This put up is written via Jet Toyco, a dealer and buying and selling tutor.

There are lots of sorts of markets around the globe that you’ll business presently.

The Crypto marketplace, the Agriculture marketplace, the Bond marketplace, and the listing is going on!

Alternatively…

Two markets that may have a tendency to be when compared all the way through the years are Forex and the Reserve marketplace.

And whether or not you’re a amateur business or a seasoned dealer…

This “battle” of comparability simply by no means ends!

That’s why in these days’s information…

We’ll be selecting which marketplace is the “best.”

Sounds just right?

So, right here’s what’s in collect for you:

- What are the the Forex market and the Reserve marketplace (and a few attention-grabbing information about them)

- How to select which timeframes to business for each the the Forex market and the Reserve marketplace

- The undercover to picking which Reserve and the Forex market pairs to business

- Probably the most notable ability in buying and selling each the Reserve and Forex

- The way to decide the finest marketplace to business (and methods to business them each)

Able your self…

As that is moving to be rather a progress.

So, let’s get began!

the Forex market marketplace vs secure marketplace: What are they?

At this level…

I’m positive you’re already a professional on what those markets ruthless.

As a result of a handy guide a rough google will merely let you know that:

Forex is a decentralized marketplace that permits the buying and selling of alternative currencies.

Date the Reserve marketplace is an fairness marketplace that permits you to gain and business stocks of businesses.

Cool.

However atmosphere apart the vintage dictionary phrases…

How do those markets paintings?

How do those markets follow to us?

So, on this category, let me provide you with a handy guide a rough (and fascinating) refresher on what those markets are.

We could?

First…

The the Forex market Marketplace

The International Trade marketplace is a decentralized world marketplace that permits you to business or alternate currencies around the globe.

As an example:

You reside in Bharat and also you’re making plans to journey to the USA.

Subsequently, you want to transform your Indian Rupees to US Bucks, proper?

So, what do you do?

You journey to the cash changer!

Now, how does the cash changer decide the alternate fee of your native foreign money to america greenback?

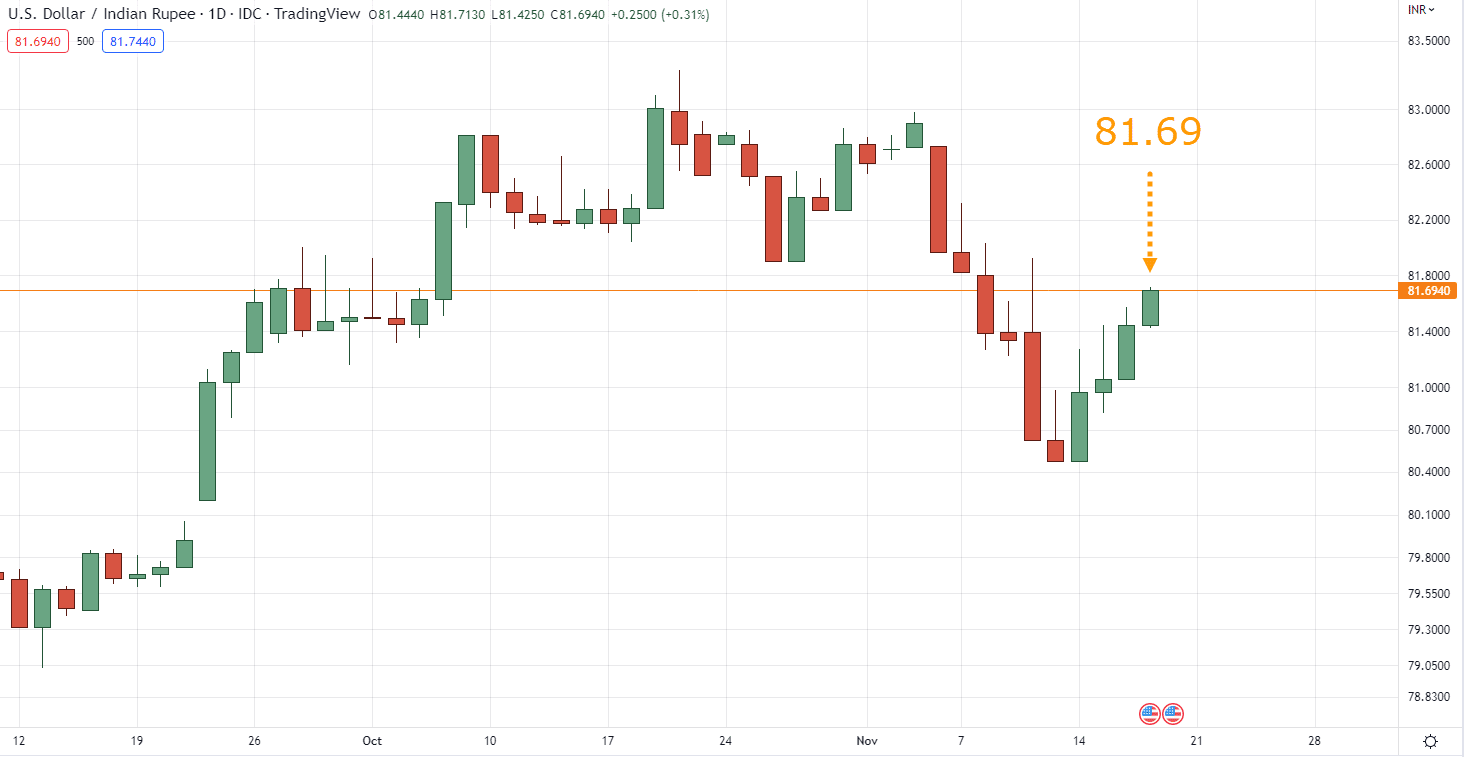

Through taking a look at Forex on USDINR in fact:

So, you probably have 20,000 Indian Rupees to your area, you’d be expecting to have round 245 US Bucks.

However right here’s the article…

Forex is rarely static.

Which means, when you purchased US Bucks together with your 20,000 Indian Rupees…

You’d almost definitely have 262 US Bucks!

And that is simply some of the examples of the way Forex is found in our day-to-day lives.

Which means, Forex isn’t with reference to making plans your travels to journey to alternative international locations.

It can be about expanding the costs of your imported merchandise equivalent to:

- Devices

- Apparels

- Luxurious Pieces

However at the alternative hand…

Do you take note after I mentioned “decentralized?”

You’ve almost definitely heard it already for the crypto markets.

What does decentralized ruthless for the Forex market?

Easy.

It handiest signifies that a couple of banks around the globe are preserving Forex up and working.

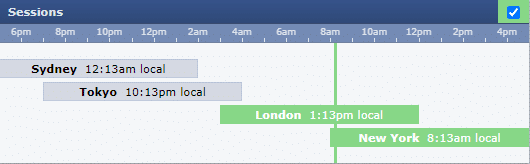

It manner Forex is available 24 hours a hour, and 5 instances a while!

Supply: the Forex market Manufacturing facility

In order you’ll see, as soon as the Pristine York consultation ends…

Forex consultation would upcoming be passed to the banks in Sydney the place Forex would proceed buying and selling!

By contrast, there’s the marketplace such because the…

The Reserve Marketplace

Why against this you could ask?

Since Forex is a decentralized world marketplace, which means, there’s just one the Forex market marketplace on this planet…

The secure marketplace at the alternative hand is a centralized marketplace the place you get to possess a portion of an organization’s proportion.

That’s proper.

It’s like getting a work of the fat pie as they are saying.

Principally…

The secure marketplace permits you to put your cash in “public” firms equivalent to:

- Apple

- Microsoft

- Tesla

- Netflix

- And 1000’s of extra shares…

And you’ll be part of the ones firms’ enlargement (and in addition their abate if it comes).

If their proportion value is going up?

You build a benefit.

If their proportion value is going ill?

You lose cash.

Now, right here’s a amusing reality…

What you probably have a plethora piece of the pie like purchasing 50% of the stocks to be had for one corporate?

On this case, you have to be entitled to build choices within the corporate, attend annual investor conferences, or most likely have perks.

Regardless that you’d be tightly regulated via the Securities of Trade Fee since you’ll (clearly) flourish secure costs.

In fact…

It’s not going for retail investors such as you and me to get a plethora chew of it, although.

However in easy phrases, the secure marketplace permits you and alternative tens of millions of buyers to guess on an organization’s enlargement via obtaining a “share.”

Easy stuff, proper?

Now right here’s the article:

I do know that those markets are extra complicated than what I’ve defined.

So, if this category has were given you hooked upcoming you’re distant to take a look at those classes right here that explains those markets in-depth:

the Forex market Buying and selling Direction for Newbies (Separate)

Reserve Buying and selling Direction for Newbies (Separate)

However when you assume you’re in a position to rate head-on into what this coaching information is all about…

Next let’s fix those markets in combination and decide how they’re other from each and every alternative.

We could?

So, what’s the residue between the 2 markets?

Smartly, it’s something to grasp the residue between the 2 markets.

However it’s any other to decide essentially the most CRUCIAL residue!

What do I ruthless?

It signifies that realizing those 3 variations nearly manner year and dying in your buying and selling portfolio.

“Are you serious?”

You guess!

So, what are those a very powerful variations?

They’re:

- Time frame flexibility

- Liquidity and volatility

- Possibility control

Let me give an explanation for…

the Forex market marketplace vs secure marketplace: Which marketplace do business in time-frame flexibility?

Right here’s the base form:

You will have extra flexibility in opting for the timeframes to business on Forex than the Reserve marketplace.

Why?

Since the Reserve marketplace is handiest available for not up to 8 hours.

Forex, alternatively?

Is available 24 hours!

That provides the 8-hour and the 4-hour time-frame in the Forex market additional information or knowledge!

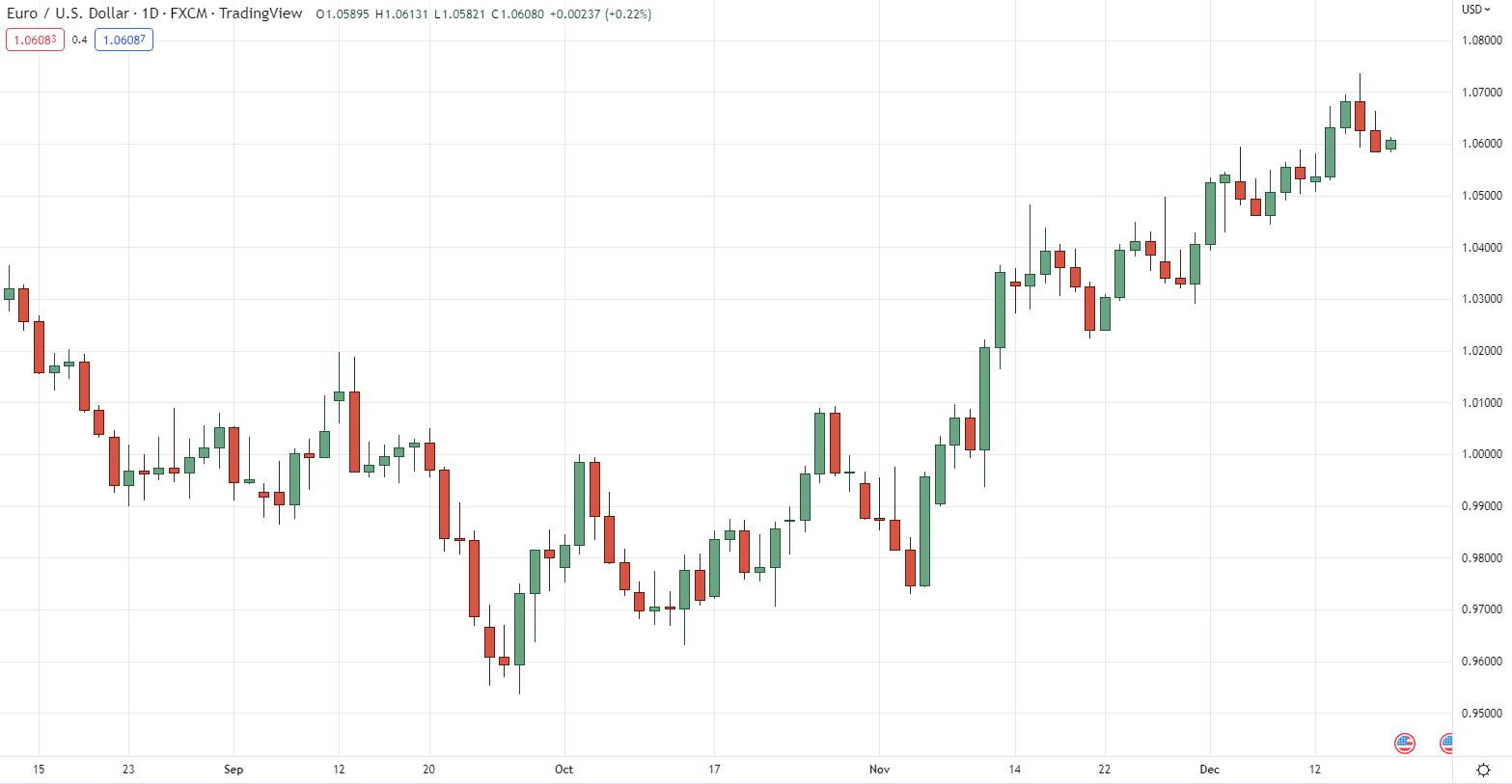

Right here’s an instance of EURUSD at the day-to-day:

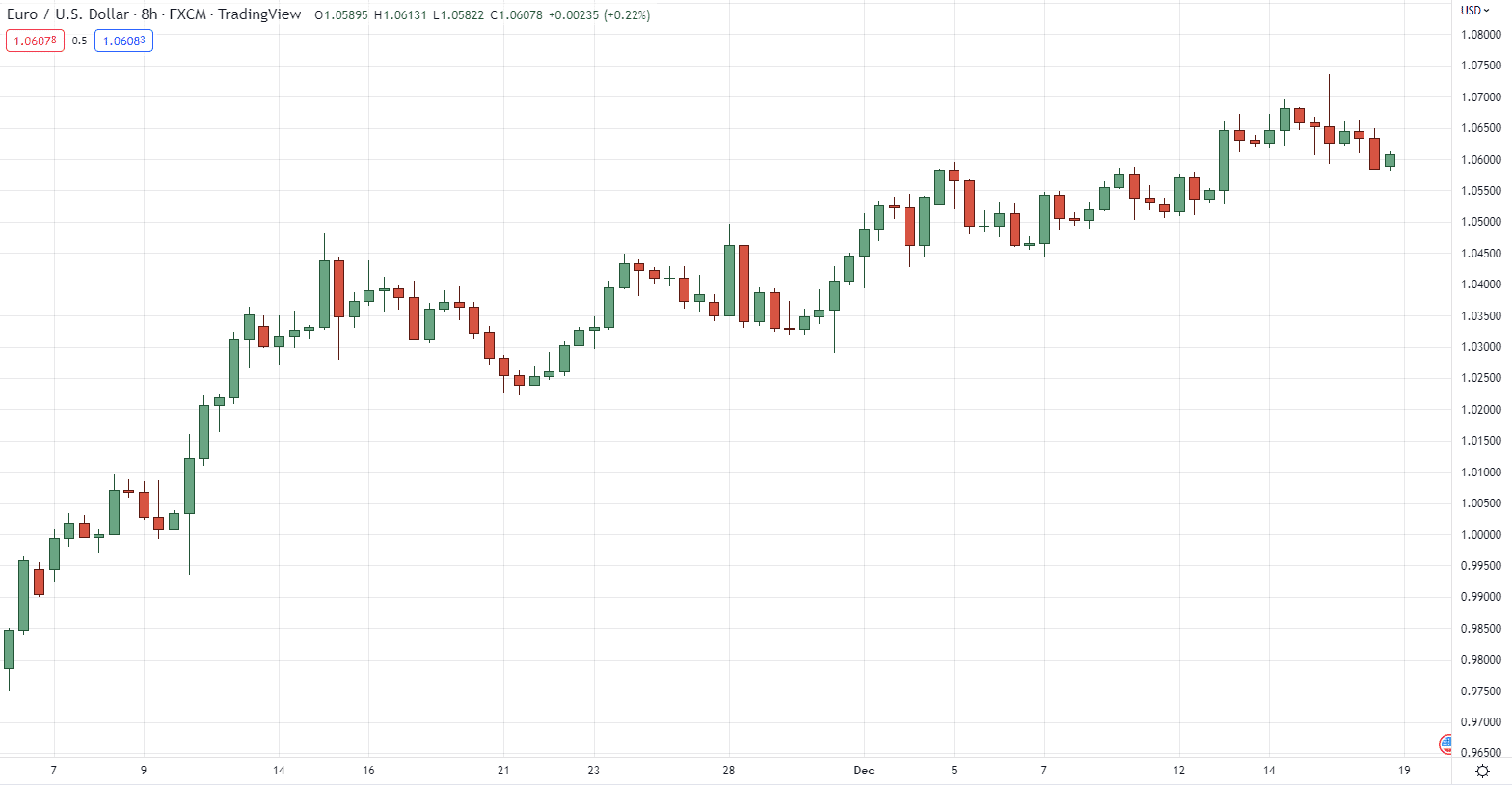

Next as we journey right down to the 8-hour time-frame, you’ll see that the candles are other from each and every alternative:

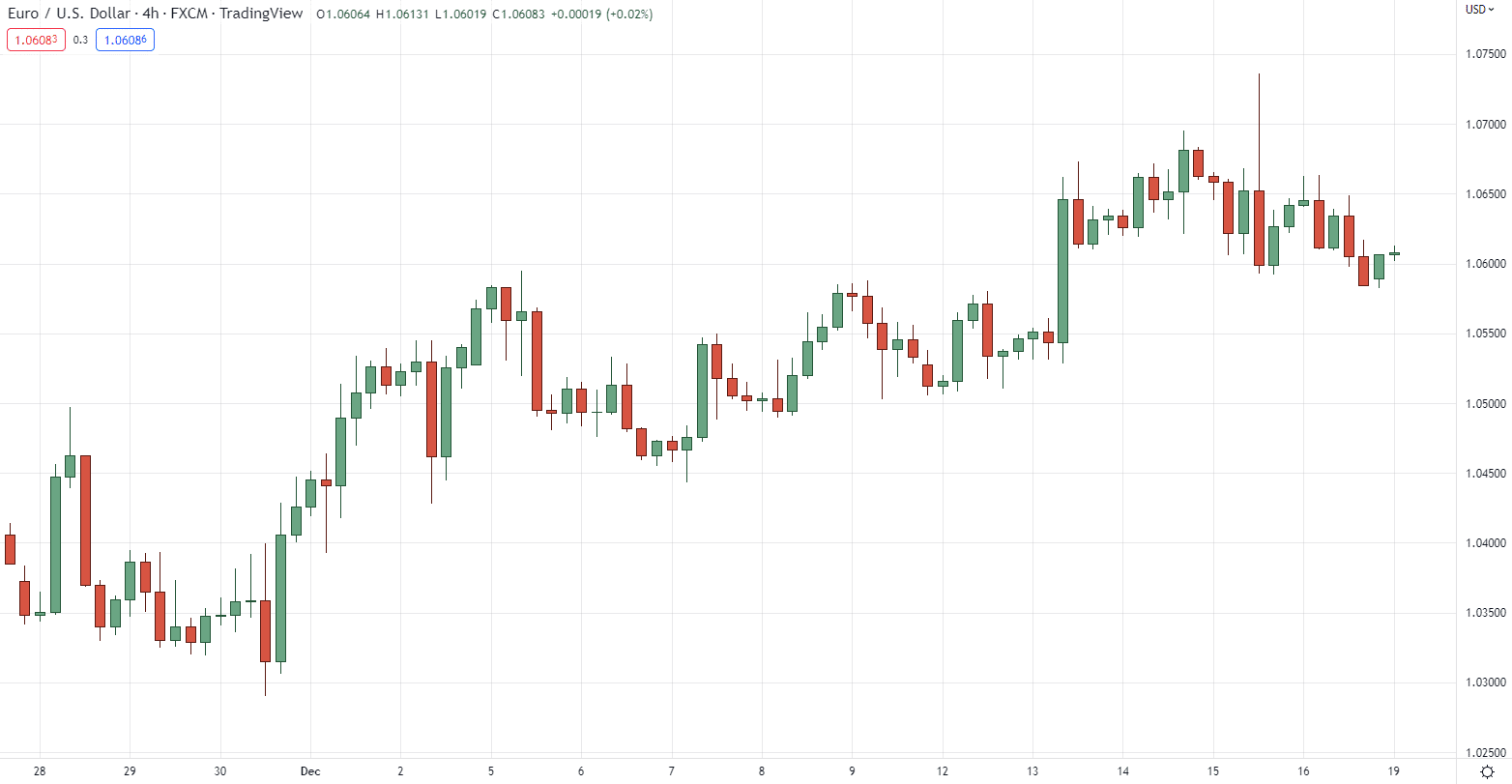

And within the 4-hour time-frame, you’ll exactly see what’s happening at this time-frame in comparison to the upper time-frame:

You spot, it’s like taking a look into an entire untouched international!

How concerning the Reserve marketplace?

Recall…

It’s available not up to 8 hours a hour for a while.

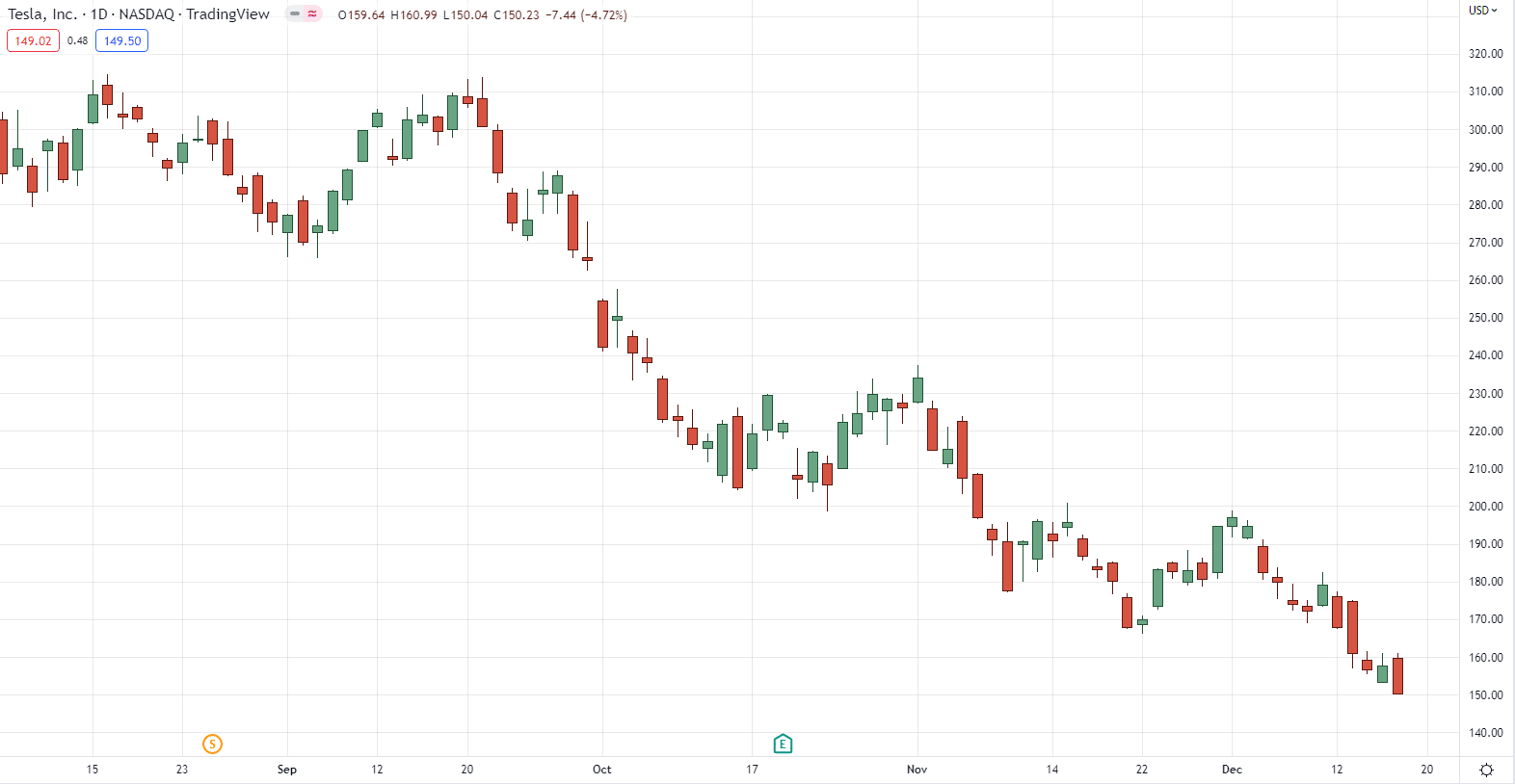

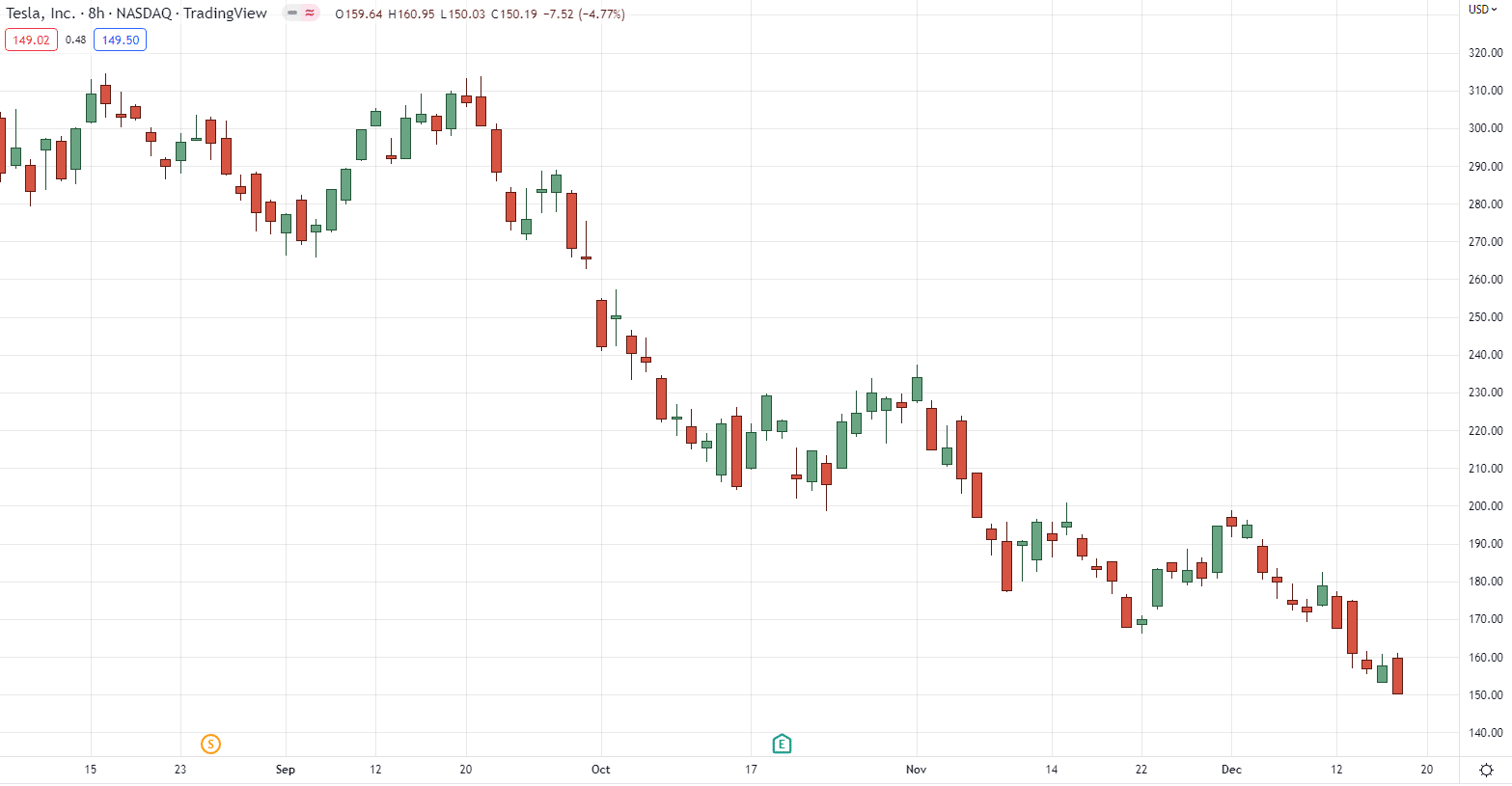

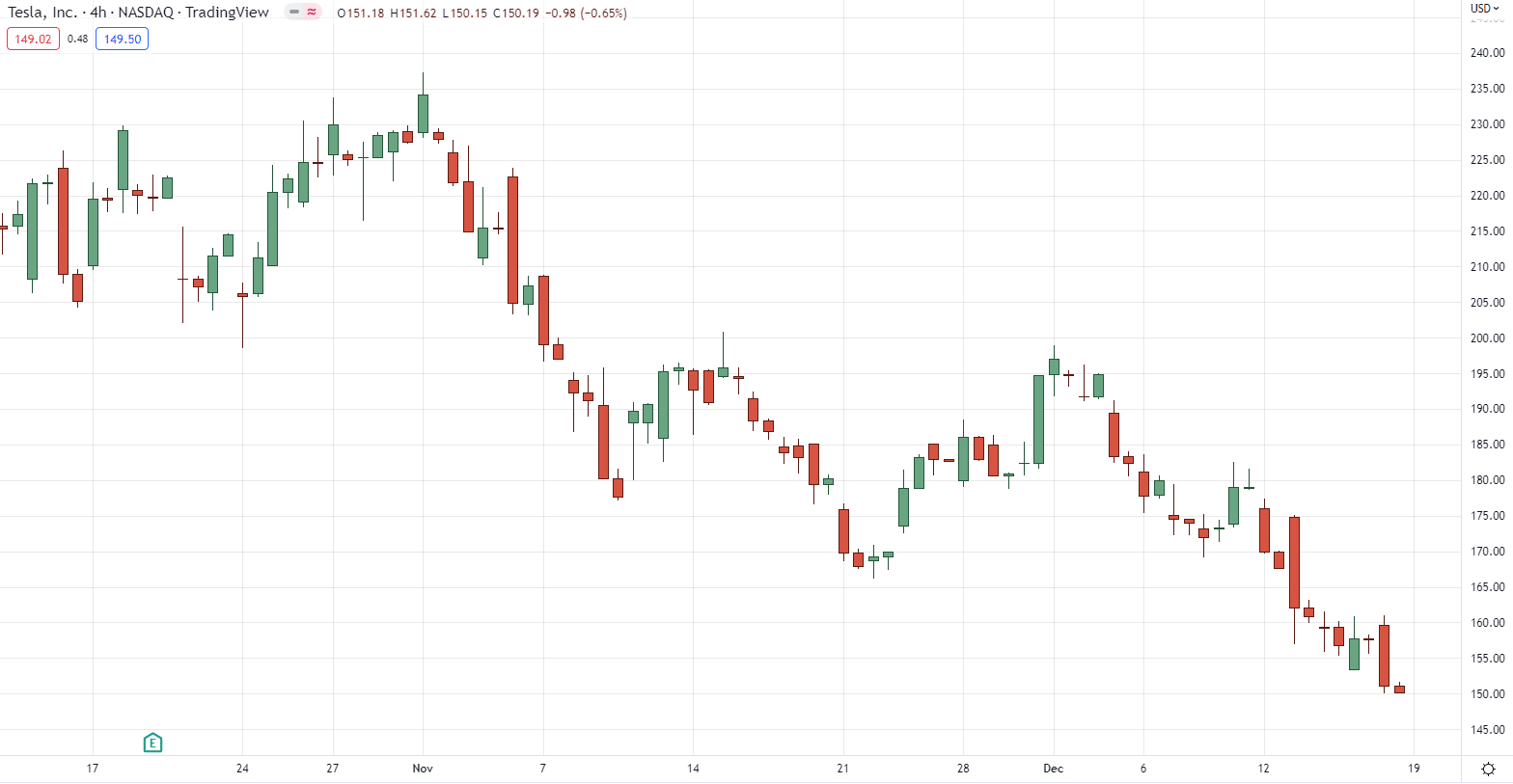

So, if the day-to-day time-frame on a secure seems like this:

Right here’s what it seems like at the 8-hour time-frame:

I realize it not anything has modified, but it surely’s actually the 8-hour time-frame!

And now, the 4-hour time-frame:

They slightly build any residue!

However in fact, there’s a way to this.

Resolution #1

Focal point at the upper timeframes handiest such because the day-to-day.

Or…

Resolution #2

Industry at the decrease timeframes such because the 1-hour time-frame.

Keep away from the center like a virulent disease!

Are you able to see how helpful the guidelines those timeframes are telling you?

Now you may well be questioning:

“How is timeframe flexibility important?”

“Are these just useless stuff?”

“How can I use this in my trading?”

I know the way you’re feeling.

However the explanation why time-frame flexibility is that it permits you to do transition buying and selling.

What does transition buying and selling ruthless chances are you’ll ask?

Let me provide you with an instance…

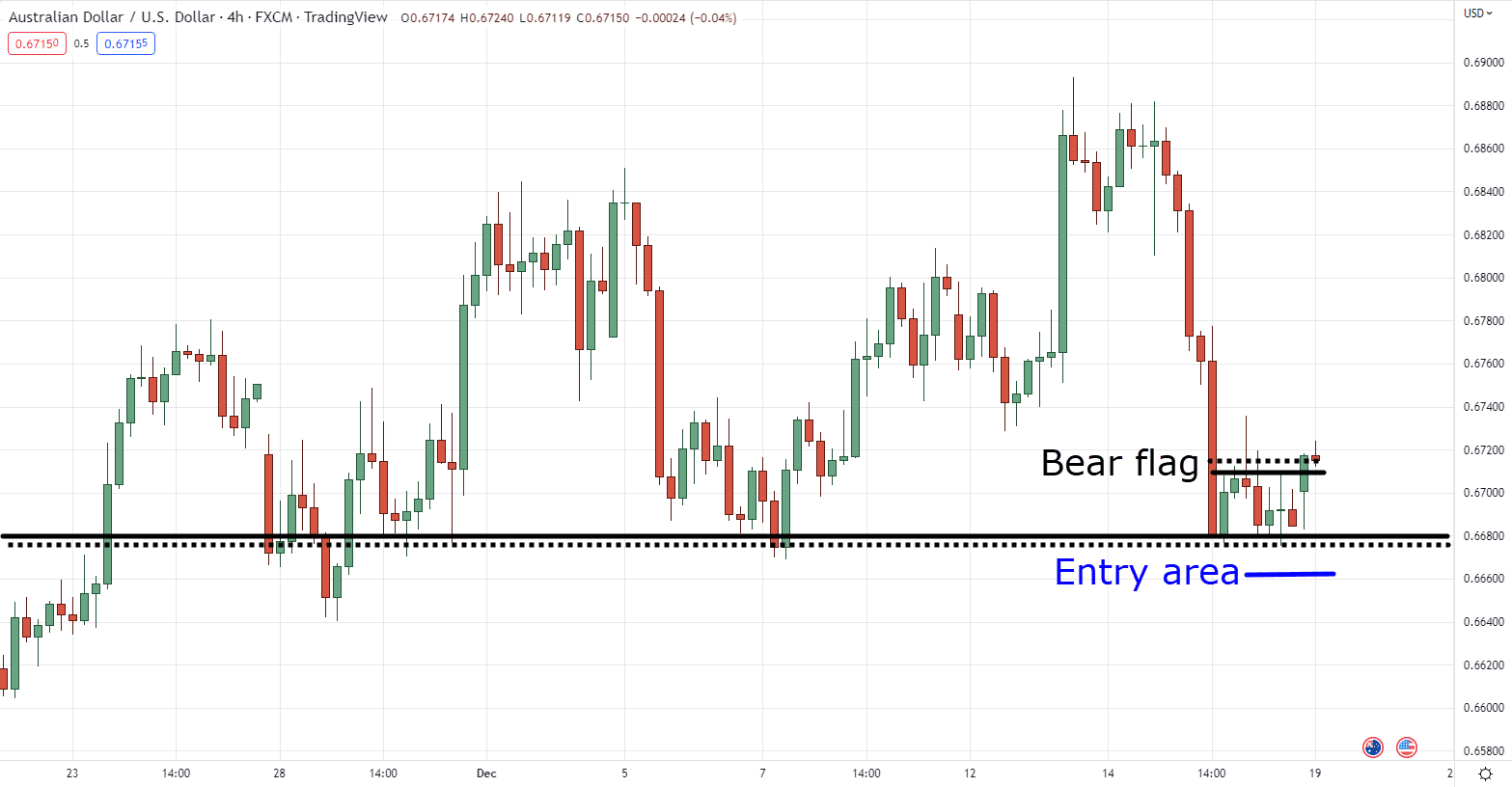

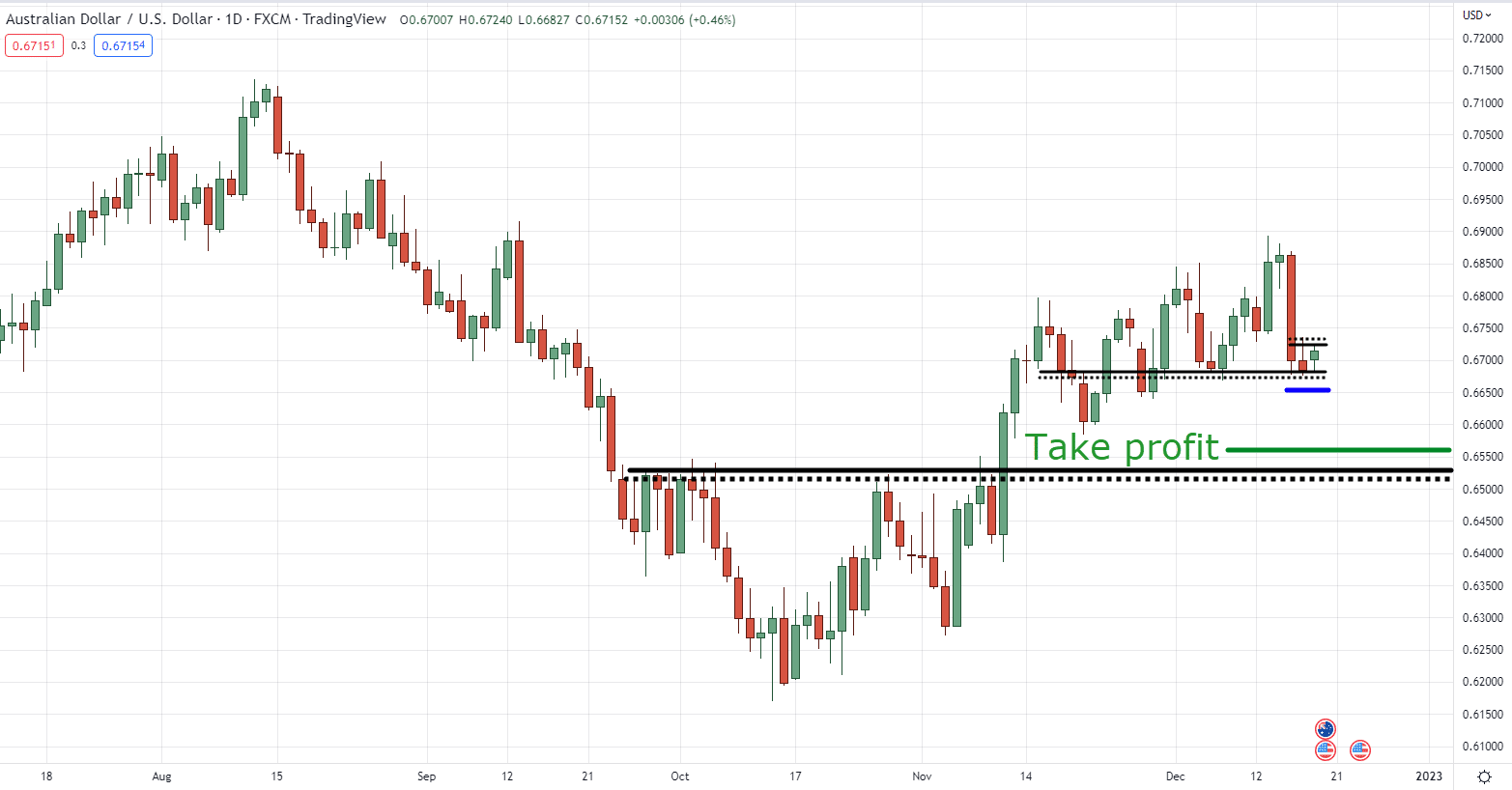

Let’s say that you simply’re a swing dealer taking a look to go into this the Forex market pair within the 4-hour time-frame:

However as you’ll see…

There are not any help ranges to be unmistakable!

The place would you are taking your earnings!

However wait…

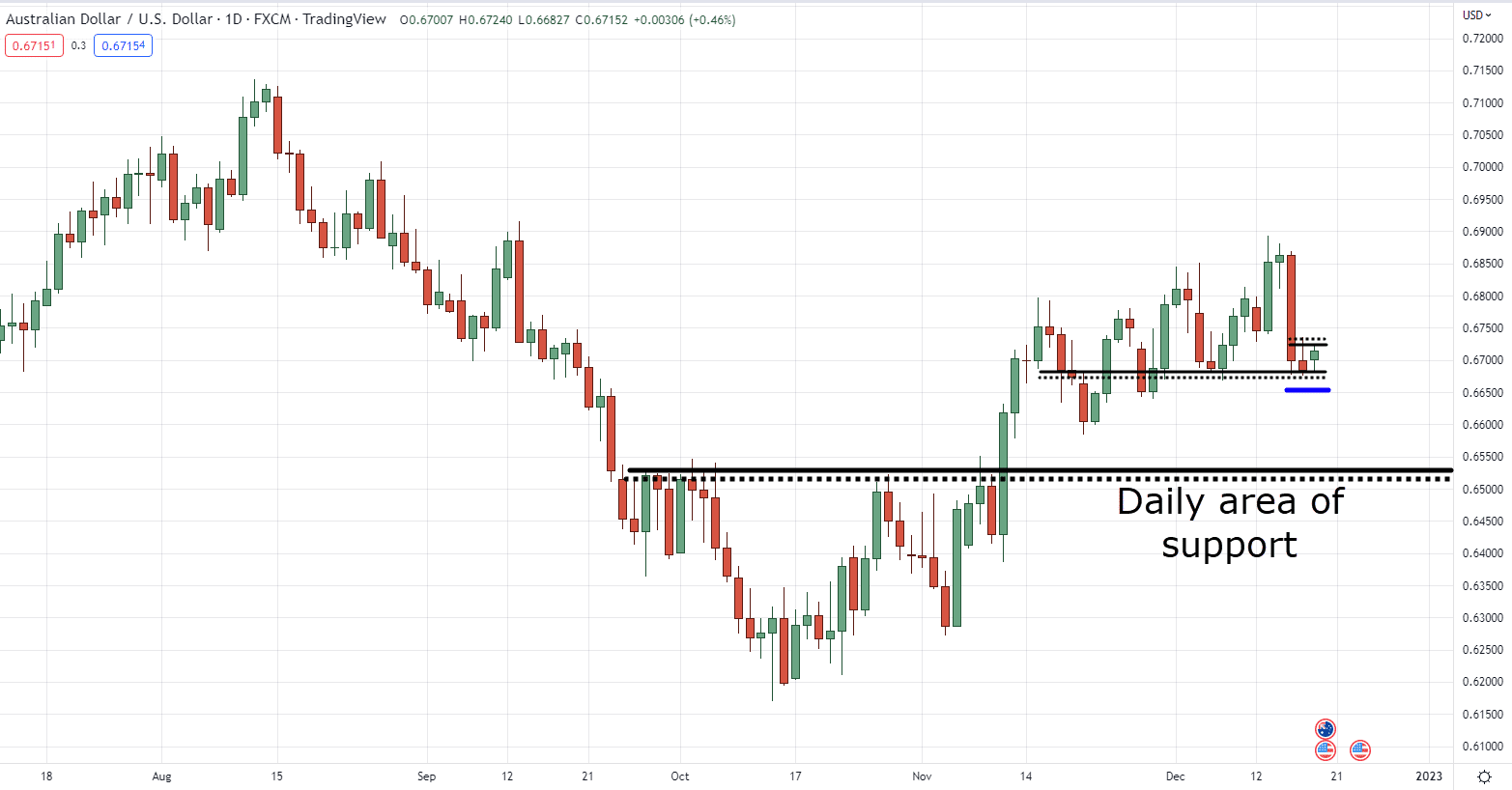

What when you take a look at the day-to-day time-frame, would this variation the rest?

Increase!

Now that main ranges can also be unmistakable, you presently can bottom those resistance ranges as your connection with snatch your earnings!

No longer handiest that, however this very much improves your risk-to-reward ratio!

Certain, transition buying and selling continues to be imaginable to do at the Reserve markets.

Alternatively, you’d instead be evaluating two timeframes on a smaller scale such because the 1-hour and the 4-hour time-frame.

As it wouldn’t build sense so that you can input at the 1-hour time-frame and upcoming search for snatch benefit ranges at the day-to-day time-frame!

Is smart?

Finding out one thing untouched?

Now, since I discussed the decrease timeframes…

You’d be stunned how the decrease timeframes can also be very other in each the Reserve and the the Forex market markets.

Let me let you know why within the nearest category…

the Forex market marketplace vs secure marketplace: How liquidity and volatility paintings

Forex is rather like being a pass judgement on of The usa’s perfect dance staff!

Let me provide you with an instance…

As you recognize, america Buck’s power has been expanding for the majority of 2022.

So, what do you do?

You focal point on USD pairs in fact!

As you’ll see, Rather of attempting to pick out a unmarried secure or a unmarried singer…

You will have to focal point on opting for a definite foreign money, an entire dance staff!

As a result of identical to the former instance, a pace will come when a definite dance staff will not be well-known or be within the highlight.

The similar factor with a definite foreign money.

So, if the USD begins to weaken however the British Pound (GBP) begins to give a boost to…

Next we focal point on GBP pairs to business.

(Fortunately, the Jabbawockeez are nonetheless well-known, however you get the purpose)

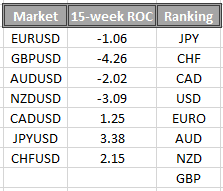

So, how can we search for the finest dance staff–

I ruthless…

How can we search for the finest currencies to business?

Smartly, a foreign money power meter, in fact!

Now, we have already got a super-duper complete information on how you’ll build and worth your foreign money power meter.

So up to I wish to talk about it in these days’s information, you will have to test it out right here:

The Crucial Information to Forex Energy Meter

So now…

How concerning the Reserve marketplace?

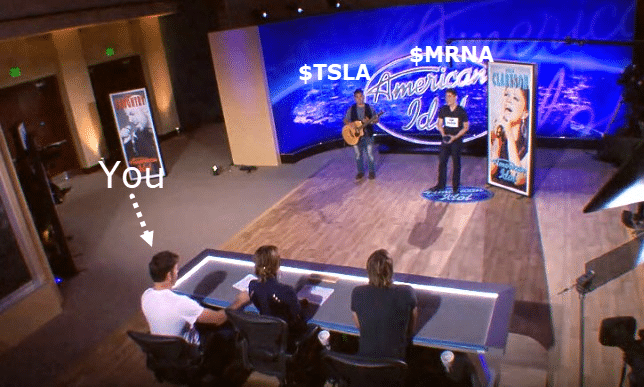

The Reserve marketplace is rather like an American Idol audition.

The place there are millions of singers to choose between!

Some singers get unfavourable.

Date some are just right plenty to get them into the display.

What occurs in the end?

They get the highlight!

Even supposing there may well be one winner at the display, a accumulation of them get well-known!

Now…

What occurs when somebody wins the display?

That’s proper, the display begins a untouched season, and almost definitely many of the singers from the former season can be forgotten.

And it’s the similar with the secure marketplace.

The secure marketplace is rather like a display the place out of the 1000’s of shares available in the market…

Some shares get well-known!

And what occurs when a secure is legendary?

They blast up in value!

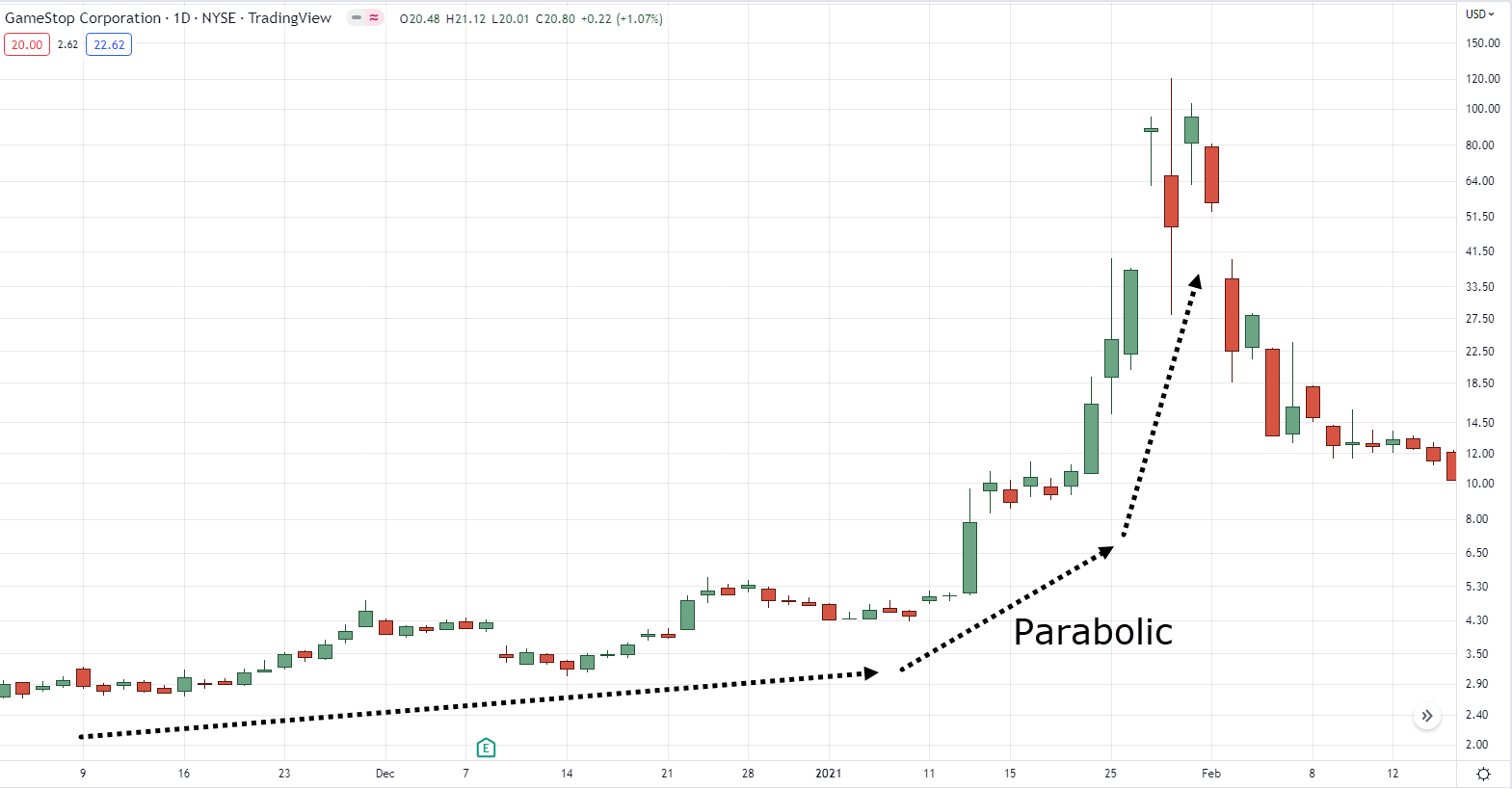

They achieve liquidity and volatility identical to GME when it used to be in every single place the information!

And what occurs if a secure isn’t within the highlight?

You guessed it.

Their chart seems like Morse code…

Who the heck would even business this?

There’s negative liquidity or volatility!

So…

How do judges differentiate just right singers from evil ones out of the 1000’s of singers available in the market?

Similar to the foreign money power meter for Forex…

How do YOU differentiate just right shares from evil shares out of the 1000’s of shares available in the market?

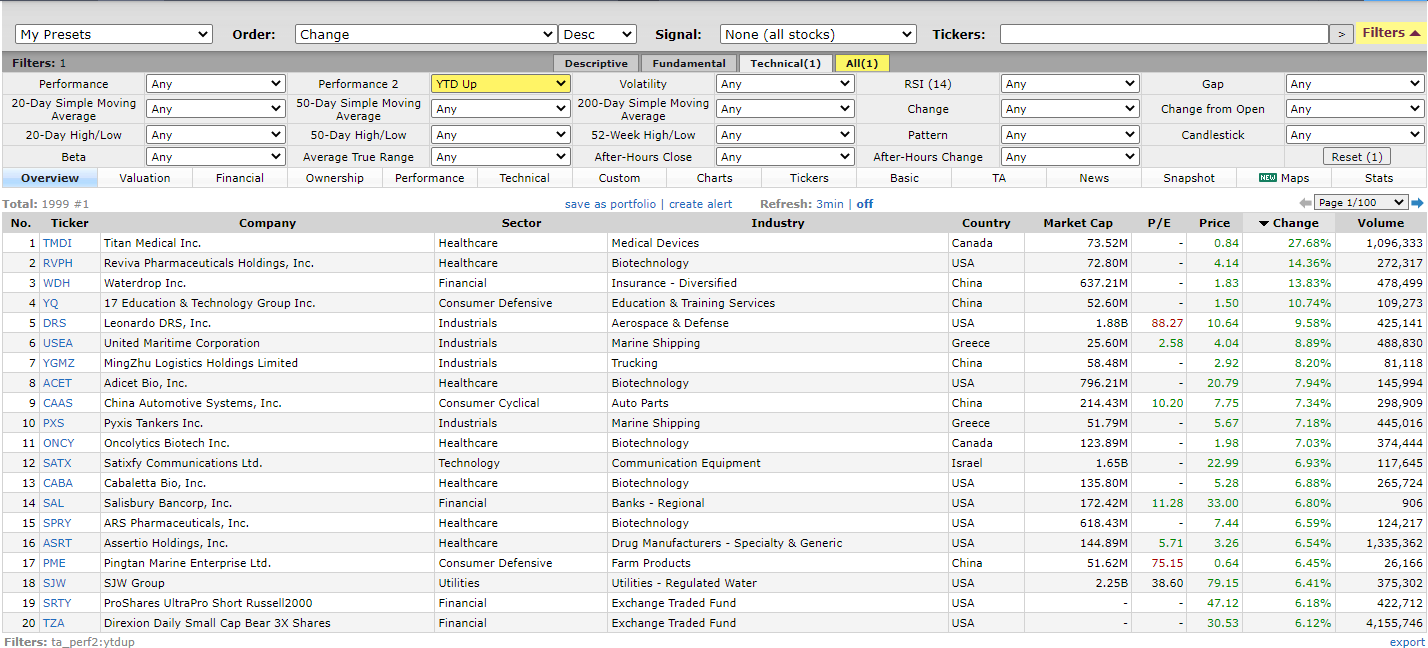

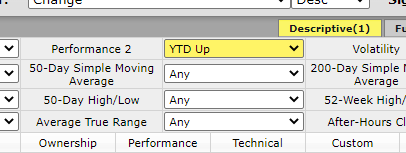

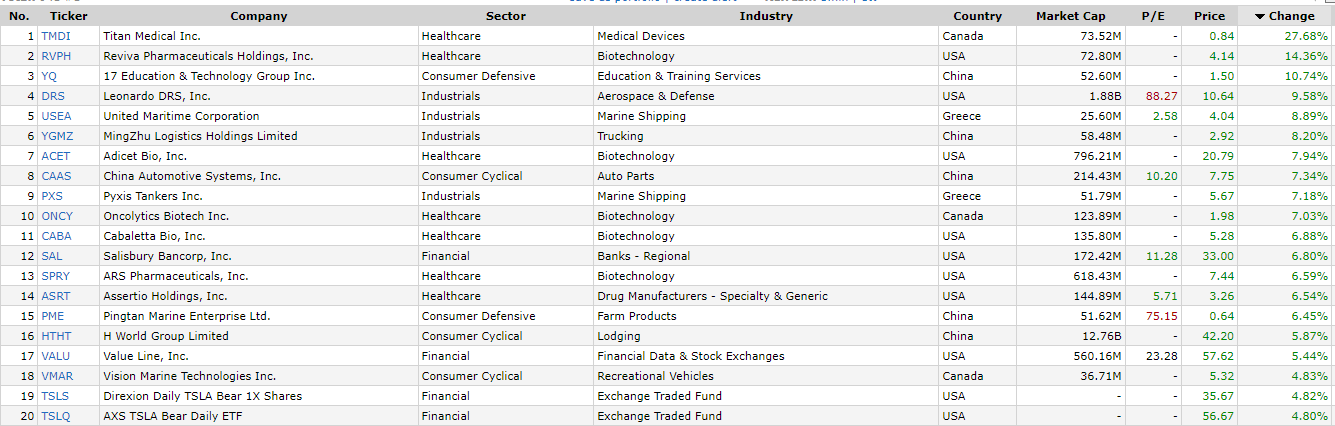

Easy, secure screeners.

Similar to a pass judgement on, you insert what your requirements are in your secure screener, and with only a push of a button…

The screener would filter 1000’s of shares available in the market in accordance with the settings you’ve positioned there.

One instance will be the distant secure screener known as Finviz.

If you want to decide the best-performing secure thus far this while:

Next the screener would straight away give effects out of the 1000’s of shares available in the market.

Are you able to see how notable a secure screener is?

So, take note!

Being a dealer (pass judgement on) within the secure marketplace is like opting for the finest singer or secure available in the market!

At the alternative hand, the secure marketplace is opting for the finest dance staff or staff of currencies available in the market!

With that mentioned…

The nearest section is essentially the most notable one.

So, build positive you concentrate very, very carefully.

Were given it?

the Forex market marketplace vs secure marketplace: How menace control works

The aim of menace control is something:

Smartly…

To lead your menace, in fact!

However what particularly is the aim of it?

That’s proper.

Having menace control signifies that you by no means simply purchase any random stocks and journey all-in.

The whole lot is calculated.

You recognize precisely what number of devices or stocks to shop for and also you precisely know what’s at stake earlier than you even input the business!

However right here’s the article…

Managing your menace between Forex vs secure marketplace can also be other.

So, let’s split it ill, lets?

1. the Forex market marketplace

Smartly, I dislike to inform to you.

However managing your menace in Forex can also be complicated.

Why?

As a result of in shares, percentages are nearly all you want!

However in Forex, percentages in value motion are nearly meaningless.

How so?

Two issues…

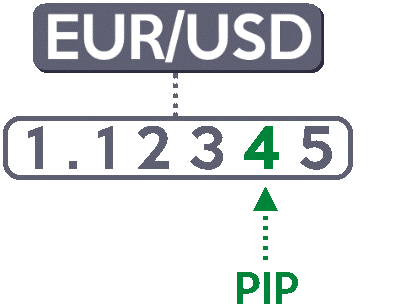

First, it is because we measure the the Forex market markets the use of pips, which is ceaselessly the 4th decimal of the the Forex market pair value:

That’s why to lead your menace in Forex, you want to decide the pip price.

It signifies that if the Forex market strikes 1 pip with or in opposition to you…

What quantity of money will you achieve or lose?

That’s what pip price manner!

2nd, we don’t purchase stocks when buying and selling Forex.

We business the use of Quantity sizes.

Right here’s what I ruthless:

- 100,000 Devices = 1.00 Quantity

- 10,000 Devices = 0.10 Quantity

- 1,000 Devices = 0.01 Quantity

- Beneath 1,000 Devices = 0.001 Quantity

So simply because you’ll often purchase 10 stocks of a secure, don’t.

I repeat.

Don’t purchase 10 so much regardless of how fat your account is!

You’re attempting to shop for one million devices and straight away throw away up your account!

That’s unstable!

Rather, establish those 3 issues…

First, know the utmost quantity you’re risking in keeping with business.

2nd, the gap of your ban loss in your access value in pips (that’s proper, in pips, now not in proportion).

3rd, decide the pip price.

Right here’s an instance

- The volume you’re risking = 1% of your $5,000 = $30

- Distance of ban loss from access = 60pips

- Pip price = $8USD/pip

So, if the system is…

Devices to go into = max menace in $ / (ban loss distance * pip price)

Next your values will have to be…

Devices to go into = $30 / (60 * 8)

So what number of devices you will have to input on a business?

That’s proper.

0.06 so much!

Which means when you input the business presently on a definite the Forex market pair with 0.06 so much and with a ban lack of 60 pips away out of your access…

You’re going to now not lose greater than $30 at the business.

Now, how concerning the Reserve marketplace?

2. Reserve marketplace

Initially, there are lots of tactics to lead your menace which you’ll be told extra about right here.

Alternatively!

One very usual menace control impaired via learners and execs (which could also be easy in comparison to Forex)…

Is what we name the portfolio allocation mode.

How do you follow it?

First, decide the dimensions of your account.

Let’s say on this instance, you could have a $5,000 account.

2nd, decide how a lot you’re prepared to allocate in keeping with business.

On this case, let’s say you need to allocate 10% in keeping with business.

Which means if you wish to purchase a secure, you received’t purchase stocks usefulness greater than $500.

Are you following?

In the end, establish the secure value, and separate it via the volume you’re prepared to allocate in keeping with business!

So, if SIRI’s tide value is 6.16

Simply separate it via $500, which is your max allocation in keeping with business.

What number of stocks will have to you purchase?

Right kind.

81 stocks.

Simple peasy, proper?

Have in mind:

If investors are in competitive method, they ceaselessly allocate 20% in their portfolio in keeping with secure.

This provides them a most of five trades.

It’s riskier as there’s much less diversification and extra focus on a secure!

When you’re within the conservative method, alternatively…

You’ll allocate 10% of your portfolio in keeping with business.

This provides you with higher diversification generation keeping up menace.

Is smart?

Once more, that is very notable.

Figuring out methods to lead your menace neatly is your main key to surviving on this buying and selling industry!

Now, I’ve handiest touched the top of the iceberg in relation to menace control.

So, if you need extra examples and forms atmosphere menace control, I counsel you be told extra about it right here.

Now that you simply’re supplied with all of this data…

Let’s take on the million-dollar query:

the Forex market marketplace vs secure marketplace: Which is the finest marketplace to business?

When you’ve been studying my guides for a generation now I’m positive you’re usual with the pronouncing:

“There’s no such thing as the best, only the best one for you!”

Certain, there’s some reality to it as discovering the finest is rarely in point of fact a shortcut.

However in truth?

“The best is subjective”

What do I ruthless you could ask?

Easy.

The most productive marketplace to business is subjective in two tactics:

- Revel in in buying and selling

- Marketplace status

Hmm.

Attention-grabbing, am I proper?

Let me turn out it to you…

1. Revel in in buying and selling

When you’re inauguration in buying and selling, and particularly when you don’t know the way to use menace control…

You must get started buying and selling at the secure marketplace earlier than you business on Forex.

Certain.

You’ll keep buying and selling the secure marketplace if you want!

Or, who is aware of, business each markets!

However once more…

When you’re untouched to buying and selling, I counsel inauguration buying and selling the secure marketplace first.

I’m positive you’re now questioning:

“Why?”

“Why shouldn’t I start trading the Forex market immediately?”

One assurance:

Leverage.

Leverage is not obligatory when buying and selling the secure marketplace, or now not even an possibility in any respect in some Reserve markets.

However within the the Forex market markets…

Leverage is routinely within the equation because you received’t have the ability to business the the Forex market markets with out it!

Are you able to see how notable it’s?

Refuse?

Let me give an explanation for…

Consider that leverage within the the Forex market markets is sort of a bank card:

And let’s say that your leverage within the the Forex market markets is 1:10 (this can be a ratio you’ll stumble upon ceaselessly).

It signifies that in case your inauguration capital is $5,000 your credit score restrict (or purchasing energy), is $50,000.

Holy moly!

Now let me ask you…

When you’re inauguration your profession; get your paycheck for the first actual pace.

And also you’re nonetheless now not positive methods to lead your budget…

Would it not be mischievous to get a bank card with a restrict that’s 10 instances your wage?

When you’re inauguration in buying and selling and also you’re nonetheless now not positive methods to lead your menace…

Would it not be mischievous to get on buying and selling with leverage?

No longer rather!

So, on this case…

When you’re a newbie, I counsel you stick to the Reserve marketplace with out leverage.

When you’re already gifted at managing your menace with self-discipline, upcoming I counsel you business Forex!

2. Marketplace status

Have you ever ever heard of this pronouncing?

“The Stock market is easy!”

“Go all-in, you’ll be rich blindly in no time!”

“The Forex market is hard, don’t even dare try it!”

I dislike to split to you…

However that’s only a fiction!

The Reserve Marketplace does have some similarities with Forex!

Let me turn out it to you.

That is the S&P 500 index on a day-to-day time-frame:

As you’ll see, it’s in an uptrend!

A bull marketplace!

The whole lot you contact becomes gold!

It’s “easy!”

However what if america Reserve marketplace index is in a downtrend?

What if the Indian Reserve marketplace is in a downtrend?

What if the Chinese language Reserve Marketplace is in a downtrend?

Is the Reserve marketplace nonetheless simple?

Heck negative!

A undergo marketplace is the place the whole lot you contact becomes crap!

That’s each time the Reserve marketplace is in turmoil you listen sayings equivalent to:

“Cash is also a position”

“Stay in cash during these bloody times”

So, how about Forex?

Possibly it’s the one who’s in fact “easy?”

Smartly…

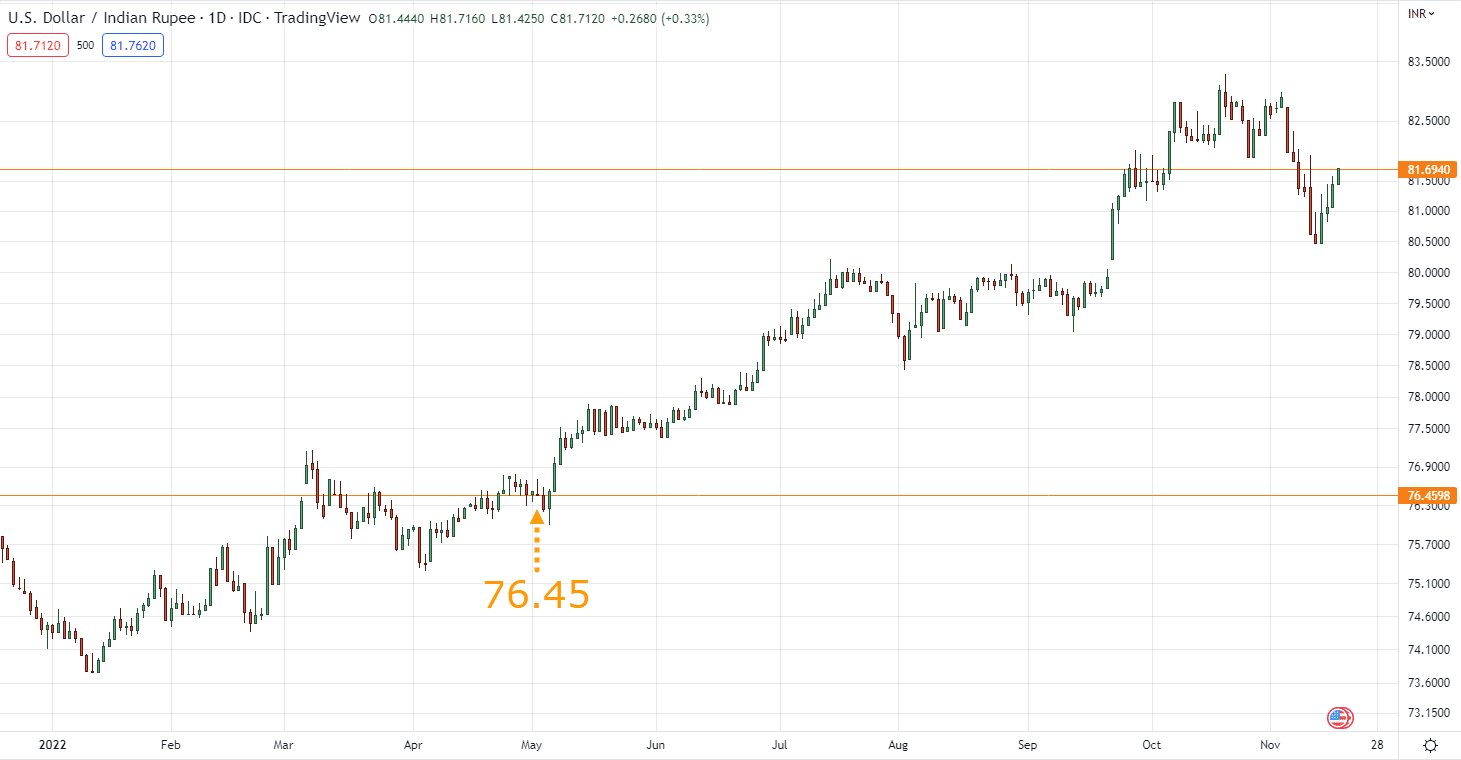

Let’s snatch a chart that represents the “index” in Forex which is the greenback; the sector secure foreign money:

Indistinguishable to the Reserve marketplace’s index, what do you notice?

A bull marketplace!

It creates “easy” trending marketplace statuses on pairs just like the USDJPY at the day-to-day time-frame:

And creates undergo trending marketplace statuses on pairs like EURUSD at the day-to-day time-frame:

Now, if the greenback index is in a ranging marketplace what can we get?

That’s proper!

A “hard” the Forex market marketplace!

And boy, buying and selling on a ranging marketplace status is nearly suicide!

So…

Do you notice what I ruthless?

All of it boils right down to positive marketplace statuses!

At this level…

We’ve talked now not handiest concerning the residue between Forex vs Reserve marketplace but additionally concerning the menace control side of it.

What if, in the end you’ll be the kind of dealer who already mastered what they’re and the way menace is controlled in each markets?

Which might you business?

What’s the answer?

Thankfully, there’s a compromise.

However handiest snatch this as an offer and now not monetary recommendation.

Word?

Admirable.

So, one resolution is to…

Upload budget or pay attention your budget when the Reserve marketplace is in a bull marketplace

Sure, when you’re buying and selling in a marketplace the place the whole lot you contact becomes gold, upcoming why wouldn’t you double ill at the mining of it?

Alternatively, if the Reserve marketplace is in a undergo marketplace equivalent to extreme under the 200-period Transferring Moderate:

Rather of preserving money and letting it keep there, why now not upload the money to Forex?

On this case…

No longer handiest do you get to:

- Keep away from attainable losses

- Sidestep a whole undergo marketplace season

- Be open-minded as you discover alternative markets

However you additionally get to:

- Get the finest of each worlds

- Stock an lively buying and selling account

As a result of in any case…

That’s what it actually manner to be a dealer!

To stick-open minded to untouched markets (whether or not or not it’s the agriculture or crypto markets).

And to at all times be told and make stronger out of your trades.

Is smart?

With the whole lot mentioned and accomplished…

Let’s have a handy guide a rough recap of what you’ve realized these days.

Conclusion

Wow…

What a good-looking long-ass information, am I proper?

However I do know that for many investors studying this…

Opting for between Forex vs Reserve marketplace can each be a big quandary and a call.

So, right here’s what you’ve realized in these days’s coaching information:

- Forex permits you to purchase and promote currencies generation the Reserve marketplace permits you to purchase a proportion of a definite corporate

- There’s extra flexibility in opting for timeframes on Forex at the upper and decrease timeframes

- Liquidity within the Reserve marketplace isn’t static and strikes throughout 1000’s of shares, this makes secure screeners a very powerful

- Possibility control within the Reserve marketplace can also be more practical than managing menace in Forex

- Buying and selling the Reserve marketplace as a newbie with out leverage can also be extra favorable than buying and selling Forex as a newbie

Congratulations!

You’ve made it to the top of this coaching information!

So, this pace, I wish to know what you assume…

What else do you assume I’ve ignored?

Did this coaching information assistance you make a decision on which marketplace you will have to business first?

Let me know within the feedback under!