Ripple’s RLUSD Stablecoin Reaches New Milestone, Surpassing $1 Billion Market Cap

The market capitalization of Ripple’s stablecoin, RLUSD, has recently surpassed $1 billion for the first time in history, marking a significant achievement for the stablecoin. This milestone makes RLUSD one of the best USD-backed stablecoins, with a current ranking as the eleventh largest stablecoin in the world.

According to data from DeFi Llama, RLUSD has achieved a market capitalization of $1.025 billion, with its growth fueled by increasing retail adoption, the proliferation of the Ethereum network, and recent institutional integrations. The stablecoin’s success can be attributed to its ability to provide a stable store of value and a means of exchange, making it an attractive option for both individual and institutional investors.

Market Capitalization and Ranking

RLUSD’s market capitalization has surpassed the $1 billion threshold, with its current ranking among the top stablecoins. While it still trails behind stablecoin giants such as Tether (USDT), Circle’s USD Coin (USDC), and Ethereum’s USDe, RLUSD’s growth is a significant achievement. Tether (USDT) maintains its position as the largest stablecoin by market cap, with a value of $183 billion, accounting for nearly 60% of the total stablecoin market cap.

Circle’s USD Coin (USDC) ranks second, with a market cap of $74.6 billion, followed by Ethereum’s USDe, with a market cap of $9.06 billion. RLUSD’s market capitalization may be lower than these stablecoin giants, but its growth is a notable achievement, especially considering it has reached this milestone within less than a year of its launch.

Growth Drivers and Institutional Adoption

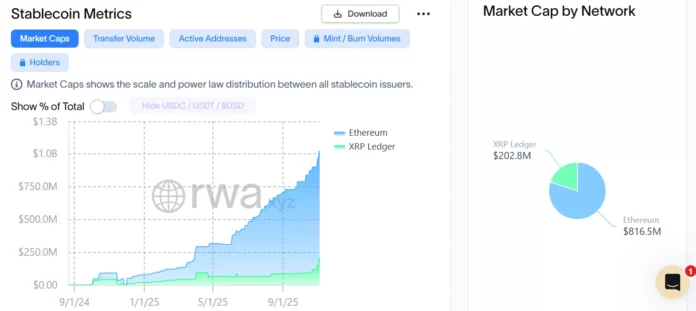

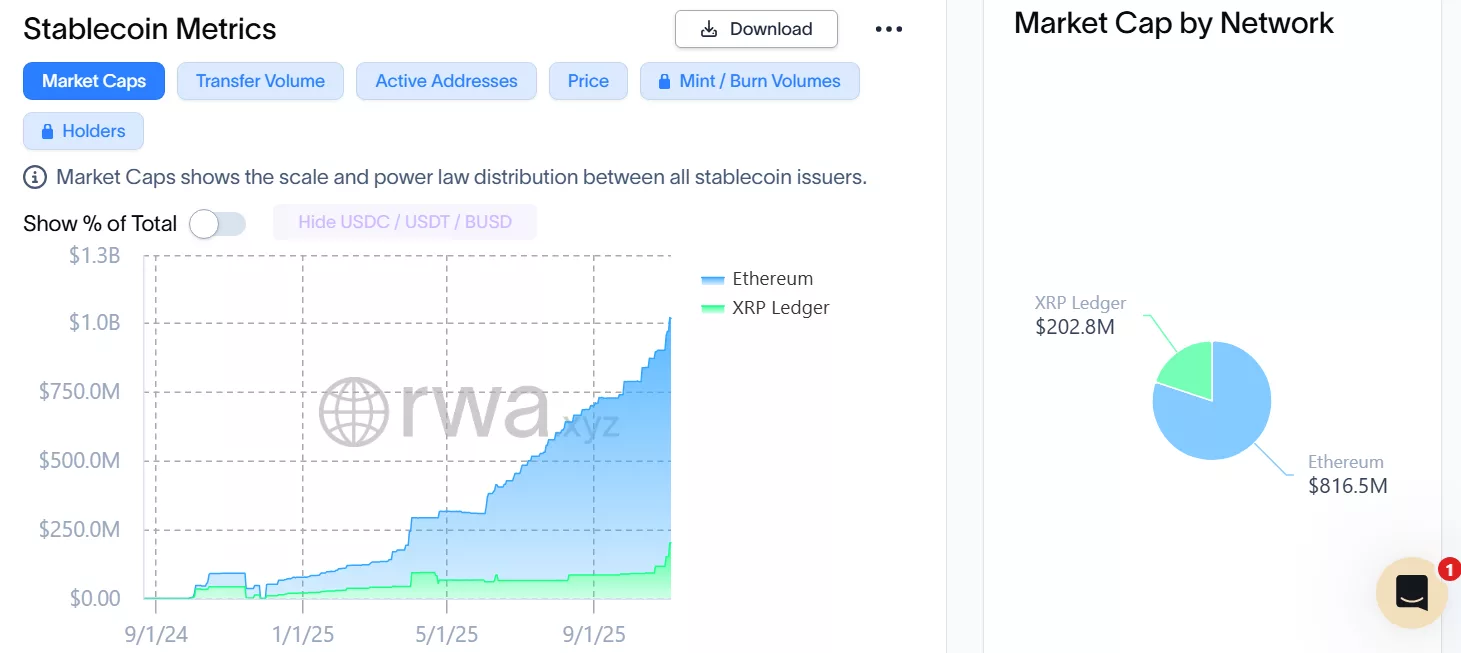

RLUSD’s growth can be attributed to several factors, including its increasing presence in self-custody wallets like Xaman and its integration with platforms like Transak. Data from RWA.xyz shows that the stablecoin’s market capitalization has increased by almost 30% compared to the previous month, with the number of RLUSD holders also increasing by 3.09% month-on-month.

The stablecoin’s growth is also driven by institutional adoption, with Chicago-based derivatives exchange Bitnomial announcing that it will expand support for Ripple USD and accept the asset as margin collateral and margin deposits. This makes Bitnomial the first regulated exchange in the US to accept stablecoins as margin collateral, further increasing RLUSD’s appeal to institutional investors.

RLUSD was largely issued on the Ethereum chain | Source: RWA.xyz

RLUSD was largely issued on the Ethereum chain | Source: RWA.xyz

Market Trends and Outlook

Despite the stablecoin industry experiencing a decline in market capitalization, with a loss of about $2.47 billion in the last seven days, RLUSD seems to be holding out. The stablecoin’s trading volume has increased by 82.5% to $276 million compared to the previous trading day, indicating a strong demand for the stablecoin.

The total stablecoin market cap may be weakening, but RLUSD’s growth is a positive sign for the industry. As more institutions and retail investors become interested in stablecoins, the market is likely to continue growing, with RLUSD well-positioned to capitalize on this trend.

For more information on RLUSD and the stablecoin market, visit https://crypto.news/ripples-rlusd-stablecoin-surpasses-1b-market-cap/