In a significant development, Solana (SOL) has surpassed Binance Coin (BNB) to become the fifth-largest cryptocurrency by market capitalization, with its price testing resistance levels of $240 and $260. This upward trend is attributed to a combination of strong technical data and improving fundamentals.

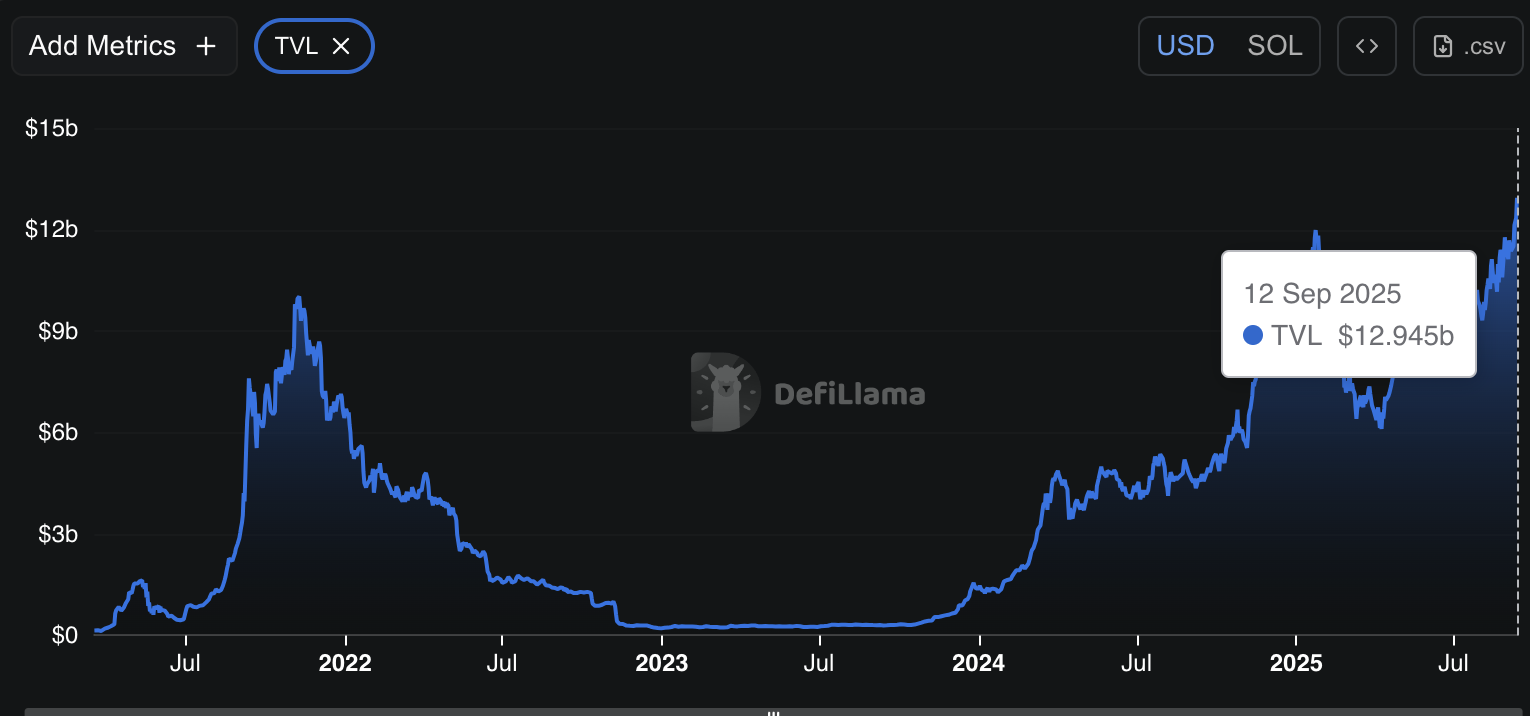

Solana’s market capitalization has reached $128.67 billion, overtaking BNB’s $125.87 billion. This surge is largely driven by the increasing adoption of Solana’s decentralized finance (DeFi) ecosystem, which has seen its total value locked (TVL) reach a record high of $12.95 billion. This represents a 20% increase in the past 30 days alone, outpacing most competing Layer 1 chains and even surpassing the combined TVL of Ethereum’s Layer 2 solutions, including Optimism and Arbitrum.

Technical Analysis

The Solana price has been on a strong upward trend since breaking through the resistance zone of $205-$211, which was geared towards the 0.382 FIB retracement. The rally has led the price up to an important level of $240, where Solana was traded at the end of January, while higher lows have been printed since mid-June. However, the Solana price now looks overstretched in relation to the 20-day exponential moving average (EMA) and the breakout zone, with the relative strength index (RSI) approaching 70, which could signal a potential withdrawal.

Source: Tradingview

Source: Tradingview

A potential withdrawal could appear at $218 as the first support, followed by the region of $208-$210 (FIB + 20-day SMA). Holding these levels would keep the wider bullish structure intact and set up a potential continuation to $260.

Driving Factors

Apart from bullish technical data, Solana’s fundamentals have been improving rapidly. The increase in TVL reflects deeper liquidity and growing trust in the Solana DeFi ecosystem. Additionally, Solana’s Memecoin sector has recorded explosive growth, with the overall market capitalization of Solana Memecoins reaching $13 billion, compared to $7.3 billion at the end of June, representing an increase of almost 80% in less than three months.

Source: Defillama

Source: Defillama

Solana is also becoming an increasingly preferred asset for corporate crypto treasuries, further driving its adoption and growth. With its improving fundamentals and strong technical data, Solana is well-positioned to continue its upward trend and potentially reach new heights.

For more information on Solana’s price movement and market trends, visit https://crypto.news/sol-flips-bnb-as-5th-largest-crypto-by-market-cap-as-solana-price-eyes-260/