Michael Saylor’s Vision for Bitcoin: A Shift from Volatility to Stability

Strategy’s Michael Saylor has warned that the growing institutional adoption of Bitcoin could transform the asset from an adrenaline-fueled investment into a “boring” store of value as mega institutions demand lower volatility before entering the market. Speaking on the Coin Stories podcast, Saylor described this transition as a natural growing stage where early volatility exists in the asset to accommodate large-scale institutional capital. This prediction comes as Bitcoin has consolidated around $115,500 after hitting an all-time high of $124,100 in August.

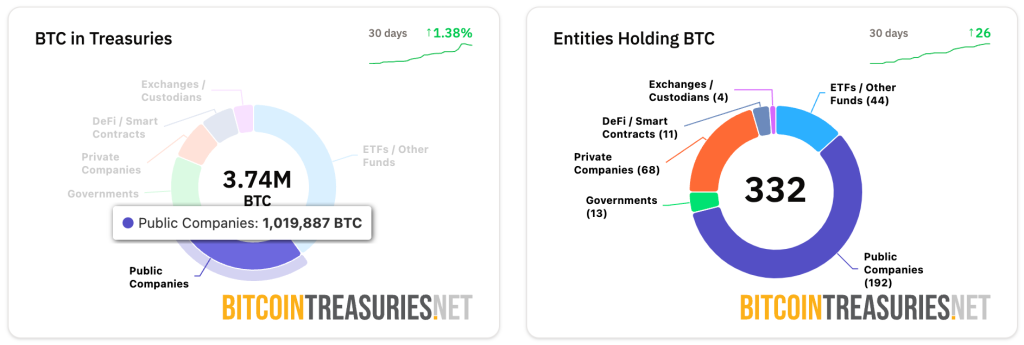

Saylor attributed current selling pressure to crypto OGs diversifying holdings rather than losing confidence, comparing the situation to startup employees selling stock options to fund life expenses despite believing in the company’s future. According to a report from Cryptonews, corporate Bitcoin treasuries reached a record 1.011 million BTC worth over $118 billion, representing approximately 5% of the circulating supply.

From Speculation to Institutional Investment

Accumulation patterns have shifted dramatically from the aggressive buying sprees that characterized 2024. MicroStrategy’s monthly purchases collapsed from 134,000 BTC in November 2024 to just 3,700 BTC in August 2025, while the company’s market premium over net asset value fell from 3.89x to 1.44x. Despite Strategy’s reduced accumulation, other companies stepped up purchases, cutting Strategy’s dominance in corporate holdings from 76% to 64% while maintaining overall growth momentum.

Public companies added 415,000 BTC to treasuries in 2025, already surpassing the 325,000 BTC acquired throughout 2024. 28 new Bitcoin treasury firms launched in July and August alone, adding 140,000 BTC to aggregate corporate holdings. However, firms now buy smaller amounts per transaction amid macro uncertainty and stricter risk management requirements from shareholders.

The Future of Bitcoin-Backed Financial Instruments

During the podcast, Saylor outlined his vision for revolutionizing credit markets through Bitcoin-backed financial instruments, addressing what he sees as fundamental weaknesses in traditional fixed-income markets. He described current credit environments as “yield starved” with Swiss banks offering negative 50 basis points and European corporate bonds yielding just 2.5% while monetary inflation exceeds these returns.

Strategy has launched four different Bitcoin-backed preferred stock instruments designed to capture various market segments. Strike offers 8% dividends with conversion rights to common stock, while Strife provides 10% perpetual yields with senior liquidation preferences. Stride removes penalty clauses for 12.7% effective yields, targeting investors with higher risk tolerance and Bitcoin conviction.

When Digital Gold Rush Meets Wall Street Reality

Saylor emphasized that Bitcoin’s institutional maturation process requires patience as market participants adapt to revolutionary financial technology. He compared the current environment to the early petroleum industry in 1870, when investors struggled to comprehend the scope of applications for crude oil derivatives before kerosene, gasoline, and petrochemicals transformed multiple industries.

The executive projected that 2025-2035 will represent a “digital gold rush” period with extensive business model experimentation, product creation, and fortune building. Strategy aims to become the first investment-grade Bitcoin treasury company, pursuing credit ratings for all instruments through extensive agency education processes.

Read more about Michael Saylor’s vision for Bitcoin and its potential impact on the market at https://cryptonews.com/news/michael-saylor-says-bitcoin-may-go-boring-as-institutional-money-kills-volatility/