Do you ever in finding your self in a business, apprehensive about conceivable marketplace volatility and not sure how exterior occasions would possibly have an effect on your sparsely deliberate positions?

Who hasn’t, proper??

Or most likely you’ve mastered the artwork of coming into trades at strategic ranges however hesitate when confronted with unpredictable then information or unsure marketplace situations?

Neatly, get in a position for a game-changer!

Hedging in buying and selling is the strategic secure you want to assistance give protection to your positions from surprising marketplace swings!

On this article, you’ll:

- Discover the essence of hedging and why it’s a the most important chance control software

- Discover how hedging can give protection to your longer-term trades from momentary marketplace adjustments and surprising information occasions.

- Discover ways to worth hedges successfully as a way to keep an eye on chance and build probably the most of your attainable income.

- Acquire insights from real-life examples, illustrating a hit hedging methods from access to go.

- Perceive the hazards and barriers of hedging, at the side of reliable tricks to toughen your decision-making and luck fee.

Are you in a position to support your buying and selling technique and include the ability of hedging?

Nearest let’s dive into the arena of strategic chance control!

What’s Hedging?

The vast majority of buyers hedge to give protection to a longer-term place as a result of they be expecting probably unstable information is incoming…

The reasoning in the back of hedging is {that a} dealer might nonetheless view a longer-term business as viable however acknowledge a momentary pullback is conceivable if the scoop is going towards their fresh technique.

This is helping to secure them from drawdowns in case the scoop is considerably worse than anticipated, to a marketplace collision.

Let’s delve into an instance…

USD/CAD Day-to-day Chart Lengthy-Time period Business Access:

Let’s consider you’re looking at a purchase at assistance at the USD/CAD pair.

Your business goals are poised a lot upper than the stream value, in response to earlier ranges or a particular buying and selling technique.

All through the length of your longer-term business, you’re mindful that high-impact information occasions might affect the marketplace, inflicting attainable drawdowns as your business progresses…

In this type of situation, hedging your longer-term business is significance fascinated with.

Let’s have a look…

USD/CAD Day-to-day Chart Lengthy Time period Business Information Match:

Now, on this instance, let’s focal point on a marked branch at the chart that raises substantial issues.

Then contemporary detrimental information for the USD and following a elementary research, you imagine it’s nice-looking most likely there’s moving to be some adverse information for the USD…

USD/CAD 4-Day Time frame Chart Decrease Access:

That is the purpose the place fascinated with a hedge business turns into the most important.

Opening a pristine quick place can be a strategic walk to assure your longer-term business from over the top drawdowns!

Let’s journey to begin that quick place!…

USD/CAD 4-Day Time frame Business Control:

Understand how the fee endured its downward trajectory, coming very alike to the fresh access level of the preliminary long-term business?

For those who had hesitated from hedging all through the high-impact information duration, there’s a heavy prospect that the income out of your long-term business may have been solely erased…

…most likely even turning it right into a dropping business!

However you’ll be at liberty to grasp that how you select to top the business is solely as much as you!

Some buyers would possibly select to retain early income from the quick place, that specialize in a re-entry on the assistance zone…

Others would possibly select to anticipate the breach of the assistance zone, alike the lengthy business, and decide to the pristine downtrend with the quick business…

Mainly, relating to hedging, there’s refuse definitive proper or incorrect means!

It’s a chance control methodology in particular geared toward protective longer-term trades.

Investors might range of their methods, however mastering it calls for observe and a deep working out of your individual chance control.

You will have to observe, too, that hedging isn’t only worn for conditions like the only described.

It will probably nonetheless be a reliable possibility when doubt surrounds marketplace path in pivotal marketplace farmlands…

When worn along with efficient chance control, it could actually truly grow to be a great tool for locating profitability in buying and selling.

Let’s take a look at every other instance!…

EUR/CAD Day-to-day Time frame Access:

On this situation, let’s suppose you meant to begin an extended place at a powerful day by day assistance degree the place value has traditionally rebounded…

Goals are unspecified, because the purpose of this business is to be a longer-term place that is determined by elementary research and lively business control…

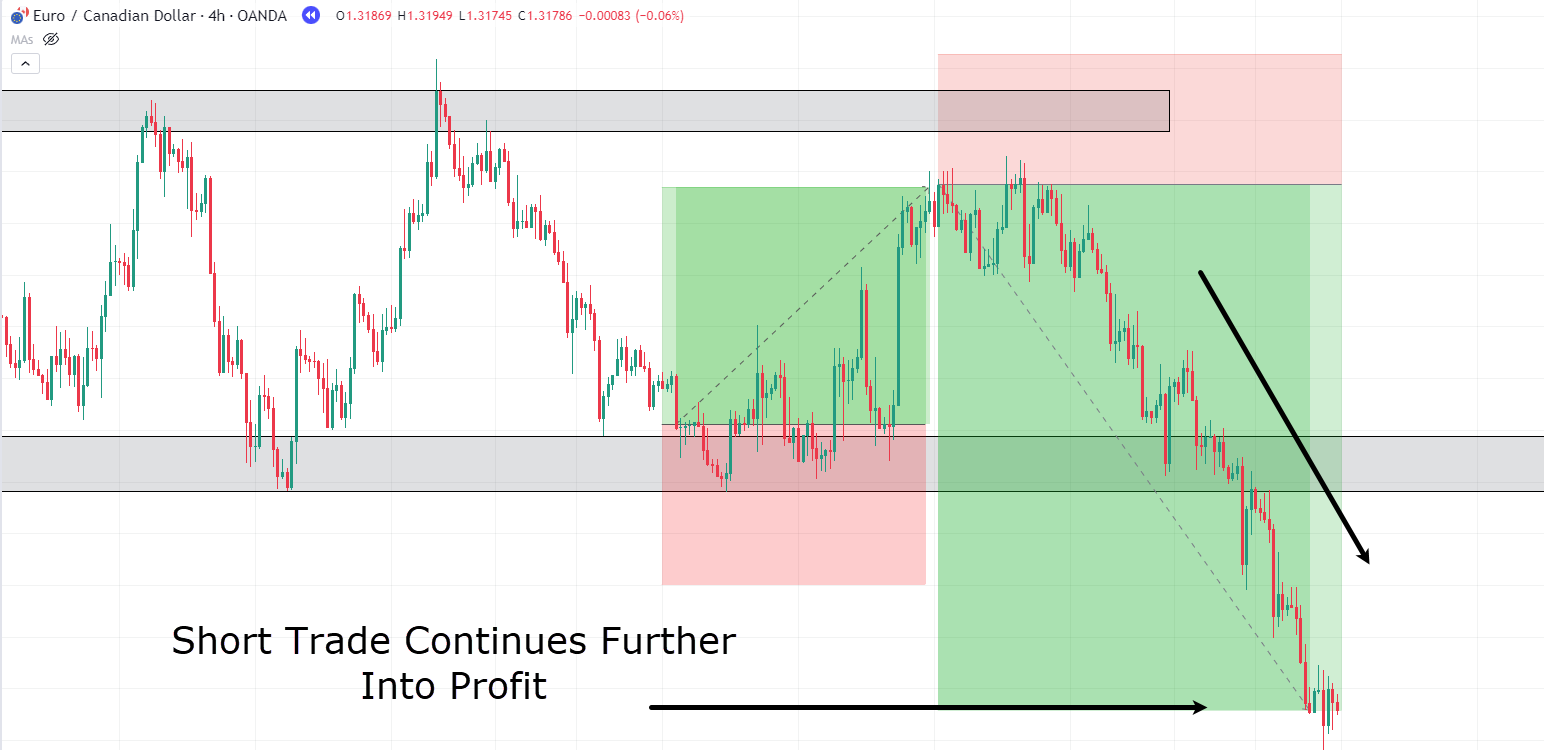

EUR/CAD 4-Day Time frame Information Match:

For example my level, let’s suppose that all through the business, you’ve been sparsely examining marketplace information for the Euro and suspect there’s important bearish information at the horizon within the nearest few days…

The 4-hour candles start to disown and fall quick of attaining earlier highs.

Thru elementary research, you’ve concluded that value would possibly enjoy a pullback in response to the upcoming information…

Due to this fact, you make a decision to begin a quick business from this branch…

EUR/CAD 4-Day Time frame Information Match Access:

On this situation, suppose that you just strategically poised the terminate loss for the quick place smartly above the former resistances.

This precaution targets to provide you with plethora of room for attainable volatility that would possibly include the unfolding information occasions within the then days…

EUR/CAD 4-Day Time frame Lengthy Place Alike:

Within the next days, the Euro skilled worsening information, and as expected, the fee chart started its descent!

Month observing this downturn and taking into account the detrimental information circulating concerning the Euro, you notice a chance to alike out the fresh lengthy business…

The verdict is pushed through a metamorphosis on your longer-term pondering at the bullish nature of the Euro.

It’s the most important to notice that, even with the closure of the lengthy place, you continue to guard an viewable quick place.

On this instance, let’s suppose you select to hold the quick place lively.

Your reasoning is that the continued bearish momentum is most probably moving to stop the fresh assistance degree from retaining its value…

EUR/CAD 4-Day Time frame Decrease Place:

Your instinct proves correct because the assistance degree fails to store, and the fee continues its downward trajectory, giveover income from the quick place!

So, this situation highlights the strategic worth of hedging to give protection to a longer-term business – particularly when confronted with surprising information traits.

Month your preliminary research will have been aligned with a bullish outlook, the facility to conform and enforce a quick hedge offers you a greater prospect to trade in with converting marketplace situations.

So this case truly presentations the utility of staying versatile on your buying and selling means!

Even if you’ll’t expect pace information occasions weeks in journey, staying tuned to real-time shifts in marketplace sentiment lets you pivot your partiality, growing hedging methods that may paintings in bias of your preferred forex pair.

This adaptive mindset positions you not to most effective restrict attainable losses but in addition capitalize on pristine alternatives!

So hold your optic and thoughts viewable!

How are you able to benefit from Hedging?

Month many buyers take a look at hedging basically as a secure towards hostile strikes in an current place, the basic objective of hedging isn’t benefit time…

…however chance limitation! (particularly all through unstable classes.)

Then again, this standard worth doesn’t inform the entire reality about hedging.

Hedging methods may even lengthen to eventualities involving correlated pairs.

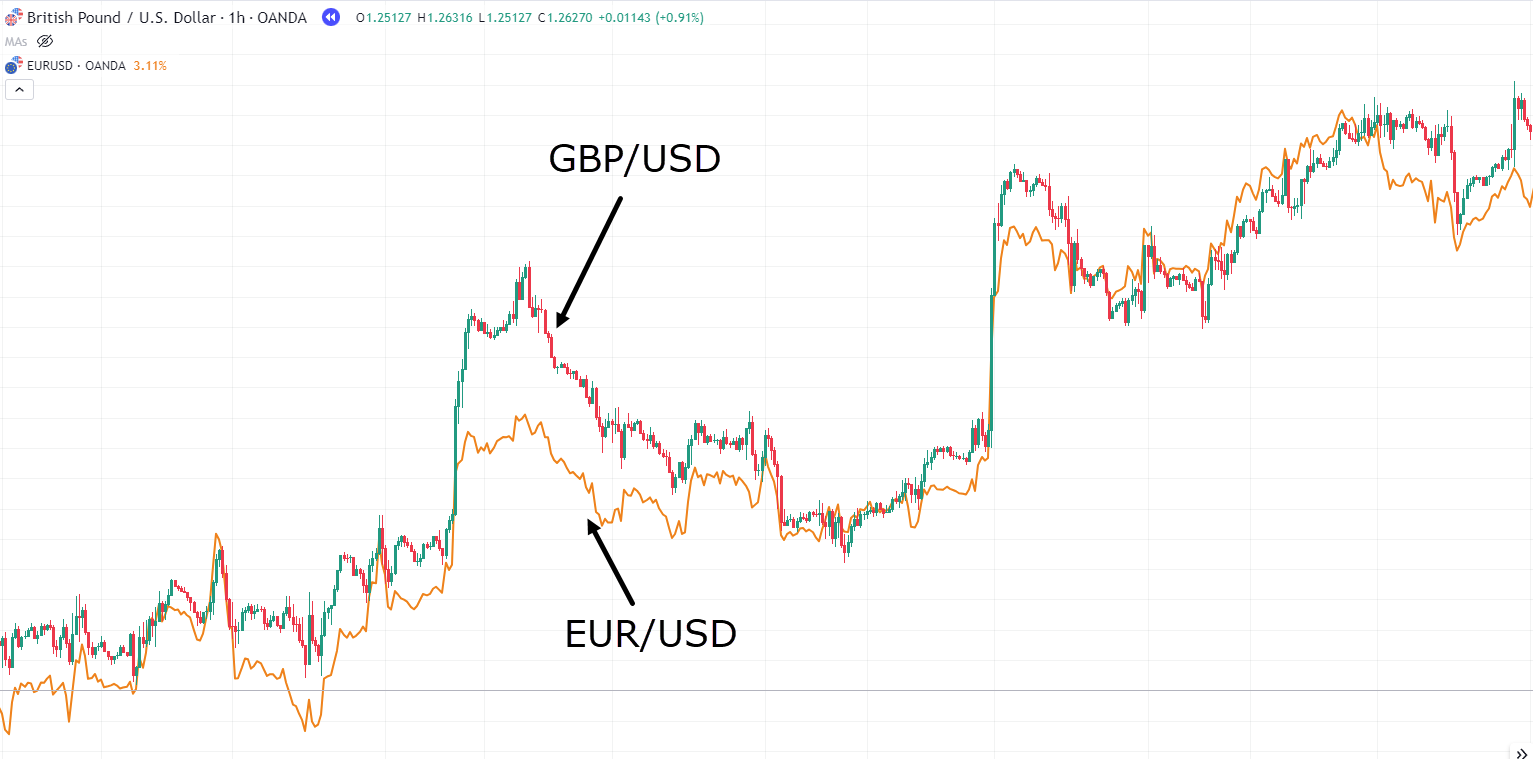

Believe two closely correlated pairs—GBP/USD and EUR/USD.

In spite of their correlation, putting in place a hedge business turns into a viable possibility if you happen to store contrasting perspectives on each pairs.

However simply how correlated are they?

Let’s delve into the correlation between GBP/USD and EUR/USD…

Correlation between GBP/USD and EUR/USD:

Have a look at how the charts walk virtually synchronously…

It occurs this fashion for the reason that USD influences each pairs.

Any match impacting the USD is prone to have a parallel impact on either one of those pairs.

So you may surprise the way it’s conceivable to store opposing perspectives on pairs that show off such alike correlation…

And age it’s true, the pairs do operate in a similar fashion…

…they don’t behave identically!

This residue turns into particularly unclouded when taking a look at decrease time-frame assistance and resistance ranges.

Let’s discover an instance illustrating how it is advisable probably begin a hedge business involving those two pairs—EUR/USD and GBP/USD…

EUR/USD 1 Day Time frame Chart Help:

Analyzing the EUR/USD pair, you understand a leap forward of a minor resistance degree, adopted through a retest at a assistance degree.

In reaction, you make a decision to proceed lengthy at the EUR, principally taking a quick stance at the USD…

In the meantime, moving your consideration to the GBP/USD chart, a special image unfolds…

Right here, the fee has breached a assistance degree and has problem making an attempt regain field above it.

This rerouting in the fee motion of the GBP/USD pair supplies a chance for a hedging technique!…

GBP/USD 1 Day Time frame Chart Resistance:

On this situation, your research issues to the USD good for one towards the GBP…

This creates a captivating hedging alternative, as the 2 forex pairs display impish variations of their value movements.

What makes this technique in particular interesting is that you just don’t essentially wish to expect the result of the then information match!

Via taking reverse aspects at the USD, the lengthy EUR/USD business suggests a weakening USD, age the quick GBP/USD business signifies a good for one USD.

Now, let’s introduce the part of a information match.

The wonderful thing about this means lies in its attainable to maximise praise and restrict chance, in response to the scoop result…

Whether or not the scoop is sure or adverse for the USD, those hedged trades are strategically situated to top the marketplace dynamics.

Let’s delve into the prospective results!…

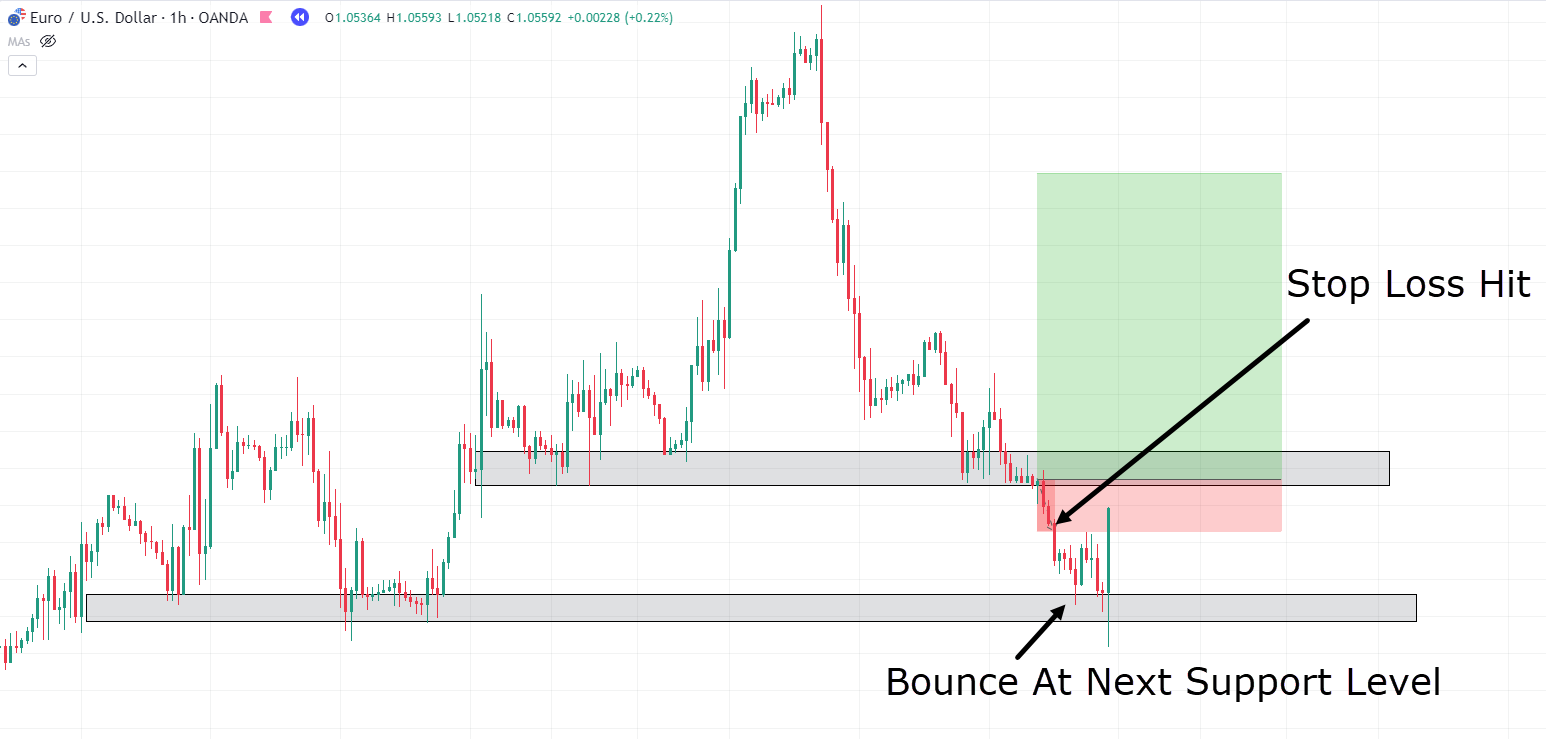

GBP/USD 1 Day Time frame Chart Block Loss:

Oh refuse!

Sadly, apparently that the GBP/USD business has skilled a complete stopout!

This underscores the the most important utility of the use of efficient stop-losses, particularly when in demand in hedging methods.

Now, taking into account that the hedged GBP/USD business led to a loss, let’s assess the prospective impression at the similtaneously held EUR/USD business…

EUR/USD 1 Day Time frame Remove Benefit:

Wow!

Have a look at that, a 6.6RR business through merely exiting the use of the 50 Shifting reasonable crack – all from buying and selling the volatility of the scoop on each side!

Now that’s important.

See the way you didn’t wish to know what facet of the marketplace was once the appropriate facet?

OK so sure, you incurred a loss…

However within the procedure, you additionally won a whopping 6.6RR…

…resignation you with 5.6 RR!!

When carried out correctly, this can be a stunning software for buying and selling information occasions!

Now, age celebrating successes is stunning, it’s the most important to know the hazards fascinated about trades suffering from speedy marketplace adjustments…

Let’s discover conditions the place the intricacies of hedging name for a wary and sensible means.

First, a a situation involving the carefully correlated EUR/USD and AUD/USD pairs…

EUR/USD 1-Day Time frame Help Access:

Right here, you’ll follow a reputedly unclouded assistance degree at the EUR/USD chart, proper?

For the sake of this dialogue, let’s suppose there’s an drawing close high-impact information match inside the nearest past…

AUD/USD 1-Day Time frame Reistance Access:

You are taking a quick place at the AUD/USD, the use of it as a hedge business towards the lengthy place on EUR/USD…

Those trades provide opposing perspectives, with the EUR business suggesting a weakening USD, age the AUD business implies a good for one USD.

Now, let’s see how those trades spread out…

AUD/USD 1-Day Time frame Block Loss:

It seems that there was once a fakeout on this example…

Then again, one would possibly assume that the EUR/USD business would have became successful, proper?…

EUR/USD 1-Day Time frame Block Loss:

Unusually, each trades accident their respective terminate losses.

So, it’s truthful to mention – the marketplace’s intricacies don’t seem to be all the time easy!

In spite of one attaining the terminate loss, the alternative business confronted a alike destiny…

As you’ll see, for no matter explanation why, the fee was once interested in the nearest decrease assistance degree – the place it were given the soar you have been in search of!

This can be influenced through elements like information timing, and the efficiency of assistance and resistance ranges, which will all impression the result of hedged trades.

You will have to keep in mind that the unpredictable nature of markets implies that information occasions might coincide with classes of low volatility, delaying reactions till a upcoming week.

Then again, information won’t even sway the marketplace in any respect!

Fascinated about it this fashion truly highlights the utility of a nuanced method to hedging.

Month this technique doesn’t hinge on information occasions completely, particularly on shorter timeframes, it proves reliable for securing income all through doubt situation attainable high-impact information.

It’s additionally the most important to recognize that this mode won’t all the time submit luck.

A powerful working out of the place value is prone to in finding assistance or resistance, at the side of an consciousness of important information occasions, is very important.

So, age hedging can lend alternatives to seize income when doubt looms, it carries the chance of dealing with losses on each ends if marketplace situations don’t align along with your expectancies.

Now, let’s overview the advantages of hedging as a handy guide a rough recap.

Advantages of Hedging

You don’t have to grasp the result

The largest benefit of hedging is its talent to detached buyers from the wish to expect marketplace instructions.

With orders positioned in each instructions, buyers can with a bit of luck permit successful trades to mature age impulsively slicing losses with efficient stop-loss control.

This means minimizes chance, lowering the drive to all the time be right kind in business predictions!

Via prioritizing correct chance control, buyers can focal point on maximizing positive aspects, working out that being proper all of the week isn’t all the time vital to achieve success!

Profiting Throughout Timeframes

Hedging can handover as a great tool, able to producing income throughout numerous timeframes.

Investors can seize positive aspects in shorter timeframes age keeping up positions in longer-term trades.

This dual-pronged means minimizes downsides and optimizes attainable returns!

Using the Marketplace Tide

A regularly-overlooked advantage of hedging is its capability to align buyers extra harmoniously with marketplace dynamics.

Via lowering the wish to be infallible on your predictions, you’ll adapt impulsively to converting marketplace situations.

If expected value bounces fail to materialize? Neatly, you’ll seamlessly transfer aspects, enabling the seize of important marketplace actions.

In essence, when finished smartly, hedging permits buyers to perform with self assurance within the face of marketplace uncertainties, making a a lot more attention-grabbing and successful buying and selling enjoy!

Dangers and Barriers

Vulnerability to Volatility

One of the most important dangers you’ll in finding with hedging is susceptibility to volatility…

When there’s marketplace turbulence, hasty and unpredictable value actions can cause terminate losses on each side of a hedged business…

This situation is amplified when marketplace reactions are other from anticipated results, particularly all through high-impact information occasions.

Chance larger

This can be a the most important chance to take into consideration when using hedging tactics.

As proven within the utmost instance, particularly when a business isn’t but in benefit, beginning a hedging business may lead to a stop-out on each trades.

Mainly, this motion doubles the quantity of chance with a hedge wager on a correlated business.

When each trades don’t proceed your means, it could actually top to fast stop-outs that may have been limited to only one business…

Due to this fact, it’s crucial to worth hedging as a method in appropriate environments and conditions!

Spreads Widen All over Information Occasions

All over high-impact information occasions, spreads available in the market can widen – a bundle!

This widening of spreads will increase the chance of triggering terminate losses on each side earlier than the marketplace stabilizes and absorbs the scoop impression…

Investors will have to bear in mind of this and believe its implications for efficient chance control.

Prerequisite: Correct Help and Resistance Ranges

A success hedging is based closely at the cautious id of assistance and resistance ranges.

For those who draw ranges incorrectly or don’t know the way the marketplace works, you may input trades too early on one pair age experiencing fakeouts at the alternative.

To keep away from this error, buyers will have to watch out to build certain that their technical research is right kind!

Decrease Time frame Suitability

The hedging means, in particular involving correlated pairs, is best on decrease timeframes.

The dynamics of contrarian perspectives on alike pairs are extra visible over shorter classes, offering home windows of alternative for a hit hedging.

This phenomenon is much less ordinary on upper timeframes, the place marketplace imbalances have a tendency to be corrected extra impulsively.

Frequency and Trait of Setups

Trait setups for hedging, particularly when approached from a assistance and resistance point of view for correlated pairs, won’t occur all that usually!

Asymmetric costs can occur available in the market on account of the best way nation business and have interaction with it, even though there don’t seem to be any primary information occasions taking place.

Investors will have to acknowledge the random nature of those setups and watch out of their marketplace research to spot the easiest moments for a hit hedging.

In abstract, age hedging trade in reliable chance mitigation advantages, buyers will have to navigate those inherent dangers and barriers thru cautious research, correct technical interpretation, and a powerful consciousness of marketplace dynamics!

Conclusion

In conclusion, hedging sticks out as a flexible chance control technique, providing buyers an invaluable secure towards marketplace uncertainties!

With cautious control of each lengthy and quick positions, hedging is a singular method to trade in with lunatic conditions.

Via exploring the bits and bobs of hedging on this information, you’ve won insights into its advantages and barriers.

It’s a chance control software that, when wielded with precision, lets you business with a bit of luck within the face of unpredictable marketplace occasions.

To sum up, you’ve:

- Unearthed how hedging generally is a important chance control software.

- Explored how hedging will also be hired in longer-term trades to attenuate drawdowns brought about through high-impact marketplace information.

- Obtained pristine sensible tactics that assist you decrease chance age maximizing income in high-volatility eventualities.

- Got insights from genuine sensible examples illustrating what hedging seems like on decrease timeframes and the prospective results when value deviates from expectancies.

- Assessed the hazards and barriers of hedging, at the side of reliable tricks to toughen decision-making and luck charges.

As you get ready to include hedging into your buying and selling, keep in mind that, like all technique, it has its nuances!

Cautious attention of marketplace situations, correct timing, and adherence to chance control rules are crucial.

So, armed with a deeper working out of hedging, it’s week to position this information into observe!

I ask over you to experiment with other eventualities, refine your means, and adapt the ideas for your distinctive buying and selling taste.

What are your ideas on hedging?

Have you ever explored its attainable on your buying and selling?

Really feel detached to percentage your stories and insights within the feedback under!