Aave Protocol Emerges from Four-Year SEC Investigation Unscathed

The U.S. Securities and Exchange Commission (SEC) has officially concluded its multi-year investigation into the Aave protocol without recommending any enforcement action. This development marks a significant milestone for the decentralized finance (DeFi) platform, which has been operating under regulatory uncertainty since the investigation began in late 2021 or early 2022.

According to Aave founder and CEO Stani Kulechov, the investigation required “significant effort and resources” from the company and himself to protect Aave, its ecosystem, and the broader DeFi space. The SEC’s decision to close the investigation without taking any enforcement action is a positive outcome for Aave and its users, who can now continue to use the platform without the risk of imminent regulatory action.

Background and Implications of the Investigation

The SEC’s investigation into Aave was part of a broader crackdown on DeFi platforms, which began in 2021. The agency expanded its enforcement focus to include protocols that offered lending, borrowing, and liquidity services without traditional intermediaries. While the SEC did not publicly disclose the scope of its concerns, industry observers assumed that the investigation centered on whether the AAVE token or aspects of the protocol’s operations fell under U.S. securities laws and whether registration requirements applied.

Aave cooperated with regulators throughout the investigation, working closely with SEC staff over several years. In June 2025, Aave representatives met with members of the SEC’s Crypto Task Force to discuss regulatory approaches, although it is unclear whether these discussions were related to the closure decision. The investigation’s conclusion without enforcement action suggests that Aave has successfully navigated the regulatory landscape and can continue to operate without the risk of imminent SEC action.

Market Reaction and Broader Regulatory Landscape

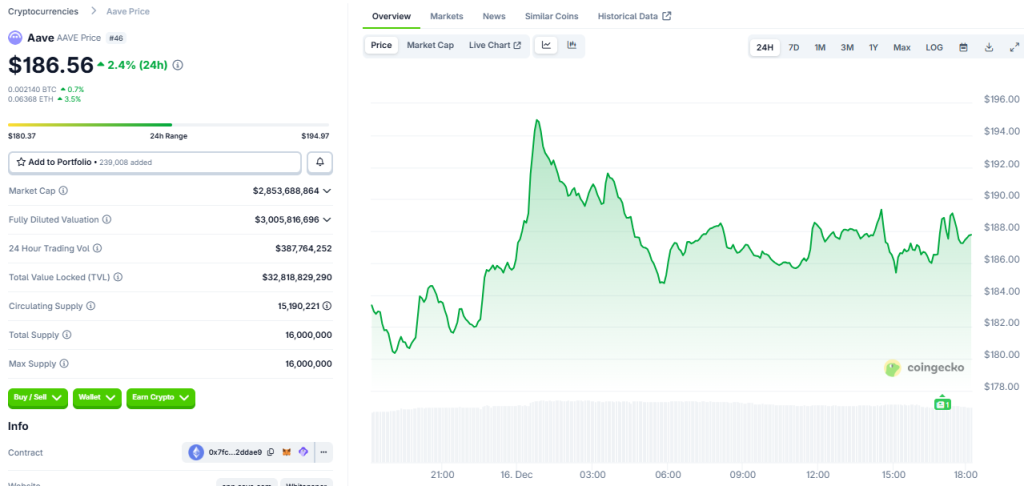

The Aave token (AAVE) responded positively to the news, reaching a high of $194 before stabilizing at $187.67, up 2.4% in the last 24 hours. The token’s price movement reflects the reduced regulatory uncertainty surrounding the platform, giving users more confidence in its stability and accessibility.

The Aave case is the latest in a series of high-profile crypto investigations that have concluded without charges in 2025. Other notable cases include Ondo Finance, which announced the end of its multi-year investigation in December, and the dismissal of lawsuits against Coinbase, Kraken, Robinhood, OpenSea, Uniswap Labs, Consensys, and Crypto.com. These developments suggest a shift in the SEC’s approach to regulating the crypto industry, with a greater emphasis on providing clearer policy guidance rather than relying on enforcement actions.

Conclusion and Future Outlook

The conclusion of the Aave investigation without enforcement action is a positive development for the DeFi platform and its users. As the regulatory landscape continues to evolve, it is essential for platforms like Aave to prioritize compliance and cooperation with regulatory bodies. The SEC’s decision to close the investigation without taking action suggests that Aave has successfully navigated the regulatory environment and can continue to operate with reduced uncertainty. For more information on this development and its implications for the crypto industry, visit https://cryptonews.com/news/sec-ends-aave-investigation-defense/.