Multichain Liquidators Secure Key Ruling in New York Court

A significant development has emerged in the ongoing saga of the Multichain Foundation Ltd., as a New York bankruptcy court has granted interim relief to the Singapore-based bankruptcy trustees overseeing the collapse of the company. The ruling, issued by Judge David S. Jones of the U.S. Bankruptcy Court for the Southern District of New York, extends the freeze on three Ethereum wallets containing approximately $63 million in stolen USD coins (USDC). This decision represents a crucial step in the cross-border efforts to recover assets siphoned from Multichain’s cross-chain bridge protocol, which suffered a staggering loss of over $210 million in one of the largest DeFi exploits of 2023.

Understanding the Multichain Case and the Significance of Freezing USDC

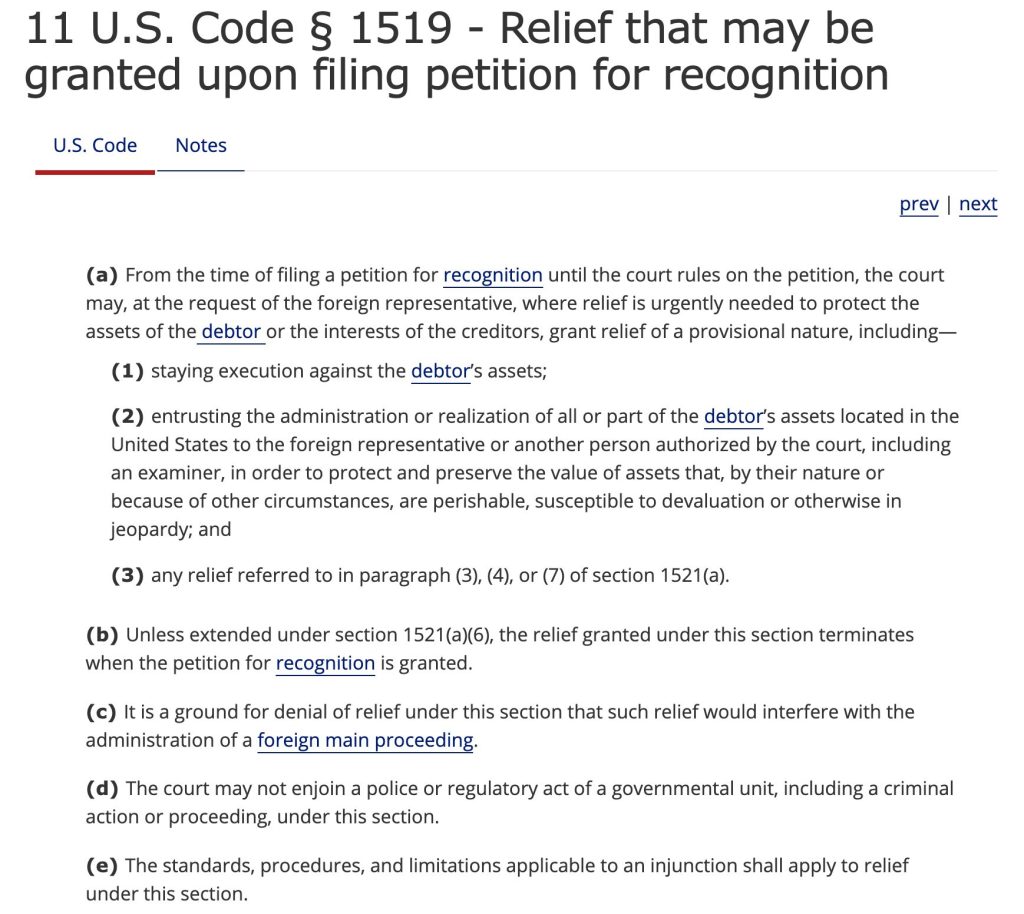

The order issued under Section 1519 of the U.S. Bankruptcy Code provides temporary relief before a foreign case receives formal recognition under Chapter 15, the framework that governs cooperation between U.S. courts and foreign bankruptcy proceedings. This legal framework is crucial for facilitating cross-border asset recovery and ensuring that the rights of all parties involved are protected. The decision to freeze the stolen USDC is particularly significant, as it prevents the potential misuse of these funds and ensures that they remain available for recovery by the rightful owners.

Source: Cornell Law School

Source: Cornell Law School

The Background of the Multichain Hack and Its Aftermath

The Multichain hack, which occurred in July 2023, resulted in the theft of over $125 million from the company’s bridge contracts on various blockchains, including Fantom, Moonriver, and Dogechain. The exploit was one of the most significant in the DeFi sector, leading to a substantial loss of user funds. Following the hack, the affected projects, including the Fantom Foundation, initiated legal action in Singapore, which ultimately led to the appointment of liquidators to oversee the asset recovery process.

The liquidators, Bob Yap Cheng Ghee, Toh Ai Ling, and Tan Yen Chiaw of KPMG, have been working to recover the stolen assets, including the $63 million in USDC that has been frozen by the New York court. The recovery of these assets is crucial for the affected users, who have suffered significant financial losses due to the hack.

Conclusion and Future Developments

The ruling by the New York court is a significant development in the Multichain case, as it ensures that the stolen USDC remains frozen until further notice. This decision provides a degree of certainty for the affected users, who can now hope for a more successful recovery of their lost funds. The case highlights the importance of cross-border cooperation in asset recovery and the need for effective legal frameworks to protect the rights of all parties involved. As the case continues to unfold, it will be interesting to see how the liquidators and the court navigate the complex issues surrounding the recovery of stolen digital assets.

For more information on this case and other developments in the cryptocurrency space, please visit https://cryptonews.com/news/multichain-liquidators-win-ruling-freeze-63m-stolen-usdc/