Metaplanet’s Enterprise Value Falls Below Bitcoin Holdings: Understanding the mNAV Metric

Metaplanet, a Japanese Bitcoin treasury company, has seen its enterprise value drop below the value of its Bitcoin holdings, marking a significant milestone in the company’s history. This development has sparked interesting discussions among market observers, with some viewing it as a sign of market misunderstanding, while others see it as a cooling of the Bitcoin treasury trend. To understand the implications of this event, it’s essential to delve into the concept of the market to Bitcoin NAV (mNAV) ratio and its significance in evaluating companies like Metaplanet.

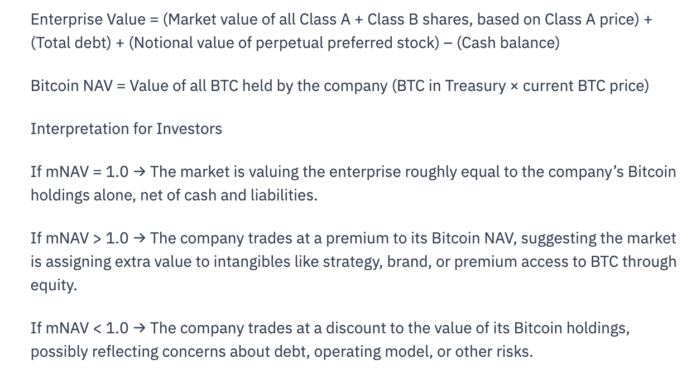

The mNAV ratio is a crucial metric designed to help investors gauge how the market values a company relative to its underlying Bitcoin holdings. Unlike traditional net asset value (NAV), mNAV is a ratio of enterprise value to Bitcoin NAV. Enterprise value in this context is defined as the market capitalization of all Class A and Class B shares, total debt, and the notional value of perpetual preferred shares, minus the company’s cash balance. Market to Bitcoin NAV (mNAV) information. Source: BitcoinTreasuries.NET

Why is mNAV Important for Investors?

When the mNAV falls below 1, it indicates that the company trades at a discount to the value of its Bitcoin holdings. This can potentially reflect market concerns about debt, the operating model, or other risks associated with the company. It’s not a substitute for audited financials but serves as a high-level indicator of how much of the company’s valuation is driven by its BTC treasury versus other factors. Therefore, understanding mNAV is crucial for investors looking to make informed decisions about companies with significant Bitcoin holdings.

Metaplanet’s mNAV dropping to 0.99, with the company holding 30,823 BTC ($3.5 billion) on its balance sheet, is a notable event. This comes about a year after Metaplanet made its first Bitcoin purchase, which initially triggered a surge in its shares. The company’s mNAV reached an all-time high of 22.59 following that purchase, a level that has not been seen since. Metaplanet’s mNAV fell below 1 on Tuesday for the first time on record. Source: Metaplanet

Market Reactions and Interpretations

Market observers have expressed mixed reactions to Metaplanet’s enterprise value falling below the value of its Bitcoin holdings. Melanion Capital’s CEO, Jad Comair, views this development as a sign of the market’s misunderstanding of Bitcoin treasury models, comparing it to the early days of Tesla when investors failed to grasp the company’s potential as an energy revolution. Comair believes that once markets understand the reflexive power of Bitcoin treasuries, these discounts will flip into persistent premiums. Metaplanet is the fourth-largest public Bitcoin holder as of Tuesday. Source: CoinGecko

On the other hand, Smartkarma’s equity analyst, Mark Chadwick, interprets Metaplanet’s mNAV dynamics as a sign of the ongoing cooling of the Bitcoin treasury trend, suggesting that the decline in crypto treasury stocks could be seen as a popping of a bubble. However, long-term Bitcoin bulls may view Metaplanet’s discount as an opportunity to buy. Cointelegraph reached out to Metaplanet for comment regarding its mNAV decline and potential implications but had not received a response by publication.

Metaplanet is not alone in experiencing a recent stock decline among Bitcoin treasury companies. Michael Saylor’s Strategy, the world’s largest public Bitcoin holder, has seen the value of its Common A stock drop about 30% since July. As the market continues to evolve, understanding metrics like mNAV and their implications will be crucial for investors and companies navigating the Bitcoin treasury space. For more information, visit the original source link: https://cointelegraph.com/news/metaplanet-enterprise-value-below-bitcoin-holdings-mnav?utm_source=rss_feed&utm_medium=rss_tag_bitcoin&utm_campaign=rss_partner_inbound