NFT Lending Market Experiences Significant Decline

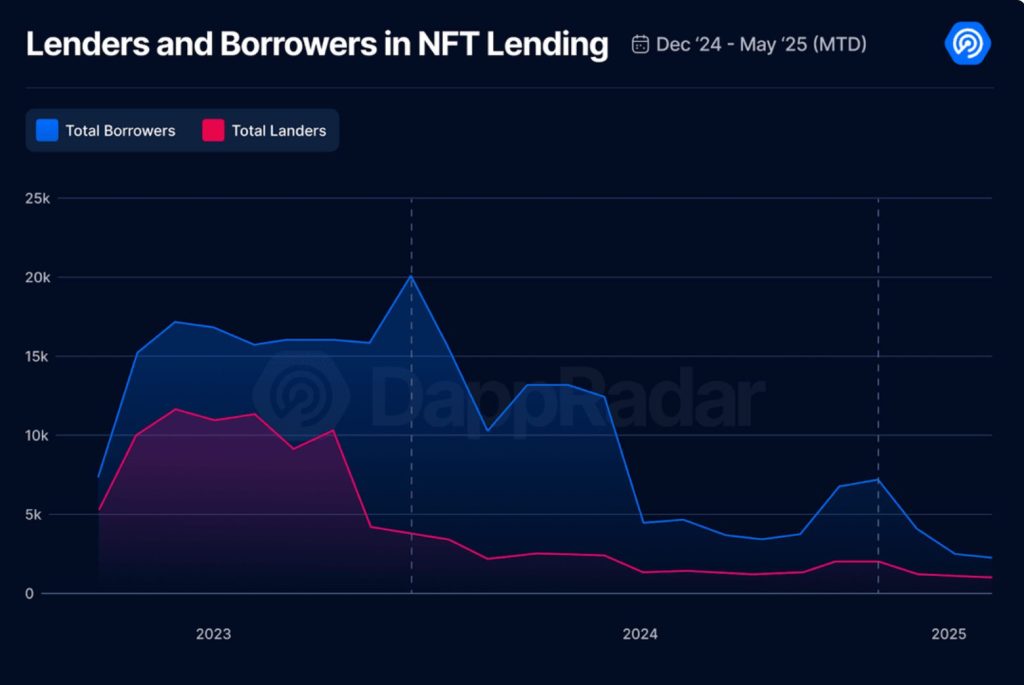

The NFT lending market has witnessed a substantial decline, with its credit volume plummeting by 97% since its peak in January 2024. According to a report by Dupradar, the market has seen a significant drop in user activity, loan sizes, and trust, resulting in a decrease from almost $1 billion to just over $50 million in May 2025. This decline is attributed to a 90% drop in borrowers and a 78% decrease in lender participation since January last year.

Gondi Takes the Lead in NFT Lending Market

The shift in platform dominance highlights a change in user behavior. Gondi now leads the sector with 54.2% of the total outstanding volume, overtaking Blur, a mixed protocol that once controlled over 96% of the market. Gondi’s rise is attributed to its focus on long-term, stable lending options for art NFTs. In contrast, Blur’s climb was driven by Airdrop incentives and aggressive marketing, but this model did not survive the bear market.

NFT Lending Market Not Dead Yet

Despite the decline, the NFT lending market is not dead yet. According to Dupradar, the sector needs real application cases and useful, controlled innovations beyond protocol optimizations. The market must assume new applications, such as tokenized real assets and borrowed lending models, to switch from speculative niche to financial benefits. If the next wave builds on benefits, culture, and better design, the NFT loan could find its second wind – one that was built for the duration.

For more information, visit https://cryptonews.com/news/nft-lending-market-crashes-97-as-users-and-loan-sizes-plummet/