Solana’s native token, Sol (SOL), has been making waves in the cryptocurrency market, with a 24% increase in value over the last 30 days. Despite a strong rejection after testing the $250 level on Sunday, SOL has shown remarkable resilience, driven by stronger on-chain activity. But what’s behind this surge, and can SOL push towards the $300 mark?

Driving Factors Behind SOL’s Rally

There are several key factors contributing to SOL’s upward momentum. Firstly, corporate treasury investments have been driving consistent demand and strengthening price dynamics. Companies like Forward Industries, originally a medical and technological design company, have been increasing their capital through stock or debt offers and allocating the proceeds to cryptocurrency, including SOL. This trend is expected to continue, with more companies exploring the potential of blockchain and cryptocurrency.

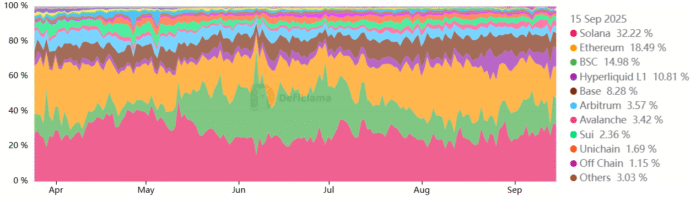

Another significant factor is the dominance of Solana in decentralized exchange (DEX) volumes. The network processed monthly volumes of $121.8 billion in September, surpassing Ethereum and the BNB chain. This leadership in DEX trade is crucial, as higher volumes create more fees, which in turn generate recurring demand for SOL to pay for transactions. According to Nansen, Solana’s fees have increased by 23% in the past seven days, a remarkable growth considering Ethereum’s total value locked (TVL) is still significantly higher.

Source: Defillama

Expanding Ecosystem and Partnerships

Solana’s ecosystem is expanding rapidly, with new partnerships and initiatives driving growth. The proposed open-source bridge between Solana and Base, an Ethereum layer-2 developed by Coinbase, is expected to enhance interoperability and create a more networked ecosystem. This bridge will allow users to move assets between chains, further increasing demand for SOL. Additionally, the Trump-supported crypto initiative World Liberty Financial (WLFI) has announced a partnership with the Memecoin platform from Solana, Bonk.fun, and the Raydium DEX, aiming to finance “multimillion-dollar advertising awards” and promote USD1 stablecoin pairs.

Source: Nansen

These developments, combined with the growing activity on the Solana network and the increasing demand for SOL, have traders speculating about the potential for SOL to reach the $300 mark. While this would represent a significant increase, it’s worth noting that Solana’s market capitalization would still be at a 70% discount to its valuation of $543 billion, making the scenario plausible in the short term.

For more information on Solana’s rally and the driving factors behind it, visit Cointelegraph.

This article serves general information purposes and should not be regarded as legal or investment advice. The views, thoughts, and opinions expressed here are solely those of the author and do not necessarily reflect the views and opinions of Cointelegraph or its affiliates.