Digital Asset Investment Products See Record Inflows

CoinShares, a leading digital asset investment firm, has reported a net inflow of $5.95 billion in digital asset investment products, marking the largest net weekly inflow in history. This significant surge in investments has reversed the outflows from the previous week and pushed the total assets under management to a new high. The U.S. led the charge with $5 billion in inflows, driving the total crypto assets under management to an all-time high of $254 billion.

According to CoinShares’ latest report on Digital Asset Fund Flows, the record-breaking inflows can be attributed to a combination of factors, including low employment data and concerns regarding the recent U.S. government shutdown. James Butterfill, Head of CoinShares Research, believes that the delayed response to the FOMC interest rate cut, compounded by weak employment data and concerns over U.S. government stability, contributed to the surge in investments. “We believe this was due to a delayed response to the FOMC interest rate cut, compounded by very weak employment data, as indicated by Wednesday’s ADP Payroll release, and concerns over US government stability following the shutdown,” said Butterfill in the report.

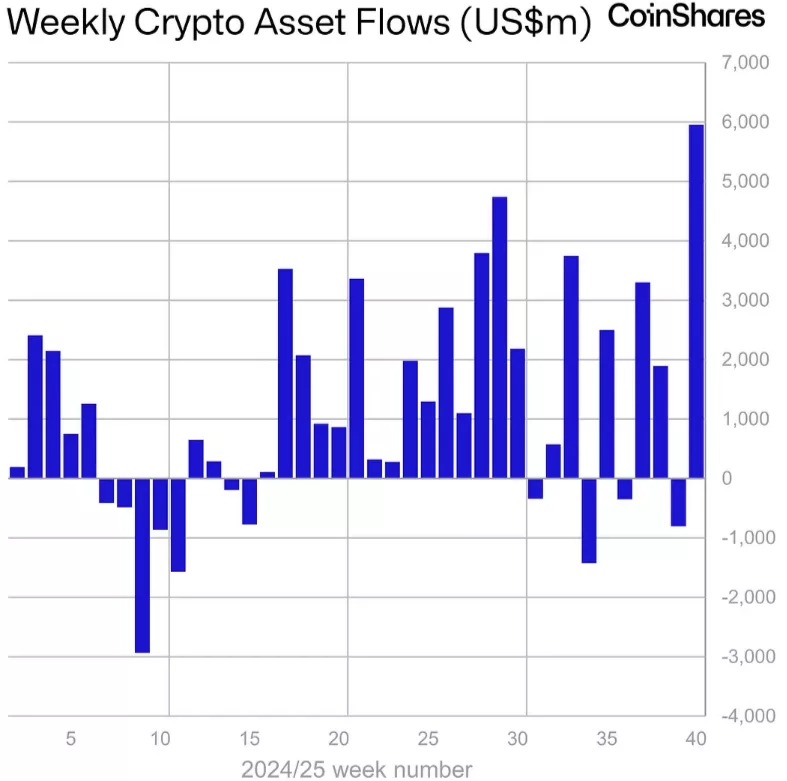

CoinShares’ chart depicting a new record for weekly inflows into digital asset investment products | Source: CoinShares

CoinShares’ chart depicting a new record for weekly inflows into digital asset investment products | Source: CoinShares

CoinShares: Bitcoin and Solana Break Records

Bitcoin (BTC) broke its own record for largest weekly inflows, with $3.55 billion in inflows, adding to the year-to-date flows that stand at $27.5 billion. This record-high weekly inflow further propelled BTC to reach its recent all-time high at $125,506. Solana (SOL) also reached a new record high for weekly inflows, with $706.5 million in inflows, bringing the year-to-date inflows for Solana to $2.5 billion. Ethereum (ETH) saw inflows reaching as much as $1.48 billion, pushing the asset’s total year-to-date inflows to a new high of $13.7 billion.

The significant inflows into digital asset investment products have been driven by a combination of factors, including positive price action on the crypto market and growing investor interest in alternative assets. The record-breaking inflows have also been driven by the growing demand for crypto-based investment products, particularly in the U.S. and Europe. As the crypto market continues to evolve, it is likely that we will see further growth in digital asset investment products, driven by increasing institutional and retail investor demand.

Year-to-Date Inflows Reach New Highs

The year-to-date inflows for digital asset investment products have reached new highs, with Bitcoin, Ethereum, and Solana leading the charge. The significant inflows into these assets have been driven by a combination of factors, including positive price action, growing investor interest, and increasing demand for crypto-based investment products. As the crypto market continues to grow and evolve, it is likely that we will see further growth in digital asset investment products, driven by increasing institutional and retail investor demand.

For more information on the latest digital asset investment trends and insights, please visit https://crypto.news/coinshares-net-inflows-surge-to-weekly-record-at-5-95b/