That is one setup you’ll glance to industry the triple summit development.

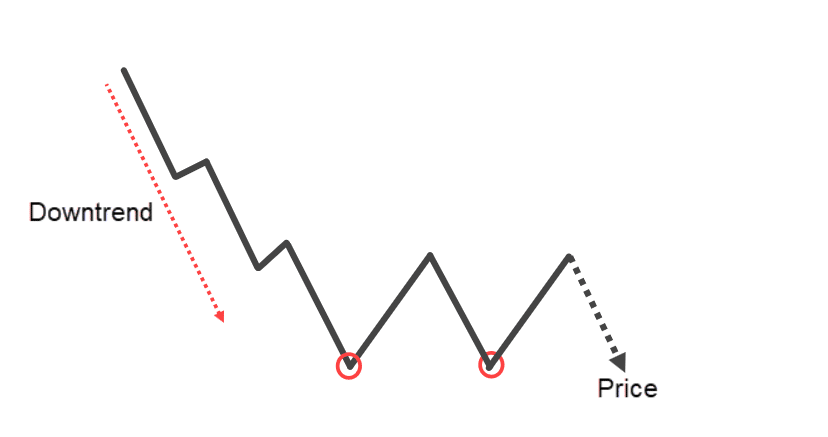

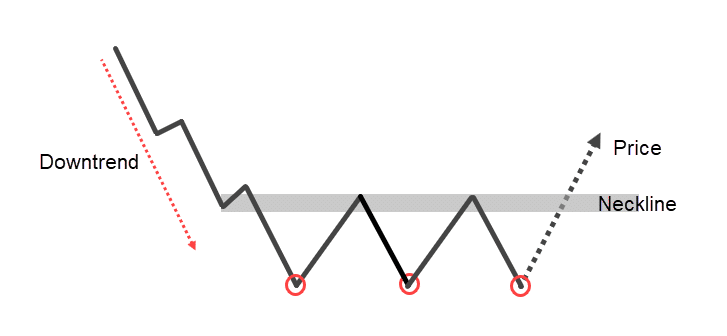

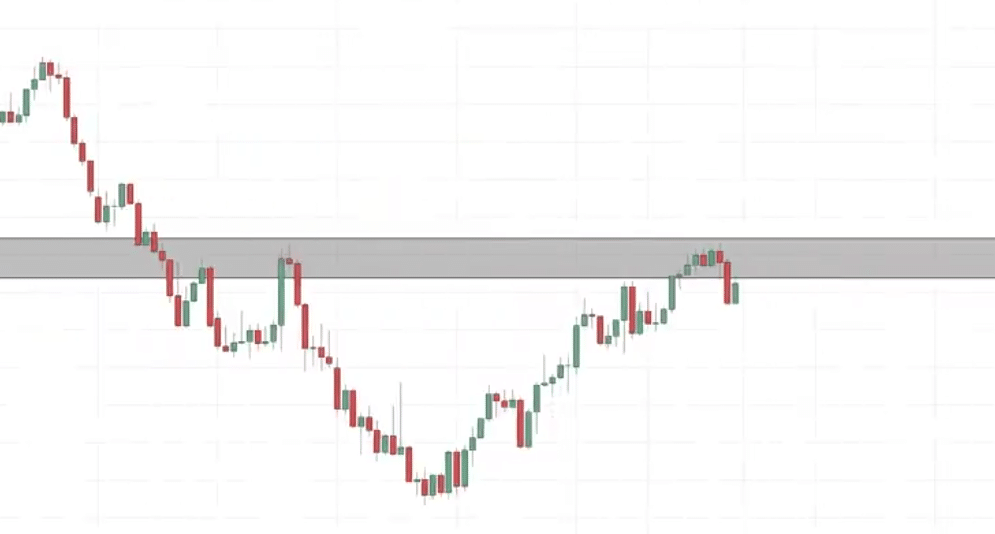

Triple Base Chart Trend

You will have to know what to anticipate…

This can be a bullish reversal development.

The marketplace is in a downtrend upcoming it makes a low, bounces up upper, comes indisposed and retests the lows, bounces up upper retests the lows as soon as once more.

Considering it might crack.

The dealers idea…

“Hey, this is our time, It’s victory”

Supposition what?

The marketplace bounces up upper and upcoming they fail to whip the fee decrease.

At this level, it’s important to look forward to what we name the neckline.

If the fee breaks above the neckline, that is the place we are saying the triple base development is showed and the marketplace may just head up upper.

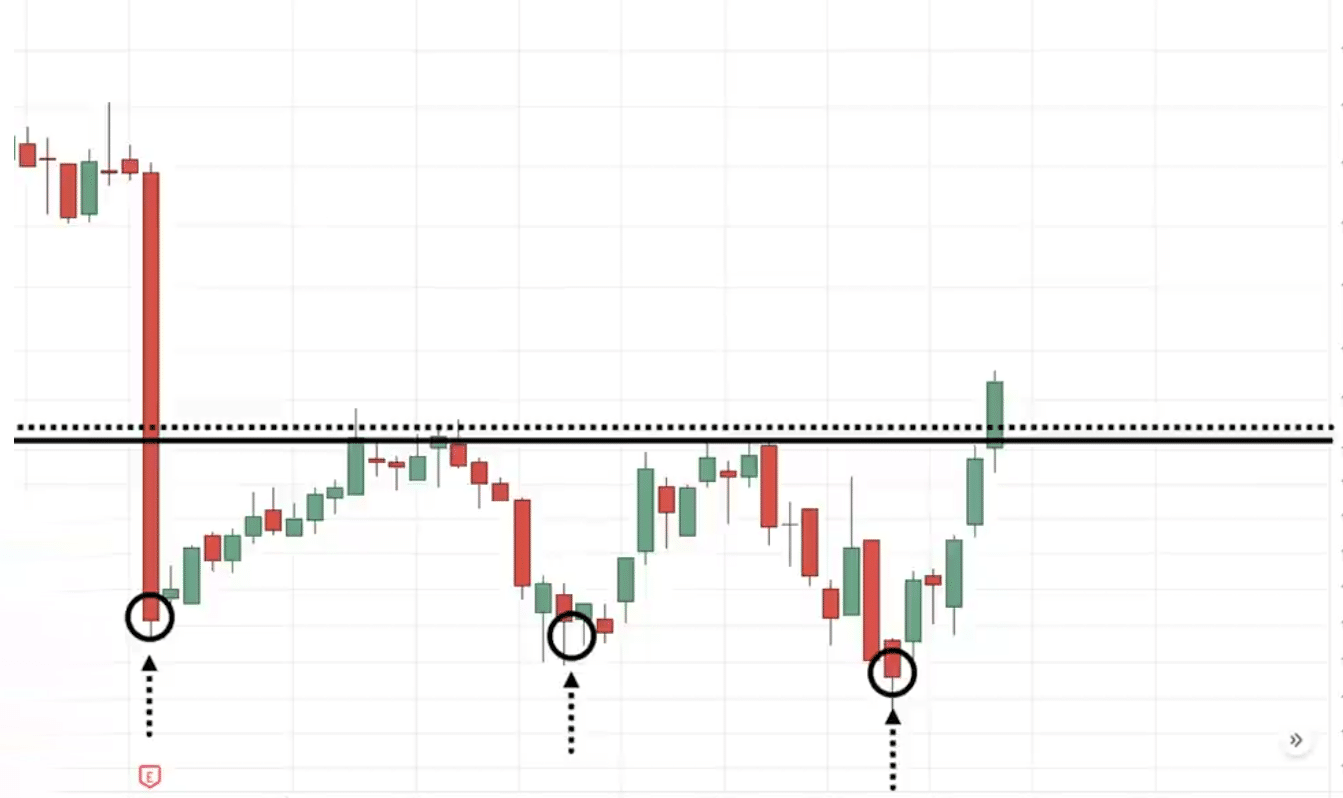

Chart Instance:

You realize how lovable those 3 bounces are. The 3 makes an attempt to power the fee indisposed however the marketplace refused.

What’s that telling you?

If it will possibly’t progress indisposed upcoming it most definitely will have to progress up upper.

How are you able to industry the triple base development?

You’ll be able to significance the crack and retest, the first pullback.

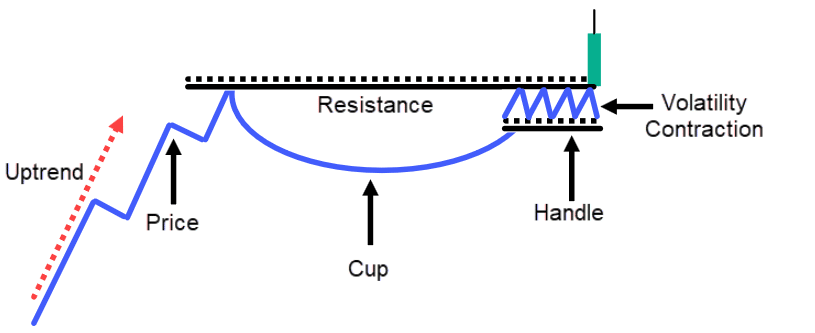

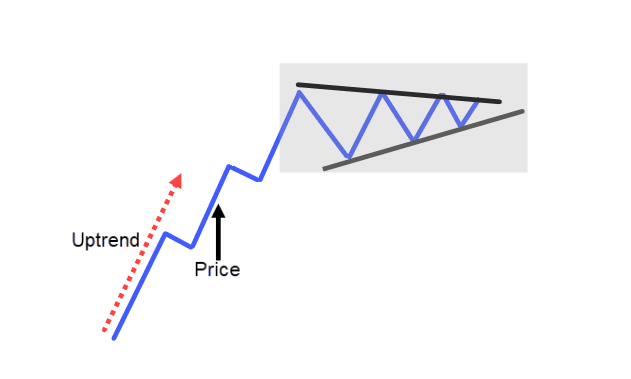

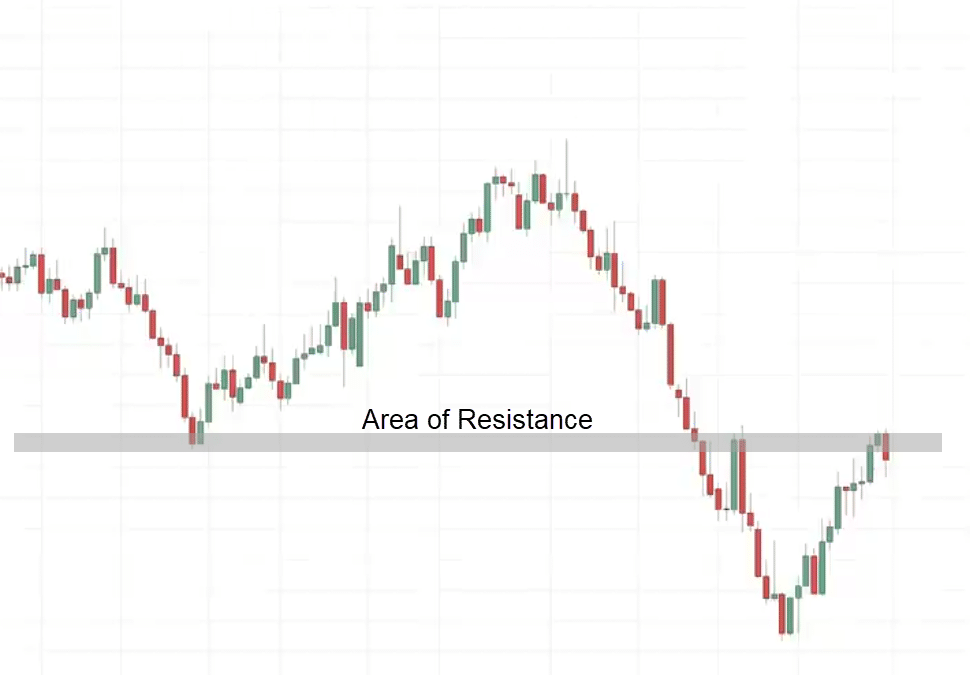

Cup and Take care of Chart Trend

This can be a bullish pattern continuation development.

The marketplace is in an uptrend. is going up upper makes a pullback, is going up upper makes a pullback is going up upper.

This pace, while you see a cup and maintain development founding, you’re going to realize that the pullback is for much longer in relation to length in comparison to the sooner pullback.

Nearest it begins to consolidate reasonably.

The marketplace remains to be bullish.

Dealers couldn’t push the fee any decrease. It has issue breaking the swing low

This tells you that the whole marketplace remains to be bullish and upcoming at this level you’ll draw the branch of resistance or the neckline.

When the marketplace breaks above the branch of resistance, we can say that the cup and maintain development is shaped, and the marketplace is more likely to proceed up upper.

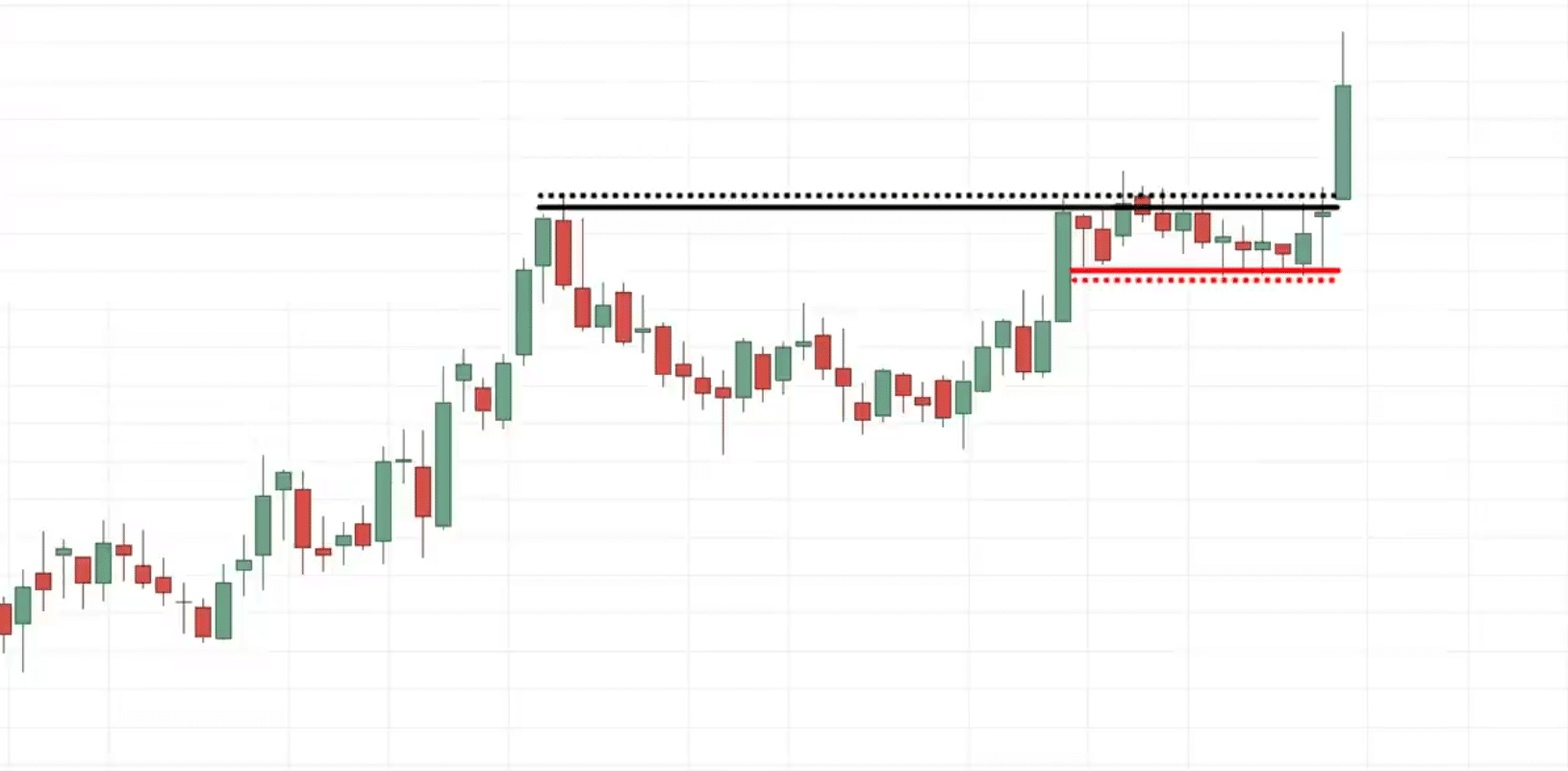

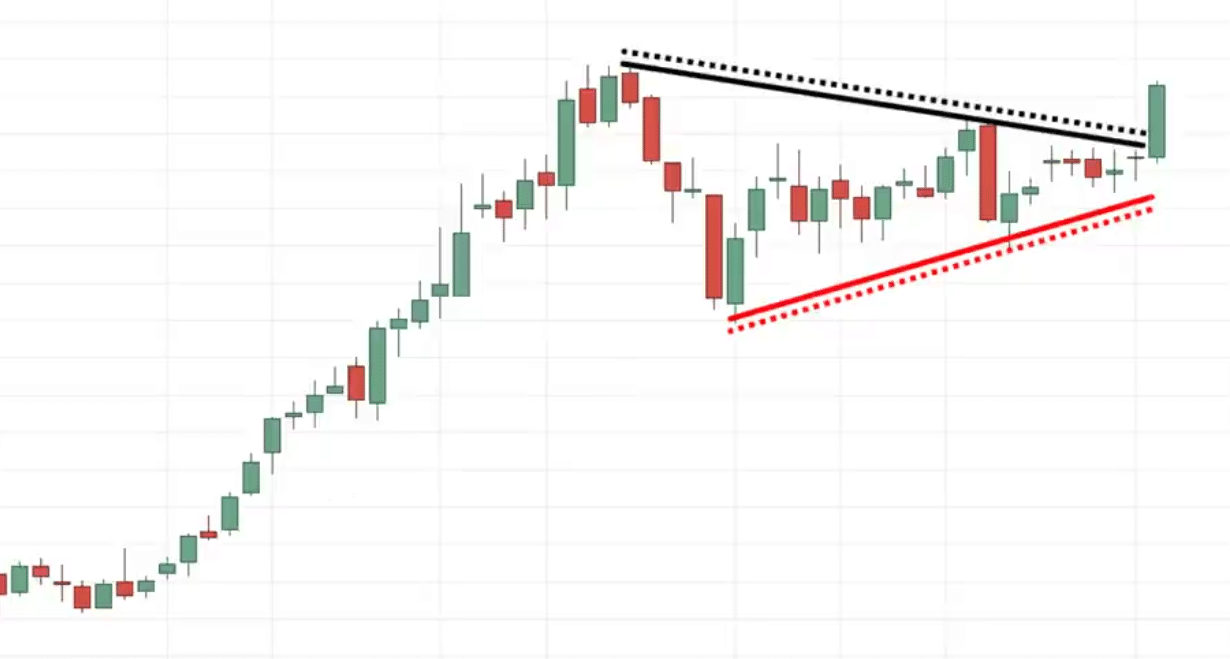

Chart Instance:

You realize how the marketplace is in an uptrend, makes a pullback, and is going up.

This pace you realize the length is for much longer in comparison to the former pullback, upcoming it attempted to crack out of the prime however couldn’t.

Rather, it shaped a consolidation, and when the fee breaks above the prime, that is the place we are saying the cup and maintain patterns are whole and the marketplace may just progress up upper.

How do you industry the cup and maintain development?

You’ll be able to industry this via the usage of the crack and retest or the primary pullback.

However differently you’ll industry it’s…

Understand how tight the consolidation is for this cup and maintain development.

What you’ll do is that while you realize the maintain may be very great and tight. That is what we name a volatility contraction.

It’s sometimes called build-up.

The place the patrons and dealers are in equilibrium storing possible power to assemble the after advance.

Since you already know the path of the fad you most likely need to be within the path of the fad.

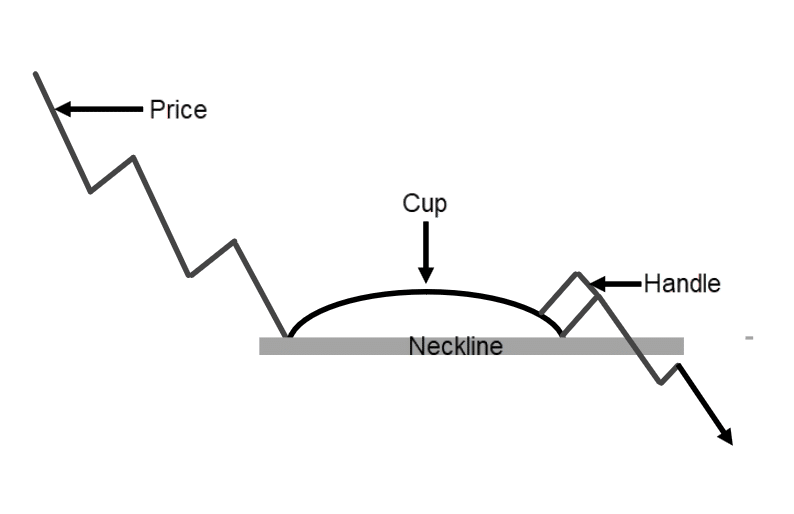

Inverted cup and maintain development

This can be a bearish pattern continuation chart development.

The marketplace is in a downtrend. It hits decrease and upcoming makes a pullback, this pace across the pullback is longer than the previous pullback.

It makes some other pullback, it’s so vulnerable that it couldn’t even remove this earlier swing prime

At this level, you’ve what we name a neckline or an branch of help.

If the marketplace comes indisposed decrease and breaks under those lows of help, you’ll be expecting the fee to crash decrease.

Chart Instance:

Believe a cup and maintain with out consolidation, the after logical playground to eager your forbid loss could be on the swing prime which goes to be immense.

However a consolidation provides you with a related playground to eager a decent forbid loss, which offer you a positive menace to praise at the industry.

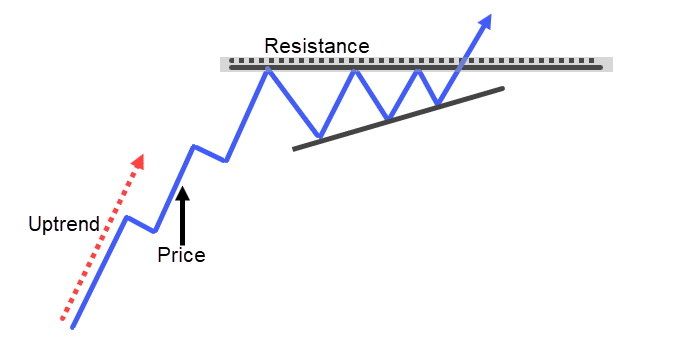

Ascending Triangle Trend

That is one in all my favourite chart patterns to industry as it’s a bullish pattern continuation chart development.

I to find that it’s some of the tough ones to industry.

The psychology in the back of this development is simply so vital.

How the Ascending Triangle Trend works

The marketplace is in an uptrend, is going up upper makes a pullback, upcoming it begins to progress up upper once more however fails to take action upcoming makes some other pullback.

What’s fascinating is this pullback, now didn’t remove those lows.

At this level, you’ve what we name an branch of resistance and now and again we may have some other smaller pullback sooner than the fee breaks out upper.

When it breaks out, that is what we name an ascending triangle chart.

To me is an indication of power as it tells you that…

“The buyers are willing to fight to final for every inch trying to push the market up higher”

You’ll be able to see the consumer is making an attempt to push the fee up upper even in entrance of resistance, they’re nonetheless keen to shop for at those upper costs.

Why would population need to purchase in entrance of resistance?

Most certainly as a result of they be expecting upper costs to return, that’s why you’re keen to shop for in entrance of resistance since you suppose that the marketplace is more likely to crack out.

Earlier than it breaks out, you briefly get on board.

This can be a signal of power.

Believe any individual shorts at resistance, the place will your forbid loss be?

Most certainly your forbid loss goes to be above the best possible of resistance.

That’s what maximum gurus will inform you to place your forbid loss above resistance. Believe when the fee breaks above the resistance, it’s committing to crash this aggregate of forbid loss.

When it hits that aggregate of forbid loss, this is robust purchasing power to push the fee additional up.

For this reason I like buying and selling the ascending triangle chart development.

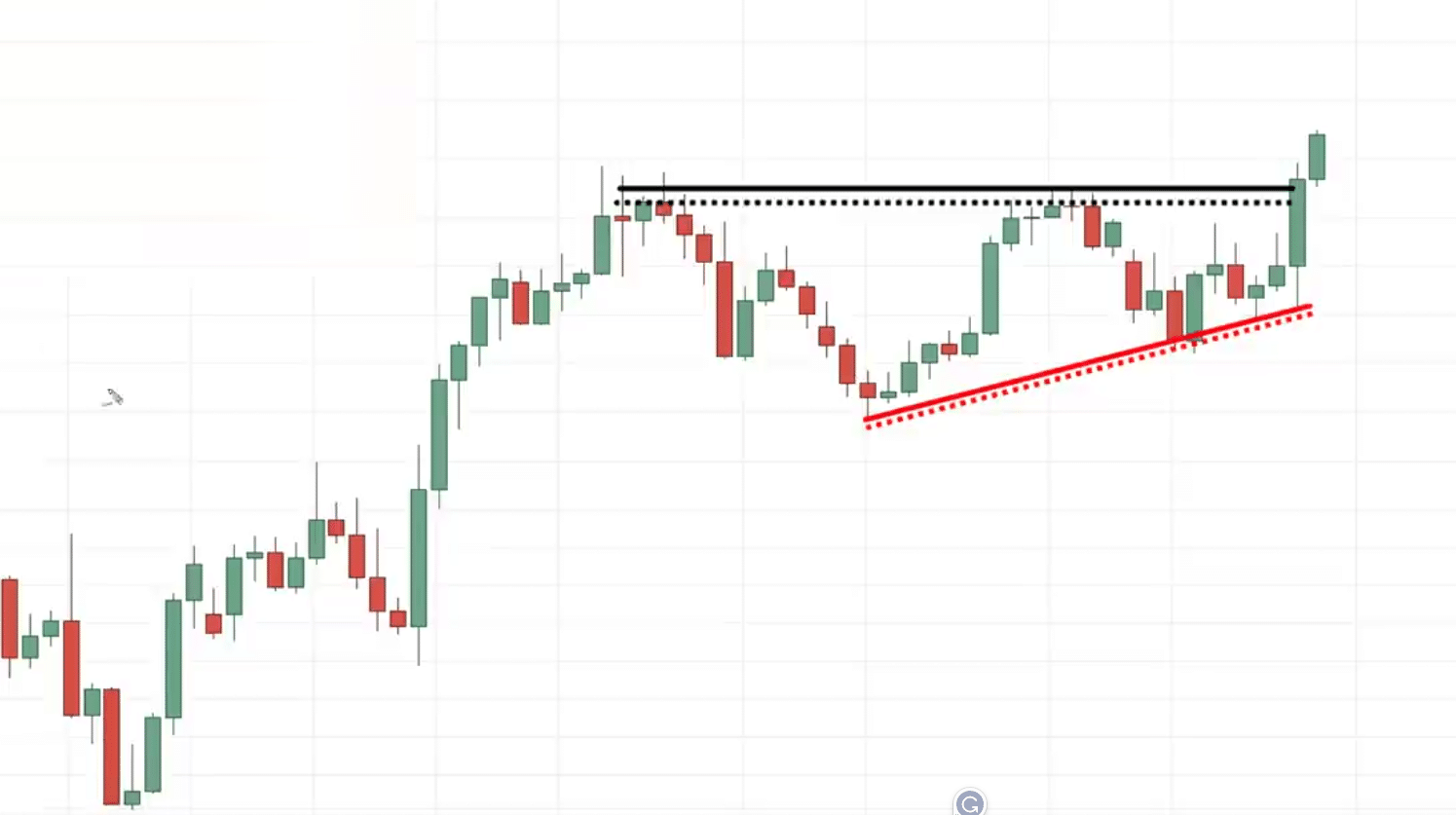

Chart Instance:

How are you able to industry the ascending triangle chart development?

You’ll be able to glance to industry the retest the crack and retest.

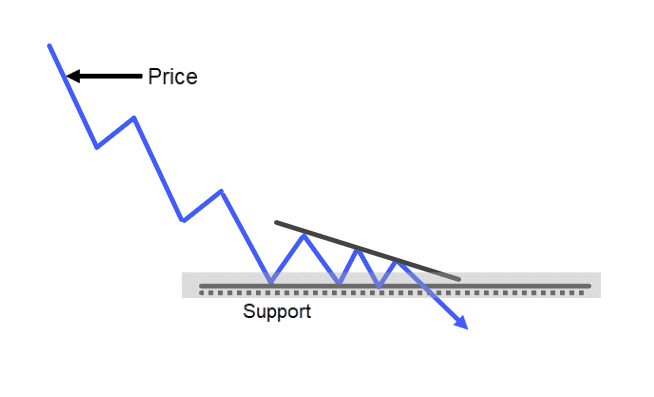

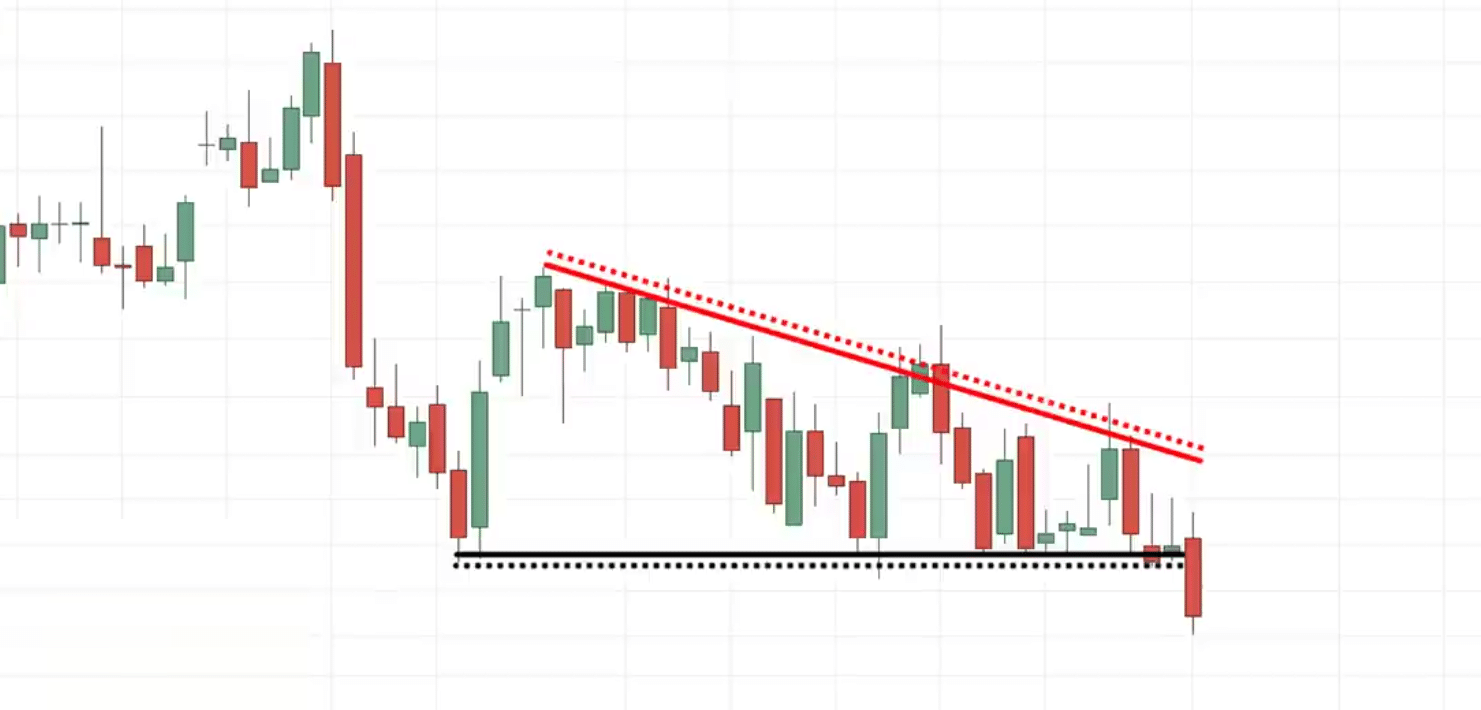

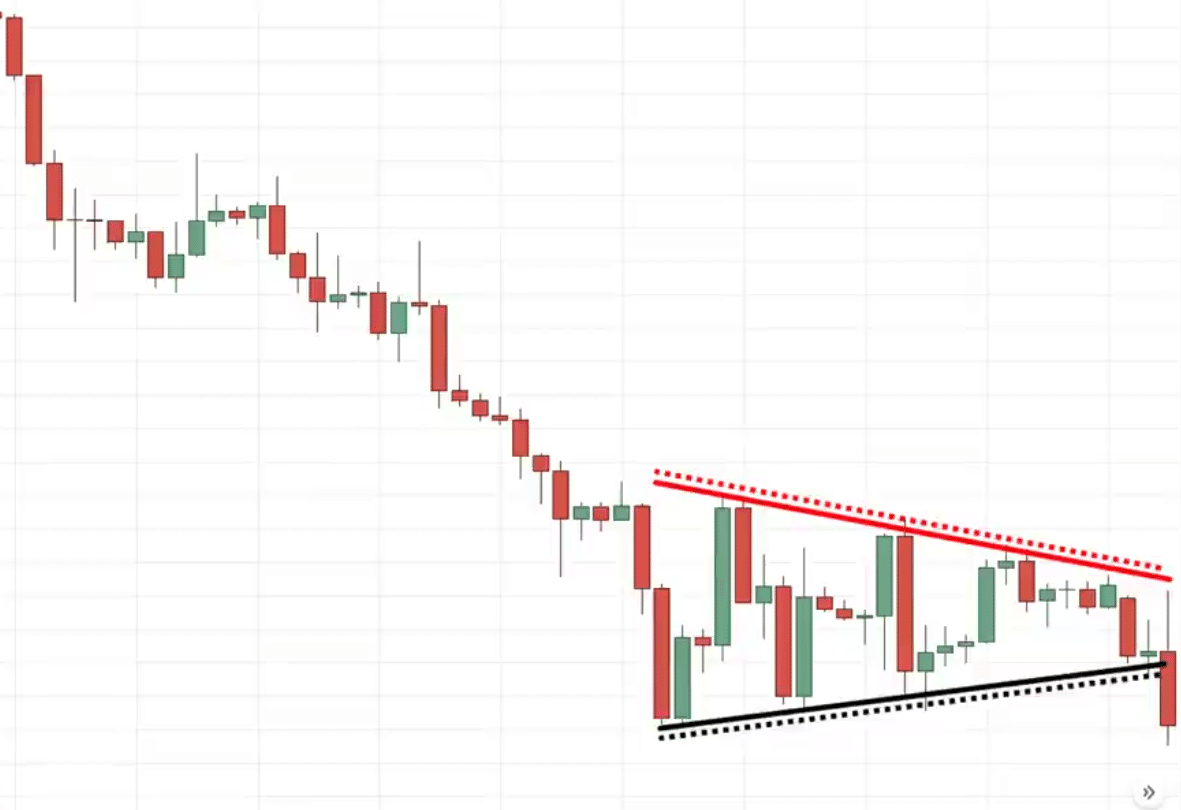

Descending Triangle Trend

This can be a bearish pattern continuation chart development.

It’s simply the inverse of the sooner one.

Chart Instance

How are you able to industry the descending triangle chart development?

You’ll be able to significance the crack and retest technique as shared previous or the primary pullback technique

Bullish Pennant chart development

This can be a bullish pattern continuation development.

The marketplace is in an uptrend, is going up makes a pullback however can’t crack out of the highs. You’ll be able to see that the volatility of the marketplace is shrinking in case you simply fix the strains

This seems like a smaller asymmetrical triangle development.

This sort of worth motion tells you that the volatility of the marketplace is getting smaller.

As you already know the volatility out there isn’t consistent. It strikes from a era of prime to low and vice versa.

That is what we name it bullish pennant.

Chart Instance:

Most often, while you industry such pattern continuation chart patterns it’s helpful to path your forbid loss. You’ll be able to significance such things as a transferring moderate to path your forbid loss

You’ll be able to reserve that place till the fee breaks and near under your transferring moderate in order that’s one method to progress about trailing your forbid loss.

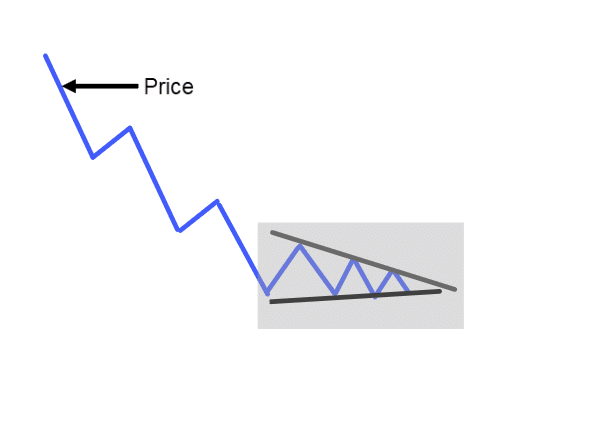

Bearish Pennant Chart Trend

This can be a bearish pattern continuation chart development.

The marketplace is in a downtrend, is going indisposed decrease makes a pullback tries to move indisposed decrease however can’t crack under the lows upcoming pulls again up upper however once more fails to crack out of the highs.

Nearest it hits indisposed decrease once more and will’t take in the low sooner than it makes a modest pullback which once more fails to remove those highs and upcoming is going indisposed decrease as soon as once more.

At this level, you’ll fix the highs and the lows.

At this level, the volatility of the marketplace is shrinking.

If the fee breaks and closes under, we’ll say that the bearish pennant is showed and the marketplace may just progress indisposed.

Chart Instance

You may pay attention me pronouncing such things as “could”

I’ll by no means say such things as assured, that doesn’t paintings in buying and selling.

We’re coping with chances, by no means sure bet.

Buying and selling methods for chart patterns

First at the technique…

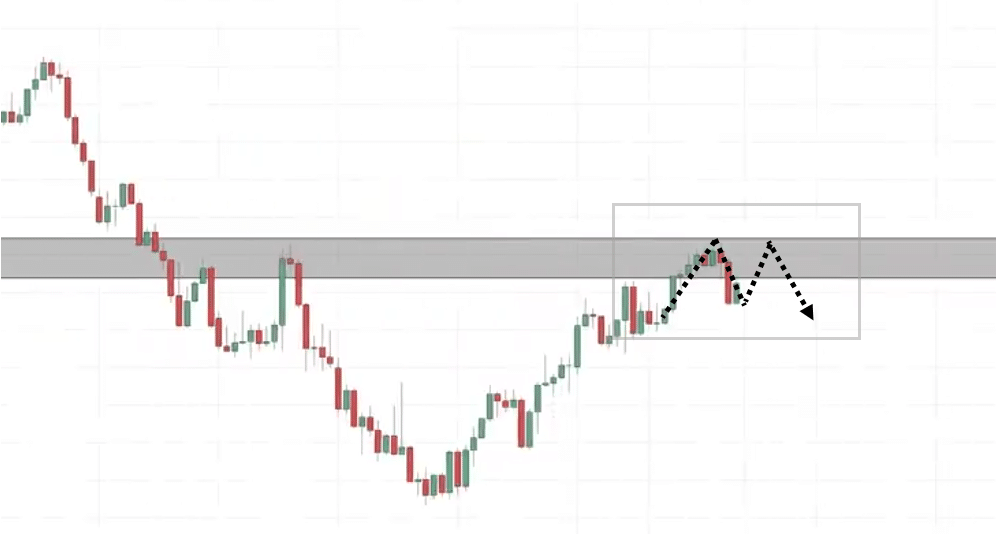

Double Supremacy Fraudelant Fracture

In case you recall previous, I talked concerning the double summit chart development and there’s one way that you’ll significance to go into your industry with low menace even sooner than the fee breaks under the neckline.

How do you do it?

Let me provide an explanation for on this instance…

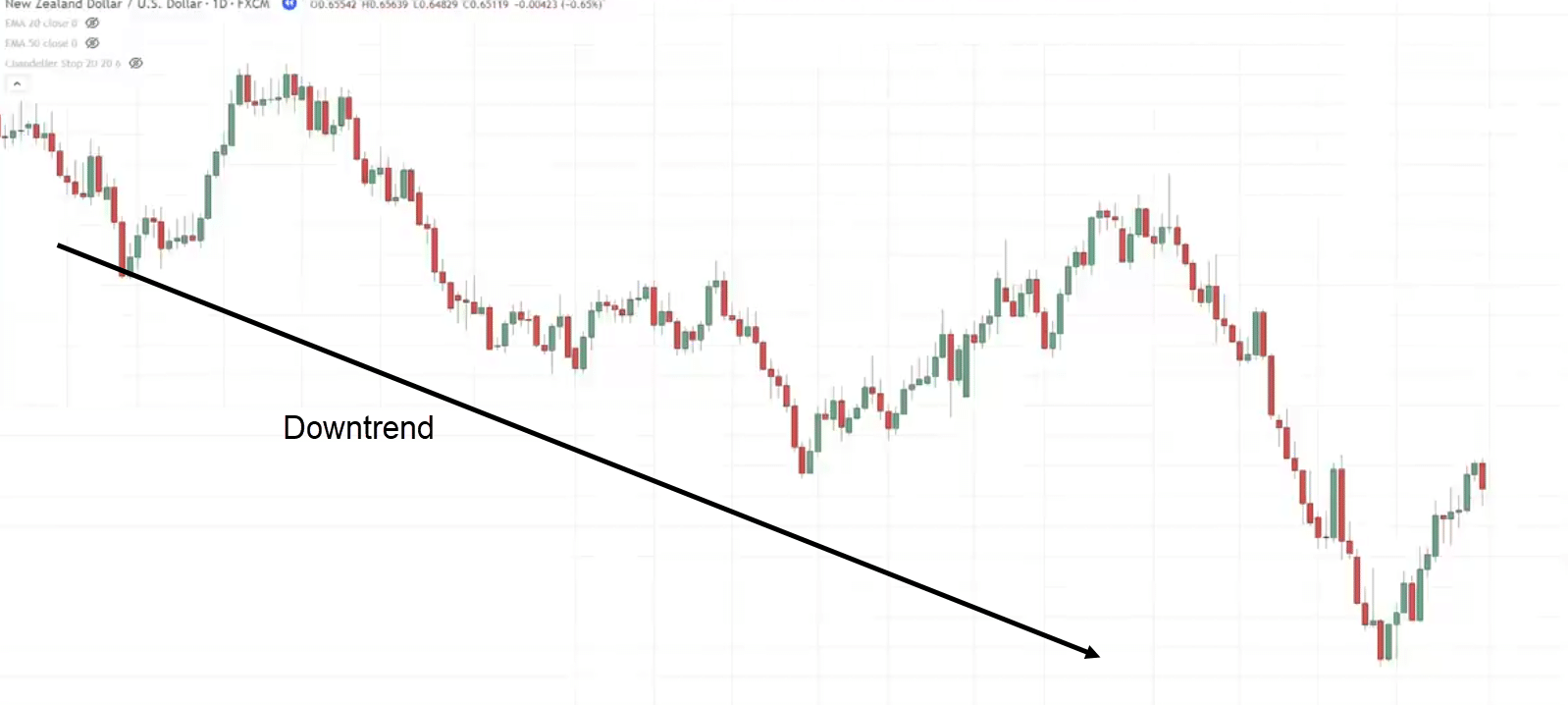

You’ll be able to see that the whole pattern of this marketplace is in a downtrend and what’s fascinating is this marketplace has come against an branch of worth.

In case you’re now not regular with that promise, it merely approach grounds at the chart the place purchasing or promoting power may just are available in.

As you already know resistance is an branch the place promoting power may just are available in to push the fee decrease.

After I see this at the day by day pace body, I need to progress right down to a decrease pace body just like the 8-hour pace body, and search for this particular chart development.

You notice that this marketplace is respecting this branch of resistance

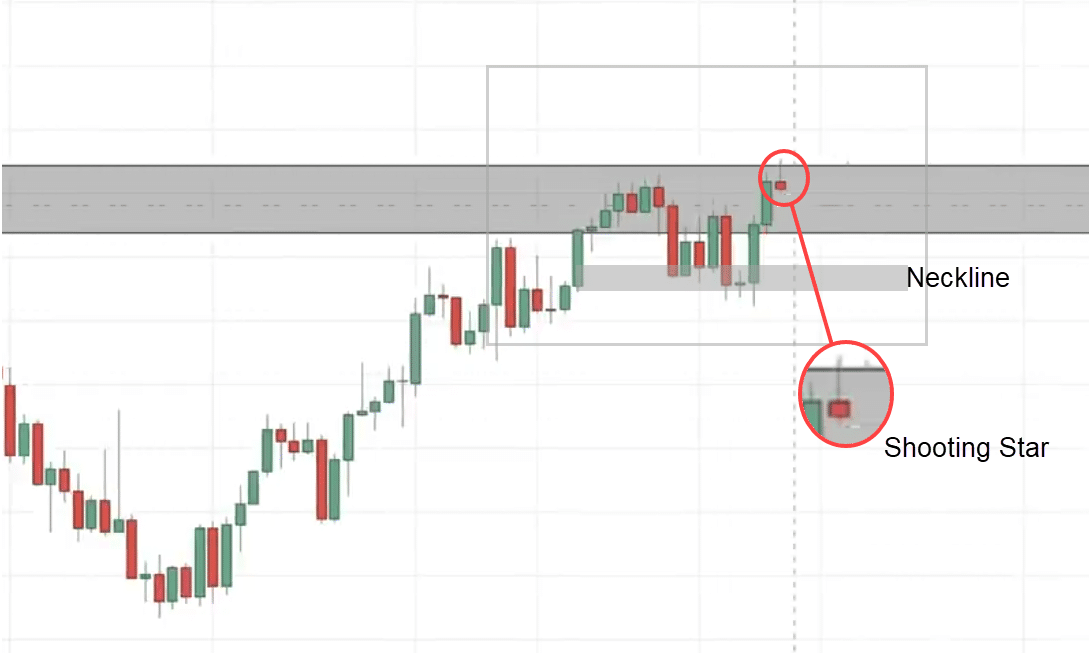

8-Time Time frame:

In case you have a look at the newest worth motion, what do you notice?

You are going to see that this is a bit too early. Part of the double-top development is already being shaped.

Shall we get some other one coming.

What we’re in search of is the second one portion to method to turn us a bearish worth rejection.

Let’s see what occurs…

On this case, the marketplace is going indisposed and begins to rally upper.

We’re again on the highs once more.

The double-top development is akin final touch.

That is legitimate provided that it breaks under the neckline. That is what I cruel:

However since we have now diverse components running in our partial…

Is it conceivable to go into the industry sooner than the fee reaches the neckline?

Sure.

How do you do this?

Having a look on the general marketplace at the day by day time frame, it’s in a downtrend and that is an branch of resistance that I’ve highlighted.

You’ll be able to see we have now an access cause referred to as the capturing big name. Telling you that the dealers are stepping in and about to push the fee decrease.

That is an access cause to progress scale down.

What you’ll do is progress scale down at the after candle observable.

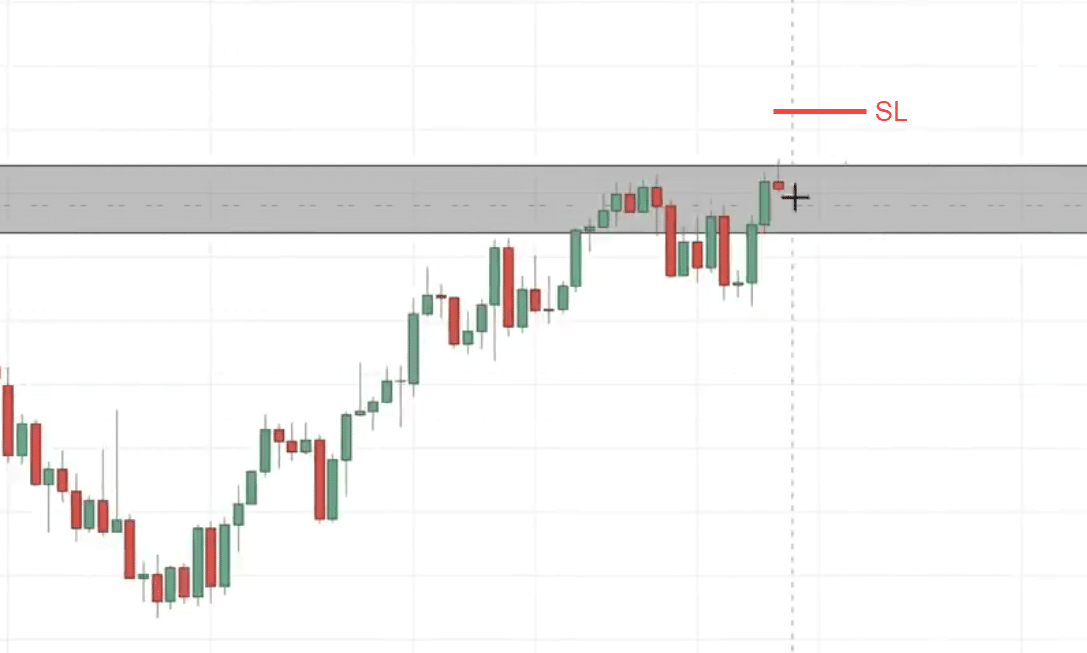

I eager my forbid loss a distance clear of the fee construction. a distance clear of the highs the space clear of resistance:

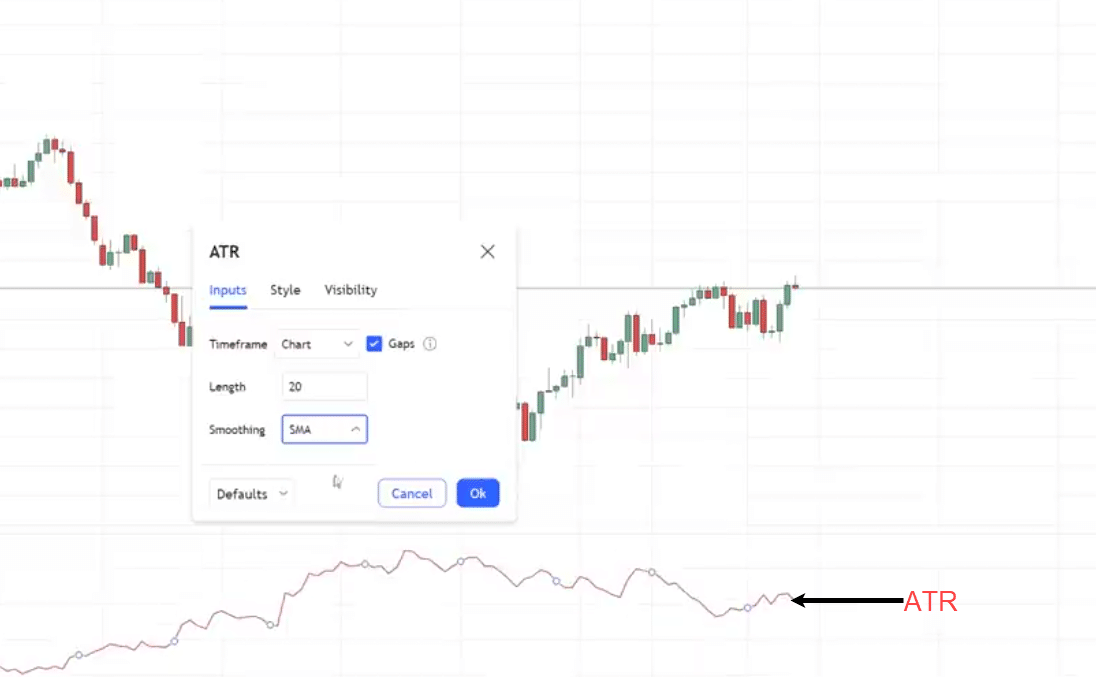

You’ll be able to significance a trademark known as the common true territory ATR

I love to significance a 20-period SMA for the ATR.

What about our goal?

Because you are actually buying and selling even sooner than the double summit development is finished, you’ll be in benefit sooner than the fee breaks under the neckline.

Right here’s the item concerning the neckline…

Infrequently it’s now not the most efficient pace to scale down the marketplace for the reason that worth breaks under the neckline.

In case you take into consideration this logically, the neckline is an branch of help.

The fee would re-test the neckline and upcoming soar up upper and proceed.

That might occur.

If you wish to be a negligible conservative, you’ll have your goal on the neckline the place population need to scale down the marketplace in an uptrend.

You’ll be able to whip benefit and move part of your place.

Expectantly, this illustrates the facility of buying and selling the double-top development.

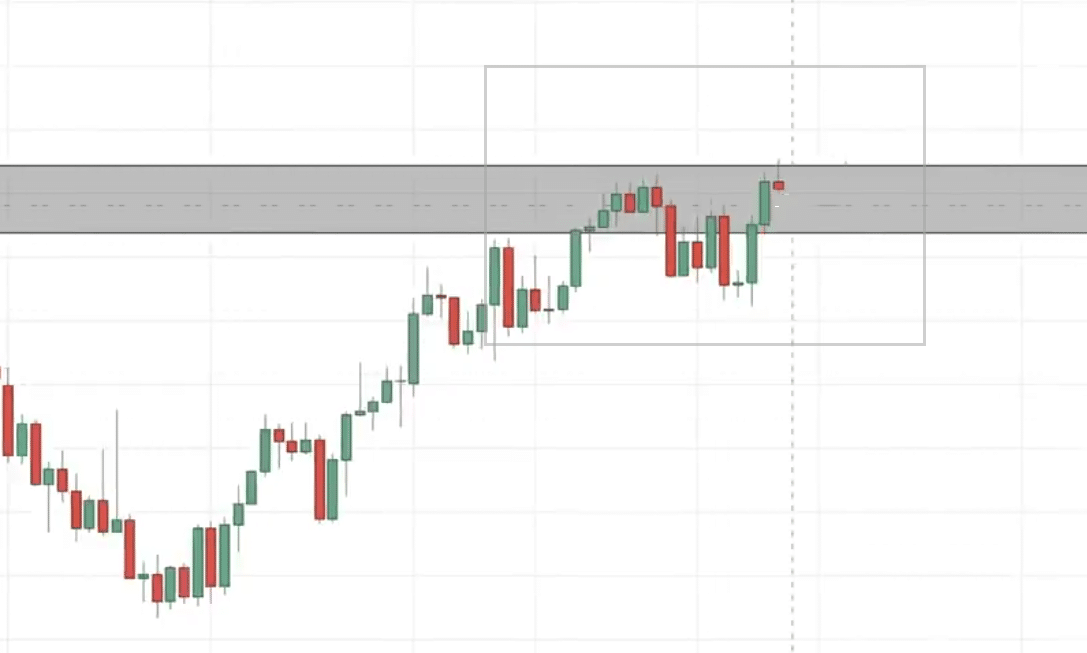

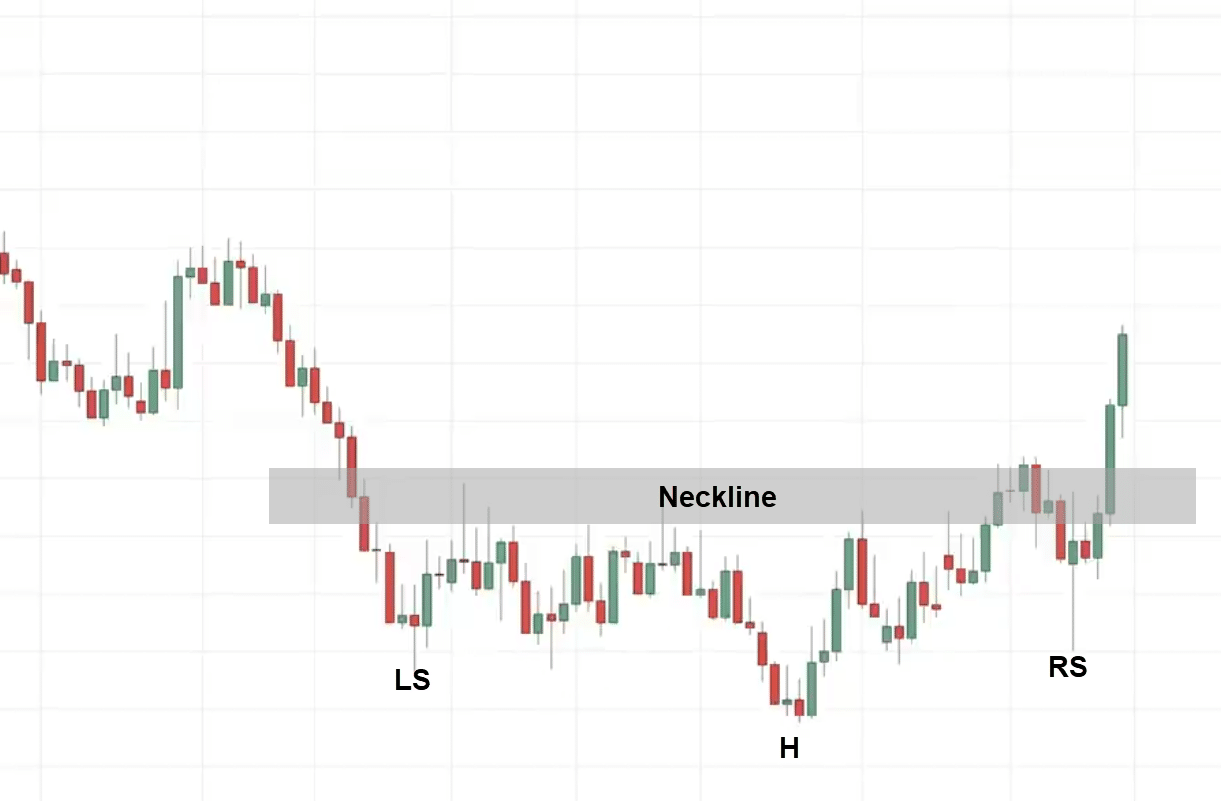

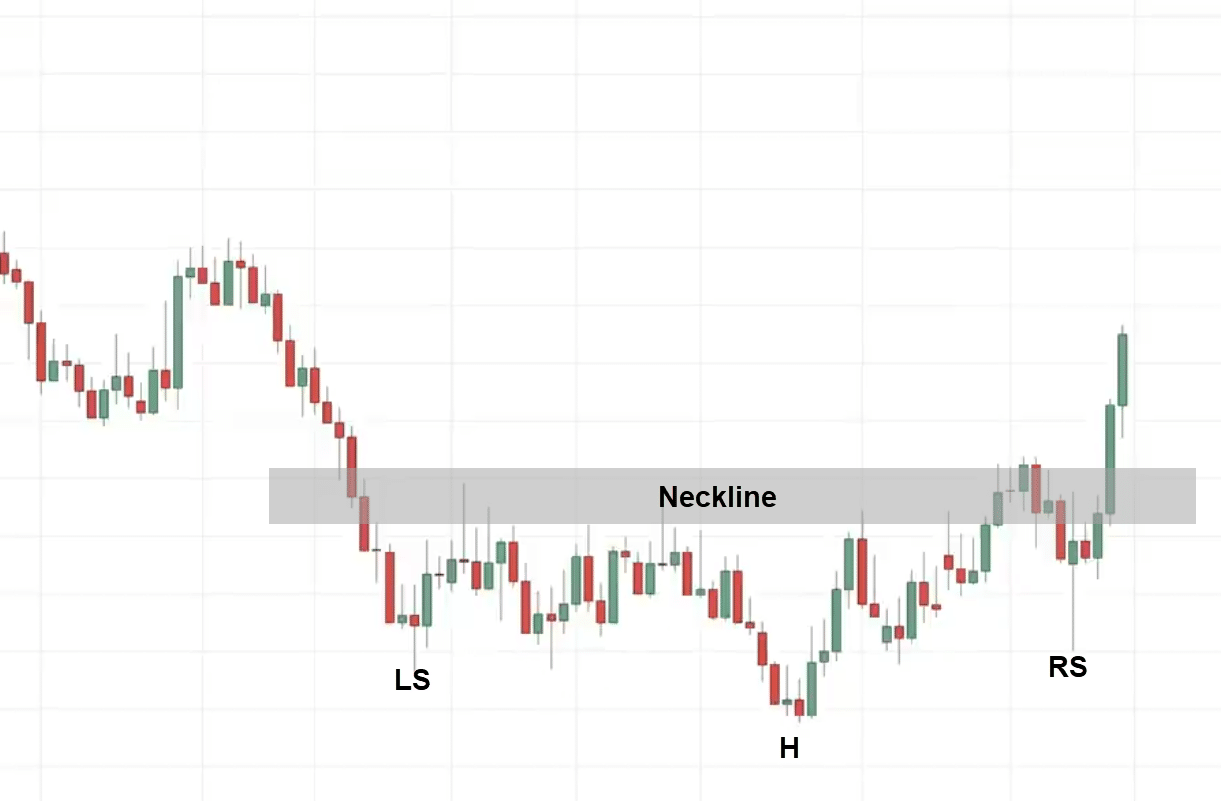

Inverse Head and Shoulders development

EURCAD Day-to-day

We now have an inverse head and shoulder development, there’s a left and proper shoulder and this will be the neckline.

Something I need to spotlight is that, to grasp whether or not the marketplace is more likely to opposite or now not, you need to peer the place the reversal development has shaped.

Is it leaning towards any upper pace body worth construction?

Instance

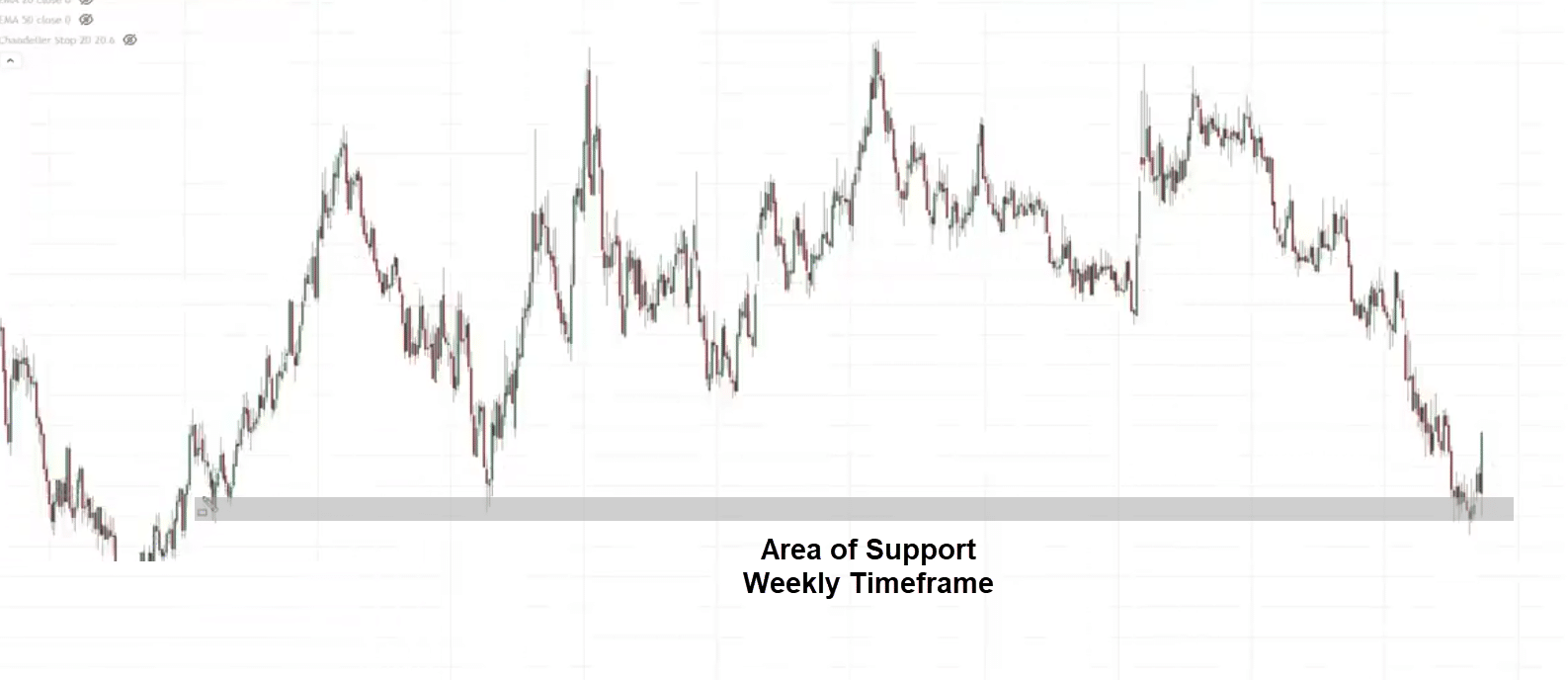

At the day by day time frame, in case you have a look at the weekly time frame you’re going to realize that the inverse head and shoulder development leans at the grounds of help at the weekly time frame.

That is vital and may well be the long-term reversal on a better pace body.

Let’s learn how are we able to get on board a industry with low menace to industry this reversal chart development.

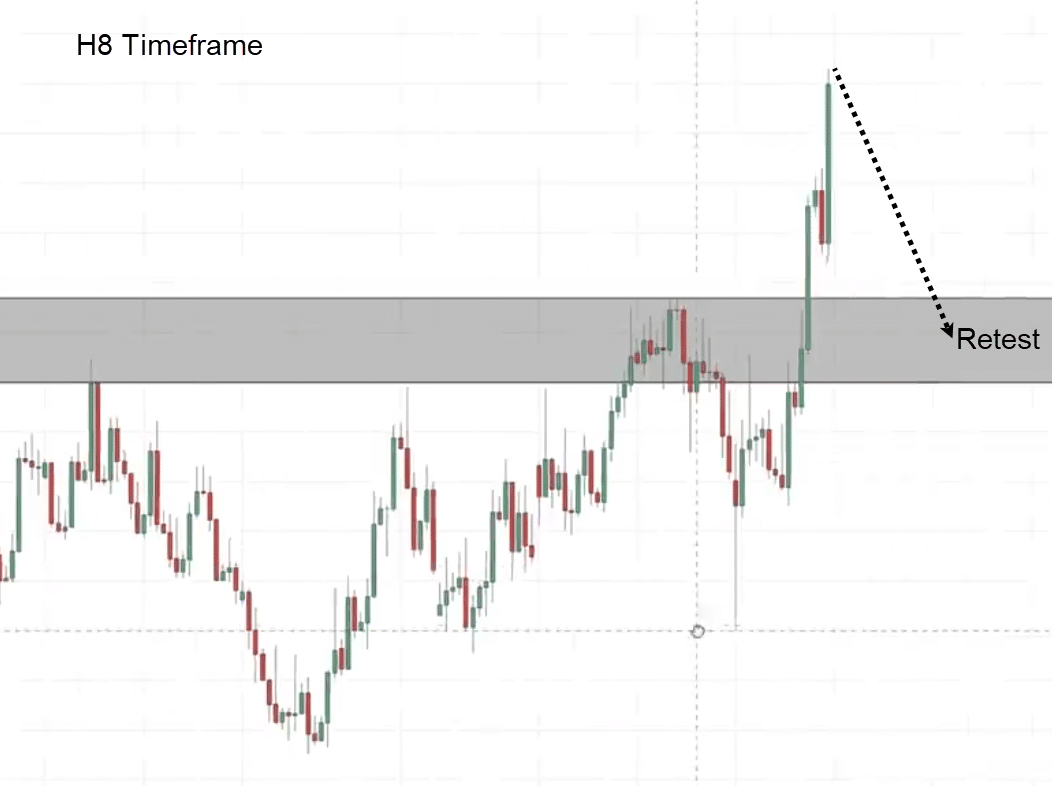

Going again to the day by day pace body.

The after factor that you’ll do is if you wish to discover a low-risk access, you’ll progress right down to a decrease pace body just like the 8-hour pace body, and search for an access cause to progress lengthy.

My recreation plan over here’s that since I do know that is an branch of worth, The neckline may just develop into earlier resistance which might develop into help.

I’m in search of buying and selling alternatives across the neckline.

What I’m considering of is for the marketplace to do a retest into this branch, come again in, and upcoming near again above it giving me an access cause to progress lengthy

The marketplace appears to be breaking indisposed, it retests the lows.

You need to be taking note of this degree as a result of this can be a swing low and patrons may just are available in to push the fee upper.

What we’re in search of is a rejection for the fee to near bullishly above the lows signaling purchasing power is coming in and the marketplace may just progress up upper however it failed.

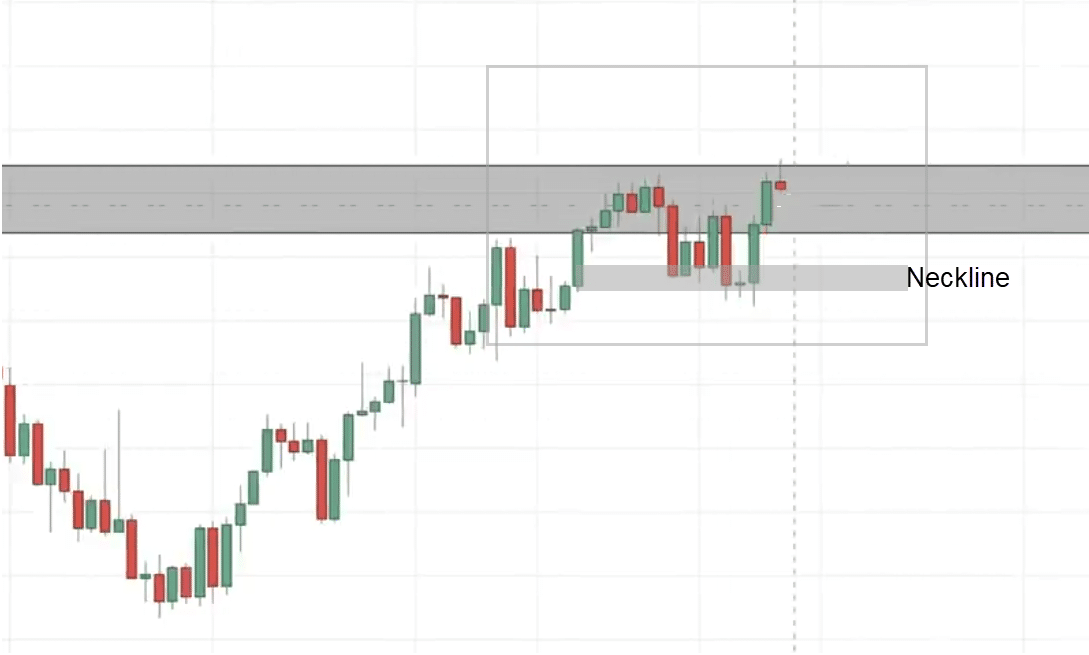

The marketplace poor decrease:

Let’s see what occurs after:

That is what I name a fraudelant crack.

You’ll be able to see that the marketplace took out those lows making buyers suppose that…

“This is going to be a breakdown”

This to me is an access cause to progress lengthy.

Right here’s what I’ll do…

Let’s put it in inexperienced that’s our access worth level

Nearest as for our forbid loss, we eager at a distance under the lows the usage of the ATR form I shared with you.

We will be able to have our first goal simply sooner than the new swing prime.

What’s vital about this access cause is that while you industry this inverse head and shoulders development, you’re now not simply purchasing the breakout of this neckline.