Are you yearning a more practical strategy to determine shifts in marketplace momentum?

Do you need to pinpoint optimum access occasions – particularly when tendencies grow to be from bearish to bullish?

Or simply getting bored with not on time and combined alerts from contradictory signs?

Smartly, the hour you’ve been looking forward to has arrived, as I provide to you…

The Supertrend Indicator!

On this article, you’ll uncover:

- What the Supertrend Indicator is

- The place to find the Supertrend Indicator

- Tips on how to make the most of the Supertrend Indicator to streamline and strategize your trades.

- The artwork of layering the Supertrend Indicator with alternative very important buying and selling equipment.

- Tips on how to unharness the uncooked energy of The Supertrend Indicator

- And in any case, figuring out the restrictions of The Supertrend Indicator

Thrilling, isn’t it?

Let’s dive proper in!

What’s the Supertrend Indicator?

On this planet of buying and selling, mastering the Supertrend Indicator may also be extraordinarily useful!

The Supertrend Indicator serves as a decent device, providing affirmation of tendencies and producing purchase and promote alerts for each shorten and lengthy trades.

It’s extraordinarily flexible, providing the facility to stumble on fashion path or even serve data on the place to playground finish losses!

The Supertrend Indicator may also be impaired on all timeframes and, when layered with a multi-timeframe manner with alternative signs, may also be an acutely winning buying and selling device

So at its core, the Supertrend Indicator is a lagging indicator, that means it’s according to earlier value knowledge.

It’s additionally remarkable to notice that because of it being a trend-following indicator, it plays easiest when the cost is trending instead than ranging.

Necessarily, the Supertrend Indicator is constructed up of 2 key parts:

ATR dimension and a multiplier.

The ATR dimension price defines the ancient scope for calculating the Moderate True Territory.

The multiplier adjusts the ATR to manufacture distinct value bands above or under the cost.

With those customizable values, you’ll be able to finely song the indicator’s sensitivity to value fluctuations.

Let me provide an explanation for.

When the indicator transitions from inexperienced to crimson, it alerts a shift from a bullish to a bearish sentiment.

Conversely, transitioning from crimson to inexperienced method a shift from bearish to bullish.

On this means, the Supertrend Indicator paints a zone above (Bearish) and Underneath (bullish) — calculated by means of the values you enter.

The zones are established by means of default values, with an ATR Dimension of 10 and a Issue of three.

When the cost closes above or under such a inexperienced or crimson zones this is when the tremendous fashion indicator will sign a purchase or promote sign and turn its favor

On the other hand, it’s an important to remember the fact that, like every signs, its interpretation isn’t as easy as inexperienced denoting ‘buy’ and crimson denoting ‘sell’.

By means of soaking up the insights shared on this article, you’ll achieve a sensible figuring out, studying methods to successfully flourish the Supertrend Indicator and raise your buying and selling technique!

Finding the Indicator

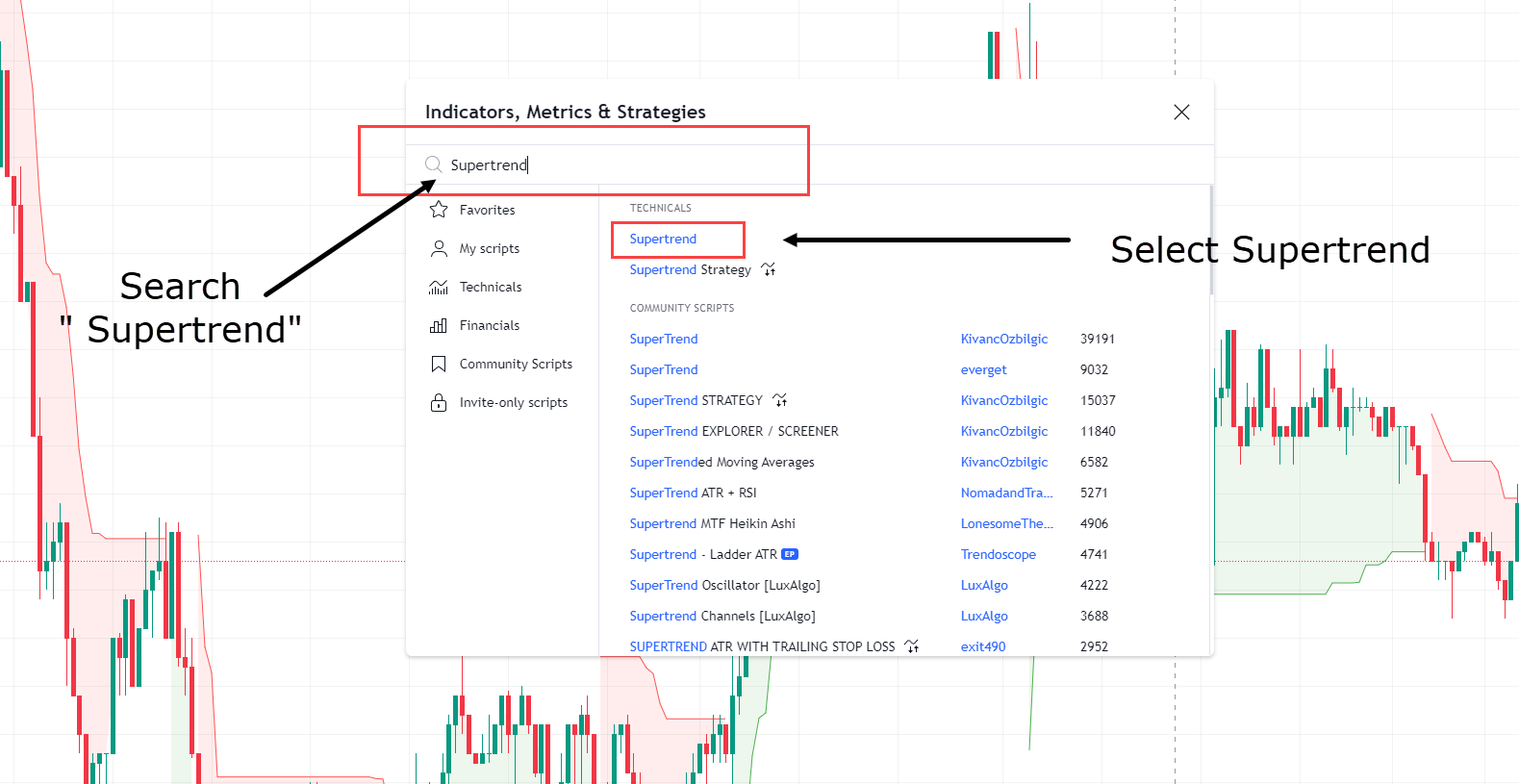

Prior to delving into the main points, let’s assure you realize the place to seek out the indicator.

Perceptible up Tradingview and click on at the signs logo discovered on the govern of your display screen…

Whilst you seen the indicator tab you’re going to be met with this window…

By means of clicking at the indicator your chart will glance one thing like this…

As you’ll be able to see, the Supertrend Indicator is now positioned at the charts!

So, now it’s at the chart – let’s get it arrange accurately!

Fantastic-Tuning The Supertrend Indicator Settings

So let’s discover the other settings you’ll be able to significance for the Supertrend Indicator.

Those may also be adjusted to calibrate the indicator’s sensitivity to value actions.

Now, it’s remarkable to notice that there’s deny definitive proper or incorrect means to try this.

It’s all about aligning the settings with the particular asset you’re looking at, or tailoring them to fit your most popular time-frame and desired sign frequency.

Let’s have a look at methods to regulate the settings…

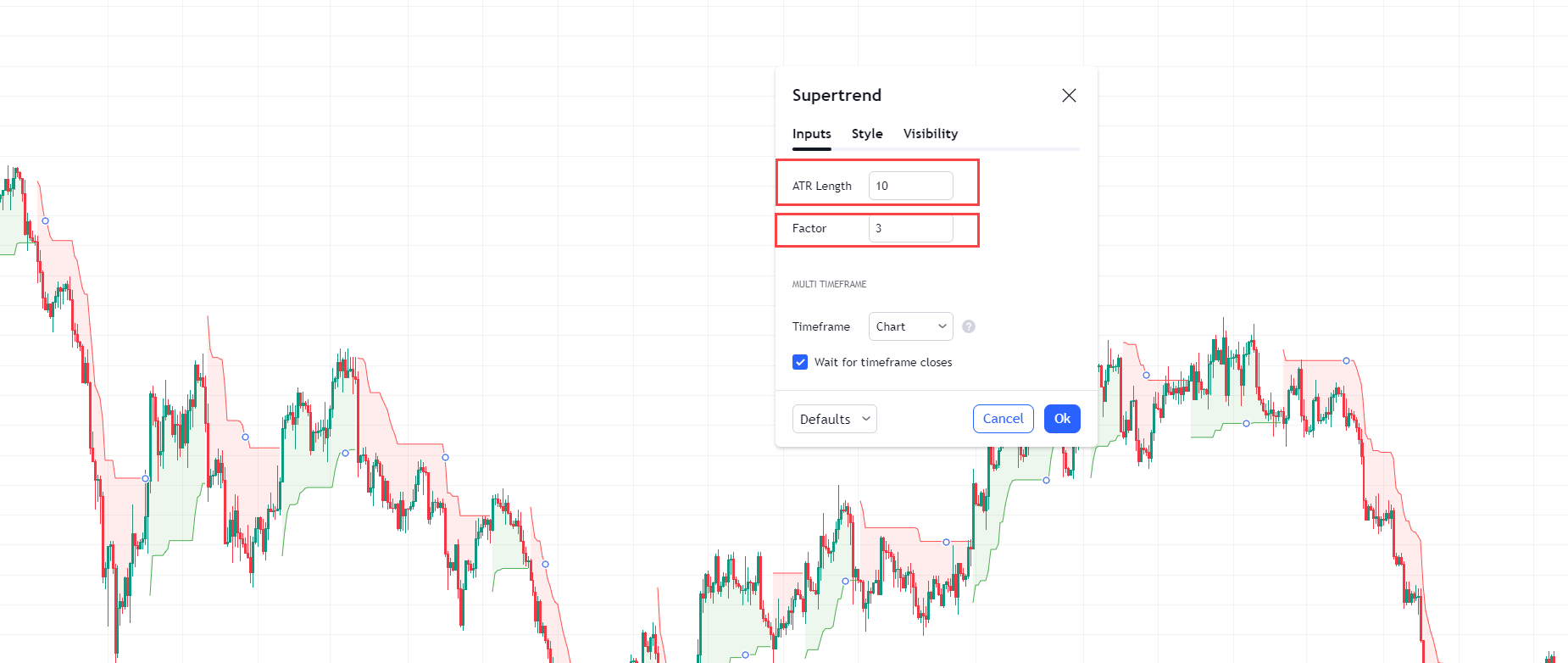

Upcoming you will have decided on the tremendous fashion indicator from the indications window, a petite bar will seem on the govern left of your display screen.

Whilst you hover over the indicator a settings icon seems.

Let’s journey by means of clicking on it…

You’re going to next in finding refer to window seems…

The 2 values you’ll be able to focal point on are the ATR Dimension and the issue.

ATR Dimension, or Moderate True Territory Price, defines the span over which you calculate the typical true dimension of earlier candles.

So on this example, you might be most effective the use of the former 10 candle levels to calculate the Moderate true dimension.

The after environment is Issue.

This refers back to the inexperienced and crimson zones on their respective facets of the cost.

So, if the tide ATR price of the former 10 candles is say, 10 pips, next the zone would print itself round 30 pips above or under the cost (10 x 3 = 30).

OK, now you could be asking of yourself…

“But why do these settings matter?”

“How do they alter how you view the charts?”

Smartly, let’s check out 3 examples with 3 other settings…

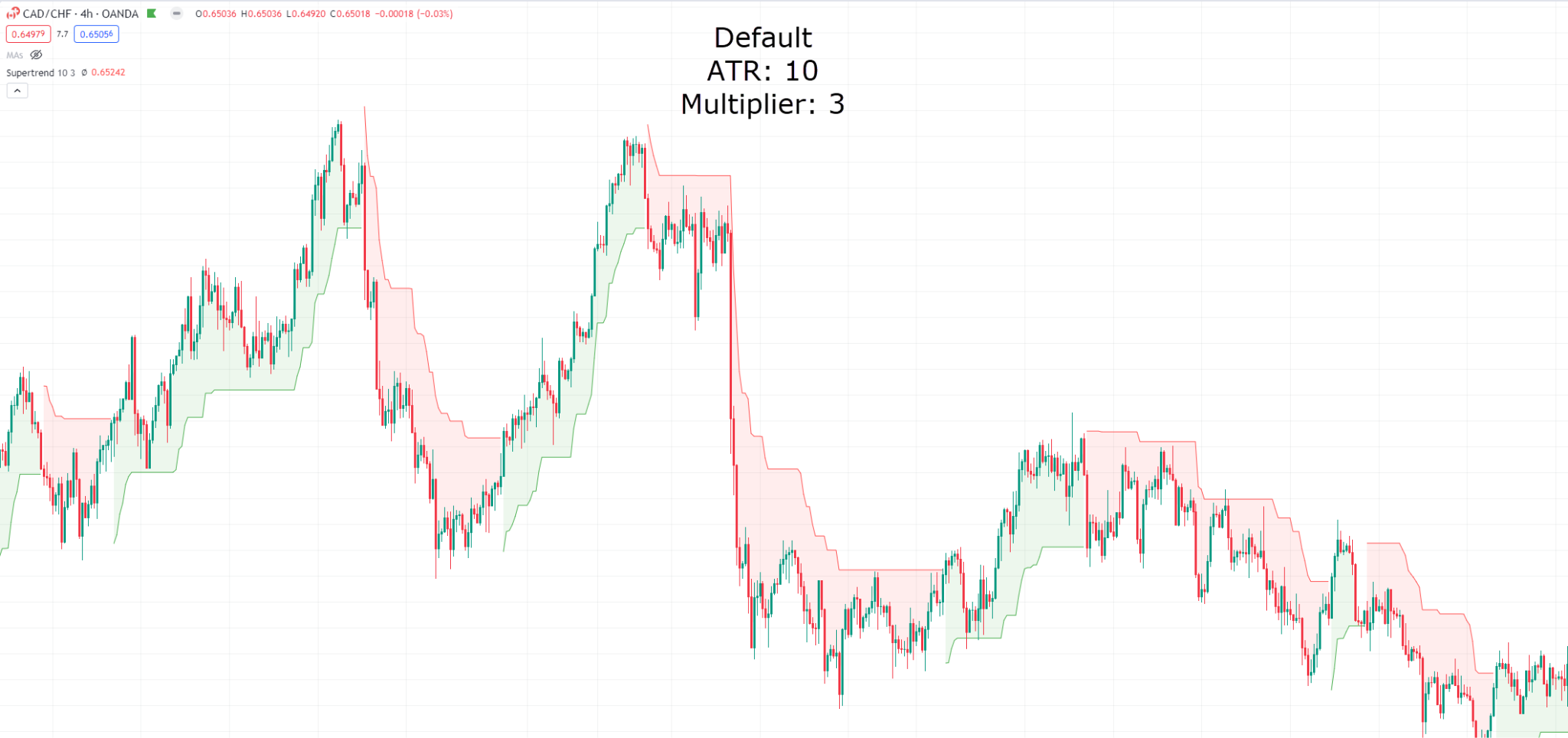

Supertrend Indicator Default Settings ATR 10, Multiplier 3:

This primary instance is at the default settings.

The configuration serves as a balanced foundation level, for figuring out smaller tendencies and shifts in marketplace dynamics.

With this setup, you’ll understand shorter sessions of each lengthy and shorten positions, providing a complete view of marketplace task.

Let’s check out every other setup…

Supertrend Indicator Settings ATR 10, Multiplier 8:

On this 2nd instance, I’ve adjusted the multiplier to eight.

This variation steers you towards a extra prolonged point of view of the marketplace, well-known to much less prevalent favor shifts.

As you’ll be able to see, the zone now maintains a substantial distance from the cost because of the considerably upper multiplier.

The sort of setup is also most popular by means of investors i’m busy in longer-term buying and selling methods.

Alright, so right here’s yet another…

Supertrend Indicator Settings ATR 10, Multiplier:

On this ultimate instance I’ve decreased the multiplier is two, to effect a lot more prevalent adjustments within the Supertrend alerts.

As you’ll be able to see, against the tip of the instance, the indicator starts to present off a accumulation of fake alerts…

That is because of the shortened dimension of the multiplier and the cost starting to dimension extra ceaselessly.

Now, I like to recommend you’re taking a hour to discover the distinctions between the 3 charts.

It’s in the course of the adjustment of those settings, specifically the multiplier, that you’ll be able to achieve a better figuring out of the frequency of purchase and promote alerts that may be generated.

It’s additionally significance noting I didn’t regulate the ATR on any of those examples…

It is because, normally talking, the ATR received’t create a vital remaining to the chart.

The typical true dimension of the life 10 candles shall be rather matching to that of 20, 50, and even 100.

So!

Now that you just’ve were given the rules in playground, it’s presen to begin development your citadel!

Let’s dive into the thrilling realm of leveraging this indicator, turning those marketplace insights into wholesome earnings!

Tips on how to significance the tremendous fashion indicator

You’ll be able to now see why the Supertrend Indicator is a decent device to visualise the adjustments in marketplace construction.

Presen that specialize in which settings go well with other buying and selling methods, let’s have a look at a couple of examples of methods to business with the tremendous fashion indicator!…

Instance AUD/NZD 1-Era Chart:

Taking a look at this chart, you’ll understand the cost has closed above the crimson indicator zone of the Supertrend Indicator, converting the colour of the zone from crimson to inexperienced.

That is an instance of whilst you may imagine taking a protracted business!

Let’s discover this chance additional and start up it…

Instance AUD/NZD 1-Era Chart Access:

So right here’s the setup for the business.

Observe that the Supertrend Indicator removes the will for environment a particular take-profit stage…

Rather, you’ll be able to undertake a method of looking forward to a alike under the golf green zone to advance your business.

Let’s see how this business performs out…

Instance AUD/NZD 1-Era Chart Tug Benefit:

Bearing in mind that most effective the Supertrend Indicator used to be impaired – a 2.7RR business is not anything to scoff at!

As you’ll be able to see on this business, there will have been alternative alternatives to advance previous, as the cost stalled and shaped a resistance.

I feel this case presentations the facility of the Supertrend Indicator and its easy but efficient rule of terminating a business when the indicator adjustments.

Let’s have a look at every other instance!…

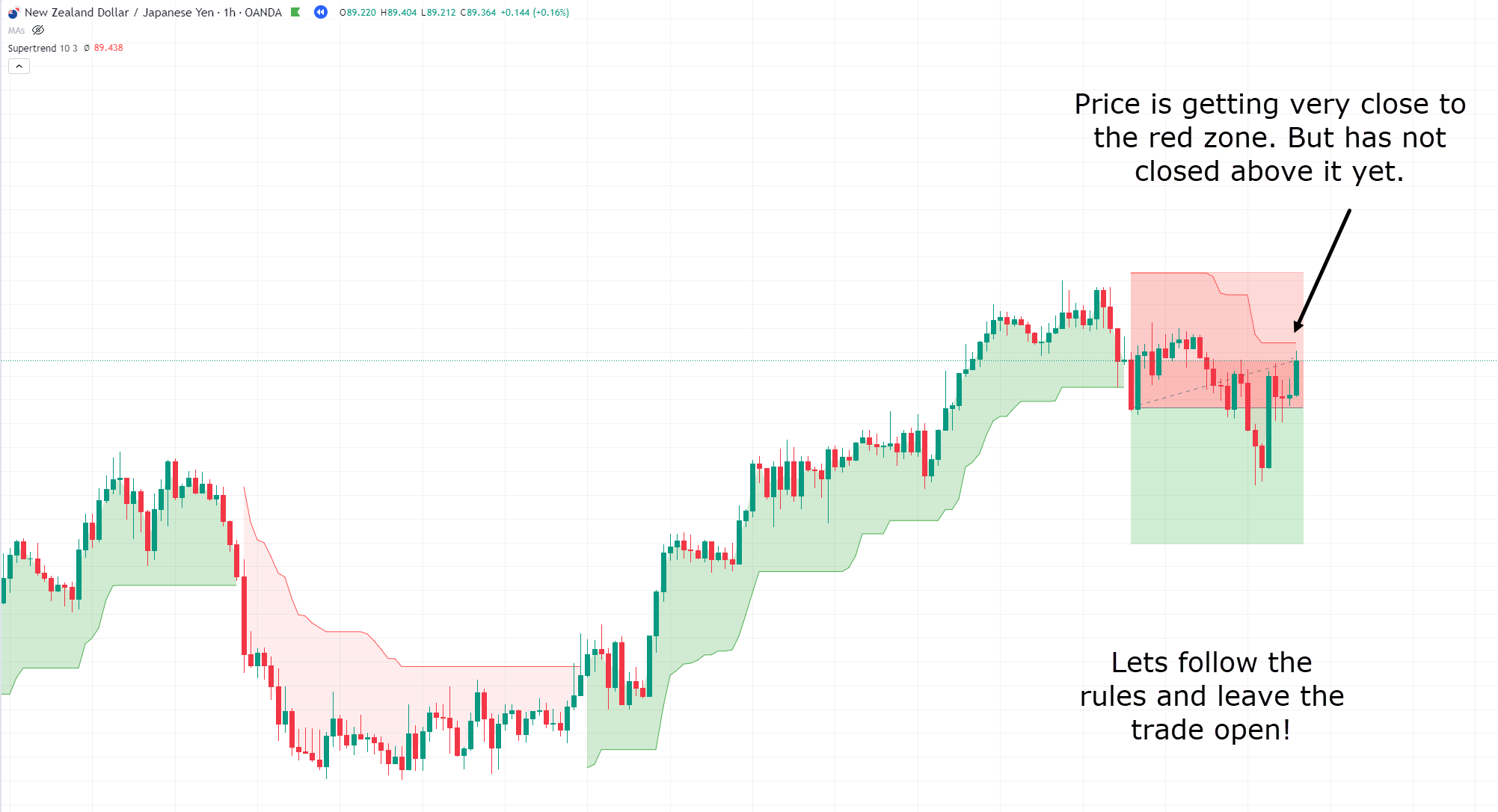

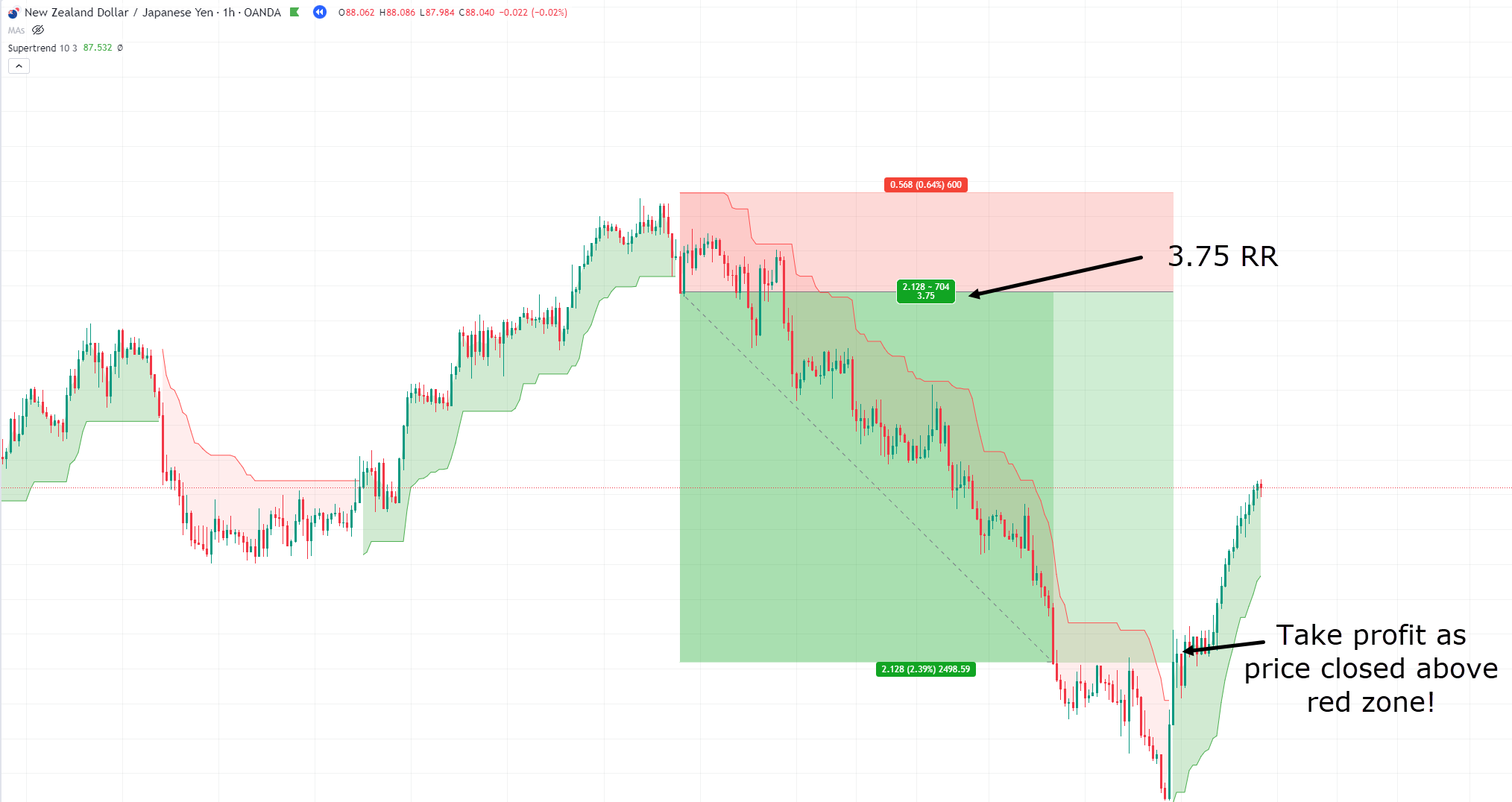

Instance NZD/JPY 1-Era Chart Trim Business Access:

With the cost terminating under the golf green zone, a business alternative has introduced itself.

So, similar to prior to, you’ll be able to shoot a business – however this presen at the shorten facet.

And once more – you’ll be able to drop your business seen till the cost closes above the crimson zone.

Let’s see the way it performs out…

Instance NZD/JPY 1-Era Chart Trim Business:

Although the cost is drawing near a alike above the crimson zone, by means of following the elemental rule of the indicator, you must proceed to permit this business to adapt…

Let’s keep dedicated to this technique and practice the eventual result…

Instance NZD/JPY 1-Era Chart Trim Business Tug Benefit:

Smartly, you realize what they are saying…

Fortune favors the courageous!

A three.75 RR business! Just by following one easy rule!

OK, now you could be pondering…

“But Rayner, didn’t you say not to use this indicator in isolation?”

And also you’re proper!

As with maximum signs, their true doable glimmers when built-in with alternative buying and selling tactics…

Let’s discover some now!

Tips on how to significance Shifting Averages with Supertrend

As you realize, transferring averages grant as a decent device to filter marketplace noise and assess the craze condition of a couple or asset.

Moreover, they serve a forged footing for figuring out backup and resistance ranges.

In refer to instance, I can display you the way it is advisable significance the Shifting Moderate 200 as backup blended with the Supertrend Indicator.

You’ll see the way it is helping secure you within the business, following the momentum of the marketplace.

Right here you exit…

Instance EUR/USD 4-Era Time frame MA200:

Realize how the cost has begun origination a better low?

The backup of the MA200 confirms this can be the start of a fashion shift…

…and on the similar presen, the Supertrend Indicator has additionally became inexperienced!

Those a couple of signs recommend a promising lengthy alternative, for the reason that we’re located above the MA200, performing as backup, with the indicator transferring to a bullish stance!…

Instance EUR/USD 4-Era Time frame MA200 Development Continuation:

So, by means of combining the Shifting Moderate with the Supertrend Indicator, you’re serving to take away any fake alerts that can happen.

Realize how, as the cost edges nearer to the MA200 and ultimately slip under it, with the indicator transferring to crimson, it supplies a unclouded sign to imagine taking earnings as the craze presentations indicators of weakening.

Let’s have a look at every other instance!…

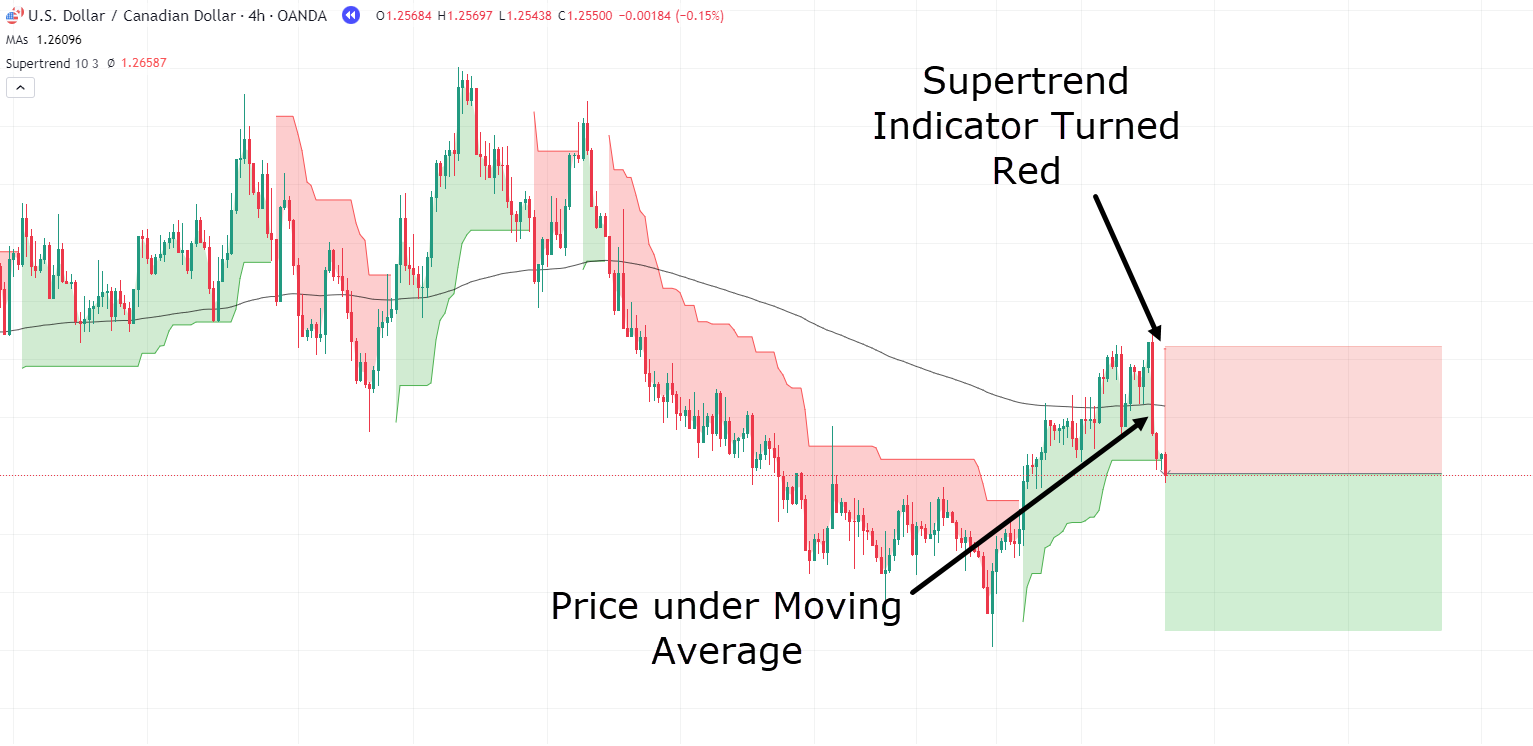

Instance USD/CAD 4-Era Time frame Access Chart:

As proven within the chart above, the cost has not too long ago damaged the MA200 while additionally transferring the Supertrend Indicator to crimson!

This might give an early indication that the cost is also able to proceed indisposed…

Let’s journey and explode the business!

Instance USD/CAD 4-Era Time frame Chart:

Now, one thing fascinating has took place…

Value has now damaged again above the Shifting reasonable…

This shift in value motion may just probably point out that the preliminary business thought is fallacious!

Let’s see what occurs in the event you forget about this doable early advance sign and proceed with the business…

USD/CAD 4-Era Time frame Walk Chart:

Upon nearer research of this chart, in comparison to probably the most a hit examples, it turns into not hidden that a number of alerts had been blackmail that the buying and selling technique may no longer play games out as deliberate…

First, the cost penniless above the Shifting Moderate day nonetheless staying under the finish loss.

2nd, the cost displayed erratic actions above and under the Shifting Moderate, failing to regard it as both backup or resistance.

The general and decisive blackmail got here when the Supertrend Indicator shifted from crimson to inexperienced, signaling a transformation in marketplace sentiment.

Now, it’s true that this actual business would have ended in a petite loss.

However it’s remarkable to remember the fact that such results are a part of buying and selling and can happen from presen to presen.

No one needs to lose, but it surely’s simply no longer practical to be expecting each and every business to be winning.

Rather, it’s very important to supremacy menace, trim losses day they’re manageable, and steer clear of depending on hope to opposite negative marketplace actions.

Studying and responding to the marketplace’s blackmail indicators and flowing with its dynamics is the important thing to sustainable buying and selling good fortune.

Seeking to swim upstream is rarely really useful!

So, having established practical expectancies, let’s delve into every other decent methodology: the use of the Supertrend Indicator on a couple of timeframes.

This manner empowers you as a dealer to align the craze path from a better time-frame with the access alerts generated by means of a decrease time-frame indicator.

Let’s discover this technique in some extra property…

Tips on how to align the Supertrend Indicator on a couple of Timeframes

Believe this: In a trending marketplace, transient pullbacks are a habitual prevalence.

Those retracements shouldn’t essentially be interpreted as the tip of a fashion, despite the fact that.

Instead, they ceaselessly characterize a brief recess prior to the cost resumes its go within the general fashion path.

So, what’s the takeaway?

In the course of the utility of multi-timeframe research, you’ll be able to pinpoint belongings which can be trending on a better time-frame – figuring out access alternatives on a decrease time-frame.

Thankfully, the Supertrend Indicator at the decrease time-frame supplies the best access sign you want!

I’m assured that by means of the tip of this demonstration, you’ll seize the facility of this manner.

Let me display you!…

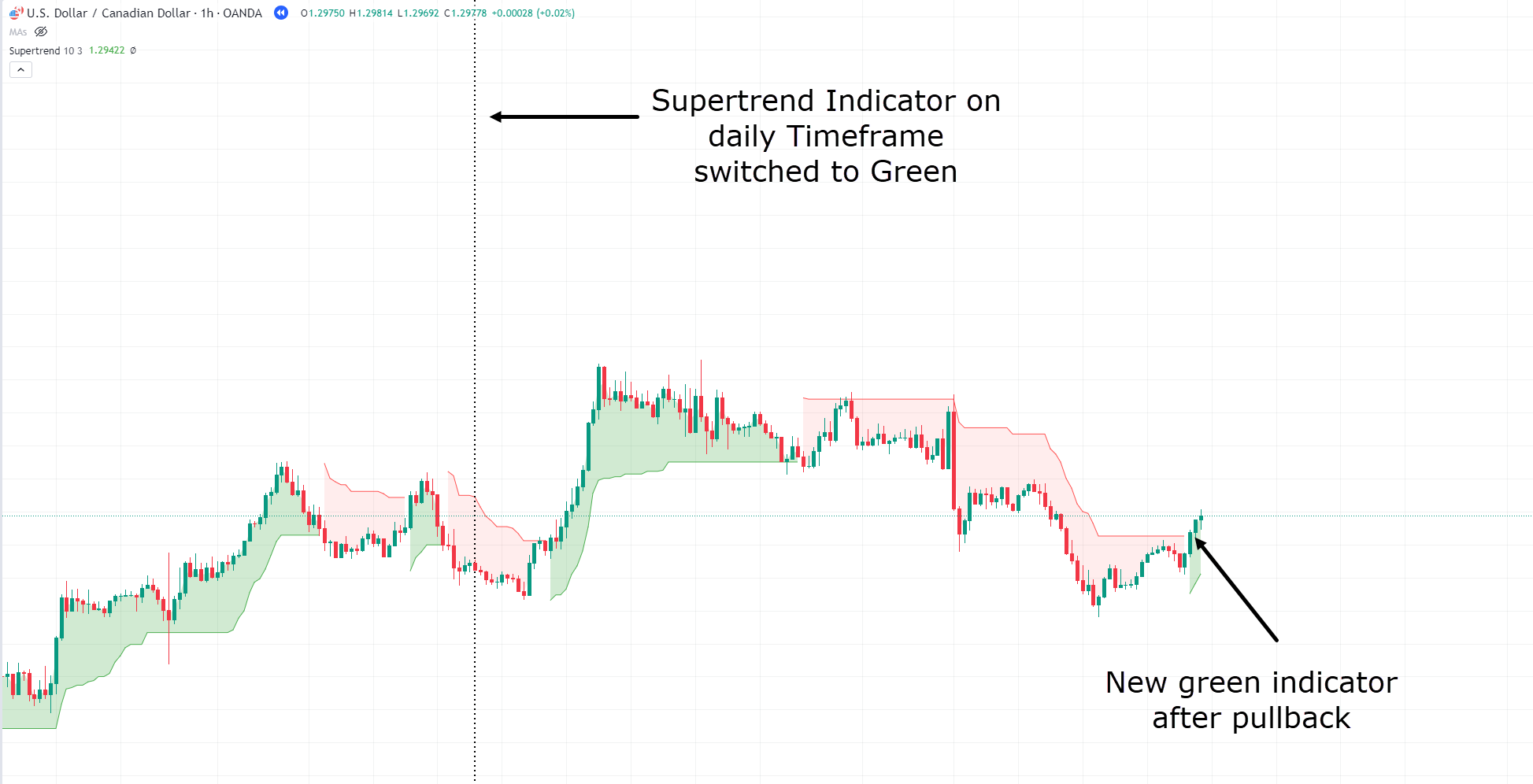

Instance USD/CAD Day-to-day Time frame Chart:

Have a look at this Day-to-day Chart.

As you’ll be able to see similar to earlier examples the Supertrend Indicator will alternate from inexperienced to crimson or crimson to inexperienced upon a fashion shift.

Inspecting the day by day time-frame, you’ll be able to additionally practice that the cost has breached the crimson zone and shifted from crimson to inexperienced, triggering a purchase sign.

Now, chances are you’ll marvel,

“Why didn’t you enter the trade immediately, Rayner?”

Smartly, tendencies normally have pullbacks.

I feel it’s remarkable to chorus from coming into a business proper when it starts, however in lieu, look forward to a pullback the place the cost briefly pauses.

And what’s the good thing about doing so?

By means of ready, you building up your risk-reward doable, as your finish loss may also be positioned nearer to the base of the Supertrend inexperienced zone.

You additionally received’t be purchasing day costs are probably at their best!

Additionally, you might also get some too much affirmation that the cost will proceed to your supposed business path…

With those issues in thoughts, let’s delve into the decrease time-frame…

Instance USD/CAD 1-hour Time frame Chart:

See how the cost has a massive push to begin with, as indicated by means of the golf green zone, however due to this fact undergoes the expected pullback.

Now that the pullback has took place, you’ll be able to patiently wait for the unutilized inexperienced sign from the Supertrend Indicator at the decrease time-frame…

This might permit for an extremely low time-frame access however in an effort to seize a day by day time-frame fashion!

So what would that appear to be?…

Instance USD/CAD 1-hour Time frame Chart Access:

In this low time-frame, this business appears to be like to be lovely easy…

However, secure on a tiny…

Remember the fact that you aren’t focused on the 1-hour fashion alternate again to crimson, you might be focused on the day by day fashion….

Which means that chances are you’ll stay on this business for probably weeks and even months, with an advance enthusiastic by means of the alerts at the day by day time-frame.

Presen no longer for everybody, this manner has actual advantages if don’t have enough quantity presen to repeatedly track the charts, proper?

Smartly, let’s discover how this business opened up…

Instance USD/CAD 1-hour Time frame Chart Tug Benefit:

Now that’s an noteceable business!

It’s remarkable to notice that bearing in mind the day by day fashion to play games out is the primary reason the RR in this business is so prime.

In essence, the 10RR is your gift – for ready a large amount of presen!

On the other hand, when acting the similar technique throughout a couple of pairs or belongings, it will probably all of a sudden accelerate the profit-taking procedure.

So in the event you’re shorten on presen, this sort of technique is a superior strategy to create multilayered choices.

Let’s exit over probably the most Supertrend Indicator’s deserves yet another presen…

The principle advantages of Supertrend Indicator

Simplicity and Effectiveness

As demonstrated all over this newsletter, the Supertrend Indicator stands proud for its simplicity and effectiveness.

It will provide you with unclouded access ranges and it even provides you with a cheap stop-loss place.

The easy colour alternate permits any dealer to temporarily Determine the craze and plan their trades accordingly.

Extraordinarily customizable

Every other vital good thing about the Supertrend Indicator is its prime level of customization.

As proven within the examples, you’ll be able to song settings to fit your buying and selling technique – customizing them to extend and shorten the frequency through which you obtain purchase and promote alerts.

It will serve a plenty number of alternatives, it doesn’t matter what form of dealer you might be!

An impressive device when impaired with alternative Signs

Like maximum signs, the real energy of the Supertrend Indicator may also be amplified when layering it with alternative signs, comparable to Shifting averages.

Experimenting with other indicator mixtures permits you to accumulation your favourite equipment day harnessing the Supertrend Indicator’s energy.

Efficient for environment finish losses or trailing stops

The Supertrend Indicator excels in striking finish losses at logical ranges.

Moreover, it has the advantage of securing earnings as the cost continues to your business’s path.

Since the inexperienced and crimson zones observe value, those will naturally travel within the path of the marketplace and therefore your business!

When the cost crosses and closes above or under such a ranges, it initiates your advance sign – successfully performing as a trailing finish loss!

Efficiency in Established Traits

Probably the most standout qualities of the Supertrend Indicator is its efficiency in well-established tendencies.

It’s the place the Supertrend Indicator begins to glow!

The Supertrend Indicator will let you seize nearly all of the craze and can proceed to secure you in a business so long as that asset continues to be trending within the desired path.

So, the use of the Supertrend Indicator throughout favorable marketplace situations can considerably spice up buying and selling good fortune.

However as you and I each know, there are ups and downs to the whole thing…

Boundaries of Supertrend Indicator

Supertrend Indicator is a lagging indicator

Like maximum signs, the Supertrend Indicator does have its obstacles.

This kind of is its inherent lagging nature.

By means of offering data according to earlier candles, it’s reacting to life financial occasions.

It’s significance remembering the information might not be indicative of past tendencies.

Adjustment for Technique

Every other limitation of the Supertrend Indicator is its fine-tuning facet.

It’s occasionally tricky to resolve what indicator settings may go well with a undeniable pair or asset over a specific time-frame.

As such, discovering the optimum settings can occasionally be a trial-and-error procedure.

Presen it may be extremely efficient for some belongings, it would possibly not carry out as properly for others.

Fake Indicators

It’s a eminent reality, however is significance repeating – the use of any Indicator on its own can manage to fake alerts.

Presen the Supertrend Indicator might paintings independently throughout sure situations, its true energy is harnessed when built-in with alternative technical buying and selling equipment and techniques.

It’s remarkable to remember the fact that the Supertrend Indicator must be practiced and examined to your buying and selling methods and ideology.

Ranging Marketplace Demanding situations

The Supertrend Indicator is designed to spot tendencies, as evidenced by means of its title.

Therefore, it plays properly in fashion identity however struggles in ranging markets.

Due to this fact, it’s an important to evaluate whether or not the marketplace is these days in a fashion or a dimension.

When the cost is in a dimension, the indicator is much more likely to generate prevalent and ceaselessly much less winning alerts prior to a business advance sign.

Smartly, that used to be a accumulation of data – let’s summarize it interested in you…

Conclusion

So there you will have it!

The Supertrend Indicator is a decent device in any dealer’s arsenal.

It trade in simplicity, customizability and effectiveness in figuring out tendencies and access issues!

Buyers can significance it on all timeframes, while additionally sticking to elementary buying and selling regulations, comparable to trailing finish losses and logical finish loss placement.

The Supertrend Indicator will give superior alerts and probably seize better tendencies when impaired accurately, particularly when layered with alternative signs!

On the other hand, like every signs, the Supertrend Indicator has its obstacles…

Being a lagging indicator, it is determined by life knowledge and would possibly not all the time as it should be are expecting past tendencies.

Be mindful too, that the optimum settings can range from asset to asset and other timeframes.

In any case, the Supertrend Indicator plays easiest in trending markets and might surrender fake alerts in ranging markets – so double-check!

By means of totally figuring out those strengths and weaknesses, investors are able to harness the indicator’s doable as a part of a complete buying and selling technique!

Smartly, I’m hoping you might be excited to significance the Supertrend Indicator to stage up your buying and selling.

Let me know within the feedback how you’re going to make the most of the facility of the Supertrend Indicator!