Michael Saylor’s Strategy Expands Bitcoin Holdings with $449.3 Million Purchase

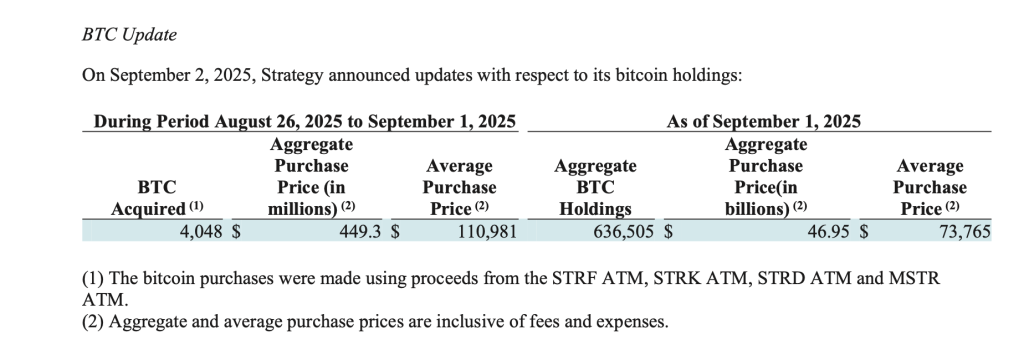

Billionaire executive chairman Michael Saylor has once again bolstered his firm’s Bitcoin war chest. According to a recent Form 8-K filing, Strategy acquired 4,048 Bitcoin at an aggregate purchase price of $449.3 million, or an average of $110,981 per Bitcoin. This significant investment demonstrates the company’s long-standing conviction in Bitcoin as a treasury reserve asset.

With this latest buy, Strategy now holds an impressive 636,505 Bitcoin. The aggregate purchase price for the company’s holdings stands at $46.95 billion, with an average cost basis of $73,765 per Bitcoin. This substantial investment solidifies Strategy’s position as a leader in the corporate adoption of cryptocurrency.

Expanding Holdings and Corporate Confidence

Strategy’s consistent funneling of capital from equity raises into digital asset purchases demonstrates its confidence in Bitcoin’s potential. The company’s public dashboard provides real-time updates on Bitcoin acquisitions, securities market prices, and other key performance metrics, offering transparency and insights into its investment strategy.

By combining traditional capital market instruments with aggressive digital asset purchases, Strategy Inc. continues to blur the line between Wall Street and crypto. Its sustained accumulation shows not just corporate confidence in Bitcoin, but also its determination to define a new standard for treasury management in the digital age.

Corporate Bitcoin Developer and Market Impact

Strategy’s aggressive buying has made it the largest corporate holder of Bitcoin, but buying no longer moves the market. Corporate treasurer Shirish Jajodia recently stated that BTC purchases are done through over-the-counter (OTC) deals, which minimize the price impact. “Bitcoin’s daily trading volume is $50 billion,” Jajodia said. “Even if you buy $1 billion over a few days, it doesn’t move the market much.”

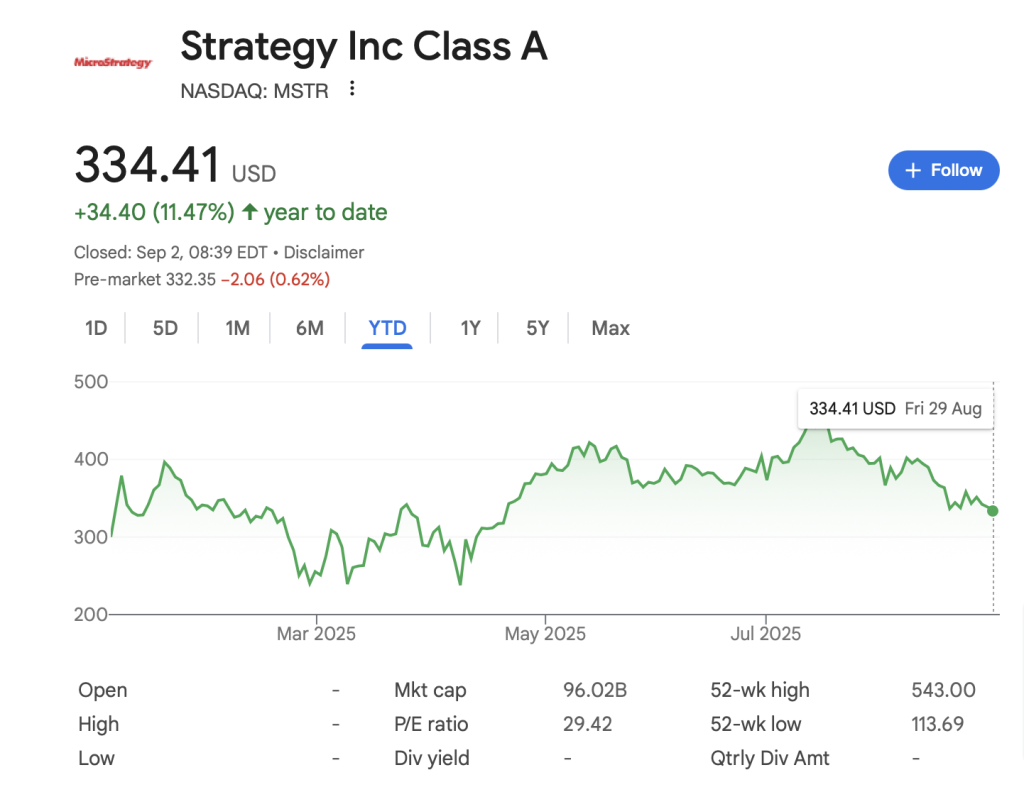

Institutional buying plays a different role in Bitcoin’s cycle. These holdings reduce long-term supply and indirectly strengthen the floor price. However, short-term price moves are driven by traders, speculation, and broader macroeconomic forces. Despite Strategy’s Bitcoin purchases, the company’s stock has been volatile, trading at $334.41, up 11.47% year-to-date, with a market cap of $96.02 billion.

Institutional Strategy and Market Trends

Strategy’s approach to Bitcoin investment has set a precedent for institutional adoption of cryptocurrency. The company’s commitment to transparency and its public dashboard provide valuable insights into its investment strategy. As the largest corporate holder of Bitcoin, Strategy’s actions are closely watched by investors and market analysts.

For more information on Michael Saylor’s Strategy and its Bitcoin holdings, visit the original source: https://cryptonews.com/news/michael-saylors-strategy-acquires-4048-btc-for-449-3m/