Solana’s tokenized assets have surpassed a significant milestone, exceeding $500 million in value, marking a substantial achievement for a blockchain network primarily known for hosting decentralized applications and non-fungible tokens (NFTs).

Overview of Solana’s Tokenized Assets

Solana has made considerable strides in the realm of Real-World Assets (RWAs), with its tokenized assets now valued at over $500 million. According to data from RWA.XYZ, a significant portion of this value comes from stablecoins, which have a market capitalization of over $17.1 billion across 17 different tokens. Circle’s USD Coin (USDC) dominates the market, accounting for over 70% of Solana’s tokenized asset market with a total value of $8.18 billion, followed by Tether Holdings’ USDT, which has a market share of almost 17% with a total value of $1.94 billion.

Breakdown of Solana’s Tokenized Assets

Beyond stablecoins, tokenized US financial debt is the second-largest category of RWAs on Solana, with a total value of $304.6 million. This segment is primarily driven by Ondo Finance, with its USDY and OUSG products accounting for a combined total of $249.4 million. Institutional alternative funds also contribute significantly, with a total value of $135.2 million, led by Onre’s Onchain Rendite Coin (Onyc), which accounts for the majority of this category.

Comparison with Other Blockchain Networks

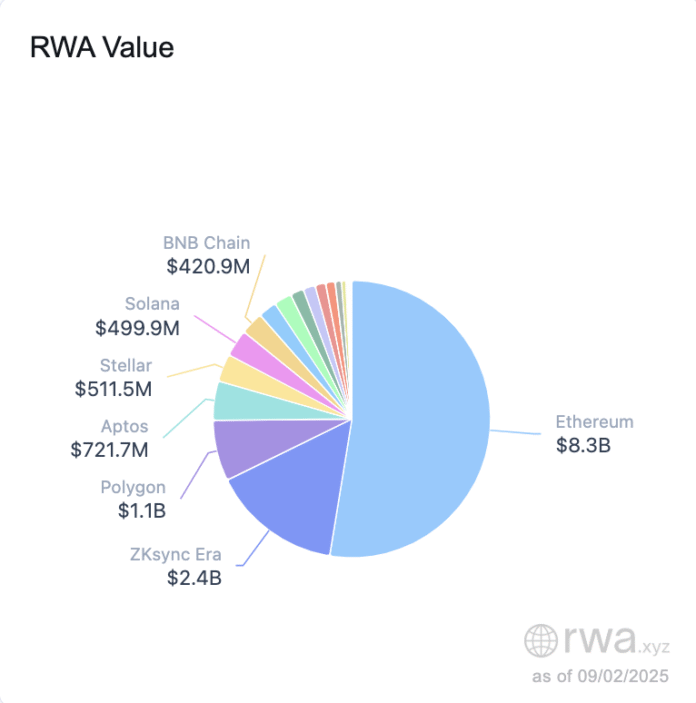

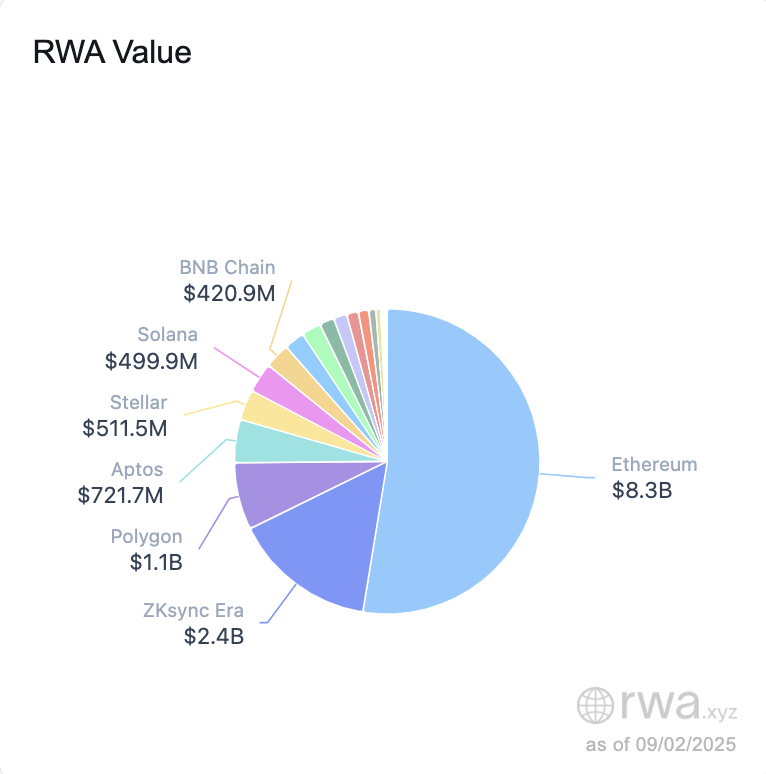

This growth positions Solana ahead of the BNB chain, which has a tokenized RWA value of $420.9 million, and nearly on par with Stellar, which has a total RWA value of $511.5 million. While Solana’s tokenized asset value is still only a fraction of that of Ethereum, ZKSync, and Polygon, it marks a significant milestone for a blockchain network that is increasingly being considered a viable platform for serious financial infrastructure.

Source: rwa.xyz

Source: rwa.xyz

Adoption by Large Banks and Institutional Actors

Large banks and institutional actors are increasingly turning to Solana for tokenization, drawn by its high throughput, low costs, and ability to handle large-scale operations. Partnerships, such as the recent deal between the Solana Foundation and R3, which counts HSBC, Bank of America, EuroClear, and Singapore’s monetary authority among its customers, demonstrate that traditional finance (TradFi) is increasingly considering Solana as a faster, more efficient alternative to Ethereum for shifting RWAs onto public blockchains.

For more information on Solana’s tokenized assets and their growth, visit https://crypto.news/solana-tokenized-assets-hit-record-500m-milestone/