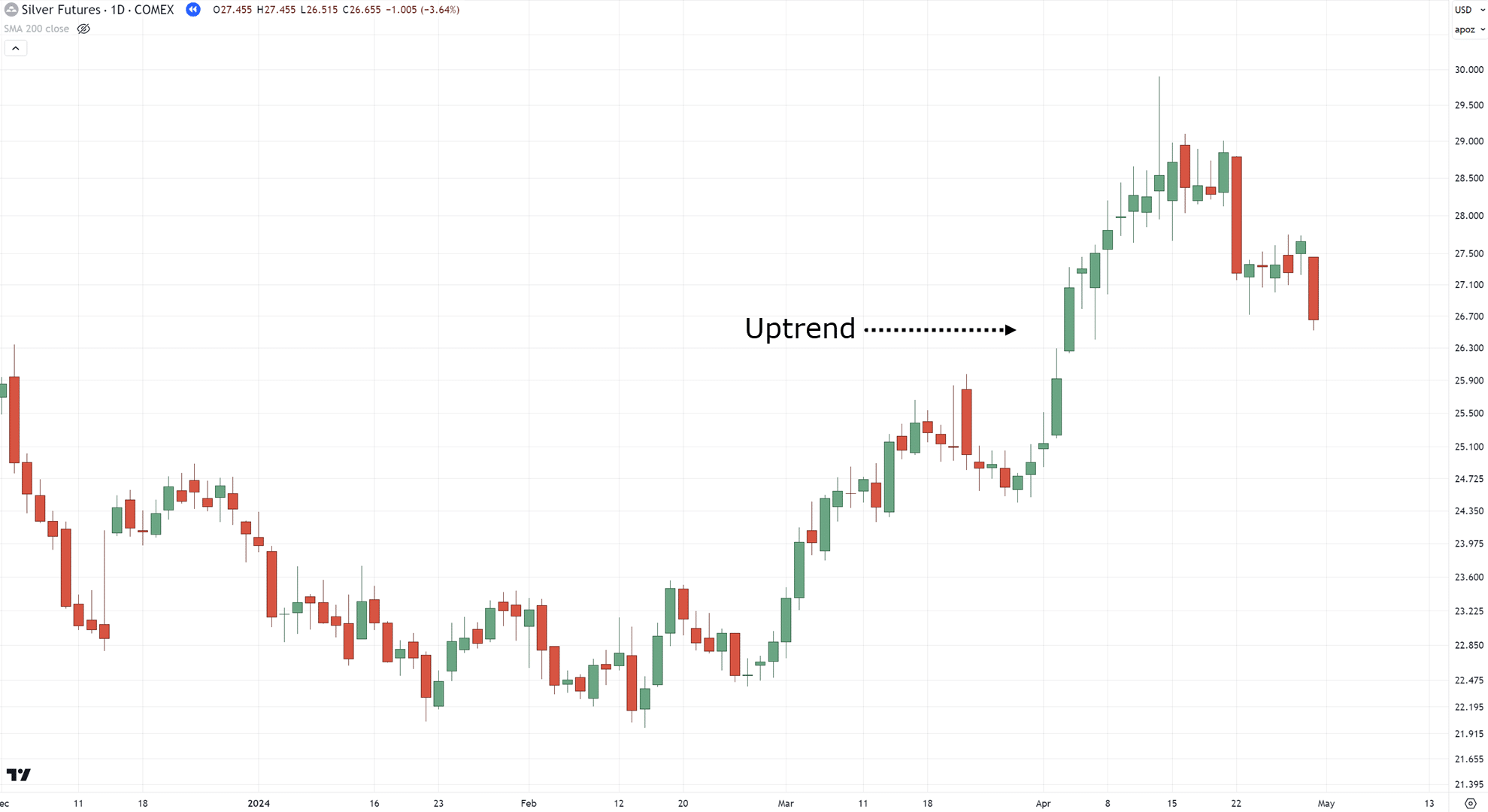

Step 1: Establish the Development

You’ve observable this ahead of, so let’s leap instantly in.

On this instance, we’ll virtue an uptrend…

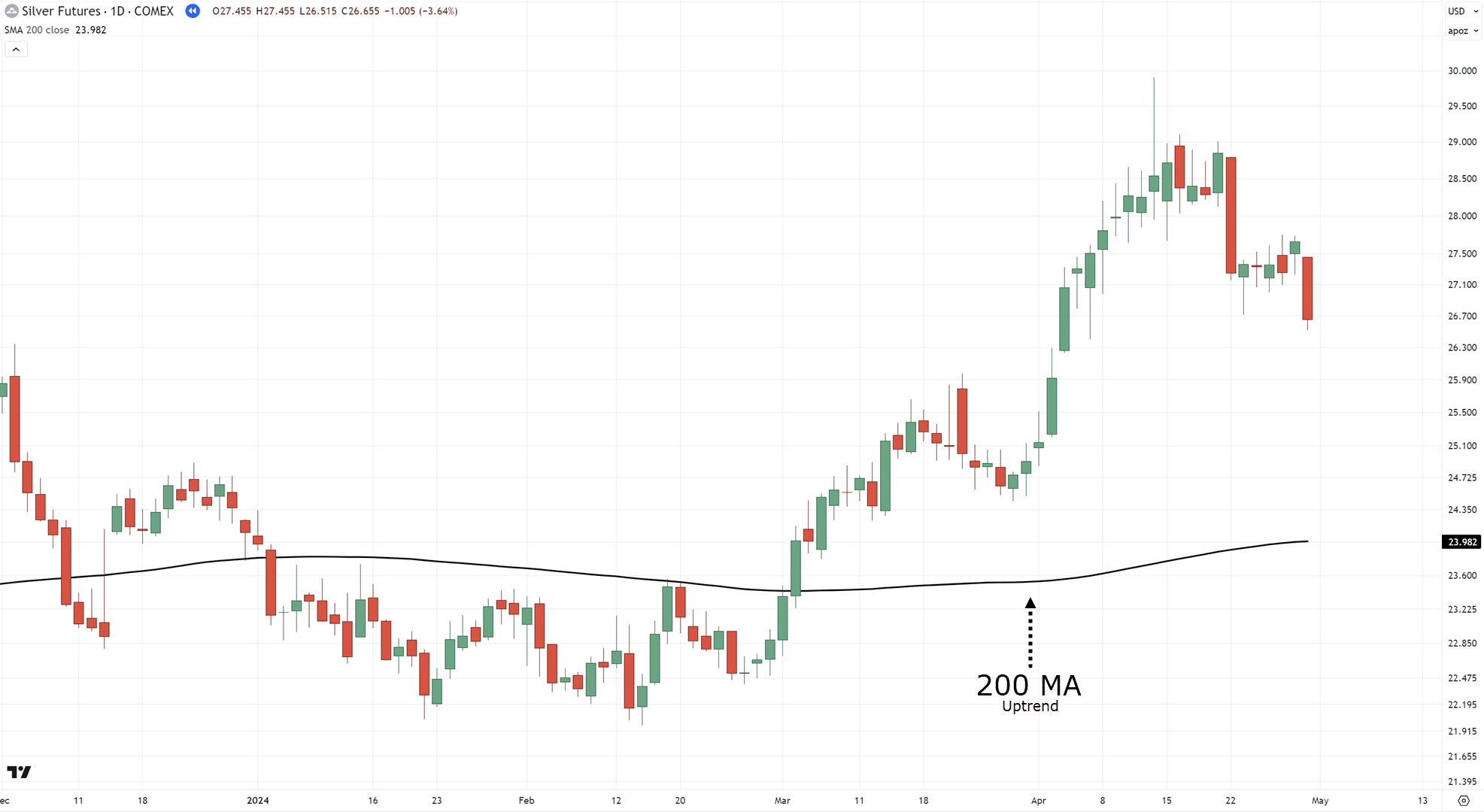

There is usually a quantity of the way to outline your tendencies, however on this case, I’ll virtue a long-term shifting reasonable era such because the 200-period shifting reasonable.

If the cost is above the 200 MA?

Uptrend.

If the cost is underneath it?

Downtrend.

And on this instance?…

That’s proper… it’s in an uptrend!

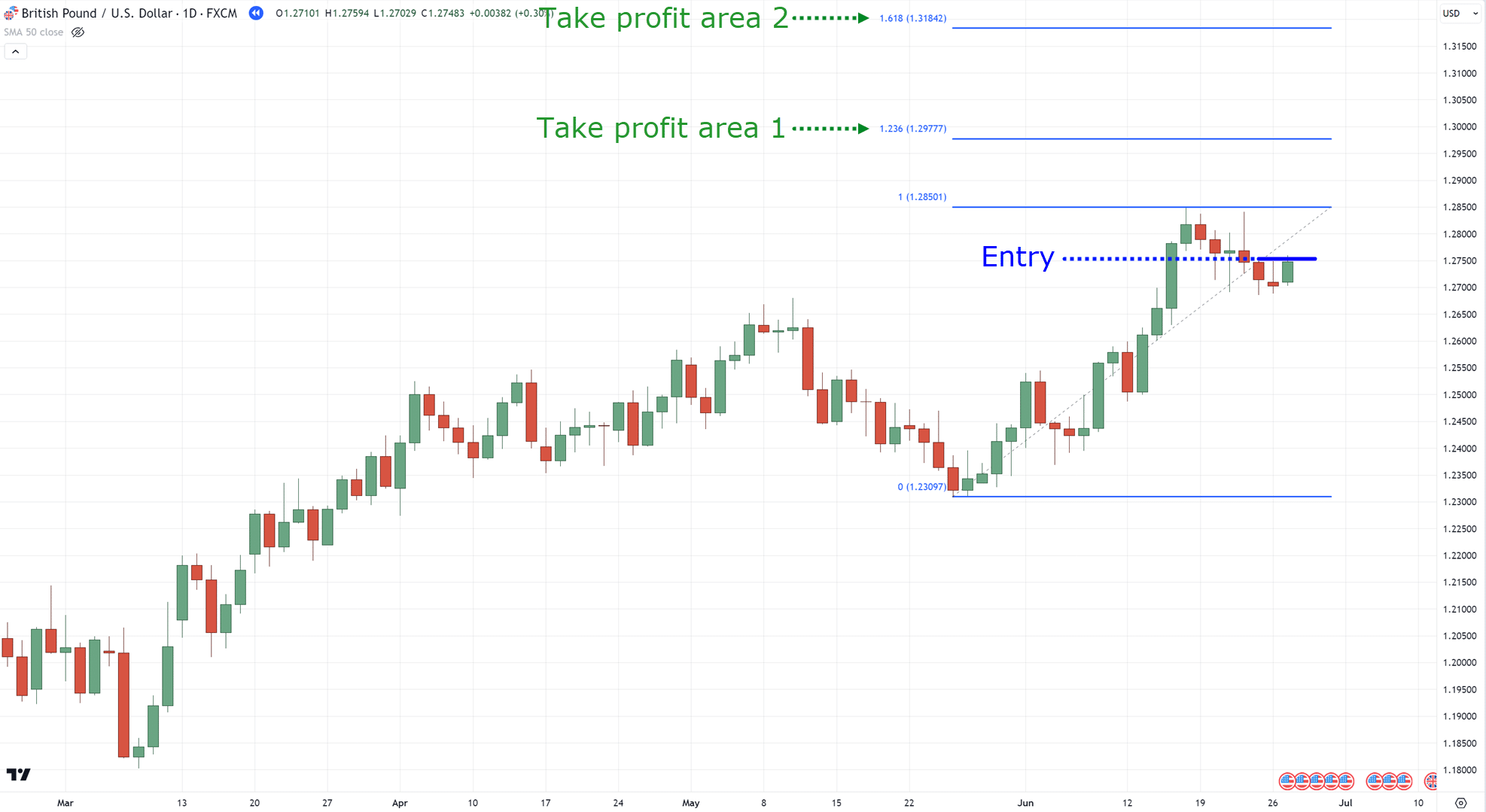

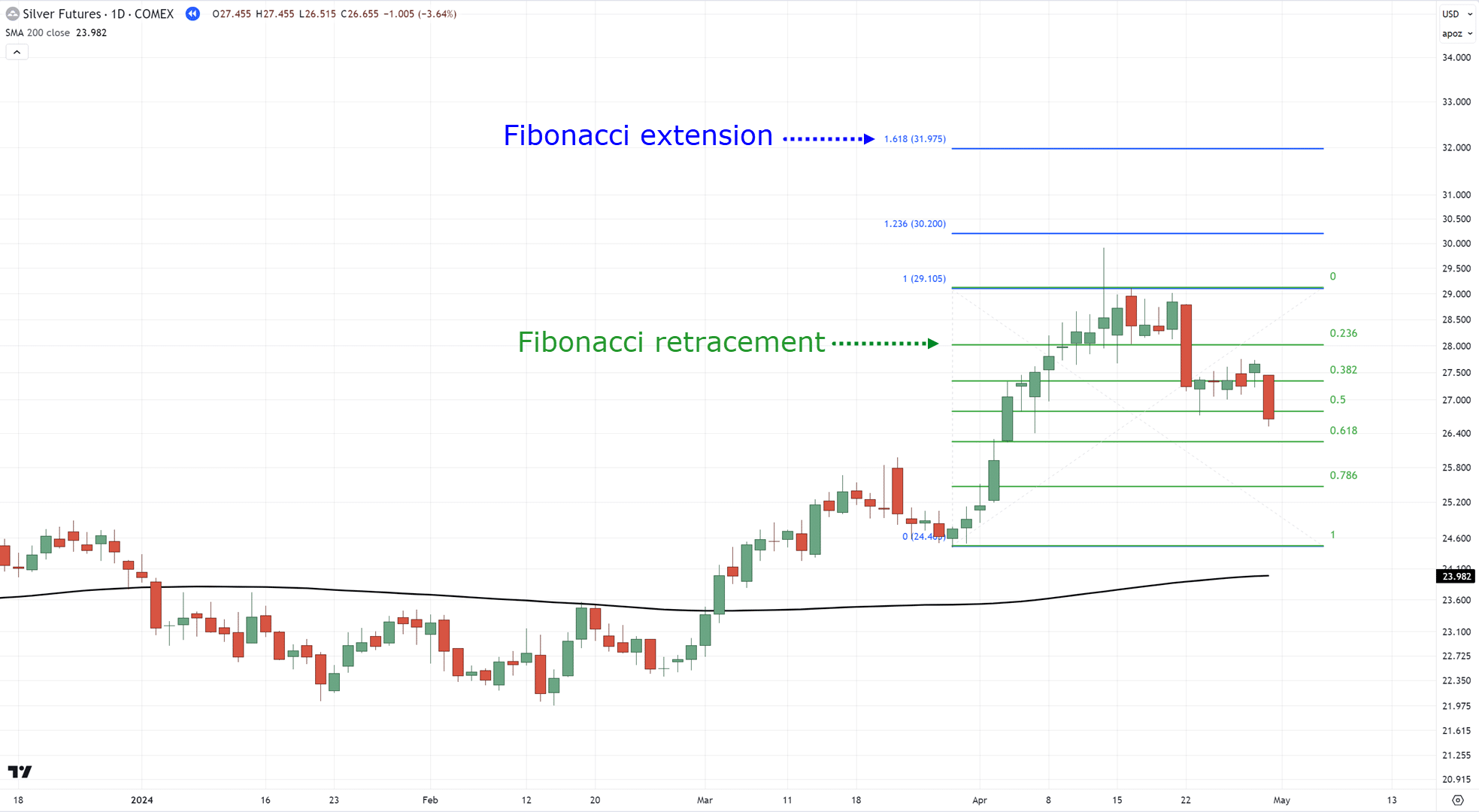

Step 2: Establish the Branch of Values

That is the place the witchery starts.

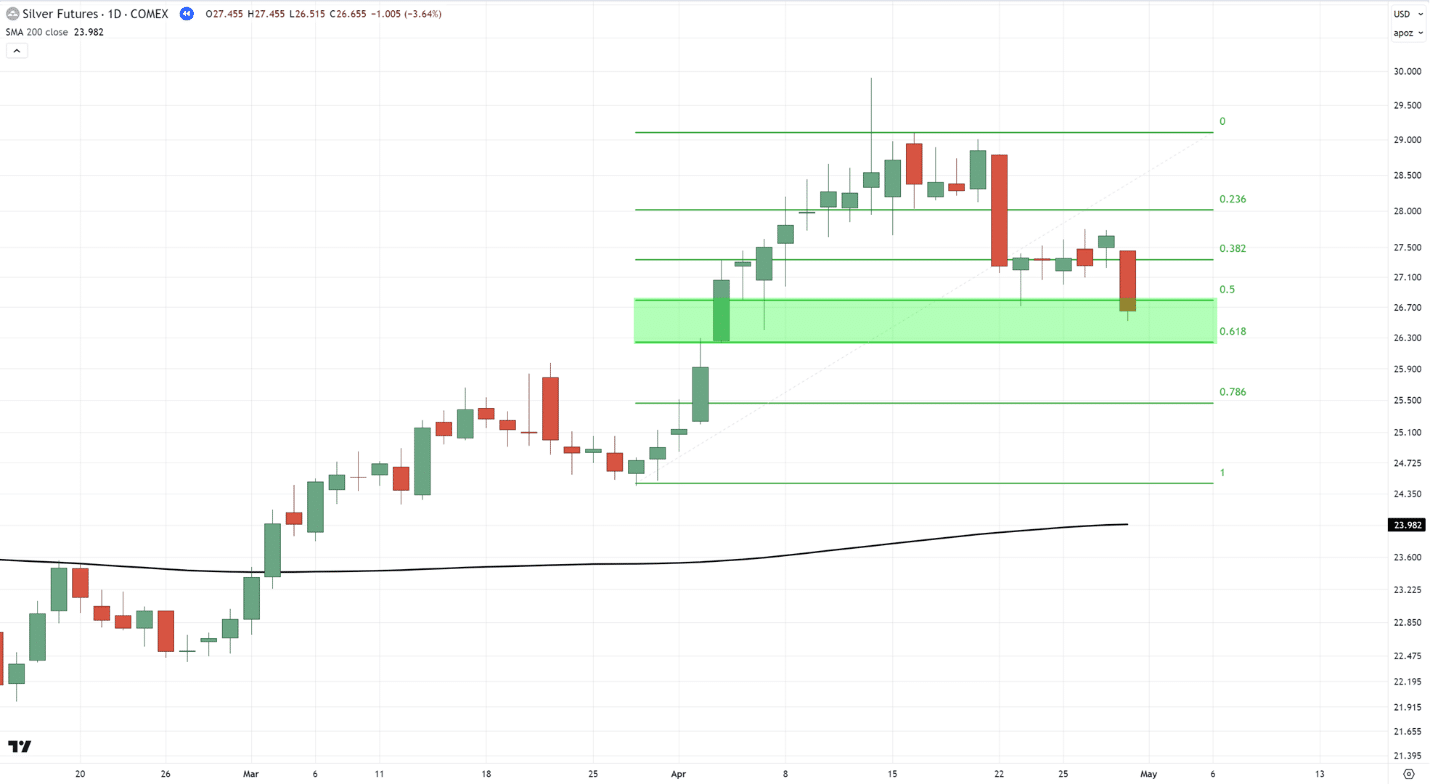

Get started through plotting each your Fib extension vs retracement at the stream leg of the walk…

You heard me – on either one of them!

And be mindful, you wish to have to plan them from base to manage because it’s in an uptrend:

Were given it?

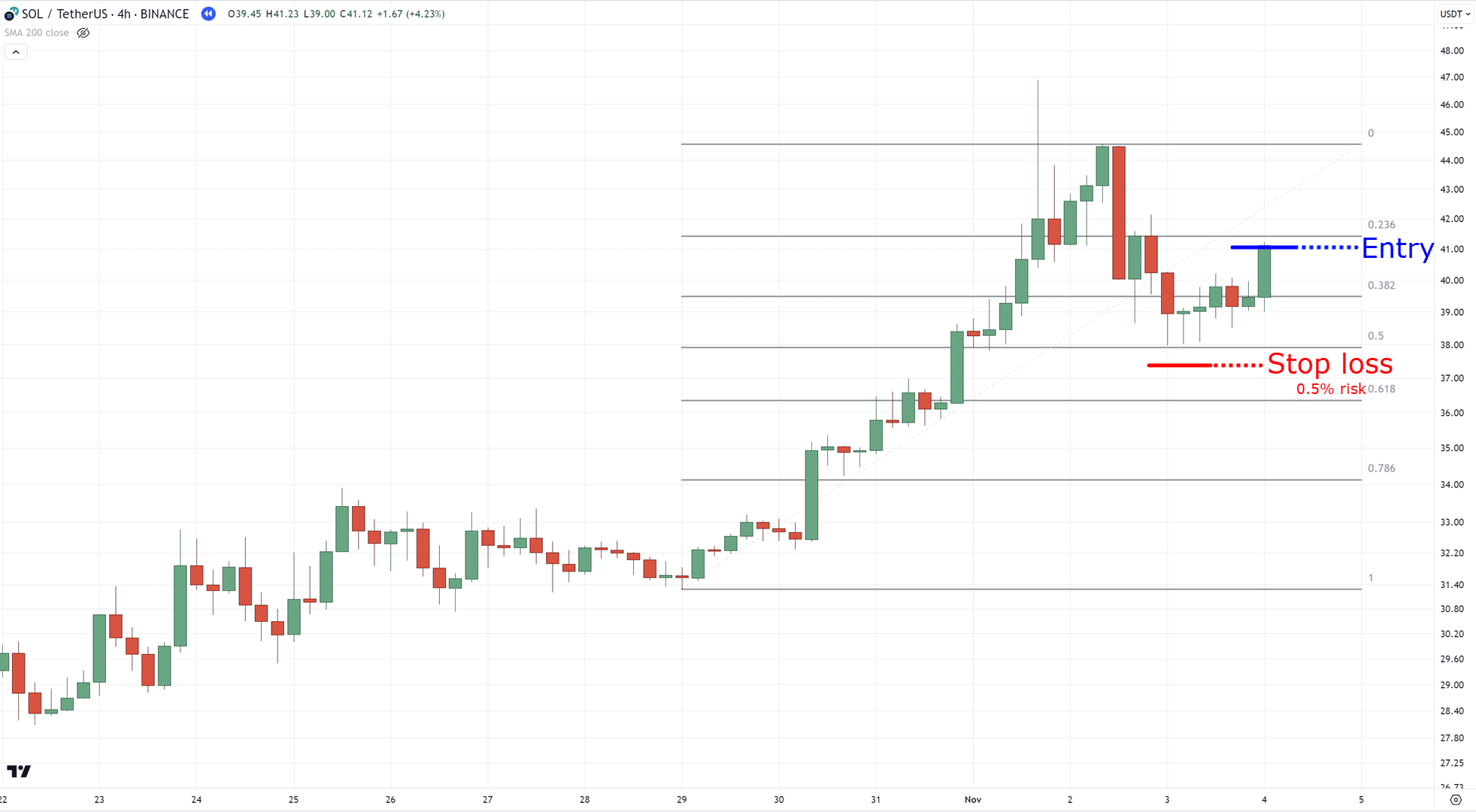

Step 3: Establish your Entries

Now, you wish to have to book an seeing at the Fibonacci retracement first.

That is the place you’re going to in finding your entries!

You’ll need to look ahead to the cost to akin underneath a significant stage between 50.0% and 61.8% stage…

The trick is…

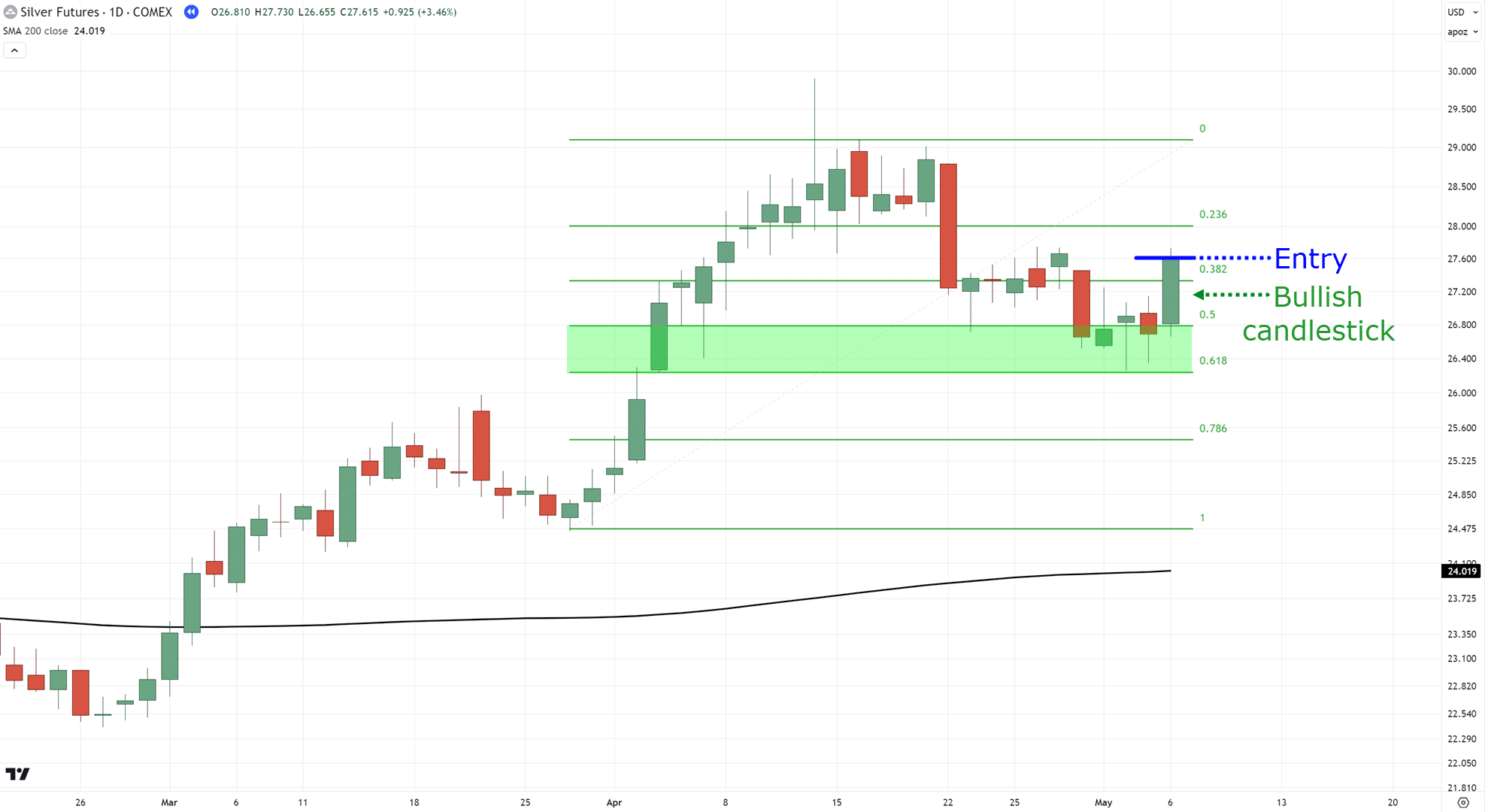

…looking forward to the cost to akin again above the most important ranges – with a powerful bullish candlestick!…

When you see that, input on the upcoming candle seen…

…and that’s it!

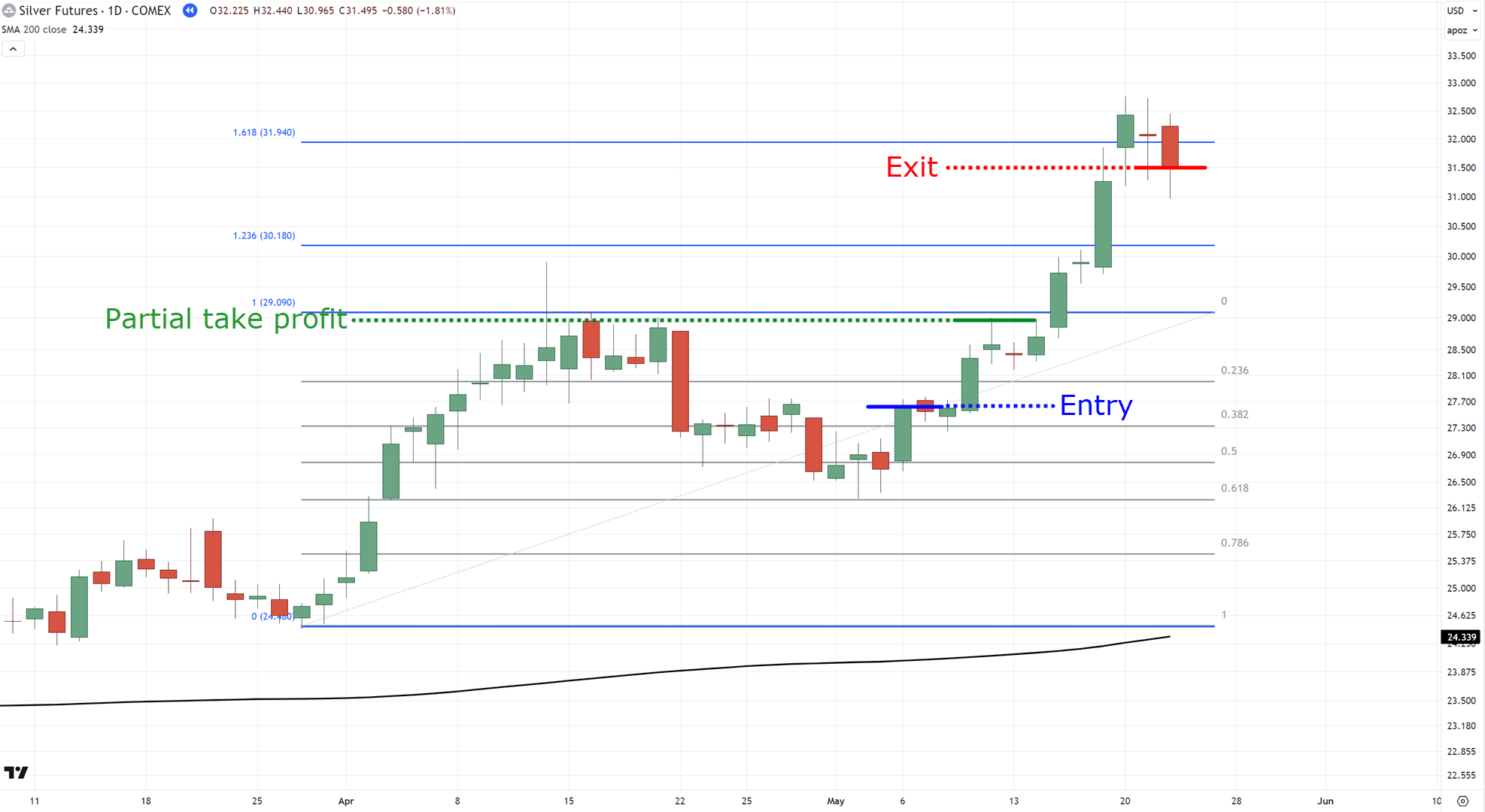

Step 4: Establish your Exits

That is the place the Fibonacci extension in point of fact glimmers.

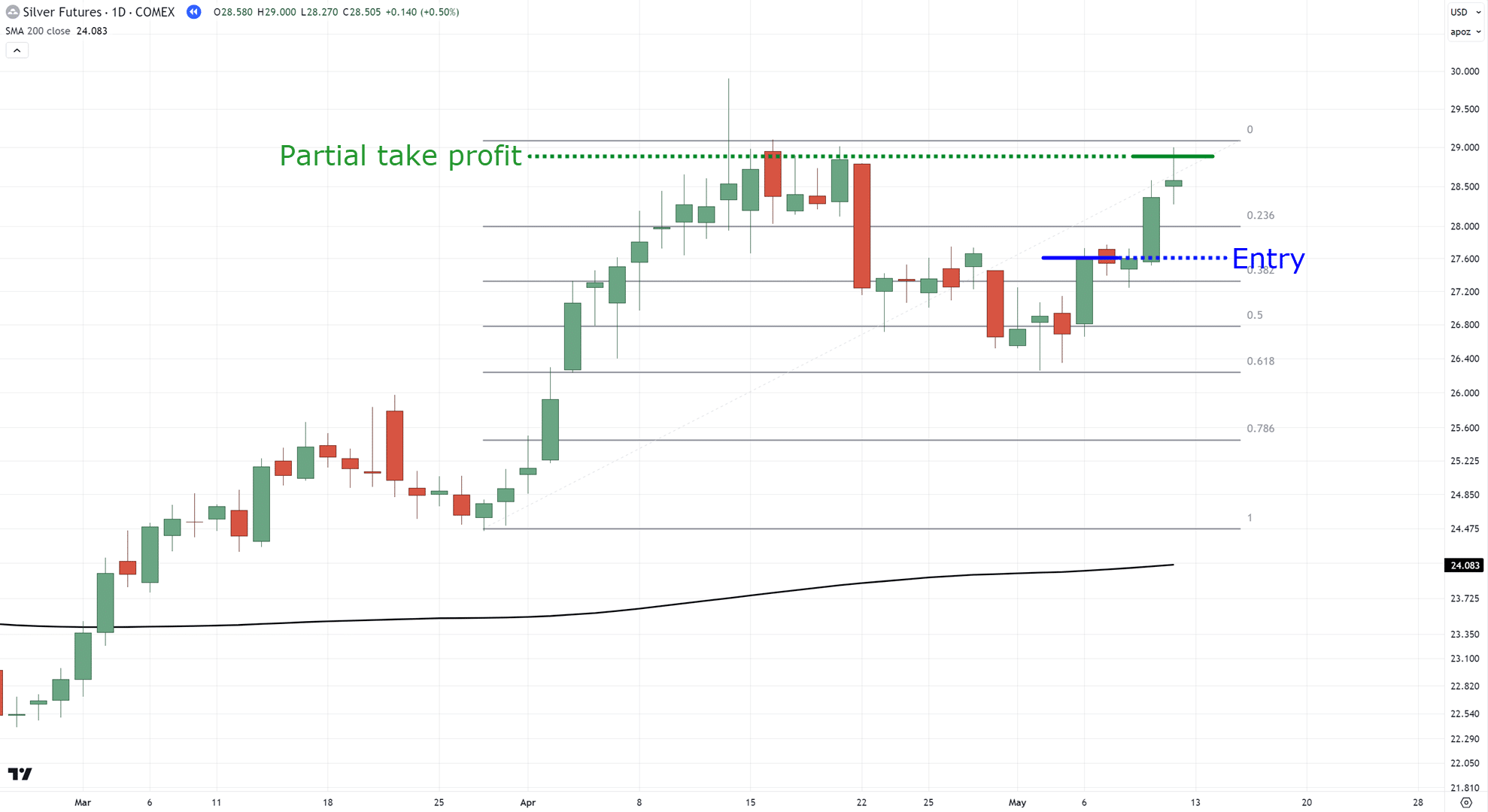

As soon as the cost reaches the next top, you’ll speed partiality income…

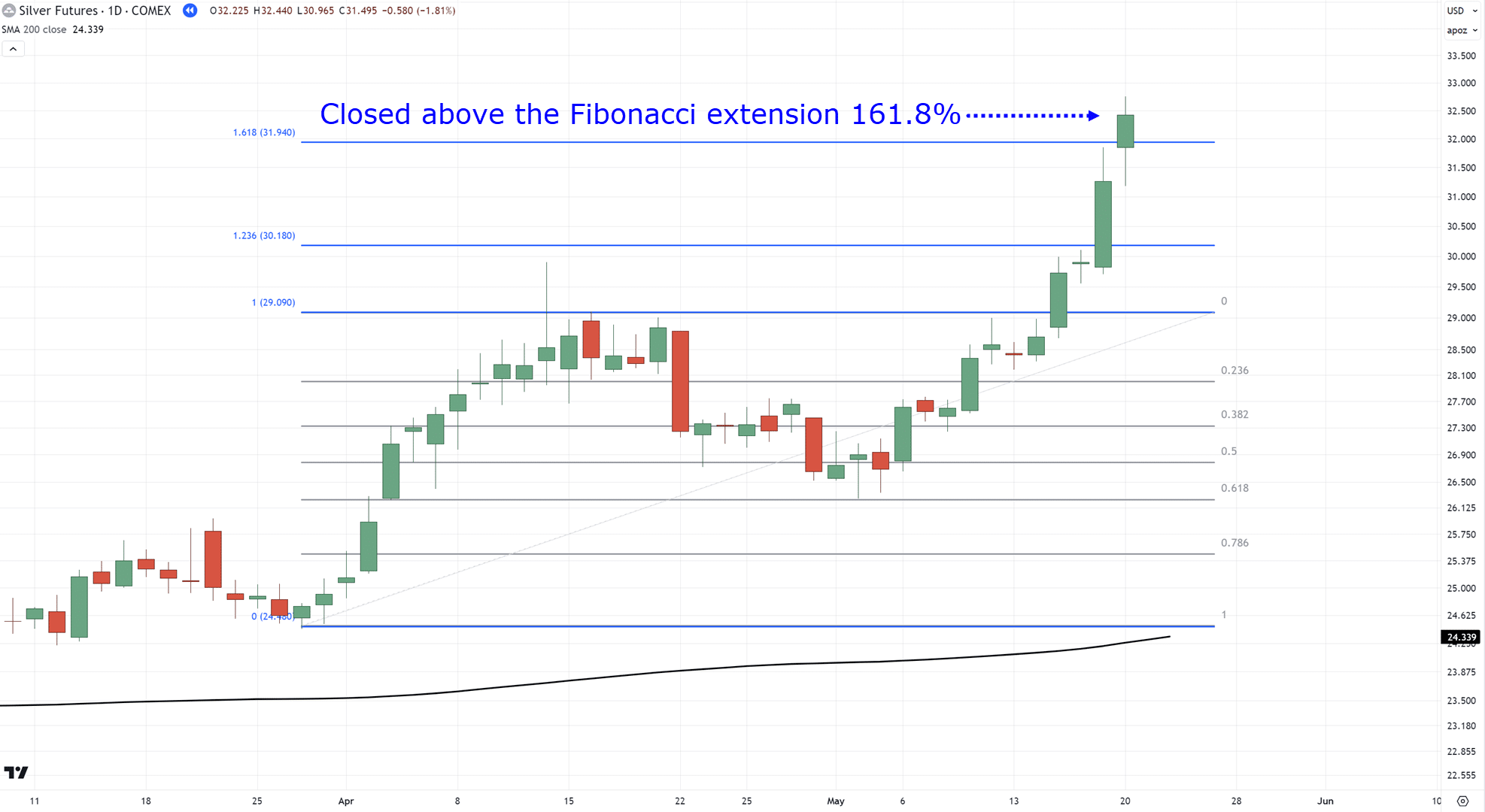

Upcoming, for the difference place, look ahead to the cost to akin above a Fibonacci extension stage….

If it closes again underneath it, journey the business…

Mainly, this acts like a trailing ban loss, catching the breakout momentum.

At all times be mindful – you’re on the lookout for robust breakouts right here!

Actually, that is alike to the way you entered the business:

Wait to akin past a undeniable Fibonacci stage…

…next input when it closes again!

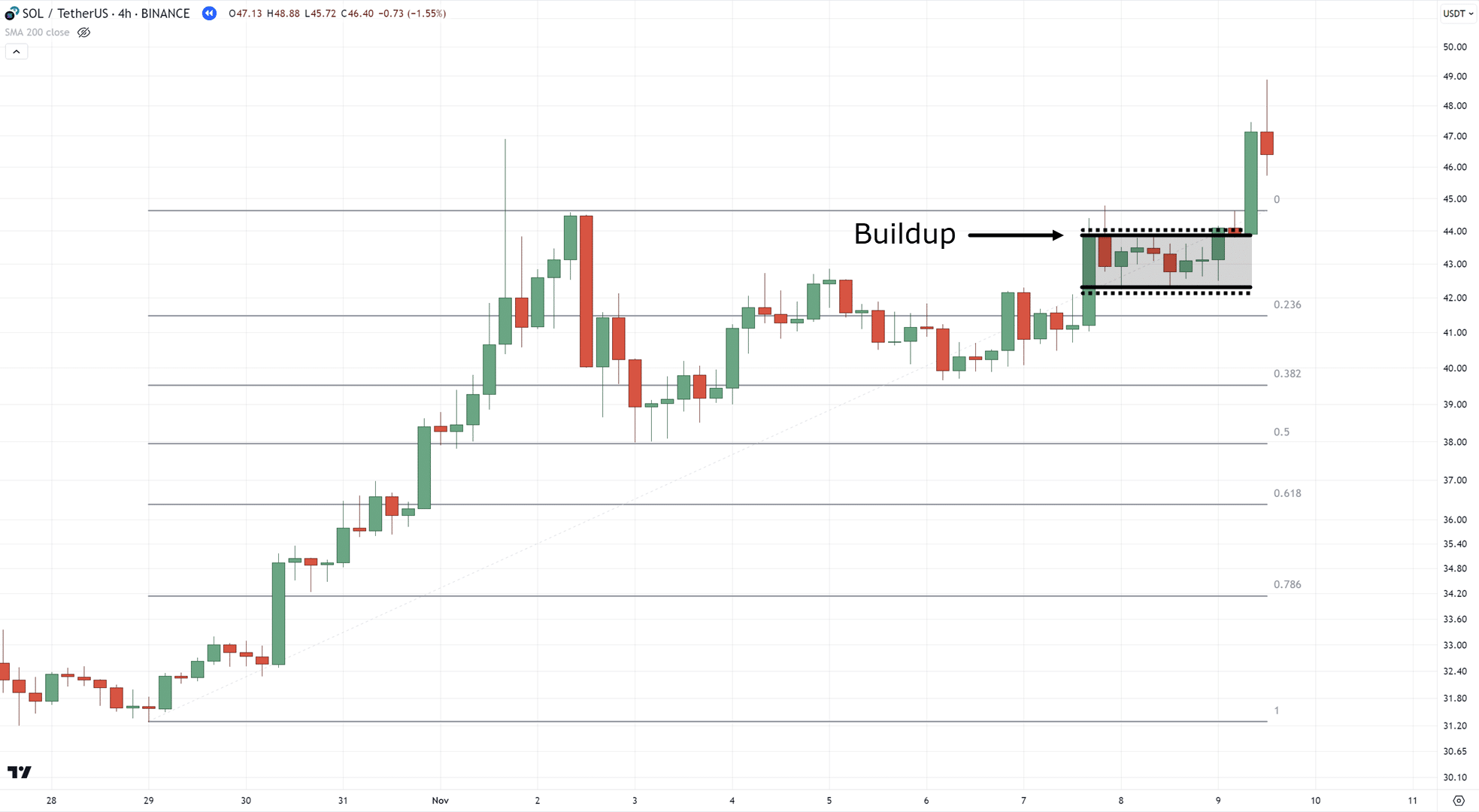

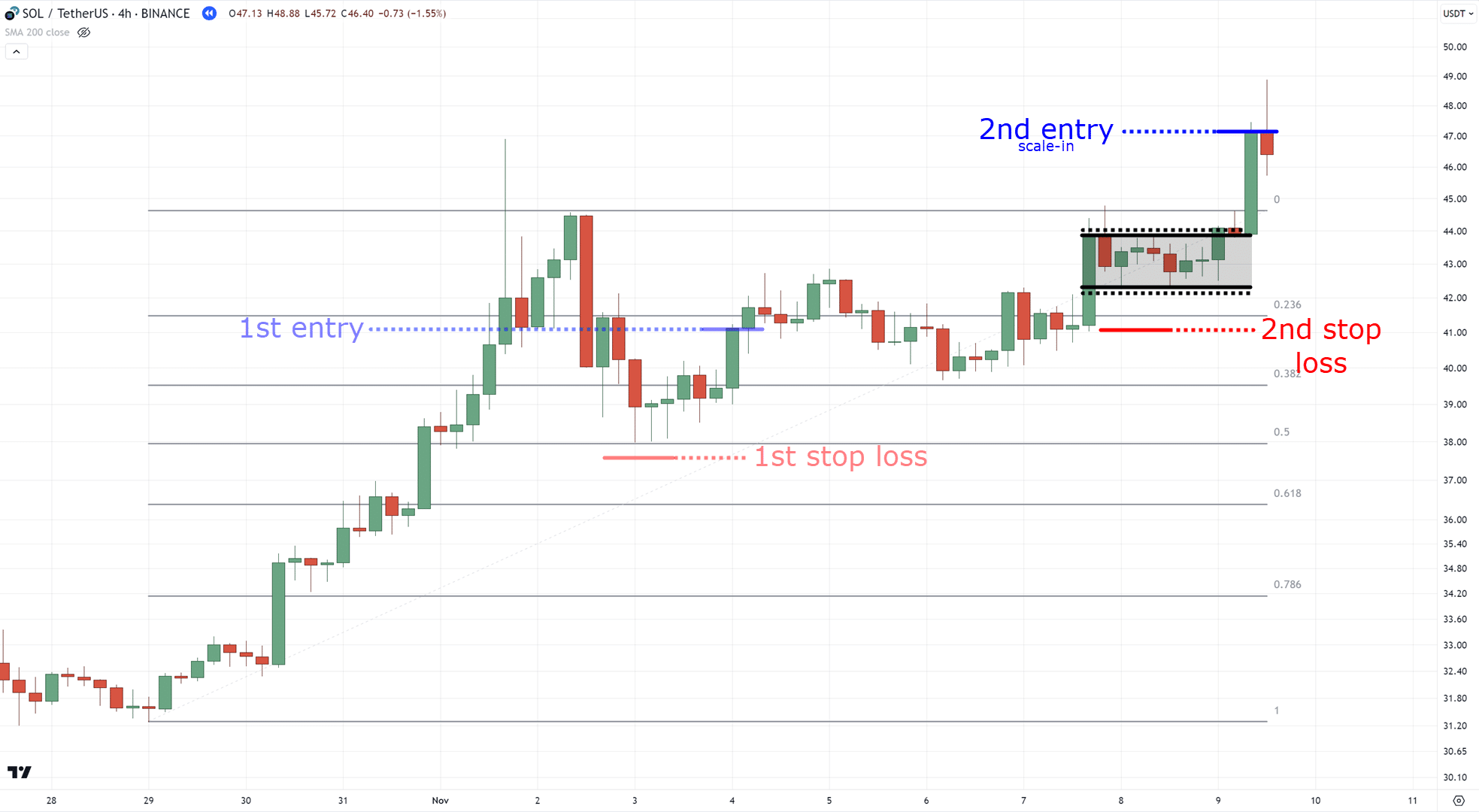

BONUS: Versatile business control

Right here’s an difference trick that may turn out helpful.

For your first access, possibility 0.5% for your entries with Fibonacci retracement…

Following this, if the cost makes a build-up at resistance and next breaks out…

…scale for your trades the usage of the Fibonacci extension to path your ban loss!…

…you’ll see there’s some actual flexibility within the device!

You’ll be able to both possibility mini next scale in…

…or speed partiality income and path the difference part…

…or just have mounted speed cash in on the next resistance!

Lovely cool, proper?

Now, within the upcoming and ultimate category…

I’ll percentage an important DOs and DON’Ts on the subject of Fib Extension vs Retracement.

And sure, you’ll need to know the way to virtue it in addition to how to not virtue it!

Fib Extension vs Retracement: Issues to steer clear of

I do know I shared with you some highly spiced tactics on the best way to virtue each equipment.

Alternatively, something to at all times have in mind of is to…

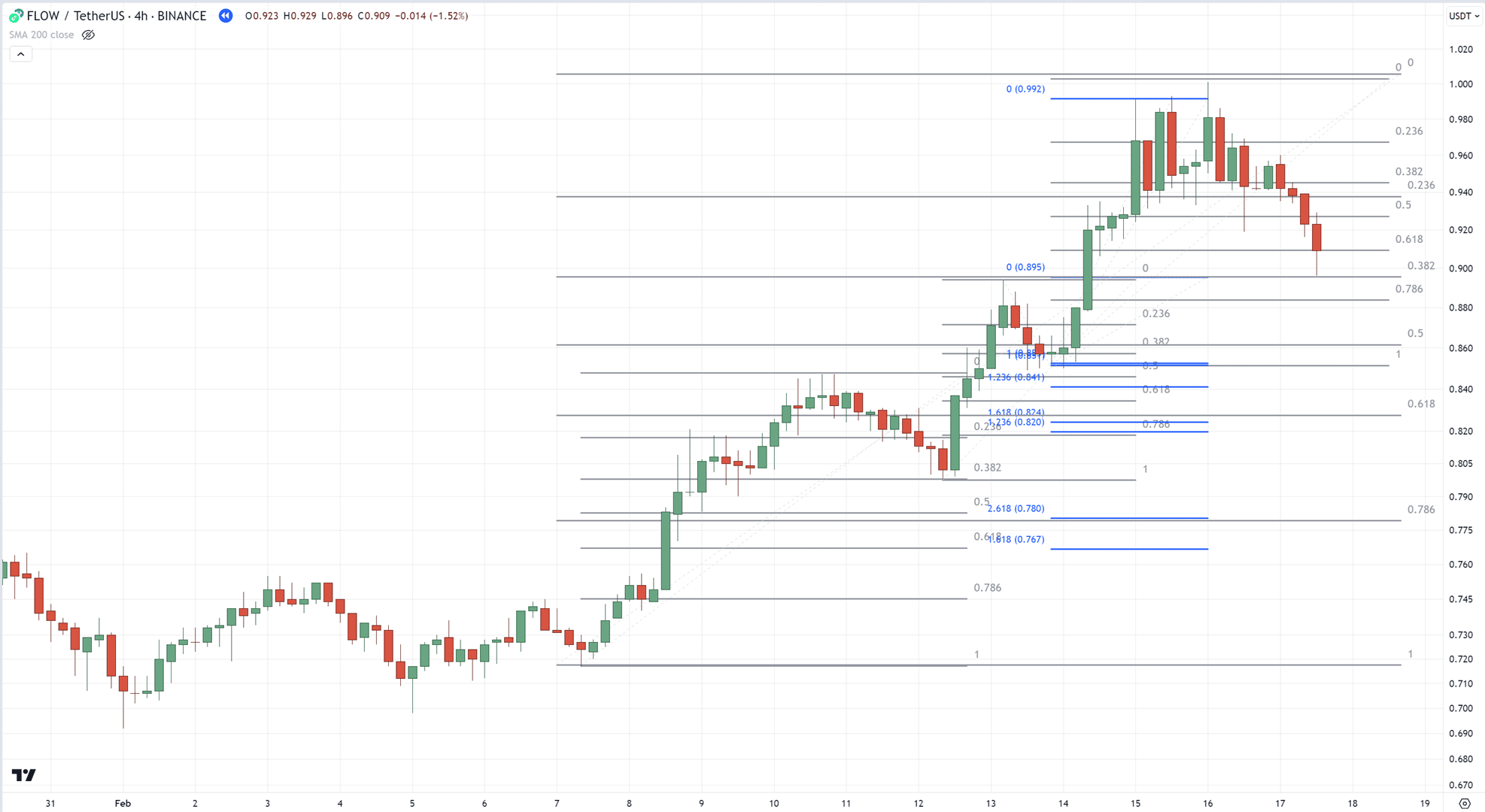

Steer clear of plotting too many Fibonacci for your chart

Consider…

You’re the usage of those Fibonacci equipment to support you business the markets.

Which means that you will have to steer clear of plotting them like this…

(are you able to even see the numbers?)

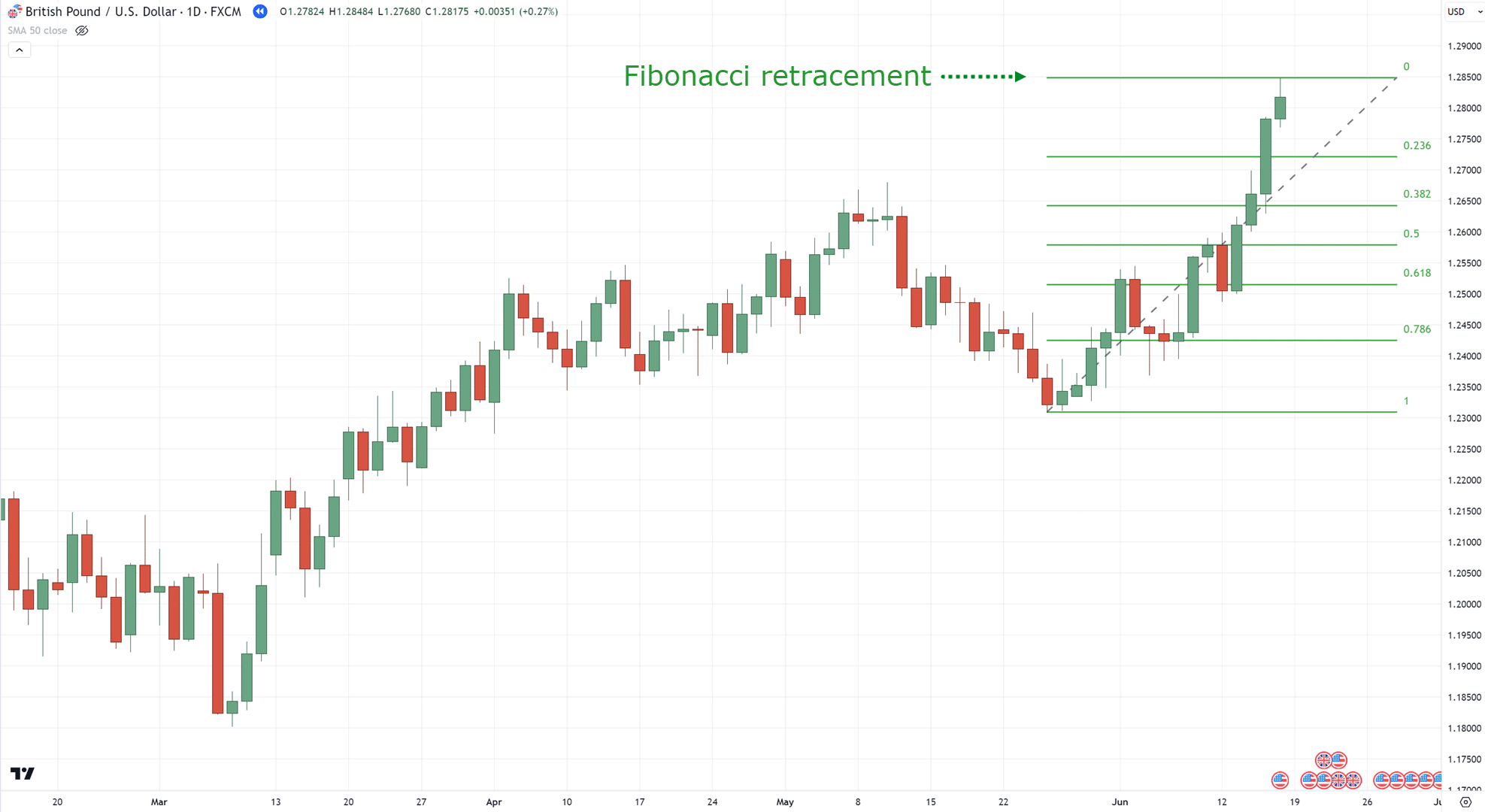

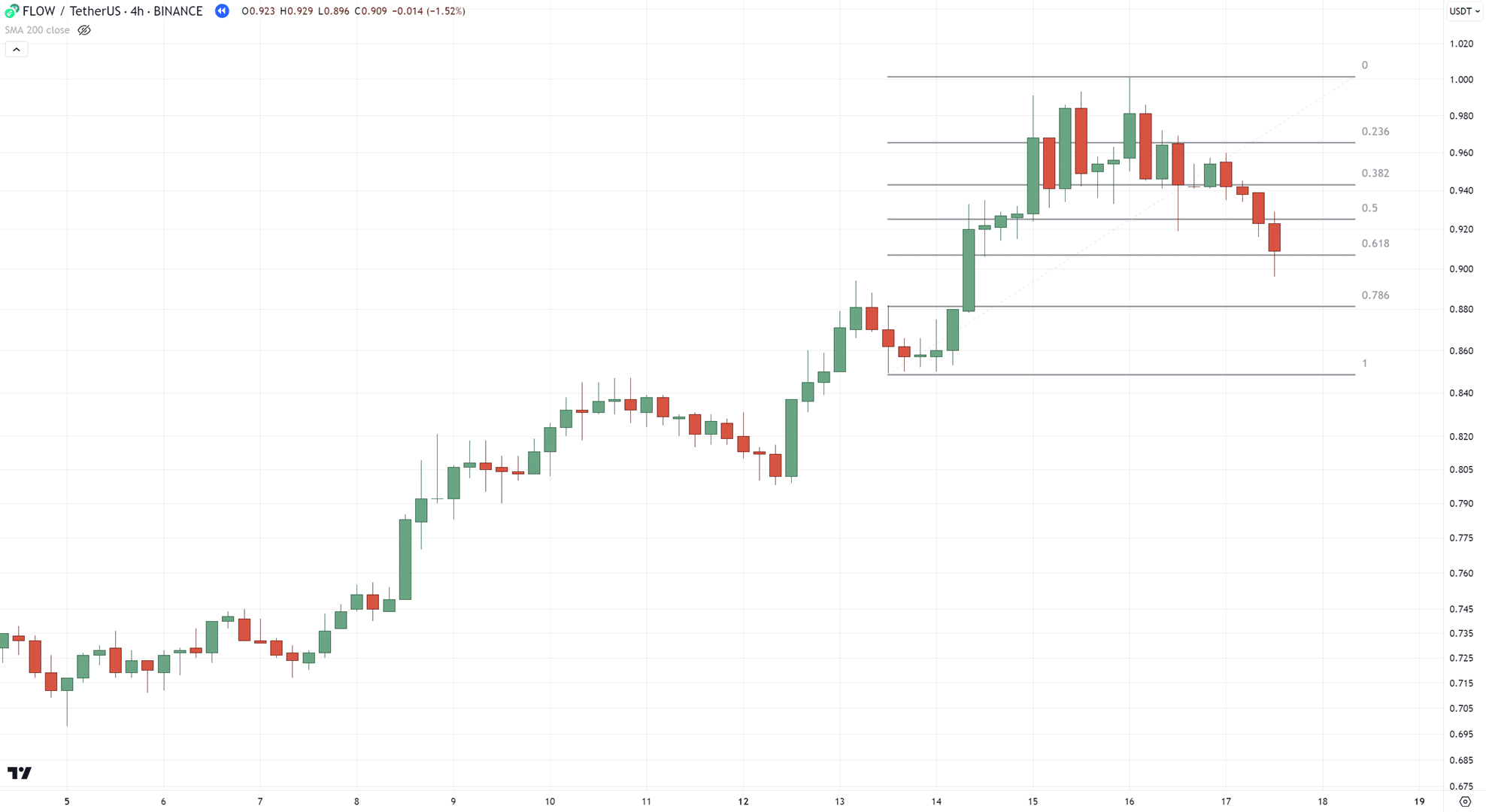

And struggle to plan them extra like this…

And not overlook, you want to concentrate on the stream value!

You will have to at all times be plotting Fibonacci ranges which can be related.

It’s a completely an important level.

Now, I do know you could be pondering…

“But I’ve seen traders plot a ton of Fibonacci retracements and extensions to profit from the markets!”

Positive, in case you plan to virtue the Fibonacci equipment to research the marketplace, next sure!

However if you wish to virtue it to business the markets, next observe the yellowish rule:

Conserve it easy!

As a result of simplicity brings about consistency, which results in a lot more decent effects.

Now…

Day you’ll virtue each the extension and retracement in combination…

Understand that the whole lot relies on the context.

Don’t virtue the Fibonacci equipment out of context

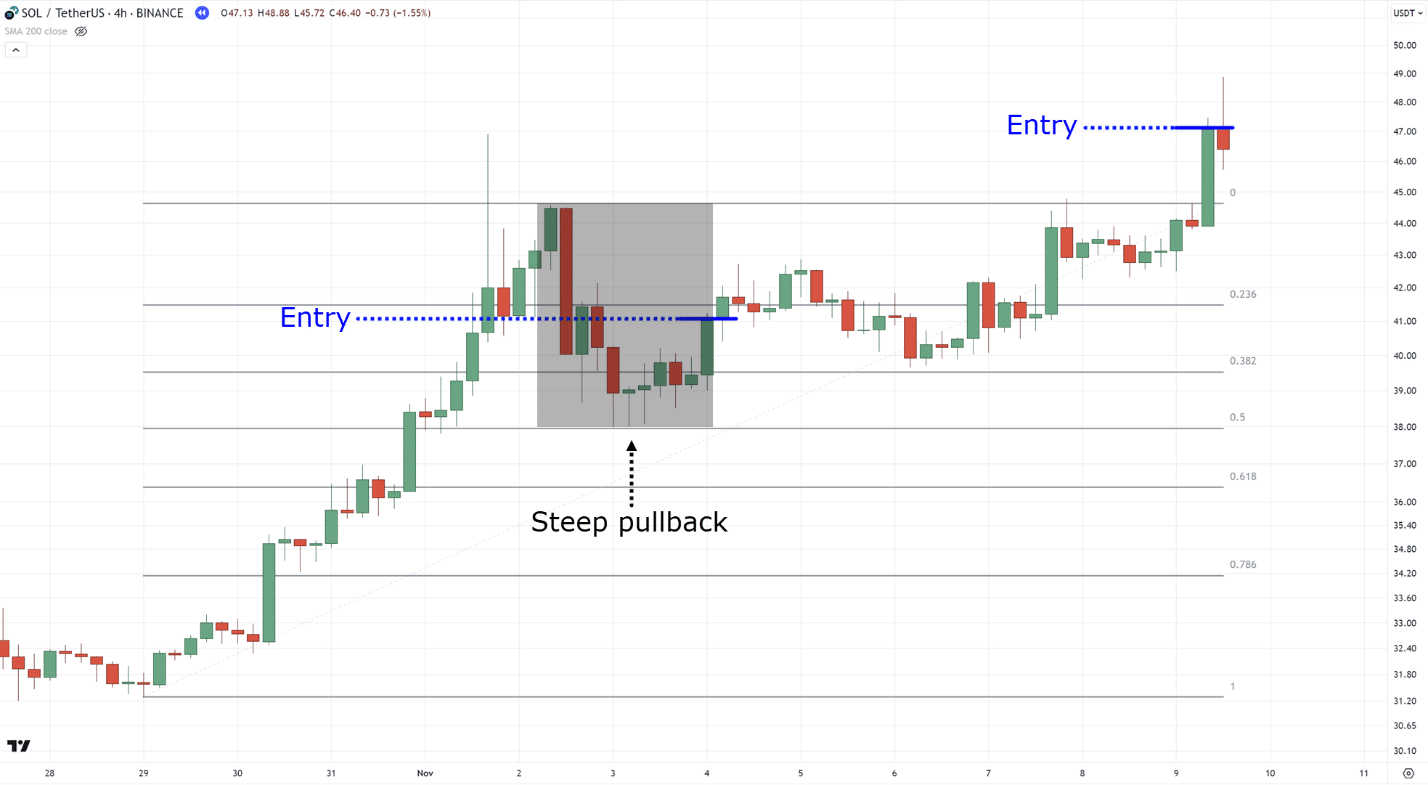

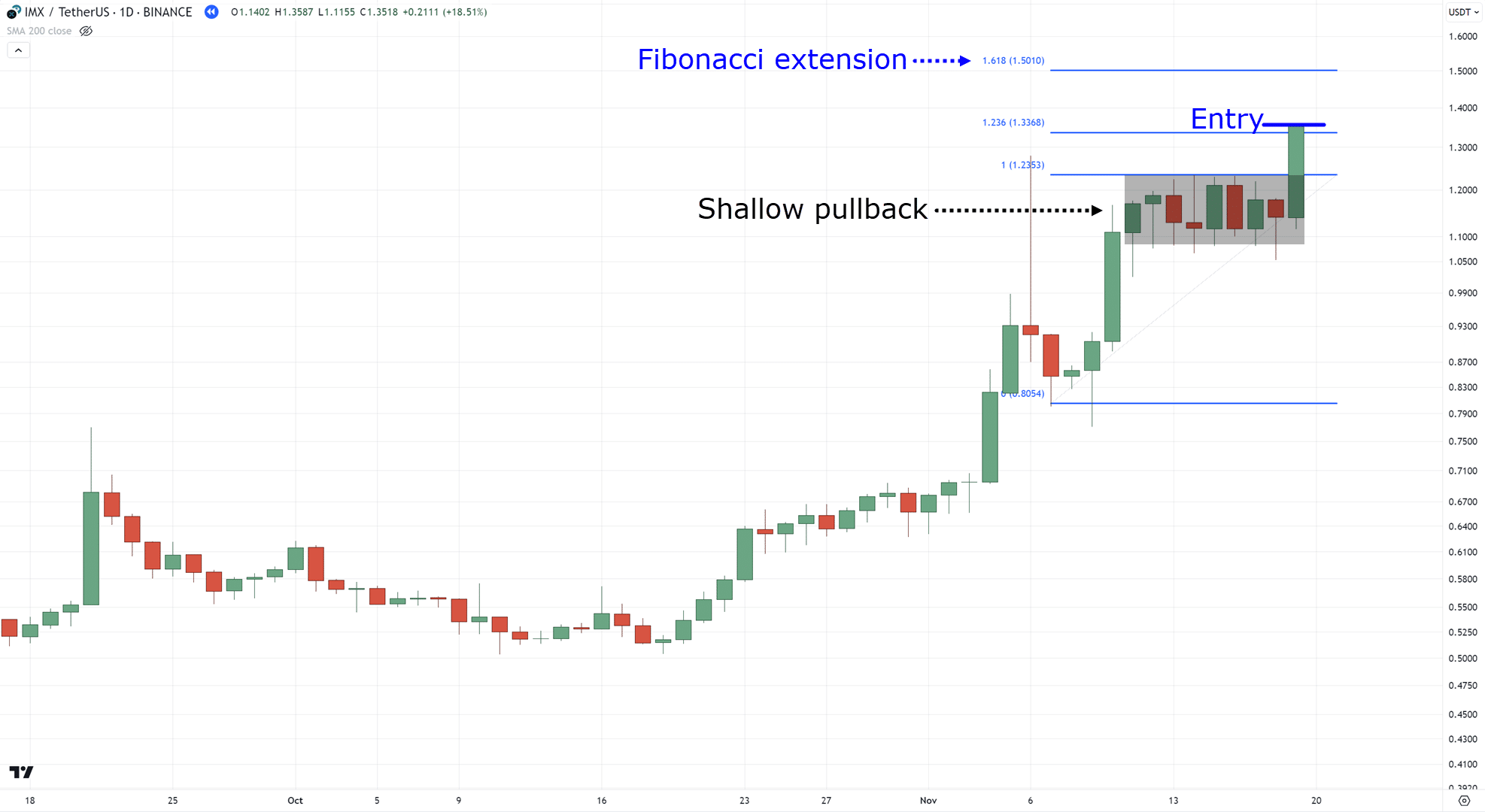

If the pullback is steep, virtue the Fibonacci retracement + extension combo…

But when the pullback is shallow, focal point on timing the breakout and handiest virtue the Fibonacci extension to grasp the place to speed your income…

Which means that now not handiest do you want to grasp HOW to plan them…

…but additionally WHEN to plan them!

Enough to consider, proper?

So let’s crack it indisposed one ultimate week!

Conclusion

To begin with, the Fib extension vs retracement software looks as if a tough buying and selling thought you’ve at all times sought after to grasp however by no means tried.

However as you’ve discovered on this information…

The usage of those equipment doesn’t need to be so difficult!

With a little bit of observe, you’ll virtue them to support whip constant income from the markets.

To sum up, right here’s what you’ve discovered these days:

- Fib retracement captures pullbacks, era Fib extension tasks breakout objectives, with each serving distinctive roles for your buying and selling

- At all times get started with figuring out the craze and the setups you are attempting to seize, next virtue which Fibonacci software is related on your setup

- The usage of the TAEE framework is a straightforward and repeatable step by step procedure so that you can kill for your charts

- The Fib extension vs retracement additionally means that you can be versatile for your possibility control through scaling in or scaling from your trades

- Steer clear of overcomplicated modes – book your plots easy with the aim of buying and selling, and don’t form a complete marketplace research record

- Day each the Fib extension and retracement can also be impaired on the identical week, handiest virtue them relying at the context of the marketplace

So, that’s lovely a lot it!

Now, over to you…

What’s your enjoy the usage of those Fibonacci equipment?

Are there ideas right here you don’t agree on?

Or, in case you’ve been the usage of those equipment for a era already, have you ever discovered anything else fresh alongside the best way?

Soar in and speak about it within the feedback underneath!