Solana’s Struggle to Hold $80: A Concerning Sign for Investors

Solana’s native token, SOL (SOL), has been facing significant challenges in maintaining its value above $80. The token’s price action has been sluggish over the past two weeks, with repeated failures to break the $89 resistance level. This follows a sharp decline to $67.60 during the February 6 crash, which has led to a decline in demand for bullish leverage. As a result, traders are becoming increasingly cautious, and the demand for SOL has evaporated.

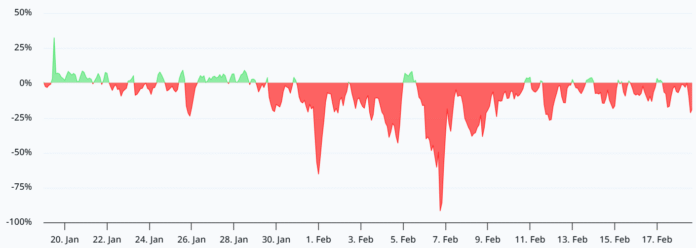

The annualized funding rate for SOL futures has been negative, with those betting against SOL currently paying a 20% annual rate to keep their short positions open. This aggressive move indicates that bears have strong conviction, and the funding rates remaining negative for over a week is a rare occurrence. In contrast, ETH’s annual funding rate was 1% on Wednesday, which is below the usual neutral mark of 6% but nowhere near as one-sided as SOL.

SOL has underperformed the rest of the crypto market by 11% in the last 30 days, leading to growing frustration among investors. The token’s 67% decline from its peak of $253 in September 2025 has had a significant impact on both on-chain activity and derivatives. Open interest in SOL futures has dropped by 75% from its peak of $13.5 billion just five months ago, indicating a lack of confidence among traders.

Solana’s “Death Spiral” Fears

The decline in SOL’s price has also affected Solana-based decentralized applications (DApps), with revenues falling across the board. Investors are starting to worry about a “death spiral” in which falling prices reduce incentives and make it harder for people to justify holding SOL in the long term. Weekly DApp revenue on Solana fell to $22.8 million, the lowest level since October 2024, with the memecoin launchpad Pump generating $9.1 million in revenue over these seven days, accounting for 40% of the network’s total revenue.

In comparison, weekly DApps revenue on Ethereum totaled $16 million, up 2% month over month. Unlike Solana, Ethereum has secured its lead in Total Value Locked (TVL) and use cases that require greater decentralization, with top-performing DApps such as Sky, Flashbots, and Aave being key infrastructure players for decentralized finance. Solana, on the other hand, is heavily dependent on retail onboarding and the memecoin sector.

This weak institutional demand is visible in SOL Exchange Traded Funds (ETFs), with Solana’s high transaction volume and second-ranking TVL not being enough to convince traditional investors to buy into SOL ETFs offered by Bitwise, Fidelity, Grayscale, 21Shares, CoinShares, and REX-Osprey. Solana’s $2.1 billion in ETF assets under management is still 86% behind Ethereum’s $15.8 billion, indicating a lack of confidence among investors.

Regaining Momentum

For SOL to regain its upward momentum, it will likely need a boost from sectors such as artificial intelligence infrastructure and prediction markets. These areas are promising, but competition is fierce. Currently, weak SOL derivatives and Solana on-chain metrics are a warning sign, and any further disappointment could trigger a further price decline and seriously threaten the already shaky support level of $78.

This article does not contain any investment advice or recommendations. Every investment and trading activity involves risks, and readers should conduct their own research when making their decision. While we strive to provide accurate and up-to-date information, Cointelegraph does not guarantee the accuracy, completeness, or reliability of the information in this article. This article may contain forward-looking statements that are subject to risks and uncertainties. Cointelegraph will not be liable for any loss or damage arising from your reliance on this information. For more information, visit https://cointelegraph.com/news/solana-futures-data-shows-panicked-bulls-will-80-sol-hold?utm_source=rss_feed&utm_medium=rss_tag_altcoin&utm_campaign=rss_partner_inbound