Solana Price Exposed to Increased Short-Term Risk

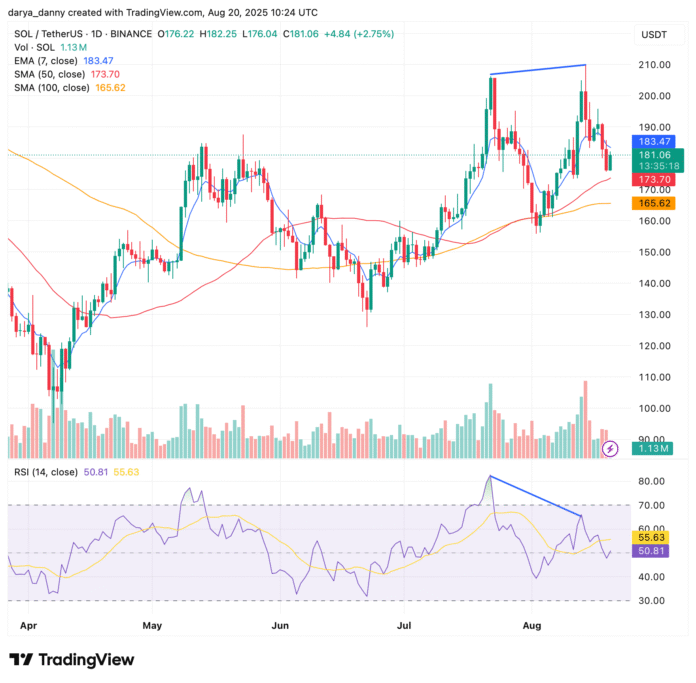

The Solana price is facing increased short-term risk, with the new Solana Perpetual Futures from Coinbase potentially fueling a strong rebound or adding downward pressure. According to recent market trends, the Solana price has shown signs of weakness, slipping under the 7-day Exponential Moving Average (EMA) of $183.5.

The Solana price had previously experienced a significant rally, with a 67% increase from its late July low of $126 to a peak of $210. However, the price has since withdrawn to a low of $175, indicating a potential reversal. The current daily candle shows signs of a diving board, but the Solana price remains below the 7-day EMA, signaling that short-term dynamics are under pressure.

Technical Indicators Point to Increased Downward Risk

A bearish RSI divergence has been observed, with the RSI printing a lower high even as the Solana price reached new heights. This signal, combined with the failure to break the culmination of $206, increases the risk that Solana will cut a double-top formation around the zone from $206 to $210. If the bounce does not recapture and take over the 7-day EMA and the resistance region of $190, the downward risk remains high.

An infringement under $173 to $170 (50-day Simple Moving Average) could open the door for a deeper correction in the 100-day SMA near $166 and possibly even the $155, which marks the completion of a cut-out with a double-top neckline. The introduction of Solana Perpetual Futures on Coinbase has added to the volatility, with the potential for both a strong rebound and increased downward pressure.

Source: Tradingview

Coinbase Futures Introduce New Risk and Opportunity

The new Solana Perpetual Futures from Coinbase offer traders a regulated option to trade SOL with up to 5-fold leverage. While this leverage can amplify gains, it also increases the risk of losses. On one hand, it could stimulate a strong rebound if buyers enter near the support zone from $175 to $180. On the other hand, it could make it easier for the Solana price to be driven lower by short positions, increasing sales pressure if the market fails to hold key levels.

US traders can now access SOL and XRP perpetual futures on the Coinbase financial markets, with the ability to trade without monthly settlement and access to 5x leverage within a safe and regulated environment. The introduction of these new contracts has added to the volatility of the Solana price, making it essential for traders to stay informed and adapt to the changing market conditions.

For more information on the Solana price and the impact of Coinbase Futures, visit https://crypto.news/solana-price-crash-incoming-coinbase-futures-add-fuel-to-sol-volatility/