The U.S. Securities and Exchange Commission (SEC) has imposed significant penalties on former executives of Alameda Research and FTX, a cryptocurrency exchange that collapsed in 2022. Caroline Ellison, the former CEO of Alameda Research, and former FTX executives Gary Wang and Nishad Singh will be banned from holding leadership positions at the company for eight to 10 years, following a court ruling.

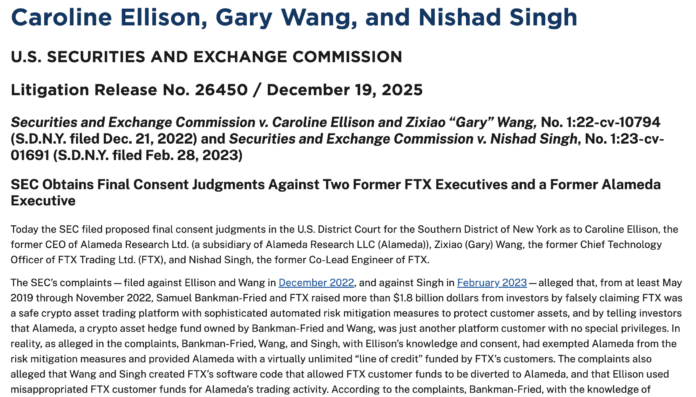

The SEC announced in a statement that it had entered final consent judgments against Ellison, Wang, and Singh for their roles in misusing investor funds at FTX from 2019 to 2022. According to the SEC, the three executives had excluded Alameda from risk mitigation measures and provided the company with a virtually unlimited “credit line” funded by FTX customers. The complaints also alleged that Wang and Singh created FTX’s software code that enabled the diversion of FTX customer funds to Alameda and that Ellison misappropriated FTX customer funds for Alameda’s trading activities.

Former FTX CEO Sam “SBF” Bankman-Fried was sentenced to 25 years in prison for his role in the exchange’s collapse. He is awaiting the results of an appeal to the U.S. Court of Appeals for the Second Circuit, where a hearing was held on November 4. Caroline Ellison, who testified against Bankman-Fried as part of a plea deal, was sentenced to two years in prison. Wang and Singh also testified against SBF in his criminal trial and were sentenced to prison in 2024.

Consequences for Former Executives

Ellison, Wang, and Singh have agreed to significant penalties, including bans on holding leadership positions at the company. Ellison has agreed to a 10-year vesting period for senior executives, while Wang and Singh have agreed to an 8-year vesting period for officers and directors each. The SEC has also imposed “conduct-based injunctions” with a term of five years on all three executives.

The consequences for the former executives are a result of their involvement in the misuse of investor funds at FTX. The SEC alleged that the executives had engaged in a scheme to divert customer funds to Alameda, which was used for the company’s trading activities. The scheme ultimately led to the collapse of FTX, resulting in significant losses for investors.

Release from Prison

Ellison is scheduled to be released from prison on February 20, about nine months before the end of her two-year sentence. She was recently moved from prison to a Residential Reentry Management field office in New York City. The timing of her release suggests that she may have been eligible for good behavior credit to reduce her prison sentence.

The penalties imposed on the former executives of Alameda Research and FTX serve as a reminder of the importance of regulatory compliance in the cryptocurrency industry. The SEC’s actions demonstrate its commitment to protecting investors and enforcing laws and regulations in the sector. For more information, visit the source link.