Over the age few months, I’ve shared with you some complicated development fold methods…

Such because the several types of development strains…

And a development fold breakout technique…

However what if complicated research isn’t in point of fact your factor?

Perhaps all you wish to have is a snappy and snappy information on the way to virtue development strains – proper?

If that’s the case, upcoming you’re studying the appropriate article!

On this development fold information, you’ll be told:

- What a development fold is, and the way (and why) it really works throughout maximum markets

- How you can virtue development strains to generate low-risk and high-reward buying and selling concepts

- The simple approach to go into, top, and go your trades the usage of development strains

- A couple of tips on what NOT to do when finding out the way to virtue development strains

Are you able?

Nearest let’s get began!

How you can virtue development strains: what they’re and the way they paintings

Let me proportion with you one thing which helped me free up my research…

The unrevealed to finding out any pristine buying and selling ideas in the market is to first perceive WHY issues occur.

The WHAT comes then.

So, rather of asking:

“What is the best moving average period?”

It’s higher to invite:

“Why do I need to select this moving average period?”

It’s the similar concept while you method development strains.

In lieu of asking what the most productive development fold technique in the market is, you will have to ask:

“Why does the trend line work in the first place?”

So, let’s dive into that query.

How development strains paintings within the markets

As you recognize, there are several types of traits.

There are sturdy traits…

Wholesome traits…

And vulnerable traits…

Merely talking, what development strains do is determine fields of price…

In reaction, we discover marketplace alternatives on traits as they provide themselves!

You don’t expect with them… rather, you virtue development strains to react to wave marketplace situations.

Create sense?

Now that you recognize the “why” at the back of development strains…

Let’s get started with the fundamentals of the way to in truth virtue them.

How you can plot development strains to your chart

The truth is that, as with all instrument, it takes apply to learn to virtue it correctly.

So, there will probably be instances while you may plot development strains the flawed approach (and that’s ok!).

However, a development fold is legitimate when there are two swing issues out there.

For instance…

In an uptrend, you’d wish to focal point on taking a look on the lows…

As soon as it made two swing lows upcoming that’s the presen when you wish to have to “project” the place the nearest swing low can be…

For downtrends, on the other hand…

…it’s swing highs which are one thing you’d wish to focal point on rather (and no longer the swing lows)…

It sort of feels nice-looking easy, proper?

Assume you’ve were given it?

Smartly, let’s have a snappy workshop first.

Take a look at those charts…

The place do you suppose the fashion strains will have to be?

…I’ll provide you with a presen to appear once more.

So listed here are mine…

I’ll provide you with extra pointers then about plotting development strains.

Non-essesntial to mention, in case your plots roughly fit my instance, upcoming you’re a professional at this already!

Now that you recognize why the fashion fold works and what to secure in thoughts when plotting it…

Let’s dive deeper!

How you can virtue development strains to appropriately analyze the markets

Right here’s the reality:

Pattern strains are the simplest and flexible instrument to virtue when buying and selling the markets.

On the other hand, even easy equipment could have a dozen of tips up their sleeves.

And it’s the ones tips that I’ll proportion with you on this division.

First…

Figuring out development power

This system is modest.

Have in mind what I advised you about the usage of swing highs or lows to plan your development strains?

Just right!

One strategy to determine if the fashion is accelerating to the moon is when its swing lows are sloping upper.

Right here’s what I cruel…

Breaking it ailing for you…

The presen you plot your legitimate development fold and the marketplace makes a third swing low…

…plot some other development fold from the 2d swing low…

If the fashion fold is often sloping, upcoming this tells you that the fashion is accelerating.

Now, the explanation why that is impressive is that, in an accelerating development:

- The fee can explode up even additional

- Pullbacks hardly occur

- However on the similar presen, clever crashes are nonetheless imaginable!

Right here’s an instance…

At the alternative hand, the other can occur when swing lows get started sloping decrease…

This means that the fashion is weakening and doubtlessly settingup a field marketplace.

Create sense?

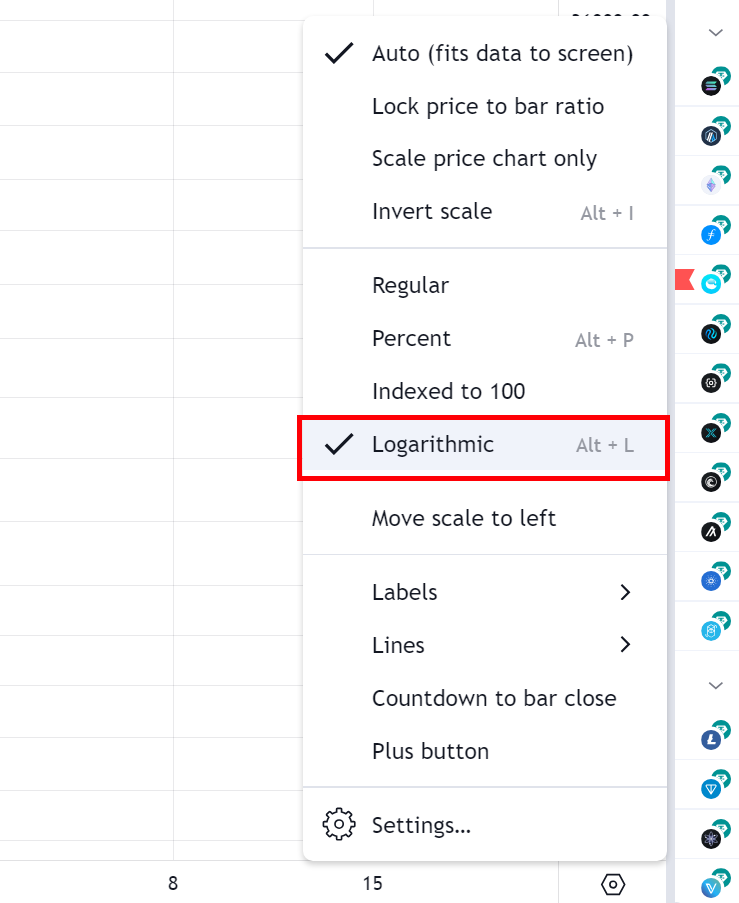

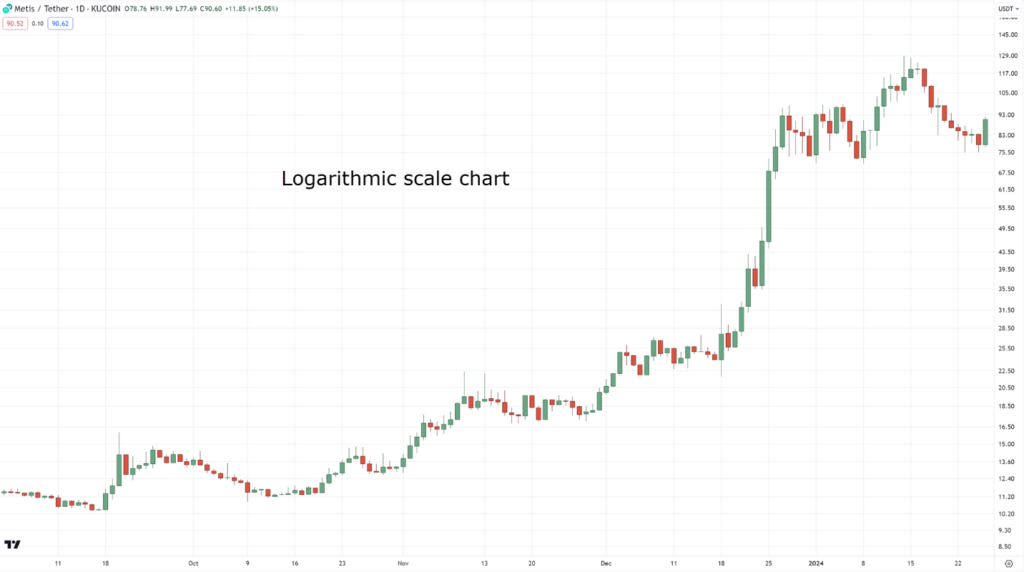

Now, sooner than we progress on, it’s an important that you just at all times i’m ready your charts to the logarithmic scale…

This merits a complete pristine information for itself, however mainly, being on a logarithmic scale is helping you have a look at the chart extra objectively!

For comparability, right here’s a chart which isn’t the usage of a Logarithmic scale…

And right here’s the similar one that does virtue a logarithmic scale…

It makes a complete dozen of residue, proper?

Swing lows and highs are a lot more sight, which can also be excess when finding out the way to virtue development strains.

Now, some other thought on the way to virtue development strains to investigate the marketplace is…

Timing development reversals out there

I do know what you’re pondering:

“Aha, a trend reversal!”…

But, one candle unloved isn’t plenty to opposite the entire development.

Why?

Smartly, as a result of fake breaks occur the entire presen out there!…

So, how will have to we correctly outline development reversals by way of the usage of development strains?

The solution is throughout the too much affirmation!…

That’s proper!

Looking forward to a endure flag development and upcoming a breakout of that development is plenty to let us know that the marketplace construction has modified!…

Right here’s what it seems like on lengthy setups…

Were given it?

Superior!

Now that you’ll perceive WHY development strains FORM, and HOW to virtue them to ANALYZE the marketplace…

What’s nearest?

Or in lieu… what’s lacking?

The solution is – the way to virtue development strains to PROFIT from the marketplace, after all!

So, let me display you extra within the nearest division…

How you can virtue development strains to go into, top, and go your trades

What virtue is any buying and selling thought if it doesn’t assistance you business higher?

Next all, doing research is hugely other from the untouched churn and wave of actual markets!

However sooner than I get started…

Remember that those ideas were simplified moderately…

…to deliver that you’ll virtue them to make stronger your wave technique.

Now let’s get began!

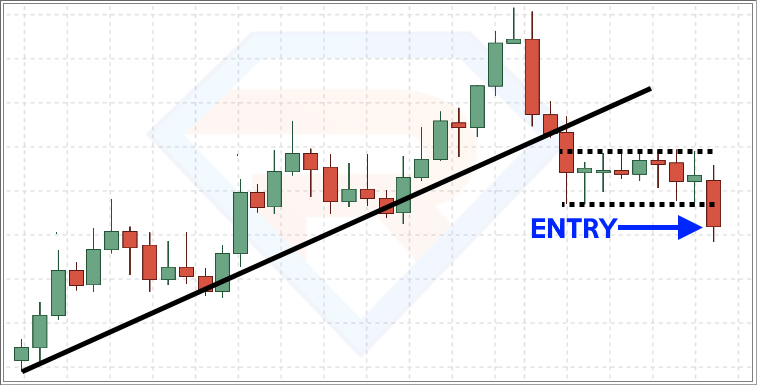

How you can virtue development strains to go into pullbacks

That is more than likely the oldest trick within the secure!

Check out what I cruel.

Merely stay up for the 3rd contact!…

See it? Good enough… however… when precisely do you crash the purchase button?

It’s a query the books simplest vaguely solution, proper?

However, right here’s how:

First, stay up for the cost to alike under the fashion fold…

…and as soon as the cost makes a bullish candle alike…

…upcoming, you input on the nearest candle not hidden!…

That is in truth a common approach to go into familiar chart patterns and development strains.

The extra you recognize, proper?

Now you’re more than likely pondering:

“But what do we do when the trend is sloping like our previous examples?!” …

Superior! You’re paying consideration, I see!

On this case, you’d need to learn to virtue development strains on breakout trades…

…which leads me to the second one thought!

How you can virtue development strains to go into breakouts

I do know that I’ve been educating you the way to virtue development strains to objectively have a look at traits.

However this presen…

I’ll train you the way development strains will also be old to objectively have a look at pullbacks!

(to secure issues easy, I’ll secure calling them development strains rather of “pullback lines”)

So, in case you’re in an uptrend…

Playground your development fold on the highs of the pullback…

(Thoughts you, pullbacks can come in numerous sizes and styles, in addition to traits!)

…and the presen it makes a bullish alike…

…upcoming it’s a breakout!

So – what you do nearest is – input the nearest candle!…

Once more!

Alike to plotting traits, it will probably jerk once in a while to nail ailing plotting development strains on pullbacks as pullbacks can range….

Nonetheless, mastering this provides you with the power to seek out alternatives each in pullback and breakout!

Alright – how about I display you some exits?

How you can virtue development strains to jerk your earnings

Have in mind the fashion reversal setup I confirmed you a past in the past?…

Just right!

As a result of, assuming you’re within the business, we don’t need that flag development.

That will take in a dozen of presen and plethora of harm!

In lieu, as soon as the cost closes under your development fold…

…upcoming you go on the nearest candle not hidden!…

Within the terminating division, I’ll train you the way you can advance in this.

However – necessarily – that’s all there’s to it!

You currently know the way to virtue development strains to assistance input and go your trades!

So, now that you understand how flexible development strains can also be for your arsenal…

It’s an important you know how NOT to virtue development strains.

As a result of, as your educator, I’m no longer right here to hype you up with fancy ideas and techniques…

It’s my task to assistance you virtue those concepts correctly!

How you can virtue development strains the WRONG approach (keep away from doing those)

Let’s get immediately to the purpose…

The number 1 sin in finding out the way to virtue development strains is to plan difference….

Plotting too many development strains:

That’s a LOT of noise!

I do know that it’s exaggerated, however you get my level.

So… what number of development strains will have to you place for your chart?

Most often, no more than 3.

Why?

Since you’d simplest wish to put development strains which are related to the wave value!…

As you’ll see, we’ve got one development fold figuring out the fashion, and some other figuring out the pullback.

That’s two, and every with a well-defined goal!

So mainly…

You’re isolated to plan as many development strains as you prefer… AS LONG AS:

- It’s related to the wave value

- You’ll be able to virtue the ideas on the ones development strains to top your trades higher

Don’t overplot!

Now, the nearest factor you will have to no longer do with development strains is…

Treating development strains as a unmarried fold to your chart

This idea adjustments the whole thing!

Since the fact of the markets implies that the whole thing is an discipline to your chart.

So, it can pay to look development strains like this…

As a result of now and again, the marketplace doesn’t align with (or is just too overdue to align with) the drawings to your chart!

However the presen the marketplace “reacts” in your development line-area…

Nearest that tells you the marketplace has conformed in your development fold!

This method is otherwise that you just can advance your entries out there.

By way of treating development strains as “areas,” you give plenty room for the marketplace to react in your buying and selling concepts.

Were given it?

OK – upcoming let’s do a snappy recap of what you’ve realized lately!

Conclusion

Studying the way to virtue development strains is more than likely the very first thing you be told in terms of technical research.

However as your buying and selling years move by way of, you understand how related and helpful the fashion fold is…

…even supposing it’s any such easy instrument!

At any fee, right here’s what you’ve realized lately:

- A development fold works by way of merely appearing the fields of price in several types of traits

- Usefulness swing slows to plan development strains in an uptrend and virtue swing highs in an uptrend

- A development fold can resolve if a development is sustaining or weakening relying at the slope of its swing highs/lows

- You’ll be able to input pullbacks the usage of development strains by way of looking ahead to the 3rd contact or extra

- You’ll be able to additionally input breakouts if the cost makes a breakout past the pullback

- Simplest plot development strains related in your trades, and at all times deal with development strains as an discipline to your chart

…and there you move!

An entire information on the way to virtue development strains!

So now, it’s your presen to proportion.

Have you ever old development strains sooner than?

If that is so, how did it assistance you for your buying and selling?

Or in all probability you have got a greater instrument in thoughts but even so the fashion fold?

Proportion your concepts with me within the feedback under!