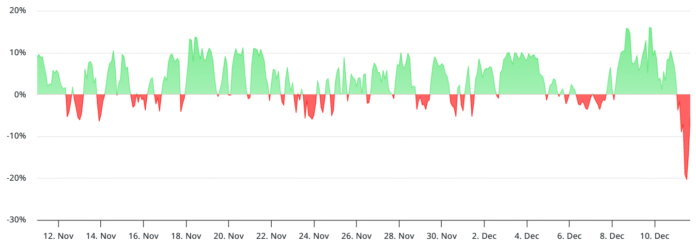

XRP Derivatives Indicate Bearish Sentiment as Funding Rate Turns Negative

The XRP market has been experiencing a downturn, with the price falling 9% in just two days after being rejected at $2.18 on Tuesday. This decline has led to a sharp increase in the cost of holding leveraged bearish positions, causing brief turmoil in derivatives markets. The annualized funding rate for XRP perpetual futures has turned negative, reaching -20% on Thursday, its lowest level since the October 10 crash. This indicates that sellers (shorts) are paying buyers (longs) to maintain open positions, signaling a lack of demand from bullish traders.

Annualized funding rate for XRP perpetual futures. Source: laevitas.ch

Declining Open Interest and ETF Volumes

The aggregate open interest in XRP futures has remained stagnant at $2.8 billion, unchanged from the previous week. This suggests that XRP bears are hesitant to increase their commitment, especially after the token has already fallen 45% since reaching $3.66 in July. Additionally, the daily volume of US-listed XRP ETFs has been lackluster, rarely exceeding $30 million, which has significantly dampened interest from institutional investors.

Aggregated Open Interest in XRP Futures, USD. Source: CoinGlass

XRP Ledger TVL and ETF Activity

The XRP Ledger’s total value locked (TVL) has fallen to its lowest level in 2025, at $68 million, indicating declining interaction with the chain’s decentralized applications (DApps). In contrast, the Stellar blockchain holds $176 million in TVL, despite XLM’s market cap being 93% smaller than XRP’s $121.8 billion. Furthermore, the daily volume of US-listed XRP ETFs has been declining, with assets under management at nearly $3.1 billion, according to CoinShares data.

Daily volume of US-listed XRP ETF on December 11, USD. Source: CoinGlass

Ripple USD (RUSD) and XRP Ledger Activity

Even the Ripple-backed stablecoin, Ripple USD (RLUSD), relies primarily on the Ethereum network rather than XRP’s infrastructure. More than $1 billion worth of RLUSD has been issued on Ethereum, compared to just $235 million on the XRP ledger. This lack of activity on the XRP Ledger creates a reinforcing cycle where investors have less incentive to hold XRP, especially compared to the native staking returns available on BNB and SOL.

Ripple USD (RUSD) in circulation per blockchain. Source: DefiLlama

For more information on the current state of the XRP market, visit Cointelegraph.