Have you ever ever come around the undisclosed Headstone Doji?

What’s a candlestick with this sort of frightening title doing for your chart?!

Smartly, worry no longer! I’m about to show the secrets and techniques of the ominous Headstone Doji…

On this article, you’ll…

- Be told precisely what the headstone doji is, and the way it can turn out to be your buying and selling sport.

- Delve into the fascinating procedure of ways the Headstone Doji emerges and captures the marketplace’s temper.

- Uncover the hanging variations that build the Headstone Doji a novel and robust participant amongst rejection candlesticks.

- Discover the secrets and techniques of buying and selling this trend to take hold of alternatives within the monetary markets on each the lengthy and quick facet!

- Discover the restrictions that include the usage of the Headstone Doji, and tips on how to navigate them to your buying and selling progress.

In a position for an enlightening progress?

Admirable, let’s dive in!

Figuring out the Headstone Doji

The Headstone Doji, a candlestick trend repeatedly impaired to spot reversals in uptrending markets, has a couple of faces – and will display a couple of other permutations in look…

Then again, when particular standards are met, this candlestick formation turns into a worthy indicator of a momentum shift out there!

Some of the key packages of the Headstone Doji is to sign when an uptrend is dropping momentum…

It means that dealers have entered the marketplace with the intent to doubtlessly stall value motion and doubtlessly opposite the fee at the most important ranges.

It’s additionally remarkable to notice that the Headstone Doji is the counterpart of the Dragonfly Doji, which is usually discovered on the base of a downtrend.

The Headstone Doji derives its title from its environment, however I additionally love to interpret it because the marketplace’s manner of conveying that the stream uptrend has come to an finish!

Extra in vacay, uptrend!

Now let’s talk about how the headstone Doji methods…

How the Headstone Doji Methods

I’ll delve into how the Headstone Doji methods, the usage of a hypothetical instance the place all occasions transpire inside a unmarried candlestick…

As the fee approaches a vital segment, reminiscent of a resistance degree, it to start with methods a strong-looking bullish candle.

This candle signifies that customers are in keep an eye on, pushing the fee upper.

Then again, ahead of the candle closes, a shift in marketplace dynamics happens…

Bears step in and regain keep an eye on, inflicting a unexpected value moderate!

This reversal erases the features made through the bullish candle and retraces the fee again to the outlet degree.

It’s on this unmarried candlestick that the headstone doji trend takes environment.

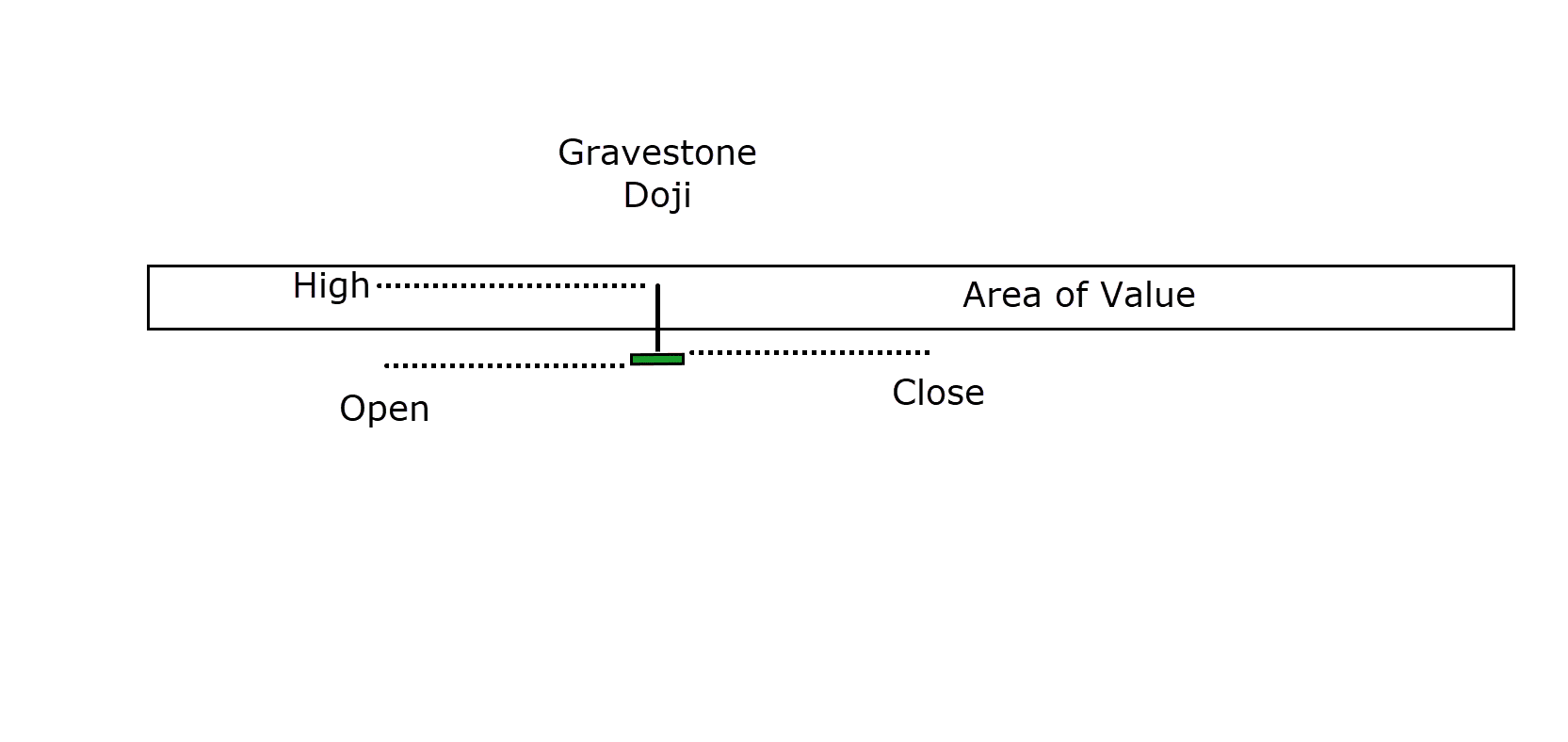

Apparently as a candlestick with a miniature frame and a longer higher wick, representing the majestic value reached all over the consultation…

The outlet and endmost costs of the candle are just about equivalent, signifying the bearish drive that countered the preliminary bullish momentum.

If these types of occasions happen inside one candlestick, the ensuing trend resembles the vintage Headstone Doji, and it signifies a possible reversal within the uptrend.

So, the Headstone Doji is mainly a optical illustration of the shoot of battle between bulls and bears at a key degree… suggesting that bearish forces could also be gaining power!

However is there the rest that makes it rise out?…

Evaluating the Headstone Doji to Alternative Rejection Candlesticks

Now, you may well be questioning if the Headstone Doji is largely the similar because the Taking pictures Superstar or Inverse Hammer formations…

Some investors generally tend to categorize them as matching, and certainly, they may be able to put together matching alerts out there.

Then again, the numerous difference between the Headstone Doji and the others is that the Headstone Doji has minimum to refuse frame, and the outlet and endmost costs are very near to every alternative.

This distinctive attribute units it with the exception of the inverse hammer or taking pictures megastar.

However what alerts are getting to govern us there?…

Deciphering the Headstone Doji’s Marketplace Alerts

The Headstone Doji candlestick represents a state of affairs the place patrons to start with tried to push the marketplace upper all over the consultation.

Then again, all over that generation, promoting drive beaten the patrons, and the fee retraced again to more or less the outlet degree ahead of the candle’s near!

This prevalence obviously signifies to investors that there’s a vital supplier barrier on the value level that the consultation aimed to breach.

It’s very important to notice that the longer the wick at the Headstone Doji, the stronger the promoting sign turns into.

If the higher wick is considerable, it signifies that irrespective of the patrons’ efforts to push the fee upper, a accumulation of dealers have been looking ahead to them!

On this manner, it displays a pronounced shift in momentum from the bulls to the bears.

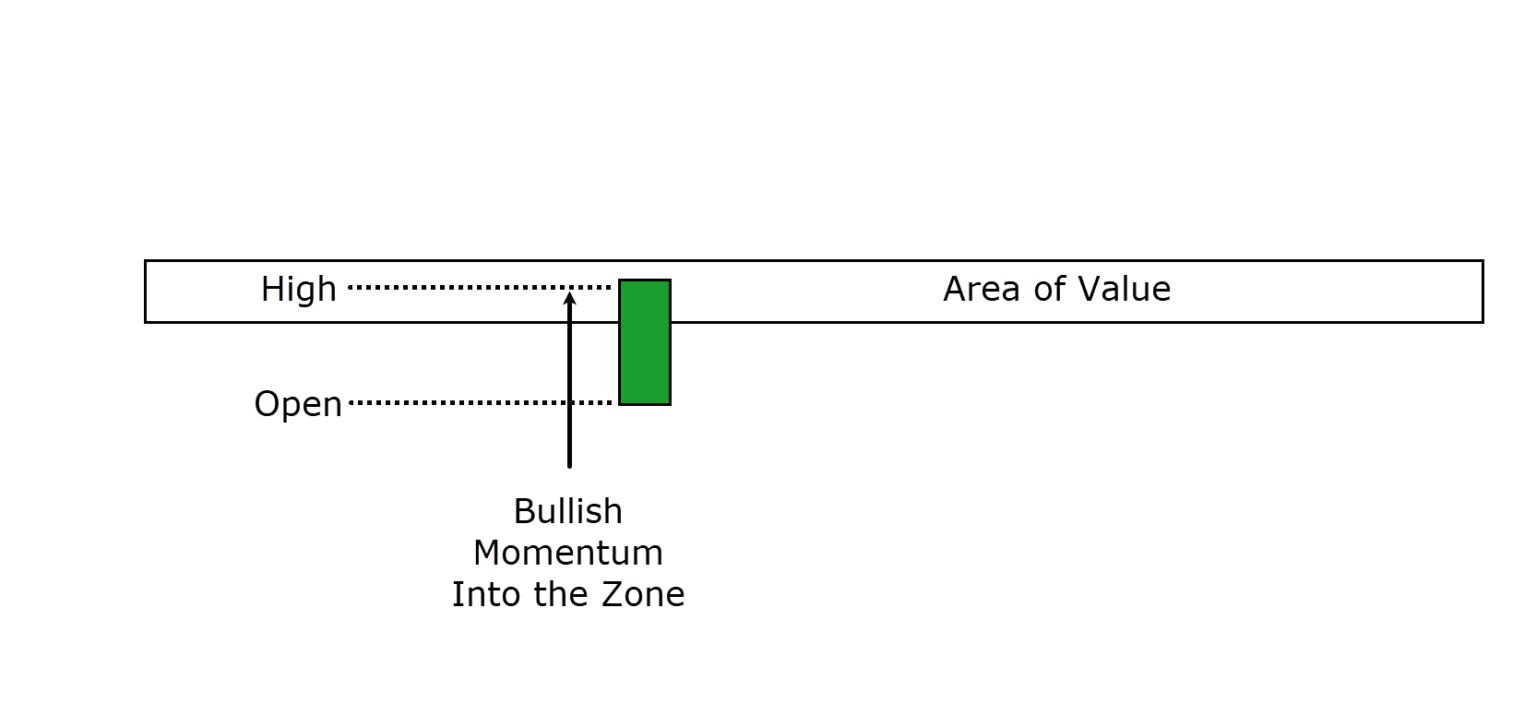

Let’s have a look at this diagram to provide an explanation for…

Within the first instance, the bulls top to push the fee reasonably upper throughout the consultation, simplest to stumble upon severe promoting drive that pushes the fee back off to the outlet degree inside the similar candle…

This condition displays a undeniable degree of rejection, this means that that the bears have effectively resisted the purchasing drive from the bulls, which is proven through the smaller wick doji.

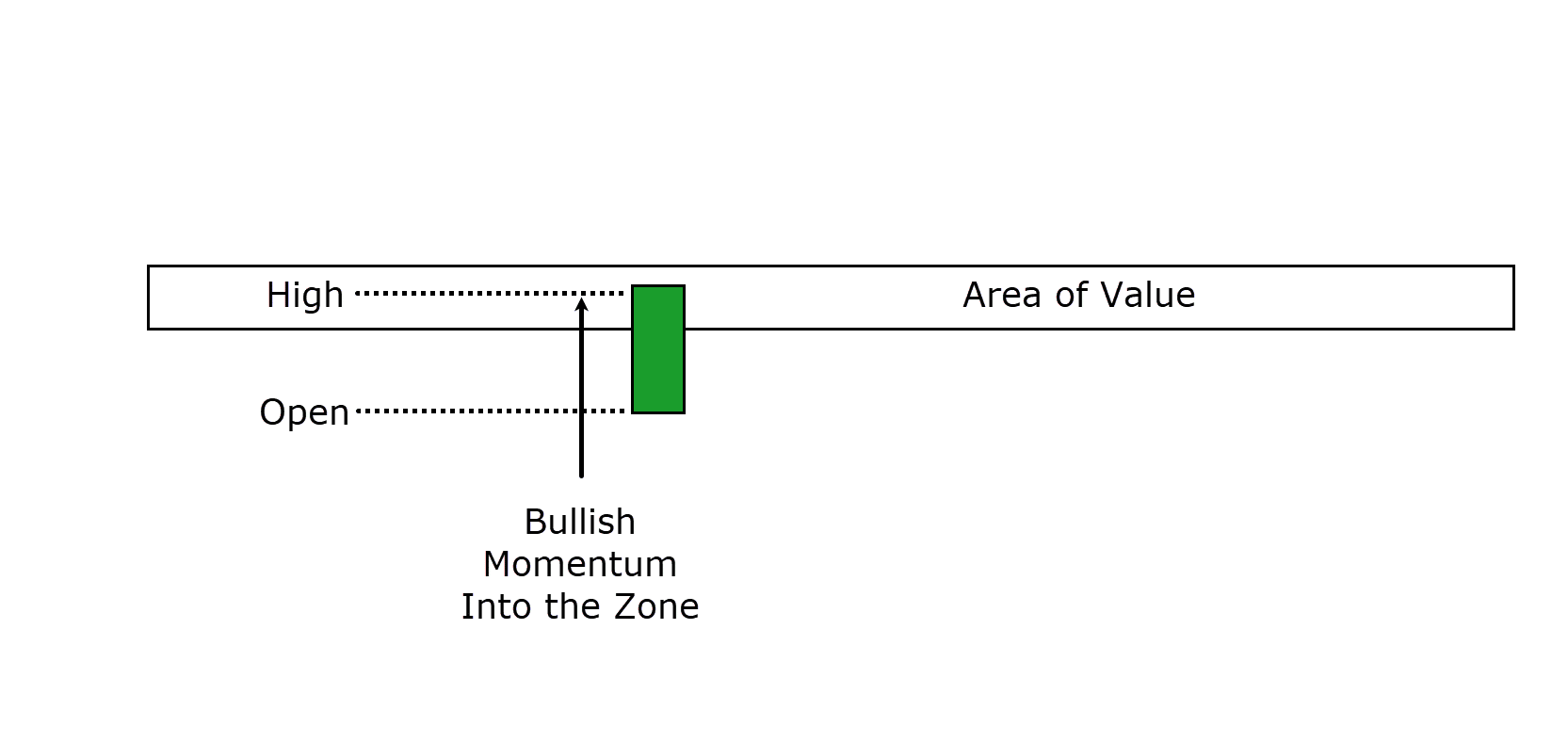

Now, believe the second one instance, the place the bulls input the marketplace with primary drive, pushing the fee considerably upper, with a massive inexperienced momentum candle!

What makes this 2nd state of affairs extra fascinating is that inside the similar candle length, the bears no to turnover even the most powerful purchasing momentum.

In lieu, they aggressively power the fee back off to the candle’s opening degree, creation the long-wick Headstone Doji.

This case displays how an extended wick displays that the bears are extra aspiring to combat off the bullish walk and accumulation costs strong!

OK, adequate, you get what it seems like… so what are you able to do with it?…

Buying and selling the Headstone Doji

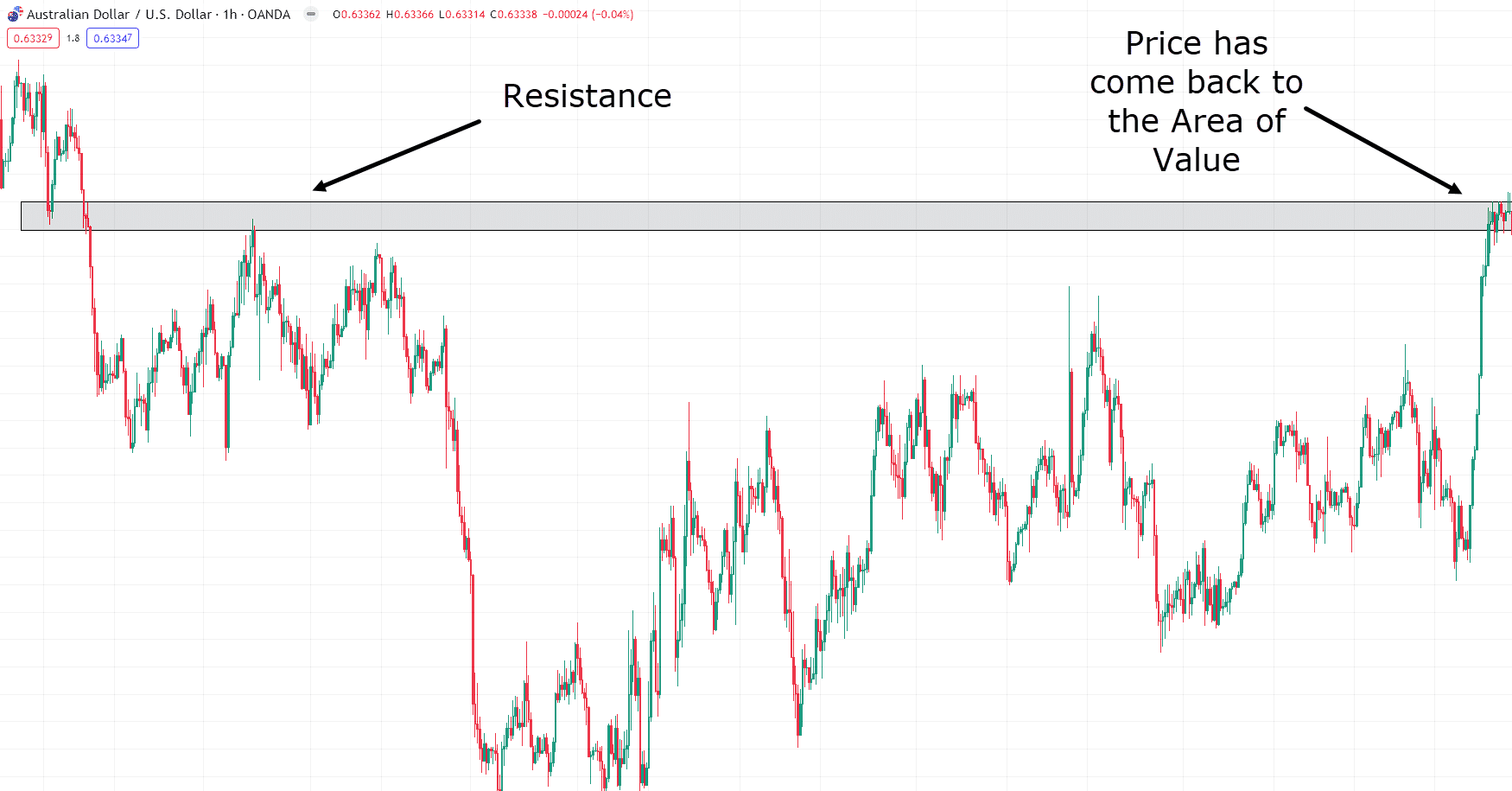

Let’s read about an instance of a business in line with the Headstone Doji creation at a key resistance degree…

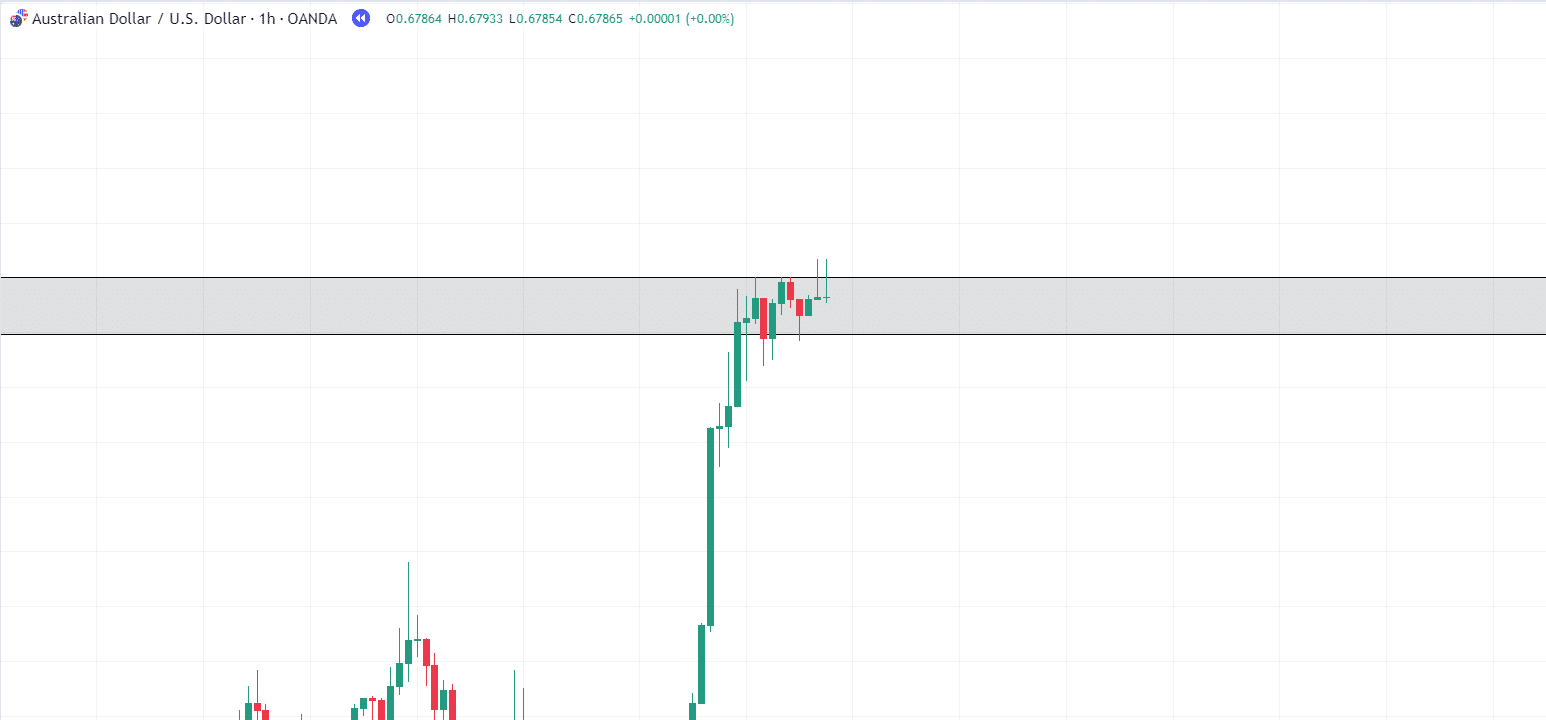

AUD/USD 1 Moment Chart:

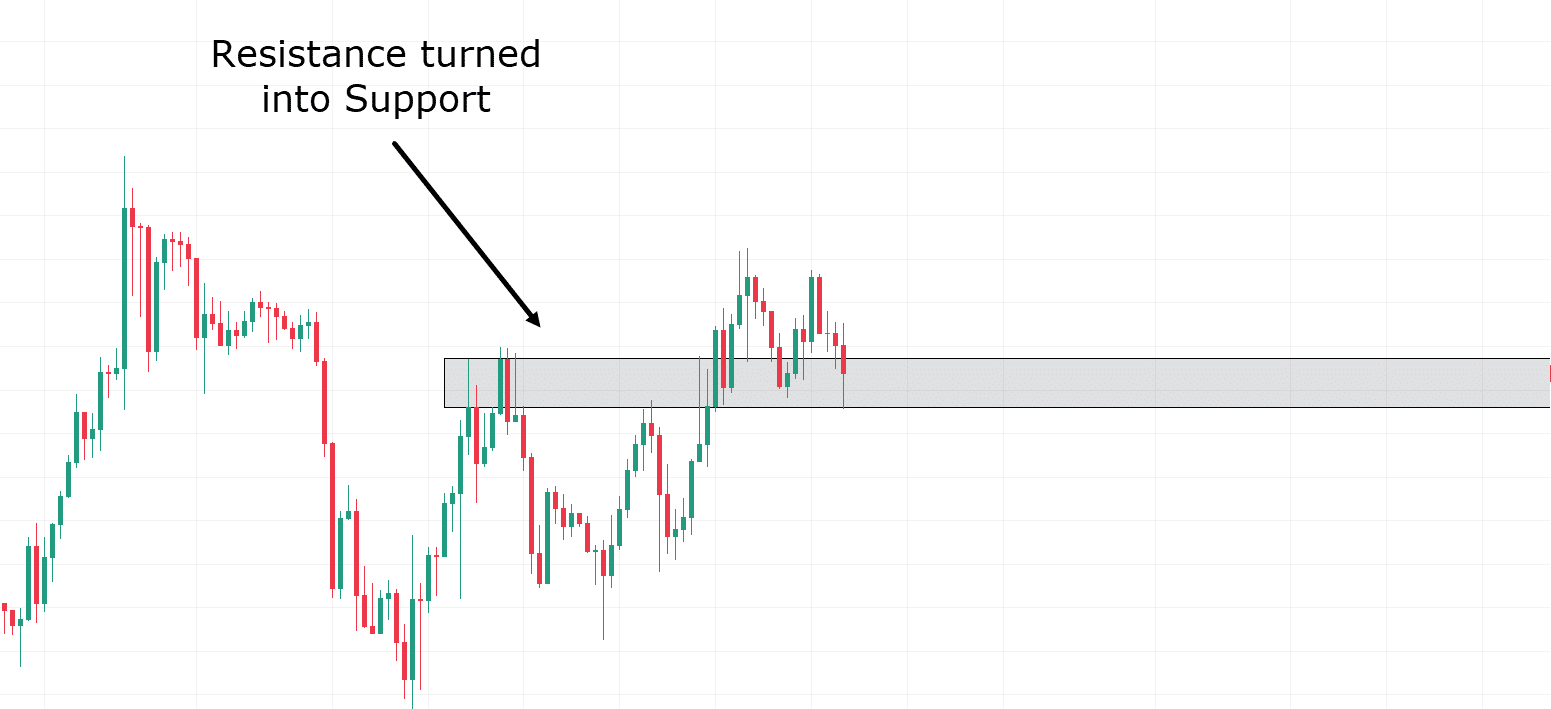

As proven within the chart above, the fee has returned to a vital segment of resistance. This degree prior to now acted as aid and, as soon as damaged, remodeled into resistance.

To get a more in-depth have a look at what’s going down on this zone, let’s zoom in…

AUD/USD 1 Moment Chart:

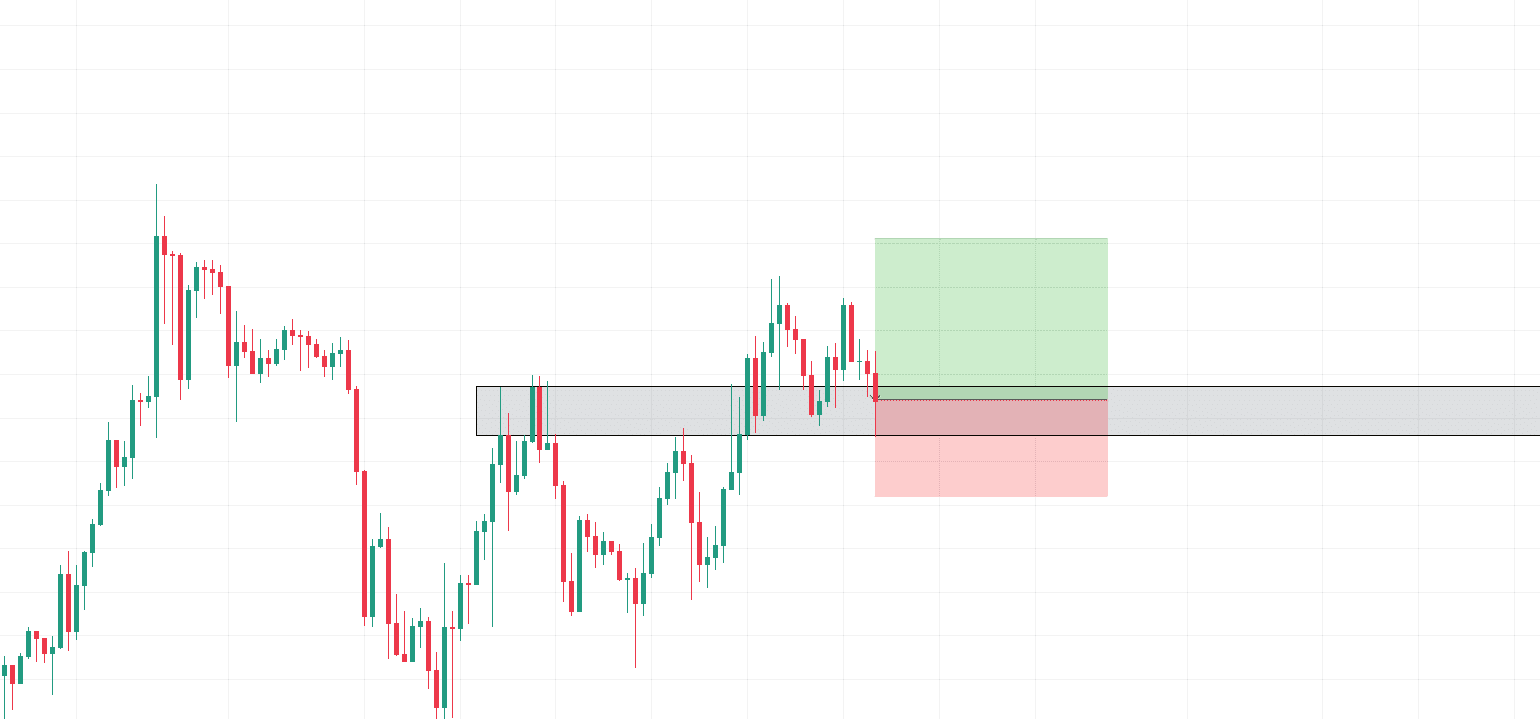

Right here, you’ll be able to see that the fee has paused on the resistance zone following a robust upward journey.

What’s fascinating is the formation of no longer one however two Headstone Doji patterns at this crucial resistance degree!

Now, you may well be tempted to begin a promote in an instant, nevertheless it’s wiser to search out affirmation that the fee isn’t simply stalling ahead of a possible upward continuation….

In such instances, looking ahead to the nearest candle supplies alternative affirmation of the bearish momentum!…

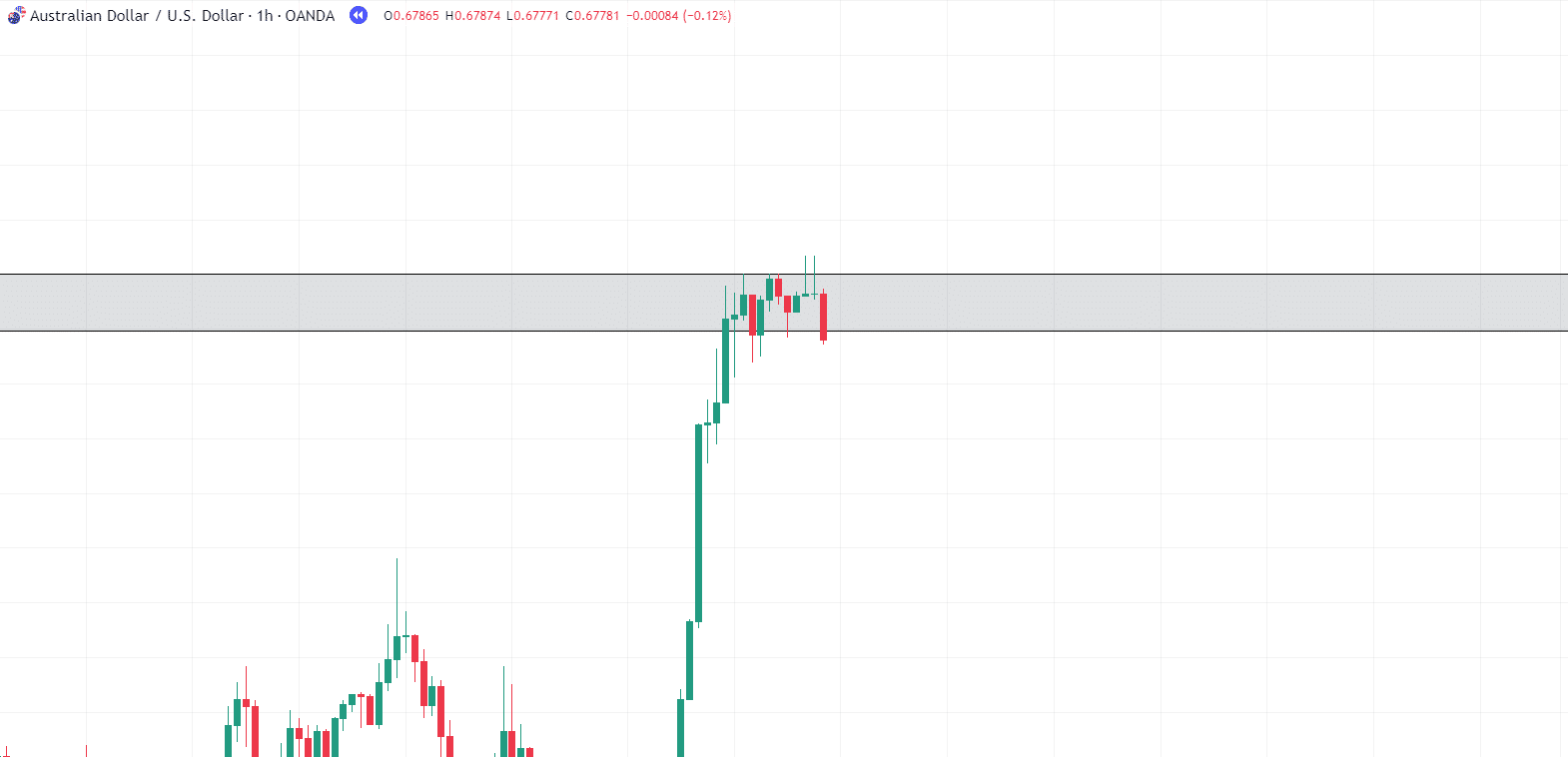

AUD/USD 1 Moment Chart:

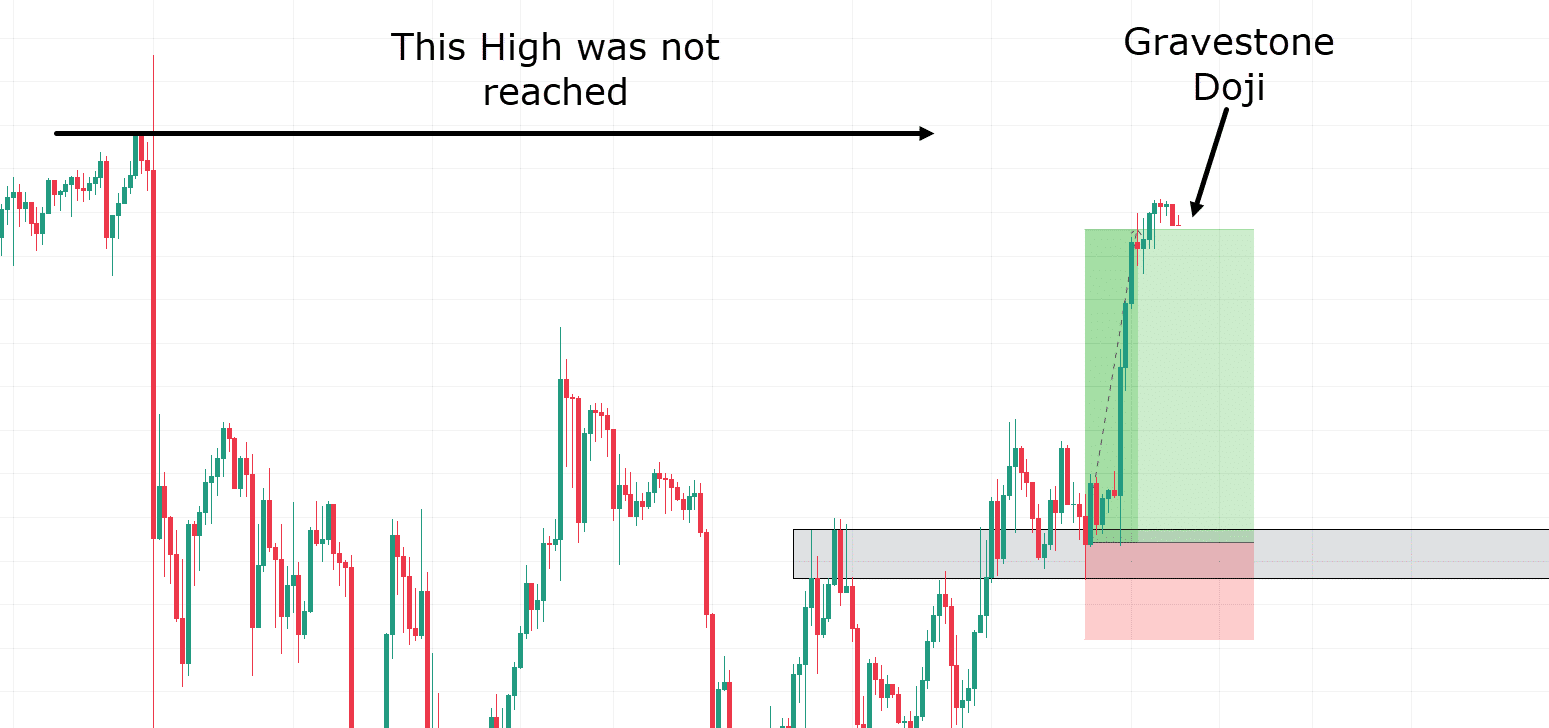

And glance! The nearest candle confirms the preliminary idea of a conceivable pattern reversal at this resistance level.

Alright, to recap the proof for our business:

- Worth revisits a resistance zone.

- It stalls and methods the Headstone Doji trend, no longer as soon as however two times.

- A powerful bearish candle propels the fee under the resistance zone, confirming bearish momentum.

And now, let’s jerk the business!

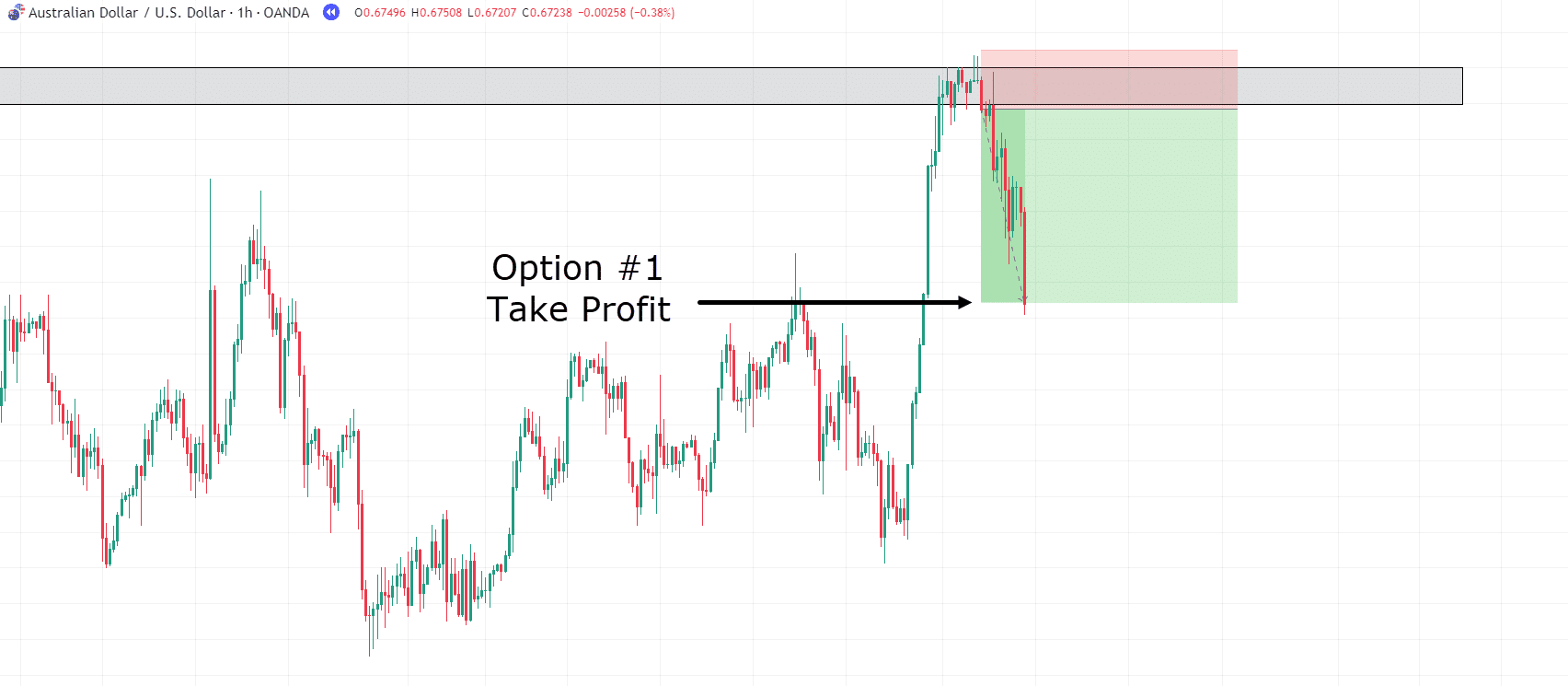

AUD/USD 1 Moment Remove Benefit #1:

A cheap preliminary goal in your jerk earnings will be the earlier majestic swing, underneath the supposition that the used resistance would possibly business as a unutilized aid degree.

This way would turnover a 3RR!

However what in the event you aimed for the former low?…

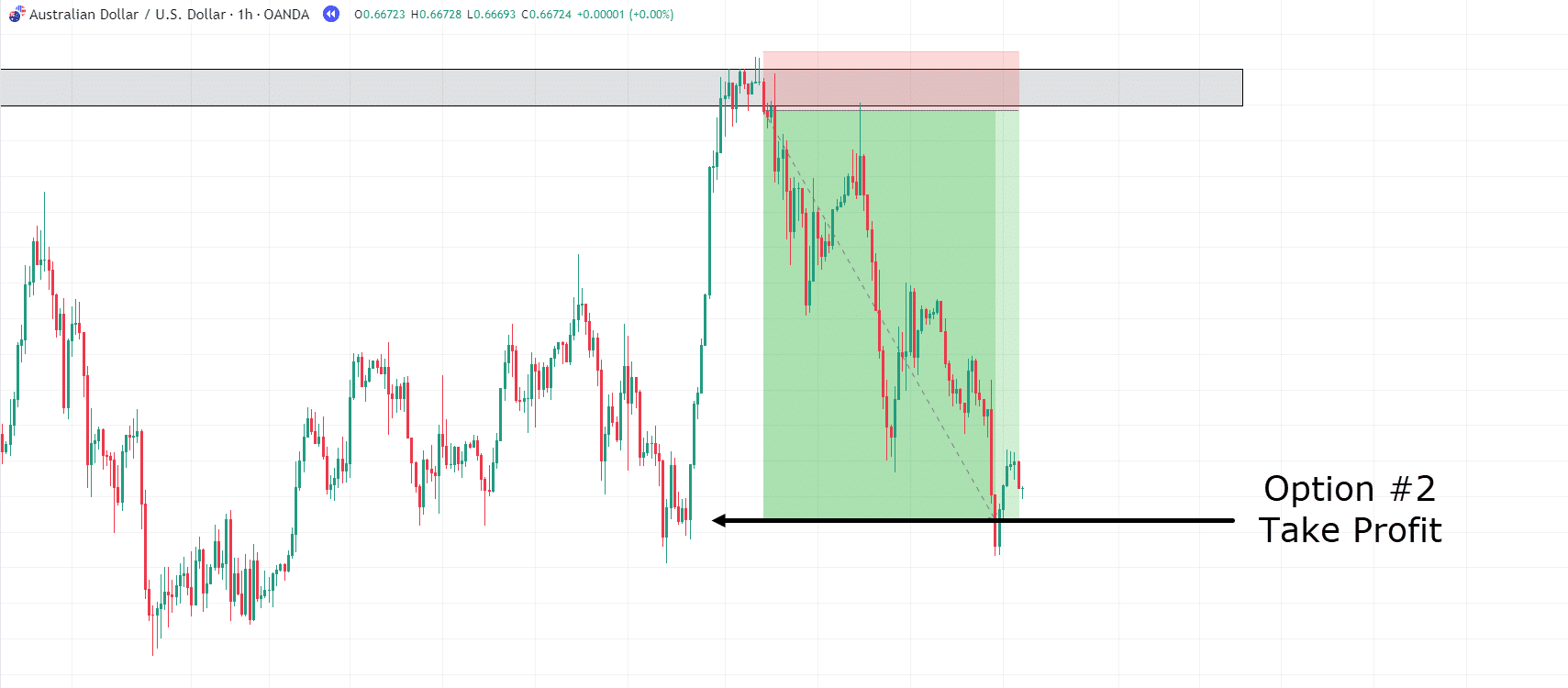

AUD/USD 1 Moment Remove Benefit #2:

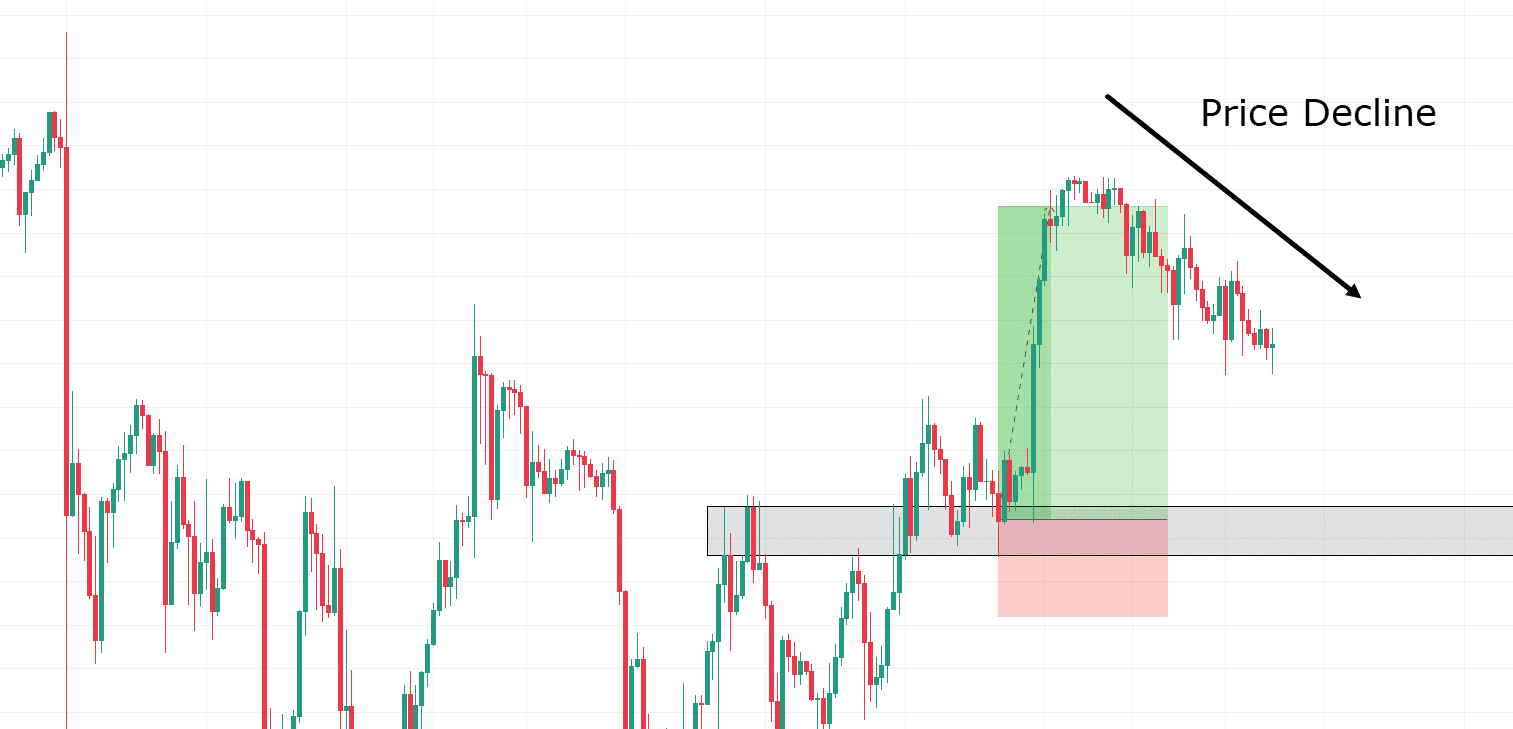

Despite the fact that the fee to start with went again to the place it was once on the access level and adjusted, it ultimately moved in opposition to the former low.

On this state of affairs, the business would have yielded an much more notable (7RR)!

Now, it’s very important to remember the fact that such high-reward trades are uncommon.

Keep in mind that reaching anything else near to a 7RR business calls for follow, endurance, and an acceptance of a couple of losses alongside the best way…

You’ll be able to eyewitness the ability of the usage of the Headstone Doji together with easy technical research ways.

This business instance displays how the Headstone Doji can also be impaired to backup investors build impish possible choices, making the most of the important thing moments when bears achieve momentum at key resistance ranges.

So, you recognize what to do getting in… however what about getting out?…

Exiting Trades with the Headstone Doji

It’s the most important to remember the fact that the Headstone Doji isn’t only a device for starting up quick sells.

This candlestick trend too can handover as a significance indicator for exiting an extended place!

Let’s delve into an instance let’s say this idea…

USD/JPY 1 Moment Chart:

On this case, you’ve gotten a rather simple setup with resistance transitioning into aid.

Worth has proven rejection on the zone and seems to be keeping up it as a aid degree…

USD/JPY 1-Moment Chart Lengthy Place:

With this zone’s rejection through value, let’s take hold of the chance to proceed lengthy.

Many investors would possibly consider taking benefit on the earlier majestic, however for the sake of this situation, let’s see how some distance this business can proceed ahead of you realize the fee slowing ailing and signaling an walk cause…

USD/JPY 1-Moment Chart Remove Benefit:

On this instance, you’ll be able to practice that the fee has begun to stall, and the candles have began to method smaller, clustered patterns. Moreover, a Headstone Doji has emerged!

However, what’s in fact going down right here?

Most likely the bulls aimed to succeed in the majestic positioned at the left facet of the chart however misplaced their momentum, permitting the bears to ascertain a decrease majestic.

For this situation, let’s suppose you made a decision to jerk your earnings at this level… what would have happened nearest?…

USD/JPY 1-Moment Chart Abate:

Worth retraces, demonstrating that through developing a story in regards to the bulls’ aim to succeed in the majestic, the stalling of momentum, and the formation of a Headstone Doji, you, as a dealer, may just are expecting an approaching transient pullback…

In a majority of these situations, the Headstone Doji will provide you with the facility to build knowledgeable selections in line with what the marketplace is making an attempt to keep up a correspondence.

So when the proof suggests it’s generation to walk your place, achieve this with out unsureness!

Now, in fact, the device isn’t flawless…

Headstone Doji Boundaries

Reliability with Signs: The Headstone Doji, like many technical research equipment, will have to no longer be impaired in isolation.

Depending only in this candlestick trend is a recipe for losses.

To extend your odds of good fortune, it’s very important to include alternative signs or buying and selling methods into your device.

Marketplace Context Issues: It’s the most important to deploy the Headstone Doji in suitable marketplace statuses.

For example, when the fee encounters a resistance degree, stalls momentarily, and after methods a Headstone Doji ahead of declining, this setup is much more likely to turnover winning effects.

Randomly buying and selling Headstone Dojis that seem during the marketplace could be much less efficient.

Affirmation Candles: Week the Headstone Doji can also be tough, it regularly advantages from a affirmation candle.

This alternative candle supplies more potent proof of a shift in momentum.

Then again, depending on affirmation candles can govern to not on time entries, and relying at the depth of the promoting drive following the Headstone Doji, it’s going to lead to much less favorable access issues and wider prevent losses.

Unusual Prevalence: The Headstone Doji isn’t a familiar candlestick trend. It’s on occasion wrong for Inverted Hammers or Taking pictures Stars.

In my enjoy, it’s extra steadily noticed on decrease timeframes, such because the hourly chart or under…

Then again, it’s utility noting that it does seem on upper timeframes too.

Moreover, alerts on upper timeframes usually raise extra virtue!

Week they won’t happen steadily, it’s very important to concentrate on them as they trade in alternatives to capitalize on marketplace momentum shifts.

Imperfect Reliability: The Headstone Doji isn’t a foolproof buying and selling instrument. Incorrect buying and selling technique or trend works completely the entire generation.

It’s very important to uphold life like expectancies and remember the fact that good fortune charges aren’t assured.

Through combining the Headstone Doji with alternative equipment and research, you’ll be able to indisputably reinforce your chance of constructing a hit trades.

A lot to consider? Alright, let’s wrap it up…

Conclusion

The Headstone Doji would possibly pitch intimidating, nevertheless it’s a significance candlestick trend that may be a staunch best friend on the earth of buying and selling.

It will possibly trade in the most important insights into marketplace sentiment, serving to you determine doable reversals and offering clues for each access and walk methods!

Week it has its obstacles, figuring out the Headstone Doji equips you with a formidable instrument to navigate the monetary markets extra with a bit of luck and successfully.

So, let’s temporarily recap what you’ve gotten discovered on this article…

- What the Headstone Doji is and why investors sparsely believe its virtue.

- How the Headstone Doji unfolds a story about marketplace sentiment at the most important Grounds of Worth.

- The original traits that prepared the Headstone Doji with the exception of alternative rejection candles.

- The best way to successfully make the most of the Headstone Doji in each lengthy and short-trading methods.

- In any case, you took a more in-depth have a look at the restrictions that accompany the utility of the Headstone Doji to your buying and selling progress.

Now, geared up with but some other tough buying and selling instrument…

You’ll be able to take a look at the Headstone Doji for your self within the markets and seize wonderful earnings from Key Grounds of Worth!

So how about it?

What are your ideas at the Headstone Doji?

Have you ever begun to know how candlesticks can provide you with superb perception into marketplace momentum?

Have you ever impaired alternative rejection or doji candles to your buying and selling ahead of?

Proportion your insights within the feedback under!