Privacy-Focused Cryptocurrencies Surge Amid Market Decline

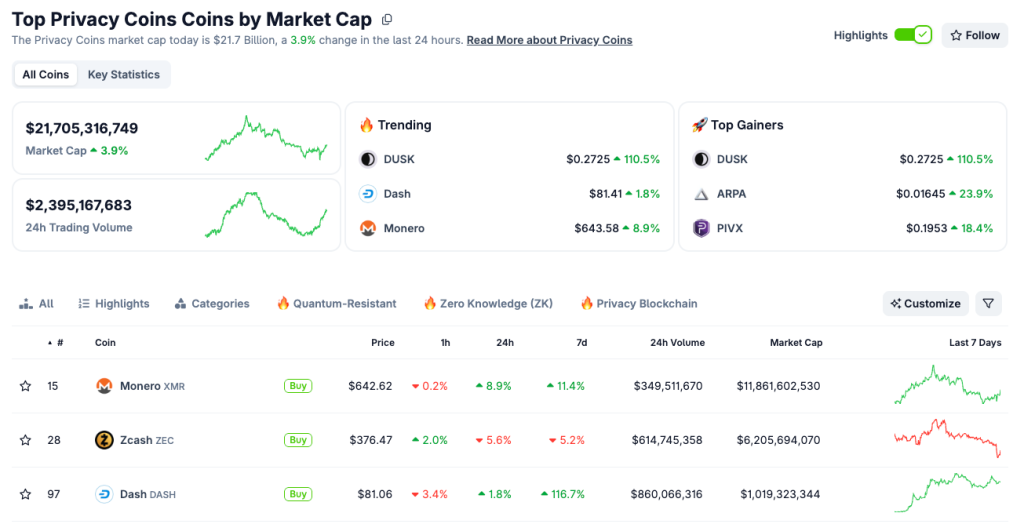

Privacy-focused cryptocurrencies have seen a significant surge in value over the past week, with the sector gaining 13%, while the broader market experienced a decline. This surge has led to a notable increase in the value of privacy tokens such as Monero, Dash, and DUSK. According to CoinGecko data, the market cap of the privacy coin category has increased to $21.7 billion, with a trading volume of $2.4 billion.

The rally has pushed these privacy tokens into the spotlight, suggesting a selective capital rotation rather than traditional risk-off behavior. In the last 24 hours, Bitcoin is down almost 3%, while most altcoins are down between 3% and 10%. However, privacy coins have been moving in the opposite direction, with Dash trading at $81.61, up 1.9% on the day and 119% on the week, and Monero trading at around $644, up 8.9% in 24 hours.

DUSK saw the strongest gains, rising 110.5% daily and over 354% weekly. This surge in privacy coins has been attributed to investors looking to preserve capital without completely abandoning crypto positions. According to Ray Youssef, CEO of crypto app NoOnes, “The outperformance of privacy coins during a broad market decline is an indicator of selective risk-taking by investors who prefer not to completely reduce risk or completely exit their positions in the crypto markets.”

Structural Demand for Privacy Coins

Youssef explained that the strength of assets like Monero, Dash, and DUSK reflects investors looking for assets that can insulate themselves from broader market weakness and are resilient in times of macroeconomic stress. Stricter KYC and AML requirements worldwide are also pushing users towards financial privacy embedded in the protocol. The mass freeze of stablecoins has accelerated this shift, with Tether freezing over $182 million worth of USDT at five addresses on January 11th.

Despite regulatory headwinds, including the ban on privacy token trading announced by the Dubai International Financial Center, the sector continued to post gains. Youssef noted that “privacy coins are taking on a new role and becoming a form of financial independence from corporate and regulatory structures.”

Technical Momentum Points to Further Upside

Privacy coins have outperformed large-cap investments in several recent market downturns and have established patterns of divergence that could solidify their role in strategic portfolios. According to Youssef, “privacy is once again recognized as fundamental to decentralization,” and the core use case and technology of privacy coins remain relevant, especially given ongoing concerns about peer risk, government surveillance, and the future of digital finance.

DUSK price chart. | Source: CoinGecko

DUSK price chart. | Source: CoinGecko

Pavel Nikienkov, founder of Zano, emphasized that privacy is more than a passing trend, pointing to a16z’s 2025 State of Crypto report, which highlights a sharp increase in Google search interest for privacy-related terms. He argued that mainstream blockchains like Ethereum and Solana indicate the sector’s maturity by incorporating optional privacy layers, although “only systems designed for confidentiality” can meaningfully protect users in an increasingly monitored digital landscape.

For more information, visit https://cryptonews.com/news/privacy-coins-defy-crash-surge-13-amid-market-wide-liquidations/