Decentralized Perpetual Exchanges See Explosive Growth in 2025

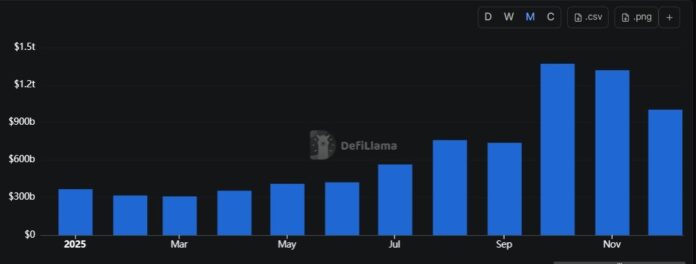

Decentralized perpetual exchanges are ending 2025 with a cumulative trading volume of $12.09 trillion, a significant increase from $4.1 trillion at the start of the year. According to data from DefiLlama, about $7.9 trillion of this lifetime total was generated in 2025, with 65% of the total DEX trading volume occurring in a single calendar year. This concentration highlights the rapid scaling of on-chain derivatives in 2025.

The increase in trading volume reflects a sharp acceleration in on-chain derivatives usage over the past 12 months, as perpetual DEXs absorbed a growing share of leveraged crypto trading activity. In December alone, perpetual bond trading volume reached $1 trillion, continuing a momentum that began in October when monthly volumes reached $1 trillion for the first time.

Perpetuals DEX volume in 2025. Source: DefiLlama

Perpetuals DEX volume in 2025. Source: DefiLlama

Growth of Perpetuals DEXs

Perpetuals DEXs emerged around 2021, with dYdX and Perpetual Protocol widely considered to be the first platforms to offer decentralized on-chain perpetual futures. The sector’s growth accelerated sharply in 2023 as the emergence of hyperliquid marked a turning point. The nearly $8 trillion in volume generated during 2025 was largely concentrated in the second half of the year.

Data from DefiLlama shows that the first half of 2025 saw volume of about $2.1 trillion, while the second half saw volume of about $5.74 trillion, accounting for 73% of the year’s overall record. Trading activity remained relatively stable in the first half of 2025, indicating a consistent baseline of on-chain derivatives usage rather than a breakout phase.

Shift in Trading Activity

This pattern changed midway through the year, with volumes accelerating in the third quarter before reaching an inflection point in the fourth quarter when monthly volumes began to consistently exceed $1 trillion. The trading volume of the fourth quarter exceeds the total trading volume of the first half of 2025. As liquidity and execution improved, perpetual DEXs increasingly functioned as primary venues for leveraged trading rather than as complementary alternatives to centralized exchanges.

Hyperliquid’s perpetuals trading volume for 2025. Source: DefiLlama

Hyperliquid’s perpetuals trading volume for 2025. Source: DefiLlama

Changes in Market Dominance

Hyperliquid dominated the offender DEX space for most of the year, especially in the first six months when its monthly volume was consistently between $175 billion and $248 billion. However, by mid-year, the competitive landscape began to change as rival platforms gained traction faster than Hyperliquid. Both Aster and Lighter saw significant increases in activity from June onwards.

Lighter’s monthly volume increased from under $50 billion to consistently over $100 billion in the third quarter, indicating growing dealer adoption and liquidity depth. The biggest challenge to Hyperliquid’s dominance occurred in the fourth quarter, with Aster seeing explosive growth in October and November as monthly volume rose to $259 billion in both months.

By year’s end, data suggested a transition from a single market leader to a more competitive multi-venue ecosystem. For more information on the growth of decentralized perpetual exchanges, visit https://cointelegraph.com/news/perpetuals-dex-volume-2025-onchain-derivatives-growth?utm_source=rss_feed&utm_medium=rss_tag_blockchain&utm_campaign=rss_partner_inbound