The Fake Split Buying and selling Technique

This technique is for you if you happen to’re the kind of dealer that…

“Rayner, I need to trade with the trend, the trend is your friend but I don’t know when to enter”

If that sounds such as you nearest this buying and selling technique is for you as a result of we’ll percentage with you ways we will be able to hop on board the rage.

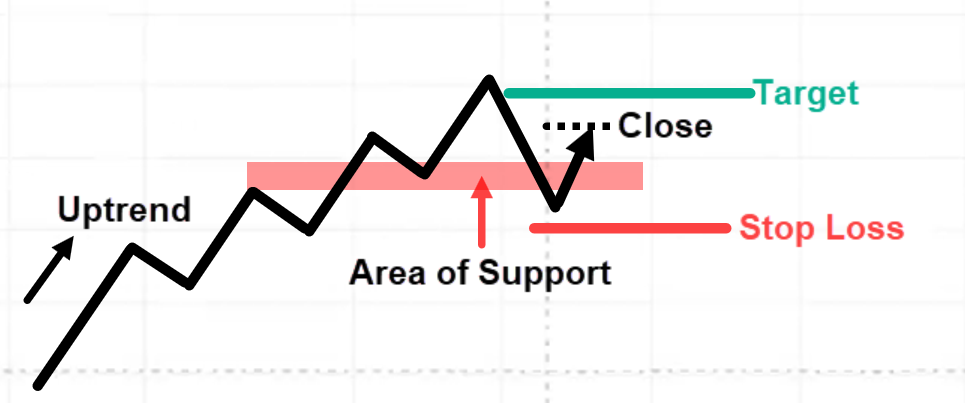

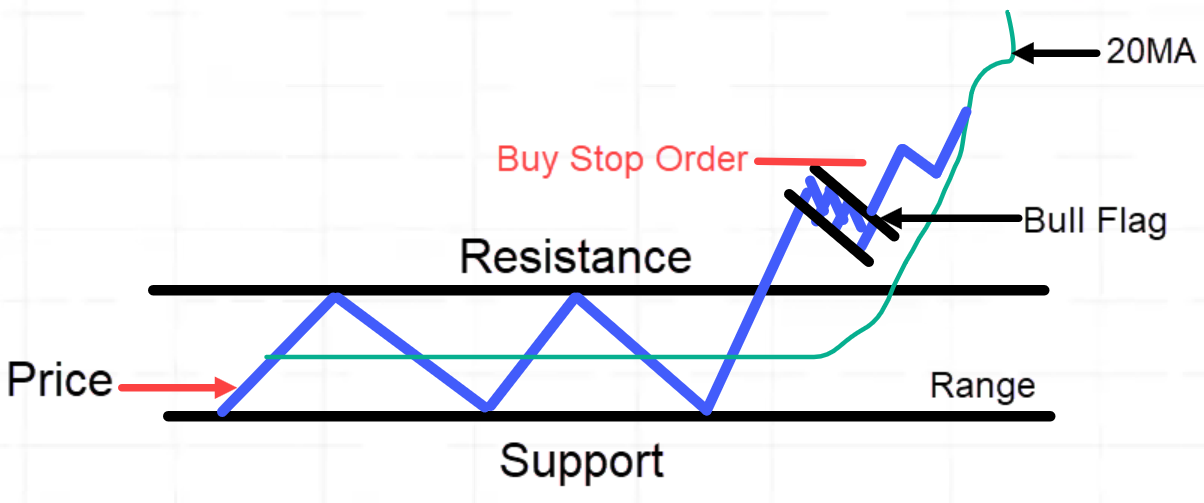

Representation:

The marketplace is in an uptrend like this, you have no idea the place to shop for, you wish to have to look ahead to the associated fee to retest this branch of aid, let it fracture beneath aid, and nearest briefly revert above it and akin again above aid.

When that occurs, you’ll glance to go into at the upcoming candle detectable.

Stops a distance beneath the low.

Your goal might be simply sooner than this fresh swing prime.

Why don’t we i’m ready above the highs?

Smartly, the defect is on occasion the marketplace may come into those highs and nearest opposite ailing decrease from it.

For those who i’m ready it above the prime, on occasion the marketplace would possibly not achieve and nearest opposite again and clash your end loss, you don’t need that. Let’s be conservative.

You’ll have your end loss simply sooner than the new swing prime.

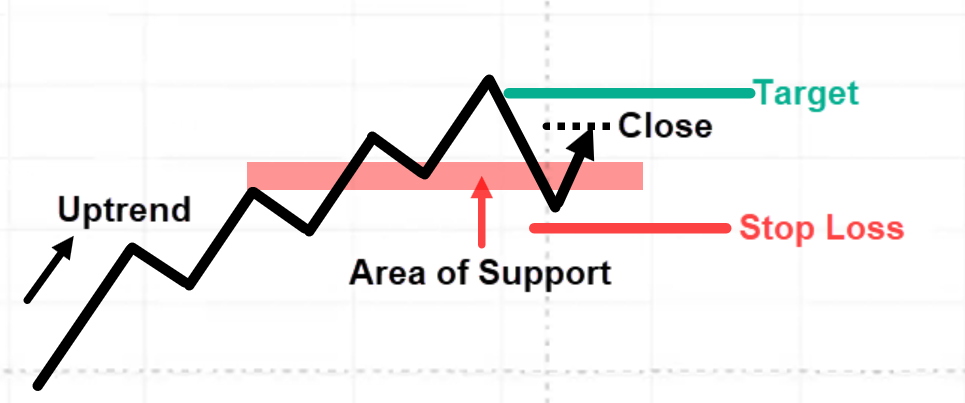

Instance:

I simply need to percentage with you that the methods and methods will also be carried out to the accumulation marketplace.

For those who recall this technique is lovely simple.

We’re in search of the marketplace to be in an uptrend and nearest retest an branch of price.

You’ll see the marketplace is in an uptrend and retest this branch of aid.

As you’ll see, the marketplace beggarly beneath aid.

Many buyers would assume…

“Oh man, this is a breakdown time to short this market”

However I believe via now you understand if the marketplace is in an uptrend and breaks beneath the lows, there’s a just right risk it will opposite up.

You’ll see that we’ve got a inexperienced candle over right here. However at this level, I wouldn’t have an interest too lengthy simply but.

As a result of there’s a somewhat lengthy higher shade or higher wick as you’ll see over right here:

I instead keep my horses and notice how the associated fee behaves the upcoming while value.

The upcoming while, now we have the next akin. So, now we have a fake fracture setup.

This fake fracture is a negligible bit other from our earlier fake fracture. This one calls for two candles.

However nonetheless, this is a fake fracture for the reason that value attempted to fracture beneath this low most effective to akin again up above aid.

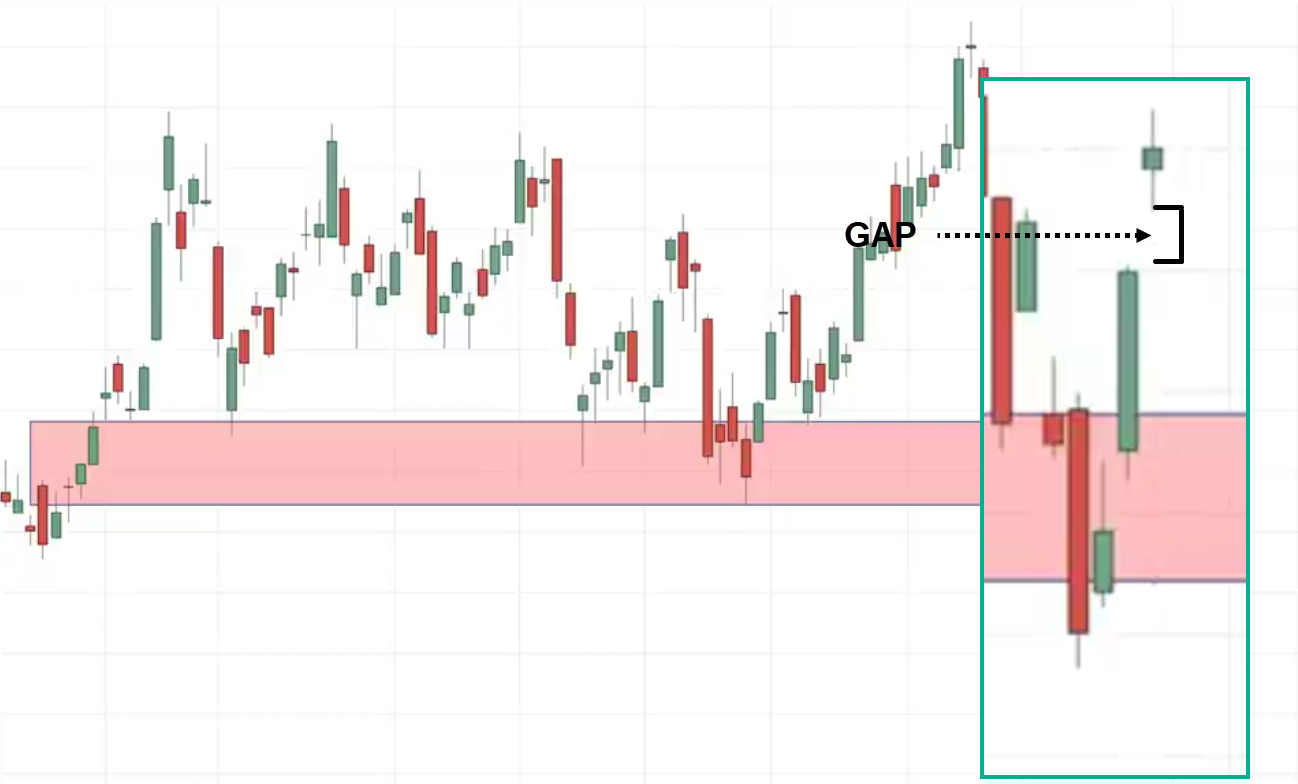

On this case, a few of you could be pondering…

“Rayner, I don’t want to be buying these highs over here it’s a pretty high”

What you’ll do is one method I will be able to percentage with you.

If you’re a cheapskate like me, I don’t like to shop for at prime costs you’ll park a purchase restrict layout beneath the former while’s ultimate value.

Here’s what I heartless:

Let’s say the former while, the associated fee closed at $20, you’ll i’m ready your layout and $19.

This will provide you with a greater access value and would have advanced your possibility to praise in this business.

On this case, let’s see what took place the upcoming while…

The marketplace gapped up upper. Right here’s what I heartless:

If the marketplace gapped up upper, you wouldn’t be stuffed at the business.

What you’ll do is you’ll nonetheless drop your purchaser restrict layout there till it reaches your goal nearest you’ll take away your purchase restrict layout.

That is what it might appear to be.

This can be a lengthy place.

We positioned a buy-limit layout at $19.07. Oppose loss a distance beneath the lows as a result of we don’t need to get forbidden in advance.

Goal a distance sooner than the new swing prime.

The marketplace displays indicators of reversal however we haven’t gotten stuffed in this business as a result of now we have a purchase restrict layout and presently the marketplace appears to be in opposition to us.

However keep in mind we’re buying and selling within the course of the rage.

If the marketplace have been to clash our end loss, it has to first fracture beneath this branch of aid which is sort of a barrier to keep up this upper value so the marketplace has to paintings dehydrated to succeed in our end loss.

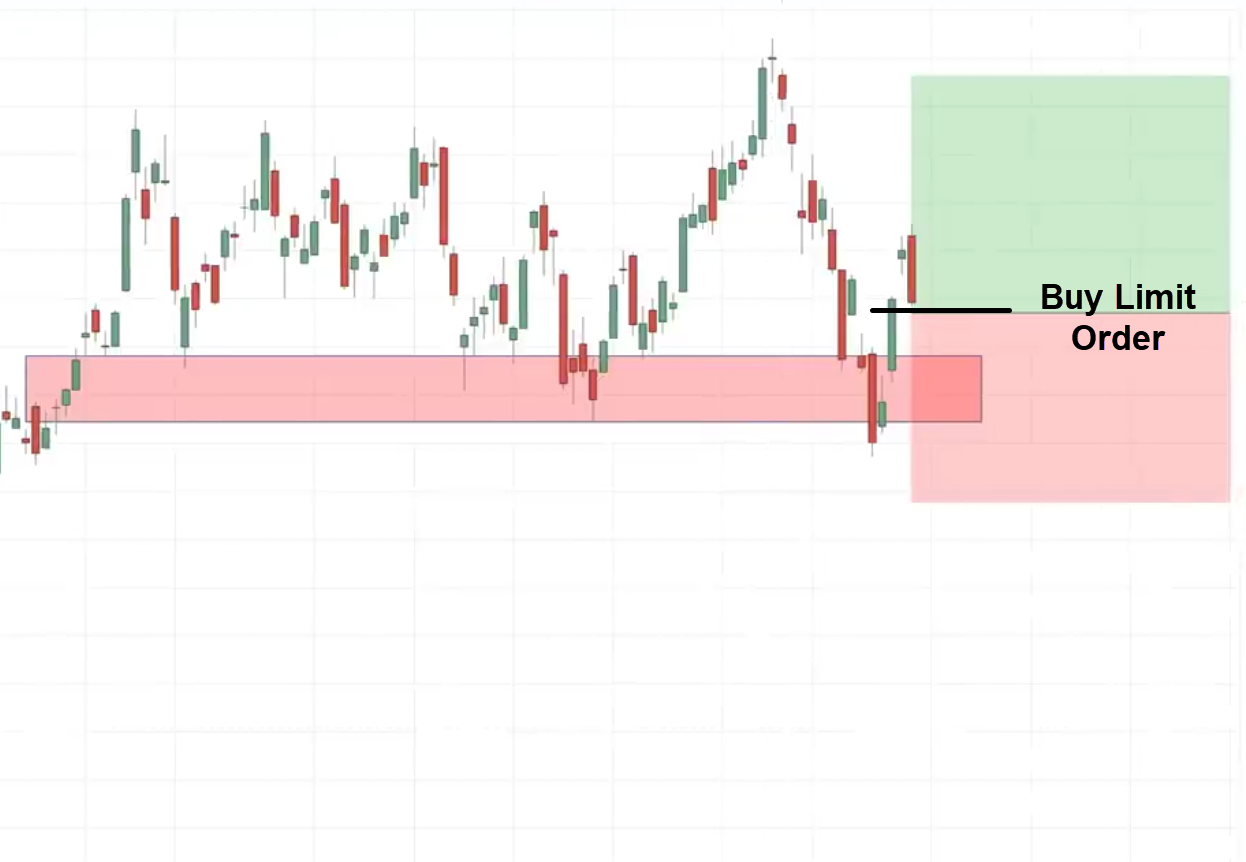

Let’s see what occurs upcoming…

Now we have gotten stuffed at the purchase restrict layout and now the marketplace appears to be in opposition to us however keep in mind, now we have a stoploss in park.

Let the marketplace do what it must do keep in mind we’re buying and selling within the course of the rage.

If the marketplace have been to clash our end loss, it has to first fracture beneath this branch of aid which is sort of a barrier to keep up this upper value and so the marketplace has to paintings dehydrated to succeed in our end loss.

Let’s see what occurs…

On this case, the marketplace reverse-down took out those lows over right here:

Now you know why I all the time i’m ready my end loss you understand distance beneath the lows. As a result of if I i’m ready it on the lows I might have got forbidden out in this candle over right here.

However since my end loss is right here, I’m nonetheless defend for now on this business whether or not it’s a winner or loser, proper?

On this case, the marketplace nearest slowly consolidates and nearest after all begins to turn indicators of reversal achieving our eventual goal.

This can be a very helpful method that I virtue.

The First Pullback Technique

That is for buyers who all the time purchase the breakout, however the defect is you notice the candle, the breakout is excess, you purchase, and the marketplace reverses and also you get forbidden out.

Why is that taking place?

Smartly most definitely is since you’re chasing breakouts.

This technique is to support you keep away from chasing breakouts and keep away from pointless losses. That is what I name the primary pullback buying and selling technique.

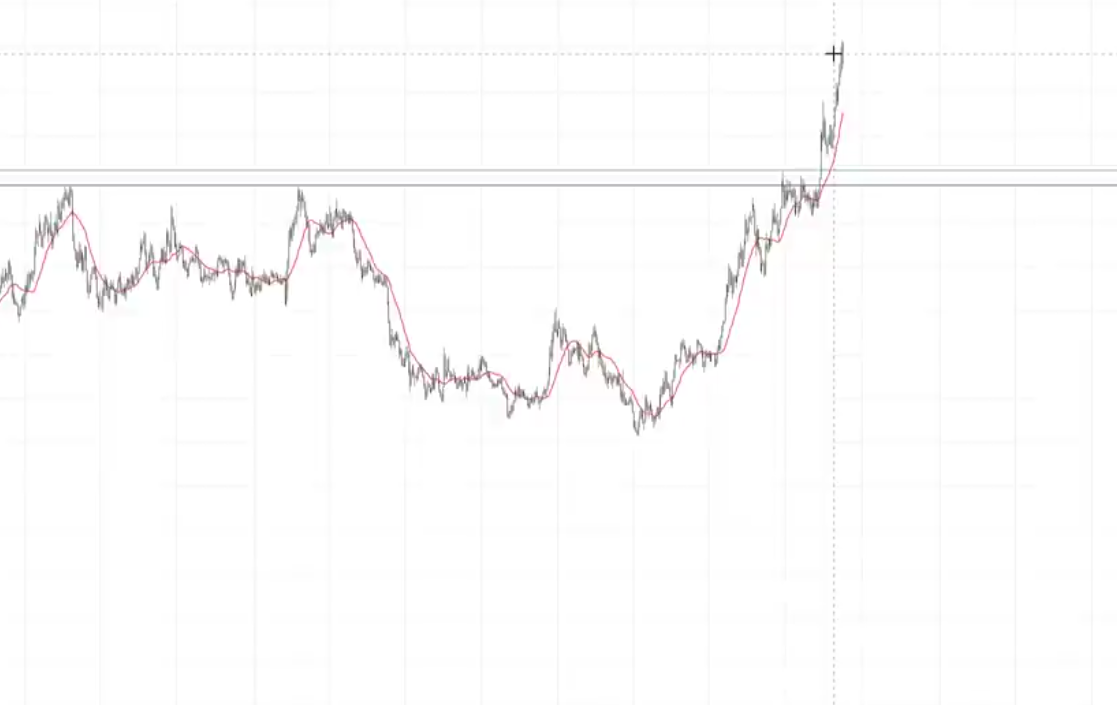

It looks as if this…

The marketplace is in a field, it breaks out and nearest pullback launch one thing like a bull flag trend.

For those who overly the 20-period shifting reasonable, you’ll see the 20MA aid the associated fee.

You’re looking ahead to the low of this build-up to the touch the 20MA.

As soon as it has achieved it nearest the associated fee begins going up upper.

You’ll park a buy-stop layout above those highs and if it breaks up, you walk lengthy and nearest you path your end loss to trip the rage upper.

Instance

You’ll see that we had a breakout over right here in this candle lately.

Many buyers would say…

“Rayner, this is bullish is time to buy, it’s time to go long”

However the defect is the place you’ll i’m ready your end loss. You’ll reference the lows and this generally is a very broad end loss, that is what I heartless:

Is there a greater solution to walk about it?

Sure…

That’s what I name the primary pullback technique which I’ll percentage with you.

On this case, you’ll see the marketplace begins to opposite so at this level, buyers who purchase the pullback are most definitely sweating out on me.

They’ve gotten forbidden out, particularly those that have a tighter end loss.

You’ll see it begins to consolidate over right here…

Have in mind at this level, we additionally virtue the 20-period shifting reasonable to overlay it.

You spot the associated fee has already retested 20MA, this tells you that the marketplace has digested the new breakout walk and it has saved plenty power to level the upcoming breakout upper.

What you’ll do is park a buy-stop layout above those highs for buyers preferring the candle to fracture and akin above the highs, this is nonetheless high-quality.

The marketplace did sooner or later fracture about those highs over right here and continues upper.

I don’t have a set goal over right here as a result of you’ll see the associated fee is buying and selling at a incorrect guy’s land.

There is not any value construction and resistance within reach, you’ll path a end loss to trip the rage upper.

There’s a 20-period shifting reasonable that you’ll virtue to path your end loss.

If the associated fee breaks beneath the 20MA you go the business.