A crypto developer has accused World Liberty Financial (Wlfi), a crypto project with connections to US President Donald Trump, of stealing his funds by refusing to unlock his tokens. This accusation has sparked a heated debate about the reliability of compliance tools used by crypto projects and the potential for unfair treatment of investors.

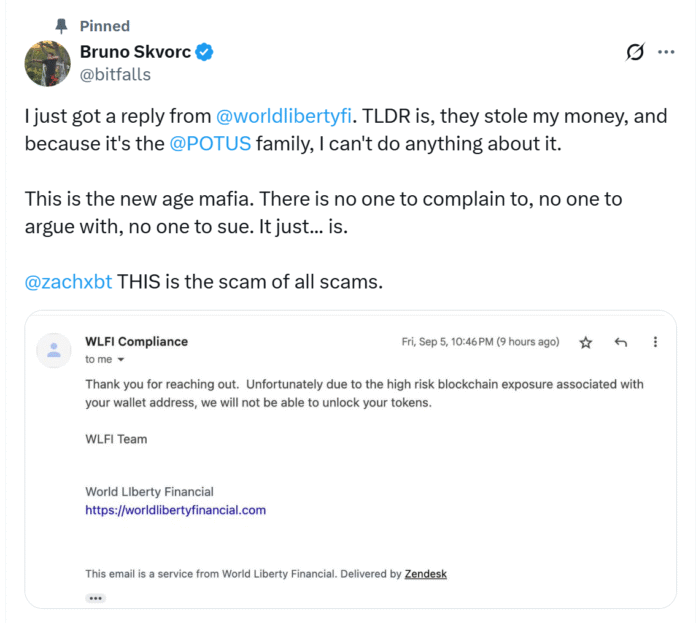

In a Saturday post on X, Polygon Devrel Bruno Skvorc shared an email from the Wlfi compliance team, which marked his item of items as a “high risk” due to blockchain exposure. The team said his tokens were not released, prompting Skvorc to claim that Wlfi had stolen his money. He expressed frustration, stating that because of the project’s connection to the President of the United States, he feels powerless to take action.

Skvorc claims that he was one of six investors who were exposed to 100% token lockups from the start. He argues that it was not a “high risk” to accept money from his address, but rather a high risk to unlock the funds. This incident has raised concerns about the fairness and transparency of crypto projects, particularly those with high-profile connections.

Compliance Tools Under Scrutiny

The incident has triggered criticism of the compliance tools used by projects such as Wlfi. Onchain Sluth ZachxBT agreed, explaining that automated tools often flag addresses as “high risk” for trivial or false reasons, including interactions with DeFi contracts or exchanges. ZachxBT noted that these tools are “deeply flawed” and can lead to unfair treatment of investors.

In Skvorc’s case, the flags were raised due to an earlier transaction via Crypto Mixer Tornado Cash, indirect connections to sanctioned entities such as Garantex and Netex24, and an earlier interaction with a now-blacklisted dashboard. Skvorc, a blockchain developer based in Croatia, has worked on Ethereum 2.0 and is the founder of RMRK, a company that integrates multi-resource NFTs in gaming metaverse.

Justin Sun’s Wlfi Token Frozen

On Friday, Tron founder Justin Sun revealed that his Wlfi token allocation was frozen. His wallet was blacklisted after a blockchain tracker flagged a $9 million transaction, labeling it as a “sale” and triggering accusations that he had sold his tokens. Sun called the freeze “unreasonable” and asked World Liberty Financial to unlock his tokens, stating that the decision was against the basic values of blockchain and calling tokens “holy and inviolable”.

This incident highlights the need for greater transparency and fairness in the crypto industry, particularly when it comes to compliance tools and the treatment of investors. As the industry continues to evolve, it is essential to ensure that investors are protected and that projects are held accountable for their actions. For more information, visit https://cointelegraph.com/news/developer-trump-wlfi-stealing-tokens?utm_source=rss_feed&utm_medium=rss_tag_altcoin&utm_campaign=rss_partner_inbound