Bitcoin’s 2025 Performance: Uncovering the Trends Behind the Headlines

Despite Bitcoin’s (BTC) year-to-date (YTD) return being in the red and struggling to trade above $100,000, short-term holders (STHs) have spent 229 out of 345 days in profit. This seemingly contradictory result warrants a closer examination of the on-chain positioning and its implications for the market. According to data from CryptoQuant, STHs have made gains of 66% in 2025, despite BTC trading below its year-opening price.

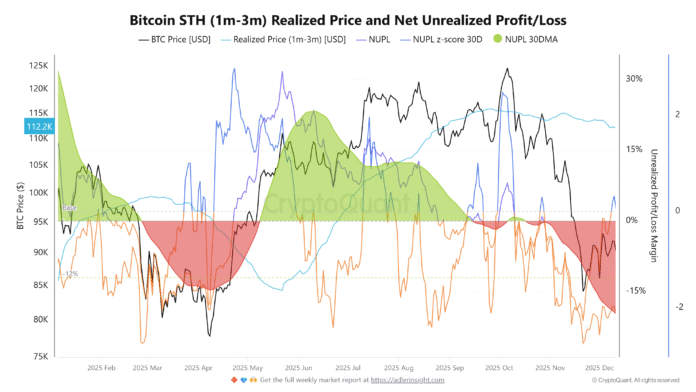

The realized STH price of $81,000 has acted as a sentiment pivot, separating the panic and recovery phases. Moreover, unrealized losses have fallen from -28% to -12%, signaling that capitulation is easing. These trends suggest that the structure of the on-chain positioning tells a different story than the overall weak performance of Bitcoin.

On-Chain Positioning and STH Profitability

The volatility of 2025 can be explained from the perspective of the one- to three-month STH cohort. As shown in the chart, Bitcoin’s price repeatedly interacted with its realized price, producing alternating waves of green net unrealized profit/loss (NUPL) profitability and red NUPL losses.

Source: CryptoQuant

In early 2025, BTC remained above this cost base for almost two months, giving STHs their first pocket of sustained gains. However, the move into February and March caused prices to fall below the cohort’s realized price, pushing STH NUPL deep into the red and marking one of the longest losing streaks of the year.

Shifting the BTC Cost Base and its Implications

The momentum reversed significantly from late April to mid-October, where the chart’s broad green zones coincide with Bitcoin’s 172-day period of predominantly profitable STH activity. Although the overall trend weakened, these rallies boosted STH profitability far higher than the market narrative implied.

Source: CryptoQuant

Bitcoin’s rally towards $92,500 has reduced STH’s unrealized losses from -28% to -12%, a sign that forced selling is easing and emotional exhaustion is setting in. The price realized by STH at $81,000 remains the psychological pivot point, as any reclaim historically marks the transition from capitulation to stability.

Source: CryptoQuant

New money and investors who get in within a few days or weeks are close to the break-even point and reinforce this stabilizing structure. If BTC continues to improve STH’s profitability while staying above this $81,000 level, the end-of-year correction could already be close to completion, laying the foundation for the next phase of expansion.

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision. For more information, visit https://cointelegraph.com/news/bitcoin-holders-were-in-profit-for-66percent-of-2025-what-will-next-year-bring?utm_source=rss_feed&utm_medium=rss_category_market-analysis&utm_campaign=rss_partner_inbound