South Korea’s StableCoin Regulation: A Path Forward

According to Lee Kwang-Jae, the former Secretary General of the South Korean National Assembly, the country needs to ensure that Krw-Pegled StableCoins are listed on international crypto exchanges like Binance and Coinbase. This move would allow non-Korean traders to access these stablecoins, potentially increasing demand and securing “international acceptance” for South Korean coins.

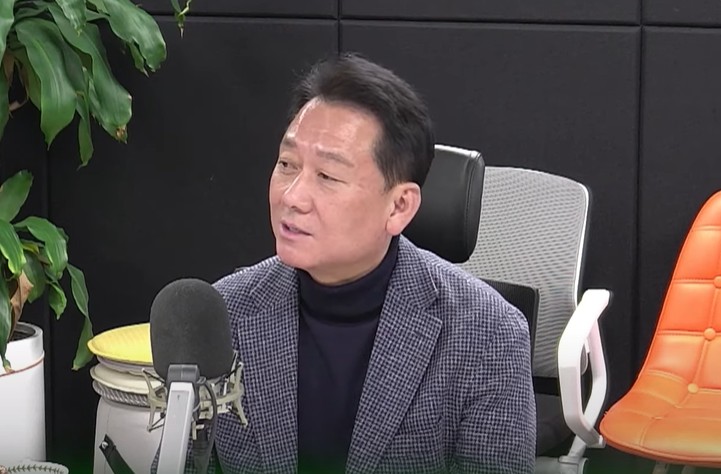

In an interview at Myongji University, Lee emphasized the importance of allowing overseas dealers to trade Krw-Pegled StableCoins on global exchanges. He stated, “If we would like to increase the demand for red-cut stable coins, we have to allow them to be traded on global cryptocurrency exchanges [like Binance and Coinbase, so non-Koreans can trade them].” This, Lee claimed, would help South Korean coins gain global recognition.

KRW StableCoins: Legislation and International Acceptance

The new South Korean government has made progress in associated legislation, but the start of Krw Peged coins has been put on hold. Lee argued that to increase demand for these stablecoins, they need to be traded on global exchanges, allowing non-Korean traders to access them. He also suggested that Seoul should open domestic crypto exchanges, such as Uupbit and Bithumb, to foreign dealers.

Currently, only South Korean residents can open fiat-compatible accounts on domestic trading platforms, limiting the accessibility of Krw-Pegled StableCoins to international traders. Lee emphasized the need for Seoul to ensure that these stablecoins are listed on international exchanges, enabling global demand and acceptance.

Seoul’s Next Steps: Expanding StableCoin Use

Lee also suggested that Seoul should ensure that cross-border cultural, education, and health services use KRW stable coins. He argued that expanding the use of these coins at the national level would increase their value and adoption. Additionally, Lee predicted that Samsung, the country’s largest conglomerate, might issue its own stablecoin in the future, potentially competing with Apple.

Some observers believe that Samsung could integrate a winning stable coin into its Samsung Pay platform, enabling its use outside of South Korea. Other domestic companies could also utilize these coins to strengthen their positions in international markets.

Conclusion: A Path Forward for KRW StableCoins

In conclusion, Lee Kwang-Jae’s suggestions for South Korea’s stablecoin regulation highlight the need for international acceptance and accessibility. By listing Krw-Pegled StableCoins on global exchanges and expanding their use at the national level, Seoul can increase demand and adoption. As the country moves forward with its stablecoin regulation, it is essential to consider the opinions of experts like Lee and ensure that the legislation is in sync with international standards.

For more information, visit https://cryptonews.com/news/ex-national-assembly-chief-south-korea-should-list-krw-stablecoins-on-binance/