Introduction to the Bitcoin AfterDark ETF

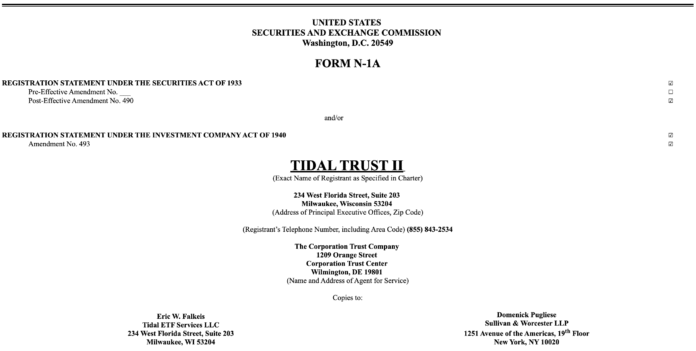

A new regulatory filing by Tidal Trust has proposed listing and trading an exchange-traded fund that will hodl Bitcoin during off-market hours. This innovative approach aims to capture the potential gains of Bitcoin during overnight hours, while minimizing exposure to daytime market volatility. The filing, submitted to the US Securities and Exchange Commission (SEC), outlines the details of the Nicholas Bitcoin and Treasuries AfterDark ETF, which will utilize a unique trading strategy to achieve its objectives.

The proposed ETF will operate by buying Bitcoin at the close of US market trading hours and selling it at the opening, effectively hodling the asset throughout the day. According to the SEC filing, “When utilizing Bitcoin Futures, the Fund trades these instruments during US overnight hours and closes them out shortly after the US market opens each trading day.” This approach allows the fund to capture any market movement that occurs during overnight hours, while avoiding the potential risks and volatility associated with daytime trading.

The asset management company behind the ETF, Tidal Trust, has allocated its assets to “US Treasuries, money market funds and other cash equivalents” during daytime hours. This investment strategy enables traders to avoid dealing with potential price volatility, while still maintaining indirect exposure to Bitcoin. As ETF analyst Eric Balchunas noted, “We looked at this last year and found most of the gains are in fact after hours. Doesn’t mean the ETFs aren’t having impact. Some of this is positioning [because] of the ETFs etc or derivatives based on flows etc etc. But yeah, Bitcoin After Dark ETF could put up better [returns].”

Regulatory Environment and Market Trends

The SEC filing does not guarantee approval, and the regulator may subject the proposal to changes. However, the SEC has given the green light to numerous crypto-tied investment vehicles, including Bitcoin and Ether (ETH) futures ETFs, spot digital asset ETFs, and staked crypto ETFs. This suggests a growing acceptance of cryptocurrency-based investment products, which could pave the way for the Bitcoin AfterDark ETF to gain approval.

Despite the potential for growth, the spot Bitcoin ETF market has experienced significant outflows in recent months. In November, US spot Bitcoin ETFs saw record outflows, with approximately $4 billion withdrawn. BlackRock’s iShares Bitcoin Trust and Fidelity’s Wise Origin Bitcoin Fund were among the largest ETFs to experience redemptions. This trend highlights the importance of innovative investment products, such as the Bitcoin AfterDark ETF, which can help attract investors back to the market.

Conclusion and Future Outlook

In conclusion, the proposed Bitcoin AfterDark ETF offers a unique approach to investing in Bitcoin, leveraging the potential gains of overnight trading while minimizing exposure to daytime market volatility. As the regulatory environment continues to evolve, it is likely that we will see more innovative investment products emerge, catering to the growing demand for cryptocurrency-based investments. For more information on this topic, please refer to the original source: https://cointelegraph.com/news/bitcoin-afterdark-etf-overnight-market-hours?utm_source=rss_feed&utm_medium=rss_tag_bitcoin&utm_campaign=rss_partner_inbound