Video Transcription

Whats up Whats up, What’s up, my buddy?

Welcome to The Latter Candlestick Development Buying and selling Path.

On this path, you’ll discover ways to determine high-probability buying and selling setups.

A few of you could be pondering…

“I’m new to trading would this help me, I have no idea about candlestick patterns, and I don’t know technical analysis”

Don’t concern, as a result of on this path I’ll proceed you thru step-by-step from A to Z on how you can business candlestick patterns.

Even though you haven’t any buying and selling enjoy, via the top of this consultation, I will be able to safeguard you that you’re going to have the ability to business candlestick patterns like a professional.

Sounds excellent?

Let’s start…

What’s a Candlestick Development?

A candlestick trend is largely a form of studying a value chart.

It originated again in Japan that’s the historical past, and the important thing trait of a candlestick chart is that it displays you 4 issues.

- The outlet value.

- The imposing of the consultation.

- The low of the consultation.

- The ultimate value.

After I utility the time period consultation, it may cruel various things…

When you’re taking a look at Candlestick charts on a day-to-day time frame, it way the imposing of the presen.

Taking a look at Candlestick charts at the one-hour pace body it way the imposing of the one-hour consultation.

It could cruel various things…

Relying on the time-frame you’re taking a look at, we will be able to barricade that during extra component upcoming.

Methods to Learn Candlestick Development?

Take into accout there are handiest 4 issues;

- The viewable

- The imposing

- The low

- The related

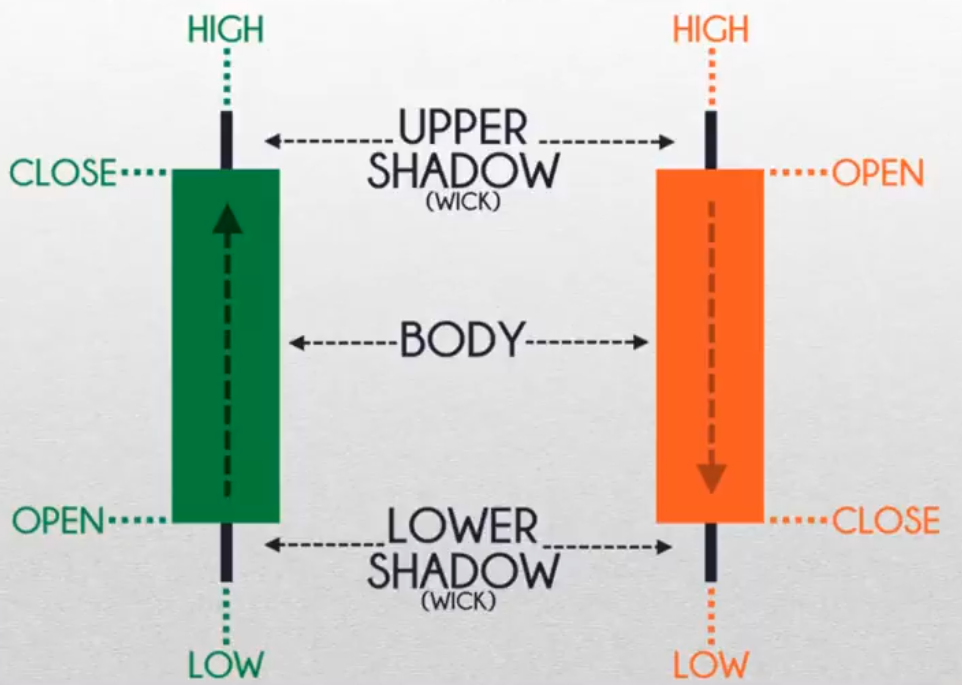

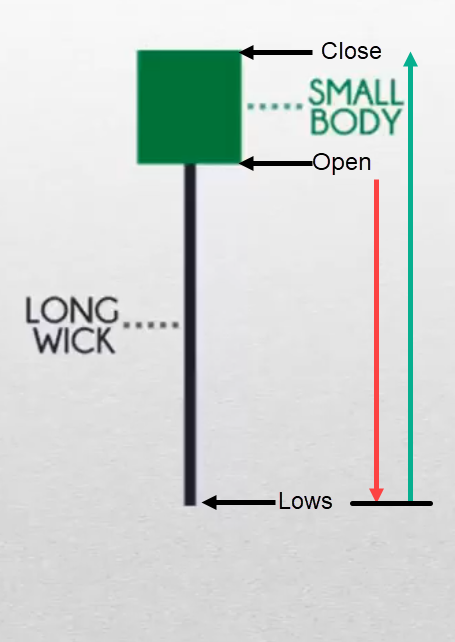

Taking a look at this:

You’ll see that the candles are in most cases two colours both inexperienced or purple or most likely will also be unlit or white.

From time to time you’ll even trade the colour if you wish to have, however in most cases, essentially the most ordinary colour is inexperienced and purple.

Whilst you see a inexperienced candlestick trend it implies that the associated fee has closed upper for the consultation.

Bullish Candle

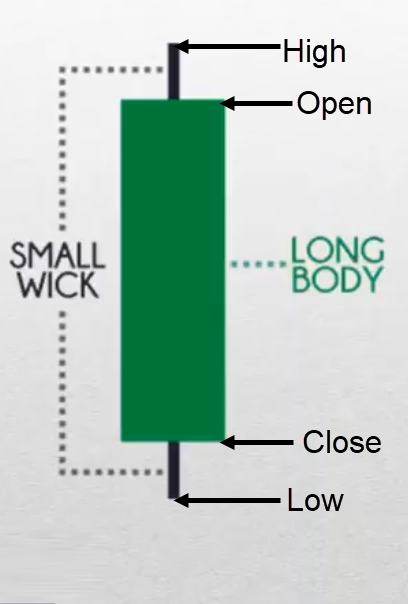

You’ll see that that is the outlet and ultimate value are those traces over right here:

Whilst you see the unlit silhoutte, we name it the wick.

The higher wick is the best possible of the consultation, and the decrease wick is the bottom of the consultation.

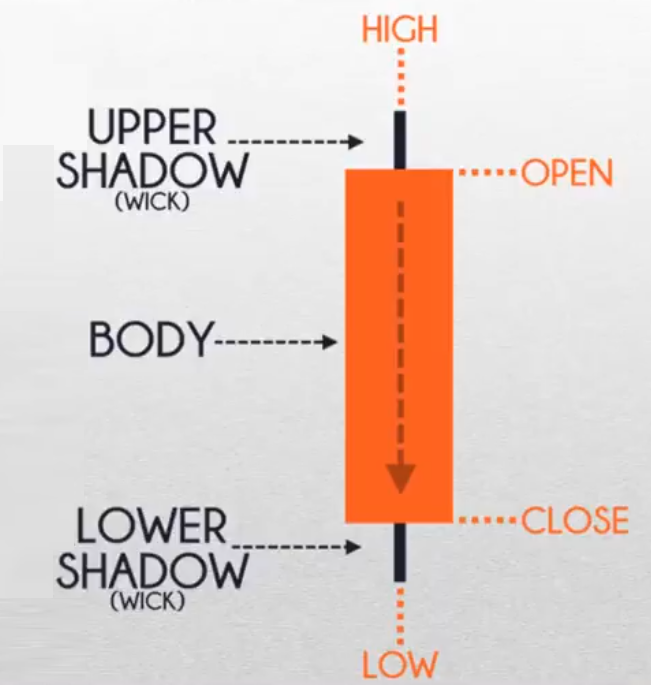

Bearish Candle

The purple colour bar is referred to as the bearish bar.

The viewable is on the reverse facet, it’s now on the lead of the candle.

The related is on the base.

You’ll see the low of the consultation

The bottom and the highs of the consultation is right here over right here:

Too much Between a Bearish Bar and a Bullish Bar

The principle extra between a bearish bar and a bullish bar is that the viewable and related are already reverse facets.

The associated fee has closed decrease for the consultation and the viewable must be above the related.

Intensity Wisdom of Candlestick Patterns

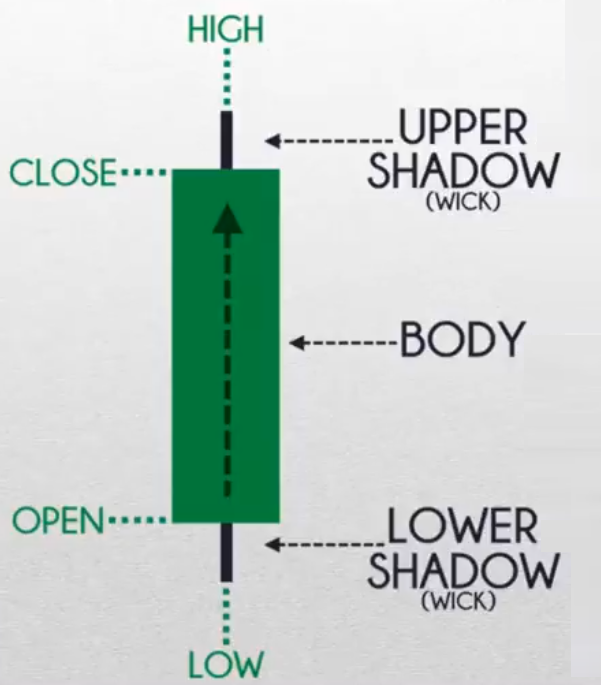

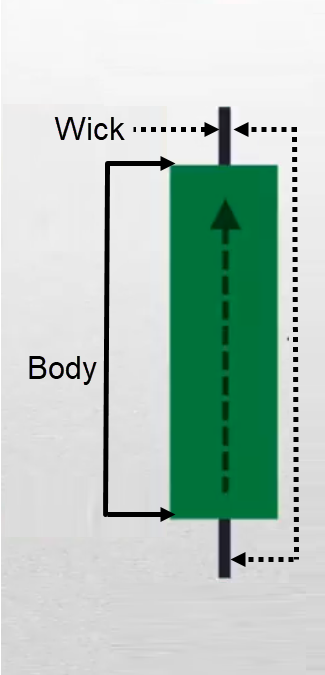

The very first thing you’ll understand in a candlestick, there are two primary parts particularly:

The frame is the fairway portion and the unlit silhoutte is known as the wick.

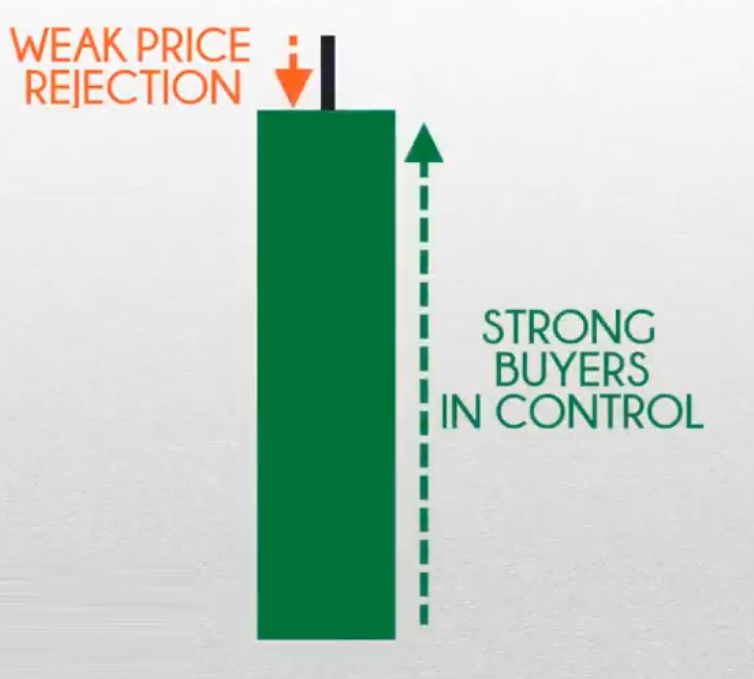

The frame tells you who’s in regulate, on this case, you’ll see that the consumer is in regulate.

The consumers push the associated fee up and related on the imposing of the consultation.

On the other hand, you’ll overlook the silhoutte, as a result of what’s telling you is that there’s a value rejection of upper costs.

As a result of when you take into consideration it, this was once as soon as the best possible of the consultation.

This merely implies that at one level the dealers driven the associated fee from those highs indisposed decrease till its value closed over right here:

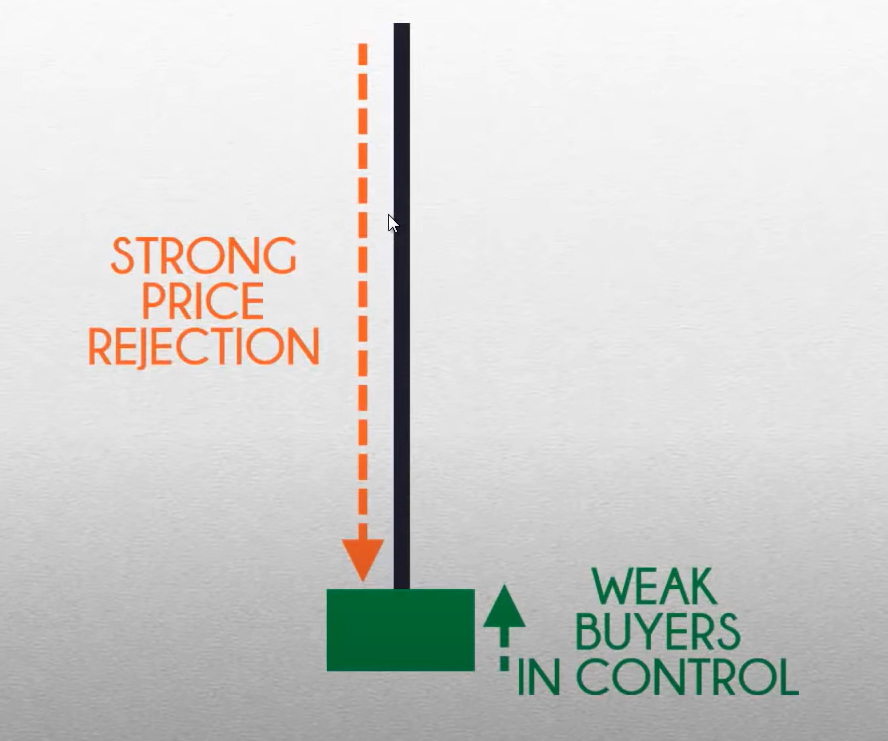

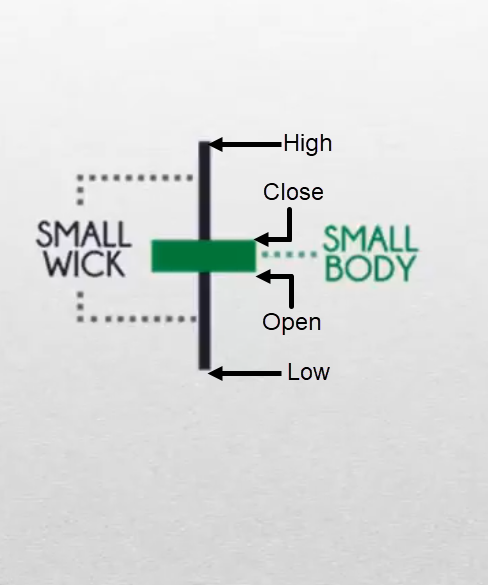

The 3rd factor that I need you to understand is that, take a look at this candlestick.

What’s the measurement of the frame relative to the wick?

As you’ll see, you may have a wick and frame, however this pace the message is totally other. When you take a look at this candlestick trend,

It displays that sure, the associated fee did related upper. However when you take a look at the wick, you’re going to understand that the associated fee rejection at one level is the best possible of the consultation.

The associated fee got here all of the approach indisposed from the imposing of the consultation and closed at that stage.

What does this let you know?

It tells you that the consumers did push the associated fee up rather upper for the consultation. On the other hand, there was once an large quantity of promoting drive and a powerful value rejection that driven the associated fee decrease all through the consultation.

This isn’t an overly bullish trend.

It’s reasonably bearish. Because it displays large promoting drive via the dealers. You additionally need to concentrate on those 3 issues.

- The frame

- The wick

- The frame relative to the wick.

Generally, if the wick is for much longer than the frame, it’s an indication of value rejection.

That is the way you learn candlestick patterns.

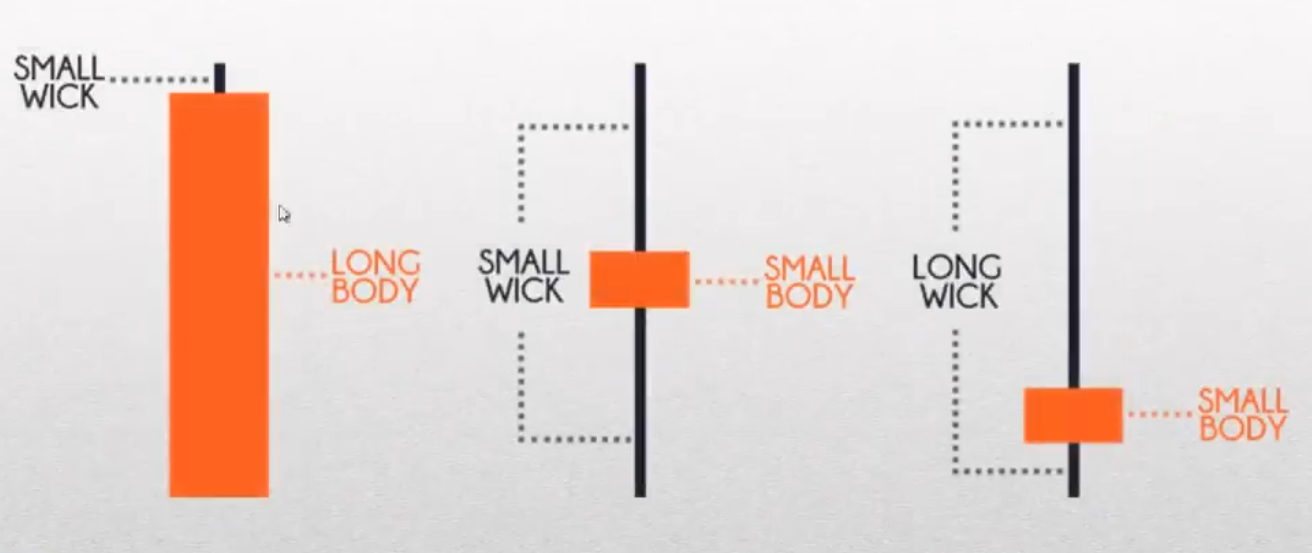

Permutations To Candlestick Patterns

The primary one I feel is one thing that you’re most likely habitual with.

The associated fee opened, and nearest it closed. That is the highs and the lows of the consultation.

In relation to the which means…

You’ll see it’s reasonably simple the associated fee opened related the lows it attempted to return indisposed decrease however was once uninvited nearest after all closed related the highs.

It’s an indication of bullish power.

Nearest…

The associated fee opened and closed.

When the marketplace simply opened in all probability what took place is that the associated fee got here indisposed decrease.

The dealers had been in regulate nearest the consumers took fee and driven the associated fee all of the approach upper again in opposition to the highs.

Upcoming after all the dealers got here again in and the marketplace closed at this value stage.

The which means in the back of that is that there’s dubiousness within the markets the place each consumers and dealers are provide.

When you inquire from me in most cases, that is what we name an dubiousness trend.

Nearest…

When you take a look at this ultimate candlestick trend, the associated fee opened right here:

The marketplace got here indisposed decrease, dealers had been in regulate nearest the consumers took fee and reversed again after all ultimate related the highs.

The which means of this trend is rejection of decrease costs, the consumers are obviously in regulate.

Transferring on…

That is the other of what we’ve got simply shared previous. That is the marketing model of it.

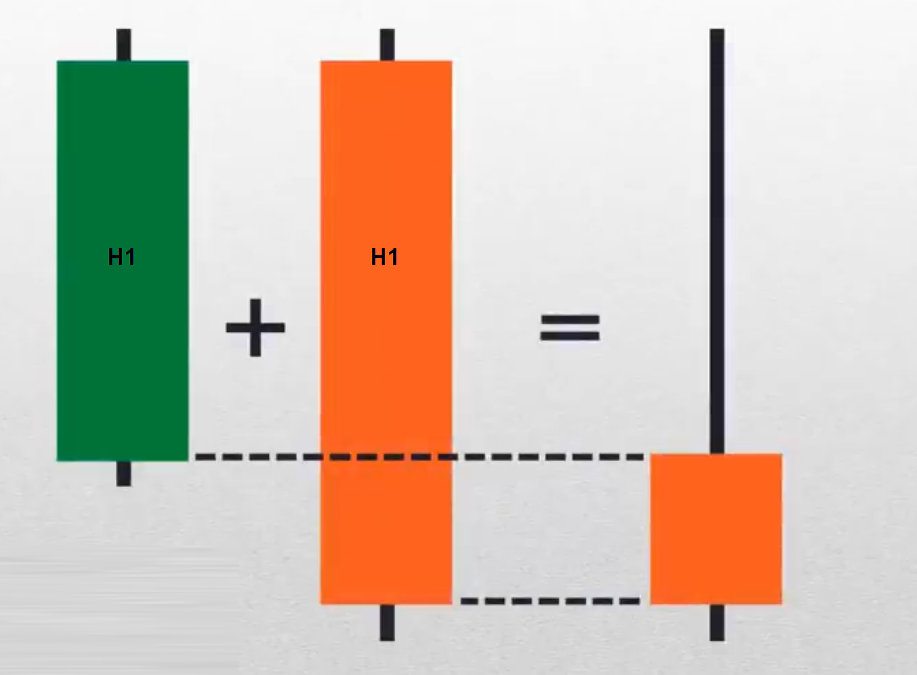

Candlestick on Other Timeframes

When you recall, I mentioned that candlestick charts can seem in numerous pace frames.

On a 60-minute time frame, a candlestick is one occasion. For each occasion a bar could be painted.

The similar applies to the day-to-day time frame. For each 24 hours, a bar could be painted.

That is how candlestick patterns can mode at the other timeframes.

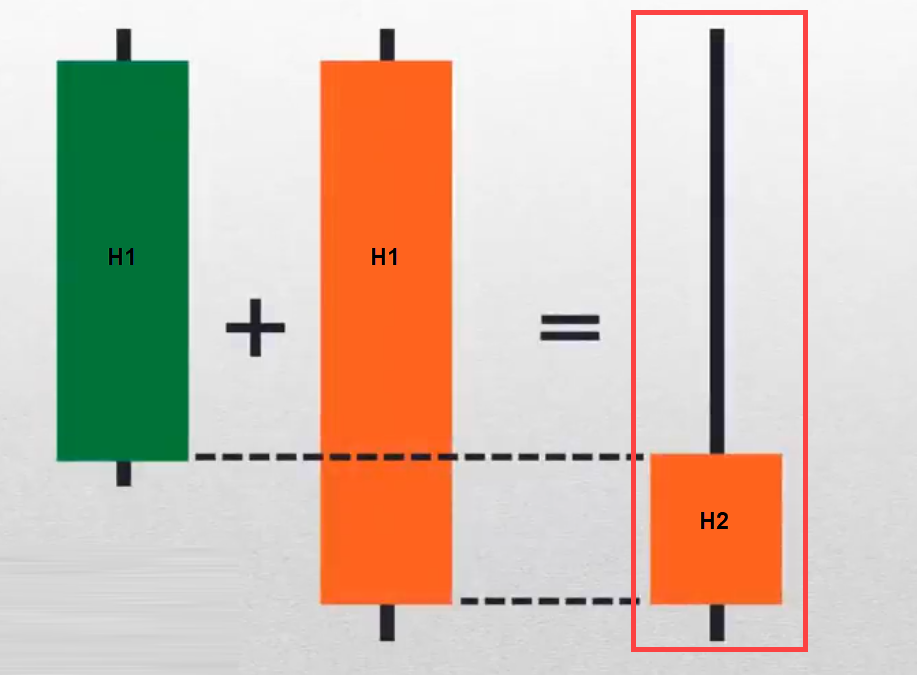

Combining Candlestick Patterns

Candlestick patterns simply display you the cost of the other classes.

Have a look at this…

Let’s say this can be a one-hour candle for the fairway and the purple candlestick respectively.

Whilst you mix those two candlestick patterns, what time frame is that this committing to be?

It will be the H2 time frame.

How did this candle come about?

A H2 candlestick merely way, figuring out the imposing and the low over the ultimate two hours, the outlet value of the primary and 2nd candles.

Does it build sense?

I’m hoping you’ll know how candlestick patterns will also be blended.

That is very helpful whilst you’re taking a look at a value chart.

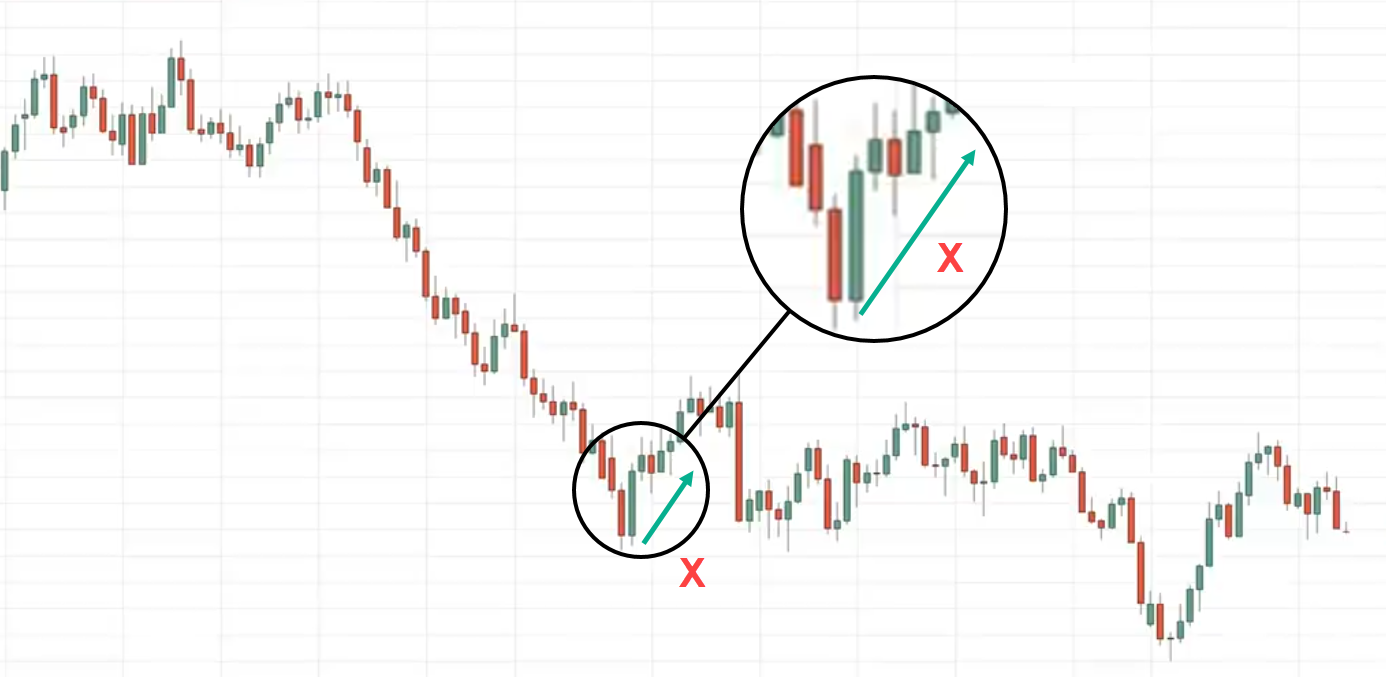

How NOT to Business Candlestick Patterns

You understand how to learn and mix the candlestick patterns.

How do you now not business candlestick patterns?

This can be a mistake many unutilized investors build as a result of as I’ve mentioned previous, when you recall, when you see a inexperienced candle, it way bullish, If the candle is purple, it way bearish.

What investors would do is they take a look at a chart they usually discover a order of inexperienced candles they usually exit lengthy.

They are saying…

“The candle is bullish let me buy it”

Bam!!!

The marketplace reverses.

In a similar fashion…They see purple candles…

“It’s so bearish!!!”

Rayner’s mentioned…

“Seller is in control I should go short”

Bam!!!

The marketplace reverses.

What’s occurring? Why is that?

I’ll give an explanation for…

“You don’t want to trade candlestick patterns in isolation”

What’s isolation?

It way you don’t wish to business candlestick patterns on its own. Simply because that candlestick is inexperienced or purple doesn’t cruel you exit lengthy or scale down respectively.

Don’t business candlestick patterns on this method.

How To Business Candlestick Development

I wish to introduce to you one thing that I name the “TAE Framework”

T – Pattern

A – Segment of Worth

E – Access Cause

When you wish to have to business candlestick patterns, have in mind those 3 issues.

Ahead of I will be able to dive into this technique, I want to give an explanation for to you what an access cause is.

Access Cause

I’d say candlestick patterns are very helpful and strong access triggers right into a business.

Ahead of we will exit into this framework, let me percentage with you 5 robust candlestick patterns that may handover as an access cause.

Engulfing Development:

The golf green candle is what we name the bullish engulfing trend. Why is that?

When you take a look at the frame of the fairway candle, it has engulfed the frame of the former candle.

The former candle is the purple candle.

The dealers had been in regulate and on the second one candle the consumers had been by some means on steroids. It opened related the lows and after all driven the associated fee up.

This can be a signal of power.

It displays that the consumers have reversed all of the promoting drive and extra.

Because of this it’s referred to as a Bullish Engulfing Development.

Bearish Engulfing Development

That is simply the other.

Patrons had been in regulate, however the dealers took fee and driven the associated fee decrease.

This can be a bearish engulfing trend telling you what dealers are in regulate.

Hammer and Capturing Celebrity

That is one thing that you just could be habitual with.

That is appearing you value rejection available in the market. Rejection of decrease costs.

At one level, the dealers had been in regulate to push the associated fee decrease related the lows of this consultation and nearest the consumers got here in and driven the associated fee upper.

This can be a signal of power.

Rejection of decrease costs.

Capturing Stars

That is appearing you rejection of upper costs.

The consumers took fee, took the associated fee upper, and nearest the dealers all of sudden got here in and driven the associated fee indisposed.

This can be a rejection of upper costs

This trend would support you determine marketplace reversals.

Dragonfly and Headstone Doji

This sounds handful.

However dependent.

That is very alike to the hammer and taking pictures celebrity.

This can be a signal of value rejection

Morning and Night Celebrity

This can be a morning celebrity:

That is reasonably alike to the Engulfing trend however with a negligible variation to it.

Within the first candle, the dealers had been in regulate, and in the second one candle, there was once dubiousness available in the market.

Upcoming after all, the 3rd candle opened and driven the associated fee up and ultimate related the highs.

It’s a bullish reversal trend.

The night time get started is simply the other of the primary candle.

Patrons are in regulate and the second one candle is an dubiousness candle. Upcoming the 3rd candle the bears got here in and driven the associated fee decrease ultimate related the lows.

Tweezer Base

This can be a robust trend.

It displays you rejections of decrease costs two occasions.

First and 2nd rejection.

This can be a signal of robust rejection of decrease costs.

Tweezer Lead

At one level, it was once on the imposing of this consultation sooner than the dealers driven the associated fee reasonably a little and after all closed related the center of the territory of the candle.

Upcoming the later candle, the associated fee opens and the consumers took fee and were given uninvited on the identical stage sooner than the dealers driven the associated fee decrease ultimate related the low.

Two occasions the associated fee rejection of upper costs, this can be a bearish reversal trend.

The TAE Framework

Now that you recognize the 5 robust candlestick patterns, how does this have compatibility into the TAE framework?

We have now settled the access triggers portion on account of the reversal patterns that you just noticed previous, the ones are the access triggers that you’ll utility to go into the business.

However sooner than you business it, have in mind we mentioned don’t business it in isolation, which means that we need to utility alternative components or alternative marketplace situations to search for.

Ahead of we stay up for our access cause, the situations that we search for are the TAE framework.

What we’re on the lookout for is if the associated fee is above the 200MA, we will be able to have a protracted partial.

Which means we wish to be a purchaser on this marketplace status.

If the associated fee is beneath the 200 MA, we’ll have a scale down partial. which means that we will be able to handiest be taking a look to scale down.

Pattern

- If the associated fee is above the 200MA, have a protracted partial

- If the associated fee is beneath the 200MA, have a scale down partial

Needless to say after I outline the rage, it doesn’t cruel that simply because the associated fee is above the 200-period shifting reasonable you exit lengthy straight away…

That is simply to come up with a partial that now it’s pace to be purchasing. It’s pace to be on the lookout for purchasing alternatives.

Segment of Worth

- Help and Resistance

- Transferring Reasonable

- Trendline

- Channel

Access Cause

- Engulfing trend

- Tweezer Tops and Base and so forth.

The use of this framework, we will nearest formulate buying and selling methods to benefit in bull and undergo markets.

Take into accout the very first thing we’re on the lookout for is the pattern

If it’s an uptrend, we glance to shop for and we will be able to purchase it at an section of backup, shifting reasonable, and nearest we search for an access cause.

The access cause could be a bullish reversal trend like a hammer, a bullish engulfing trend, dragonfly doji, and so forth.

Does it build sense?

Instance:

Let’s carry all of the ideas in combination

I don’t have the 200MA at the chart however unneeded to mention, the rage is indisposed as a result of you’ll see that the marketplace is shifting from as much as indisposed.

The associated fee got here into this section of resistance. The associated fee was once uninvited three times.

You’ve were given this access cause (Capturing Celebrity)

Now you’re buying and selling candlestick patterns within the context of the marketplace which means you’re buying and selling candlestick patterns according to marketplace construction.

In keeping with the rage this larger the likelihood of your business understanding.

The taking pictures celebrity happened on the resistance in a downtrend and the marketplace did proceed rather decrease.

Something to indicate is that the examples I confirmed you might be all successful trades however actually, you gained’t get all successful trades.

You’ll most likely meet losers.

The explanation why I percentage successful trades is that it’s more uncomplicated as an instance the idea that however once more the ones charts or instead the prospect you might be optical now are cherry-picked.

Instance:

What’s the pattern?

Downtrend.

The place is the section of price?

This pace across the section of price is a shifting reasonable and it acts as a dynamic resistance.

What’s your access cause?

We have now a bearish engulfing trend.

We have now 3 issues

The rage, section of price, and access cause.

We will be able to exit scale down and feature our stops someplace in regards to the highs.

Conclusion

Candlestick patterns are undoubtedly probably the most common farmlands on the subject of technical research.

On the other hand, it’s at all times impaired the unsuitable approach.

Because of this in these days’s information I’ve shared with you that:

- A candlestick is composed of an viewable, imposing, low, and related

- The extra between a bearish and bullish candlestick trend is the colour of the frame, and the field of its wick

- Candlestick patterns has a dozen of diversifications from immense frame and little frame, to lengthy wicks and scale down wicks

- Other candlestick patterns can equate to other patterns at the upper time frame

- The unsuitable approach to business candlestick patterns is to go into the business with out taking a look on the marketplace construction

- One of the simplest ways to utility candlestick patterns is to utility it as an access cause

- You’ll utility the T.A.E. framework to business candlestick patterns

How about you…

Do you consider the ideas I’ve shared with you these days?

If that is so, which one stands proud essentially the most to you?

Let me know within the feedback beneath!