Solana’s recent price surge has given way to a sharp retreat, testing the strength of the rally. Despite continued institutional buying, the token’s price has dropped below $220, sparking concerns about a deeper pullback. According to data from Coingecko, Solana’s price slid to $213 before recovering to $218 at the time of writing.

Solana Price Drop

The withdrawal comes as institutional interest in Solana continues to build, with several companies steadily accumulating the token over the past few weeks. However, this buying has done little to offset the immediate effects of profit-taking and risk-off orders in digital markets. The decline is not isolated, reflecting a broader downturn in crypto prices triggered by macro concerns and a wave of liquidity-driven liquidations. Bitcoin, Ethereum, and other large-cap tokens have also recorded similar declines, increasing pressure on the entire market.

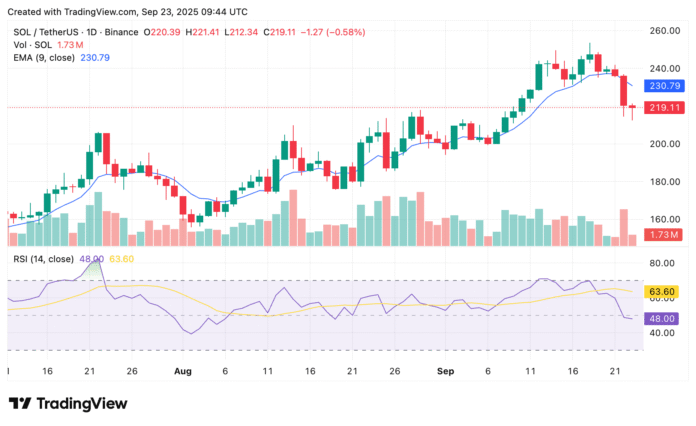

Solana’s price has dropped by about 7% over the past week but still maintains a modest gain of 5% for the month. With the wider market under pressure, all eyes are on whether Sol can remain above key support levels or if further downside is coming. The token’s price action is being closely watched, with technical indicators such as the Relative Strength Index (RSI) pointing to a possible change in direction.

Technical Analysis

The RSI has dropped to 48, down from over 60 at the beginning of the week, indicating that the bullish momentum has faded. The RSI is not yet in oversold territory, leaving room for further downside if selling pressure persists. Solana’s price is now below its 9-day exponential Moving Average (EMA), currently at $230.79, which had supported the token at short notice during the rally. This level had signaled a possible shift in dynamics, and a break below the current support zone of $210-$215 could open the door to a deeper pullback towards the $200 level.

A token unlock of over 500,000 SOL, worth around $116 million, is scheduled for this week, which could increase selling pressure. Although the amount is only about 0.09% of the circulating supply of SOL, its timing, coinciding with a wider market weakness, could exacerbate the decline. The unlock is part of a broader wave of token releases, including projects such as Worldcoin and Trump-connected tokens, which could create short-term volatility as retailers reposition and liquidity shifts.

Solana price chart | Source: crypto.news

In conclusion, Solana’s price drop below $220 has raised concerns about a deeper pullback. While institutional buying continues, the token’s price action is being driven by broader market trends and technical indicators. As the market navigates this volatility, it is essential to keep a close eye on key support levels and technical indicators to gauge the direction of the rally. For more information, visit https://crypto.news/solana-price-slips-below-220-is-deeper-pullback-comping/