The Spinning Manage candlestick is an interesting puzzle for buyers in quest of a very powerful marketplace insights!

Its skill to spot marketplace hesitation and pauses in worth actions makes it a in reality helpful device for your buying and selling arsenal.

On this terminating information, I can delve into the nitty-gritty of the Spinning Manage candlestick…

Uncovering all of its secrets and techniques…

And also you’ll be informed the whole thing from how it’s shaped to how you’ll be able to in fact business it!

Are you able?

So right here’s what you’ll be informed:

- Spinning Manage candlestick defined for novices.

- The mysterious that means of the Spinning Manage candlestick that no one tells you.

- 2 habitual errors you must keep away from in any respect prices.

- Buying and selling methods to business the Spinning Manage candlestick successfully.

Let’s start!

What’s the Spinning Manage candlestick?

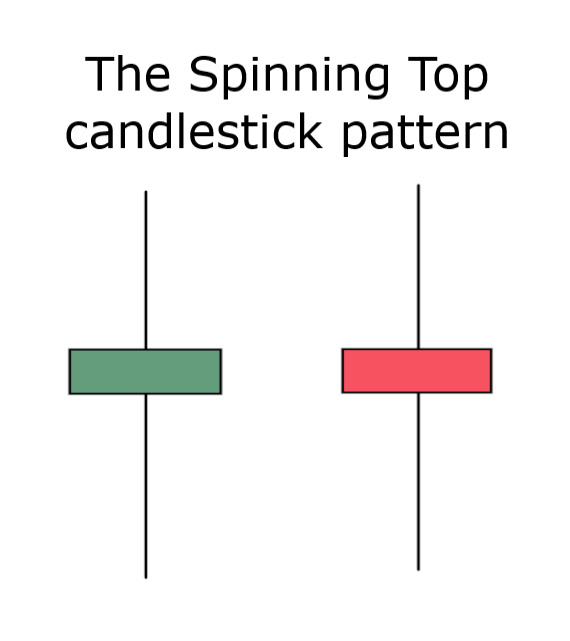

Smartly, the Spinning Manage candlestick is mainly a small-to-medium differ candle marked by means of a petite frame and moderately longer wicks…

It could let you know when there’s a relaxation or hesitation going down out there.

Right here’s what it seems like…

For the reason that frame is so petite, it doesn’t in fact topic what the colour of the frame is.

As I mentioned, the Spinning Manage candlestick is an hesitation candle…

However have you ever ever heard of bullish hesitation or bearish hesitation?

That merely doesn’t assemble sense, proper?

The article is…

The Spinning Manage candlestick is a trend, that needs to be considered within the context of the entire marketplace statuses.

If you’ll be able to discover ways to establish the underlying marketplace context by which the Spinning Manage candlestick is showing, it may possibly paintings wonders for you!

However don’t concern, we can get to that section quickly…

First, I wish to proportion a tiny bit extra in regards to the Spinning Manage candlestick, to support additional solidify your figuring out of this tremendous trend. Learn on!

What does the Spinning Manage candlestick represent?

As discussed, the Spinning Manage candlestick tells you that there’s a relaxation or hesitation out there.

Let’s dig a tiny deeper now!

Take a look at one of the vital basic constructions of any traded marketplace…

{that a} marketplace will cycle between classes of low volatility and top volatility.

A length of low volatility might be adopted by means of a length of top volatility and vice versa.

A length of top volatility is when the marketplace makes bulky strikes…

While a length of low volatility is when the marketplace simply pauses with out making any significant strikes.

Take a look on the chart underneath to peer what I cruel…

EUR/USD Day by day Chart:

I want to emphasize a couple of issues within the chart above, too:

- Understand the cyclical nature of volatility: Prime volatility is adopted by means of low volatility which is once more adopted by means of top volatility.

- The top volatility length was once marked by means of long-range candles with broad our bodies.

- The low volatility length was once characterised by means of small-range candles with little-to-no our bodies, which as we’ve perceivable are the traits of a Spinning Manage candlestick.

Now in case you secured the dots…

You are going to notice that the Spinning Manage candlestick tells us that the marketplace is in low volatility form!

This means that a length of top volatility is prone to observe, and that’s precisely what you and I want, as buyers, proper?

Upcoming all, how are you going to assemble cash if the fee simply sits there doing not anything?

Preferably, you want a marketplace that can assemble a bulky proceed.

And if you’ll be able to as it should be perceive the context inside which this low volatility length is showing, you’ll be able to put your self ready to profit from the higher volatility that follows.

That is precisely the idea upon which the methods that I proportion on this article are in line with!

However sooner than we get to the methods, let me temporarily let you know the two errors that you simply must keep away from month buying and selling the Spinning Manage candlestick…

Steer clear of those errors month buying and selling the Spinning Manage candlestick…

Mistake #1: The use of it as a development reversal sign isn’t a good suggestion…

Now, conventionally, it’s mentioned that the Spinning Manage candlestick trend is a development reversal trend…

However I encourage to fluctuate!

I argue that it takes greater than a unmarried candle to opposite an entire development.

Extra ceaselessly than now not, then establishing the Spinning Manage candlestick, the fee will relaxation for a month or have a petite response, simplest to assemble a trending proceed once more.

To turn you what I cruel, let me come up with a couple of examples…

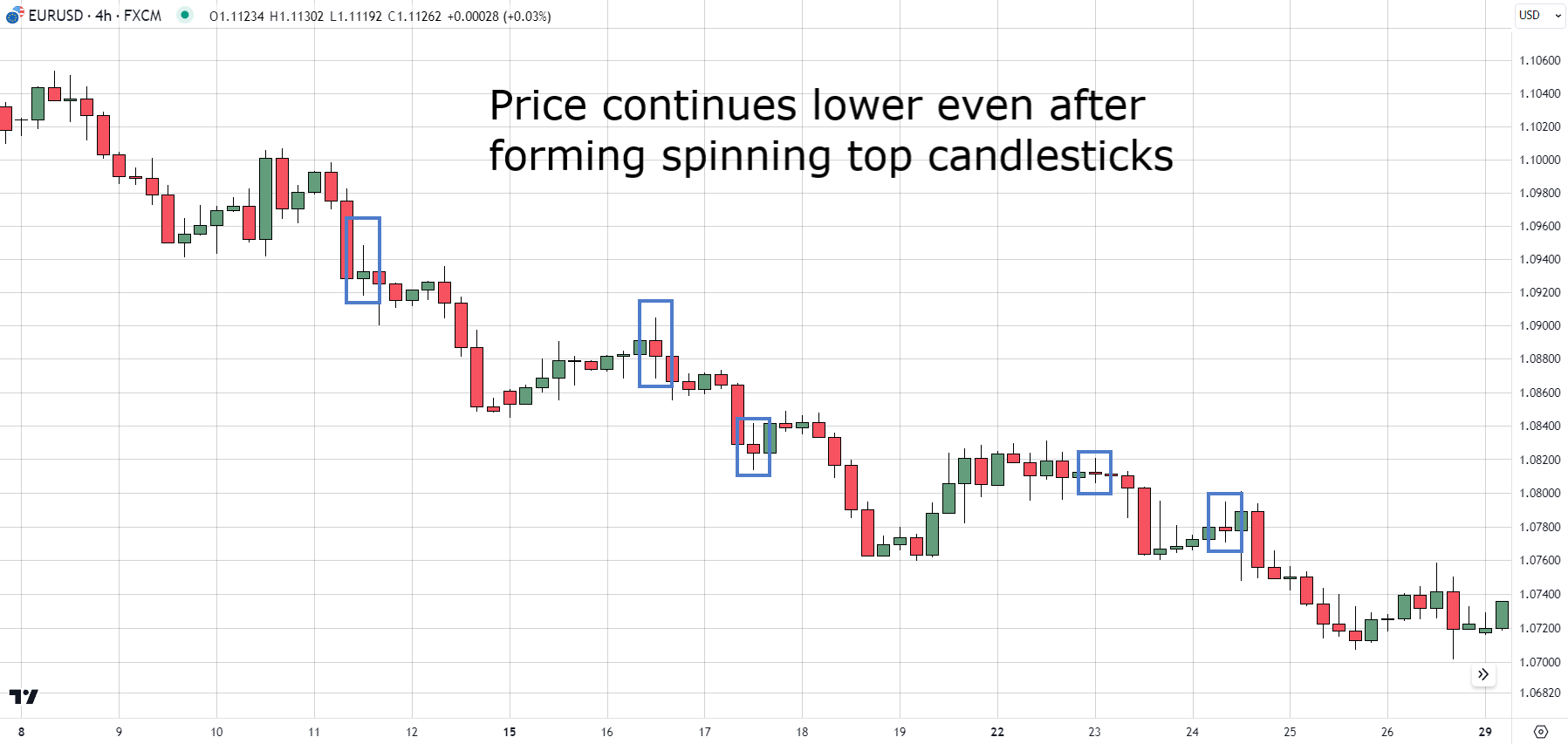

EUR/USD 4-Pace Chart:

Right here, in a pervasive downtrend, the fee shaped a number of Spinning Manage candlesticks however didn’t opposite.

In lieu, it endured decrease.

Additionally, observe that there are so many extra Spinning Tops on this chart, however I’ve marked simplest the very best ones to additional emphasize my level.

Check out every other…

NVIDIA Day by day Chart:

On this chart, then the Spinning Manage candlesticks had been shaped, the fee paused for slightly sooner than proceeding upper.

Are you able to see why it’s not a good suggestion to wager in opposition to the fad simply in line with a unmarried candle?

This leads me to the second one mistake to keep away from…

Mistake #2: Don’t usefulness the Spinning manage candlestick as a standalone trend…

The Spinning Manage trend isn’t a method in itself!

Let me give an explanation for…

Should you test any chart, you’ll see that the Spinning Manage candlestick may be very habitual.

It sounds as if so often that if you wish to in fact usefulness it, you will have to be capable of perceive the context inside which it’s showing.

Take a look on the chart underneath…

Walmart Day by day Chart:

Do you spot how some Spinning manage candlesticks led to a cost arise, month some resulted in falls and in some instances, the fee simply went sideways?

So, what number of are you taking to business?

Additionally, it’s shield to suppose that the majority buyers are monitoring multiple reserve/pair.

Are you able to consider the choice of Spinning Manage candlesticks that can display up each and every life?

Obviously, it’s taking to be a bundle!

That is why it’s not a good suggestion to usefulness the Spinning Manage candlestick as a buying and selling sign by itself.

Now…

Allow us to have a look at the way you must be buying and selling this superior trend…

Tips on how to as it should be business the Spinning Manage candlestick trend

Technique #1: The flag technique

On this technique, we can incorporate the Spinning Manage candlestick, into the classical flag trend.

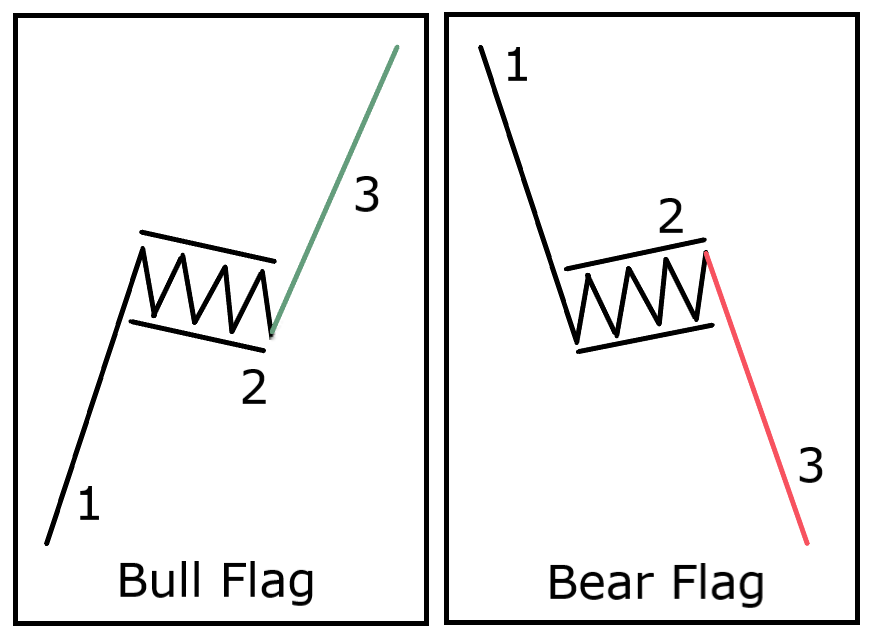

Should you don’t know, right here’s what a flag trend seems like…

Let’s crack this trend indisposed:

- A trending proceed, sometimes called the pole of the flag.

- A relaxation, which seems like a flag, therefore the identify. Right here, the volatility promises.

- That is the continuation length. Volatility will increase once more and value makes a trending proceed.

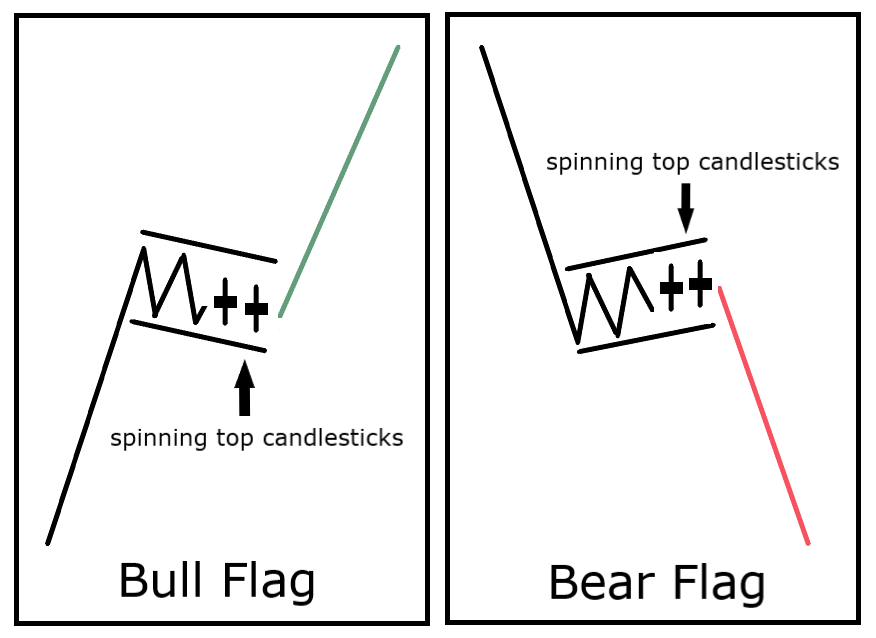

However, the place does the Spinning Manage have compatibility into this?

As I mentioned previous, a Spinning Manage candlestick tells us that the volatility is low…

So, the place within the flag does the fee have low volatility?

That’s proper! Within the flag patch the place worth pauses!

Low volatility is impressive, as the fee will have to digest its earlier trending proceed sooner than it may possibly development once more with out turning into exhausted.

Necessarily, what we’re on the lookout for is for the fee to assemble a trending proceed…

…pull a relaxation…

…sooner than establishing a number of Spinning Manage candlesticks!

This tells us that the volatility is low, and volatility is prone to make bigger from right here.

And for the reason that worth is trending, a continuation within the course of the fad turns into much more likely.

Now, take a look at this common diagram I’ve made as an instance what we’re on the lookout for at the charts…

Earlier than I display you some examples, although, check out the principles of this technique:

The context:

Search for a trending proceed this is adopted by means of a relaxation. The semblance of Spinning Manage candlesticks tells us that volatility is low and the fee is digesting its earlier trending proceed.

Access standards:

For bull flags: Input when there’s a sturdy breakout candle that closes above the bull flag.

For undergo flags: Input when there’s a sturdy breakdown candle that closes underneath the undergo flag.

Stoploss:

For bull flags: Underneath the flag low.

For undergo flags: Above the flag top.

Taking Earnings:

You’ll be able to both keep earnings at a set praise: possibility ratio like a 1:1, 1.5:1, or 2:1.

However, if you wish to experience the fad, you’ll be able to usefulness the 20 SMA to experience the fad.

An progress sign can be generated while you get a near underneath (for bull flags) or above (for undergo flags) the 20 SMA.

So, mainly, a mixture of the above two ways the place favor earnings are booked at a undeniable RR ratio and a undeniable portion is saved to experience the fad is a good suggestion!

Additionally, conserve in thoughts that profit-taking is a dynamic workout and in addition is dependent upon whether or not there’s every other offer which your finances can also be higher applied.

OK, let’s glance slightly nearer at some examples now…

Goldman Sachs Workforce Day by day Chart:

On this instance, the fee first had a stunning proceed upper, establishing the pole of the flag.

This was once adopted by means of a relaxation the place the formation of Spinning Manage candlesticks indicated low volatility.

So, we’d get started observing the reserve at this level!

Access was once caused when the fee unpriviledged out of the flag and extra importantly, closed above it.

The access will have been taken simply sooner than the near, or on the after life’s opening.

Prohibit loss can be underneath the low of the flag as marked.

Value had a pleasant proceed upper. Earnings may just’ve been booked as in line with the ways mentioned above.

Now let’s have a look at a undergo flag instance after…

Sea Day by day Chart:

On this chart, the fee had a proceed indisposed establishing the pole of the flag.

It went right into a consolidation establishing a number of Spinning Manage candlesticks throughout the flag.

Access was once caused when the fee had a breakdown and closed underneath the flag.

Stoploss can be above the top of the flag as marked and this was once adopted by means of a excellent proceed decrease.

So, that was once the flag technique!

I’m hoping the examples helped you recognize the method higher.

When you’ve got any questions, please don’t hesitate to invite them within the feedback!

Now, there’s every other attention-grabbing method by which we will usefulness the Spinning Manage candlesticks.

Presenting to you the after technique…

Technique #2: The fake crack technique

A fake crack merely approach a failed breakout or breakdown.

On this technique as smartly, we’re taking a look at issues throughout the context of the pervasive development and can pull trades simplest within the course of the fad.

However you’ll be questioning…

What the Spinning Manage candlestick has to do with this, proper?

Smartly, when a Spinning Manage candlestick modes when the fee is making an attempt to breakout/breakdown, it tells us that there’s nonetheless hesitation and the crack in worth lacks conviction.

For lengthy trades…

We will be able to glance to shop for a failed breakdown at an impressive swing low or help zone, throughout the context of an total uptrend.

When a breakdown fails, all those that shorted on the breakdown will see their stops getting strike and get started protecting their shorts, which additional provides to the upward momentum.

Access cause: A bullish candle, which tells us that the breakdown has most probably failed.

Stoploss: Underneath the low of the failed breakdown.

Taking earnings: The ways are the similar as the ones mentioned in technique #1.

Right here’s an instance…

Apple Day by day Chart:

On this chart, we see a pervasive uptrend.

The associated fee makes an attempt to breakdown underneath the swing low, however modes a Spinning Manage candlestick rather.

This tells us that the crack in worth lacks conviction.

A bullish bar provides confluence to this fake crack and serves as our access cause.

Our cancel loss can be underneath the low as marked.

We see a pleasant proceed upper!

Now allow us to have a look at the cut aspect of items, we could?

For cut trades,

We will be able to glance to cut a failed breakout at an impressive swing top or resistance degree, throughout the context of an total downtrend.

When the breakout fails, the stops of all those that went lengthy might be strike, and it’s going to additional upload to the promoting drive.

Access cause: A bearish candle, which tells us that the breakout has most probably failed.

Stoploss: Above the top of the failed breakout.

Taking earnings: The ways are the similar as the ones mentioned in technique #1.

Take a look at this case…

GBP/USD Day by day Chart:

Right here, the fee tried to breakout above the former swing top, however failed and reversed intraday, which served as an access cause.

The presence of a Spinning Manage candlestick simply sooner than this failed breakout informed you that there was once hesitation going into the breakout.

This was once adopted by means of a pleasant proceed decrease.

So…

That was once all in regards to the Spinning Manage candlestick.

Via now, I’m hoping you know how robust the Spinning Manage candlestick can also be whether it is impaired in the appropriate context.

Let’s do a handy guide a rough recap of all that we’ve realized!

Conclusion

On this article, you realized:

-

A Spinning Manage candlestick is a petite to medium candle that tells you that there’s an hesitation out there

-

A Spinning Manage candlestick additionally means that a top volatility proceed is set to happen

-

Buying and selling with the Spinning Manage candlestick as a development reversal sign and the usage of it in isolation is a sure-fire technique to bust your account

-

The use of the Flag trend supplies you a easy technique so that you can cash in with the Spinning Manage candlestick

I’m hoping you loved and received a bundle of price from this publish!

Now, a handy guide a rough query for you,

What was once your maximum impressive takeaway from this publish?

I’m keen to grasp!

I appreciate it!

Disclaimer: The contents of this newsletter are for tutorial functions simplest. They aren’t to be constituted as monetary recommendation.