The cryptocurrency community is abuzz with uncertainty as the U.S. Securities and Exchange Commission (SEC) failed to take action on the Canary Capital Litecoin Exchange-Traded Fund (ETF) on Thursday, the original deadline for a decision. The SEC’s silence has sparked concerns about how the regulatory body will operate amidst the federal government shutdown and how its new generic listing standards will impact the schedules of dozens of crypto ETF applications awaiting approval.

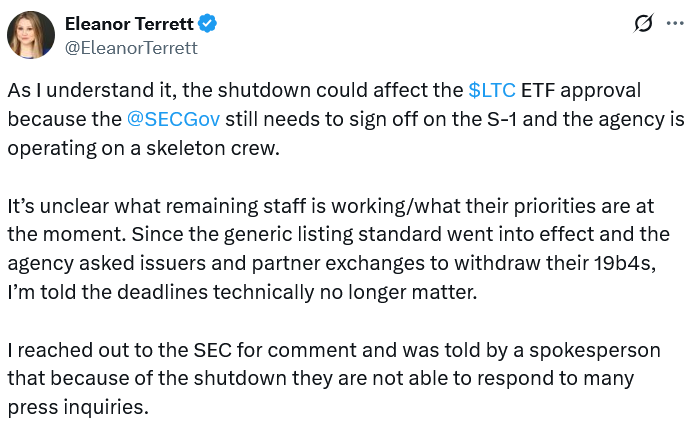

The Bloomberg ETF analyst, James Seyffart, and Fox News reporter, Eleanor Terrett, have discovered that the traditional 19b-4 process for crypto ETF applications may no longer be relevant. This is because the SEC has requested applicants to withdraw their 19b-4 filings, leaving only the S-1 registration statement as the required document for regular approval.

The government shutdown has added another layer of uncertainty to the situation. In August, the SEC released an “operating plan” stating that, in the event of a government shutdown, it would not review or approve applications for registration, including new financial products and changes to self-regulatory organization rules.

Impact of the SEC’s Silence on Canary’s Spot Litecoin ETF

It is unclear whether the SEC’s inaction on Canary’s Spot Litecoin ETF is solely due to the government shutdown or if the new generic listing standards have rendered the 19b-4 process irrelevant. Canary withdrew its 19b-4 application on September 25 at the request of the SEC, which may have contributed to the regulatory body’s decision not to act on Thursday.

The effects of the 19b-4 withdrawals on applicants who have not taken this step are still unknown. CoinTelegraph reached out to the SEC and Canary for comment but did not receive an immediate response.

SEC Operations During the Government Shutdown

Despite the government shutdown, the SEC announced that it would continue to operate, albeit with a “very limited” number of employees. The Electronic Data Gathering, Analysis, and Retrieval (EDGAR) database will remain functional.

Altcoins and the US Market

The market is preparing for the potential approval of several new spot crypto ETFs, including those for Litecoin (LTC), Solana (SOL), XRP (XRP), Avalanche (AVAX), Cardano (ADA), Chainlink (LINK), and Dogecoin (DOGE). Each approval would increase the currently available ETFs from Bitcoin (BTC) and Ether (ETH).

According to Eric Balchunas, a Bloomberg ETF analyst, the new SEC listing standards would have increased the probability of a spot crypto ETF approval to 100%. The listing standards are expected to rationalize the process, in line with Rule 6c-11, and significantly reduce the approval timeline, which typically takes up to 240 days.

SEC Chairman Paul Atkins stated that the new listing standards will reduce obstacles to access to digital wealth products and provide investors with more choices.

For more information on the SEC’s decision and its impact on the cryptocurrency market, visit https://cointelegraph.com/news/sec-takes-no-action-on-canary-litecoin-etf?utm_source=rss_feed&utm_medium=rss_tag_litecoin&utm_campaign=rss_partner_inbound