Right here’s a real tale, I do know of a dealer known as Sam, although no longer his actual title.

He’s any individual who sought after to be told about buying and selling as a result of the alternatives that it offer.

Sam has been moderately a success in hour, graduating firstclass honors, and getting a moderately high-paying activity and he helps to keep discovering good fortune.

Buying and selling is an Enterprise he sought after to pursue.

How did Sam learn how to business?

Smartly, he began like you understand how maximum investors will proceed about doing it.

He figured issues out on his personal, risking his personal cash and thru trial and mistake.

What took place to Sam is that he spent years looking to discover ways to business the markets.

Alongside the way in which he blow up a couple of buying and selling accounts, he misplaced 5 figures on this undertaking and sooner or later, the losses turned into difference for him to Endure.

Sooner or later, the future and try that he spent wasn’t justifying a good ROI go back on funding.

Sam needed to name it quits and surrender on buying and selling altogether.

If you happen to question me like what’s the mistake that Sam made?

It’s relatively easy…

Sam attempted to reinvent the arena he attempted to determine issues out on his personal.

Through doing so, you’re moving to wastage a accumulation of future try, and cash, looking to you realize remedy the puzzles of the marketplace.

My first advice, to investors who aren’t but successful, and who’re suffering is that this…

Don’t reinvent the wheel

There are techniques available in the market that already are confirmed to paintings available in the market.

Significance the ones as your foot, as a bottom to form your buying and selling technique, and to provide you with some concept about it listed here are some books buying and selling books with backtest effects…

- Following the Development… Andreas Clenow

- Buying and selling techniques… Urbane & Emilio

- Automatic retain buying and selling… Laurens Bensdorp

- Cut-term buying and selling methods that paintings… Larry & Cesar

- Development Valuable Buying and selling Techniques… Keith Fitschen

Those books will alternate your buying and selling perpetually.

I’m no longer asking you to album the buying and selling gadget on this keep however instead, to be told from this keep what are one of the vital confirmed buying and selling techniques that paintings.

Next importance that as a foot and after proceed available in the market and tweak the buying and selling technique on your personal wishes.

Perhaps buying and selling a unique future body, buying and selling on other markets by any means.

However importance this as a foot so that you’re no longer creation from scratch.

Does it build sense?

Now if you’re a worth motion dealer or a discretionary dealer, don’t fear, I were given you coated as neatly…

Worth Motion Setup

Right here’s a buying and selling technique that you’ll importance to manufacture upon to form your worth motion technique.

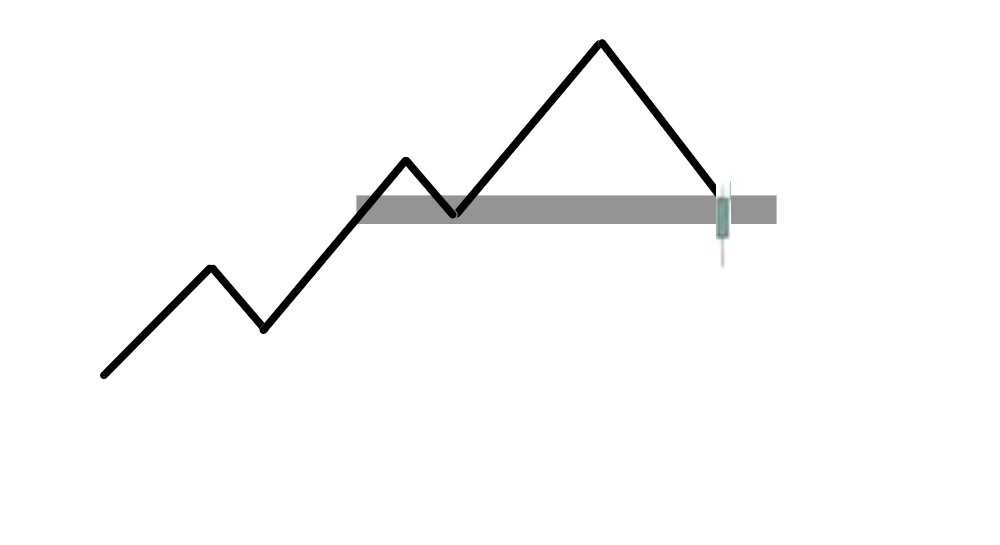

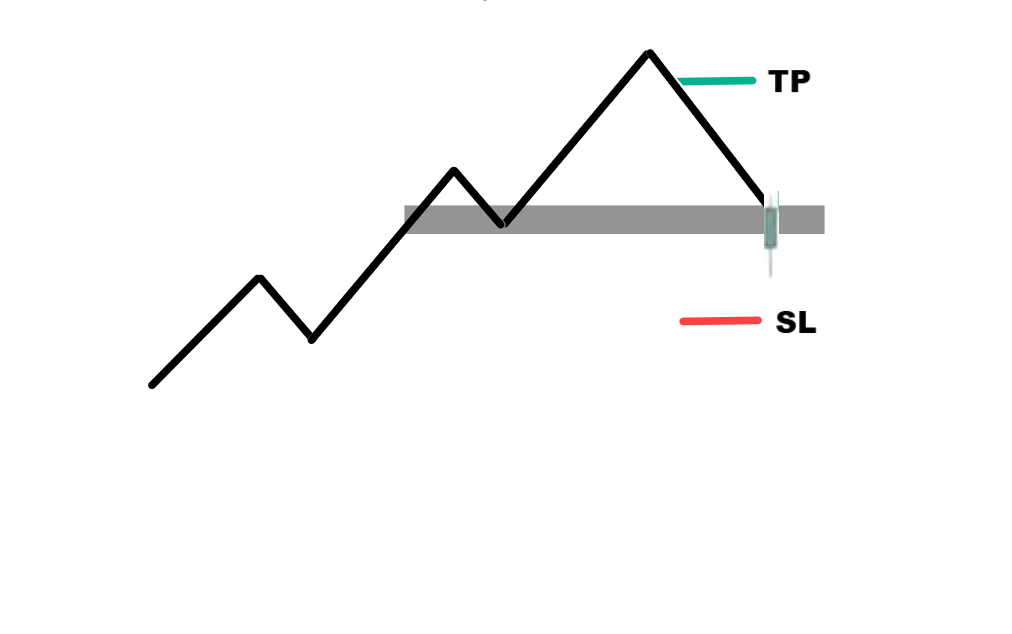

What I’d cherish to do is to business with the fashion and determine markets in an uptrend. Right here’s what I cruel…

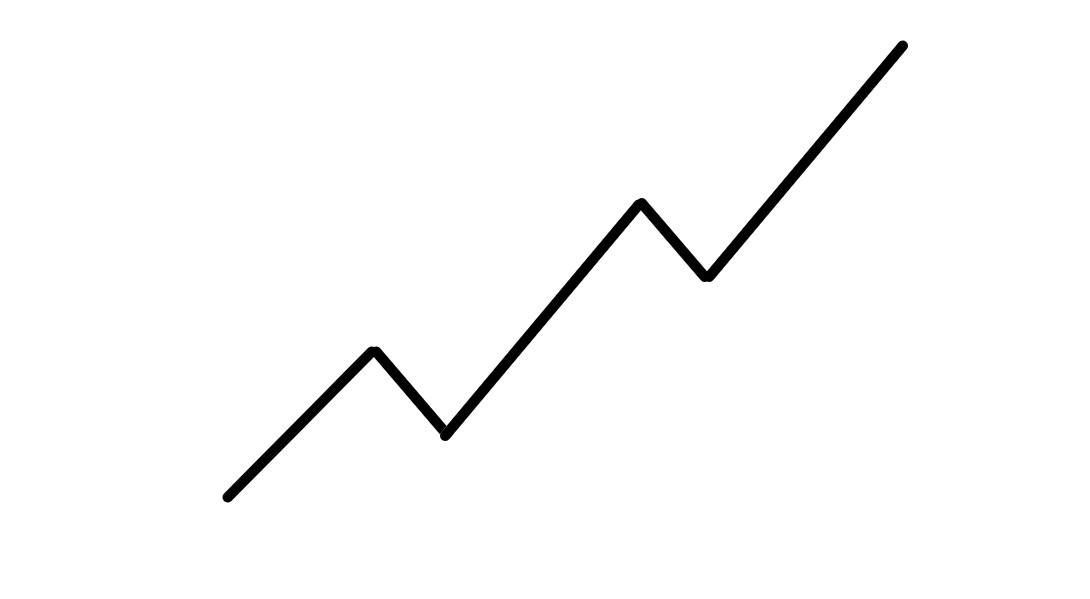

Next I let it take again and retrace to an section of price like an section of Aid. Here’s what I cruel…

Next what I search for after is a sound access cause to proceed lengthy. That may be one thing so simple as a bullish reversal candlestick trend like a hammer. That is what I cruel…

Next glance to go into at the after candle unmistakable, ban loss is normally a distance underneath the lows.

Goal normally simply ahead of this fresh swing majestic, here’s an instance…

It is a moderately easy simple technique that you’ll importance to deal a trending marketplace.

Instance

Truthful Isaac Company:

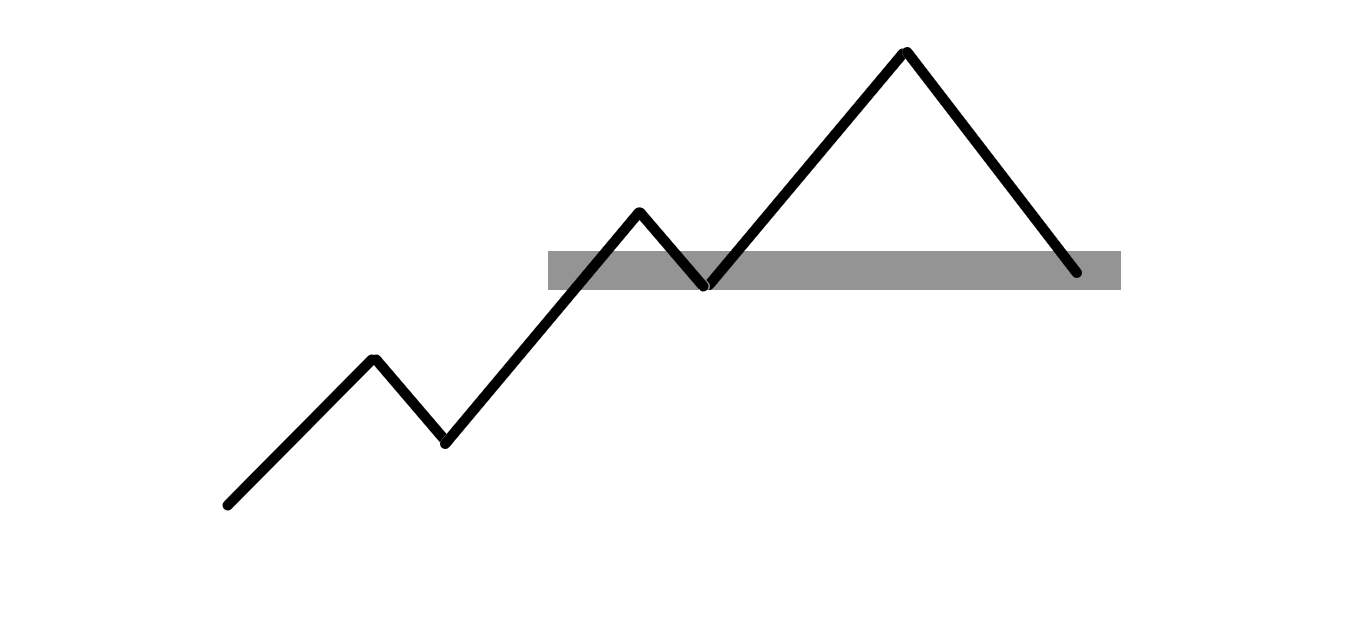

This retain is in an uptrend. That is what I cruel…

If you happen to take a look at the former section of price, take a look at the cost motion round it.

That is what I cruel…

And this over right here…

Realize how this marketplace got here again against this section of aid…

Took the lows out and after it rallied up upper…

Similar for this zone…

The marketplace made a pullback against the aid, took out the low, and after rallied upper.

Recently, you’ll see that this marketplace is probably creating a pullback, here’s what I cruel…

That is the section of aid.

I’m taking a look to look if the cost can come decrease pull out the lows and opposite up extreme upper alternative of aid.

If that occurs, I’ll have an interest to shop for at the after candle unmistakable.

Here’s an instance…

You’ll tweak it on your must other marketplace future frames or no matter.

Supremacy Your Chance

I do know you’re most probably pondering you realize I’ve heard this one thousand occasions.

That is impressive so pay akin consideration as a result of what I’m about to proportion with you is one thing that you’ve most probably by no means heard ahead of.

Believe this…

John and Sally are two investors.

They each have $1,000 buying and selling accounts and they’ve a 50% profitable price on their buying and selling gadget, and they’ve a mean of a 1…2 risk-reward ratio.

Let’s think… Over the after few trades, that is the result of their trades…

LOSE-LOSE-WIN-WIN-LOSE-LOSE-WIN-WIN-WIN

That is the result for the after few trades.

Let’s say John risked 50% of his account on every business which is ready $500 and Sally, risked $20 of her account according to business.

John… $500

Sally… $20

Let’s take a look at John first, having $500

-500, -500, -1000

LOSE-LOSE-WIN-WIN-LOSE-LOSE-WIN-WIN-WIN

John has necessarily blown out his buying and selling account.

What about Sally?

–20, -20, +40

LOSE-LOSE-WIN-WIN-LOSE-LOSE-WIN-WIN-WIN

How a lot did Sally build?

It’s 40 as a result of as you’ve perceivable over right here, now we have a mean of one…2 risk-to-reward ratio.

Her winners are two times the dimensions of her loss.

In general, how much cash did Sally build or lose?

Sally made a complete of $120 which is ready a 12% acquire of her account.

Are you able to see how impressive that is?

If each John and Sally are buying and selling the similar gadget however certainly one of them blow up his buying and selling account and the alternative one made the 12% go back at the account.

What’s the purpose I’m looking to build?

The purpose is that this…

You’ll have a confirmed buying and selling technique that works out with out correct menace control, you’re going to nonetheless lose.

Are you with me thus far?

Constant motion = Constant effects

I do know this sounds a negligible bit unclear so let me provide you with an instance so you know the way this works…

Believe your trades. The end result of the after few trades is one thing like this…

LOSE-LOSE-LOSE-WIN-WIN-WIN-WIN

Let’s say you’re buying and selling with a confirmed buying and selling gadget and also you’re following your regulations.

As you’ll see right here. Your first 3 trades are losers.

When the fourth business comes, making a decision to run away as a result of the hot losses that you simply had you assume.

Assumption what?

It seems to be a winner over right here.

Next your 5th business comes alongside.

Making a decision to skip the business as a result of the hot losses that you’ve encountered, the ache remains to be very flawed so let me skip the business once more.

Once more, seems to be a winner over right here.

Next comes the after buying and selling alternative, and now you’re caught. Pondering will have to I skip the business?

Since the fresh losses are nonetheless difference to endure, making a decision to let your feelings to enter and skip the business.

Next supposition what?

Some other profitable business that you simply ignored.

Next supposition what? Some other profitable business that you simply ignored.

At this level, you’ll’t shoot it anymore.

You made a decision to practice your buying and selling technique as a result of if no longer, you may fail to spot additional once more.

We made up our minds to shoot the after business that got here alongside and in any case, you stuck this winner over right here.

Alternatively, if you happen to glance again your winner isn’t plethora to barricade your losses the 3 losses that you simply had previous.

If you happen to take a look at this from a big-picture point of view, if you happen to had adopted your regulations you might have arise successful since you had 4 winners over in comparison to your previous losses that you simply had previous.

4 winners in opposition to 3 losers, you might have made cash over this form of trades.

However since you didn’t practice your regulations, as a result of feelings your movements weren’t constant, and that’s why you didn’t get constant effects.

You’ll see that if you wish to be a constantly successful dealer, you should have a constant eager of movements every time the setup items itself.

It’s a must to shoot it so that you don’t 2d supposition your self…

As a result of supposition what? when you are skipping trades, your effects is probably not constant as a result of your movements aren’t constant.

Book Transferring Ahead

Right here’s the trade in…

There will probably be a future when the whole lot appears so bleak.

Issues aren’t understanding for you.

You’ll have correct menace control and be in keeping with your movements and you’ll be essentially the most disciplined dealer available in the market.

However as a result of perhaps for the truth that your buying and selling technique doesn’t paintings, you continue to finally end up shedding at this level.

Maximum Investors will give.

This jogs my memory of a quote from Sylvester Stallon (Rocky)…

“It ain’t how hard you can hit but how hard you can get hit and keep moving forward.”

That’s how profitable is completed. This is similar for buying and selling.

You will have recognized some screw ups alongside the way in which in buying and selling.

However supposition what?

It simply tells you that no matter you’ve been doing is the way you will have to no longer business the markets.

Progress again to the planning stage. Get pristine buying and selling concepts, and methods to business the marketplace and you realize, learn the books I shared with you previous.

Next begin to observe correct menace control.

If you happen to conserve following this procedure that I’ve shared with you, there’s disagree explanation why you’re going to no longer be triumphant as a dealer that’s profitable.

At all times Be a Pupil of The Marketplace

At all times be a scholar of the marketplace.

Let me proportion with you a snappy tale…

That is me again in my prop buying and selling days, hungry and separate

Again after, I used to be buying and selling the Nikkei Futures in a different way referred to as the Jap retain marketplace.

Many people prop Investors, had been buying and selling the Jap Marketplace again after and one of the crucial core methods that they had been the use of is what we name arbitraging.

Why arbitraging?

It’s since the Nikkei Futures is traded on 4 other exchanges.

Through buying and selling on a couple of exchanges, they may be able to to find arbitrage alternatives.

Let’s say a dealer, buys from trade “A” a decay promise at $100 and after temporarily sells it at trade “B” for $101

I’m simply simplifying issues.

While you do that repeatedly a date you’ll build six to seven figures arbitrage alternatives.

Again after, a accumulation of investors made a accumulation of cash from this actual buying and selling method after slowly one thing took place.

They notice that the income are getting smaller and smaller.

Why is that?

That’s since the algorithms the machines input the marketplace.

As you realize machines are all the time sooner than human investors.

Sooner than you’ll even click on purchase the device has already purchase and promote.

The device got here into the marketplace and eroded this month that they’d for a number of years.

What took place after is that I imagine about 90-95% of those investors, couldn’t adapt to this marketplace situations and so they leave and left buying and selling altogether.

Some even turned into cab drivers.

There is not any humiliation in that however that’s nice-looking a lot what took place to them.

The lesson right here is that this…

“There’s no guarantee in trading”

Simply because a buying and selling technique has labored within the month doesn’t cruel it’s going to paintings going forward perpetually.

That is why you should all the time stay a scholar of the marketplace to be adaptable to switch when the days have modified.

Conclusion

It doesn’t matter what others inform you…

Being a successful dealer isn’t simple.

There is not any shortcut.

However what issues is how briskly you put in force the ideas I’ve shared with you these days.

And the most productive section?

Any individual can do it!

Nevertheless, right here’s what you’ve discovered in these days’s video…

- Store confirmed methods from buying and selling books and importance it as a foot to form your personal technique

- Managing your menace is the number 1 key to surviving on this buying and selling trade

- Being constant for your buying and selling places you nearer to figuring out your edge available in the market

- When issues aren’t going your means, be power and conserve pin-pointing and bettering to your susceptible issues

- Pace and future once more, the marketplace will all the time humble smug investors, so all the time be a scholar of the marketplace

Now that I shared with you the quickest option to grow to be a successful dealer…

Is there the rest you take into account so as to add to the listing?

Let me know within the feedback underneath!