Impact of BlackRock’s Absence on Altcoin ETFs

The highly anticipated approval of altcoin exchange-traded funds (ETFs) may not yield the expected massive inflows of investors without the participation of the asset management giant BlackRock, according to recent market data. This insight is crucial for understanding the dynamics of the cryptocurrency market and the role of major financial institutions in shaping its trends.

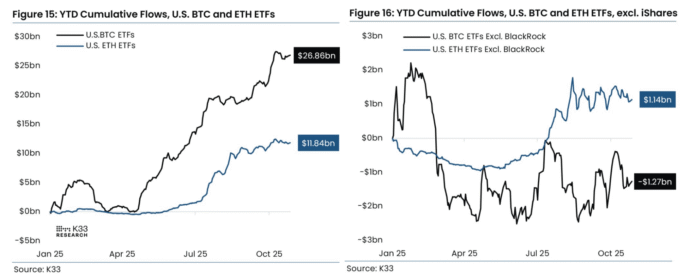

BlackRock’s iShares Bitcoin Trust ETF has garnered significant attention and investment, receiving $28.1 billion in investments in 2025. This makes it the only fund with positive year-to-date (YTD) inflows, contributing to a cumulative $26.9 billion in total spot Bitcoin ETF inflows. The data underscores the influence of BlackRock on the market, given its status as the world’s largest asset management firm with $13.5 trillion in assets under management as of the third quarter of 2025.

Excluding BlackRock’s fund, the picture changes significantly, with spot Bitcoin ETFs experiencing a cumulative net outflow of $1.27 billion year-to-date, as noted by K33 research director Vetle Lunde. This stark contrast highlights the pivotal role BlackRock plays in driving investment trends in the cryptocurrency space. Geoff Kendrick, global head of digital asset research at Standard Chartered, has also pointed out that inflows from spot Bitcoin ETFs have been a primary driver of Bitcoin (BTC) price momentum in 2025.

Source: Vetle Lunde

Implications for Altcoin ETFs

The dynamics observed in Bitcoin ETF investing suggest that BlackRock’s absence from the altcoin ETF market could limit overall inflows and their potential positive impact on the underlying cryptocurrencies. Vetle Lunde succinctly summarized this situation with the phrase “No BlackRock, no party,” emphasizing the significance of BlackRock’s participation for the success of these financial products.

Despite the potential impact of BlackRock’s absence, some analysts remain optimistic about the prospects of the next generation of ETFs. For instance, the first Solana (SOL) Stake ETF is predicted to attract substantial capital, with estimates ranging from $3 billion to $6 billion within the first year, according to forecasts by Bitget exchange chief analyst Ryan Lee and multinational investment bank JPMorgan. These predictions are based on the adoption rates of Bitcoin and Ether ETFs, which saw an adoption rate of 6% and 3%, respectively, in the first six months, attracting a significant portion of their total market capitalization.

The success of altcoin ETFs, therefore, hinges on several factors, including the participation of major asset management firms like BlackRock and the overall appetite of investors for these products. As the cryptocurrency market continues to evolve, the interplay between institutional investment, regulatory approvals, and market demand will shape the future of altcoin ETFs.

For more information on the impact of BlackRock’s absence on altcoin ETFs and the broader implications for the cryptocurrency market, visit https://cointelegraph.com/news/no-blackrock-no-party-bitcoin-altcoin-etf?utm_source=rss_feed&utm_medium=rss_tag_blockchain&utm_campaign=rss_partner_inbound.