Solana Inflows Plummet to 6-Month Low as Price Struggles to Break $200

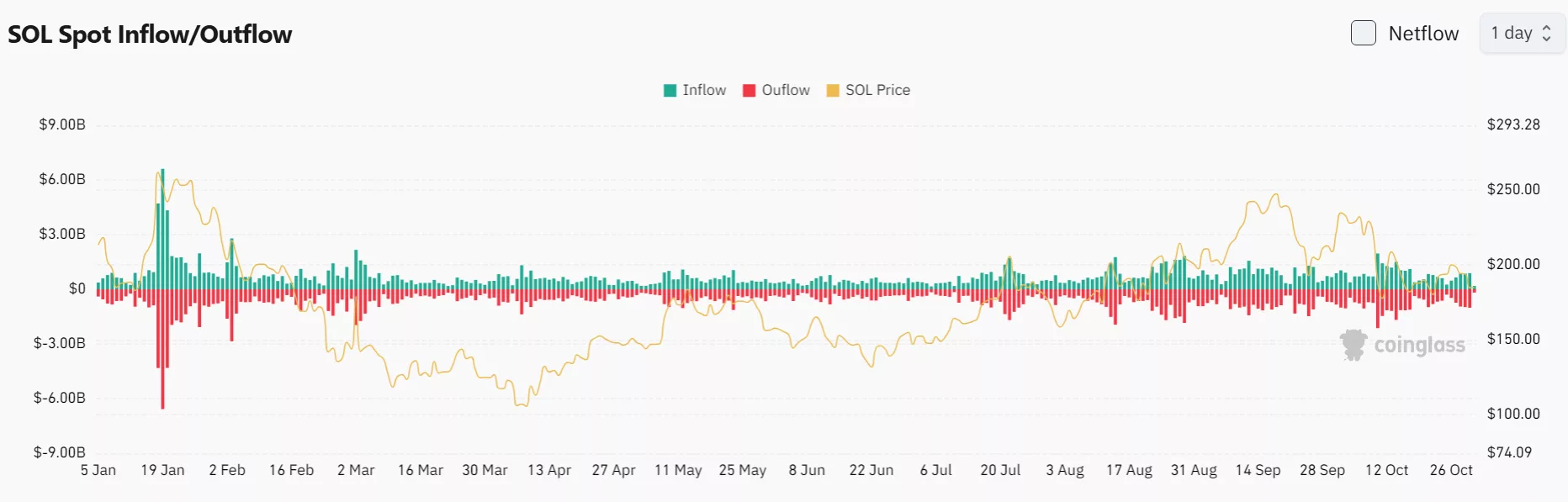

Solana’s spot inflows have reached a six-month low, with a mere $180 million in inflows, down from $885.02 million in the previous day, according to data from Coinglass. This significant decline in inflows suggests waning demand in the market, particularly after the launch of two Solana ETFs in the US market. The Solana price has also slipped to around $186, failing to sustain above the $200 mark, with technical indicators and moving averages signaling a short-term downtrend.

The launch of the Bitwise Solana Staking ETF and Grayscale’s SOL-backed ETF initially sparked investor enthusiasm, driving the token’s value above $200. However, the recovery was short-lived, and the price has since fallen back to $195 and now hovers around $186. The daily net inflows for the two Solana ETFs have also decreased, from over $110 million to just $37.33 million, according to SoSoValue, indicating a potential loss of interest in the new ETFs.

Solana Price Analysis

After failing to break through the $200 mark, Solana’s price continues to decline, with a 4.7% drop in the last 24 hours. The token is currently trading at around $186, below the 30-day moving average of $187.50. The moving average has turned into resistance, indicating a shift in the short-term trend to the downside. Unless Solana can reclaim the $190-$195 zone, a retest of lower support levels near $180 and possibly $172 remains likely.

Momentum indicators, such as the Relative Strength Index (RSI), confirm the weakening structure, with a lack of bullish momentum and a failure to climb above the neutral 50 line. The recent lower RSI highs suggest easing buying pressure, consistent with the assumption that liquidity and demand for SOL are waning. The Chaikin money flow indicator has also dropped significantly, indicating weakening liquidity and no large-scale accumulation.

Net outflows have risen, with major exchanges such as Binance, OKX, Coinbase, and Bybit recording outflows for SOL. Binance alone recorded net outflows of around $52.89 million, while OKX recorded outflows of $26.98 million. The only exchanges to see inflows for SOL over the past day were Bitstamp with $1.19 million and Kraken with $501,160.

Conclusion

Solana’s failure to break above $200 reflects a cooling in market sentiment after months of strong gains. With both the moving average and RSI showing weakness, the path of least resistance appears to be to the downside in the short term. To reverse this scenario, bulls would need to reclaim and hold the $190-$195 range with renewed volume. If SOL fails to recover, there could be further consolidation or another decline below $180 before a meaningful recovery attempt can be made.

For more information, visit https://crypto.news/solana-inflows-hit-6-month-low-as-price-fails-to-break-200/

Disclosure: This article does not constitute investment advice. The content and materials presented on this site are for educational purposes only.