Solana (SOL) has been exhibiting a notable shift in its on-chain flows, with a significant influx of capital into the ecosystem. The cryptocurrency has been hovering just above the $120 support zone, indicating a strong structural advantage. However, despite this optimistic outlook, market participation remains sluggish, and the bulls need to intensify their efforts to convert this advantage into bullish momentum.

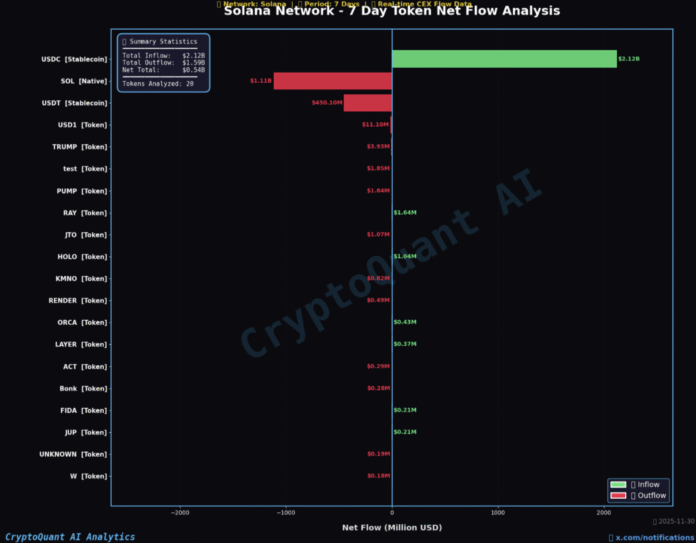

According to data from CryptoQuant, $2.12 billion flowed into Binance, while $1.11 billion flowed out of SOL, forming a textbook bullish structure around the $120 mark. This liquidity divergence is crucial in defending key support levels and suggests that whales or institutional entities are accumulating the cryptocurrency.

On-Chain Flows and Supply Shortages

The stablecoin inflows, particularly USDC, have been surging, with $2.12 billion entering the ecosystem. Meanwhile, native token outflows have reduced selling pressure on the exchange side, reinforcing the idea of a structural supply shortage. The fact that USDT saw an outflow of $450 million underscores the shift towards USDC-driven capital deployment in Solana ecosystems, a trend that has historically accompanied constructive market behavior.

Seven-day net flow analysis of Solana. Source: CryptoQuant

Large clusters of buyers have recently acquired approximately 17.8 million SOL at a cost basis of $142 and another 16 million SOL at $135, according to Glassnode’s cost basis distribution heatmap. These clusters behave similarly to on-chain support and resistance zones, with large clusters below price leading to strong support and large clusters above price creating potential resistance.

SOL cost base distribution heatmap. Source: Glassnode

Futures Activity and Profitability

While on-chain flows are showing accumulation, derivatives activity suggests a more cautious environment. SOL futures volume fell 3%, while BTC and Ether (ETH) saw significant gains of 43% and 24%, respectively. This imbalance suggests that Solana traders have been unusually quiet, in contrast to the capital entering ecosystems via stablecoins.

Comparison of BTC, ETH and SOL futures data. Source: Glassnode

Relative unrealized profit has fallen to October 2023 levels, indicating that speculative surpluses have been wiped out and the market is in an attractive re-accumulation zone. Net realized profit/loss also recorded sharply negative values in November, reflecting the large realized losses experienced during the formation of the lower range in February-April 2025.

SOL net realized profit/loss. Source: Glassnode

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision. For more information on Solana and its market trends, visit https://cointelegraph.com/news/solana-data-highlights-supply-shift-as-bulls-defend-dollar120?utm_source=rss_feed&utm_medium=rss_tag_altcoin&utm_campaign=rss_partner_inbound