A recent report by Redstone, a Blockchain Oracle Network, highlights Solana’s emergence as the backbone of blockchain infrastructure for capital markets. This development is significant, given the growing importance of blockchain technology in the financial sector.

Solana has made considerable strides in the tokenization of real-world assets (RWAs), with a total value of $700 million in RWAs and over $13.5 billion when including stablecoins. This represents a growth of over 500% compared to the previous year, solidifying Solana’s position as one of the largest networks for tokenized assets. The network’s performance, which can handle up to 100,000 transactions per second (TPS), has been a key driver of its dominance in the sector.

Key Statistics and Milestones

Some notable statistics and milestones that demonstrate Solana’s growing dominance include:

- Solana holds $700 million in RWAs and $13.5 billion including stablecoins

- The network’s performance is a key driver of its growing dominance in the sector

- Prominent institutions such as Blackrock, Apollo Global, Janus Henderson, and Vaneck have adopted Solana

These statistics underscore Solana’s position as a leading player in the blockchain infrastructure for capital markets.

According to Robert Leshner, CEO of the superstate of tokenization platforms, “There are really only 2 places for RWAS: it is either Ethereum or Solana.” This statement highlights the significance of Solana’s performance and its appeal to institutional investors. The network’s ability to handle high-throughput transactions has made it an attractive choice for many investors.

Network Performance and Adoption

Solana’s performance has been a key factor in its adoption by institutional investors. The network’s capacity to handle up to 100,000 TPS has made it an ideal choice for applications that require high-throughput transactions. This has led to partnerships with stock exchanges such as Octopuses, enabling quick and inexpensive transmissions for their users. The integration of Xstocks into the network has also contributed to the acceleration of trade volumes on Solana, which have quickly surpassed those of Ethereum.

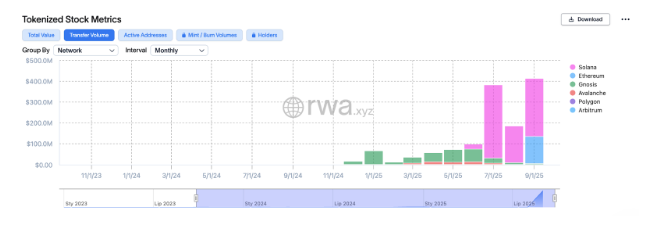

Tokenized stock transmission volumes on Solana compared to other main chains | Source: rwa.xyz

Tokenized stock transmission volumes on Solana compared to other main chains | Source: rwa.xyz

In addition to its performance, Solana’s attractiveness among retail users is demonstrated by the popularity of applications such as Phantom, Raydium, Jupiter, and Pump.fun. These applications have contributed to the network’s growing dominance in the tokenization of assets.

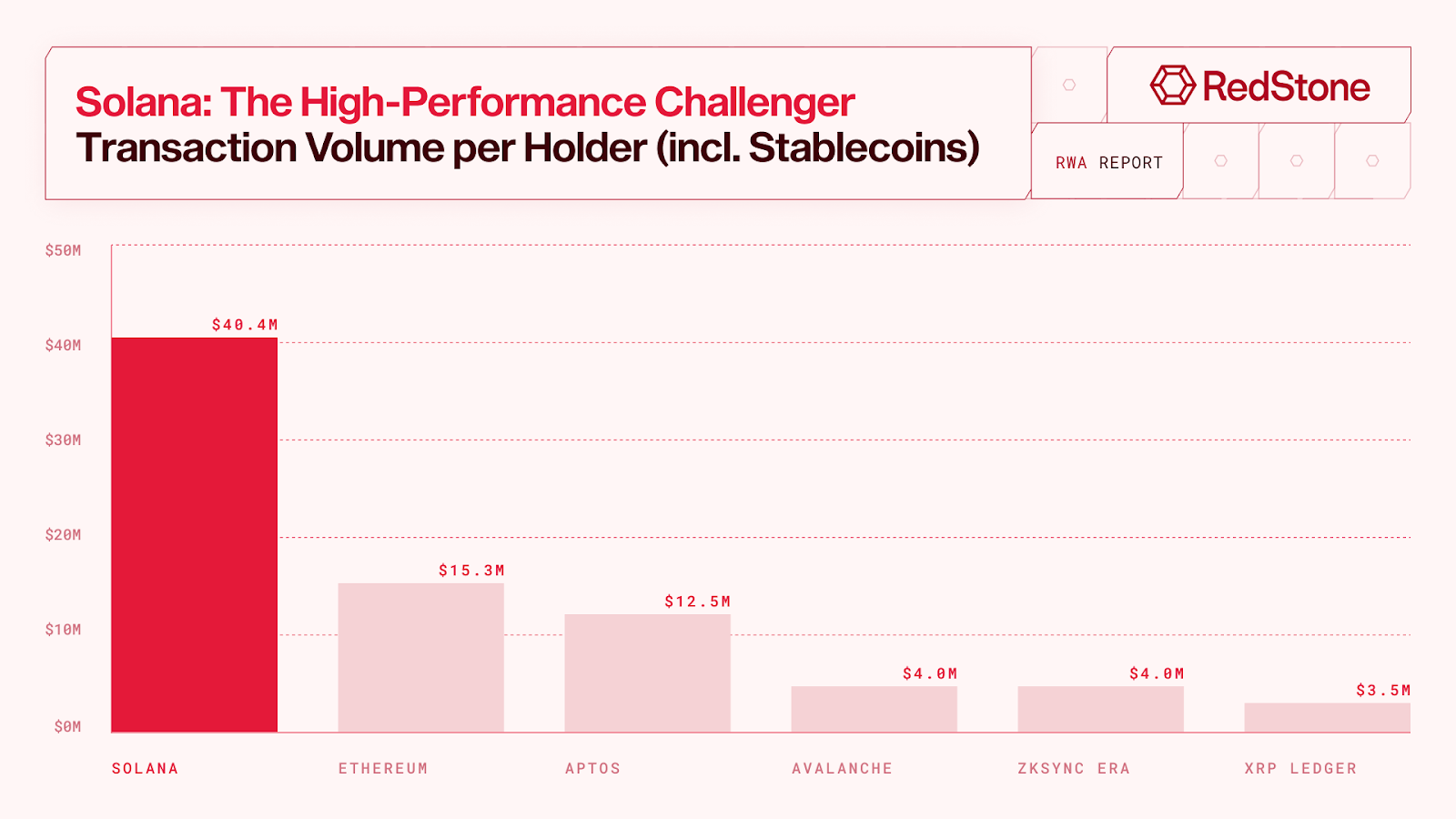

Transaction volume per RWA address on important chains from June 2025 | Source: Redstone

Transaction volume per RWA address on important chains from June 2025 | Source: Redstone

For more information on Solana’s emergence as an institutional hub for RWAs, please refer to the original report by Redstone.