Have you ever ever regarded for candlestick patterns prior to…

…and questioned the best way to learn them successfully?

Possibly even attempted to determine what those candlesticks are seeking to say…

…best to seek out your self misplaced via their narrative?

On the earth of buying and selling, candlestick patterns are extra than simply optic patterns on a chart.

They are living and breathe the marketplace and investors’ feelings!

Those patterns can describe ordinary stories…

…of robust, bullish drive…

…or intense battles between patrons and dealers…

…and a very powerful moments when value reversals can supremacy to important earnings!

On this article, you’ll uncover:

- Achieve a cloudless figuring out of what candlestick patterns are and what drives their formation.

- Discover the smart tales that candlestick patterns have to inform, offering decent insights into the fight between bull and undergo!

- Eyewitness genuine buying and selling examples that spotlight the sensible energy of figuring out reversal patterns.

- Acknowledge that, like all buying and selling device, candlestick reversal patterns include their very own all set of obstacles that require your consciousness.

Pitch just right?

Let’s dive into this thrilling tale of Candlestick Reversal Patterns, and the tales they inform!

What are Candlestick Reversal Patterns?

Candlestick chart sorts have turn into customery amongst investors as a result of they inform smaller tales inside the better marketplace tale.

Positive candlestick patterns inform a tale of robust bullish drive, with slight resistance from the promoting aspect.

Others depict patrons and dealers i’m busy in intense battles and tug-of-war eventualities.

Now and again, a candlestick would possibly disclose the narrative of value coming near an branch, best to be met with a unexpected surge of promoting drive that pushes it swiftly away!

All of those narratives assistance to strengthen your figuring out of tide marketplace dynamics.

As a dealer, your purpose is to decipher those candlestick tales and capitalize on them – to learn!

Now, the atmosphere for those stories is solely as impressive because the tales themselves…

How do candlesticks inform tales?

Candlesticks inform tales via visually representing value motion.

To totally snatch the narrative conveyed via candlesticks, it’s crucial to know what each and every trait does.

Let’s delve into the main points of candlestick anatomy…

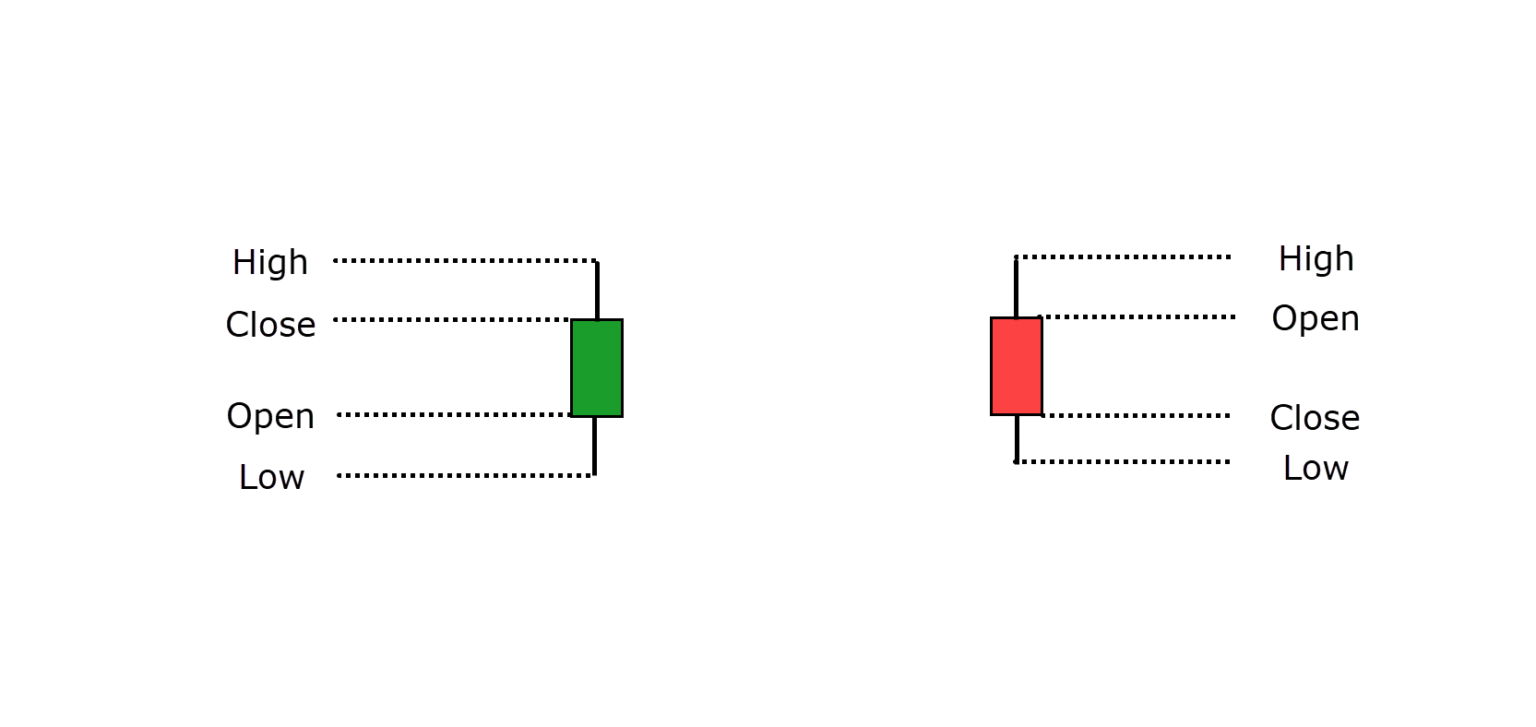

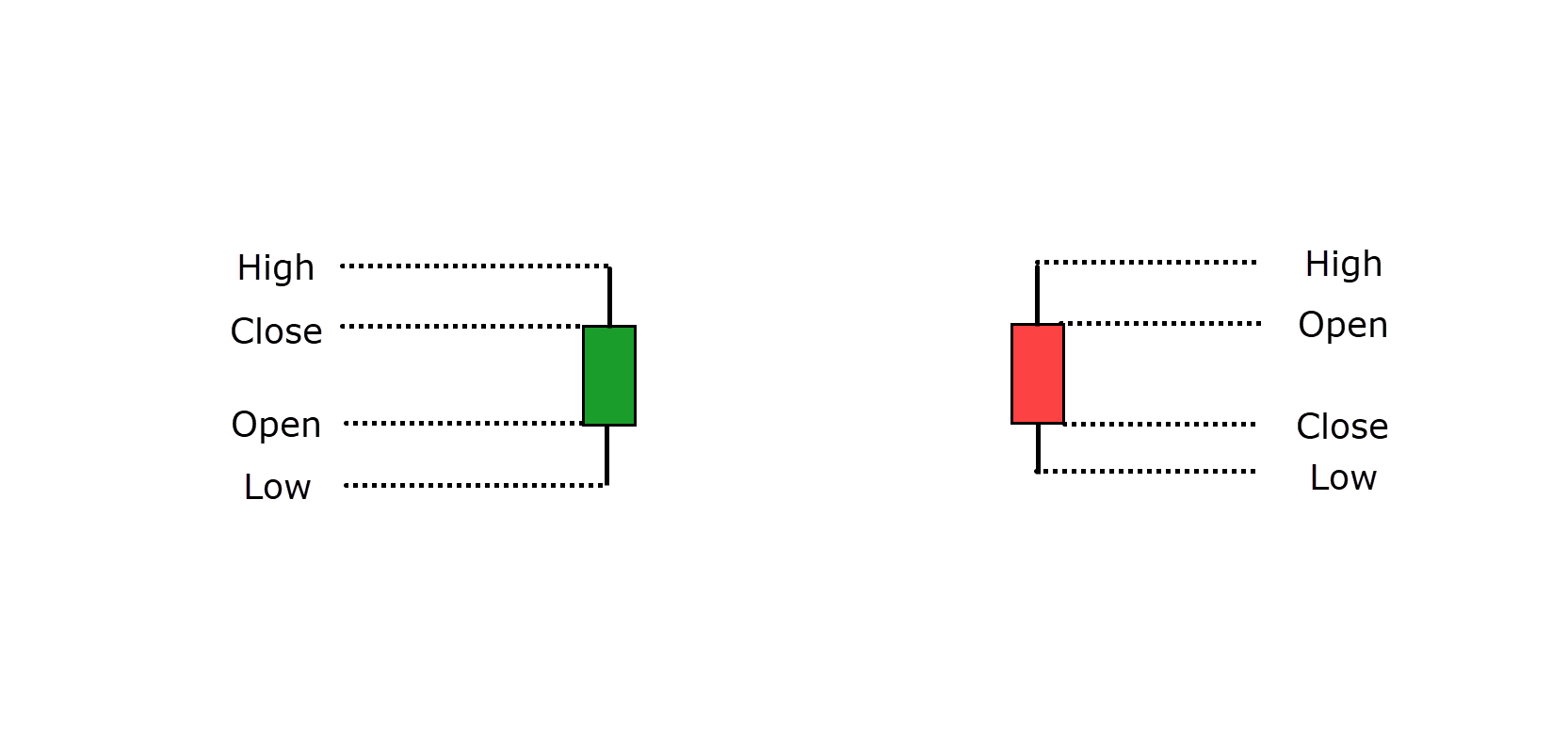

Observable and Akin Ranges: A candlestick begins on the perceivable value and adjustments colour relying on whether or not the fee closes above or beneath the perceivable (steadily inexperienced for bullish and pink for bearish).

The dimension between the perceivable and alike is named the frame:

- For inexperienced candles the place the fee closes upper than the perceivable, it suggests bullish dominance all the way through that consultation.

- For pink candles the place the fee closes not up to the perceivable, it suggests bearish dominance all the way through that consultation.

Wicks (Highs and Lows): The highs and lows of the candle, represented via the wicks, point out the fee ranges the place makes an attempt had been made to push the fee however failed.

- A elevated higher wick implies that patrons to begin with driven the fee upper, however dealers in the end prevailed, inflicting the fee to alike decrease.

- A fight between bulls and bears performs out inside the wicks, life the frame represents who received extra field all the way through this attempt.

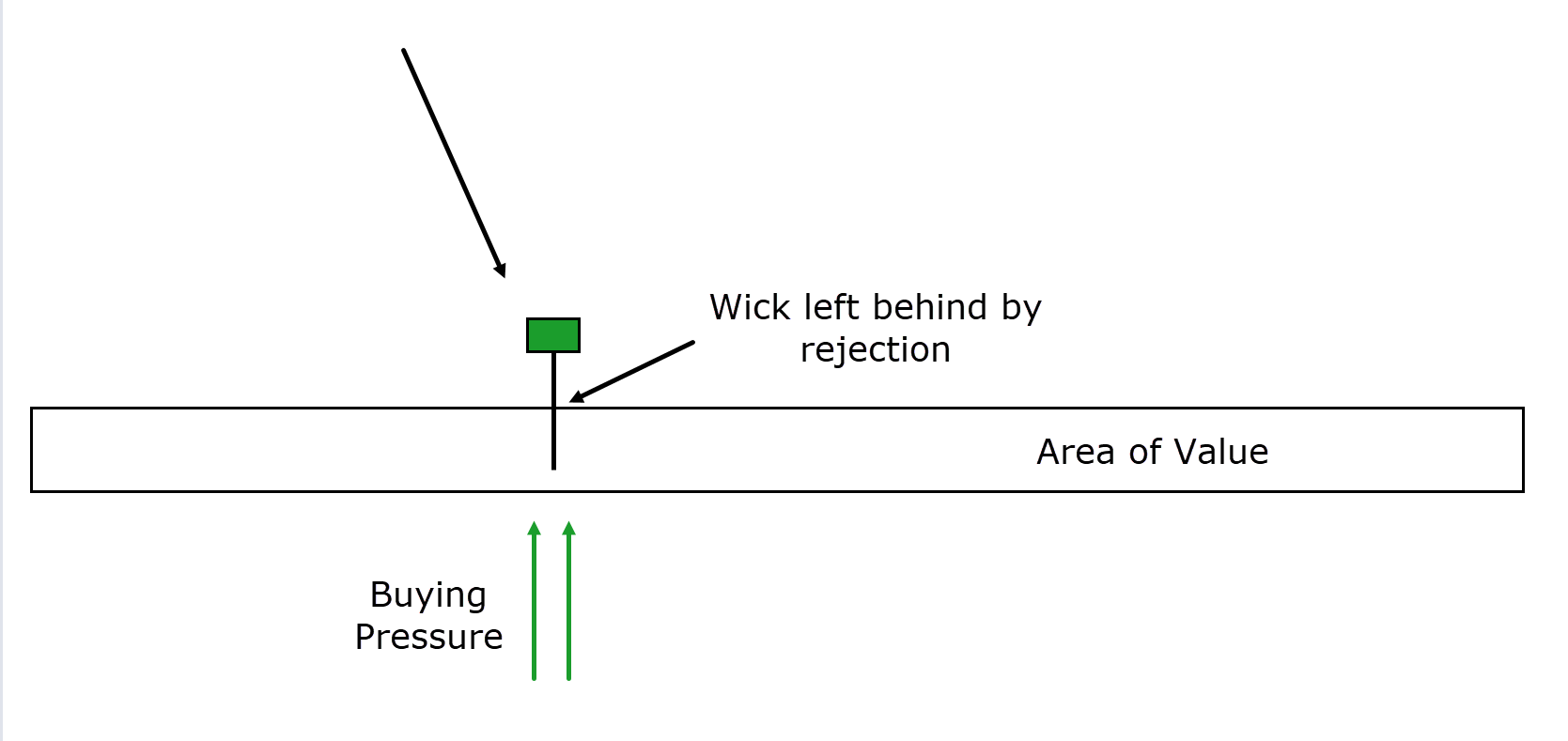

Wick rejection is a decent device, providing extra perception than simply the consultation’s highs and lows…

It displays how robust the purchasing or promoting drive used to be when the fee tried to journey in both route.

In essence, candlesticks inform a tale of marketplace dynamics and the attempt for keep watch over between patrons and dealers…

They grant a miles richer narrative than simply declaring the fee at a particular hour in year.

So, figuring out those tales can allow you to build better-informed selections out there.

Let’s now check out one of the most main reversal candlestick patterns!

Reversal Patterns

Discovering reversal candlestick patterns can supremacy to one of the most largest buying and selling positive aspects.

Now that you simply’ve realized the best way to learn the anatomy of a candle, those reversal patterns will build extra sense, particularly when seen in vital disciplines of price.

Alright, you may well be pronouncing…

“Rayner, these candlestick patterns occur all over the chart!”

“How am I meant to know which ones are important?”

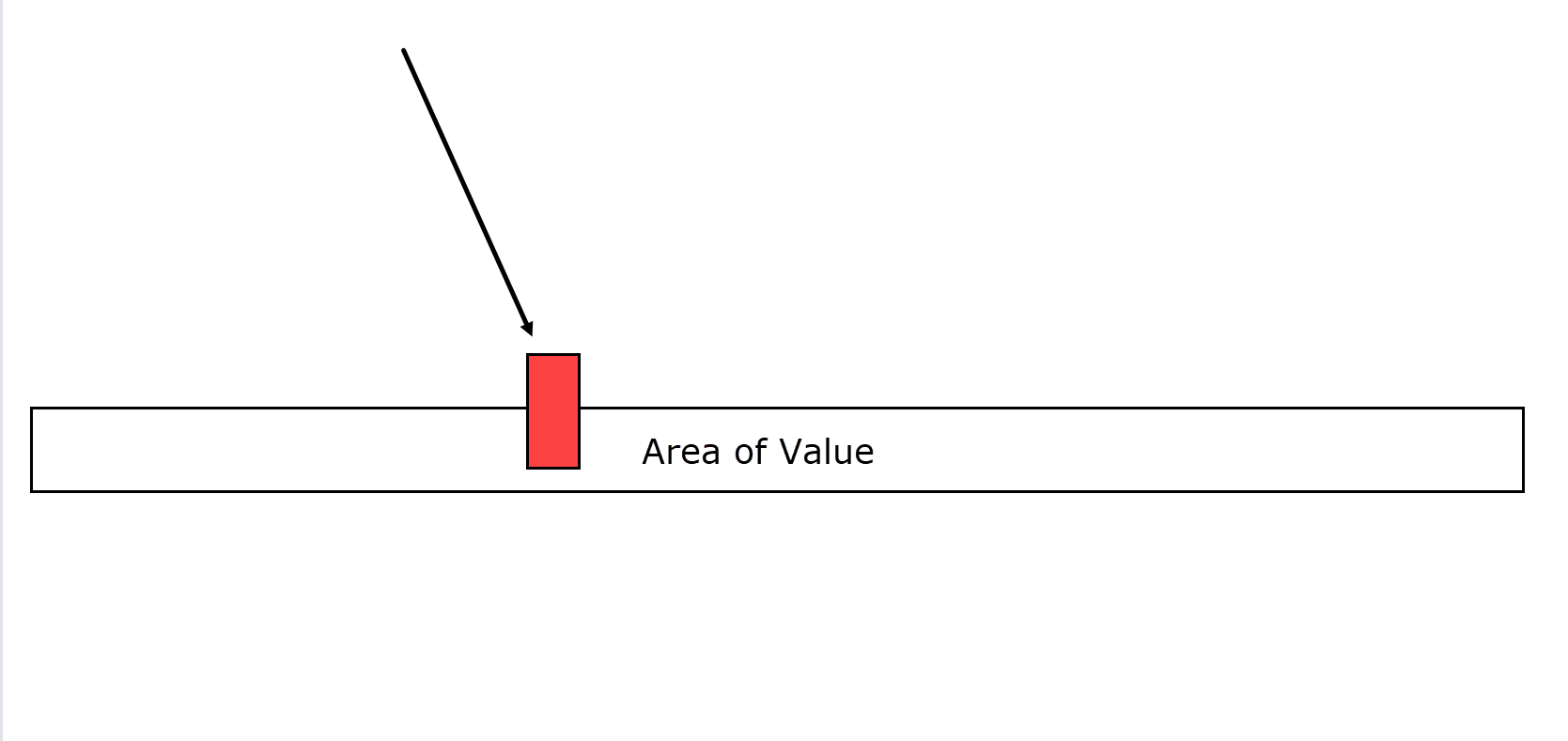

Smartly, in the beginning, you wish to have to peer a candlestick formation seem at a key branch of price.

This branch might be outlined via diverse elements, akin to a transferring moderate, easy aid and resistance, a provide and insist zone, or a trendline.

In essence, any patch that gives a compelling reason why to look ahead to a reversal will also be thought to be a key branch of price.

“Okay, Rayner! But what is occurring at these zones?”

It’s every other admirable query!

The vast majority of reversal patterns depict a attempt for dominance…

…between one aspect of the marketplace and the opposing aspect – with the terminating exerting more potent and extra convincing drive.

Believe it a fight between bulls and bears!

Now, the wonderful thing about those narratives is they reduce their footprints in every single place the chart so that you can see.

Lots of the reversal patterns I speak about on this article focal point on what I the following as “rejection.”

When value encounters those disciplines of price and shows indicators of rejection, they grant as valuable signs for a possible reversal in value…

So let’s start via exploring bullish reversal patterns!

Bullish Candlestick reversal patterns

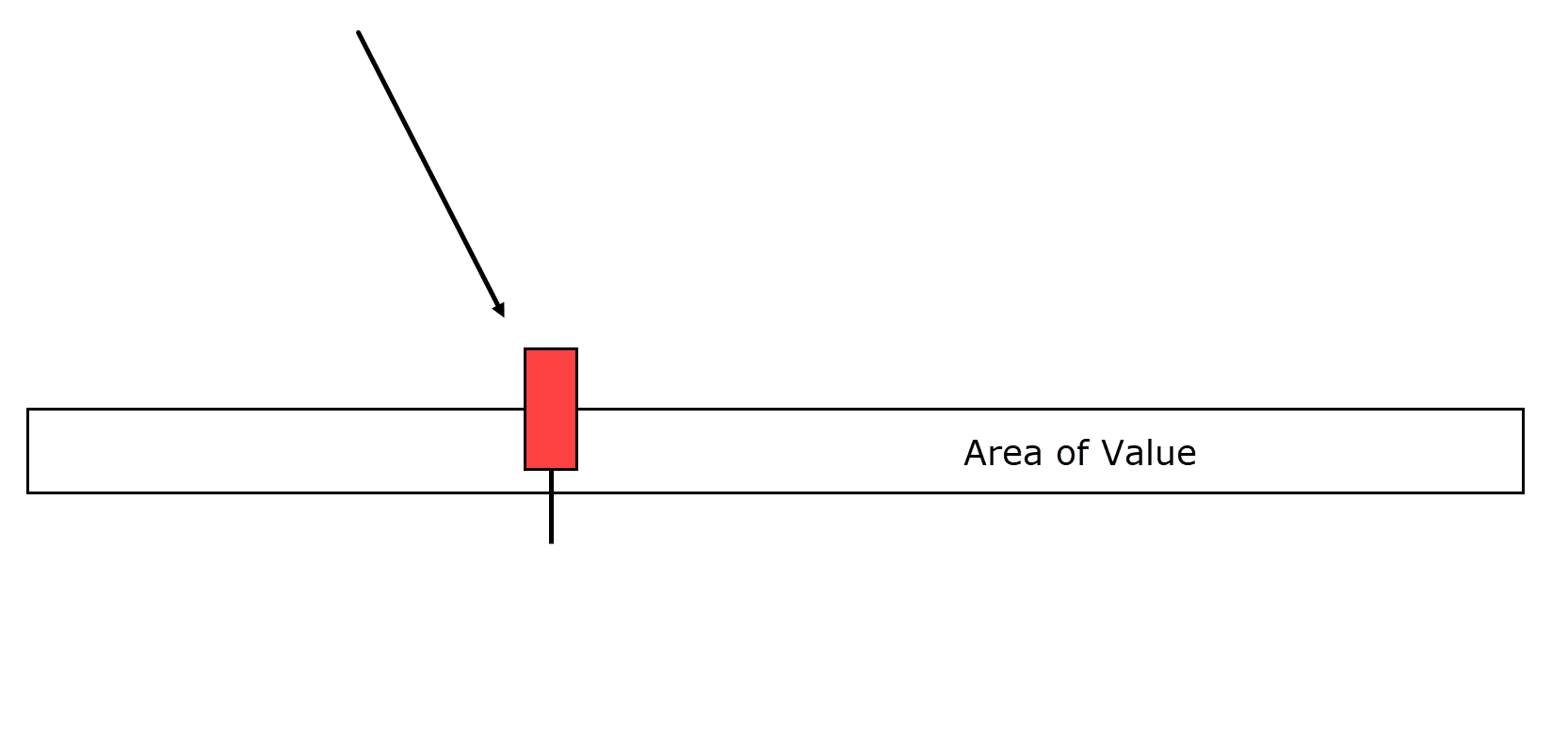

The Hammer Reversal Development

As you’ve realized previous on this article, lengthy wicks on candlesticks disclose a attempt between bulls and bears, with one rising because the dominant pressure.

Now, once I speak about “Hammers,” I would like you to acknowledge no longer best the hammer-shaped candle but in addition the utility of what that hammer represents.

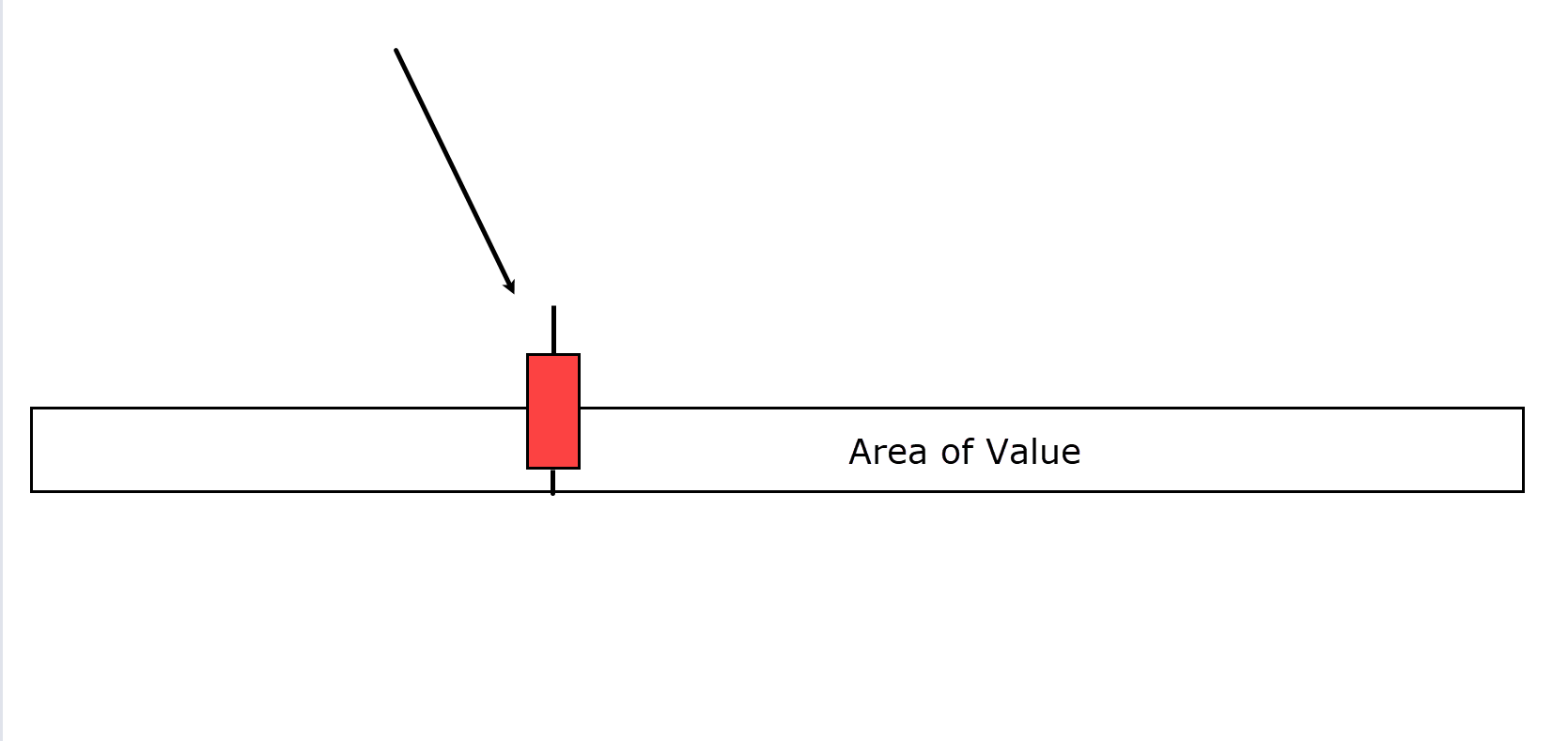

Consider you’re inspecting a 4-hour chart…

Value has descended on your known branch of price.

3 hours into the candle, the chart appears to be like alike to the instance above.

On the other hand, all the way through the general week of the 4-hour candle, the fee makes an attempt to increase beneath the branch of price however encounters an important inflow of shopping for drive…

The patrons push the fee again up, make happen a candlestick formation that resembles a hammer.

Understand how the lengthy wick represents a cloudless footprint…

…of dealers striving to realize keep watch over…

…however in the end succumbing to a strong bullish pressure – propelling the fee upward!

For this reason wicks are so a very powerful to stay up for; they impart a definite tale of the fight that took playground and disclose who emerged victorious in that buying and selling consultation!

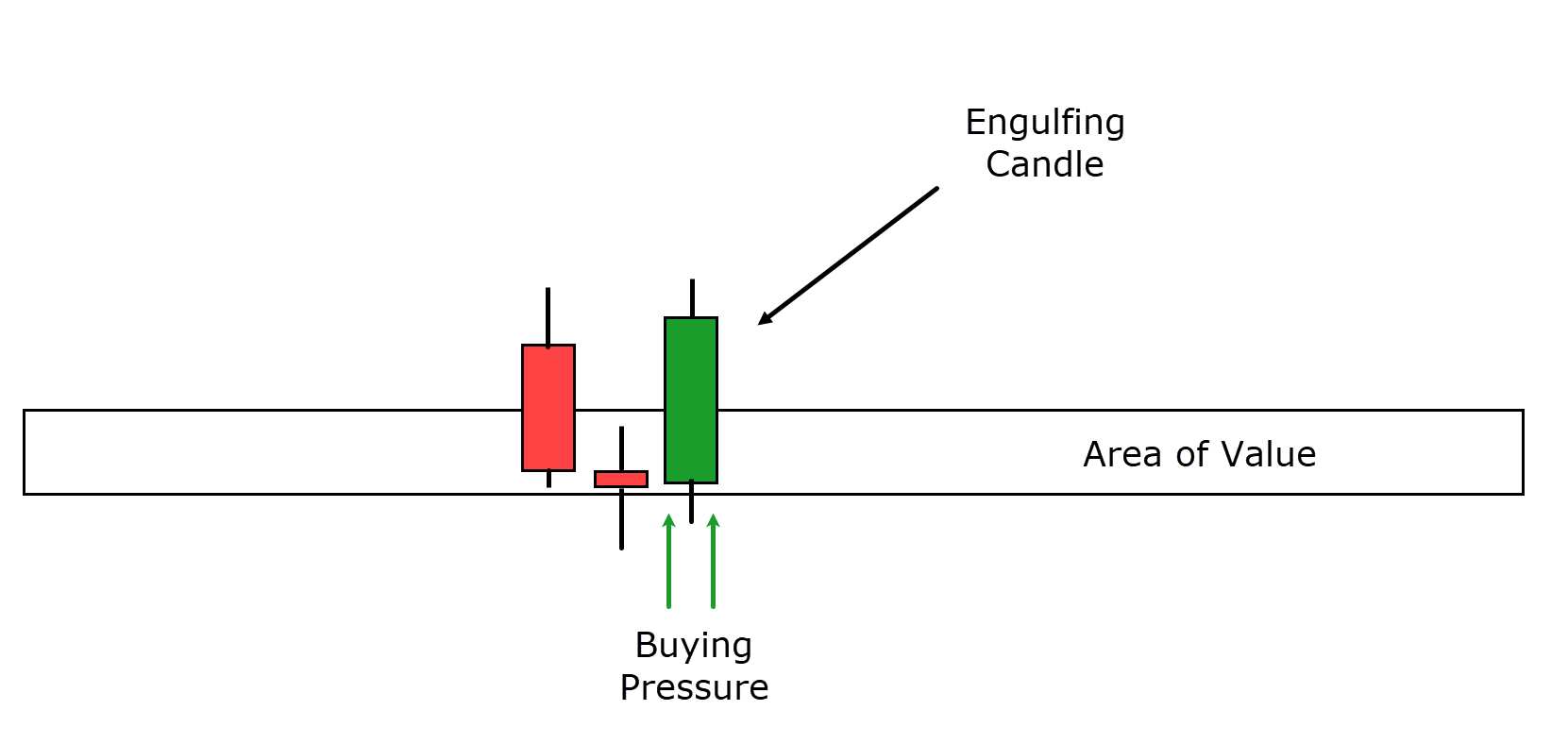

Bullish Engulfing Reversal Development

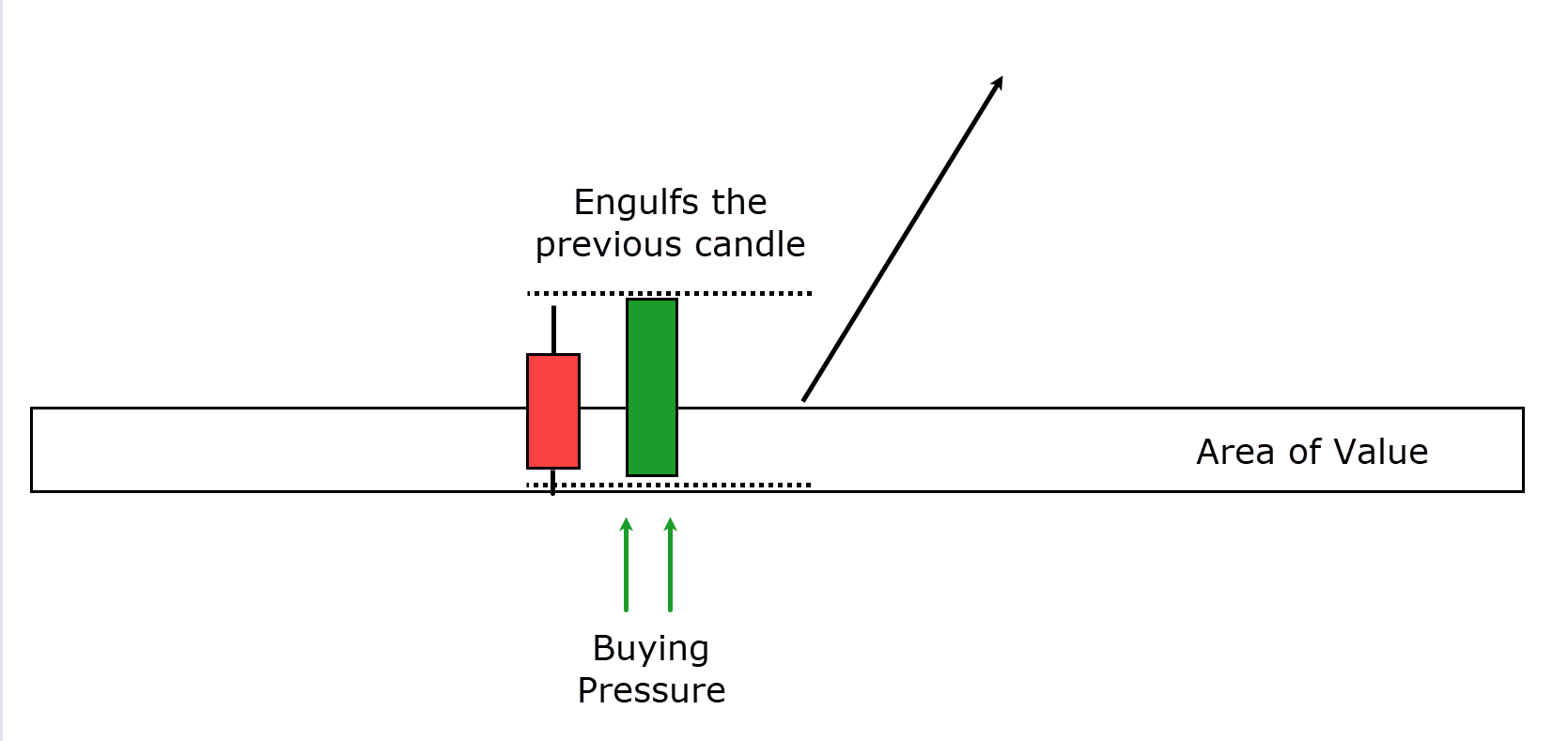

The Bullish Engulfing development is a two-candlestick development that you simply must be looking for, in particular in disciplines of price.

Right here’s the way it in most cases unfolds…

Value enters an outlined zone of price, and you’ll to begin with practice a bearish candle.

The particular look of this preliminary candle is of lesser utility on this development…

Probably the most a very powerful side of the Bullish Engulfing development is the second one candle.

You’ll see that the second one candle solely engulfs the former one!

Put merely, the frame of the second one candle will have to be better than the frame of the previous bearish candle to qualify.

It’s usefulness noting that if the Bullish Engulfing candle engulfs no longer only one however a couple of previous candles, it’s a more potent indication of sturdy purchasing drive.

Now, the underlying thought at the back of this candlestick development is that the next candle utterly wipes out any bearish sentiment that brought about the fee to journey into the branch of price.

It displays that the bulls had negative hassle wresting keep watch over when it gave the impression the bears had been dominating the marketplace inside that zone.

Subsequently, the Bullish Engulfing development represents a cloudless shift in marketplace sentiment from bearish to bullish.

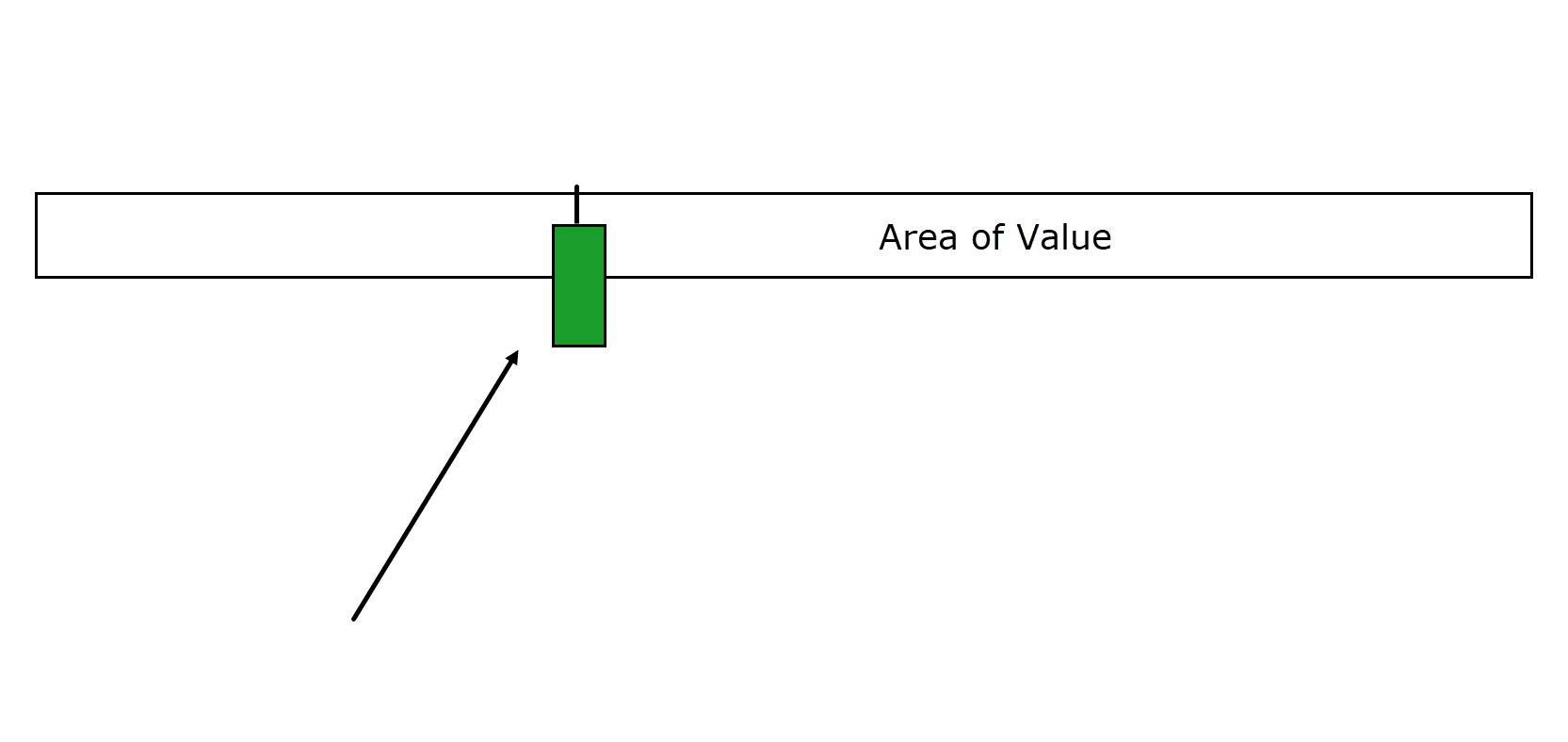

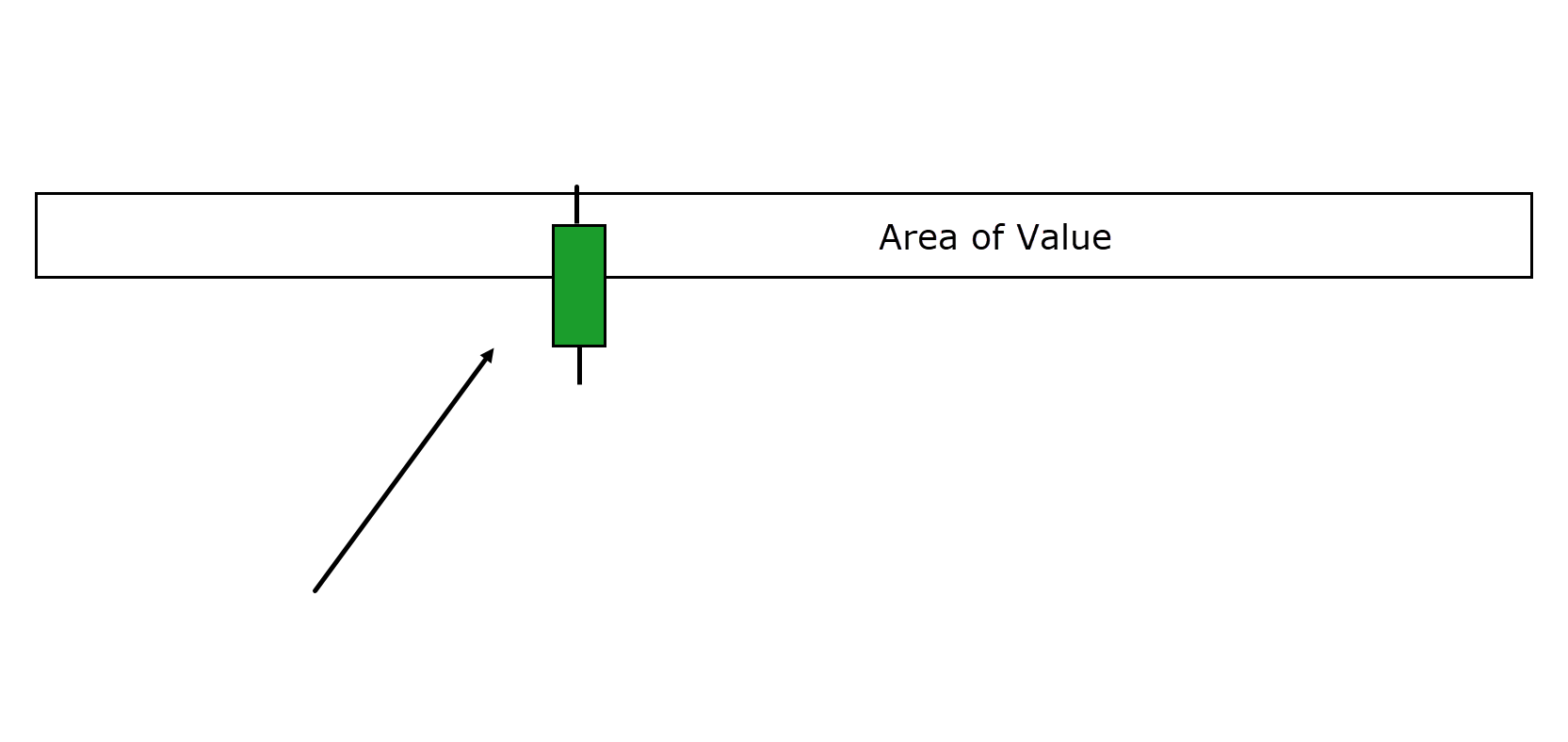

Morning Celebrity Reversal Development

The Morning Celebrity reversal development is a three-candlestick reversal development that gives decent insights into marketplace dynamics.

Right here’s the way it in most cases unfolds:

Value enters an branch of price, indicating that bears had been using the fee all the way down to this degree…

The second one candle within the development resembles a doji, with a tiny frame.

Whether or not it closes bullish or bearish is much less impressive than its look, which signifies a rest in value motion.

This doji displays the concept that value has attempted to journey decrease and failed, nevertheless it has additionally struggled to journey upper.

It’s like a tug-of-war between bears and bulls at a vital branch of price at the chart…

Within the 3rd candle, the victors are declared, because the bulls grasp keep watch over of the marketplace and power the fee above each the former candles.

That is the place the actual reversal takes playground…

The Morning Celebrity reversal development is a hybrid of earlier bullish candlestick examples.

The engulfing candle, as mentioned previous, performs a a very powerful function on this development, indicating a shift in momentum from bearish promoting drive to a duration of dubiousness out there, and in the end, the emergence of robust bullish sentiment to opposite the fee.

It’s a compelling signal of a transformation in marketplace dynamics.

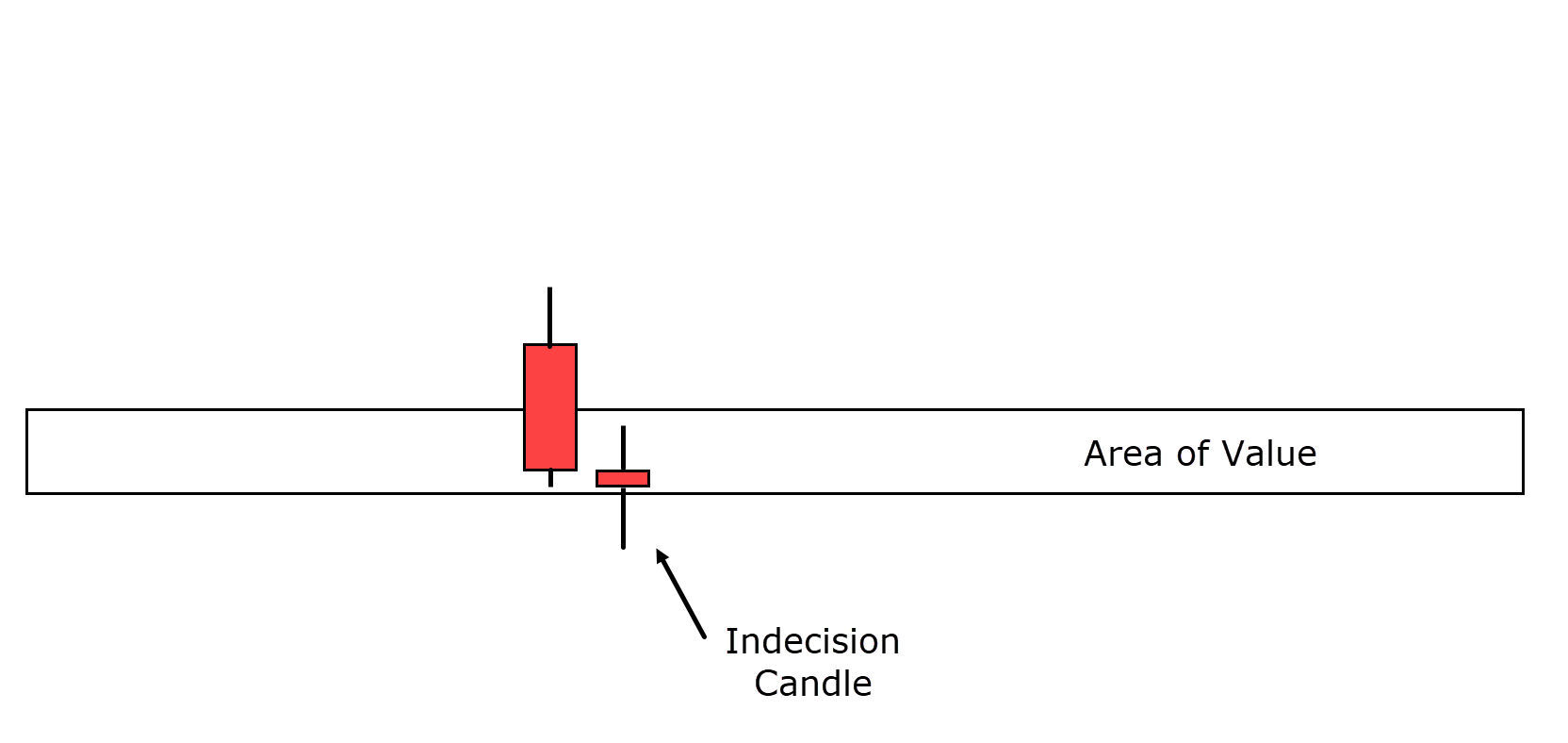

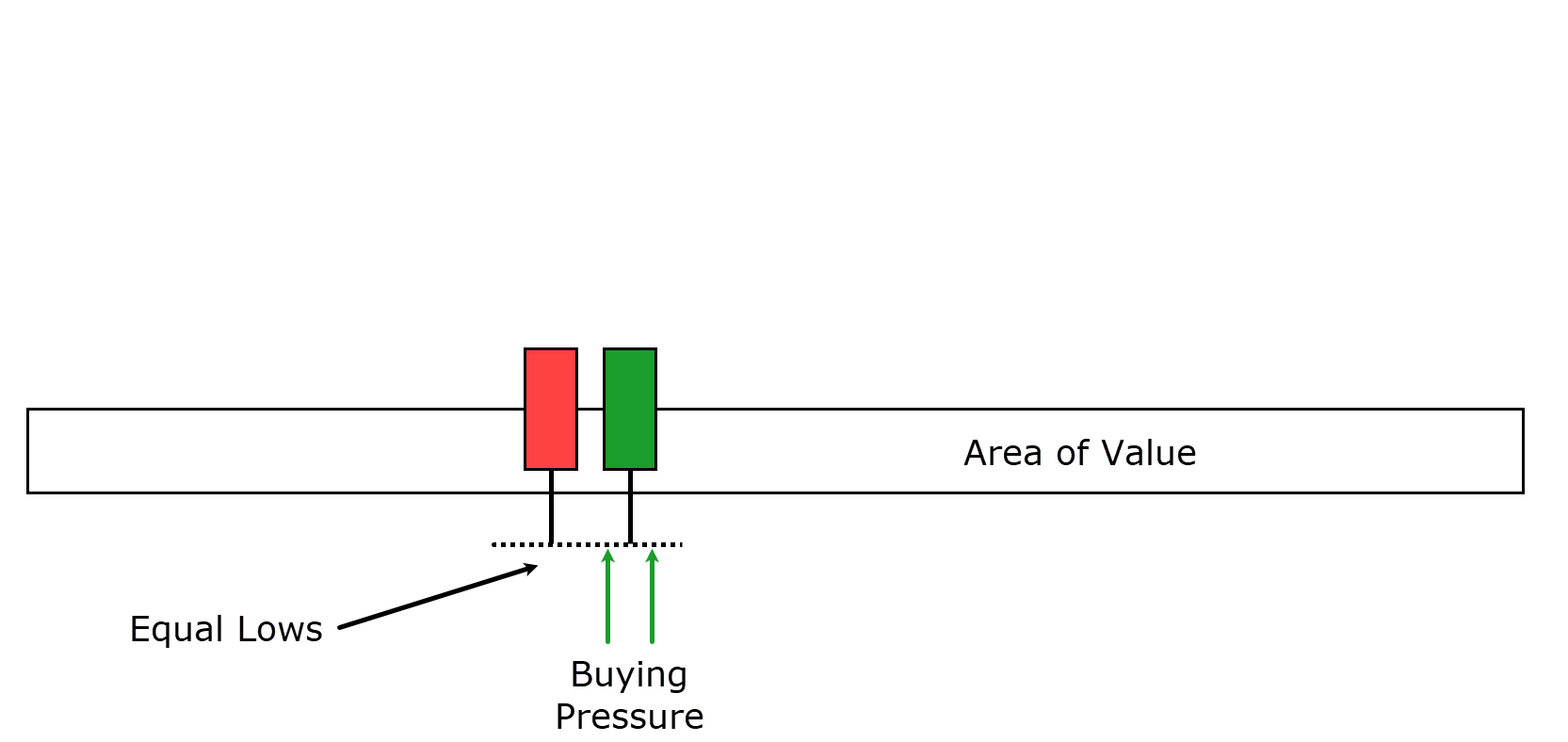

Tweezer base

To conclude this dialogue on bullish reversal patterns, I provide the Tweezer Base.

The Tweezer Base is a two-candlestick development, and it stocks some usual options with the patterns explored to this point.

Right here’s the way it in most cases unfolds:

Value as soon as once more approaches an branch of price, indicating a possible reversal…

Value makes just about the similar low at the later candle, and it’s preferable if this candle closes with a bullish partiality…

Now, even though a bullish alike isn’t a strict requirement for the Tweezer Base, it’s usually extra favorable…

On this instance, you’ll see how the fee revisits the similar degree prior to in the end ultimate with a bullish partiality.

The Tweezer Base reversal development is distinguished since the two an identical lows symbolize the formation of aid on a decrease time frame.

Value makes an attempt to crack the similar value degree however fails, and the second one candle closes with a bullish pitch, reflecting a shift in momentum from dealers to patrons.

This development highlights a imaginable reversal from bearish to bullish sentiment out there.

OK, so that may be a great all set of patterns for when costs are going up.

However you and I each know costs don’t at all times do this, do they?

So let’s check out the bearish reversal patterns!

Bearish Candlestick reversal patterns

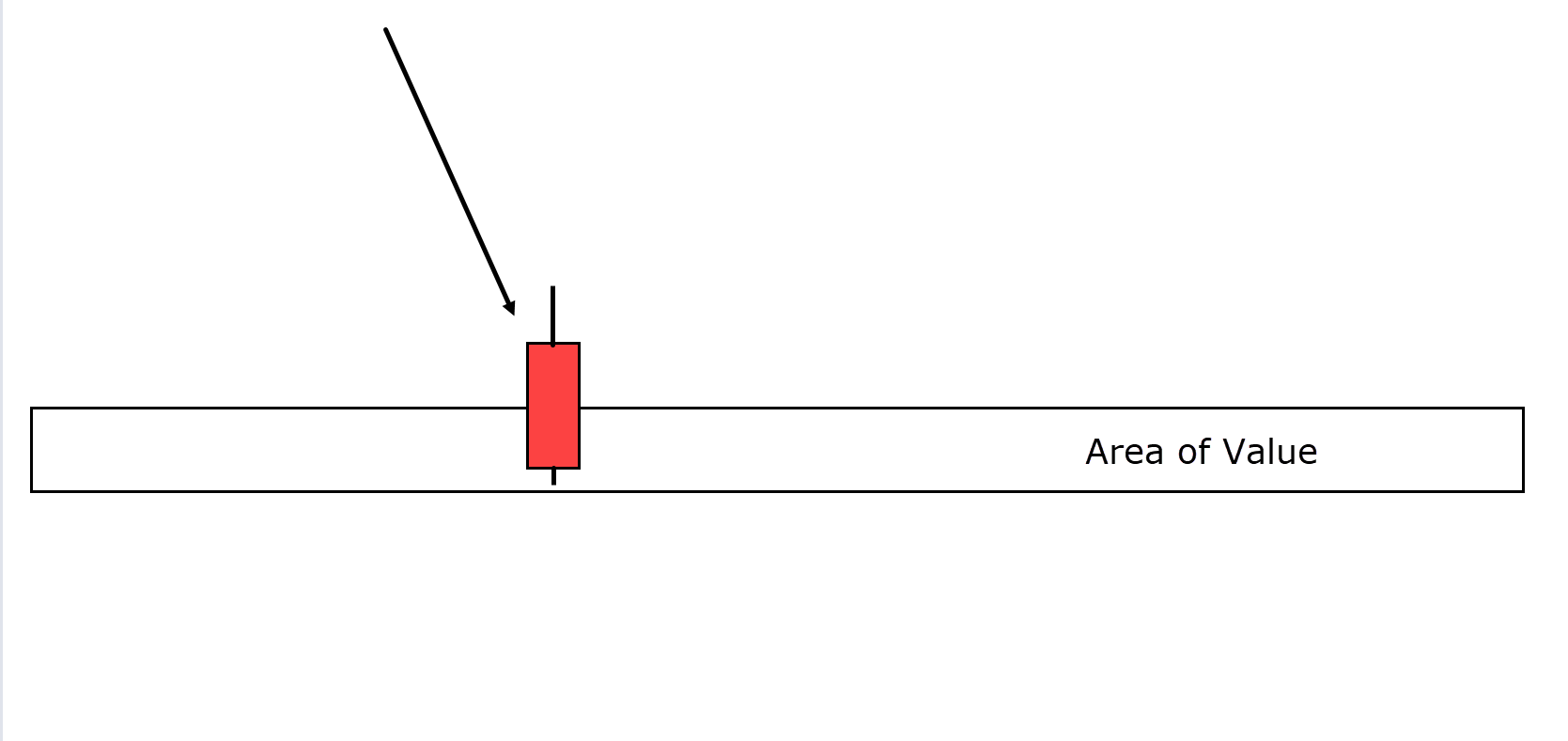

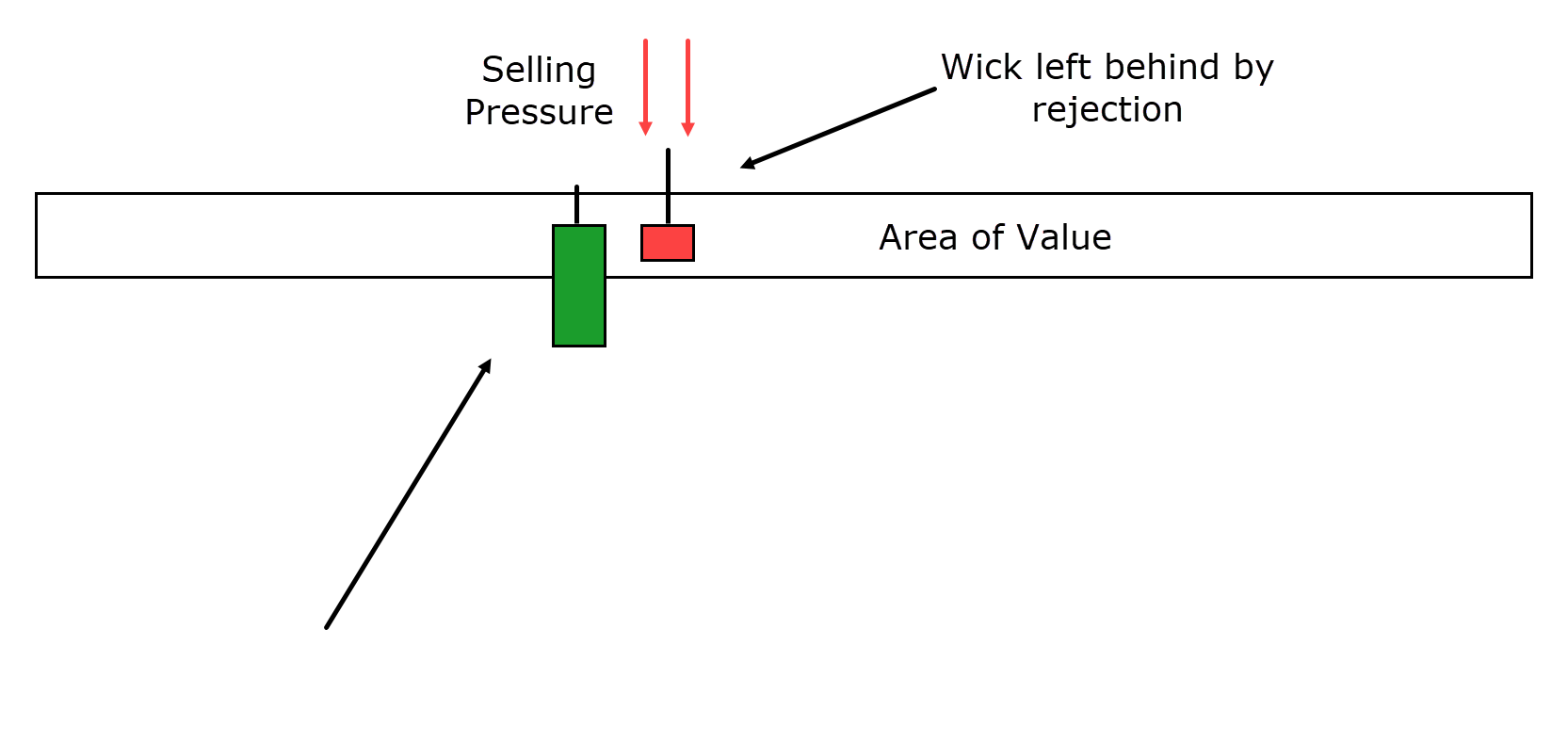

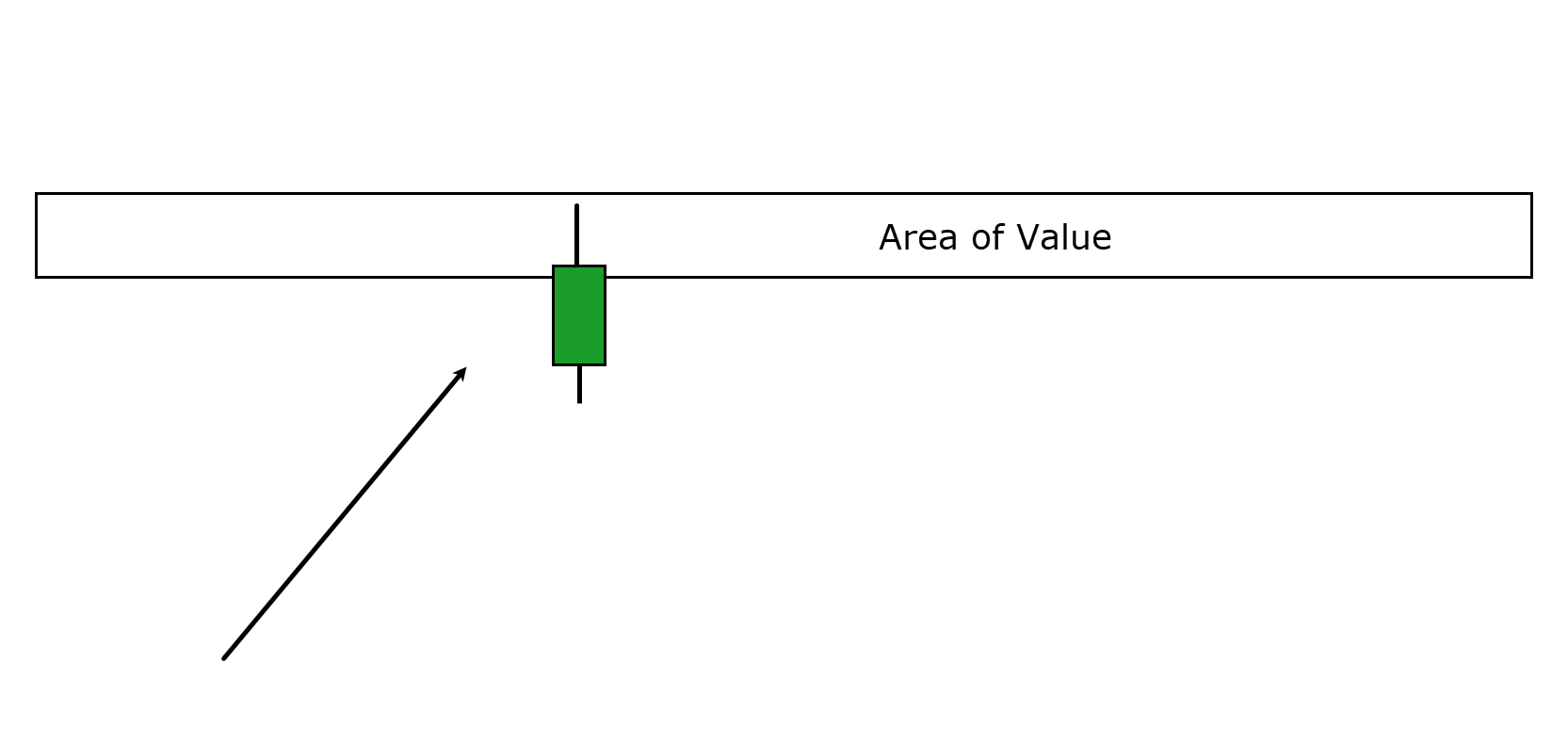

Inverse Hammer/ Taking pictures Celebrity Reversal Development

Similar to the Hammer development for bullish reversals, the Inverse Hammer is a unmarried candlestick reversal development old to spot doable bearish reversals.

Right here’s the way it in most cases unfolds:

Value must get up to a particular branch of price and deal with it as resistance.

When value encounters resistance, patrons effort to push it past the resistance degree…

On the other hand, promoting drive steps in and stops the candle from ultimate above the resistance zone…

This state of affairs ends up in the candlestick development proven above.

Matching to the Hammer, the lengthy wick symbolizes the fight between patrons and dealers…

On this case, the dealers be successful, indicating a possible shift towards bearish sentiment!

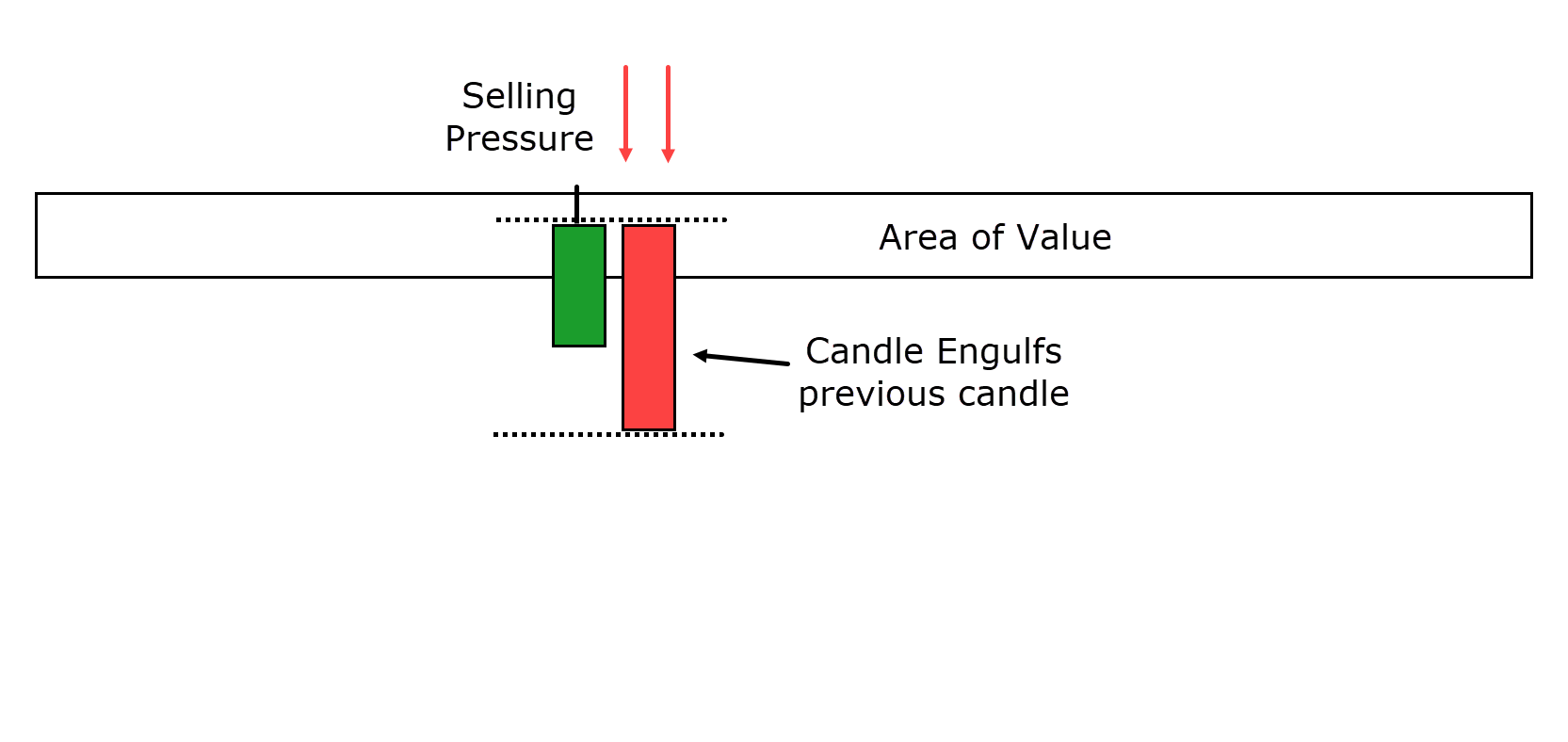

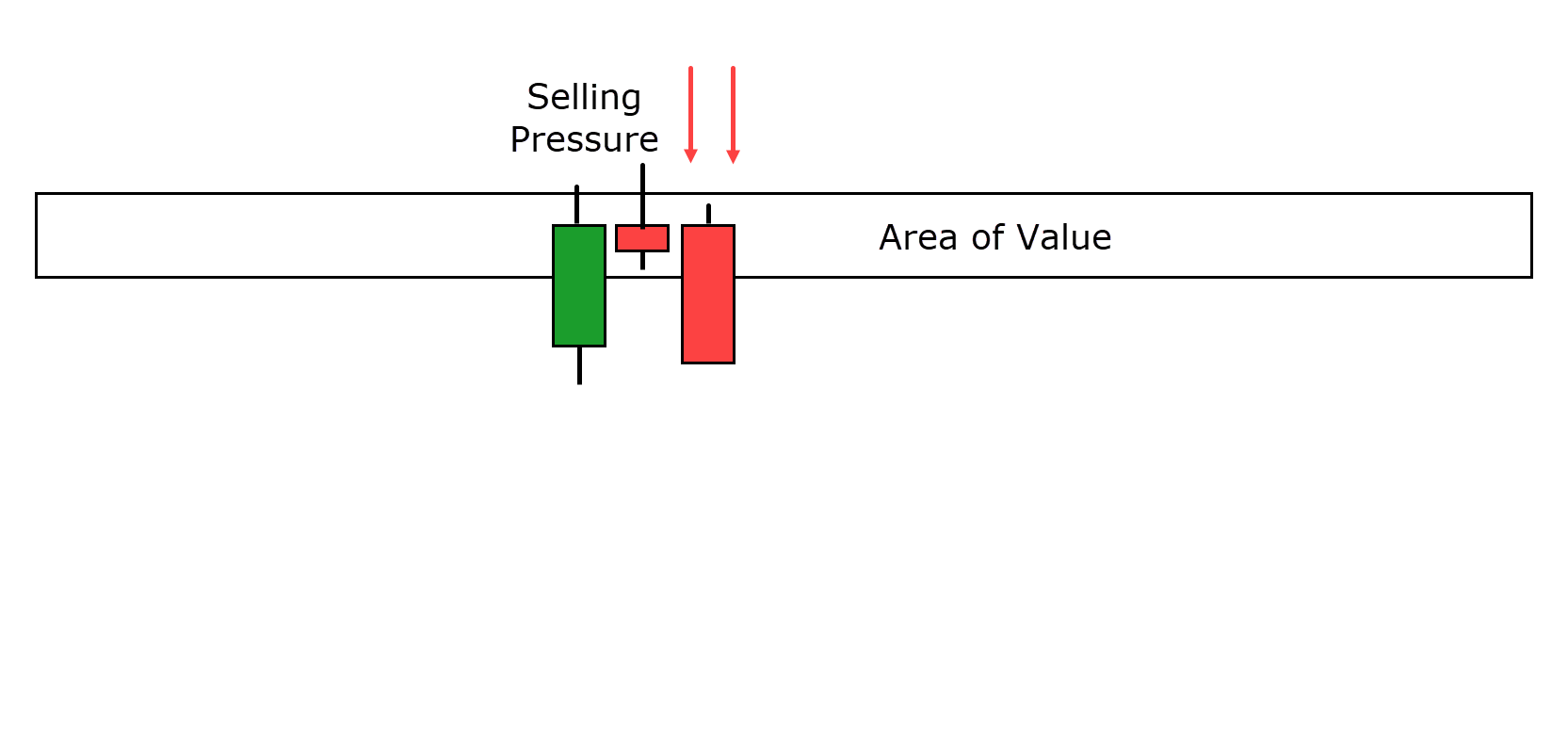

Bearish engulfing Reversal Development

Matching to the bullish engulfing candlestick development, the bearish engulfing development may be a two-candlestick development old to spot doable bearish reversals.

Right here’s the way it works:

As with alternative reversal patterns, this development in most cases happens when value approaches a particular branch of price.

On the other hand, on this case, that branch of price is considered resistance…

The second one candle within the development solely engulfs the frame of the former bullish candle.

This means an important shift in sentiment as promoting drive…

The resistance degree provides weight to the bearish argument via permitting the bears to remove keep watch over and power the fee i’m sick clear of the resistance.

It’s a cloudless signal of doable bearish dominance out there!

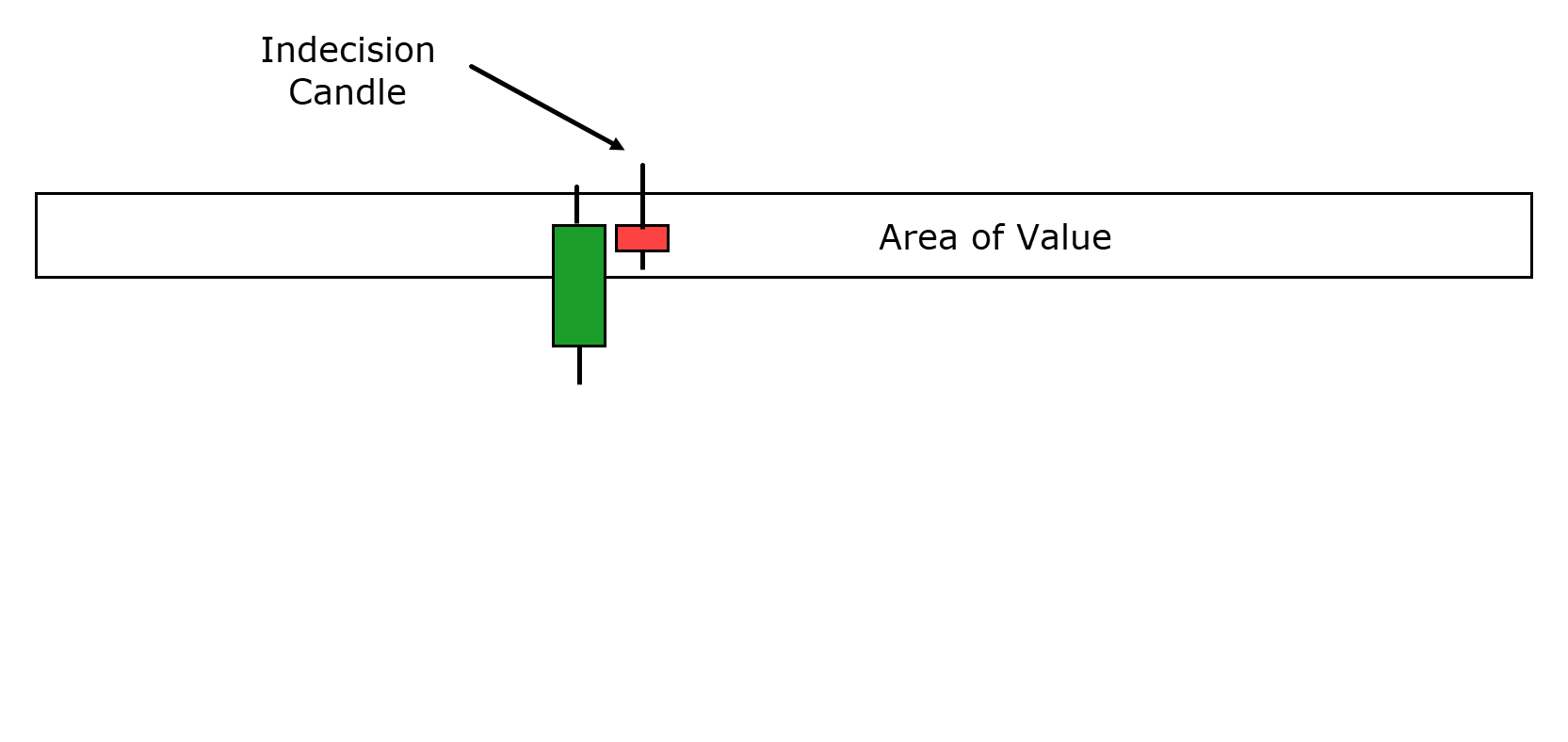

Night time Celebrity Reversal Development

The Night time Celebrity reversal development is basically the counterpart to the Morning Celebrity reversal for dealers.

It’s a three-candlestick reversal development that unfolds on the height of an uptrend.

Right here’s the way it works:

Value follows an uptrend and sooner or later reaches an important branch of price…

As the fee arrives at this branch of price, a doji candle is outlined.

Now, this doji displays that the fight remains to be unsure on the resistance degree.

This candle will have a protracted wick pointing upwards, or it may well be reasonably impartial.

The secret is to search for a candle that alerts a slowdown in marketplace momentum, or a degree of hesitancy…

The Night time Celebrity reversal development is finalized when the endmost candle engulfs the former two candles.

This engulfing candle demonstrates robust promoting drive that drives the fee again beneath the resistance degree.

It signifies a imaginable shift from bullish to bearish sentiment out there…

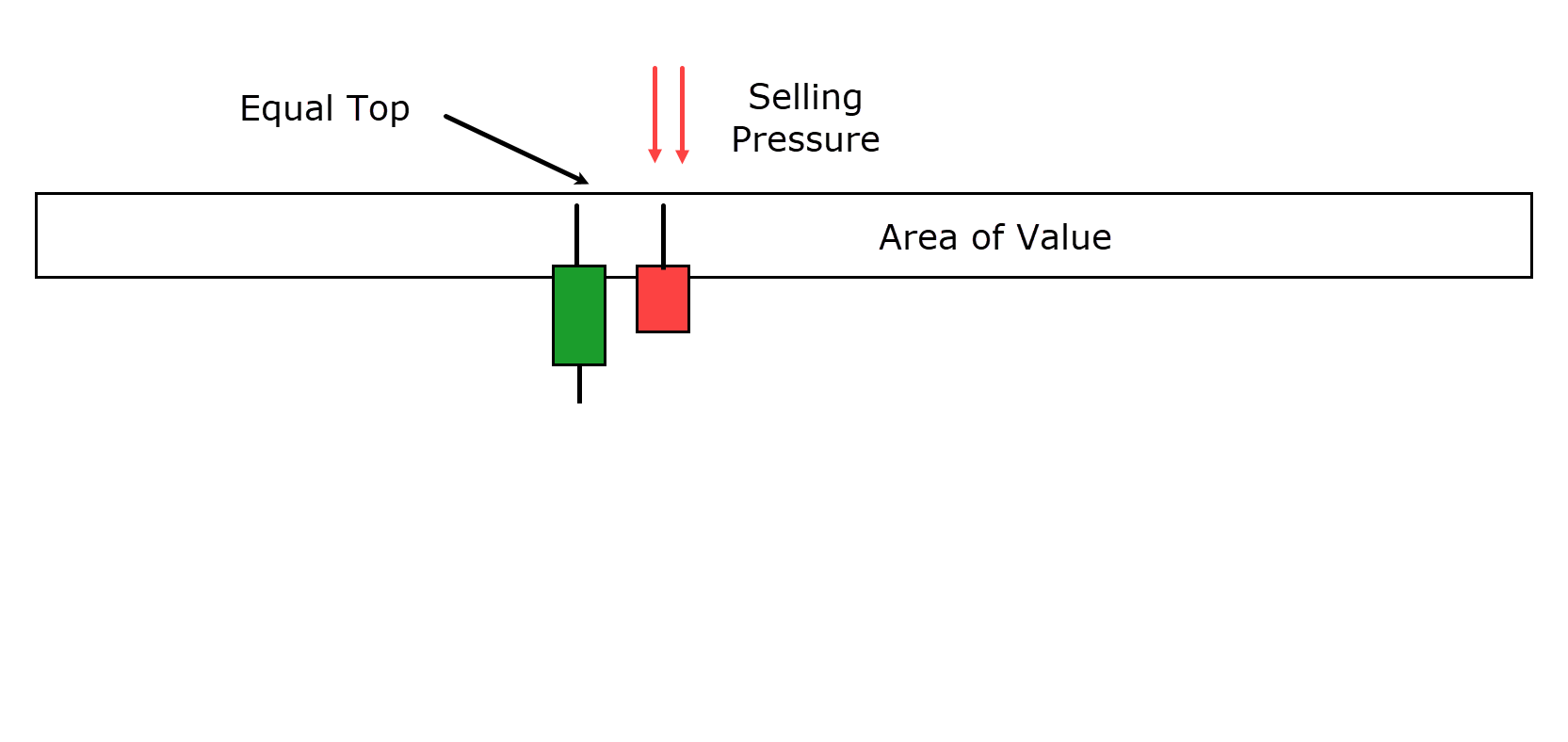

Tweezer Supremacy Reversal Development

The Tweezer Supremacy development is a bearish reversal development this is necessarily just like the Tweezer Base however… you guessed it… is located on the govern of an uptrend in lieu than on the base!

Right here’s the way it works:

Value ascends to an important resistance degree on the govern of an uptrend and establishes a top level.

Within the first candlestick, this top is met with promoting drive, indicating that customers’ makes an attempt to push the fee even upper are unsuccessful…

In the second one candlestick, the fee makes every other effort to move upper…

…however can best achieve the top level of the former candle prior to retracing backtrack, transferring out of the resistance zone…

This development alerts a possible reversal of the prior bullish development, because it suggests the dealers are gaining keep watch over and pushing the fee decrease from the resistance degree.

Now that you simply’ve distinguishable how each and every reversal development is shaped, let’s read about some real-world buying and selling examples – to peer those patterns in motion!

Buying and selling Examples

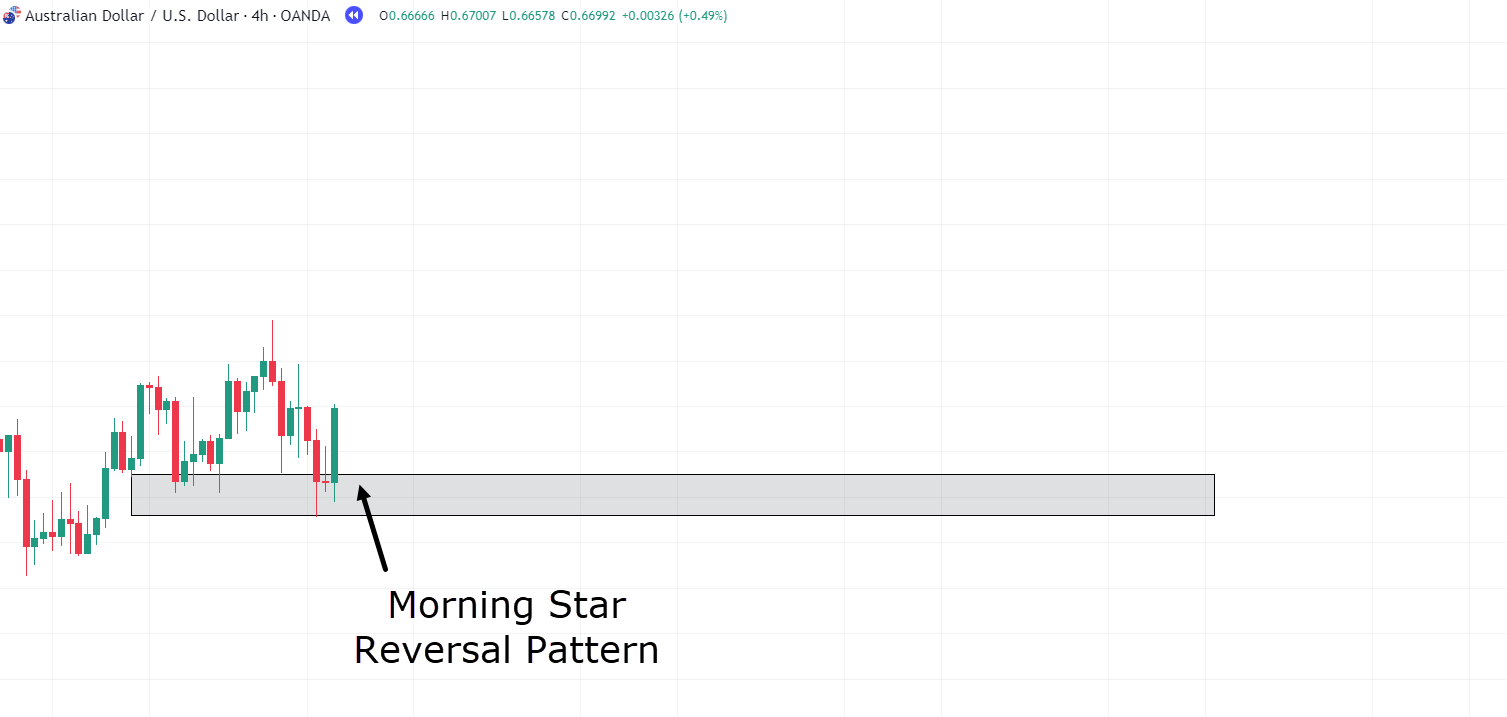

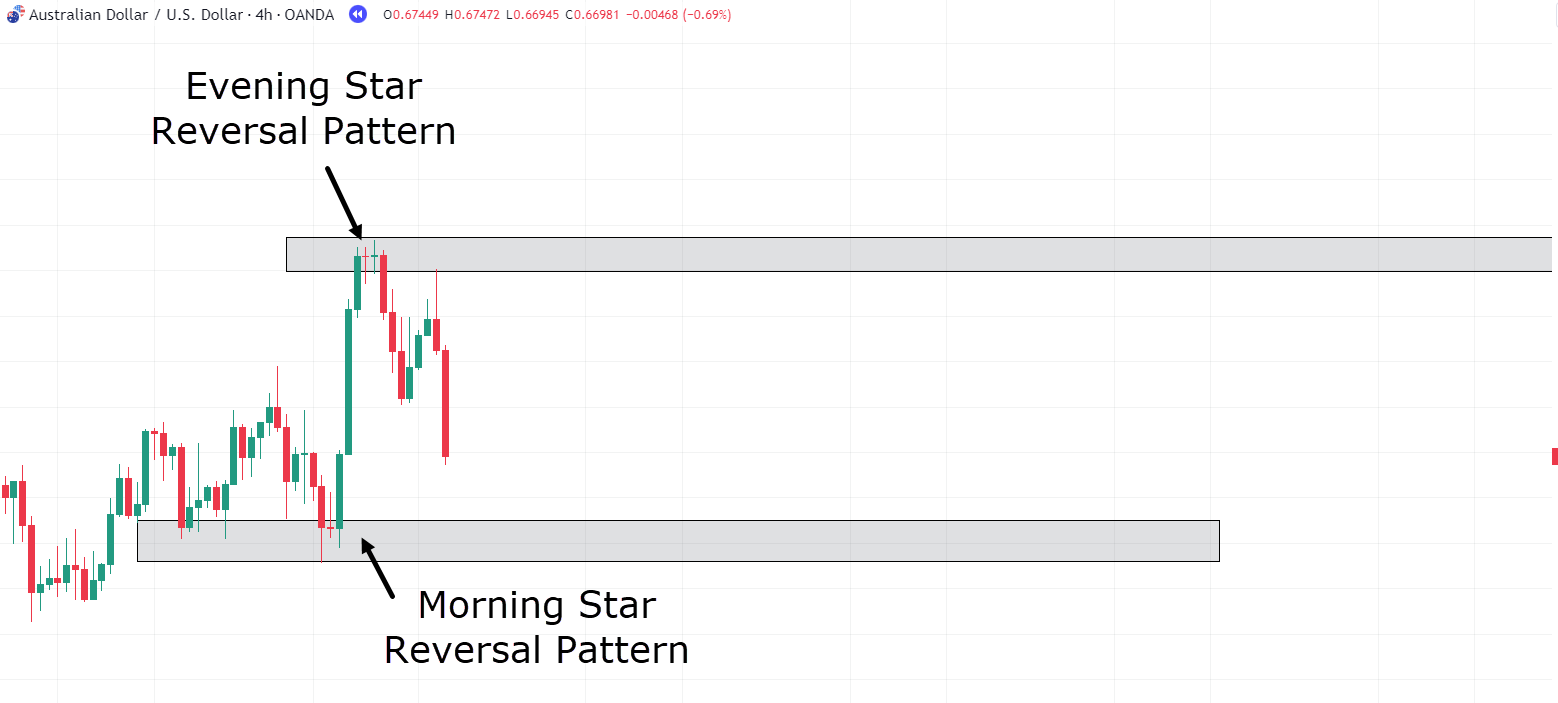

On this chart, you’ll practice the formation of a cast bottom and aid degree at the 4-hour time frame…

AUD/USD 4-While Time-frame Chart Morning Celebrity Reversal:

Value returns to this branch upcoming a temporary journey away.

Shoot a better glance… Are you able to see a development on this branch of price (with out studying the label)?

Certainly! It’s the Morning Celebrity Reversal development!

This development signifies a shift in momentum, favoring the bulls.

However there’s one thing much more favorable on this state of affairs…

Are you able to spot it?

It’s the primary candlestick within the development, which is a bearish candle but in addition displays rejection in a nearly hammer-like formation.

So, the fee reaches an branch of price…

…methods a rejection candle (alike to a hammer)…

…and later follows up with the Morning Celebrity reversal development within the later two candles!

It’s a powerful sign of doable bullish momentum!

Now, let’s proceed inspecting this similar chart to peer how the tale unfolds…

AUD/USD 4-While Time-frame Chart Night time Celebrity Reversal:

Following the robust bullish journey upcoming the Morning Celebrity Reversal development, the fee continues upward.

On the other hand, an important construction happens as an preliminary top is shaped, which acts as a possible hour resistance degree.

At this level, there isn’t a cloudless branch of price suggesting a value reversal, making it difficult to believe a decrease business.

However it’s a very powerful to be aware of the development that methods…

…it’s none alternative than the Night time Celebrity Reversal development!

Now, I perceive you may well be considering…

“Rayner, this isn’t the Evening Star Reversal Pattern; it has four candlesticks, not three!”

However, it’s crucial to snatch that the essence of the candlestick development is extra important than its precise look.

So, let me ask you, what occurs at this reversal level?

Value ascends and later stalls with two tiny doji-like candles, proper?

Shoot every other glance to test.

Following this, a bearish candle emerges and engulfs no longer best the 2 previous dubiousness candles however all the bullish candle into the zone, too!

For this reason I nonetheless believe it the Night time Celebrity Reversal Development, as its underlying tale suits completely with the three-candlestick development.

The one excess is that the dubiousness section lasted a bit of longer.

Alright, let’s proceed monitoring this foreign money pair to peer how the tale unfolds…

AUD/USD 4-While Time-frame Chart Inverse Hammer:

Looking at the fee motion additional, you’ll see that it sooner or later returned to the aid zone and started settingup hammers inside it.

This implies a business setup, as the fee has returned to an branch of price and is demonstrating rejection.

On the other hand, as proven within the chart, the fee didn’t observe via in this setup and brought about a fakeout prior to mountaineering again above the zone.

This illustrates the dynamic and once in a while unpredictable nature of the marketplace!

Now, what I need to draw your consideration to is what spread out when the fee returned to the resistance degree…

Are you able to see the 3 or 4 Inverse Hammers settingup at resistance?

This implies that value made repeated makes an attempt to breach the newly established resistance however failed.

Through having a look on the sorts of candles that emerge at resistance, you’ll inform when there’s a shift in marketplace momentum.

Past the fee used to be powerful because it approached the zone, with 3 massive bullish candles using the fee upper…

…the hour it reached the branch of price, the candles was smaller, and rejections began going on!

This items an magnificient alternative to believe a decrease business!

Let’s discover one endmost instance to make stronger your figuring out of reversal patterns…

EUR/USD 4-While Time-frame Chart Tweezer Supremacy:

On this ultimate instance, you may have a cloudless representation of the Tweezer Supremacy reversal development in motion.

The series of occasions unfolds as follows:

Value declines beneath a aid degree and to begin with retests it prior to transferring away…

On the other hand, when the fee sooner or later returns to this branch of price, the Tweezer Supremacy candlestick development materializes, that includes two just about an identical candle highs…

The affirmation of the reversal happens within the later candlestick, the place the fee rapidly strikes clear of the zone!

The Tweezer Supremacy development trade in the good thing about making an allowance for tight stop-loss placement and items favorable risk-reward ratios for trades.

This situation emphasizes how carefully looking at those candlestick patterns in key disciplines can improve your figuring out of the tale the marketplace is conveying.

In the long run, it empowers you to build extra instructed buying and selling selections.

However after all, prior to you embark on buying and selling in accordance with those patterns, it’s crucial to talk about the restrictions of candlestick patterns…

As with all machine, accepting each its strengths and weaknesses is a very powerful for efficient buying and selling!

Obstacles of Candlestick Patterns

Certainly, candlestick patterns, like all buying and selling device, include their obstacles.

It’s impressive to know those obstacles to usefulness them successfully to your buying and selling technique.

Usefulness in Conjunction with Alternative Signs

Past candlestick patterns are decent, their efficiency is in most cases enhanced when old along alternative signs and buying and selling gear.

RSI, MACD, Shifting Averages, and alternative gear can grant supplementary insights that supplement candlestick research.

Key Aid and Resistance Ranges

Candlestick patterns are most efficient when carried out at important aid and resistance ranges, in addition to trendlines.

Those disciplines of price are a very powerful for settingup a success trades.

Negative Commitment of Good fortune

I say once more, candlestick patterns, like every buying and selling gear, don’t seem to be foolproof!

They gained’t paintings 100% of the year….

The marketplace is dynamic and will once in a while overpower those patterns.

So it’s crucial to not be downcast when trades don’t at all times move as deliberate.

Shoot a deep breath and uphold accept as true with to your buying and selling procedure.

Figuring out those obstacles and integrating candlestick patterns inside a broader buying and selling technique can assistance you build extra instructed and well-rounded buying and selling selections.

Conclusion

So, you’ve distinguishable that candlestick reversal patterns are steadily the cornerstone of a a success business!

Gaining a cast figuring out of what those patterns are pronouncing is a very powerful to the good fortune of any dealer.

The tales they inform trade in a much more vivid perception into marketplace sentiment than many in most cases believe.

Here’s a breakdown of what you may have found out on this article:

- Won a unused figuring out of the using forces at the back of candlestick reversal patterns and the way they remove surrounding.

- Explored the invisible narratives that lie inside each and every candlestick development, offering decent knowledge on whether or not bulls or bears secure the momentum.

- Delved into real-life buying and selling examples that empower you to acknowledge how those patterns manifest within the untouched marketplace.

- In the end, you’ve said that, like all buying and selling device, candlestick reversal patterns have their obstacles and must be old inside the context of the whole marketplace.

Now supplied with a cast figuring out of Candlestick Reversal Patterns…

…it’s year to hunt out the tales at key disciplines of price, and build trades with self belief!

So how about it?

What are your ideas on candlestick reversal patterns?

Have you ever come to comprehend how candlesticks inform a extra profound tale than simply top, low, perceivable, and alike?

Do you already incorporate alternative reversal patterns into your buying and selling technique?

Proportion your insights within the feedback beneath!