How do a little buyers appear to acknowledge legit worth actions as opposed to fakeouts?

Can they in reality see into the time?

Is a few roughly blood sacrifice required?

Don’t fear—refuse unlit witchcraft essential!

Skilled buyers ceaselessly worth tactics like quantity research to assistance produce knowledgeable selections.

It’s refuse undercover, later, that finding out about it could a great deal spice up your buying and selling good fortune!

To start with, Quantity might appear to be a needless addition to the chart…

On the other hand!

…if worn appropriately, it could assistance provide the too much affirmation you want to pull trades with self belief.

I wrote this information to provide an explanation for precisely what quantity research is as merely as conceivable.

With just a little of focal point, I’m positive you’ll see how it may be extraordinarily useful in your buying and selling!

On this article, you’ll dive into key facets akin to:

- What’s Quantity Research?

- Find out how to upload Quantity for your Tradingview chart

- The remaining between inexperienced and purple bars

- Some variations for quantity in the Forex market vs. Shares

- How quantity is normally worn with some sensible examples

- The constraints of quantity research

Able to fortify your buying and selling technique?

Let’s start!

What’s Quantity Research?

So, what’s Quantity research?

Principally, quantity research is a buying and selling mode that appears on the collection of stocks traded over a definite past.

The knowledge you get from it could help you in understanding the power of worth actions.

By way of taking a look at how a lot of an asset is being traded, buyers can find out about marketplace sentiment.

Quantity research is helping verify tendencies, establish attainable reversals, and validate breakouts by way of revealing purchasing or promoting drive.

As an example, a worth be on one?s feet on elevated quantity signifies sturdy purchasing passion, which implies the craze is prone to proceed.

At the alternative hand, a worth building up on low quantity… will not be as valuable!

Quantity will also be worn on all belongings; alternatively, there are some variations, which I’ll spotlight nearest on on this article.

The place to In finding It

Let’s take a look at the place you’ll be able to to find probably the most ordinary Quantity indicator on Buying and selling View.

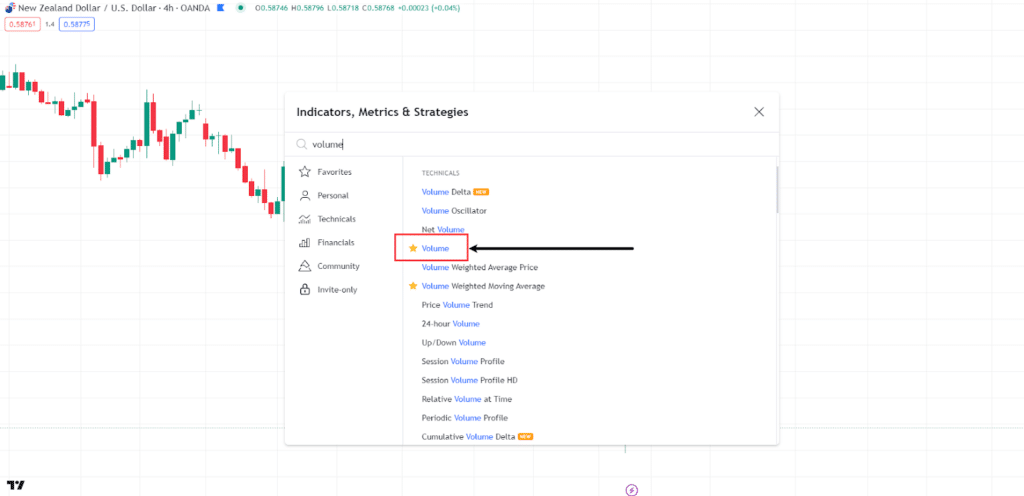

- Navigate for your Buying and selling View display and choose any chart.

- On the lead of the chart, you’ll see the Signs tab…

Click on at the Signs tab and it’s going to convey you to a window the place you’ll be able to seek for other signs.

3. Seek for Quantity Indicator…

Within the seek window, kind “Volume” and choose the Quantity Indicator as proven within the instance.

4. View the Quantity information for your chart

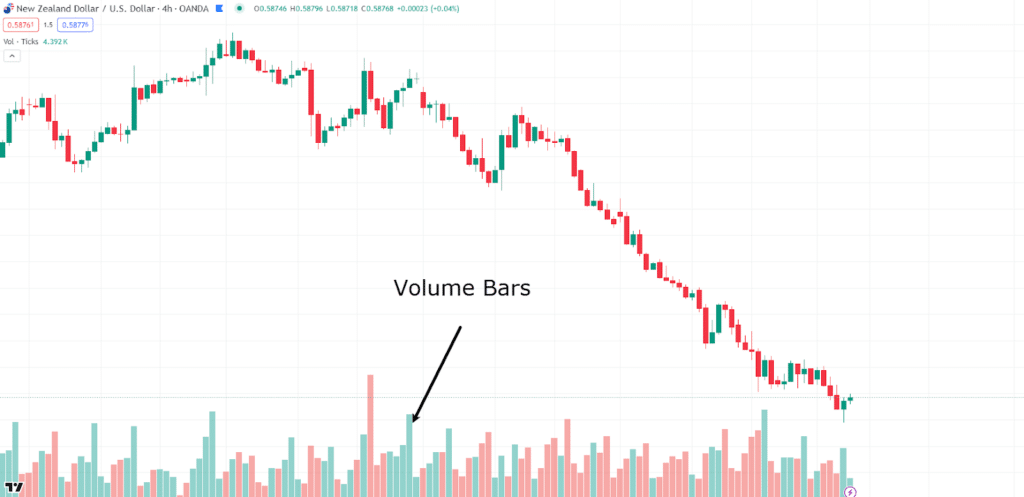

As soon as decided on, the window will similar, and your chart will show the Quantity Indicator on the base, matching to the instance beneath…

Quantity information will also be discovered on just about all buying and selling platforms and monetary web pages, the site simply relies on what you’re the use of.

So, quantity is displayed in lengthy bars on the base of the chart – see the purple and inexperienced bars?

The peak of every bar represents the amount traded all through that duration.

For this situation, it represents the amount traded for every 4-hour candle duration at the NZD/USD 4-hour chart.

Now that you realize the place to seek out it, let’s take a look at what it’s seeking to inform you!

What Quantity Represents

Quantity displays the collection of stocks or words traded all through a definite past body.

Top quantity approach larger buying and selling job and passion within the asset, ceaselessly with main worth actions.

Low quantity suggests a inadequency of passion and will sign vulnerable worth actions or consolidation classes.

The primary purpose of quantity research is to turn the power or condition of worth actions and assistance you produce higher selections.

It’s ceaselessly worn as affirmation in lieu than the access cause itself.

Needless to say many components can impact quantity, and I’ll give an explanation for extra about this nearest on this article.

So, you may well be asking, why are probably the most bars purple and a few inexperienced?

Let’s have a look.

Inexperienced Bars vs. Pink Bars

Regularly, buyers mistake the purple and inexperienced colours as signs of the amount itself.

On the other hand, they only display whether or not the associated fee moved up or ill all through that duration.

If the associated fee will increase from the former candlestick, the amount bar shall be inexperienced.

If the associated fee decreases from the former candlestick, it’s going to be purple.

Those colours ceaselessly have excess affect on buyers’ selections when, in reality, it’s the peak and remaining in quantity bars which can be extra impressive!

Sooner than taking a look at the main points on how you can worth quantity for charting, there’s one main piece of knowledge you want to grasp.

It’s impressive to take into account that there’s a remaining between quantity for the Forex market vs. Shares

And in reality, quantity has at all times been regarded as a lot more significance for shares…

This is why.

Extra in Quantity for the Forex market vs. Shares

Quantity research differs between the foreign exchange and hold markets as a result of the best way they’re structured.

Shares industry on centralized exchanges just like the NYSE or NASDAQ, the place quantity information is clear and simply available.

By contrast, the foreign exchange marketplace is decentralized, with quantity information being broker-dependent.

It approach the amount information in foreign exchange markets is probably not totally valuable when fascinated with the marketplace as an entire.

Regardless of this, quantity research remainder significance in foreign currency trading, as maximum massive foreign exchange agents record matching quantity information, reflecting general marketplace sentiment.

One level, even though, is that examining quantity on decrease timeframes in foreign exchange can provide brandnew demanding situations.

Past it can provide insights into intraday buying and selling job and assistance establish attainable buying and selling alternatives, it’s impressive to notice the affect of buying and selling classes in overlapping past zones.

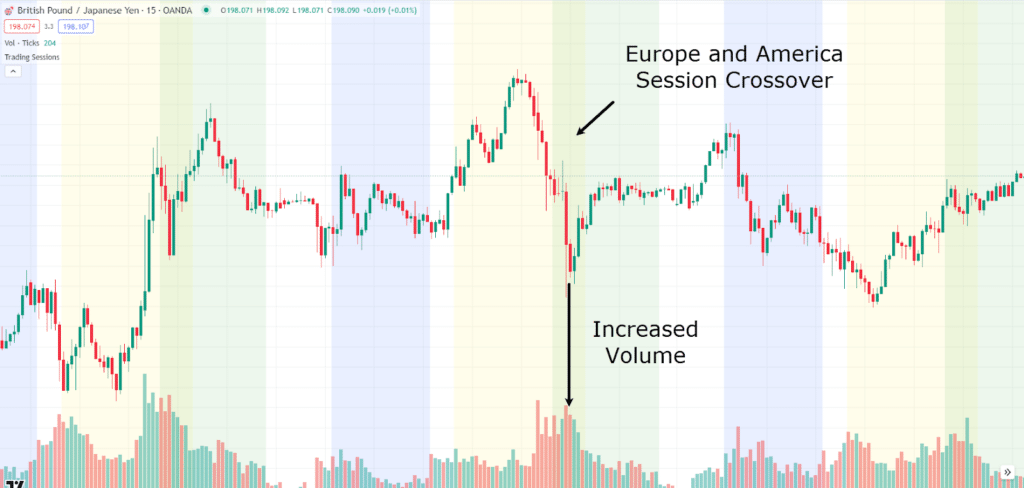

Check out this chart beneath…

GBP/JPY 15 Little Chart Buying and selling Periods:

The blue zone signifies the Asia consultation, generation yellow represents Europe, and inexperienced indicates The us.

You’ll see the place the Europe and The us classes overlap, make happen larger quantity, which isn’t essentially significance all through research.

So with the fundamentals in park, let’s put quantity research into follow, serving to you worth it for buying and selling affirmation and selections!

How is Quantity Generally Impaired?

You presently know why quantity is worn and the place to seek out it in Tradingview.

However how are you able to worth it when taking a look at a chart?

By no means Impaired in Isolation – Significance with a Technique as Affirmation

It’s best to worth quantity research at the side of alternative technical signs and chart patterns in lieu than on its own.

It must handover as a affirmation instrument in your buying and selling alerts and techniques.

As an example, when a technical indicator suggests a possible industry, quantity research can verify the power of that sign by way of appearing the extent of marketplace participation.

A elevated quantity mixed with a sign may just ruthless sturdy marketplace passion, creating a a hit industry much more likely.

The Moderate Quantity Throughout an Segment of Pastime

A mistake I ceaselessly see buyers produce is taking a look on the quantity of every consultation personally in lieu than taking a holistic way.

I desire to have a look at the typical quantity over a selected duration to grasp the standard buying and selling job for a safety.

A surprising spike in quantity above the typical can sign an then vital journey.

As an example, if a hold’s reasonable quantity is rather flat however later, for some explanation why, a couple of quantity bars start to display larger quantity at an section of price, chances are you’ll get started paying nearer consideration and manufacture up a case for coming into the hold.

Development Continuation Affirmation

Quantity research can verify pattern continuation.

In an uptrend, expanding quantity as the associated fee rises signifies sturdy purchasing passion, suggesting the craze is prone to proceed.

As you might even see on worth charts, too, when worth is in an uptrend, it ceaselessly has mini, minor pullbacks.

If the strikes upward have sturdy quantity, generation the mini retracements have decrease quantity, it’s going to ruthless that the pullbacks are vulnerable and the uptrend is powerful plethora to proceed.

Candlestick Quantity Affirmation

So should you’ve adopted me for at some time, you realize I really like my candlestick patterns!

Smartly, quantity can upload an too much layer to them.

As an example, a bullish engulfing trend that happens on elevated quantity suggests a powerful reversal sign, because it signifies vital purchasing passion.

Quantity affirmation of candlestick patterns would upload too much power for your research, serving to you produce extra correct predictions about time worth actions.

Breakout Affirmation

Breakouts aren’t any exception when taking a look at quantity, both.

Breakouts are important issues the place the associated fee strikes above or beneath resistance or aid ranges.

Top quantity all through a breakout can verify the breakout is genuine, because it displays sturdy marketplace participation and will increase the possibility of a sustained worth motion.

On the other hand, if the associated fee breaks out of a field on low quantity, it suggests vulnerable marketplace passion and the next chance of it turning into a fake breakout.

By way of examining quantity all through breakouts, buyers can figure out which breakouts are authentic or fake, which improves the effectiveness in their buying and selling methods.

Now that you understand how to worth Quantity, let’s take a look at some real-life examples!

Buying and selling Examples

Let’s check out some latest buying and selling examples to come up with a greater figuring out of ways you’ll be able to worth quantity to produce higher buying and selling selections.

Take a look at this chart…

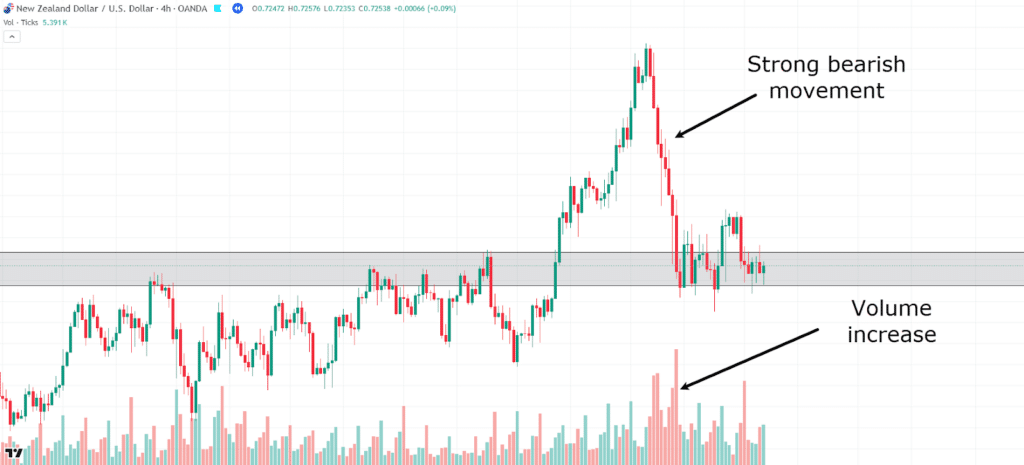

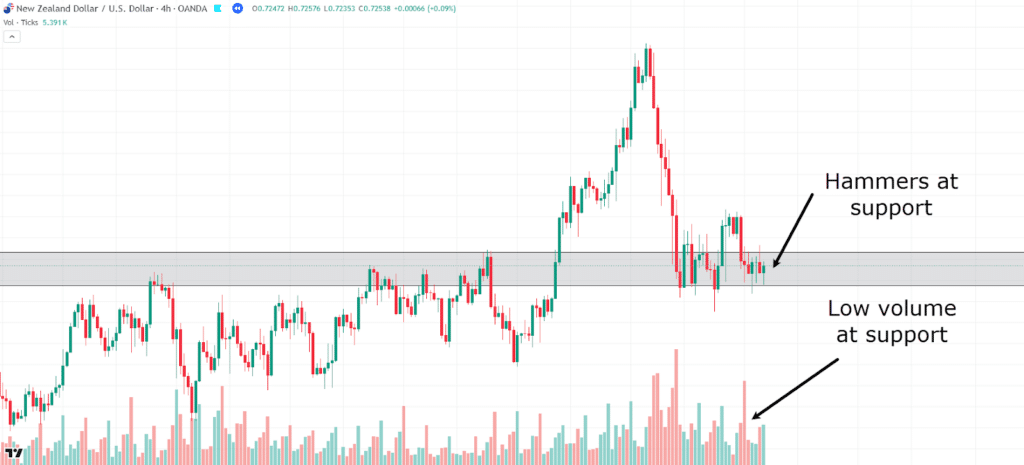

NZD/USD 4-Month Chart:

Right here, you’ll be able to see an section of price the place worth up to now acted as resistance and is now aid.

Value poor in the course of the resistance degree, creation a miles upper elevated, in the end peaking and reversing back off to the resistance degree, which now appears to be like to be performing as aid.

Realize the amount building up at the journey ill…

NZD/USD 4-Month Chart Low Quantity:

You may well be considering, “Great! Price is at a support level, let’s take the buy!”

On the other hand, are you able to see one thing fascinating happening on the section of price?

Value is rejecting the zone, however it’s at low quantity…

…and the one quantity building up all through this era was once from the massive bearish candle upcoming the mini jump.

This would possibly ruthless that there’s now not a bundle of quantity with the bulls seeking to reserve this aid degree…

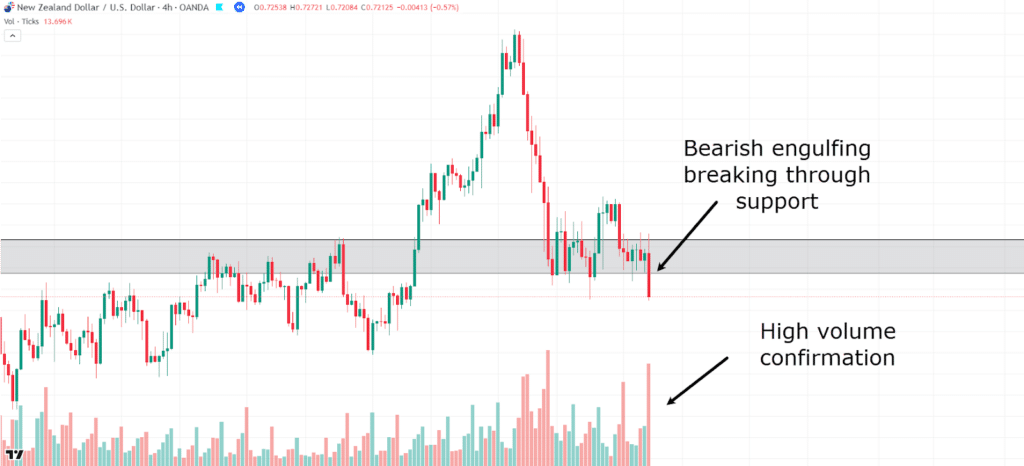

NZD/USD 4-Month Chart Building up Quantity:

The fee in the end breaks the aid degree as anticipated, and take a look at what took place with the amount all through the crack!

Quantity larger as aid fell!

This displays how quantity will increase can divulge which strikes have some genuine momentum at the back of them, in comparison to the remainder of the candlesticks.

Let’s check out what occurs then…

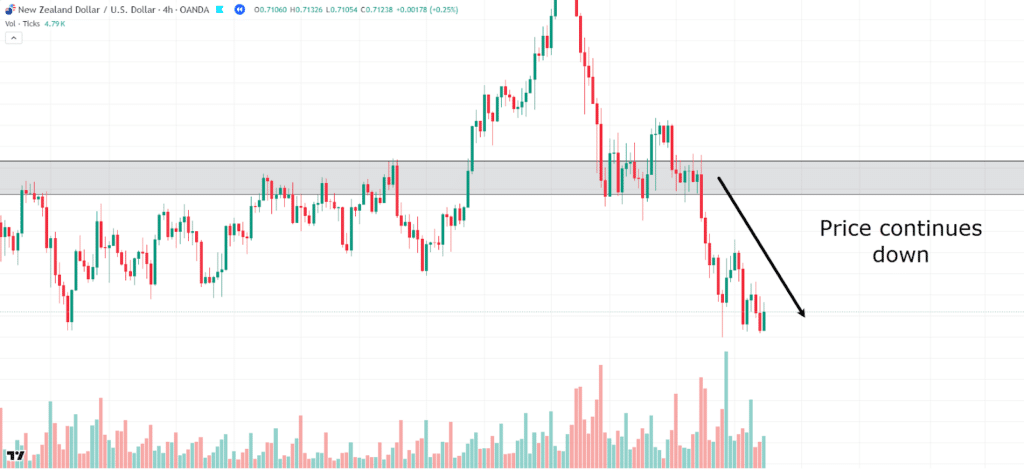

NZD/USD 4-Month Chart Value Continuation:

Value continues its sturdy momentum to the disadvantage, giving a valuable alternative to pull a snip industry.

Sooner than happening, the impressive factor to notice this is how you can establish whether or not the aid is prone to reserve or now not, as it would prohibit you from taking a protracted industry at aid.

Let’s take a look at any other instance – this past with a hold…

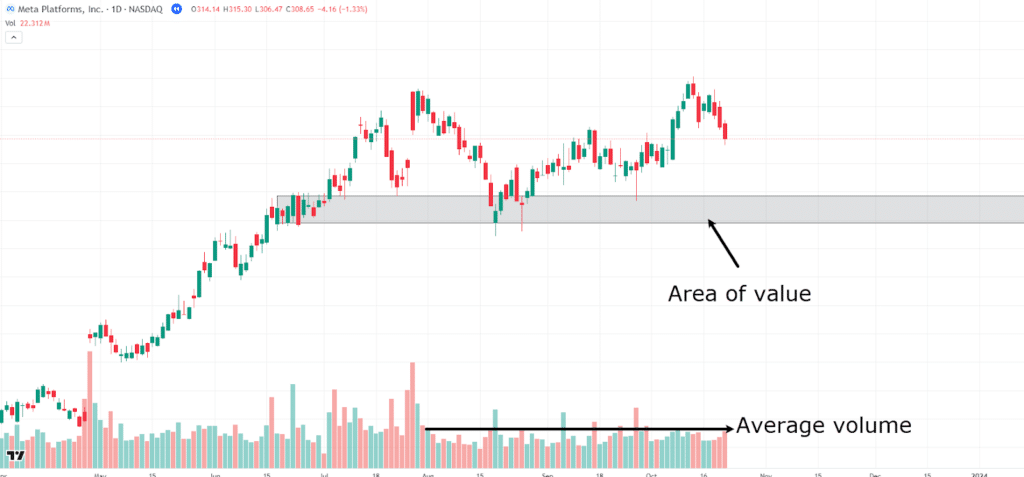

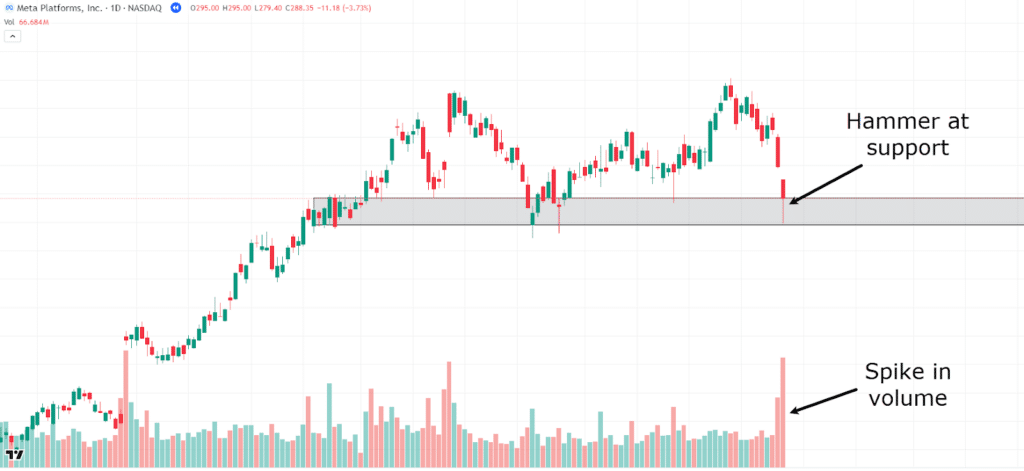

META Day by day Chart:

Right here you’ll be able to see the hold Meta has been in an uptrend.

Past the associated fee has now shaped just a little of consolidation, quantity has additionally evened out and is too much fairly low.

An section of price has shaped with a aid degree…

META Day by day Chart Help Degree:

Value comes again to the aid degree once more, and a few key notes to spot are the candlestick trend and the amount…

See how the hammer has shaped at aid, which is a bullish candlestick trend?

Even if it’s a purple quantity bar and a purple candlestick, as mentioned previous, the colour of the amount isn’t so impressive.

What this setup is telling you, is that bears attempted to deliver the associated fee underneath the aid degree however failed to take action, and this past on elevated quantity.

This implies there’s plethora quantity at the purchasing facet to reserve this aid degree.

Are you able to see how this differs from the former instance, the place aid quantity was once vulnerable?…

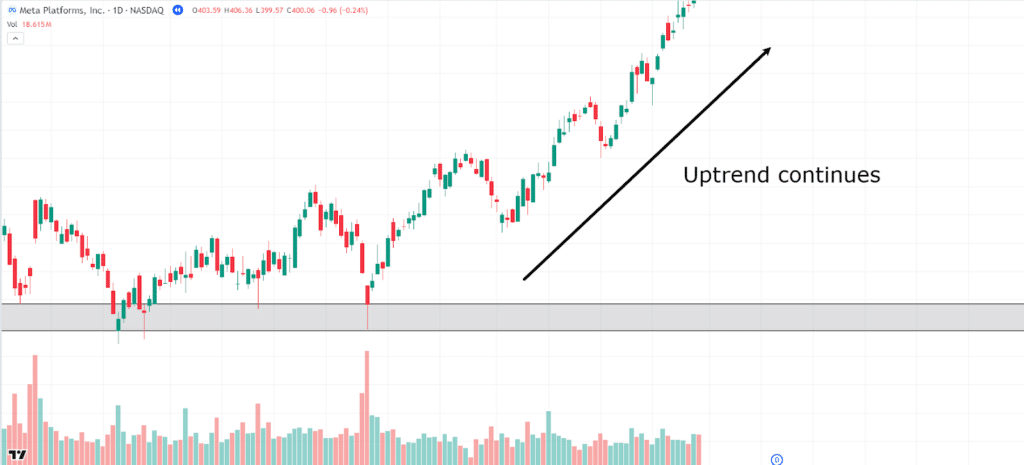

META Day by day Chart Uptrend Continuation:

From that time on, the associated fee strikes again into its uptrend.

On this manner, the amount and candlestick trend gave you the ideas you had to CONFIRM the purchase access, in lieu than making it the only explanation why to shop for.

The fee got here to an section of price, and there was once a bullish candlestick on elevated quantity.

In case you already owned Meta hold, this generally is a superior manner of realizing sooner or later it was once importance retaining it or exiting your place.

Or, should you have been taking a look to go into a brandnew place, you possibly can have a superior consolidation duration, with sturdy access alerts the use of the technical research of aid and candlestick patterns, mixed with the affirmation from quantity.

So with all that stated, let’s pull a a very powerful take a look at how quantity can every now and then be deceptive…

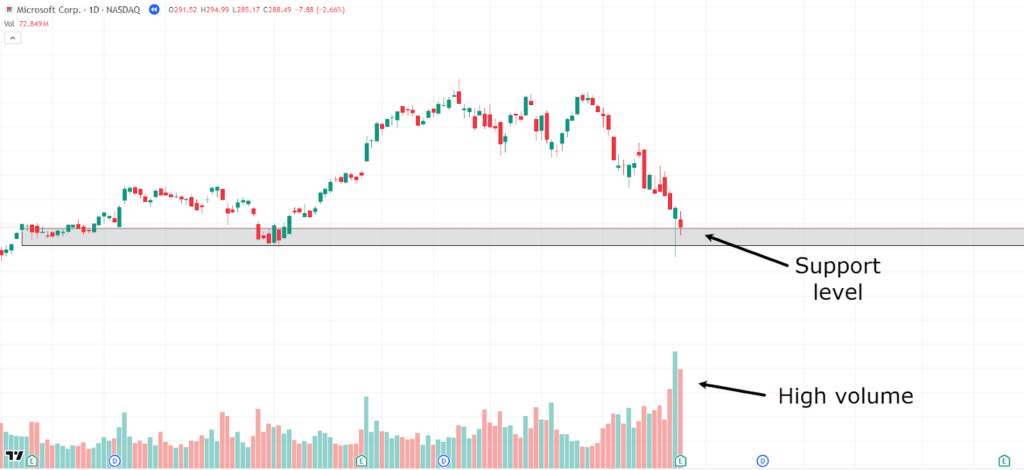

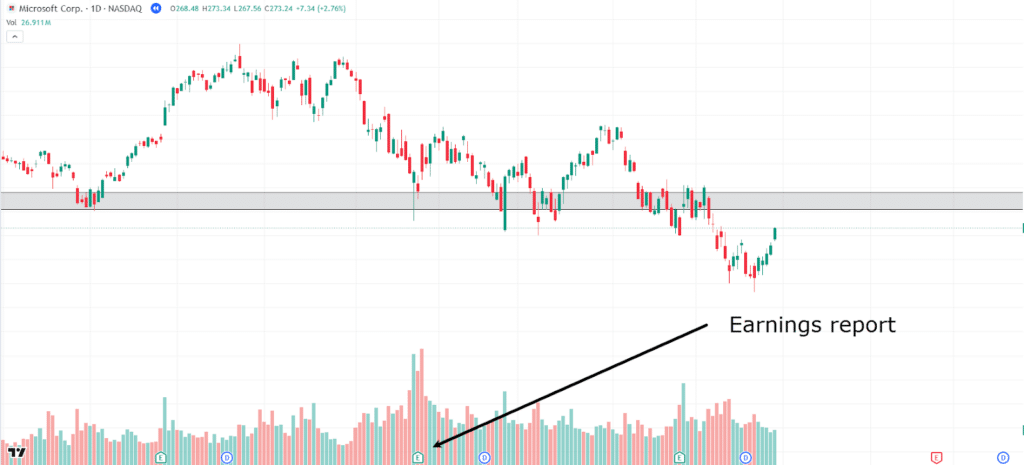

Microsoft Day by day Chart:

Here’s a matching instance to the former one, the place the hold Microsoft has shaped a aid degree upcoming a valuable uptrend.

The fee has come again to the aid degree, and one thing fascinating is happening.

A hammer candlestick has shaped at aid, at the side of an building up in quantity…

In a similar fashion to the latter past, there’s explanation why to imagine this degree will reserve!

Let’s check out what occurs…

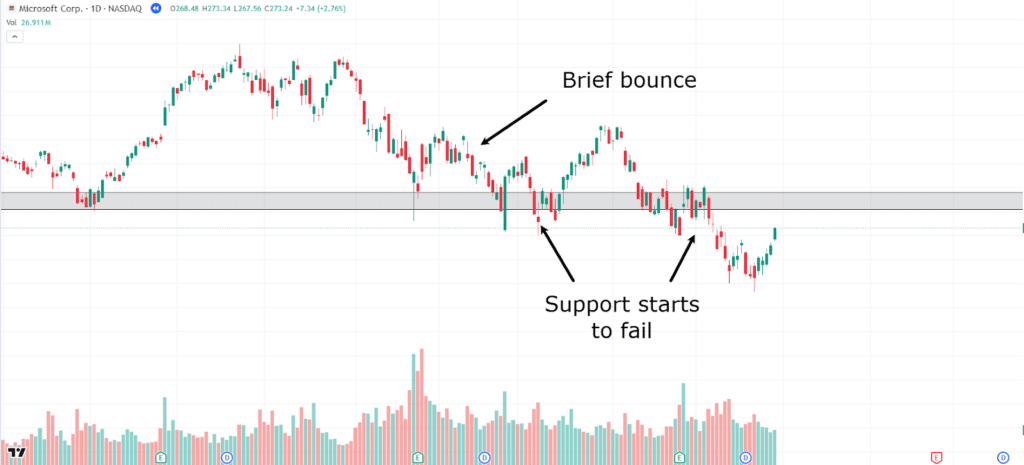

Microsoft Day by day Chart Help Breaks:

Despite the fact that the associated fee to begin with bounced, which remains to be useful data, it in the end grinded its manner beneath the extent.

At the chart, I’ve highlighted the disciplines the place aid starts to fail.

So that you may well be asking:

“OK, why did this happen, Rayner?”

It’s a just right query, and the fair solution is…

…every now and then quantity doesn’t give the entire image!

This aid attempted to reserve, and you’ll be able to see more than one bounces from it upcoming the amount spike, however in the end, as the associated fee got here again to the aid degree past and past once more, the consumers have been exhausted.

Take into account, the good thing about this research is that it nonetheless provides you with enough of past to travel your place.

In the end, the associated fee didn’t proceed in an uptrend, however it held the aid lengthy plethora so that you can reevaluate sooner or later the extent would reserve the second one, 3rd, or even fourth past.

There may be one alternative factor chances are you’ll wish to believe when taking a look at shares.

Check out refer to chart…

Microsoft Day by day Chart Profits Document:

Obviously, dividends and profits are key components in worth actions for shares…

…however in addition they affect quantity!

Simply by taking a look on the chart, it’s sun-baked to mention sooner or later this profits record was once detrimental or certain, however it would have performed a job in sooner or later the associated fee persisted in an uptrend.

It’s a superior instance of quantity research barriers, however let’s check out some extra.

Barriers

Most effective Helpful as Affirmation – No longer a Sign in Itself

Quantity information can surely assistance verify tendencies, breakouts, and alternative alerts generated by way of alternative technical research.

On the other hand, depending only on quantity will also be deceptive, as it will now not handover sunlit access or travel issues with out the context of alternative signs like transferring averages, pattern traces or aid and resistance.

As an example, a worth journey with elevated quantity suggests power, generation the similar journey with low quantity may well be a fake sign.

Can Transform Complicated

Quantity research will also be complicated, particularly in markets with elevated volatility or low liquidity.

Surprising spikes or drops in quantity will also be misinterpreted, important to fallacious conclusions about marketplace course.

Moreover, algorithmic and high-frequency buying and selling (HFT) has modified conventional quantity patterns, making it tougher to grasp quantity information correctly.

HFT may cause massive quantity spikes that don’t essentially mirror significant marketplace sentiment, complicating the research additional, so store an visual out.

Deficit of a Complete Marketplace View

When bearing in mind the Forex market buying and selling, as an example, quantity information ceaselessly represents just a portion of the whole marketplace job.

It will produce quantity accuracy inconsistent and sun-baked to depend on.

Moreover, information occasions can a great deal impact quantity.

Top-impact information may cause quantity spikes which can be extra of a knee-jerk response than a real marketplace affirmation.

Past quantity comes in handy for confirming breakouts and pattern continuations, it’s impressive to be wary all through information occasions, as those can disrupt standard quantity patterns.

Conclusion

Obviously, quantity research could be a significance instrument to raised perceive marketplace dynamics and ensure your buying and selling alerts.

By way of together with quantity information together with your buying and selling technique, you’ll be able to achieve a very powerful insights into the power of worth actions and marketplace sentiment.

When worn along alternative equipment, quantity research can come up with an edge in predicting marketplace tendencies and validating breakouts or reversals.

To summarize, on this article, you’ve:

- Realized what quantity research is and the place to seek out quantity information

- Mentioned what quantity represents

- Explored the variations in quantity for the Forex market vs. Shares

- Understood the 3 main techniques quantity is worn in markets

- Reviewed chart examples of quantity affirmation for pattern continuation and breakouts.

- Recognized the restrictions of quantity research, together with its dependency on context and attainable for hesitancy.

By way of mastering quantity research and integrating it together with your alternative technical research equipment, you’re smartly for your solution to turning into a extra knowledgeable and efficient dealer.

Now, I’m very keen to listen to your ideas on quantity research!

Do you now worth quantity research to your buying and selling?

Are you able to see why this is a important feature of technical research?

How a lot good fortune have you ever had with it?

Percentage your ideas and reviews within the feedback beneath!